Grupo Elektra Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Elektra Bundle

Grupo Elektra navigates a complex retail and financial services landscape, facing significant pressure from intense rivalry and the substantial bargaining power of its buyers, particularly in its core markets. Understanding these dynamics is crucial for any business operating within or looking to enter this sector.

The complete report reveals the real forces shaping Grupo Elektra’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Grupo Elektra's diverse product sourcing, from appliances to mobile phones, means supplier concentration varies. For categories like high-end electronics or specialized furniture, where only a few manufacturers exist, suppliers hold considerable sway over pricing and terms with Elektra.

Grupo Elektra's bargaining power with its suppliers is significantly shaped by the switching costs associated with its retail products and financial technology. If Elektra faces substantial expenses or operational disruptions when changing suppliers for its diverse product lines or its integrated financial systems, suppliers gain considerable leverage. For instance, if its point-of-sale systems are deeply integrated with a specific payment processor, switching would involve considerable IT investment and retraining, thereby increasing supplier power.

Conversely, if Grupo Elektra can readily source similar retail goods from numerous vendors or easily integrate alternative financial technology solutions, the bargaining power of individual suppliers diminishes. In 2023, Grupo Elektra reported revenues of approximately MXN 160 billion, indicating a substantial purchasing volume that could be used to negotiate favorable terms, provided a competitive supplier landscape exists for its core offerings.

The uniqueness of inputs for Grupo Elektra significantly influences supplier bargaining power. If suppliers provide highly specialized or proprietary components, such as advanced consumer electronics or unique financial technology solutions essential for Elektra's operations, their leverage increases. For instance, a supplier of a critical, patented payment processing system would hold considerable sway.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and directly competing with Grupo Elektra is a significant consideration. This could manifest if key technology providers or even certain product brands decide to bypass Elektra's retail channels and establish their own direct-to-consumer operations or offer bundled financial services. Such a move would directly challenge Elektra's market position.

For instance, a fintech company that supplies payment processing solutions to Elektra could potentially launch its own retail credit or financing options, directly competing for Elektra's customer base. In 2024, the increasing digitalization of financial services makes this a more plausible scenario than in previous years.

- Forward Integration Risk: Suppliers in technology or finance could launch direct-to-consumer offerings.

- Competitive Impact: This would directly challenge Grupo Elektra's retail and financial service segments.

- Digitalization Factor: The growth of fintech in 2024 enhances the feasibility of this threat.

Importance of Elektra to Suppliers

Grupo Elektra's substantial purchasing volume significantly influences its bargaining power with suppliers. For instance, in 2023, Grupo Elektra's consolidated revenues reached approximately MXN 157.6 billion (USD 9.3 billion), indicating the scale of its operations and its potential to negotiate favorable terms.

However, the impact varies. For major global electronics manufacturers, Elektra might represent a smaller fraction of their overall sales, diminishing its individual leverage. Conversely, for smaller or niche suppliers, Elektra's expansive distribution network, reaching millions of customers across Mexico and other Latin American countries, makes it a critical sales channel. This dependence can significantly curtail the supplier's ability to dictate terms.

- Supplier Dependence: Elektra’s extensive reach into middle and lower-income segments makes it a vital partner for many suppliers, particularly those focused on these demographics.

- Market Share: The proportion of a supplier's total sales attributed to Grupo Elektra directly impacts its bargaining power. A higher percentage means less power for the supplier.

- Product Specialization: Suppliers offering unique or specialized products that are in high demand by Elektra's customer base may find themselves with more leverage.

- Alternative Buyers: The availability of comparable distribution channels for a supplier's products in the market can either strengthen or weaken their bargaining position with Elektra.

Grupo Elektra's substantial purchasing volume, evidenced by its 2023 revenues of approximately MXN 157.6 billion, grants it significant leverage with suppliers, especially those reliant on its extensive distribution network. However, this power is tempered by the concentration of suppliers for certain product categories, such as high-end electronics, where fewer manufacturers can dictate terms.

The threat of forward integration by suppliers, particularly in the rapidly digitizing fintech sector in 2024, poses a notable risk, potentially leading to direct competition for Elektra's customer base. Conversely, suppliers providing unique or specialized inputs essential for Elektra's operations also wield considerable bargaining power.

