GS Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Holdings Bundle

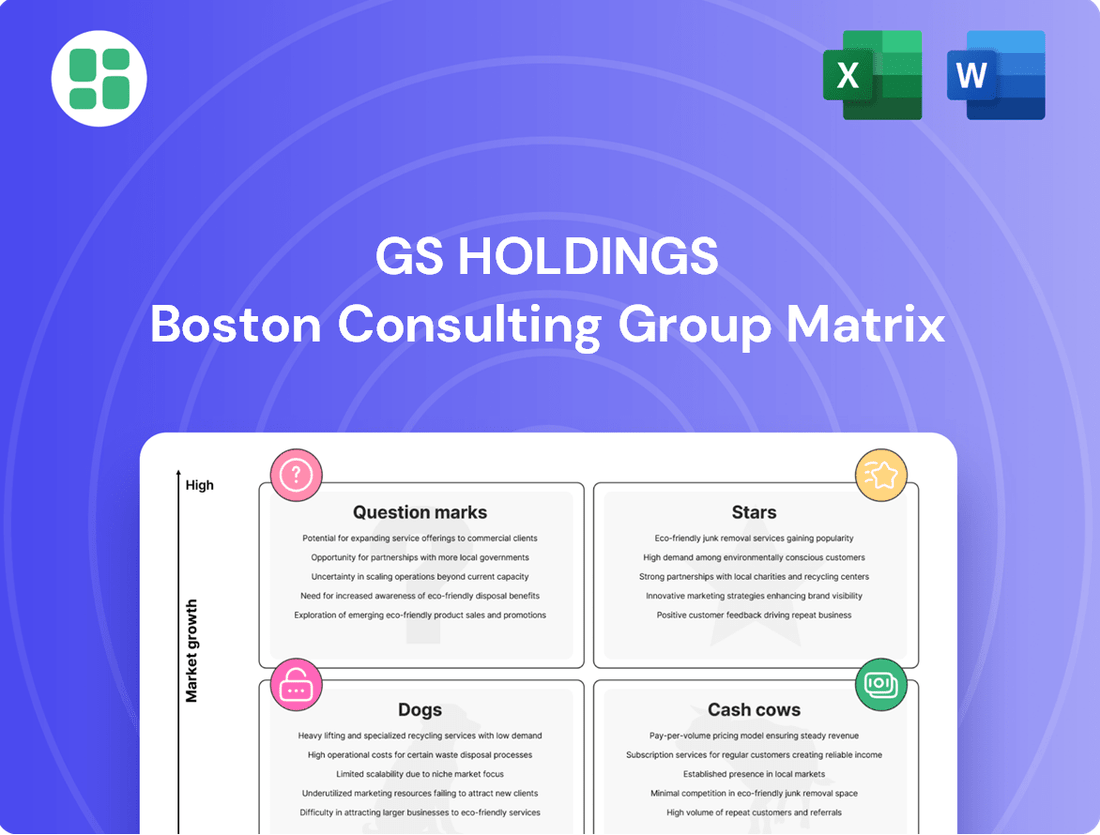

Curious about GS Holdings' strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in terms of market share and growth potential. Understand which segments are fueling growth and which might need a strategic rethink.

Don't settle for a partial view. Purchase the full GS Holdings BCG Matrix to unlock a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks. Gain actionable insights to optimize your investment strategy and drive future success.

Stars

GS Retail's convenience store division, exemplified by GS25, is a clear star in the GS Holdings BCG Matrix. This segment thrives in South Korea's booming convenience store market, which experienced a projected 5.1% growth in 2024, building on a remarkable 10.4% average annual expansion over the last decade.

As a dominant player with a significant market share in this high-growth sector, GS25 consistently delivers strong profitability. Its ongoing expansion and robust financial performance solidify its position as a key revenue generator and a star performer within the broader GS Holdings portfolio.

