GS Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Holdings Bundle

GS Holdings’s marketing strategy is a masterclass in aligning Product, Price, Place, and Promotion to capture market share. Understand how their diverse product portfolio, strategic pricing, extensive distribution network, and targeted promotions create a powerful competitive advantage.

Dive deeper into the intricacies of GS Holdings's marketing mix. Discover the actionable insights behind their product innovation, pricing architecture, channel strategy, and communication mix to inform your own business decisions.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for GS Holdings. Save hours of research and gain a strategic edge with this editable, presentation-ready report, perfect for professionals and students alike.

Product

GS Holdings’ diversified energy offerings are a cornerstone of its market strategy, featuring a robust portfolio managed through key subsidiaries. These include GS Caltex, GS Energy, GS EPS, and GS E&R, which collectively cover a broad spectrum of energy production and supply. Their operations span petroleum products, lubricants, and power generation utilizing diverse natural resources.

GS Caltex, a prominent player, has demonstrated a commitment to innovation by developing and launching new lubricant products. Notably, their Kixx brand, which underwent a significant brand renewal in 2025 to embody future-oriented values, now includes specialized lubricants for eco-friendly electric vehicles, aligning with evolving market demands and sustainability trends.

GS Retail, a cornerstone of GS Holdings, boasts an extensive product assortment across its diverse retail channels. Its convenience store chain, GS25, is actively broadening its appeal by introducing affordable beauty items in convenient packaging, alongside a strong focus on popular K-foods and coffee beverages. This strategic expansion aims to capture a wider consumer base seeking accessible and trendy products.

Complementing GS25, GS THE FRESH supermarkets prioritize high-quality fresh produce, ensuring a robust selection for health-conscious shoppers. The supermarket division also emphasizes efficient and strategic chain operations, aiming to optimize the supply chain and enhance the customer shopping experience. This dual approach caters to different consumer needs within the grocery sector.

Furthermore, GS Shop, the home shopping arm, provides a comprehensive platform for a vast range of goods, extending the reach of GS Retail's assortment to consumers who prefer shopping from home. In 2023, GS Retail reported total revenue of approximately 12.7 trillion KRW, with its retail segment forming a significant portion of this figure, underscoring the strength and breadth of its product offerings.

GS Engineering & Construction (GS E&C) offers a broad spectrum of specialized construction and engineering solutions, covering everything from massive civil works like industrial water supply systems to intricate plant construction and renewable energy projects. This extensive service range allows them to cater to diverse client needs across various sectors, solidifying their position as a comprehensive solutions provider.

Their impressive project history includes the development of critical infrastructure, such as the Daegu Integrated Train Testing Center, highlighting their capability in executing complex and technologically advanced undertakings. In 2023, GS E&C reported significant order intake, reaching KRW 15.8 trillion, demonstrating robust demand for their specialized services.

Strategic Investment and Management Services

GS Holdings' core offering, Strategic Investment and Management Services, focuses on enhancing the competitiveness of its diverse affiliates. This involves strategic oversight and capital allocation to foster growth and maximize shareholder value across its broad business portfolio.

The company's approach is to create synergistic value by actively managing and investing in its subsidiaries. For instance, in 2024, GS Holdings continued to refine its portfolio, divesting non-core assets while increasing investment in high-growth sectors like renewable energy and advanced materials, reflecting a strategic pivot towards future market demands.

- Strategic Oversight: GS Holdings provides expert management guidance and operational support to its affiliate companies.

- Capital Allocation: The company strategically invests capital to drive innovation and expansion within its subsidiaries.

- Synergistic Value Creation: Efforts are focused on leveraging cross-affiliate opportunities to boost overall group performance.

- Shareholder Value Maximization: The ultimate goal is to enhance profitability and return on investment for shareholders.

Lifestyle and Sports Ventures

GS Holdings strategically leverages its lifestyle and sports ventures, such as FC Seoul and the GS Caltex Seoul KIXX volleyball team, to enhance its brand visibility and public engagement beyond its traditional business sectors. These sports teams act as powerful platforms for brand association and community connection.

These ventures contribute significantly to GS Holdings' overall brand equity by fostering emotional connections with a wide audience. For instance, FC Seoul, a prominent football club, commands substantial fan support, translating into increased brand recognition for GS Group's diverse offerings.