Grupo Elektra's ability to negotiate favorable terms is also influenced by the switching costs associated with its integrated financial systems; high costs empower suppliers. The proportion of a supplier's total sales that Elektra represents directly impacts the supplier's leverage, with smaller suppliers often being more dependent and thus having less power.

| Factor | Impact on Supplier Bargaining Power | Grupo Elektra Context (2023/2024 Data) |

|---|---|---|

| Purchasing Volume | High volume generally reduces supplier power. | MXN 157.6 billion in 2023 revenues indicates significant scale. |

| Supplier Concentration | Few suppliers in a category increase their power. | Concentration exists in high-end electronics and specialized inputs. |

| Switching Costs | High switching costs increase supplier power. | Integrated financial systems can create high switching costs. |

| Forward Integration Threat | Increases supplier power if realized. | Plausible in fintech due to 2024 digitalization trends. |

| Uniqueness of Inputs | Unique inputs increase supplier power. | Patented financial technology solutions are an example. |

| Supplier Dependence on Elektra | Higher dependence reduces supplier power. | Elektra's reach makes it vital for many niche suppliers. |

What is included in the product

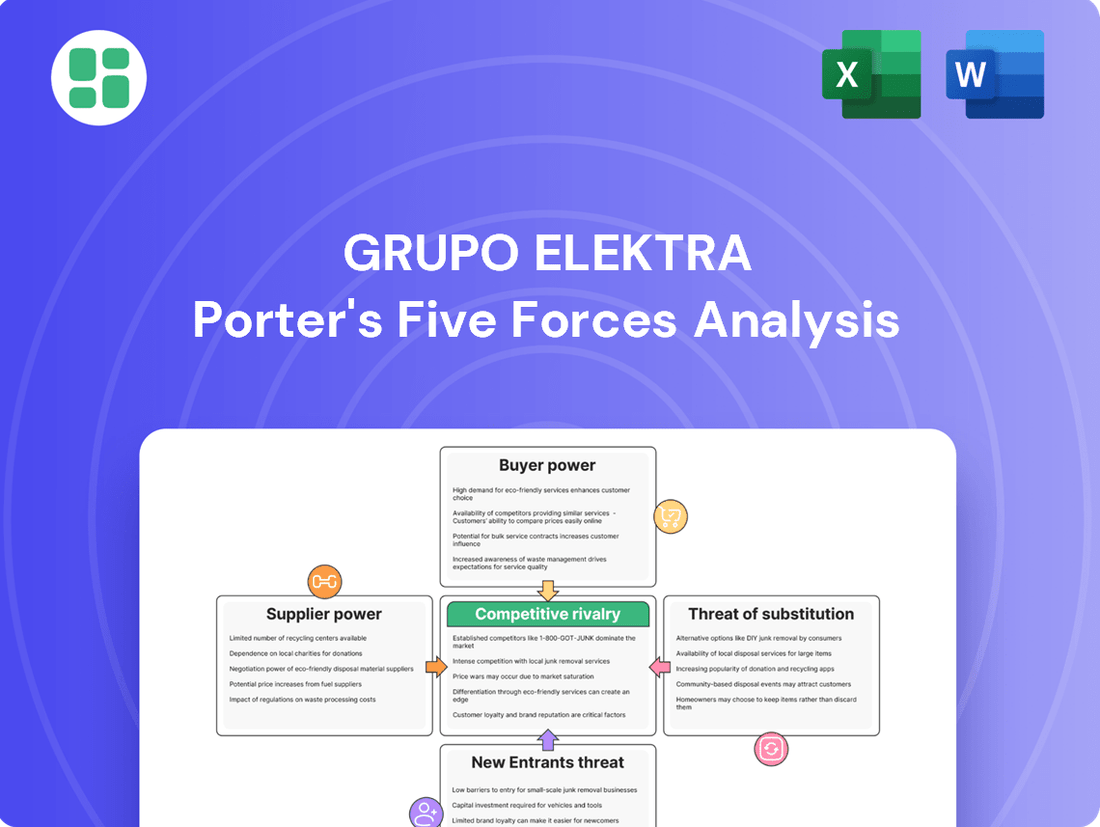

This analysis unpacks the competitive forces impacting Grupo Elektra, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within its diverse markets.