GS Energy is strategically investing in South Korea's burgeoning renewable energy sector, a market anticipated to expand at a compound annual growth rate of 8.6% in TWh from 2025 to 2033. This focus on solar and wind power development places GS Energy within a dynamic, high-growth segment.

The company's commitment to these initiatives, despite potentially nascent market share, is crucial for its long-term expansion trajectory. These investments directly support South Korea's national decarbonization objectives, signaling a forward-thinking approach to energy infrastructure.

GS E&C's plant division is a star in the GS Holdings BCG Matrix, driven by substantial overseas infrastructure projects. For instance, in 2023, GS E&C secured significant orders for hazardous waste treatment facilities in Saudi Arabia, a key indicator of this division's high-growth trajectory in specialized global niches.

While domestic construction faces challenges, these international industrial projects are crucial for offsetting declines in other business segments. The division's success in securing these large-scale overseas ventures, like the Saudi projects, underscores its strategic importance and future growth potential.

GS Retail's E-commerce and Digital Retail Innovations

GS Retail is making significant strides in the rapidly expanding South Korean e-commerce sector, a market that commanded over 41% of total retail revenue in 2024. This digital push is crucial as the overall retail landscape prioritizes online channels and digital integration.

The company’s strategic investments in digital transformation are evident in initiatives like the Energy Plus app, which integrates services for GS Caltex customers. This move capitalizes on the growing consumer demand for seamless, digitally-enabled experiences.

GS Retail’s approach to converging mobile shopping with social commerce taps into a high-growth segment of the market.

- E-commerce Dominance: South Korean e-commerce captured over 41% of retail revenue in 2024, underscoring its importance.

- Digital Integration: GS Retail’s Energy Plus app exemplifies their strategy to enhance customer experience through digital platforms.

- Social Commerce Focus: The company is leveraging the potential of merging mobile shopping with social media engagement.

- Market Growth: These digital efforts align with the substantial growth trajectory of online and mobile retail in South Korea.

GS Energy's Electric Vehicle (EV) Charging Infrastructure

The global electric vehicle (EV) market is experiencing rapid expansion, with projections indicating continued strong growth through 2030. This surge in EV adoption directly fuels the demand for robust charging infrastructure. GS Energy's strategic focus on developing this network places it at the forefront of a high-growth opportunity.

GS Energy's investments in EV charging infrastructure are designed to capitalize on this burgeoning sector. By establishing a presence early, the company aims to secure a significant market share as EV penetration accelerates globally. For instance, the global EV charging market was valued at approximately USD 25 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 25% in the coming years.

- High Growth Potential: The increasing global adoption of electric vehicles presents a substantial growth opportunity for charging infrastructure providers.

- Strategic Positioning: GS Energy's investments are strategically aligned with the burgeoning EV market, aiming to capture future demand.

- Market Development: While the EV charging market is still evolving, early and strategic investments by GS Energy are intended to establish a strong competitive position.

GS25, GS Retail's convenience store arm, is a prime example of a star in the GS Holdings portfolio. Its dominance in South Korea's convenience store sector, which saw a 5.1% growth in 2024, is a testament to its strong market position and consistent profitability. This segment's robust performance and ongoing expansion make it a key revenue driver.

GS Energy's strategic investments in renewable energy, particularly solar and wind power, position it as a star. With the renewable energy market in South Korea projected for an 8.6% CAGR in TWh from 2025 to 2033, GS Energy is tapping into a high-growth area aligned with national decarbonization goals.

GS E&C's plant division shines as a star due to its success in securing substantial overseas infrastructure projects, such as hazardous waste treatment facilities in Saudi Arabia in 2023. This focus on specialized global niches helps offset challenges in the domestic construction market and highlights its future growth potential.

GS Retail's e-commerce ventures are also star performers, capitalizing on South Korea's digital shift where e-commerce accounted for over 41% of retail revenue in 2024. Initiatives like the Energy Plus app demonstrate a commitment to digital integration and enhancing customer experience in a rapidly growing online market.

