GS Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Holdings Bundle

Unlock the strategic advantages of understanding GS Holdings's external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Gain critical insights to inform your investment decisions and competitive strategy.

Don't get left behind – equip yourself with the comprehensive PESTLE analysis of GS Holdings. Discover how shifting market dynamics and regulatory landscapes present both challenges and opportunities. Download the full report now for actionable intelligence to navigate the complex business terrain.

Political factors

The South Korean government's energy policy is undergoing a significant shift, with the upcoming 11th Basic Plan for Long-Term Electricity Supply and Demand, slated for finalization in early 2025. This plan aims for renewable energy to constitute 21.6% of the national energy mix by 2030.

This strategic pivot, coupled with ongoing discussions about a coal phase-out by 2050, directly impacts GS Holdings' energy sector investments, particularly for subsidiaries like GS Caltex and GS Energy. The government's commitment to fostering clean hydrogen and offshore wind power presents both new avenues for growth and necessitates adaptation to evolving regulatory landscapes for the conglomerate.

Recent political developments in South Korea have created a climate of consumer uncertainty, with negative economic sentiment projected to persist into 2025. This political backdrop can dampen private consumption and investment, directly affecting GS Holdings' retail and construction businesses.

The South Korean government is actively pursuing economic recovery measures, including income tax deductions, to bolster domestic demand. For instance, the proposed tax relief for middle-income households in late 2024 aims to inject spending power into the economy, potentially offsetting some of the negative sentiment.

Global trade policies, particularly the potential for increased tariffs and protectionist measures from major economies like the United States under a new administration, represent a significant downside risk for South Korea's export-driven economy. These shifts directly impact GS Holdings' diverse business segments, especially those heavily involved in international trade or dependent on global supply chains.

Geopolitical tensions, such as those in Northeast Asia, further exacerbate these risks by introducing volatility and uncertainty into the business environment. For GS Holdings, this could translate into disrupted supply chains, fluctuating raw material costs, and altered demand patterns across its various industries, from energy and chemicals to retail and construction.

Competition Law and Digital Platform Regulation

The Korea Fair Trade Commission (KFTC) is actively scrutinizing the digital landscape, with ongoing discussions in 2024 and 2025 concerning new regulations for digital platforms. While a broad platform regulation initiative was shelved in 2024, the possibility of its revival, along with potential amendments to the Monopoly Regulation and Fair Trade Act, remains a key consideration. These evolving legal frameworks could significantly influence GS Holdings' retail ventures, particularly its e-commerce and convenience store segments, by shaping market power dynamics and dictating operational strategies.

The KFTC's focus on fair competition in the online space could lead to new rules impacting how digital platforms operate and interact with consumers and businesses. For GS Holdings, this translates to potential adjustments in how its online retail arms, like GS Shop and GS25's digital offerings, manage their market presence and engage in promotional activities. The ongoing debate signifies a proactive stance by South Korean regulators to ensure a level playing field, which might necessitate strategic adaptations within GS Holdings' digital business models.

- KFTC Enforcement: The KFTC has historically been assertive in enforcing competition laws, with a particular focus on the digital economy in recent years.

- Platform Regulation Debate: Discussions around new digital platform regulations are a prominent feature of the 2024-2025 regulatory environment in South Korea.

- Impact on GS Holdings: Potential new regulations could affect GS Holdings' e-commerce and convenience store operations by influencing market share and operational practices.

Corporate Governance Reforms

South Korea is actively implementing significant corporate governance reforms throughout 2024 and 2025. These initiatives are specifically designed to boost transparency and bolster the protections afforded to minority shareholders. A key proposal involves amending the Capital Markets Act to ensure boards prioritize shareholder rights during M&A activities, including mandating objective fair value assessments.

These reforms, which will extend to expanded disclosure requirements for all KOSPI-listed firms by 2026, will require companies like GS Holdings to proactively evaluate and likely update their existing governance structures and internal policies. The aim is to ensure full compliance with the new regulations and, crucially, to sustain and enhance investor confidence in the company's operations and management.

- Enhanced Shareholder Rights: Amendments to the Capital Markets Act will legally bind boards to protect minority shareholder interests during M&A transactions.

- Mandatory Fair Value Assessments: Mergers and acquisitions will necessitate independent fair value evaluations, preventing undervaluation of assets.

- Broader Disclosure Obligations: By 2026, all KOSPI-listed companies, including GS Holdings, will face more stringent disclosure requirements, increasing transparency.

- Compliance Imperative: GS Holdings must adapt its governance frameworks to align with these evolving regulatory standards to maintain investor trust.

South Korea's energy policy is shifting towards renewables, with a target of 21.6% of the energy mix by 2030 under the 11th Basic Plan for Long-Term Electricity Supply and Demand, finalized in early 2025. This, alongside a potential 2050 coal phase-out, directly influences GS Holdings' energy investments, pushing for adaptation to clean hydrogen and offshore wind power opportunities.

