Grupo Elektra SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Elektra Bundle

Grupo Elektra's robust retail presence and strong brand recognition offer significant market advantages, but its reliance on credit sales and economic sensitivity present notable challenges.

Want the full story behind Grupo Elektra's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grupo Elektra's integrated business model is a significant strength, seamlessly combining retail sales with financial services. This allows customers, especially those in lower-income brackets, to access credit for purchases, creating a powerful synergy where retail fuels financial product adoption and vice versa. This approach effectively serves a demographic often overlooked by conventional financial institutions.

Grupo Elektra's strength lies in its incredibly vast distribution network, reaching over 6,000 locations across Mexico, the United States, and Central America. This includes its well-known Elektra stores, Salinas y Rocha, and the significant presence of Banco Azteca branches.

This extensive physical footprint ensures remarkable proximity and accessibility to its customer base, particularly in areas underserved by traditional financial institutions. Banco Azteca's reach is so profound that it operates in municipalities where other banks have no presence, solidifying its role as a financial lifeline.

Furthermore, Grupo Elektra leverages digital channels effectively, with Banco Azteca's app being a leading digital banking platform in Mexico. This dual approach of physical and digital accessibility allows them to connect with a broad spectrum of consumers, from those who prefer in-person interactions to digitally savvy users.

Grupo Elektra boasts formidable brand recognition, particularly with its key brands like Banco Azteca and Italika. Banco Azteca, a cornerstone of its financial services, is consistently ranked among Mexico's most valuable brands, reflecting deep customer trust.

This widespread recognition translates into a substantial and loyal customer base. Millions of Mexicans rely on Banco Azteca for financial services, holding numerous deposit accounts and actively engaging with its digital platforms, a testament to the brand's ingrained presence in the market.

The strong brand loyalty and extensive customer network create a significant competitive moat for Grupo Elektra. This established base ensures a consistent and predictable revenue stream, underpinning its market position and offering a solid foundation for future growth initiatives.

Growth in Financial Services Segment

Grupo Elektra's financial services segment is a powerhouse for growth, consistently driving increased financial income. Banco Azteca Mexico, a key part of this segment, saw its gross loan portfolio expand significantly, demonstrating strong market demand for its credit offerings. This robust performance is underpinned by substantial deposit growth and a healthy deposits-to-loan ratio, reflecting customer trust and the need for accessible banking solutions.

The company's strategic expansion of its financial product suite further solidifies this strength. For instance, in the first quarter of 2024, Grupo Elektra reported a notable increase in its financial services revenue, contributing substantially to the overall company performance. This segment’s ability to attract deposits and effectively deploy them through loans highlights its operational efficiency and market penetration.

- Financial Income Growth: The financial services division consistently generates substantial financial income, acting as a primary revenue driver.

- Banco Azteca Mexico's Loan Portfolio: Experienced significant expansion in its gross loan portfolio during 2024, indicating strong credit demand.

- Deposit Growth and Ratio: Benefited from robust deposit growth, maintaining a healthy deposits-to-loan ratio that supports lending activities.

- Product Expansion: Continues to broaden its range of financial products, catering to evolving customer needs and market opportunities.

Digital Transformation and Efficiency Initiatives

Grupo Elektra is making significant strides in digital transformation, notably through its Banco Azteca app, which has emerged as a frontrunner in digital banking within Mexico. This digital push is evident in the sheer volume of transactions processed, with the app handling billions annually, underscoring its widespread adoption and operational capacity.

Complementing its digital investments, Elektra is strategically optimizing its physical retail presence. By closing underperforming stores, the company is focusing resources on more profitable locations, a move designed to boost overall profitability and streamline operations. This dual approach of enhancing digital channels while refining its physical footprint is key to its efficiency drive.

- Banco Azteca's Digital Leadership: The app is a leading digital bank in Mexico, processing billions of transactions yearly.

- Physical Footprint Optimization: Closing less profitable units to enhance operational efficiency and profitability.

- Customer Experience & Cost Reduction: The strategy aims to improve customer interactions and lower operational costs.

Grupo Elektra's extensive retail and financial services integration creates a unique synergy, particularly serving lower-income segments. Its vast network, exceeding 6,000 locations across Mexico, the US, and Central America, ensures unparalleled customer accessibility, with Banco Azteca filling gaps where other banks do not operate.

Strong brand recognition, especially for Banco Azteca and Italika, fosters deep customer loyalty and a significant, predictable revenue stream. The financial services segment is a consistent growth engine, evidenced by Banco Azteca Mexico's expanding loan portfolio and robust deposit growth, maintaining a healthy deposits-to-loan ratio.