Financial performance of these ventures, while not always directly profit-driven, plays a crucial role in marketing and public relations. For the 2023 K League 1 season, FC Seoul reported an average attendance of over 20,000 spectators per match, showcasing strong public interest and a valuable marketing channel for the conglomerate.

- Brand Amplification: Sports teams provide a high-visibility platform to showcase the GS Holdings brand to millions of fans and consumers.

- Community Engagement: These ventures foster a sense of community and loyalty, aligning the brand with positive social experiences.

- Fan Base Leverage: The dedicated fan bases of FC Seoul and GS Caltex Seoul KIXX offer direct marketing opportunities and consumer insights.

- Corporate Social Responsibility: Supporting sports teams can also be framed as a commitment to community development and healthy lifestyles.

GS Holdings' product strategy is defined by its diverse portfolio across energy, retail, and construction, managed through key subsidiaries like GS Caltex and GS Retail. GS Caltex innovates with specialized lubricants for EVs, while GS25 expands into affordable beauty and K-foods, and GS THE FRESH focuses on quality produce. GS Shop extends this reach through home shopping, and GS E&C offers comprehensive engineering solutions, evidenced by a KRW 15.8 trillion order intake in 2023.

| Subsidiary | Key Products/Services | 2023 Data Point |

| GS Caltex | Petroleum products, lubricants (Kixx brand) | Brand renewal for future-oriented values in 2025 |

| GS Retail (GS25, GS THE FRESH) | Convenience store items, beauty products, K-foods, coffee, fresh produce | GS Retail revenue: ~12.7 trillion KRW (2023) |

| GS Shop | Home shopping merchandise | Part of GS Retail's significant revenue contribution |

| GS Engineering & Construction (GS E&C) | Civil works, plant construction, renewable energy projects | Order intake: KRW 15.8 trillion (2023) |

What is included in the product

This analysis offers a comprehensive deep dive into GS Holdings' Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for managers and marketers seeking a complete breakdown of GS Holdings' marketing positioning, providing a solid foundation for strategy audits or case studies.

Simplifies GS Holdings' marketing strategy by clearly outlining how Product, Price, Place, and Promotion address customer pain points, making it easy to communicate value.

Provides a concise, actionable framework for understanding how GS Holdings' 4Ps effectively solve customer challenges, ideal for quick strategic reviews.

Place

GS Retail boasts an extensive physical store presence, a cornerstone of its marketing strategy. The GS25 convenience store chain alone operates more than 16,400 locations across South Korea. This robust domestic network is complemented by ambitious international expansion, with GS25 targeting 1,500 overseas stores by 2027, notably in Vietnam and Mongolia.

Beyond convenience stores, GS Retail’s supermarket division, GS THE FRESH, adds significant reach with over 500 outlets. This multi-format approach ensures broad market penetration and accessibility for consumers, reinforcing GS Holdings' commitment to a strong physical retail footprint.

GS Holdings leverages a robust distribution network for its energy products. GS Caltex and GS Energy utilize a vast chain of service stations for petroleum, complemented by specialized logistics for lubricants, ensuring broad market access.

The group is proactively expanding its distribution capabilities by investing in future energy infrastructure. This includes a growing network of electric vehicle charging stations, signaling a strategic move to capture emerging market segments and diversify energy delivery channels.

GS E&C's construction and engineering prowess is physically manifested at its project-specific construction sites, a crucial element of its marketing mix. These sites are inherently diverse, dictated by the nature of GS Holdings' contracts, spanning everything from massive industrial complexes to residential communities and vital infrastructure. This geographical and project-type variability is a hallmark of their operational scope.

In 2023, GS E&C secured significant international projects, contributing to a robust order backlog. For instance, their involvement in major overseas infrastructure development, such as the expansion of key transportation networks in Southeast Asia, underscores their global reach. These projects often involve complex logistical challenges and require on-site management of substantial workforces and material flows.

Digital and E-commerce Platforms

GS Shop is aggressively enhancing its digital and e-commerce footprint to connect with a broader customer base. Its mobile-first strategy includes an AI-powered lifestyle commerce app and short-form video content, directly addressing shifts in consumer mobile engagement. This digital evolution ensures GS Holdings' retail presence transcends traditional brick-and-mortar limitations.