Political uncertainty and negative economic sentiment are projected to persist into 2025, potentially impacting consumer spending and investment for GS Holdings' retail and construction sectors. Government measures like income tax deductions in late 2024 aim to counter this by boosting domestic demand.

Global trade policy shifts, including potential US tariffs, and geopolitical tensions in Northeast Asia pose risks to South Korea's export-driven economy, affecting GS Holdings' international trade and supply chains. The Korea Fair Trade Commission's scrutiny of digital platforms in 2024-2025 could also impact GS Holdings' e-commerce operations through new regulations.

Corporate governance reforms in 2024-2025, focusing on transparency and minority shareholder rights, will require GS Holdings to update its structures and policies to meet expanded disclosure requirements by 2026.

What is included in the product

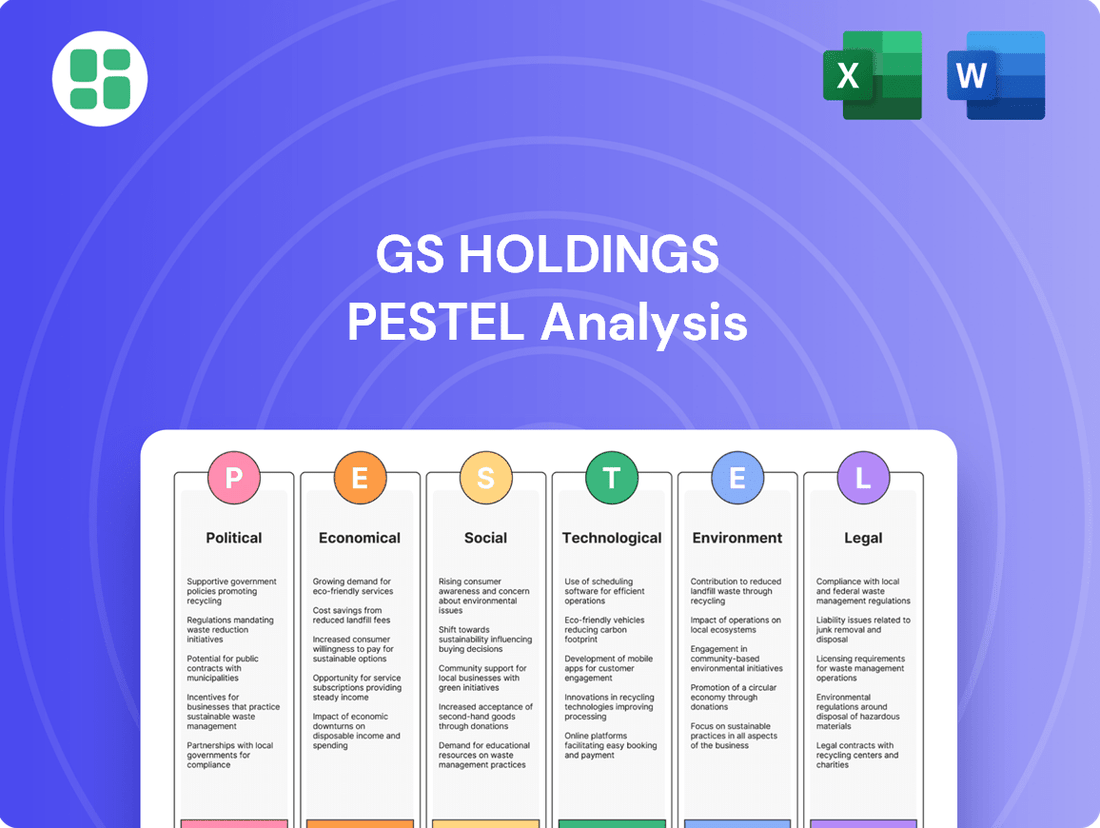

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting GS Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A PESTLE analysis for GS Holdings offers a clear, summarized version of external factors, simplifying complex market dynamics for efficient decision-making during strategy sessions.

Economic factors

South Korea's Gross Domestic Product (GDP) growth has seen a slowdown, with forecasts for 2024 and 2025 being adjusted downward by institutions like the Bank of Korea and international organizations. For instance, the Bank of Korea projected a 2.1% GDP growth for 2024 in their May 2024 report.

While the economy is anticipated to stabilize in 2025, achieving its potential growth rate with inflation close to the target, this moderated growth directly affects market demand across GS Holdings' various business segments, from energy and chemicals to retail and construction.

This economic backdrop requires GS Holdings to implement astute strategic planning for future growth and investment opportunities across its diverse affiliate companies to navigate the less robust demand environment effectively.