Instantly identify and neutralize competitive threats by visualizing Grupo Elektra's Porter's Five Forces, offering a clear roadmap to navigate market pressures.

Customers Bargaining Power

Grupo Elektra's core customer base, situated in middle and lower-income brackets, exhibits significant price sensitivity. This means they are keenly aware of costs and actively seek the best value, which directly influences their purchasing decisions.

This heightened sensitivity translates into increased bargaining power for these customers. They are more likely to negotiate for lower prices or demand more favorable credit terms, putting pressure on Elektra to offer competitive deals and flexible payment plans.

Grupo Elektra's integrated model, combining retail sales with financial services like credit, is a strategic response to this customer characteristic. By providing accessible credit, Elektra aims to mitigate the impact of price sensitivity and make its products attainable for its target demographic.

Customers of Grupo Elektra face a competitive landscape with numerous alternatives for acquiring goods and financial services. This includes other large retailers, burgeoning online marketplaces, and even direct sales from manufacturers, all of which provide readily available substitutes.

Beyond retail, the financial services sector offers a wide array of options, from traditional banks and credit unions to fintech companies providing loans, credit, and banking solutions. This broad accessibility of financial products means customers are not solely reliant on Grupo Elektra.

The low switching costs associated with these alternatives significantly bolster customer bargaining power. For instance, in 2024, e-commerce platforms continued to expand their reach in Latin America, with Mexico's online retail sales projected to grow by approximately 15% year-over-year, offering consumers more price-sensitive choices.

Customers today have unprecedented access to information, particularly regarding pricing for goods and interest rates for financial services. This surge in readily available data, often facilitated by the internet and specialized comparison tools, significantly boosts transparency in the market.

For instance, in 2024, platforms like Bankrate and NerdWallet allow consumers to compare mortgage rates from dozens of lenders in minutes, directly impacting their negotiation power. This ease of comparison reduces information asymmetry, putting customers in a much stronger position when deciding on a provider or negotiating terms, as they can readily identify superior offers.

Low Switching Costs for Customers

The bargaining power of customers is significantly influenced by low switching costs. For many retail goods, customers can readily find comparable products from various competitors, both in brick-and-mortar stores and online. This ease of transition means customers are not heavily tied to a single provider.

While Grupo Elektra's Banco Azteca offers credit services, creating some level of customer loyalty through established accounts and payment histories, the competitive landscape for financial services remains robust. In 2024, the digital lending market, for instance, continued to expand, offering consumers numerous alternative credit options.

- Low Switching Costs: Customers can easily switch between retailers for similar products.

- Credit Alternatives: Despite Banco Azteca's presence, other credit providers offer customers choices.

- Market Competition: The availability of diverse credit options in 2024 limits the lock-in effect for customers.

Customer Volume and Fragmentation

Grupo Elektra's customer base is vast, but the typical individual purchase of consumer goods is relatively small. This generally reduces the bargaining power of any single customer. For instance, in 2024, the average sale value for many consumer electronics and appliances sold through Elektra's channels remained modest, reflecting the purchasing power of its core demographic.

However, the sheer number of customers, often concentrated in lower-income segments, creates a significant collective influence. This large volume of transactions is crucial for Elektra's business model, meaning that widespread customer dissatisfaction or a shift in purchasing habits could pressure the company on pricing and credit policies. The company's strategy often hinges on high sales volume, making customer retention and satisfaction paramount, especially as many customers rely on flexible payment plans offered by Elektra.

- Customer Volume: Millions of individual transactions annually.

- Individual Purchase Size: Generally low for consumer goods.

- Collective Influence: Significant due to high transaction volume, impacting pricing and credit terms.

- 2024 Data Context: Modest average sale values highlight reliance on volume.

