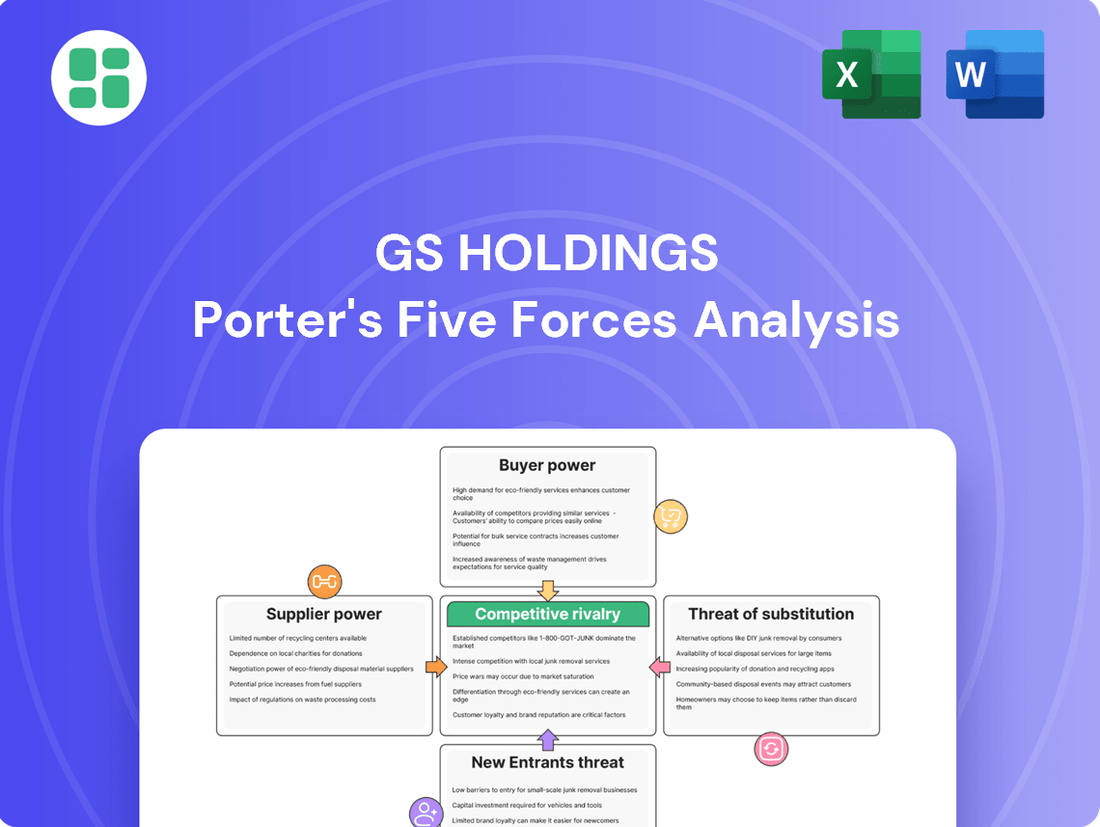

GS Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Holdings Bundle

GS Holdings faces a dynamic competitive landscape, with moderate bargaining power from both buyers and suppliers potentially impacting profitability. The threat of new entrants is a key consideration, as is the intensity of rivalry within its operating sectors.

The complete report reveals the real forces shaping GS Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Commodity price volatility significantly impacts GS Holdings, particularly within its energy sector. For instance, fluctuations in crude oil prices directly affect the cost of inputs for its petrochemical businesses. In 2024, Brent crude oil prices have seen considerable swings, trading in a range that can substantially alter GS Holdings' operating expenses and profitability.

This exposure means GS Holdings’ energy generation and petrochemical divisions are susceptible to price shocks. When raw material costs surge due to supply disruptions or increased global demand, the company's profit margins can be compressed. For example, a sharp increase in natural gas prices in early 2024 directly impacted the cost of electricity generation for utilities.

The bargaining power of suppliers in these commodity markets is often amplified by factors outside of GS Holdings' influence. Geopolitical events and global economic trends dictate supply and demand, giving suppliers leverage over pricing. This makes it challenging for GS Holdings to secure stable, predictable input costs.

GS Holdings' reliance on specialized equipment and advanced technology, especially in its energy and advanced manufacturing segments within construction, means suppliers in these niches can hold considerable sway. For instance, if a key supplier of advanced drilling equipment for GS Energy has few competitors, their pricing power increases.