Consumer spending in South Korea is experiencing a noticeable slowdown. Projections for 2025 suggest a continued contraction in discretionary spending, largely driven by persistent inflation and increasing household debt levels. This economic climate directly impacts GS Holdings' retail operations, such as its convenience stores and department stores, necessitating adjustments in sales approaches and product assortments.

While the convenience store segment has demonstrated a degree of resilience, overall retail sector growth is anticipated to remain minimal in the near term. For instance, retail sales growth in South Korea was around 2.5% in early 2024, a figure expected to moderate further as economic headwinds persist through 2025.

Inflationary pressures in South Korea have shown a notable cooling trend, with the rate falling to 1.9% by December 2024. This moderation is largely attributed to the easing of global supply chain disruptions and the impact of the Bank of Korea's restrictive monetary policies. Projections for 2025 indicate inflation will likely remain close to the central bank's 2% target, suggesting a period of relative price stability.

While contained inflation offers a more predictable economic landscape, the prevailing interest rate environment, shaped by monetary policy, directly influences GS Holdings' borrowing costs and strategic investment decisions. The current stable inflation outlook, though positive for operational planning, is tempered by the persistent challenge of high household debt, which can act as a constraint on overall economic activity and consumer spending.

Investment in Green Industries

South Korea's commitment to green growth, with a target for significant clean energy exports by 2027, creates substantial economic avenues for GS Holdings. This national push encourages investment in renewable energy, clean hydrogen, and sustainable infrastructure, directly benefiting GS Holdings' energy and construction divisions.

The government's strategy involves robust public-private partnerships and dedicated green export funds, signaling a supportive financial environment for green technology development and deployment. For instance, in 2024, the Ministry of Trade, Industry and Energy announced plans to significantly increase funding for renewable energy R&D, with a particular emphasis on offshore wind and hydrogen technologies.

- Government Export Target: Aiming for substantial clean energy exports by 2027.

- Key Sectors: Renewable energy, clean hydrogen production, and sustainable infrastructure.

- Funding Mechanisms: Joint exploration by public and private sectors, supported by green export funds.

- Economic Impact: Opportunities for GS Holdings' energy and construction businesses.

Global Supply Chain Dynamics

The unwinding of global supply chain frictions has been a positive development, contributing to more contained inflation. For instance, South Korea's producer prices saw a notable slowdown in early 2024, with the Bank of Korea reporting a 1.4% year-on-year increase in March 2024, a significant decrease from the higher figures seen in previous years. This easing has helped stabilize input costs for businesses like GS Holdings.

Despite this improvement, ongoing global economic uncertainties and potential disruptions remain a concern. Events such as geopolitical tensions or natural disasters can still impact the cost and availability of raw materials and finished goods crucial for GS Holdings' diverse operations, spanning energy, retail, and construction sectors. For example, disruptions in key shipping lanes, like those experienced in the Red Sea in late 2023 and early 2024, led to increased shipping costs and delivery times for many industries.

- Contained Inflation: South Korea's producer price index (PPI) growth slowed to 1.4% year-on-year in March 2024, down from over 5% in early 2023, easing cost pressures.

- Geopolitical Risks: Ongoing conflicts and trade disputes continue to pose a threat to global logistics and commodity prices.

- Shipping Costs: Re-routing of vessels due to security concerns, such as in the Red Sea, has increased freight rates by as much as 60% for some routes in early 2024.

- Supply Chain Resilience: GS Holdings must continue to prioritize strategies that build resilience against potential future shocks to ensure stable operations and pricing.

South Korea's economic trajectory in 2024 and 2025 presents a mixed outlook. While inflation is expected to stabilize around the Bank of Korea's 2% target, GDP growth is projected to be moderate, with the Bank of Korea forecasting 2.1% for 2024. This slower growth environment, coupled with persistent household debt, is dampening consumer spending, particularly for discretionary items, impacting GS Holdings' retail segment.

However, the nation's strong push towards green growth, targeting substantial clean energy exports by 2027, offers significant opportunities. Government initiatives and funding for renewable energy and hydrogen technologies directly benefit GS Holdings' energy and construction divisions.

The easing of global supply chain issues has been a boon, contributing to lower producer prices, with year-on-year increases slowing to 1.4% by March 2024. Yet, ongoing geopolitical uncertainties and potential disruptions in global logistics, which saw shipping costs rise significantly in early 2024, necessitate continued focus on supply chain resilience for GS Holdings.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on GS Holdings |

|---|---|---|---|

| GDP Growth | 2.1% (Bank of Korea, May 2024) | Stabilization towards potential growth rate | Moderated demand across all sectors |

| Inflation Rate | Cooling trend, 1.9% by Dec 2024 | Close to 2% target | More predictable operating costs, but high household debt may limit spending |

| Consumer Spending | Noticeable slowdown, moderating retail sales growth | Continued contraction in discretionary spending | Challenges for retail operations, requiring adjusted sales strategies |

| Supply Chain Status | Easing disruptions, PPI growth slowed to 1.4% (Mar 2024) | Continued easing expected, but risks remain | Stabilized input costs, but need for ongoing supply chain resilience |

Same Document Delivered

GS Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of GS Holdings delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Gain actionable insights into the external forces shaping GS Holdings' business landscape.