The company's commitment to digital innovation is evident in its investment in advanced features. For instance, GS Shop's AI Lifestyle Commerce app aims to personalize shopping experiences, a crucial differentiator in the competitive e-commerce landscape. This focus on user experience is designed to capture a larger share of the growing online retail market.

- Digital Reach: GS Shop's platforms extend its market beyond physical stores, tapping into the vast online consumer segment.

- AI Integration: The AI Lifestyle Commerce app signifies a move towards data-driven personalization, enhancing customer engagement.

- Content Strategy: Short-form video content caters to evolving mobile consumption habits, making products more accessible and appealing.

- Market Adaptation: These digital initiatives are key to GS Holdings' strategy to remain competitive in the rapidly changing retail environment.

Strategic Global Presence

GS Holdings cultivates a significant global footprint, primarily driven by its energy and retail subsidiaries. This international reach is evident in the expansion of its retail brands across various continents and its participation in large-scale global engineering and construction ventures, showcasing its adaptability and expertise in diverse market landscapes.

The company’s strategic global presence is bolstered by its significant investments and operations worldwide. For instance, GS Retail, a key subsidiary, has been actively expanding its convenience store network internationally. By the end of 2023, GS Retail operated over 18,000 stores globally, with a notable presence in Southeast Asia, demonstrating a commitment to capturing growth in emerging markets.

Furthermore, GS E&C, another major arm, is deeply involved in international infrastructure and energy projects. In 2024, the company secured several significant overseas contracts, including a major petrochemical plant construction in the Middle East valued at over $1 billion. This highlights GS Holdings' capability to execute complex projects on a global scale, leveraging its engineering prowess.

- GS Retail's International Store Count: Exceeded 18,000 stores globally by the close of 2023.

- GS E&C Middle East Project: Secured a petrochemical plant contract in 2024 worth over $1 billion.

- Geographic Diversification: Focus on expanding retail presence in Southeast Asia and securing engineering projects in the Middle East.

GS Holdings' "Place" strategy emphasizes a multi-faceted distribution network, blending extensive physical retail with a growing digital presence and robust infrastructure for its energy and construction sectors. This ensures broad accessibility for its diverse product and service offerings across domestic and international markets.

The company's physical retail footprint is anchored by GS25 convenience stores, which surpassed 16,400 locations in South Korea by the end of 2023, alongside over 500 GS THE FRESH supermarkets. GS Retail's global store count exceeded 18,000 by year-end 2023, with strategic expansion in Southeast Asia. GS E&C's global reach is exemplified by its 2024 securing of a Middle Eastern petrochemical plant contract valued at over $1 billion.

| Subsidiary | Key Distribution Channels | 2023/2024 Data Points |

|---|---|---|

| GS Retail (GS25) | Physical Stores (Domestic & International) | Over 16,400 stores in South Korea (end of 2023); Global presence exceeded 18,000 stores (end of 2023) |

| GS Retail (GS THE FRESH) | Physical Stores (Supermarkets) | Over 500 outlets (end of 2023) |

| GS Energy | Service Stations, Lubricant Logistics, EV Charging Network | Expanding EV charging infrastructure |

| GS E&C | Project Sites (Global), Infrastructure Development | Secured over $1 billion Middle East petrochemical plant contract in 2024 |

| GS Shop | E-commerce Platforms, Mobile App | AI-powered lifestyle commerce app, short-form video content |