GS Energy's expansion into electric vehicle (EV) charging infrastructure is a strategic move into a star market. The global EV charging market, valued at approximately USD 25 billion in 2023, is expected to grow at a CAGR exceeding 25%. Early investments by GS Energy aim to secure a significant share in this rapidly expanding sector.

| GS Holdings Segment | BCG Category | Key Growth Driver | Market Data Point |

|---|---|---|---|

| GS25 (Convenience Stores) | Star | South Korea's expanding convenience store market | 5.1% projected market growth in 2024 |

| GS Energy (Renewable Energy) | Star | Growth in South Korea's renewable energy sector | 8.6% projected CAGR in TWh (2025-2033) |

| GS E&C (Plant Division) | Star | Overseas infrastructure projects | Secured Saudi Arabian projects in 2023 |

| GS Retail (E-commerce) | Star | South Korea's digital retail transformation | 41% of retail revenue in e-commerce (2024) |

| GS Energy (EV Charging) | Star | Global EV adoption and charging infrastructure demand | USD 25 billion market value (2023), >25% expected CAGR |

What is included in the product

This BCG Matrix overview details GS Holdings' product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs for strategic decision-making.

The GS Holdings BCG Matrix provides a clear visual of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

GS Caltex's traditional oil refining and petroleum products segment is a quintessential cash cow for GS Holdings. This business boasts a commanding presence in South Korea's oil market, consistently securing a leading market share. Its impressive streak of 17 consecutive years topping customer satisfaction rankings for gas stations underscores its deep-rooted customer loyalty and operational excellence.

The segment's strength lies in its ability to generate significant and stable cash flows, a hallmark of a cash cow. This is largely attributable to its robust, well-established infrastructure and the enduring demand for essential petroleum products, even amidst the volatility of refining margins. For instance, in 2023, GS Caltex reported operating profit of 1.8 trillion KRW, demonstrating the resilience and profitability of its core refining business.

GS Energy's conventional power generation, encompassing LNG and nuclear, acts as a strong Cash Cow within GS Holdings' portfolio. These operations, managed by subsidiaries such as GS EPS and GS E&R, are cornerstones of South Korea's energy infrastructure, providing reliable base-load power.

Despite operating in a mature, low-growth market, these assets consistently generate substantial and stable cash flows. For instance, in 2023, GS EPS reported operating profits of approximately ₩345 billion, demonstrating the robust cash-generating capability of its LNG power generation business.

GS Retail's established supermarket and hypermarket operations are firmly positioned as Cash Cows within the company's BCG Matrix. While the broader retail sector experiences slower growth, these mature formats, such as GS Supermarket and GS The Fresh, continue to command substantial market share, demonstrating resilience in providing daily consumer needs.

These operations are vital for generating consistent and predictable cash flow, even with lower growth potential compared to newer ventures like convenience stores. In 2023, GS Retail's total revenue reached approximately 13.2 trillion KRW, with its retail division, encompassing these established formats, forming a significant portion of this figure, underscoring their role as reliable income generators.

GS E&C's Domestic Housing and Building Construction (Completed/Ongoing Profitable Projects)

GS E&C's domestic housing and building construction segment is a cornerstone of GS Holdings' portfolio, consistently ranking among South Korea's leading construction firms. This established strength translates into a robust and diverse project pipeline, ensuring sustained revenue streams even amidst market fluctuations.

Despite current headwinds in the residential sector, GS E&C benefits from the completion of several high-value housing developments. Furthermore, a significant backlog of ongoing projects provides a predictable and stable source of cash flow, solidifying its position as a cash cow.

- Market Leadership: GS E&C consistently holds a top-tier position in South Korea's construction industry, evidenced by its extensive project completions.

- Revenue Stability: The company's large order backlog, estimated to be in the tens of trillions of Korean Won, guarantees consistent revenue generation.

- Profitability: The successful delivery of high-cost housing projects contributes significantly to the segment's profitability and cash inflows.

- Resilience: Despite short-term residential market challenges, GS E&C's diversified project base and strong execution capabilities ensure ongoing operational success.