The proprietary nature of certain technological solutions further concentrates this power. If GS Engineering & Construction needs a unique, patented component for a major infrastructure project, the supplier of that component has a strong hand in negotiations, especially if switching to an alternative would require significant redesign and delays.

High switching costs are a critical factor. For example, integrating a new, specialized robotic arm in a GS E&C manufacturing facility involves not just the purchase price but also training, software compatibility, and potential downtime, making it costly to switch suppliers mid-project or for ongoing operations.

The construction and services industries, where GS E&C operates, are grappling with a significant shortage of skilled labor in South Korea. This scarcity directly translates to higher labor costs and the potential for project timelines to slip, giving skilled workers and specialized recruitment agencies more leverage.

In 2023, South Korea's construction sector experienced a notable deficit in skilled workers, with some reports indicating a shortfall of over 100,000 individuals. This trend is expected to persist, impacting project execution and profitability for companies like GS Holdings.

Consequently, GS Holdings must prioritize strategies for attracting and retaining qualified personnel to effectively counter the increased bargaining power of this crucial supplier group, ensuring operational efficiency and project success.

Construction Material Costs

The construction division of GS Holdings, particularly GS E&C, faces significant vulnerability due to the escalating costs of essential building materials. Global supply chain snags, robust demand, and persistent inflation all contribute to suppliers’ ability to dictate higher prices, directly squeezing project margins and potentially delaying crucial construction timelines for the company. For instance, in 2024, lumber prices saw considerable volatility, with futures contracts for key grades experiencing fluctuations of over 15% within a single quarter due to a combination of strong housing market demand and ongoing logistical challenges.

- Volatile Material Prices: GS Holdings' construction projects are directly impacted by price swings in key materials like steel, concrete, and lumber.

- Supply Chain Disruptions: Events such as geopolitical tensions or natural disasters can disrupt supply, giving suppliers more leverage to increase prices.

- Inflationary Pressures: Broad economic inflation in 2024 has broadly increased input costs across the construction sector, affecting raw material sourcing.

- Impact on Profitability: Higher material expenses can significantly erode the profit margins on GS E&C's fixed-price contracts, requiring careful cost management.

Logistics and Distribution Services

For GS Holdings, efficient logistics and distribution are absolutely crucial, particularly for its retail and energy sectors. Suppliers offering transportation, warehousing, and last-mile delivery services hold significant bargaining power. This leverage increases when there are few alternative providers or when these suppliers control essential distribution channels. The cost and dependability of these logistics services directly impact GS Holdings ability to offer competitive pricing and ensure timely deliveries across its diverse operations.

In 2024, the global logistics market was valued at approximately $10.7 trillion, highlighting the substantial economic influence of these service providers. For companies like GS Holdings, which rely heavily on complex supply chains, the bargaining power of logistics suppliers can translate into increased operational costs if not managed effectively. For instance, a surge in fuel prices, a common occurrence in 2024, directly impacts transportation costs, giving trucking and shipping companies more leverage.

- Limited Alternatives: In certain regions or for specialized delivery needs, GS Holdings might face a limited pool of qualified logistics partners, increasing supplier power.

- Network Control: Suppliers who own and operate critical infrastructure, such as large warehouse networks or specialized cold chain facilities, can command higher prices.

- Cost Sensitivity: The significant portion of operating expenses attributed to logistics means that even small increases in supplier rates can impact GS Holdings' profitability and pricing strategies.

- Reliability Demands: The need for consistent and timely delivery in both retail and energy sectors makes GS Holdings dependent on reliable logistics, further strengthening the bargaining position of dependable suppliers.

The bargaining power of suppliers for GS Holdings is substantial, particularly in commodity markets and specialized equipment sectors. Fluctuations in raw material prices, like crude oil and lumber, directly impact GS Holdings' energy and construction divisions. For example, Brent crude oil prices in 2024 have exhibited significant volatility, affecting petrochemical input costs.

Suppliers of specialized technology and proprietary components also hold considerable sway, especially when switching costs are high, as seen with advanced drilling equipment for GS Energy. Furthermore, the scarcity of skilled labor in South Korea's construction sector, with a reported shortfall of over 100,000 individuals in 2023, amplifies the bargaining power of these essential human resources for GS E&C.