Digital transformation is a key strength, with Banco Azteca's app being a leading digital banking platform in Mexico, processing billions of transactions annually. This digital focus, combined with the optimization of its physical retail footprint by closing underperforming stores, enhances operational efficiency and profitability.

| Metric | Value | Period | Source |

|---|---|---|---|

| Financial Services Revenue | Significant increase | Q1 2024 | Grupo Elektra Reports |

| Banco Azteca Mexico Gross Loan Portfolio | Significant expansion | 2024 | Grupo Elektra Reports |

| Banco Azteca App Transactions | Billions annually | 2024 | Grupo Elektra Reports |

| Store Network | Over 6,000 locations | 2024 | Grupo Elektra Reports |

What is included in the product

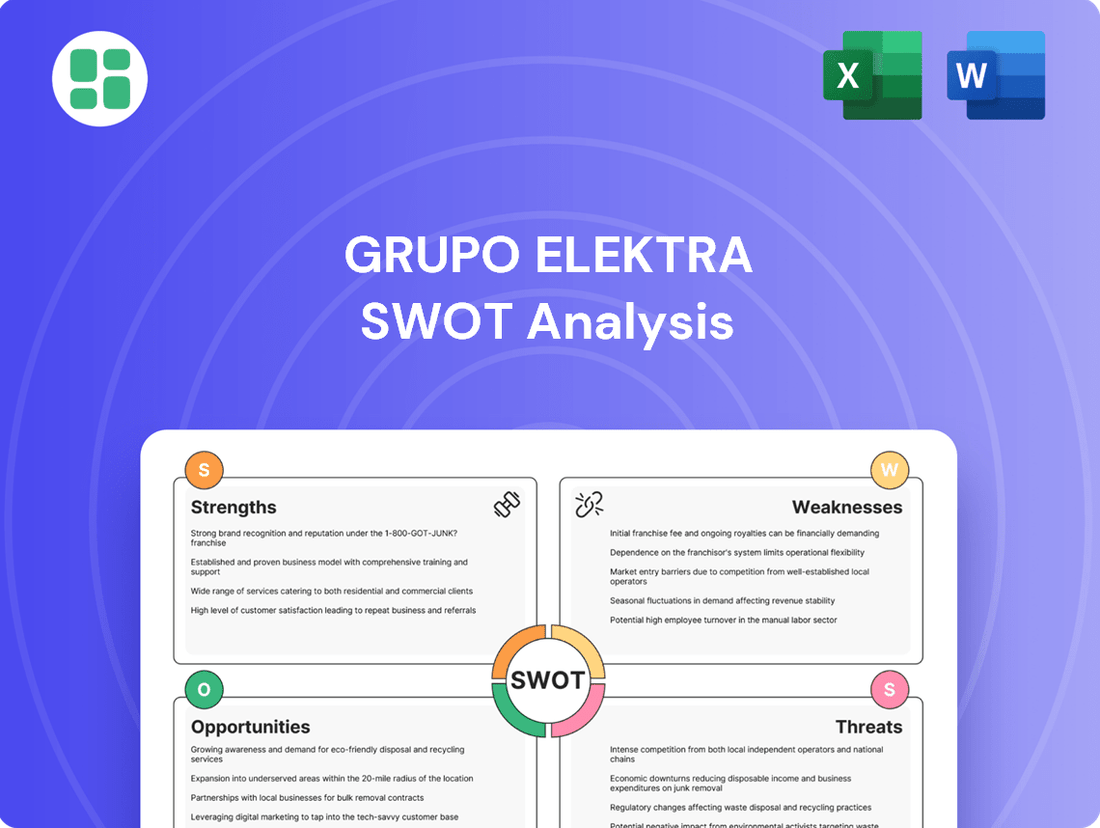

Delivers a strategic overview of Grupo Elektra’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and address Grupo Elektra's competitive challenges and leverage its market strengths.

Weaknesses

Grupo Elektra's focus on middle and lower-income consumers, while expanding its market, also presents a significant weakness: high exposure to credit risk. This demographic, by its nature, is more susceptible to economic downturns and unexpected financial shocks, increasing the likelihood of loan defaults.

This inherent risk in consumer finance and credit sales directly impacts Grupo Elektra's asset quality and profitability. For instance, in the first quarter of 2024, the company reported a slight increase in its non-performing loan ratio, underscoring the ongoing challenge of managing defaults within its customer base.

