Grupo Elektra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Elektra Bundle

Grupo Elektra operates within a dynamic landscape shaped by political shifts, economic volatilities, and evolving social trends across Latin America. Understanding these external forces is crucial for forecasting growth and mitigating risks. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence.

Gain a competitive edge by understanding the political stability, economic growth, and technological advancements impacting Grupo Elektra. This ready-made PESTLE Analysis delivers expert-level insights, perfect for investors and strategic planners. Buy the full version to get the complete breakdown instantly.

Political factors

Grupo Elektra, especially its banking division Banco Azteca, navigates a complex regulatory landscape across Mexico and Latin America. Recent shifts in financial regulations, such as updated consumer credit protection laws and stricter anti-money laundering (AML) protocols, necessitate ongoing compliance efforts. For instance, Mexico's National Banking and Securities Commission (CNBV) consistently enforces evolving capital adequacy ratios and operational guidelines that directly affect Banco Azteca's business model and risk management strategies, requiring substantial investment in compliance infrastructure.

Grupo Elektra's operations are significantly shaped by the political stability of its key markets, particularly Mexico. Instability can deter foreign investment and complicate long-term strategic planning, impacting confidence in the retail and financial services sectors. For instance, Mexico's presidential election cycle often brings policy uncertainties that can temporarily affect market sentiment.

Government economic policies directly influence consumer spending power, a critical driver for Grupo Elektra's diverse product offerings. Fiscal policies, such as changes in income tax or government spending on social programs, can either boost or dampen demand for electronics, appliances, and financial services. In 2024, Mexico's fiscal policy, including its approach to public spending and potential stimulus measures, will be closely watched for its impact on household disposable income.

Grupo Elektra has navigated considerable legal headwinds, notably a substantial tax debt and rulings for contempt of court against its controlling shareholders due to non-compliance with financial reporting. These legal entanglements have resulted in penalties and exclusion from key Mexican stock market indices, directly impacting the company's public image and operational continuity.

Trade and Import Policies

Grupo Elektra's retail operations, particularly its commercial segment, are significantly influenced by trade and import policies. As a major importer of consumer goods like electronics, appliances, and motorcycles, the company is directly impacted by shifts in international trade agreements, tariffs, and import restrictions. For instance, a change in tariffs on electronics could increase Grupo Elektra's cost of goods sold, potentially forcing price adjustments for consumers or squeezing profit margins.

The evolving trade landscape presents both opportunities and challenges. For example, new trade pacts could streamline import processes and reduce costs, while protectionist measures could lead to higher prices and reduced product variety. In 2024, Mexico's trade relations with key manufacturing hubs remain a critical factor. The ongoing negotiations and potential adjustments to existing trade frameworks, such as those impacting electronics from Asia, will directly affect Grupo Elektra's sourcing strategies and pricing competitiveness in the Mexican market.

- Tariff Impact: Changes in import tariffs on key product categories like consumer electronics can directly increase Grupo Elektra's procurement costs, affecting product pricing and consumer affordability.

- Supply Chain Vulnerability: Import restrictions or trade disputes can disrupt the supply chain, leading to stockouts or delays in product availability for Grupo Elektra's diverse customer base.

- Competitive Landscape: Trade policies influence the cost of imported goods relative to domestically produced alternatives, impacting Grupo Elektra's competitive positioning against other retailers and manufacturers.

- Regulatory Compliance: Grupo Elektra must navigate complex and evolving import regulations, ensuring compliance with customs procedures, product standards, and any specific trade agreements Mexico enters into.

Consumer Protection Regulations

Consumer protection regulations significantly influence Grupo Elektra's operations, particularly given its target market of lower and middle-income consumers. Laws governing credit terms, interest rates, and debt collection are paramount. For instance, in 2024, Mexico's central bank maintained its benchmark interest rate at 11.00%, impacting the cost of credit for companies like Elektra and potentially influencing the margins on its financial products.

Stricter enforcement or new legislation in these areas could require Grupo Elektra to adapt its lending models and customer service. This might involve more transparent fee structures or limitations on certain collection practices. Such changes could affect profitability by increasing compliance costs or reducing revenue from interest and fees.

- Regulatory Scrutiny: Increased government focus on consumer protection in Latin America, particularly in 2024-2025, could lead to more audits and stricter adherence requirements for financial service providers.