Sociological factors

South Korean consumer lifestyles are rapidly evolving, with a pronounced emphasis on personalization and convenience shaping purchasing decisions in 2025. This trend is particularly evident as consumers navigate economic uncertainties, leading to more conservative spending. For GS Holdings, this means a strategic pivot towards customized product offerings and a streamlined shopping experience across its diverse retail segments.

Health consciousness remains a dominant force, driving demand for functional foods and eco-friendly products. Reports indicate that the health food market in South Korea is projected to grow significantly, with consumers actively seeking out items that offer tangible health benefits. This presents a clear opportunity for GS Holdings to expand its private label brands and develop innovative solutions that cater to these growing preferences.

South Korea boasts exceptionally high internet penetration, nearing 99% as of early 2024, and widespread smartphone adoption, with over 95% of adults owning one. This digital infrastructure fuels the dominance of e-commerce, making it a critical channel for consumer engagement and sales.

GS Holdings' retail arms, such as GS25 convenience stores and GS SHOP’s online platform, must prioritize robust digital strategies. With a significant majority of South Koreans actively shopping online, investing in seamless omnichannel experiences and user-friendly digital platforms is essential for GS Holdings to capture market share and meet the expectations of its tech-savvy customer base.

South Korean consumers increasingly prioritize convenience, driving demand for hyper-local retail solutions. GS25, a key GS Holdings brand, exemplifies this with its aggressive expansion, aiming for over 17,000 stores by the end of 2024, a significant jump from its 2023 count of around 16,000. This strategy taps into the desire for immediate access to goods and services, even in densely populated urban areas.

The success of convenience stores like GS25, which saw its sales increase by 6.1% in 2023, underscores a shift in consumer behavior towards on-demand consumption. By offering localized products and creating inviting in-store dining spaces, GS25 caters to this preference for immediate gratification and personalized experiences, a trend expected to continue through 2025.

Work-Life Balance and Labor Force Changes

South Korea's labor landscape is undergoing significant shifts, with 2024 and 2025 seeing key amendments to labor laws prioritizing work-life balance. These include enhanced family-related leave and a rising minimum wage, impacting operational costs and HR strategies for companies like GS Holdings. The nation's persistently low fertility rate, projected to remain below 0.7 children per woman in 2024, and a rapidly aging population further complicate workforce planning.

These demographic and legislative trends necessitate a strategic adaptation of human resource policies for GS Holdings. Attracting and retaining skilled labor in this evolving market requires competitive benefits and flexible work arrangements. The conglomerate must address the challenge of a shrinking, aging workforce while simultaneously meeting the expectations of a generation that values work-life integration.

- Labor Law Amendments (2024-2025): Increased family leave, higher minimum wage.

- Demographic Challenges: Persistently low fertility rate (below 0.7 in 2024), aging population.

- HR Strategy Impact: Need for enhanced talent attraction and retention through improved work-life balance initiatives.

- Operational Cost Considerations: Rising labor costs due to minimum wage increases and potential for increased leave utilization.

Sustainability and Ethical Consumption

South Korean consumers are increasingly prioritizing sustainability, with a significant portion actively seeking out organic and eco-friendly options. This burgeoning eco-consciousness is also fueling the growth of the second-hand market, reflecting a broader shift towards more conscious consumption patterns. For instance, a 2023 survey indicated that over 60% of Korean millennials and Gen Z consider environmental impact when making purchasing decisions.

This evolving consumer sentiment directly pressures companies like GS Holdings to bolster their Environmental, Social, and Governance (ESG) initiatives. The demand for sustainable products and services is no longer a niche concern but a mainstream expectation, requiring GS Holdings to integrate eco-friendly practices and offerings across its diverse business segments, from retail to energy.

The expectation for corporate social responsibility is intensifying. Consumers and investors alike are scrutinizing companies' commitments to environmental stewardship and social equity. By 2024, over 70% of global institutional investors are expected to have integrated ESG factors into their investment strategies, underscoring the financial imperative for GS Holdings to demonstrate tangible progress in these areas.

- Growing Eco-Consciousness: South Korean consumers are showing a marked preference for sustainable and organic products.

- Second-Hand Market Boom: The rise of the resale market indicates a shift towards circular economy principles among consumers.

- ESG Integration: GS Holdings faces pressure to enhance its ESG performance and offer more sustainable solutions.