Grupo Elektra's profitability is closely tied to the health of the economies where it operates. For instance, in 2024, a slowdown in consumer spending in Mexico, a key market, could directly affect its retail sales and credit operations. This sensitivity means that economic instability, like rising inflation or job losses, poses a significant risk to the company's revenue streams and the ability of its customers to repay loans.

Grupo Elektra, as a significant player in financial services, particularly banking, operates under intense regulatory scrutiny. This oversight can lead to substantial compliance costs and potential limitations on its business activities. For instance, evolving consumer protection laws or shifts in credit policies, which are common in the financial sector, could directly impact Grupo Elektra's operational flexibility and profitability.

The company has a history of facing regulatory challenges, including past allegations of stock manipulation and tax disputes. These past events underscore the inherent risks associated with operating in a highly regulated environment and the potential for significant financial and reputational consequences if compliance standards are not meticulously met.

Net Loss and Market Valuation Concerns

Despite positive revenue and EBITDA trends, Grupo Elektra faced a notable net loss in 2024. This was primarily driven by a decrease in the market value of its financial instruments, which, importantly, did not reflect a reduction in actual cash flow.

This financial performance, coupled with a significant drop in its stock price in July 2024, partly due to issues surrounding a bitcoin loan, highlights potential weaknesses in its market valuation and investor sentiment.

- Net Loss in 2024: Grupo Elektra reported a substantial net loss for the year.

- Market Value Fluctuations: The loss was mainly due to the declining market value of financial instruments, not operational cash flow issues.

- Stock Price Decline: A sharp stock price fall in July 2024, linked to external factors like a bitcoin loan, signals investor concerns.

- Valuation and Confidence Impact: These events raise questions about the company's market valuation and the stability of investor confidence.

Competition in Retail and Financial Sectors

Grupo Elektra operates in highly competitive retail and financial sectors. Traditional banks are increasingly targeting previously underserved customer segments, directly challenging Elektra's financial services offerings. For instance, as of early 2024, many established banks have been expanding their digital platforms and micro-loan products, aiming to capture a larger share of the lower-income and unbanked populations that Elektra has historically served.

The rise of fintech companies presents another significant challenge. These agile digital lenders and payment providers offer innovative, often faster, and more convenient solutions, which can attract customers away from Elektra's established channels. By mid-2024, the fintech market in Latin America, where Elektra is a major player, continued its rapid growth, with new entrants frequently disrupting traditional financial models.

This dual pressure from both established financial institutions and nimble fintechs puts Grupo Elektra's market share at risk across both its retail operations and its banking and financial services divisions. The ability of competitors to adapt quickly to changing consumer preferences and technological advancements could erode Elektra's customer base if it cannot maintain its own pace of innovation and service delivery.

Grupo Elektra's reliance on a customer base more vulnerable to economic shifts creates a significant credit risk. This exposure was highlighted in Q1 2024 with a slight uptick in non-performing loans. Furthermore, the company's 2024 net loss, largely due to market value fluctuations in financial instruments rather than operational cash flow, coupled with a stock price dip in July 2024 linked to a bitcoin loan, signals potential investor confidence issues and market valuation concerns.

Preview Before You Purchase

Grupo Elektra SWOT Analysis

The preview you see is the actual Grupo Elektra SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the company's internal strengths and weaknesses, as well as external opportunities and threats.

Opportunities

Grupo Elektra has a substantial opportunity to broaden its digital financial services, moving beyond core banking and credit offerings. This involves creating advanced online lending, digital wallets, insurance, and investment tools accessible through the Banco Azteca app, aligning with changing customer digital preferences.

By enhancing its digital platform, Grupo Elektra can tap into the growing demand for convenient financial solutions. For instance, in 2024, digital payments in Latin America were projected to see significant growth, with fintech adoption rates rising across the region, indicating a ripe market for expanded digital financial products.

Grupo Elektra has a solid foundation with its presence across multiple Latin American countries, but there's significant room to grow. For instance, in 2024, the company could focus on increasing its market share within Mexico, where it already has a strong brand recognition. This could involve targeted marketing campaigns or introducing new product lines tailored to specific consumer segments.

Expanding into new, underserved markets within Latin America presents another compelling opportunity. Consider countries like Ecuador or Paraguay, where the formal financial sector might be less developed, creating a demand for Elektra's integrated offerings. By replicating its successful model of providing credit, banking, and retail services, Elektra could capture substantial market share in these emerging economies.

The company's established integrated business model is a key asset for geographic expansion. In 2025, Elektra could explore strategic partnerships or acquisitions in countries like Colombia or Peru, leveraging its expertise to quickly establish a foothold. This approach would allow them to tap into new customer bases and drive revenue growth by offering their unique value proposition in previously unreached territories.