- Impact on Margins: Potential caps on interest rates or fees, driven by consumer protection mandates, could compress the profit margins on Grupo Elektra's core financial offerings.

- Operational Adjustments: Companies may need to invest in enhanced compliance systems and staff training to meet evolving regulatory standards, adding to operational expenses.

Government stability and policy continuity are crucial for Grupo Elektra's long-term investments in markets like Mexico. Political shifts can introduce regulatory uncertainty, impacting consumer confidence and the company's strategic planning. For instance, election cycles often bring temporary policy ambiguity that affects market sentiment.

Economic policies, particularly fiscal measures, directly influence consumer purchasing power for Grupo Elektra's products and services. Government spending and taxation policies in 2024, such as those impacting disposable income in Mexico, are key determinants of demand. The benchmark interest rate in Mexico, maintained at 11.00% by the Banco de México in early 2024, directly affects credit costs for Elektra.

Grupo Elektra faces significant legal and compliance challenges, including past tax disputes and shareholder contempt rulings that led to penalties and market index exclusion. These legal entanglements underscore the importance of strict adherence to financial reporting and regulatory frameworks.

What is included in the product

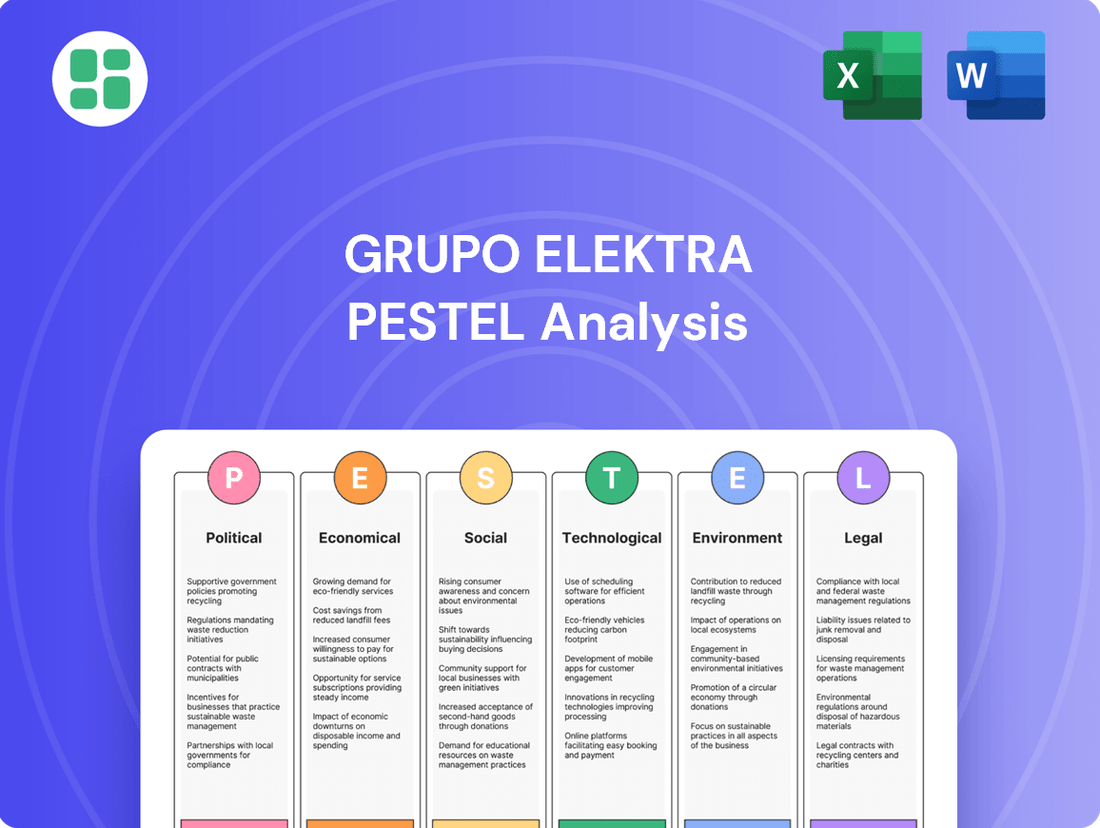

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Grupo Elektra's operations and strategic decisions.