GS Global's Traditional Trading and Distribution Business

GS Global's traditional trading and distribution business is a cornerstone of GS Holdings, functioning as a classic Cash Cow within its portfolio. This segment thrives on the high-volume, steady flow of commodities and industrial materials, benefiting from deeply entrenched networks and long-standing client relationships. While the market for these goods is mature and often characterized by thin margins, the sheer scale of operations ensures a reliable and significant contribution to the group's overall financial health.

In 2024, GS Global's trading and distribution arm continued to demonstrate its resilience. For instance, the company reported significant activity in steel trading, a key commodity, with volumes remaining robust despite global economic fluctuations. This consistent performance is vital, as the cash generated here underpins investments in other, potentially higher-growth, but riskier ventures within the GS Holdings umbrella.

- Stable Revenue Generation: The business consistently generates substantial revenue through its high-volume trading activities.

- Mature Market Operations: Operates within established markets, leveraging existing infrastructure and expertise.

- Low-Margin, High-Volume Strategy: Focuses on efficient, large-scale transactions to achieve profitability.

- Financial Support for Diversification: Provides crucial cash flow to fund innovation and growth in other business units.

GS Holdings' established businesses, like GS Caltex's refining and GS Energy's conventional power, are prime examples of cash cows. These mature operations benefit from consistent demand and strong market positions, generating stable profits. GS Retail's supermarkets and GS Global's trading also fit this profile, providing reliable cash flow despite slower growth prospects.

| Business Segment | Key Characteristic | 2023 Financial Highlight (Approx.) | BCG Matrix Role |

|---|---|---|---|

| GS Caltex (Refining) | Dominant market share, customer loyalty | Operating Profit: 1.8 trillion KRW | Cash Cow |

| GS Energy (Conventional Power) | Reliable base-load power provider | GS EPS Operating Profit: ₩345 billion | Cash Cow |

| GS Retail (Supermarkets/Hypermarkets) | Established formats, consistent demand | Total Revenue: 13.2 trillion KRW (Retail division significant portion) | Cash Cow |

| GS E&C (Domestic Construction) | Strong project pipeline, market leadership | Large order backlog (tens of trillions KRW) | Cash Cow |

| GS Global (Trading & Distribution) | High-volume, steady commodity flow | Robust steel trading volumes in 2024 | Cash Cow |

Full Transparency, Always

GS Holdings BCG Matrix

The GS Holdings BCG Matrix preview you are viewing is the identical, fully editable document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional, ready-to-use report.

Dogs

Underperforming traditional retail formats within GS Retail, such as older hypermarket branches or department store formats, are likely categorized as cash traps in the BCG Matrix. These segments grapple with slowing growth in the South Korean retail market, facing intense competition and declining profitability.

For instance, while specific GS Retail data isn't public for this precise categorization, the South Korean department store sector, a proxy for traditional retail, saw sales growth of only 1.5% in the first half of 2024, a significant slowdown from previous years. This indicates a challenging environment for legacy formats.

GS E&C's domestic residential developments are currently facing headwinds within the South Korean market. The sector is experiencing a contraction, evidenced by a notable decrease in building permits issued, signaling a slowdown in new construction activity.

Compounding this challenge is a rising inventory of unsold homes, creating a more competitive environment for developers. GS E&C's older or less strategically positioned residential projects, particularly those with high development costs or slow sales, could be classified as underperforming assets within the BCG matrix.

These projects may be generating low returns relative to the capital invested, reflecting the current market contraction. For instance, as of early 2024, the number of unsold new apartments across South Korea had surpassed 70,000 units, a significant increase from previous years.

Obsolete or Non-Strategic Conventional Energy Assets represent entities with low market share and low growth prospects. In South Korea's decarbonization drive, older coal-fired power plants that are not being upgraded or repurposed for cleaner fuels fall into this category. These assets face declining demand and increasing regulatory pressure, leading to high operating costs and a diminishing future value.