- Stakeholder Expectations: Demonstrating environmental and social responsibility is becoming a critical factor for investor and consumer trust.

South Korean societal values are increasingly emphasizing work-life balance, a trend amplified by recent labor law amendments in 2024 and 2025 that expand family leave. This, coupled with a rapidly aging population and a persistently low fertility rate, presents significant human resource challenges for GS Holdings. Adapting HR strategies to attract and retain talent through improved work-life integration is crucial for maintaining a competitive workforce.

Health and wellness continue to be paramount, driving demand for functional foods and eco-friendly products, with the health food market showing robust growth projections. Simultaneously, high internet and smartphone penetration, exceeding 95% for smartphones among adults in early 2024, solidifies e-commerce as a dominant sales channel. GS Holdings must therefore continue to invest in personalized offerings and seamless digital experiences to align with these evolving consumer priorities.

| Sociological Factor | Trend Description | Impact on GS Holdings | Supporting Data/Observation |

|---|---|---|---|

| Work-Life Balance | Growing emphasis on personal time and family, influenced by 2024-2025 labor law changes. | Requires enhanced employee benefits and flexible work arrangements. | Amendments include increased family leave; low fertility rate (below 0.7 in 2024) indicates societal shifts. |

| Health & Wellness Consciousness | Increased demand for functional foods and sustainable products. | Opportunity to expand private label health brands and eco-friendly product lines. | Health food market projected for significant growth; over 60% of millennials/Gen Z consider environmental impact (2023 survey). |

| Digital Adoption & E-commerce | Near 99% internet penetration and over 95% smartphone ownership (early 2024). | Necessitates strong omnichannel strategies and user-friendly digital platforms. | E-commerce is the critical channel for consumer engagement and sales. |

| Convenience Focus | Consumer preference for immediate access to goods and services. | Supports GS25's expansion strategy and localized offerings. | GS25 saw 6.1% sales increase in 2023; aiming for over 17,000 stores by end of 2024. |

Technological factors

GS Holdings' subsidiaries are deeply engaged in digital transformation, a key technological factor. GS Caltex, for instance, is developing an in-house generative AI platform, with plans to roll out an AI-driven smart manufacturing platform in 2025. This strategic move underscores a commitment to leveraging cutting-edge technology.

The integration of AI and digital innovation is designed to significantly boost operational efficiency and elevate customer experiences. By adopting advanced digital tools, GS Holdings aims to solidify its competitive edge across its various business sectors, ensuring it remains a leader in an increasingly digitalized market landscape.

South Korea's commitment to renewable energy is a significant technological driver, with substantial investments pouring into solar, wind, and clean hydrogen. This focus creates a fertile ground for GS Holdings' energy ventures, particularly as the nation pioneers the world's first clean hydrogen-power bidding market, a move expected to reshape the energy landscape by 2025.

Technological advancements in large-scale wind turbines are crucial, enabling more efficient energy capture and contributing to South Korea's ambitious offshore wind targets. Furthermore, the development of advanced biofuel projects presents another avenue for GS Holdings to diversify its energy portfolio and capitalize on evolving green technologies.

GS Holdings can significantly boost customer engagement by replicating the success of GS Caltex's Energy Plus app. This app, recognized for digital innovation, integrates features like Quick Refuel, Car Play, and Android Auto, streamlining the customer journey. For instance, GS Caltex reported a substantial increase in app usage for refueling transactions in 2024, demonstrating the direct impact of such user-friendly technology on customer convenience and loyalty.

Smart Manufacturing and Operational Automation

The increasing adoption of AI-driven smart manufacturing platforms, exemplified by GS Caltex's strategic initiatives, highlights a significant shift towards automating operations for greater efficiency. This trend is crucial for industrial sectors aiming to streamline processes and reduce overheads.

For GS Holdings, integrating these advanced technologies offers a pathway to optimize production across its varied business segments, including energy refining and construction. This can translate into substantial cost savings and a marked improvement in product quality, ultimately boosting overall productivity and market competitiveness.

Key technological advancements impacting GS Holdings include:

- AI and Machine Learning in Manufacturing: GS Caltex's investment in AI for predictive maintenance and process optimization is a prime example, aiming to reduce downtime and enhance output.

- Robotics and Automation: Increased deployment of robots in construction and logistics can improve safety and speed up project completion times, contributing to lower operational costs.

- IoT Integration: Connecting various operational units through the Internet of Things allows for real-time data monitoring and analysis, enabling more agile decision-making and resource allocation.

- Digital Twins: The development of digital replicas of physical assets can facilitate simulation and testing of new processes, identifying potential efficiencies before physical implementation.