It provides a comprehensive overview of external influences, highlighting potential challenges and opportunities for the company's growth and market positioning.

A PESTLE analysis of Grupo Elektra offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for swift decision-making during meetings.

Economic factors

Mexico experienced elevated inflation throughout 2024, with figures remaining above Banxico's target range. This persistent inflation directly impacts Grupo Elektra's core customer base by diminishing their purchasing power, which can lead to reduced demand for retail goods. For instance, if inflation averages 5% in 2024, a product costing $100 at the start of the year would effectively cost $105 by year-end, making discretionary purchases more challenging.

In tandem with inflation, interest rates in Mexico saw an upward trend in 2024. Higher benchmark rates increase the cost of capital for Grupo Elektra, particularly affecting its financial services segment. This can translate into higher borrowing costs for the company and potentially higher lending rates for its customers, impacting loan origination volumes and the profitability of its credit operations.

Grupo Elektra's performance is closely tied to the economic health of its core customer base, which largely comprises middle and lower-income households. When the Gross Domestic Product (GDP) grows robustly, it typically signals a stronger economy with increased employment opportunities. This translates directly into higher disposable income for these segments, enabling them to purchase more consumer goods and manage their credit obligations more effectively.

For instance, Mexico's GDP growth was estimated at 3.1% in 2023 and projections for 2024 suggest continued expansion, albeit potentially at a slightly moderated pace. This economic expansion directly fuels consumer spending power, a critical driver for Grupo Elektra's sales of electronics, appliances, and financial services.

Remittances from the United States represent a vital economic lifeline for many of Grupo Elektra's customer base in Mexico. These flows are a significant driver of consumer spending and overall financial well-being for recipient households. Between 2010 and 2024, remittances to Mexico experienced a robust compound annual growth rate of 8.0%, underscoring their sustained importance.

Credit Market Dynamics and Loan Portfolio Quality

The credit market's condition directly impacts Grupo Elektra's financial services arm. A robust credit market generally means easier access to funds for customers and lower risk for lenders.

Grupo Elektra's loan portfolio quality is a key indicator of its operational health. For instance, Banco Azteca Mexico saw its non-performing loan ratio improve significantly, falling to 3.7% in the first quarter of 2024, down from 4.9% in the same period of the previous year. This positive trend suggests better credit risk management and a healthier borrower base.

- Improved NPL Ratio: Banco Azteca Mexico's non-performing loan ratio decreased to 3.7% in Q1 2024 from 4.9% in Q1 2023.

- Credit Risk Management: The ongoing health of the credit market necessitates continuous monitoring of credit risk exposure.

- Market Liquidity: Ensuring adequate market liquidity is crucial for sustained lending operations and financial stability.

Currency Fluctuations

Currency fluctuations, especially between the Mexican Peso and the US Dollar, significantly influence Grupo Elektra's financial performance. These shifts directly affect the value of its assets and liabilities denominated in foreign currencies.

For instance, in the second quarter of 2025, Grupo Elektra reported a foreign exchange gain. This gain stemmed from the appreciation of the Mexican Peso relative to the US Dollar, demonstrating how currency movements can positively impact its net monetary liability position.

- Peso Appreciation: The strengthening of the Mexican Peso against the US Dollar in Q2 2025 led to a favorable foreign exchange gain for Grupo Elektra.

- Monetary Position Impact: This gain highlights how currency movements can reduce the real cost of liabilities denominated in a weaker currency.

- Financial Reporting: Such fluctuations are a key consideration in Grupo Elektra's quarterly and annual financial reporting, affecting profitability and balance sheet values.

Mexico's economic landscape in 2024 and early 2025 presented a mixed bag for Grupo Elektra. While robust GDP growth provided a tailwind for consumer spending, persistent inflation and rising interest rates posed challenges. Remittances continued to be a significant income source for its customer base, supporting demand, but currency volatility, particularly the Mexican Peso's strength against the US Dollar in mid-2025, also influenced financial results.