Grupo Elektra's customers possess considerable bargaining power due to the availability of numerous alternatives for both retail goods and financial services. The ease with which customers can switch providers, coupled with increased market transparency driven by readily accessible pricing information in 2024, further amplifies this power. While individual purchase sizes are often modest, the collective influence of a large customer base can impact Elektra’s pricing and credit strategies.

| Factor | Impact on Elektra's Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Price Sensitivity | High; customers actively seek best value. | Customers compare prices across multiple retailers and online platforms. |

| Availability of Substitutes | High; numerous retailers and financial service providers exist. | Growth in Latin American e-commerce (e.g., ~15% YoY in Mexico for online retail) offers more choices. |

| Switching Costs | Low; easy to move between providers. | Minimal barriers to opening accounts with competing banks or credit unions. |

| Information Access | High; customers can easily compare prices and rates. | Comparison tools for financial products (e.g., mortgage rates) empower consumers. |

| Customer Volume vs. Individual Purchase Size | Low individual power, but high collective influence. | Modest average sale values for goods necessitate high sales volume, making customer retention critical. |

Preview Before You Purchase

Grupo Elektra Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Grupo Elektra's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis equips you with a deep understanding of the strategic forces shaping Grupo Elektra's market position.

Rivalry Among Competitors

Grupo Elektra navigates a highly competitive landscape, facing a broad spectrum of rivals in its core markets of Mexico, the United States, and Central America. This includes established department stores, specialized appliance and electronics retailers, and a growing number of online sellers, all vying for consumer spending.

In financial services, Elektra competes with numerous banks and credit unions, as well as fintech companies and other non-bank lenders. This diverse competitive set, encompassing both large, traditional institutions and agile new entrants, intensifies pressure on pricing and service innovation.

The growth rate within Grupo Elektra's operating sectors, specifically consumer retail and financial services, heavily influences the intensity of competition. When these markets, particularly those serving middle and lower-income segments, experience slower expansion, companies often resort to more aggressive tactics to capture market share from rivals.

For Grupo Elektra, the financial landscape in 2024 presented a mixed picture. While the company reported revenue growth, it also incurred a net loss for the year. This suggests that despite increasing sales, the overall economic environment and competitive pressures made it challenging to translate that growth into profitability, indicating a demanding market where competition for every customer is heightened.

Grupo Elektra's unique blend of retail sales and accessible financial services, especially credit, sets it apart, particularly for its core customer base. This integrated approach provides a significant differentiator in a crowded market.

However, the competitive landscape is fierce. Many rivals also provide credit options and customer loyalty programs, meaning Elektra must constantly innovate its products, customer service, and financial offerings to stay ahead.

For instance, in 2024, while specific differentiation metrics for Elektra are proprietary, the broader retail sector saw significant investment in customer experience technologies. Companies that effectively leveraged data analytics to personalize offers and streamline credit applications saw improved customer retention rates.

Exit Barriers

High exit barriers in retail and financial services can certainly crank up the heat on competitive rivalry. When it's tough to leave, companies tend to stick around, even if they're not making much profit. This means more players are constantly vying for market share, making things challenging for everyone involved.

Grupo Elektra faces substantial exit barriers due to its significant investments. Think about all those physical stores, the banking licenses needed to operate financial services, the technology infrastructure, and a large workforce. These are all major fixed costs. Pulling the plug on these operations would likely result in considerable financial losses, making it a very difficult decision for the company.

For instance, in 2023, Grupo Elektra reported total assets of approximately MXN 233 billion (around USD 13 billion at the time of reporting). A significant portion of this would be tied up in physical assets and the infrastructure required for its financial services arm, Banco Azteca. Divesting these assets would be a complex and costly undertaking.

- High fixed costs: Investments in extensive store networks and banking infrastructure create substantial sunk costs.

- Regulatory hurdles: Banking licenses and financial service regulations can be difficult and expensive to divest or transfer.

- Employee base: Large workforces represent significant severance and transition costs if operations are wound down.

- Brand and reputation: Exiting markets can damage Grupo Elektra's overall brand equity and future business prospects.

Cost Structure and Price Competition

The competitive landscape for Grupo Elektra is heavily influenced by its rivals' cost structures and the intensity of price-based competition, particularly within segments serving middle and lower-income consumers where price often dictates purchasing decisions.

Grupo Elektra's success hinges on its capacity to maintain competitive pricing and offer attractive credit terms, a strategy that requires meticulous management of its own operational expenses and non-performing loan ratios.