Any Divested or Liquidated Non-Core Business Units (historically)

Any divested or liquidated non-core business units, historically, would fall under the Dogs category in the GS Holdings BCG Matrix. These are typically operations that have a low market share and operate in a low-growth market, offering little potential for future profitability or strategic advantage. For instance, if GS Holdings had previously divested a small, underperforming subsidiary in a mature industry with minimal competitive differentiation, it would exemplify a Dog.

These units are often exited to free up capital and management focus for more promising ventures. The principle of divesting such units applies across the conglomerate, including its South Korean operations, as a strategy to streamline the business portfolio. While specific historical examples for South Korea are not publicly detailed in this context, the classification represents a common corporate strategy for managing underperforming assets.

The decision to divest is usually driven by consistent low market share and a lack of growth prospects. This proactive approach helps GS Holdings to shed unprofitable ventures and reallocate resources towards areas with higher potential returns, thereby improving overall portfolio performance.

Small-Scale, Unsuccessful Diversification Ventures

Small-scale, unsuccessful diversification ventures, often referred to as Dogs in the BCG Matrix, represent investments that GS Holdings might have made but which failed to achieve significant market share or growth. These could be minor, non-core projects that didn't gain traction.

While specific disclosures on such ventures are limited for conglomerates like GS Holdings, it's common for them to pilot various initiatives. For instance, a failed attempt to enter a niche market with a new product line, or an investment in a struggling startup that didn't meet expectations, could fall into this category. These ventures typically operate in low-growth industries and have a weak competitive position.

- Low Market Share: These ventures struggle to capture a meaningful portion of their target market.

- Low Growth Prospects: The industries these ventures operate in are typically mature or declining, offering little room for expansion.

- Resource Drain: They often consume management attention and capital without generating substantial returns, potentially hindering investment in more promising areas.

- Potential Divestment: Companies often consider divesting or shutting down these "dog" businesses to reallocate resources more effectively.

Businesses classified as Dogs within GS Holdings' portfolio are those with a low market share in slow-growing industries. These ventures typically struggle to generate significant profits and may even drain resources. Examples include underperforming traditional retail formats, older energy assets facing regulatory pressure, or past diversification attempts that failed to gain traction.

These "dog" units often represent a drag on overall company performance, consuming capital and management attention without delivering commensurate returns. South Korea's retail sector, for instance, saw department store sales grow by a modest 1.5% in the first half of 2024, highlighting the challenges for legacy formats within GS Retail.

The strategy for such units is often divestment or liquidation to free up capital for more promising investments. This approach is crucial for optimizing the company's portfolio and enhancing overall profitability.

GS E&C's older residential projects, particularly those with high costs and slow sales, can also be categorized as Dogs, especially given the over 70,000 unsold new apartments in South Korea as of early 2024.

| Business Unit Example | Market Share | Market Growth | Profitability | BCG Category |

|---|---|---|---|---|

| Underperforming Hypermarkets (GS Retail) | Low | Low | Low/Negative | Dog |

| Obsolete Coal Power Plants (GS Energy) | Low | Declining | Low/Negative | Dog |

| Unsuccessful Niche Product Ventures (Various Subsidiaries) | Low | Low | Low/Negative | Dog |

| Older Residential Developments (GS E&C) | Low (in specific segments) | Low | Low | Dog |

Question Marks

GS Caltex's foray into Sustainable Aviation Fuel (SAF) positions it within a nascent yet rapidly expanding market, driven by stringent global decarbonization mandates. The company's investments in SAF production and associated feedstock projects underscore a strategic commitment to this high-growth sector.

While the SAF market is poised for significant expansion, its current share remains relatively small. GS Caltex faces the challenge of substantial capital investment required to scale its operations effectively and secure a leading position in this evolving industry.

GS Energy views hydrogen as a critical growth engine, aligning with South Korea's ambitious clean energy goals. The company is strategically investing in the entire hydrogen value chain, from production to distribution and utilization, aiming to capture future market share.