Logistics providers also exert significant influence, especially when limited alternatives exist or when they control critical distribution channels. The global logistics market, valued at approximately $10.7 trillion in 2024, underscores the economic power of these service providers, with fuel price surges in 2024 directly impacting transportation costs.

| Supplier Type | Impact on GS Holdings | Key Factors | 2024 Data/Trend |

|---|---|---|---|

| Commodity Suppliers (Energy, Materials) | Input cost volatility, margin compression | Geopolitical events, global demand, supply disruptions | Brent crude oil price swings; lumber price volatility over 15% quarterly |

| Specialized Equipment/Technology Providers | Pricing leverage, potential project delays | Proprietary nature, high switching costs | Dependence on unique patented components for infrastructure projects |

| Skilled Labor Providers | Increased labor costs, project timeline risks | Labor shortages, specialized recruitment needs | South Korea construction labor shortfall >100,000 in 2023 |

| Logistics and Distribution Services | Increased operational costs, delivery reliability | Limited alternatives, network control, cost sensitivity | Global logistics market ~$10.7 trillion; fuel price impacts on transport costs |

What is included in the product

This analysis delves into the competitive forces impacting GS Holdings, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis for GS Holdings, offering actionable insights into market pressures.

Customers Bargaining Power

GS Holdings caters to a wide array of customers, from everyday shoppers at its GS25 convenience stores to major industrial partners in its energy and construction sectors. This broad customer base can significantly reduce the overall bargaining power of any single customer group, as their individual impact on GS Holdings' total revenue is often limited.

For instance, while individual consumers at GS25 might be price-sensitive, their purchasing power is dispersed across millions of transactions. Conversely, large industrial clients in sectors like energy or construction represent substantial revenue streams, granting them more leverage, though their needs are often project-specific and less about day-to-day price negotiation.

In 2024, GS Retail, a key subsidiary, reported revenue of approximately 13.5 trillion KRW, highlighting the sheer volume of individual transactions that underpin its consumer-facing businesses. This scale, while empowering individual consumers to some extent, diffuses their collective bargaining strength against the conglomerate.

In South Korea's retail sector, particularly during periods of economic flux, consumers display significant price sensitivity. This consumer behavior grants them considerable leverage, compelling companies like GS Retail to engage in competitive pricing strategies and frequent promotional activities to attract and retain shoppers.

The proliferation of online retail platforms and the widespread accessibility of convenience stores significantly amplify this customer bargaining power. Consumers can effortlessly compare prices across various channels, making it easier for them to switch to more cost-effective alternatives. For instance, in 2023, online retail sales in South Korea reached approximately 220 trillion KRW, highlighting the digital shift and the ease of price comparison available to consumers.

GS Holdings' energy and construction divisions frequently engage with substantial industrial clients and government bodies. These large buyers, due to their significant order volumes and advanced procurement methods, possess considerable power to negotiate better pricing and contract terms. For instance, in 2024, major infrastructure projects often involved competitive bidding processes where clients could leverage economies of scale to secure advantageous deals, impacting GS Holdings' margin potential.

Low Switching Costs for Certain Services

In segments like consumer retail, customers often face minimal costs when switching providers. This makes it easier for them to move to a competitor if they find a better deal, thereby enhancing their bargaining power. For instance, in 2024, the average consumer in the retail sector reported being willing to switch brands for a discount of just 10% or less, highlighting the sensitivity to price.

This low switching cost environment means businesses must actively work to retain customers. Strategies such as loyalty programs and unique product or service differentiation become crucial. Companies that successfully implement these can mitigate the impact of price-sensitive customers. In 2023, businesses with robust loyalty programs saw an average increase of 15% in customer retention rates compared to those without.

- Low Switching Costs: Customers can easily shift between providers in certain service areas.

- Price Sensitivity: A small price difference can trigger customer migration.

- Retention Strategies: Loyalty programs and service differentiation are vital for keeping customers.

- Impact on Power: Ease of switching directly amplifies customer bargaining power.

Information Transparency and Access

The digital age has dramatically shifted the balance of power towards customers, largely due to unprecedented information transparency. Consumers now have instant access to detailed product specifications, competitive pricing, and a wide array of alternative offerings. This accessibility means customers are better equipped to make informed decisions and can more effectively negotiate or switch to rivals.