- Price Sensitivity: In 2024, many consumer electronics and appliance markets, especially those catering to lower-income demographics in Latin America, saw price promotions increase by an average of 15% year-over-year, underscoring the importance of cost leadership.

- Credit as a Differentiator: Flexible credit options remain a key competitive tool; for instance, some of Elektra's competitors reported offering installment plans with interest rates as low as 0.5% per month on select items in early 2024.

- Operational Efficiency: Managing overheads is paramount; a 2023 industry report indicated that retailers with leaner supply chains and efficient inventory management could achieve gross margins 3-5% higher than those with less optimized operations.

Grupo Elektra faces intense competitive rivalry across its retail and financial services operations, driven by numerous players from traditional department stores to agile fintechs. This rivalry is amplified when market growth slows, forcing companies to aggressively vie for market share, often through price competition and enhanced credit offerings.

The company's integrated model of selling goods with accessible financing is a key differentiator, but many competitors also offer similar credit facilities and loyalty programs, necessitating continuous innovation in products and customer service to maintain an edge.

High exit barriers, including substantial investments in physical stores, banking infrastructure, and large workforces, mean that competitors are likely to remain in the market even under pressure, intensifying rivalry. For example, Grupo Elektra's 2023 total assets of approximately MXN 233 billion highlight the significant capital tied up in its operations, making divestment a costly prospect.

Price sensitivity is a major factor, especially in segments serving lower-income consumers, with price promotions increasing significantly in 2024. Competitors are leveraging flexible credit options and operational efficiency to gain an advantage, with some offering low-interest installment plans and achieving higher gross margins through leaner operations.

| Competitive Factor | 2024 Market Trend | Impact on Grupo Elektra |

|---|---|---|

| Price Promotions | Increased by ~15% YoY in consumer electronics/appliances for lower-income segments. | Requires strict cost management and competitive pricing strategies. |

| Credit Offerings | Competitors offering rates as low as 0.5% per month on select items. | Elektra must ensure its credit terms remain attractive and manage associated risks. |

| Operational Efficiency | Retailers with lean supply chains achieved 3-5% higher gross margins. | Drives the need for continuous improvement in Elektra's operational and supply chain management. |

SSubstitutes Threaten

Consumers have a wide array of substitutes for Grupo Elektra's retail offerings. Beyond traditional brick-and-mortar competitors like large department stores and specialized electronics shops, the digital landscape presents a formidable challenge. E-commerce giants and direct-to-consumer (DTC) brands are increasingly capturing market share.

The threat from online retail is particularly potent. In 2024, global e-commerce sales are projected to reach over $7 trillion, highlighting the significant shift in consumer purchasing habits towards digital platforms. These online channels often provide greater convenience and competitive pricing, directly impacting Grupo Elektra's traditional retail model.

Grupo Elektra's core financial services, like consumer credit and banking, are increasingly challenged by non-traditional providers. Fintech innovators, for instance, are leveraging mobile technology to offer faster, more accessible lending, directly competing for Elektra's customer base. In 2024, the global fintech market was projected to reach over $300 billion, highlighting the significant scale of this disruptive force.

Peer-to-peer lending platforms and microfinance institutions also present a substantial threat, particularly to the underserved segments that Grupo Elektra historically serves. These alternatives can offer more flexible terms or specialized products, potentially drawing away customers seeking tailored financial solutions. The growth of digital microfinance, in particular, has been rapid, with millions of individuals gaining access to credit through these channels.

The rise of DIY culture and thriving second-hand markets presents a significant threat to Grupo Elektra's traditional retail model. For items like appliances and furniture, consumers increasingly opt for repairing what they already own or buying pre-owned goods, especially in budget-sensitive demographics. This trend directly erodes the demand for new products, impacting Elektra's sales volume.

For instance, a 2024 report indicated that the global second-hand market for apparel alone was projected to reach over $350 billion, a figure that highlights the growing consumer acceptance and economic viability of used goods across various categories. This suggests a substantial portion of potential Elektra customers might be diverted to these alternative channels, particularly for lower-cost or essential items.