This segment is currently a question mark for GS Energy. While the global hydrogen market is projected to reach hundreds of billions of dollars by 2030, with significant growth expected in South Korea, GS Energy's current market penetration in this nascent sector is minimal. Their substantial investments in hydrogen hubs and related infrastructure signal a belief in high future growth potential, but success hinges on technological advancements and widespread market acceptance.

GS Energy is strategically investing in battery recycling and next-generation battery technologies as a core component of its electrification push. These sectors are experiencing explosive growth and rapid technological advancements, driven by the global shift towards sustainable energy solutions.

While these emerging areas offer significant long-term potential, GS Energy's current market presence is likely nascent. For example, the global battery recycling market, projected to reach over $30 billion by 2030, is still developing, with GS Energy aiming to carve out a niche. Similarly, next-generation battery technologies like solid-state batteries are in early commercialization phases, presenting both opportunity and significant investment hurdles.

GS Holdings' Ventures into Deep Tech/Biotech Investments

GS Holdings' deep tech and biotech ventures, targeting areas like infectious diseases and neurology, are classified as Stars or Question Marks within its BCG Matrix. These investments are characterized by their presence in rapidly expanding markets with substantial long-term potential, though currently, they command a modest market share. For instance, the global biotech market was valued at approximately $1.77 trillion in 2023 and is projected to grow significantly, offering fertile ground for these early-stage, high-risk, high-reward plays.

- High Growth Potential: Investments in sectors like infectious disease diagnostics and treatments, which saw increased funding and research post-2020, represent significant growth opportunities.

- Early-Stage Focus: Many of these ventures are in their nascent stages, mirroring the characteristics of Question Marks, requiring substantial capital infusion for development and market penetration.

- Market Position: While GS Holdings' current market share in these specific niches might be low, the overall market size and projected growth, such as the neurology market expected to reach $150 billion by 2027, indicate strong future potential.

- Risk and Reward: These investments carry inherent risks due to technological uncertainties and regulatory hurdles but offer the potential for substantial returns if successful, aligning with the high-risk, high-reward profile of Stars or emerging Stars.

GS E&C's Advanced Smart City and Modular Construction Solutions

GS E&C's advanced smart city and modular construction solutions are positioned as potential stars within the GS Holdings BCG Matrix. The South Korean construction sector is experiencing a notable uptick in demand for innovative approaches like modular housing and smart city infrastructure.

While the broader construction market might show varied growth, these technologically advanced niches are showing significant promise for expansion. GS E&C's investments in these areas, although not yet market leaders, signify a strategic move to secure a strong position in the evolving market landscape.

- Market Growth Potential: The global smart city market is projected to reach $2.56 trillion by 2026, indicating substantial growth opportunities for companies like GS E&C.

- Modular Construction Adoption: In 2024, the modular construction market is expected to grow by 6.7%, driven by demand for faster, more sustainable building solutions.

- GS E&C's Strategic Focus: The company's participation in projects like the Busan Eco Delta City, a smart city initiative, demonstrates its commitment to these high-growth segments.

GS Holdings' investments in areas like hydrogen and battery recycling are currently classified as Question Marks. These ventures operate in rapidly expanding markets with significant future potential, yet GS Holdings' current market share in these segments is minimal.

While the global hydrogen market is projected to grow substantially, and the battery recycling market is also expanding, GS Holdings is in the early stages of establishing its presence. Their strategic investments aim to capitalize on future growth, but success depends on technological advancements and market acceptance.

These segments represent high-risk, high-reward opportunities. The significant capital required for scaling operations and the inherent technological uncertainties place them firmly in the Question Mark category of the BCG Matrix.

GS Holdings' ventures in deep tech and biotech, focusing on areas like infectious diseases and neurology, also fall into the Question Mark category. These are high-growth markets, with the global biotech market valued at approximately $1.77 trillion in 2023, but GS Holdings' current market share in these specific niches is modest.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.