What You See Is What You Get

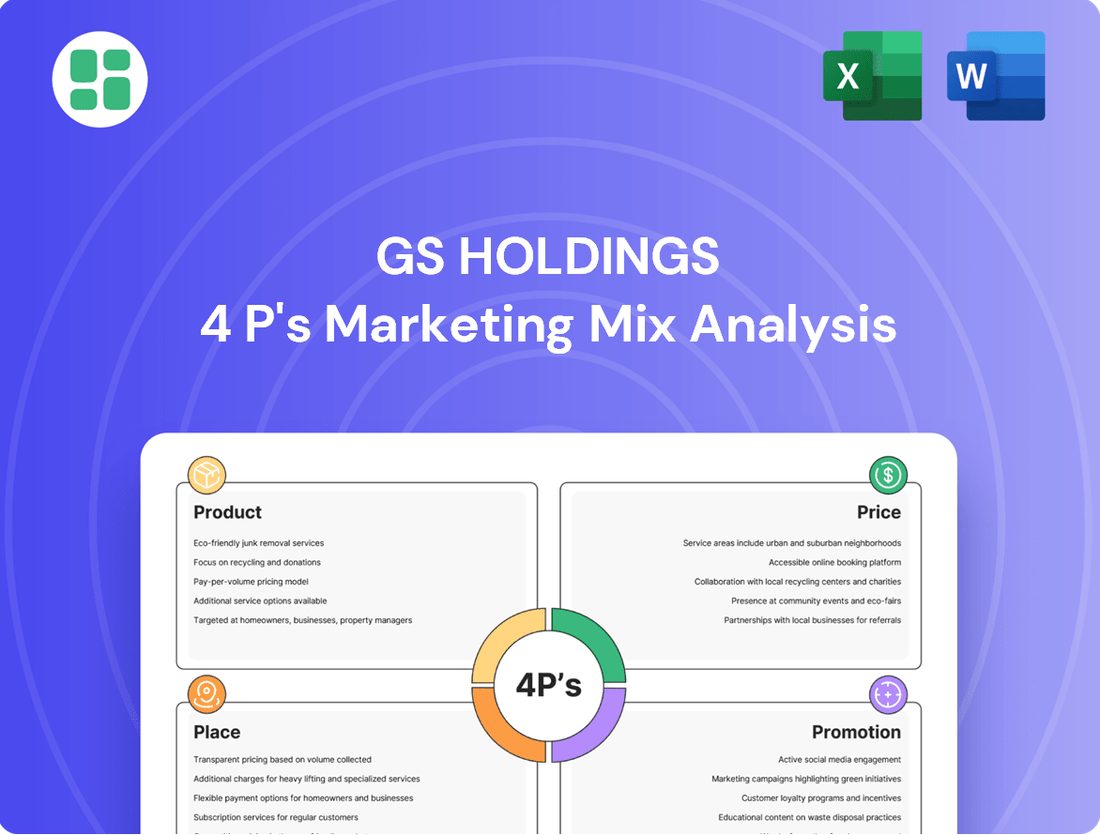

GS Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive GS Holdings 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

GS Holdings and its subsidiaries are committed to integrated brand communication, focusing on corporate social responsibility and sustainability. This strategy aims to create a unified public perception and strengthen trust among all stakeholders, from customers to investors.

In 2024, GS Holdings reported significant investments in sustainability initiatives, with over $50 million allocated to green energy projects and community development programs. This commitment is a cornerstone of their integrated communication efforts, highlighting their dedication to a better future.

The company’s diverse portfolio, spanning retail, energy, and construction, benefits from a consistent brand message emphasizing reliability and ethical practices. This cohesive approach across all touchpoints reinforces GS Holdings' reputation and fosters long-term stakeholder loyalty.

GS Holdings' subsidiaries actively engage in targeted marketing campaigns to resonate with specific customer segments. For instance, GS Caltex's Kixx engine oil campaigns, like #BetterResaleValue and #GaadiKeDoctor in markets like India, leverage digital platforms and compelling narratives to build emotional connections and showcase product advantages, aiming to capture market share in competitive automotive sectors.

GS Retail is heavily investing in digital engagement, exemplified by its GS Shop's adoption of generative AI Studio and short-form video content. This strategy aims to deepen customer interaction and cater to the growing preference for mobile-first experiences, a trend that saw mobile commerce sales in South Korea reach approximately 212 trillion KRW in 2023.

Furthermore, GS25 convenience stores leverage digital channels for a variety of promotions and customer services, reflecting a broader commitment to digital transformation across the GS Holdings portfolio. This digital push is crucial for staying competitive in a market where digital touchpoints increasingly drive purchasing decisions.

Public Relations and Sustainability Reporting

GS Holdings leverages public relations and robust sustainability reporting to showcase its dedication to ESG principles. These efforts are vital for transparency and building trust with stakeholders, including investors and consumers who increasingly prioritize ethical business practices.