Grupo Elektra has a significant opportunity to expand its retail offerings by incorporating new, in-demand consumer goods and services. This could involve strategically adding categories that resonate with its existing customer base or exploring adjacent markets. For instance, a deeper dive into electronics, home appliances, or even personal care items could capture additional market share.

In the financial services sector, Elektra can unlock new revenue streams by developing more specialized credit products. This includes tailoring offerings for small businesses through micro-financing initiatives, which could foster economic growth and customer loyalty. Furthermore, enhancing digital payment solutions and expanding into fintech services can attract a broader demographic and streamline transactions, aligning with the growing trend of digital commerce.

Leveraging Data Analytics for Personalized Offers

Grupo Elektra's substantial customer base, particularly within its integrated retail and financial services model, generates a wealth of valuable data. By employing sophisticated data analytics and artificial intelligence, the company can move beyond generic offerings to deliver highly tailored product recommendations, customized credit solutions, and precisely targeted marketing efforts. This approach is poised to significantly boost customer engagement and enhance cross-selling opportunities.

The strategic application of data analytics allows for a deeper understanding of individual customer behaviors and preferences. This granular insight is crucial for refining risk assessment models, thereby improving the accuracy of credit decisions and potentially reducing default rates. For instance, in 2024, many leading financial institutions reported a 10-15% increase in customer retention through personalized offers derived from data insights.

Opportunities for leveraging this data include:

- Personalized Product Bundles: Offering bundled product and service packages based on individual purchase history and predicted needs.

- Dynamic Credit Limit Adjustments: Using real-time data to adjust credit limits, offering more favorable terms to low-risk customers.

- Targeted Loyalty Programs: Designing loyalty rewards and promotions that directly appeal to specific customer segments identified through data analysis.

- Predictive Marketing Campaigns: Utilizing AI to forecast customer needs and proactively present relevant offers before a customer actively seeks them.

Strategic Partnerships and Acquisitions

Grupo Elektra can significantly boost its digital transformation and market penetration by forging strategic alliances with leading technology firms and established e-commerce players. These collaborations could streamline the integration of advanced digital solutions and broaden access to new customer segments. For instance, a partnership with a major online retailer could expand Elektra's reach into previously underserved digital markets, mirroring trends seen across the retail sector in 2024 as companies increasingly prioritize omnichannel strategies.

Acquiring innovative fintech startups or specialized retail businesses presents another avenue for rapid growth and capability enhancement. Such moves would allow Grupo Elektra to quickly integrate cutting-edge financial technologies, diversify its product offerings, and capture a larger share of evolving consumer demands. For example, acquiring a company with a strong mobile payment platform could bolster Elektra's financial services division, a sector that saw substantial investment and growth in emerging markets throughout 2024.

- Digital Acceleration: Partnerships with tech companies can speed up the adoption of AI, cloud, and data analytics for enhanced customer experiences.

- Market Expansion: Collaborating with e-commerce platforms can unlock new geographic markets and customer demographics.

- Fintech Integration: Acquiring fintechs can rapidly introduce innovative payment, lending, or investment solutions.

- Retail Diversification: Strategic retail acquisitions can broaden product categories and customer appeal.

Grupo Elektra can significantly enhance its digital financial services by expanding its offerings to include advanced online lending, digital wallets, and investment tools, accessible via its Banco Azteca app, catering to evolving customer preferences. This digital push is timely, as fintech adoption and digital payment growth in Latin America were projected to be strong in 2024.

The company has a prime opportunity to deepen its market penetration within Mexico by leveraging its strong brand recognition through targeted marketing and new product introductions. Furthermore, expanding into less developed Latin American markets like Ecuador or Paraguay, where formal financial services are less prevalent, presents a chance to replicate its successful integrated model of credit, banking, and retail.

Grupo Elektra can also broaden its retail footprint by integrating new, in-demand consumer goods and services, potentially focusing on electronics or home appliances to capture more market share. Developing specialized credit products, such as micro-financing for small businesses, can foster economic growth and customer loyalty, while enhancing digital payment solutions can attract a wider demographic.

Leveraging its substantial customer data through advanced analytics and AI offers a significant opportunity to deliver highly personalized product recommendations, customized credit solutions, and precisely targeted marketing efforts, thereby boosting customer engagement and cross-selling. For instance, in 2024, financial institutions saw improved customer retention by 10-15% through personalized data-driven offers.