| Economic Factor | 2023 (Actual/Estimate) | 2024 (Estimate/Projection) | Early 2025 (Projection/Trend) | Impact on Grupo Elektra |

|---|---|---|---|---|

| GDP Growth (Mexico) | 3.1% | ~2.5% - 3.0% | Projected steady growth | Supports consumer spending and credit demand |

| Inflation Rate (Mexico) | 4.7% (Year-end) | Averaging above 5.0% | Expected to moderate but remain elevated | Reduces purchasing power, increases operating costs |

| Interest Rates (Banxico) | 11.25% (Year-end) | Likely to remain high, potential for slight cuts | Continued elevated levels impacting borrowing costs | Increases cost of capital, affects credit profitability |

| Remittances to Mexico | Record highs, ~$60 billion | Projected continued strong inflows | Sustained high levels | Boosts disposable income of customer base |

| USD/MXN Exchange Rate | ~17.0 MXN/USD (Year-end) | Fluctuated, with periods of Peso strength | Continued volatility, with Peso strength observed mid-2025 | Affects foreign exchange gains/losses, cost of imported goods |

Same Document Delivered

Grupo Elektra PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Grupo Elektra covers all key external factors impacting its operations, providing a comprehensive strategic overview.

Sociological factors

Grupo Elektra's strategy heavily relies on serving middle and lower-income demographics, making shifts in population age, size, and geographic distribution critical. For instance, a growing youth population in Latin America presents opportunities for new product adoption, while an aging population might require different financial services. Understanding these evolving needs is key to tailoring offerings.

Income inequality is a significant factor for Grupo Elektra. In 2023, while specific figures for their target segments vary by country, broader trends show persistent income gaps across Latin America. For example, the Gini coefficient in countries like Mexico and Brazil remained elevated, indicating substantial income disparities. This means Elektra must carefully assess the purchasing power and creditworthiness of its customer base.

Consumer preferences for credit and retail access are fundamental to Grupo Elektra's business model. The company thrives when consumers are comfortable using credit for purchases and value the convenience of readily available retail and financial services. This inclination is particularly strong in the markets where Elektra operates, where access to traditional banking can be limited for many.

Grupo Elektra's vast network, boasting over 6,000 points of contact across Mexico, the United States, and Central America, directly addresses these consumer preferences. This extensive reach ensures proximity and service, especially for populations that might otherwise be underserved by conventional financial institutions and retailers, facilitating their access to goods and credit.

Grupo Elektra is a major player in expanding financial inclusion, reaching millions of families who might not have access to traditional banking services. This is particularly impactful in Latin America, where financial exclusion remains a significant challenge. For instance, in 2023, Grupo Elektra's Banco Azteca served over 19 million customers, many of whom are in lower-income segments.

The company is actively focusing on enhancing digital tools for credit applications and promoting financial literacy through digital channels. This strategy aims to make financial services more accessible and understandable for its diverse customer base. By the end of 2024, Elektra plans to increase its digital touchpoints by 25%, aiming to onboard an additional 2 million users onto its digital platforms.

Trust in Financial Institutions

Public perception and trust in financial institutions, such as Grupo Elektra's Banco Azteca, are crucial for customer acquisition and retention. A recent survey in Mexico indicated that while trust in banks generally remains, specific institutions can face scrutiny due to their affiliations or past issues. For instance, if allegations of fraud or legal challenges emerge against a controlling group, it can erode customer confidence, making transparent communication and strong ethical governance paramount.

Grupo Elektra's controlling group has faced scrutiny. For example, in late 2023, reports highlighted ongoing investigations into certain business practices. Such situations can lead to a decline in customer trust, potentially impacting Banco Azteca's deposit growth and loan origination. Maintaining robust ethical practices and clear communication strategies are therefore essential to counter negative sentiment and reinforce customer loyalty.

- Consumer Confidence: Trust directly impacts a customer's willingness to deposit funds or take out loans.

- Reputational Risk: Negative publicity surrounding the controlling group can spill over to its financial subsidiaries.

- Regulatory Scrutiny: Allegations can invite closer examination from financial regulators, potentially leading to compliance costs or operational restrictions.

- Market Share: A loss of trust can result in customers moving their business to competitors, impacting market share.

Cultural Attitudes Towards Debt

Cultural attitudes towards debt vary significantly across Latin America, influencing how customers engage with credit offerings. In many of Grupo Elektra's operating markets, there’s a growing acceptance of credit for purchasing durable goods, reflecting a desire for improved living standards. However, a history of economic instability in some regions can also foster a cautious approach to borrowing, emphasizing the need for transparent and manageable repayment terms.