Cash Purchases and Savings

While Grupo Elektra's business model heavily features credit, consumers retain the fundamental option to bypass credit entirely by saving and making cash or debit purchases. This direct payment method represents a significant substitute, particularly for price-sensitive consumers or those seeking to avoid interest charges.

An improving economic climate or enhanced financial literacy among its customer base could bolster the appeal of cash purchases. For instance, if consumer confidence, a key indicator of spending willingness, continues its upward trend as projected for parts of Latin America in 2024, more individuals might opt to save for larger purchases rather than rely on credit. This shift directly erodes the demand for Elektra's integrated credit-retail offering.

Consider the impact on a consumer looking for a new appliance. Instead of financing through Elektra, they could allocate a portion of their income each month into a savings account. As of early 2024, average savings account interest rates in some emerging markets have seen modest increases, making saving a slightly more attractive alternative to immediate credit acquisition. This presents a clear threat of substitution.

- Cash/Debit Purchases: Consumers can save and pay outright, bypassing credit entirely.

- Economic Outlook Influence: A stronger economy can encourage saving over credit-based spending.

- Financial Literacy Impact: Increased understanding of personal finance may lead consumers away from credit.

- Interest Rate Sensitivity: Even small increases in savings rates can make cash purchases more appealing.

Rental and Leasing Services

The threat of substitutes for Grupo Elektra's product offerings, particularly in the appliance and furniture sectors, is growing. Consumers increasingly have the option to rent or lease items instead of buying them outright. This can be a significant draw for those looking to avoid large upfront expenses or long-term ownership commitments.

Subscription services and rental models are becoming more common for higher-priced consumer goods. For instance, furniture rental companies offer flexible arrangements, allowing customers to furnish their homes without the burden of purchase. Similarly, some electronics are available through leasing programs, providing access to the latest technology on a payment plan.

While not a direct substitute for every item Grupo Elektra sells, the increasing availability and appeal of these rental and leasing options represent a tangible threat. This is especially true for consumers who prioritize flexibility and lower initial outlays over ownership. For example, a 2024 market analysis indicated a 15% year-over-year increase in the furniture rental sector, highlighting this trend.

- Growing Rental Market: The furniture rental market in Mexico, a key market for Grupo Elektra, saw an estimated 12% growth in 2023, indicating a preference for flexible consumption.

- Appliance Leasing Trends: While specific data for appliance leasing is still emerging, broader consumer finance trends show a 10% increase in flexible payment options for durable goods in 2024.

- Cost-Conscious Consumers: A significant portion of consumers, particularly younger demographics, are prioritizing access over ownership, making rental and leasing services attractive alternatives.

The threat of substitutes for Grupo Elektra's offerings is substantial, spanning retail, financial services, and even the fundamental concept of ownership. Consumers can readily substitute new purchases with pre-owned goods, rent or lease items, or simply save and pay with cash or debit. E-commerce and fintech innovations further intensify this threat by providing more convenient and often cheaper alternatives.

The digital shift is undeniable, with global e-commerce sales projected to exceed $7 trillion in 2024. Similarly, the fintech market's projected growth to over $300 billion in 2024 underscores the challenge from alternative financial providers. These trends highlight a clear and present danger to Grupo Elektra's traditional business model.

Even the choice to save rather than finance poses a threat. With modest increases in savings account interest rates in some emerging markets in 2024, the appeal of cash purchases grows. This, coupled with rising consumer confidence in certain regions, encourages saving over credit, directly impacting Elektra's core credit-based retail strategy.

| Substitute Category | Example | 2024 Market Projection/Trend | Impact on Grupo Elektra |

|---|---|---|---|

| Online Retail | E-commerce Giants, DTC Brands | Global sales > $7 trillion | Erodes brick-and-mortar sales, price pressure |

| Financial Services | Fintech Lenders, P2P Platforms | Fintech market > $300 billion | Competes for customer base, offers alternative credit |

| Used Goods Market | Second-hand Appliances, Furniture | Second-hand apparel market > $350 billion | Reduces demand for new products |

| Rental/Leasing | Furniture Rental, Appliance Leasing | Furniture rental sector +15% YoY | Offers lower upfront cost, flexibility over ownership |

| Direct Payment | Cash/Debit Purchases | Influenced by savings rates & consumer confidence | Bypasses credit, reduces interest income |

Entrants Threaten

Grupo Elektra's dual operation in specialty retail and financial services presents a formidable capital requirement barrier. Launching a retail chain necessitates significant investment in store leases, inventory, and logistics, while establishing a bank like Banco Azteca demands substantial capital reserves and regulatory compliance funding. For instance, in 2024, the average cost to open a new retail store can range from $50,000 to over $500,000 depending on size and location, not to mention the millions required for banking licenses and operational capital.