Threats

Grupo Elektra faces a significant threat from economic downturns and persistent inflationary pressures in its core markets, especially Mexico. These macroeconomic headwinds can sharply reduce consumer spending power, making it harder for individuals to afford Elektra's products and increasing the likelihood of delayed or defaulted payments on credit extended. For instance, Mexico's inflation rate, which saw fluctuations in 2023 and early 2024, directly impacts the real value of household incomes and raises the cost of imported goods that Elektra might sell.

High inflation also escalates the cost of doing business for Grupo Elektra, potentially squeezing profit margins if these increased costs cannot be fully passed on to consumers. Furthermore, currency depreciation, a risk often associated with economic instability, can make imported inventory more expensive and impact the company's financial reporting when consolidating results from different currencies. The combination of reduced demand and increased operational costs creates a challenging environment for the company's retail and financial services segments.

The financial sector's transformation presents a significant threat. Fintechs are rapidly gaining traction with user-friendly digital platforms, while established banks are bolstering their digital offerings and focusing on financial inclusion, directly challenging Grupo Elektra's customer base and potentially impacting its market share, especially in lucrative financial services.

This heightened competition could lead to margin compression for Grupo Elektra. For instance, as of Q1 2024, the digital banking sector saw a 15% year-over-year growth in customer acquisition, indicating a strong shift towards online financial solutions that both fintechs and traditional banks are actively capturing.

Grupo Elektra faces significant threats from evolving regulatory landscapes. Adverse shifts in banking regulations, consumer credit laws, or central bank interest rate policies could directly impact its operations. For instance, stricter lending requirements might curtail credit origination, a core business driver for Banco Azteca.

Furthermore, a substantial increase in interest rates, a potential policy by central banks aiming to curb inflation, could escalate funding costs for Banco Azteca. This would not only squeeze margins but also potentially dampen consumer demand for credit products, affecting sales across Elektra’s retail divisions.

Cybersecurity Risks and Data Breaches

Grupo Elektra, by its nature of managing extensive customer financial and personal information, faces significant cybersecurity risks. A breach could result in substantial financial repercussions, including direct losses and recovery costs, alongside severe reputational harm.

The potential for cyber-attacks poses a critical threat, potentially leading to operational disruptions and loss of customer confidence. For instance, the global cost of data breaches reached an average of $4.45 million in 2024, a figure that underscores the financial gravity of such incidents.

- Financial Losses: Direct costs from recovery, legal fees, and potential compensation.

- Reputational Damage: Erosion of customer trust and brand image.

- Regulatory Penalties: Fines and sanctions for non-compliance with data protection laws.

- Operational Disruption: Interruption of services and business activities.

Reputational and Legal Challenges

Grupo Elektra faces significant reputational and legal threats stemming from past and ongoing governance issues. Allegations of stock manipulation and tax disputes have previously cast a shadow over the company, and any resurgence or new developments in these areas could severely damage its standing. For instance, in early 2024, the company continued to navigate scrutiny regarding its corporate governance practices, which can impact investor confidence.

These legal and governance challenges directly threaten Grupo Elektra's financial stability. Diverting management's attention from core business operations to address these matters incurs substantial legal costs and potential fines. Furthermore, negative perceptions arising from such issues can deter new investment and negatively influence customer loyalty, impacting overall market performance.

- Ongoing legal scrutiny: Grupo Elektra has faced persistent investigations and allegations related to its financial dealings and corporate governance.

- Reputational damage: Past legal battles and tax disputes have created a perception that could affect investor and public trust.

- Financial impact: Legal costs and potential penalties can significantly drain financial resources, impacting profitability and operational flexibility.

- Management distraction: Addressing these challenges diverts crucial executive time and focus away from strategic growth initiatives.

Grupo Elektra is vulnerable to economic downturns and inflation, which can reduce consumer spending and increase payment defaults, impacting its retail and financial services. The company also faces intense competition from agile fintechs and digitally-focused traditional banks, potentially leading to margin erosion in its financial offerings. Evolving regulations and rising interest rates pose further risks, potentially increasing funding costs and limiting credit demand.

Cybersecurity threats are a critical concern, with data breaches costing an average of $4.45 million globally in 2024, risking financial losses and reputational damage for Elektra. Persistent governance issues and legal scrutiny, including past allegations of stock manipulation and tax disputes, continue to pose a threat to investor confidence and can lead to significant legal costs and management distraction.

SWOT Analysis Data Sources

This Grupo Elektra SWOT analysis is built upon a foundation of credible data, including Grupo Elektra's official financial reports, comprehensive market research, and expert industry analyses to provide a robust and insightful strategic overview.