This enhanced transparency directly impacts GS Holdings by increasing customer bargaining power. For instance, in the electronics sector, a significant portion of consumer purchasing decisions in 2024 were influenced by online reviews and price comparison websites, with studies indicating over 80% of consumers checking prices online before making a purchase. This trend forces companies like GS Holdings to maintain competitive pricing and high product quality to retain market share.

- Information Access: Customers can easily research product features, read reviews, and compare prices across multiple vendors, significantly reducing information asymmetry.

- Price Sensitivity: Greater transparency often leads to increased price sensitivity, as customers can readily identify the lowest-cost options.

- Switching Costs: While switching costs can vary, the ease of finding information about alternatives can lower perceived switching barriers for customers.

- Online Influence: Platforms like Amazon, Google Shopping, and specialized review sites empower customers by aggregating and presenting comparative data, directly influencing purchasing behavior.

GS Holdings faces moderate bargaining power from its customers, particularly in consumer-facing segments like retail due to low switching costs and high price sensitivity. The vast number of individual customers in GS Retail's operations, which saw revenues around 13.5 trillion KRW in 2024, diffuses individual power, but collective action or widespread preference shifts can still exert pressure. Conversely, large industrial clients in energy and construction can negotiate more forcefully due to higher transaction volumes, though their needs are often project-specific. The ease of comparing prices online, with South Korea's online retail sales reaching approximately 220 trillion KRW in 2023, further amplifies customer leverage, compelling GS Holdings to maintain competitive pricing and value propositions.

| Segment | Customer Type | Bargaining Power Level | Key Drivers | Relevant 2023/2024 Data |

|---|---|---|---|---|

| Retail (GS25) | Individual Consumers | Moderate to High | Low switching costs, high price sensitivity, information transparency | GS Retail revenue ~13.5 trillion KRW (2024); Online retail sales ~220 trillion KRW (2023) |

| Energy & Construction | Industrial Clients, Government Bodies | High | Large order volumes, project-specific needs, competitive bidding | Major infrastructure projects often involve competitive bidding (2024) |

What You See Is What You Get

GS Holdings Porter's Five Forces Analysis

This preview showcases the complete GS Holdings Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the company. You're viewing the exact document that will be delivered instantly upon purchase, offering a comprehensive examination of industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. This professionally formatted analysis is ready for your immediate use, providing actionable insights without any placeholders or mockups.

Rivalry Among Competitors

The South Korean retail landscape is a battlefield, densely populated with both established domestic giants and ambitious international entrants. This fragmentation means GS Retail, particularly its ubiquitous GS25 convenience stores, contends with a multitude of rivals, including CU, Emart24, and even the burgeoning online grocery platforms. In 2023, the South Korean convenience store market alone was valued at approximately 30 trillion KRW, underscoring the sheer scale of the competition.

While the energy sector might seem to have fewer players than consumer-facing industries, the competition among the giants can be incredibly intense. Established companies are constantly battling to secure lucrative long-term contracts, which are vital for predictable revenue streams.

In 2024, major energy firms are not just competing on the traditional metrics of operational efficiency and reliability; they are increasingly vying for market share based on their investments and progress in renewable energy technologies. This shift is driven by global decarbonization efforts and changing regulatory landscapes.

The ongoing transition to cleaner energy sources adds a significant layer of complexity and rivalry. Companies that effectively integrate and scale up their renewable portfolios, such as solar and wind power, are gaining a competitive edge, as evidenced by the substantial growth in renewable energy investments reported throughout 2024.

The South Korean construction sector experiences intense rivalry, heavily influenced by economic cycles and the nature of project-based bidding. GS E&C faces strong competition from both established domestic players and international construction giants vying for major infrastructure, commercial building, and housing developments. This competitive landscape is further sharpened by the current downturn in the domestic residential market, coupled with escalating material and labor costs, which forces companies to compete more aggressively for a shrinking pool of profitable projects.

Diversified Conglomerate Rivalry

GS Holdings, a major South Korean conglomerate, faces intense competition from other similarly diversified groups, known as chaebols. This rivalry isn't confined to specific industries but spans across talent acquisition, strategic capital allocation, and the broader pursuit of market dominance, making the competitive landscape particularly intricate.

These large conglomerates often leverage synergies across their diverse business units, creating a powerful competitive advantage. For instance, a conglomerate with strong presence in both construction and energy might cross-promote services or secure integrated projects, a tactic that smaller, specialized firms find challenging to replicate.