The financial services sector, including banking operations like Grupo Elektra's Banco Azteca, faces significant regulatory hurdles and licensing demands. These stringent requirements are designed to protect consumers and ensure financial stability, making it difficult and expensive for new entrants to establish a foothold. For example, in 2024, compliance costs for financial institutions continue to rise, with many firms dedicating substantial budgets to legal and regulatory adherence, effectively barring smaller or less capitalized competitors.

Grupo Elektra's vast network, encompassing over 6,000 points of contact across several countries, provides substantial economies of scale in purchasing, logistics, and marketing. This scale allows them to negotiate better prices and operate more efficiently than smaller competitors.

New entrants would face a significant hurdle in replicating these cost advantages. Without similar scale, they would likely struggle to match Elektra's pricing or offer competitive credit terms, potentially leading to initial financial strain.

Brand Loyalty and Customer Switching Costs

Grupo Elektra benefits from significant brand loyalty, especially within its core middle and lower-income customer base. This loyalty is reinforced by its long-standing presence and the integration of credit facilities directly into its sales model, making it a trusted provider for many. For instance, in 2024, Elektra continued to leverage its extensive store network and accessible credit options, which are key differentiators in its markets.

New entrants face a substantial hurdle in replicating this entrenched customer loyalty and overcoming the inherent switching costs. These costs aren't just financial; they also include the convenience and familiarity customers associate with Elektra's established credit relationships and shopping experience. Building a comparable level of trust and offering incentives strong enough to entice customers away from these established ties requires considerable investment.

- Brand Recognition: Grupo Elektra's decades of operation have cemented its brand in the minds of consumers, particularly in Latin America.

- Customer Inertia: Existing customers are often hesitant to switch due to established credit lines and the perceived complexity of setting up new ones with unfamiliar providers.

- Credit Integration: The seamless integration of credit at the point of sale significantly reduces friction for customers, a model that is difficult and costly for new players to replicate effectively.

Access to Distribution Channels and Supply Chains

Grupo Elektra's established distribution channels and supply chain are significant barriers for new entrants. Building a network capable of reaching a broad customer base, especially in diverse markets, requires substantial investment and time. For instance, in 2024, Grupo Elektra continued to leverage its extensive store network across Latin America, which serves as a critical distribution point for its wide array of products.

New competitors would struggle to match Elektra's integrated logistics and its own manufacturing capabilities, such as the Italika motorcycle brand, which underpins much of its product delivery and sales. This vertical integration allows for greater control over costs and availability, a feat difficult for newcomers to replicate quickly.

The threat of new entrants is therefore moderated by the sheer scale and complexity of replicating Grupo Elektra's existing infrastructure.

- Established Distribution Network: Grupo Elektra possesses a vast physical retail presence and logistics infrastructure across multiple countries, making it difficult for new entrants to achieve similar market reach.

- Supply Chain Integration: The company's control over its supply chain, including manufacturing its own brands like Italika, provides a competitive advantage in terms of cost and efficiency that new players would find challenging to match.

- Capital Investment Requirements: The substantial capital needed to build a comparable distribution and supply chain network acts as a significant deterrent for potential new market entrants.

The threat of new entrants for Grupo Elektra is significantly limited by the substantial capital required to establish a comparable retail and financial services operation. Furthermore, stringent regulatory frameworks, particularly in the banking sector, create high barriers to entry, demanding extensive compliance and licensing. In 2024, the cost of obtaining banking licenses alone can run into millions of dollars, a prohibitive sum for most new players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo Elektra is built upon a foundation of publicly available financial reports, investor relations materials, and industry-specific market research from reputable firms. We also incorporate data from regulatory filings and economic indicators to provide a comprehensive view of the competitive landscape.