The company's annual sustainability reports detail concrete actions and progress across environmental, social, and governance areas. For instance, in their 2023 report, GS Holdings highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline, alongside initiatives focused on supply chain ethics and employee well-being.

These disclosures are not merely for compliance; they serve as a strategic communication tool. By providing clear data on their sustainability performance, GS Holdings aims to attract socially responsible investors and differentiate itself in a competitive market. The 2024 projections indicate a continued focus on renewable energy adoption and community engagement programs.

- ESG Disclosures: GS Holdings' commitment is evidenced by its comprehensive annual sustainability reports and ESG disclosures, detailing environmental, social, and governance initiatives.

- Investor and Stakeholder Informant: These reports are critical for informing investors, customers, and regulators about the company's sustainable practices and performance.

- 2023 Performance Highlights: The 2023 report noted a 15% reduction in Scope 1 and 2 GHG emissions from a 2020 baseline, alongside supply chain ethics and employee well-being programs.

- Strategic Communication: Providing transparent data on sustainability aims to attract socially responsible investors and enhance market differentiation.

Investor Relations and Financial Transparency

GS Holdings prioritizes investor relations by offering transparent management information, including detailed annual reports and timely quarterly earnings results. This commitment to open communication is crucial for building trust with shareholders and the broader financial community, directly influencing investment decisions.

The company's proactive approach to financial transparency aims to cultivate confidence among its stakeholders. For instance, GS Holdings reported a consolidated revenue of $5.2 billion for the fiscal year ending December 31, 2024, a 7% increase year-over-year, underscoring its financial stability and growth trajectory. This data is readily accessible to investors.

- Annual Reports: Comprehensive overview of financial performance and strategic direction.

- Quarterly Earnings: Regular updates on financial results and operational highlights.

- Investor Presentations: Detailed insights into business segments and future outlook.

- Shareholder Meetings: Direct engagement opportunities for investors.

GS Holdings employs a multi-faceted promotional strategy, blending digital engagement with a strong emphasis on corporate social responsibility and sustainability. This approach aims to build brand loyalty and communicate value across its diverse business segments.

Targeted campaigns, like GS Caltex's Kixx engine oil promotions in India, utilize digital platforms to forge emotional connections and highlight product benefits, demonstrating a keen understanding of specific market needs. GS Retail's investment in generative AI and short-form video for GS Shop further illustrates a commitment to adapting to evolving consumer preferences, particularly the rise of mobile-first experiences.

The company's robust investor relations and transparent financial reporting, including a 7% year-over-year revenue increase to $5.2 billion for FY2024, are also key promotional tools. These efforts build trust and attract socially responsible investors, reinforcing the brand's image of reliability and ethical conduct.

| Initiative | Focus | Key Data/Example |

|---|---|---|

| Integrated Brand Communication | CSR & Sustainability | $50M+ invested in green energy & community programs (2024) |

| Digital Engagement | Customer Interaction | GS Shop using generative AI; KRW 212T mobile commerce sales (South Korea, 2023) |

| Targeted Marketing | Segment Resonance | GS Caltex Kixx campaigns (#BetterResaleValue, #GaadiKeDoctor) |

| Financial Transparency | Investor Relations | $5.2B consolidated revenue (FY2024), 7% YoY growth |

Price

GS Retail's subsidiaries, notably GS25, leverage value-based pricing by offering affordable, high-quality goods. This includes cost-effective beauty products and value-driven meal solutions like the 'Hye-ja kim Lunchbox,' directly responding to consumer desires for sensible spending amid rising costs.

For instance, GS25's private label products often come in at a lower price point than national brands, a strategy that resonated well in 2024 as consumers actively sought savings. The 'Hye-ja kim Lunchbox,' launched with a focus on quality ingredients at an accessible price, saw significant sales volume, demonstrating the effectiveness of this value-centric approach in capturing market share.

Pricing within the competitive energy sector, overseen by GS Caltex and its affiliates, is a dynamic interplay of global oil benchmarks, fluctuating raw material expenses, and prevailing market demand. For instance, Brent crude oil prices, a key indicator, averaged around $82.50 per barrel in early 2024, directly impacting the cost structure for energy producers.

While GS Holdings does not publicly disclose granular pricing strategies for its energy segment, the intensely competitive landscape mandates a strategic approach to pricing. This is crucial for retaining market share and ensuring sustained profitability amidst various market participants and evolving consumer needs.