Emergence of Biofuels and Sustainable Materials

Technological advancements are significantly reshaping the energy landscape, with a notable focus on biofuels and sustainable materials. GS Holdings, through its subsidiary GS Caltex, is actively investing in and expanding its biodiesel business. This strategic move is in direct response to the growing global demand for cleaner energy alternatives and environmentally friendly materials. The company's commitment is further demonstrated by its involvement in exporting sustainable aviation fuel and its participation in collaborative projects for bio-marine fuel development.

This technological pivot towards bio-based solutions represents a substantial opportunity for GS Holdings to drive innovation and capture market share within the evolving energy sector. By embracing these sustainable technologies, GS Holdings is positioning itself for future growth and aligning with international efforts to reduce carbon emissions.

- GS Caltex is actively expanding its biodiesel production capacity.

- The company is a key exporter of sustainable aviation fuel.

- GS Holdings is exploring partnerships for bio-marine fuel initiatives.

- These technological shifts align with global sustainability goals and market demand for eco-friendly products.

Technological factors are driving significant operational enhancements and market positioning for GS Holdings. The company's embrace of AI, seen in GS Caltex's generative AI platform development, is set to optimize smart manufacturing by 2025, aiming for increased efficiency and better customer experiences.

South Korea's robust investment in renewable energy, particularly in clean hydrogen and advanced wind turbine technology, creates a favorable environment for GS Holdings' energy ventures. The nation's pioneering clean hydrogen-power bidding market, expected by 2025, highlights this technological push.

GS Holdings is also leveraging digital tools to improve customer interaction, as demonstrated by GS Caltex's Energy Plus app, which saw increased refueling transactions in 2024. This focus on user-friendly technology directly boosts customer loyalty and engagement.

The company's expansion into biofuels and sustainable aviation fuel, with GS Caltex actively increasing biodiesel capacity and exploring bio-marine fuel partnerships, positions it to capitalize on the growing demand for eco-friendly energy solutions. These initiatives align with global sustainability trends and market demand.

| Technological Focus | GS Holdings Initiative | Impact/Target | Year |

|---|---|---|---|

| AI in Manufacturing | GS Caltex AI platform | Smart manufacturing, operational efficiency | 2025 |

| Renewable Energy | Clean hydrogen market | Energy landscape transformation | 2025 |

| Digital Customer Engagement | Energy Plus app features | Increased refueling transactions, customer loyalty | 2024 |

| Biofuels & Sustainable Fuels | Biodiesel expansion, SAF exports | Market share in green energy, reduced emissions | Ongoing |

Legal factors

South Korea's labor laws have seen significant shifts in 2024 and 2025. A key change is the national minimum wage increase to KRW 10,030 per hour, effective January 1, 2025. Additionally, penalties for delayed wage payments have become more stringent, and family-related leave entitlements are now more robust.

Further regulatory evolution includes the expansion of the Serious Accident Punishment Act (SAPA) to encompass small and medium enterprises. GS Holdings needs to diligently update its human resources policies and wage structures to align with these evolving legal requirements across all its business units, thereby mitigating the risk of non-compliance penalties.

South Korea is tightening corporate governance rules to boost investor trust. By 2026, all KOSPI-listed companies must submit detailed governance reports, increasing transparency around insider dealings and director responsibilities to all shareholders.

This means GS Holdings, operating as a holding company, will face greater oversight to ensure it adheres to these stricter standards, particularly in safeguarding the rights of minority shareholders.

Amendments to South Korea's Monopoly Regulation and Fair Trade Law (FTL) in 2024 are designed to streamline merger reviews and enhance the Korea Fair Trade Commission's (KFTC) hearing procedures. This includes exemptions for certain business combinations, though the KFTC continues its robust oversight of cartels, especially in sectors affecting consumers, which saw a notable increase in cartel investigations in 2023.

GS Holdings must maintain a strong focus on competition law compliance, particularly within its retail and construction segments, to proactively address potential antitrust issues. The KFTC's active stance, underscored by the 2023 imposition of over 100 billion KRW in fines for bid-rigging in the construction industry, highlights the critical need for vigilance.

Environmental Compliance and Carbon Reduction Mandates

South Korea's commitment to carbon neutrality by 2050, with a mid-term goal of a 40% emissions reduction by 2030, places significant pressure on companies like GS Holdings. The Constitutional Court's recent findings that current climate measures are insufficient underscore the urgency for stricter adherence to environmental regulations. This means GS Holdings must actively engage in reducing greenhouse gas emissions across its energy and industrial sectors.

The company's operations will need to align with evolving environmental standards, which may include mandates for biofuel blending and enhanced emission control technologies. Non-compliance with these increasingly stringent regulations could lead to substantial financial penalties and considerable damage to GS Holdings' corporate reputation.

- Carbon Neutrality Target: South Korea aims for carbon neutrality by 2050.