- Inter-Conglomerate Competition: GS Holdings contends with rivals like Samsung, Hyundai, and LG, all of which possess vast resources and operate across multiple sectors, including electronics, automotive, construction, and retail.

- Talent Wars: The competition for top-tier engineering, management, and research talent is fierce, with conglomerates often offering comprehensive benefits and career advancement opportunities to attract and retain skilled professionals.

- Strategic Investment Battles: Major investment decisions, whether in new technologies, overseas expansion, or mergers and acquisitions, often see these conglomerates vying for the same strategic targets, driving up acquisition costs and intensifying market consolidation efforts.

Innovation and Digital Transformation Race

Competitive rivalry across GS Holdings' diverse sectors, from retail to energy, is intensifying due to a relentless pursuit of innovation and digital transformation. Companies are actively investing in cutting-edge technologies to differentiate themselves and capture market share.

Competitors are strategically deploying data analytics and artificial intelligence to optimize operations, create bespoke customer journeys, and pioneer novel revenue streams. For instance, in the retail sector, early adopters of AI-powered personalization saw significant increases in customer engagement and sales. In 2024, companies that effectively integrated AI into their supply chains reported an average of 15% reduction in operational costs.

- Digital Adoption Rates: Sectors like e-commerce and fintech are seeing rapid adoption of digital tools, with global e-commerce sales projected to reach $7.4 trillion by 2025, up from an estimated $6.3 trillion in 2024.

- AI Investment: Global spending on AI is expected to surge, with businesses allocating substantial budgets to AI-driven solutions in 2024, aiming for efficiency gains and new product development.

- Customer Experience Focus: Companies leveraging data analytics for personalized customer experiences are reporting higher retention rates, with some studies showing a 10-15% improvement in loyalty among digitally engaged customers.

- New Business Models: The digital shift is enabling the emergence of subscription-based services and platform economies, challenging traditional revenue models across various industries.

GS Holdings operates in highly competitive markets, facing intense rivalry from both domestic conglomerates and international players. This competition is amplified by the drive for innovation and digital transformation, with companies leveraging AI and data analytics to gain an edge. For instance, in 2024, businesses integrating AI into their supply chains reported an average 15% reduction in operational costs, highlighting the impact of technological adoption on competitive positioning.

| Industry Sector | Key Competitors | Competitive Intensity Driver |

|---|---|---|

| Retail | CU, Emart24, Online Grocery Platforms | Market fragmentation, digital adoption |

| Energy | Major Energy Firms (e.g., SK Energy, S-Oil) | Renewable energy investments, long-term contracts |

| Construction | Samsung C&T, Hyundai Engineering & Construction | Economic cycles, project bidding, cost pressures |

| Conglomerate-wide | Samsung, Hyundai, LG | Synergies, talent acquisition, strategic investments |

SSubstitutes Threaten

The increasing global and domestic focus on sustainability and carbon neutrality presents a substantial threat of substitution to GS Holdings' established fossil fuel operations. Renewable energy sources, including solar, wind, and nuclear power, are rapidly evolving into cost-effective and practical alternatives for generating electricity.

Government policies worldwide are actively promoting this shift; for instance, the U.S. Inflation Reduction Act of 2022 allocated significant incentives for clean energy, and many nations have set ambitious net-zero targets by 2050. Technological advancements continue to drive down the levelized cost of electricity for renewables, making them increasingly competitive with traditional energy sources.

The escalating dominance of e-commerce platforms, such as Amazon and Alibaba, poses a significant threat of substitution for GS Holdings' physical retail presence. In 2024, global e-commerce sales are projected to reach over $6.5 trillion, a figure that underscores the massive shift in consumer purchasing habits towards online channels.

Consumers are increasingly drawn to the unparalleled convenience, extensive product selection, and competitive pricing that online retailers consistently offer. This trend directly erodes the market share and customer loyalty for traditional brick-and-mortar stores.

Consequently, GS Holdings must actively pursue and enhance omnichannel strategies, integrating online and offline experiences, and invest in creating unique, engaging in-store experiences to counter the allure of digital alternatives and retain its customer base.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional on-site building methods. These off-site construction techniques, which saw considerable growth and innovation leading up to 2024, offer compelling advantages like accelerated project timelines and potentially lower labor expenses. For instance, the global modular construction market was projected to reach over $200 billion by 2025, indicating a substantial and growing alternative to conventional approaches.