Grupo Elektra's success hinges on aligning its financial products with these diverse cultural perceptions of debt. For instance, in Mexico, while credit penetration for consumer goods is rising, a strong emphasis on family and community support can impact individual repayment behaviors. Understanding these dynamics allows for the development of more effective and culturally sensitive collection strategies.

- Cultural Acceptance: In 2024, consumer credit adoption in Mexico continued to grow, with a significant portion of household spending on appliances and electronics facilitated by installment plans.

- Repayment Behavior: Surveys in 2024 indicated that while trust in formal credit providers is increasing, a preference for clear, fixed payment schedules remains paramount for a majority of consumers in the region.

- Financial Literacy: Initiatives aimed at improving financial literacy are crucial, as they help customers better understand the implications of debt and foster responsible borrowing habits, which is a key focus for companies like Grupo Elektra.

Grupo Elektra's core customer base is highly sensitive to economic shifts and societal trends, making demographic changes a critical consideration. The company's strategy is deeply intertwined with the age distribution and growth rates within its operating markets, particularly in Latin America, where a youthful demographic often signals a greater receptiveness to new financial products and digital services.

Income inequality remains a defining characteristic of Grupo Elektra's target markets. In 2023, persistent income disparities across Latin America, evidenced by elevated Gini coefficients in key countries, underscore the importance of assessing customer purchasing power and creditworthiness. This necessitates a nuanced approach to product development and risk management.

Consumer attitudes towards credit are foundational to Grupo Elektra's business model; a comfort level with utilizing credit for purchases and a preference for accessible retail and financial services are key drivers of its success. This inclination is particularly pronounced in regions where traditional banking infrastructure may be less developed, highlighting Elektra's role in bridging this gap.

Grupo Elektra's extensive physical presence, with over 6,000 points of contact across Mexico, the United States, and Central America, directly caters to these consumer preferences by ensuring proximity and accessibility. This vast network is instrumental in serving populations that might otherwise be excluded from conventional financial and retail channels, thereby enhancing their access to essential goods and credit facilities.

Technological factors

Grupo Elektra benefits immensely from the soaring adoption of digital banking and mobile apps like Banco Azteca and baz. This technological shift is a key enabler for the company's growth.

In 2024 alone, the Banco Azteca app processed an impressive 6.1 billion transactions, highlighting the massive scale and customer engagement these digital platforms achieve. This surge in mobile usage directly translates to greater convenience for customers and boosts operational efficiency for Grupo Elektra.

The continued expansion of e-commerce presents a significant technological factor for Grupo Elektra. To capitalize on this, a robust omnichannel strategy is essential for their retail operations. This means seamlessly integrating online and in-store experiences to meet customers wherever they prefer to shop.

Grupo Elektra's ability to grow its online credit operations is directly tied to this technological shift. By offering digital credit solutions, they can attract a wider demographic and cater to the increasing preference for convenient, online purchasing. This integration is key to adapting to evolving consumer behaviors in the 2024-2025 period.

Grupo Elektra increasingly leverages data analytics to sharpen its credit scoring and risk management processes. By analyzing vast datasets, the company can refine how it assesses borrower creditworthiness, leading to more accurate lending decisions. This focus on advanced analytics is crucial for maintaining the quality of its loan portfolio, especially in diverse markets.

In 2023, financial institutions globally saw a significant increase in the adoption of AI and machine learning for credit risk assessment, with some reporting up to a 20% improvement in prediction accuracy. Grupo Elektra's investment in these technologies allows it to personalize financial product offerings, catering better to individual customer needs and mitigating potential defaults.

Cybersecurity and Data Privacy

Grupo Elektra, as a major financial services provider, is increasingly exposed to sophisticated cybersecurity threats. The financial sector globally saw a significant rise in cyberattacks in 2024, with costs escalating. Protecting customer data and financial assets from breaches is paramount, requiring continuous investment in advanced security infrastructure.

Stringent data privacy regulations, such as updated GDPR-like frameworks being considered or implemented in key Latin American markets through 2024 and 2025, impose significant compliance burdens. Failure to adhere to these laws can result in substantial fines and reputational damage. Grupo Elektra must prioritize compliance to maintain customer trust and operational integrity.