- Emissions Reduction Goal: A 40% reduction in greenhouse gas emissions is targeted by 2030.

- Regulatory Scrutiny: The Constitutional Court has deemed existing climate measures inadequate, signaling stricter enforcement.

- Compliance Requirements: GS Holdings must adapt to mandates such as biofuel blending ratios and emission reduction efforts.

Consumer Protection and Retail Regulations

South Korea's legislative landscape is increasingly focused on safeguarding consumers and smaller enterprises, especially within the burgeoning online marketplace. Recent legislative proposals target 'gatekeeper' platforms to curb unfair transaction practices, underscoring a persistent commitment to consumer welfare despite some adjustments in digital platform regulation strategies.

GS Holdings' retail division, GS Retail, must navigate these evolving legal requirements. This necessitates a proactive approach to ensuring equitable dealings across both its digital and physical storefronts. Maintaining consumer confidence and mitigating the risk of legal challenges are paramount, especially as the e-commerce sector continues its rapid expansion. For instance, in 2023, South Korea's Fair Trade Commission (KFTC) continued its scrutiny of large online platforms, with ongoing investigations into potential anti-competitive practices impacting smaller merchants and consumer choice.

- Consumer Protection Laws: South Korea's Act on Consumer Protection in Electronic Commerce and Information and Communication Network Act are key legal frameworks GS Retail must adhere to.

- Platform Regulation: Bills introduced in 2024 aim to regulate large digital platform operators, impacting how GS Retail interacts with third-party sellers and manages its online marketplace.

- Fair Trade Practices: Adherence to KFTC guidelines on unfair trade practices is crucial to prevent penalties and maintain brand reputation.

- Data Privacy: Compliance with the Personal Information Protection Act (PIPA) is essential for handling customer data securely in both online and offline retail environments.

South Korea's legal framework is increasingly emphasizing corporate accountability and environmental stewardship. The nation's commitment to carbon neutrality by 2050, with a 2030 interim goal of a 40% emissions reduction, is driving stricter environmental regulations. Furthermore, amendments to the Monopoly Regulation and Fair Trade Law in 2024 aim to streamline merger reviews while maintaining robust oversight of cartels, particularly in consumer-facing sectors.

GS Holdings must remain vigilant regarding labor law changes, including the KRW 10,030 per hour minimum wage effective January 2025 and expanded Serious Accident Punishment Act coverage. Enhanced corporate governance reporting requirements for KOSPI-listed companies by 2026 will also necessitate greater transparency and adherence to minority shareholder protection standards.

| Legal Area | Key Development/Regulation | Impact on GS Holdings | Relevant Year(s) |

|---|---|---|---|

| Labor Law | Minimum Wage Increase to KRW 10,030/hour | Increased labor costs, need for wage structure review | 2025 |

| Labor Law | Expansion of Serious Accident Punishment Act (SAPA) | Heightened safety compliance requirements, potential penalties | Ongoing |

| Competition Law | FTL Amendments for Merger Reviews & Hearing Procedures | Need for proactive antitrust compliance, especially in retail and construction | 2024 |

| Environmental Law | Carbon Neutrality Target & Emissions Reduction Goals | Mandates for emission control, biofuel blending, potential penalties for non-compliance | 2030, 2050 |

| Corporate Governance | Mandatory Detailed Governance Reports for KOSPI-listed firms | Increased oversight, focus on transparency and minority shareholder rights | 2026 |

Environmental factors

South Korea has set ambitious environmental goals, aiming for carbon neutrality by 2050 and a substantial 40% reduction in greenhouse gas emissions by 2030, measured against 2018 levels. This national commitment directly influences energy-intensive industries and large conglomerates like GS Holdings.

The pressure to decarbonize is particularly acute for GS Holdings' key subsidiaries, GS Caltex and GS Energy. These companies must navigate the transition to lower-carbon operational models and significantly increase investments in technologies that facilitate decarbonization to align with these national targets.

South Korea is aggressively pursuing a renewable energy future, aiming for 21.6% of its total energy mix to come from renewables by 2030. This ambitious target, with a particular focus on expanding solar and wind power capacity, presents a significant opportunity for GS Holdings.

This governmental push creates a compelling environment for GS Holdings to ramp up its investments in renewable energy infrastructure, such as participating in offshore wind and solar power tenders. Such strategic investments are vital for the company to align with national energy transition objectives and to position itself for sustained growth in the evolving energy landscape.

South Korea's vulnerability to escalating extreme weather events, such as intensified typhoons and heatwaves, underscores the critical need for robust climate change adaptation and resilience measures. These shifts directly impact GS Holdings by necessitating a thorough evaluation of climate-related risks affecting its extensive infrastructure, intricate supply chains, and diverse operational segments, including construction and energy.