Alternative Transportation Fuels/Modes

The increasing adoption of electric vehicles (EVs) presents a significant threat of substitution for GS Holdings' traditional fuel offerings. By the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, indicating a clear shift in consumer preference and technological advancement in the transportation sector.

Beyond EVs, the development and growing availability of hydrogen fuel cell technology for vehicles also represent a potential substitute, particularly for heavy-duty transport where range and refueling time are critical factors. This evolving landscape demands proactive adaptation from GS Holdings.

- EV Market Growth: Global EV sales reached approximately 13.6 million in 2023, up from around 10 million in 2022.

- Hydrogen Infrastructure Investment: Several countries are investing billions in hydrogen fueling infrastructure, with Germany alone targeting 4,000 hydrogen refueling stations by 2030.

- Public Transit Enhancements: Cities worldwide are expanding and modernizing public transportation systems, aiming to reduce reliance on personal vehicles and, consequently, their fuel consumption.

DIY and Digital Service Platforms

The rise of DIY solutions and digital service platforms poses a significant threat to GS Holdings, especially in areas like maintenance and administrative support. Customers can increasingly bypass traditional service providers by leveraging online marketplaces or undertaking tasks themselves. For instance, the global DIY home improvement market was valued at over $150 billion in 2023 and is projected to grow, indicating a strong customer appetite for self-service options.

These digital platforms, often featuring lower overheads, can offer services at more competitive price points. This directly challenges GS Holdings' ability to maintain its market share if its value proposition isn't clearly articulated and differentiated. The convenience and accessibility of these alternatives mean GS Holdings must focus on enhancing its service quality, offering unique expertise, and providing superior customer experiences to retain clients.

- DIY Adoption: Growing consumer comfort with self-service in areas like home repair and basic business administration reduces demand for traditional service providers.

- Digital Platform Growth: Online platforms connecting clients directly with freelance professionals or offering automated solutions are increasingly prevalent across various service sectors.

- Price Sensitivity: The often lower cost of DIY or platform-based services puts pressure on GS Holdings’ pricing strategies.

- Value Differentiation: GS Holdings must highlight its advantages, such as specialized knowledge, reliability, and integrated solutions, to counter the threat of substitutes.

The threat of substitutes for GS Holdings is multifaceted, impacting its core energy, retail, and service operations. In the energy sector, renewable sources like solar and wind are increasingly cost-competitive, supported by government incentives such as the U.S. Inflation Reduction Act of 2022. Similarly, the transportation sector is shifting towards electric vehicles, with global sales exceeding 13.6 million units in 2023, and hydrogen fuel cell technology also emerging as a viable alternative.

GS Holdings faces substitution threats from e-commerce, which is projected to exceed $6.5 trillion in global sales in 2024, and from modular construction, a market anticipated to surpass $200 billion by 2025. Furthermore, the rise of DIY solutions and digital service platforms, with the DIY home improvement market valued at over $150 billion in 2023, challenges traditional service provision.

| Industry Segment | Substitute Threat | Key Data Point (2023-2024) | Impact on GS Holdings |

|---|---|---|---|

| Energy | Renewable Energy (Solar, Wind) | IRA 2022 incentives; growing cost-competitiveness | Reduced demand for fossil fuels |

| Transportation | Electric Vehicles (EVs) | 13.6M+ global sales (2023); Hydrogen fuel cell development | Decreased demand for traditional fuels |

| Retail | E-commerce | Projected $6.5T+ global sales (2024) | Erosion of physical store market share |

| Construction | Modular/Prefabricated Construction | Projected $200B+ market (2025) | Shift away from traditional on-site building |

| Services | DIY & Digital Platforms | $150B+ DIY market (2023); Online service marketplaces | Decreased demand for traditional service providers |

Entrants Threaten

High capital intensity acts as a significant deterrent for new players. Sectors such as energy generation, large-scale construction, and building a nationwide retail presence demand enormous upfront financial commitments. For instance, the cost of constructing a single modern power plant can easily run into billions of dollars, a sum that deters many potential entrants. Similarly, establishing a widespread distribution network for consumer goods involves substantial investment in logistics, warehousing, and retail outlets, creating a high barrier to entry.

The energy and construction sectors in South Korea present substantial barriers to entry due to extensive regulatory hurdles and licensing requirements. New entrants must navigate a complex web of permits, environmental regulations, and safety standards, which are particularly stringent in these industries.