- Cybersecurity Investment: Financial institutions globally are projected to increase cybersecurity spending. For instance, global spending on cybersecurity solutions and services was estimated to reach over $200 billion in 2024, a figure expected to grow.

- Data Privacy Compliance: Regulations like Mexico's Federal Law on the Protection of Personal Data Held by Private Parties continue to evolve, demanding robust data handling policies.

- Customer Trust: Data breaches can erode customer confidence, impacting Grupo Elektra's ability to attract and retain clients in the competitive financial services landscape.

- Financial Impact: The average cost of a data breach in the financial sector reached approximately $5.90 million in 2024, underscoring the financial risks associated with inadequate security.

Technological Investments for Operational Efficiency

Grupo Elektra is strategically channeling significant investments into technological advancements, particularly focusing on automation and digital solutions. This initiative is designed to sharpen operational efficiency and drive down expenses across its vast retail and financial services network. By streamlining core processes, the company aims to elevate the customer journey and boost the overall profitability of its numerous touchpoints.

These technological upgrades are crucial for maintaining a competitive edge in the rapidly evolving retail and financial sectors. For instance, the implementation of advanced inventory management systems and AI-powered customer service bots can lead to substantial cost savings and improved service delivery. In 2024, Grupo Elektra has earmarked a substantial portion of its capital expenditure for these digital transformations, signaling a strong commitment to future growth and operational excellence.

- Automation of back-office functions to reduce manual errors and processing times.

- Digitalization of customer interactions through enhanced mobile apps and online platforms.

- Implementation of data analytics for better inventory management and personalized marketing.

- Investment in cloud infrastructure to support scalable and efficient operations.

Grupo Elektra's technological strategy is deeply intertwined with its digital banking platforms, Banco Azteca and baz, which saw 6.1 billion transactions processed through the Banco Azteca app in 2024. This digital focus extends to e-commerce, where an omnichannel approach is vital for integrating online and in-store experiences. The company's growth in online credit operations is directly supported by these technological advancements, catering to evolving consumer preferences for digital transactions.

The company leverages data analytics for refined credit scoring and risk management, a trend mirrored globally where AI in credit risk assessment saw up to a 20% accuracy improvement in 2023. Grupo Elektra is also investing in automation and digital solutions to boost operational efficiency and reduce costs, with significant capital expenditure allocated to digital transformations in 2024.

However, Grupo Elektra faces escalating cybersecurity threats, with the financial sector experiencing a rise in cyberattacks in 2024, costing an average of $5.90 million per breach. This necessitates substantial investment in security infrastructure, alongside strict adherence to evolving data privacy regulations, like those being considered in Latin America through 2024-2025, to maintain customer trust and avoid significant fines.

| Technological Factor | Grupo Elektra's Strategy/Impact | 2024/2025 Data Point |

| Digital Banking Adoption | Expansion of Banco Azteca and baz apps | 6.1 billion transactions via Banco Azteca app in 2024 |

| E-commerce Growth | Omnichannel strategy for retail | Continued growth expected in online sales channels |

| Data Analytics & AI | Improved credit scoring and risk management | Global AI in credit risk saw up to 20% accuracy improvement (2023) |

| Cybersecurity | Investment in advanced security infrastructure | Average financial sector data breach cost: $5.90 million (2024) |

| Data Privacy Compliance | Adherence to evolving regulations | Increased regulatory scrutiny in Latin American markets (2024-2025) |

Legal factors

Grupo Elektra faces significant ongoing tax litigation, with a substantial debt stemming from a 2013 dispute that has ballooned due to accrued interest and penalties. This unresolved legal challenge presents a material financial risk, as the company continues to navigate complex tax liabilities that impact its bottom line and operational flexibility. The company's financial statements for the period ending December 31, 2023, indicate ongoing provisions and potential impacts related to these tax disputes, underscoring the persistent nature of this legal factor.

Grupo Elektra's financial operations are heavily influenced by stringent regulatory compliance, particularly concerning directives from Mexico's National Banking and Securities Commission (CNBV). Adherence to these financial regulations is not merely a suggestion but a critical operational imperative for the company.