For GS Holdings, this translates into a strategic imperative to invest in resilient infrastructure and embed sustainable practices throughout its business model. For instance, the company's construction arm must prioritize building designs that can withstand more severe weather, while its energy division needs to secure supply chains against climate-induced disruptions, ensuring continued operations and mitigating potential financial losses.

Circular Economy and Waste Management Initiatives

South Korea is increasingly emphasizing a circular economy and enhanced waste management, a trend that presents both opportunities and challenges for conglomerates like GS Holdings. This focus necessitates a strategic shift towards minimizing waste generation and maximizing resource utilization across its varied business segments, from retail to construction and energy.

The push for sustainability aligns with global Environmental, Social, and Governance (ESG) directives. For GS Holdings, this translates into a need to integrate circular economy principles, such as increased recycling rates and the adoption of eco-friendly materials, into its operational frameworks. For instance, the South Korean government's 2023 targets aimed to boost the recycling rate of construction waste to 85%, a significant undertaking for companies involved in infrastructure development.

- Circular Economy Push: South Korea's national strategy aims to decouple economic growth from resource consumption by promoting reuse, repair, and recycling.

- Waste Management Improvements: Initiatives focus on reducing landfill waste and increasing the efficiency of waste collection and processing systems.

- ESG Alignment: GS Holdings' operations are increasingly scrutinized for their environmental impact, requiring proactive waste reduction and resource efficiency measures.

- Industry Impact: Sectors like construction face pressure to adopt sustainable building materials and manage demolition waste responsibly, with targets for recycling rates influencing procurement and project planning.

ESG Reporting and Sustainability Disclosure

The corporate landscape is increasingly prioritizing environmental, social, and governance (ESG) factors. Listed companies are facing growing requirements to detail their corporate governance, including adherence to key indicators for shareholders, board oversight, and internal audit functions. This heightened focus on ESG reporting signals a significant shift in how businesses are expected to operate and disclose their impact.

While mandatory ESG disclosures have been pushed back to at least 2026, this delay does not diminish the imperative for companies like GS Holdings to proactively bolster their sustainability reporting. Integrating environmental performance metrics into strategic decision-making is becoming a critical element for long-term value creation and risk management.

The global push for sustainability is evident in various market trends. For instance, a 2024 report indicated that over 80% of investors consider ESG factors when making investment decisions. This underscores the financial implications of robust ESG practices and transparent reporting for GS Holdings.

- Shareholder Demand: Investors are increasingly scrutinizing companies' ESG performance, with a significant majority incorporating these factors into their investment strategies.

- Regulatory Evolution: Although specific mandatory ESG disclosure deadlines have shifted, the underlying trend points towards stricter reporting requirements in the near future.

- Strategic Integration: Companies are being pushed to move beyond mere compliance and embed environmental considerations into their core business strategies for competitive advantage.

- Market Expectations: The growing emphasis on sustainability reporting reflects evolving market expectations and the recognition of ESG as a material factor in business success.

South Korea's ambitious environmental agenda, including carbon neutrality by 2050 and a 40% greenhouse gas reduction by 2030, directly impacts GS Holdings' energy-focused subsidiaries, GS Caltex and GS Energy. These entities must accelerate investments in decarbonization technologies and transition to lower-carbon models to meet these national objectives.

The nation's drive towards renewable energy, targeting 21.6% of its energy mix from renewables by 2030, presents a significant growth avenue for GS Holdings. The company is strategically positioned to capitalize on this by increasing investments in solar and wind power projects, aligning with governmental energy transition goals.

South Korea's vulnerability to climate change, evidenced by more frequent extreme weather events, necessitates that GS Holdings fortify its infrastructure and supply chains. This includes adapting construction practices for resilience and securing energy operations against climate-related disruptions to mitigate financial risks.

The growing emphasis on a circular economy and improved waste management requires GS Holdings to integrate sustainable practices across its diverse operations. This includes boosting recycling rates, particularly in construction, with national targets like an 85% recycling rate for construction waste in 2023 influencing operational strategies.

| Environmental Factor | South Korean Target/Trend | Impact on GS Holdings |

|---|---|---|

| Carbon Neutrality | By 2050 | Requires significant investment in low-carbon technologies for GS Energy and GS Caltex. |

| Greenhouse Gas Reduction | 40% by 2030 (vs. 2018) | Drives operational changes and investment in emissions reduction strategies. |

| Renewable Energy Share | 21.6% by 2030 | Creates opportunities for GS Holdings to expand its renewable energy portfolio. |

| Circular Economy | Increased recycling, waste reduction | Prompts adoption of sustainable materials and waste management practices across subsidiaries. |

| Climate Resilience | Adaptation to extreme weather | Necessitates investment in robust infrastructure and supply chain security. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for GS Holdings is meticulously crafted using a blend of publicly available government data, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.