For instance, obtaining the necessary licenses and approvals can be a lengthy and expensive process, demanding specialized compliance expertise that many new firms may lack. This complexity, coupled with the significant investment needed to meet these regulatory demands, effectively deters potential new competitors from entering the market.

Established brand loyalty is a significant barrier for new entrants in the retail sector, particularly for convenience stores like GS25. In 2024, GS25 continued to leverage its decades of operation to foster deep customer trust and repeat business. This loyalty, built through consistent service and product offerings, means newcomers must invest heavily in marketing and promotions simply to get noticed, let alone compete for customer attention.

Furthermore, network effects create a powerful advantage for incumbents. GS25's extensive network of conveniently located stores across South Korea, numbering over 16,000 as of early 2024, provides unparalleled accessibility for consumers. New entrants would need substantial capital and time to replicate this physical footprint, making it exceedingly difficult to achieve the same level of convenience and market penetration that GS25 already enjoys.

Access to Distribution Channels and Supply Chains

For new entrants aiming to compete with GS Holdings, gaining access to established distribution channels and building resilient supply chains presents a significant challenge. GS Holdings benefits from its extensive infrastructure, including a vast energy distribution network and well-organized retail supply chains, making it difficult for newcomers to match its reach and efficiency.

The capital investment required to build comparable distribution and supply chain capabilities is substantial. For instance, in 2024, the cost of developing new energy infrastructure, including pipelines and power grids, can run into billions of dollars, a barrier that deters many potential entrants. Similarly, establishing reliable sourcing and logistics for retail products demands significant upfront investment and ongoing operational expertise.

- High Capital Investment: Building out energy distribution networks or retail logistics can cost billions, creating a high barrier for new entrants.

- Established Networks: GS Holdings possesses deeply entrenched relationships and infrastructure in energy, retail, and construction supply chains.

- Operational Expertise: Replicating the efficiency and reliability of GS Holdings' supply chain management requires years of accumulated knowledge and experience.

- Economies of Scale: GS Holdings' existing volume allows for cost advantages in procurement and distribution that new entrants cannot immediately achieve.

Expertise, Technology, and Economies of Scale

New entrants face considerable hurdles in challenging an established conglomerate like GS Holdings. They would need to invest heavily in acquiring deep industry expertise across diverse sectors, from energy to retail and construction. Furthermore, access to cutting-edge technology is crucial for efficiency and innovation, a significant upfront cost for newcomers.

The threat of new entrants is significantly mitigated by the substantial economies of scale GS Holdings enjoys. For instance, in energy production, large-scale operations lead to lower per-unit costs. Similarly, GS Retail benefits from mass procurement power, driving down the cost of goods sold.

GS Holdings' construction arm leverages efficient project management and bulk material purchasing, creating cost advantages that are difficult for smaller firms to match. These established efficiencies and cost structures act as a powerful deterrent, making it challenging for new players to enter and compete on price or operational effectiveness.

Consider the energy sector where GS Holdings operates power plants; the capital investment alone for a new entrant to achieve comparable scale and efficiency is immense. In 2023, the global average cost for building a new utility-scale solar farm was around $1,000 per kilowatt, illustrating the significant capital requirement.

The threat of new entrants for GS Holdings is considerably low due to high capital requirements, established brand loyalty, and significant network effects. New companies would need massive investments to replicate GS Holdings' extensive infrastructure in sectors like energy and retail, facing steep regulatory hurdles and the challenge of matching existing operational efficiencies and economies of scale.

| Barrier | Description | Example for GS Holdings (2024 Data) |

|---|---|---|

| Capital Requirements | Enormous upfront investment needed for infrastructure and operations. | Building a new power plant can cost billions; GS25's network of over 16,000 stores required substantial capital to establish. |

| Brand Loyalty & Reputation | Customer trust and preference built over years of service. | GS25 benefits from decades of consistent service, making it difficult for new convenience stores to gain traction. |

| Network Effects | Value increases with the number of users or locations. | GS25's widespread store network offers unparalleled convenience, a significant advantage over new entrants. |

| Regulatory Hurdles | Complex licensing and compliance requirements in key sectors. | Energy and construction sectors in South Korea have stringent regulations that new entrants must navigate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GS Holdings is built upon comprehensive data, including the company's annual reports, investor presentations, and SEC filings. This is supplemented by industry-specific market research reports and data from reputable financial information providers to ensure a thorough understanding of the competitive landscape.