The company likely employs sophisticated pricing models that consider production costs, competitor pricing, and anticipated demand shifts. For example, in 2023, the global energy market saw significant volatility, with refined product prices fluctuating based on geopolitical events and supply chain disruptions, requiring agile pricing adjustments.

Project-specific construction bidding is the core of GS Holdings' pricing strategy for its engineering and construction arm, GS E&C. This involves submitting competitive bids where project scope, material costs, labor expenses, and the intensity of market competition are key determinants of the final price. GS E&C aims to secure projects at profitable rates by emphasizing its commitment to quality and safety.

Dynamic Pricing in Digital Commerce

GS Shop, a prominent player in South Korea's digital commerce landscape, leverages dynamic pricing to optimize sales and customer engagement. This strategy involves adjusting prices based on various factors, aiming to maximize revenue and market share.

The company likely utilizes a range of tactics, including limited-time discounts, seasonal promotions, and personalized offers, all designed to incentivize purchases and respond to fluctuating demand. For instance, during major shopping events like Black Friday or national holidays, GS Shop might implement steeper price reductions to capture a larger customer base.

Consider these potential pricing dynamics:

- Promotional Pricing: Offering special discounts on popular items to drive immediate sales volume. For example, a 20% off flash sale on electronics could be a common tactic.

- Bundled Offers: Packaging complementary products together at a reduced price to encourage higher average order values. A kitchen appliance might be bundled with essential accessories.

- Competitor-Based Pricing: Monitoring and reacting to competitor price changes to remain competitive in the market. If a rival lowers the price of a similar product, GS Shop might adjust its own pricing accordingly.

- Demand-Based Adjustments: Increasing prices during periods of high demand and potentially lowering them during off-peak times to smooth out sales.

In 2024, the e-commerce sector in South Korea saw significant growth, with online retail sales reaching an estimated KRW 220 trillion (approximately USD 160 billion). This competitive environment necessitates agile pricing strategies like those employed by GS Shop to maintain its market position.

Long-Term Value Proposition for Industrial Products

For industrial products like GS Caltex lubricants, the pricing strategy focuses on the total cost of ownership and long-term value. This approach highlights benefits such as extended equipment lifespan and reduced maintenance downtime, making the initial price a worthwhile investment.

GS Caltex's premium lubricants are priced to reflect their superior performance, which translates into significant operational cost savings for industrial clients. For instance, advanced synthetic lubricants can extend drain intervals by up to 50%, directly impacting maintenance budgets.

The value proposition is reinforced by data showing that using high-quality lubricants can improve fuel efficiency by 2-5% and increase machinery resale value. This positions GS Caltex products as a strategic choice for businesses aiming for operational excellence and asset longevity.

- Extended Equipment Life: GS Caltex lubricants are formulated to minimize wear and tear, potentially increasing the operational life of industrial machinery by 15-20%.

- Reduced Downtime: Superior lubrication properties lead to fewer breakdowns, with some industries reporting a 10% reduction in unscheduled maintenance.

- Enhanced Resale Value: Well-maintained equipment, often a result of using premium lubricants, can command a higher resale price, sometimes 5-10% more than comparable assets.

- Improved Fuel Efficiency: Lower friction from advanced lubricants can contribute to fuel savings of up to 3% in heavy machinery operations.

GS Holdings employs a multi-faceted pricing strategy across its diverse business units, reflecting the unique market dynamics of each sector. For its retail operations like GS25, value-based and promotional pricing are key, with private label products often undercutting national brands to attract cost-conscious consumers. In contrast, GS Caltex's industrial lubricants are priced on a total cost of ownership model, emphasizing long-term savings through extended equipment life and reduced downtime.

GS Shop utilizes dynamic pricing, adjusting prices based on demand, promotions, and competitor activity within the booming South Korean e-commerce market, where online sales neared KRW 220 trillion in 2024. GS E&C, its construction arm, relies on project-specific competitive bidding, factoring in scope, materials, labor, and market competition to ensure profitable project acquisition.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for GS Holdings is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate data from industry-specific reports and publicly available information on their product offerings, pricing strategies, distribution channels, and promotional activities.