The recent imposition of fines and the subsequent delisting of Grupo Elektra from key Mexican stock indexes serve as stark reminders of the severe repercussions that can arise from non-compliance. These events highlight the intense scrutiny and the significant financial and reputational risks involved in navigating the current regulatory landscape.

Allegations of fraud involving depositaries of Grupo Elektra's shares, coupled with ongoing legal disputes concerning ownership, have demonstrably influenced the company's stock performance, including instances of unusual trading activity and even delisting. These events directly reflect and amplify concerns about the corporate governance framework within the larger Grupo Salinas conglomerate.

Such governance issues significantly erode investor confidence, as evidenced by market reactions to these disputes. For instance, in early 2024, the ongoing legal challenges contributed to volatility in Elektra's share price, with some analysts pointing to the lack of transparency as a key deterrent for potential investors seeking stable returns.

Contempt of Court Rulings and Sanctions

Grupo Elektra and its controlling group have encountered significant legal challenges, including contempt of court rulings from US courts. These rulings stem from a failure to comply with financial disclosure requirements, leading to escalating daily fines. For instance, by early 2024, these fines had reached substantial figures, underscoring the seriousness of the non-compliance.

These legal actions carry considerable financial implications, with potential for significant penalties and direct seizure of assets. The company's adherence to judicial orders is therefore paramount to mitigate these risks. The ongoing nature of these sanctions highlights a critical legal vulnerability for the group.

- Escalating Fines: Daily fines imposed by US courts for non-compliance with financial disclosures reached tens of thousands of dollars by early 2024.

- Asset Pursuit: Contempt of court rulings can authorize direct pursuit and seizure of company or controlling group assets to satisfy judgments.

- Reputational Damage: Persistent legal battles and sanctions can negatively impact investor confidence and the company's overall market standing.

Consumer Credit and Lending Laws

Grupo Elektra, as a significant player in consumer finance, operates under a stringent regulatory environment. Laws dictating credit origination, permissible interest rates, and debt collection procedures are paramount. For instance, in Mexico, the Law to Regulate Financial Institutions (Ley de Instituciones de Crédito) and consumer protection laws set clear boundaries for lending practices. Failure to comply can result in substantial fines and the potential revocation of operating licenses. In 2024, regulatory bodies across Latin America continued to emphasize consumer protection, leading to increased scrutiny of lending terms and fees.

Adherence to these legal frameworks is not merely about avoiding penalties; it's fundamental to maintaining customer trust and the company's social license to operate. For example, regulations around transparency in loan terms and conditions directly impact how Grupo Elektra communicates with its borrowers. In 2025, we anticipate continued focus on fair lending practices and data privacy, requiring robust compliance mechanisms. Grupo Elektra's ability to adapt to evolving consumer credit legislation, such as those concerning digital lending and credit reporting, will be key to its sustained success in markets like Mexico and other Latin American countries.

Grupo Elektra faces substantial legal headwinds, particularly concerning tax disputes that have led to significant accrued interest and penalties, impacting its financial health. The company's ongoing compliance with directives from Mexico's National Banking and Securities Commission (CNBV) is critical, as evidenced by past fines and delistings that underscore the severe consequences of non-compliance.

Furthermore, allegations of fraud and ownership disputes have eroded investor confidence, contributing to stock volatility and delisting concerns, reflecting broader corporate governance issues within its conglomerate. US court rulings for contempt of court, stemming from financial disclosure failures, have resulted in escalating daily fines, with potential asset seizure posing a direct financial risk.

Grupo Elektra's consumer finance operations are governed by strict lending and debt collection laws, with increased regulatory emphasis on consumer protection and fair lending practices in 2024 and anticipated for 2025 across Latin America. Compliance with these evolving credit regulations, including those for digital lending, is vital for maintaining customer trust and operational viability.

| Legal Factor | Impact on Grupo Elektra | Key Data/Events (2023-2025) |

| Tax Litigation | Material financial risk due to accrued interest and penalties. | Substantial debt from 2013 dispute; ongoing provisions in 2023 financial statements. |

| Regulatory Compliance (CNBV) | Operational imperative; risk of fines and delisting. | Past fines and delistings; continued scrutiny in 2024. |

| Corporate Governance & Ownership Disputes | Erodes investor confidence, causes stock volatility. | Allegations of fraud; delisting events; market reaction in early 2024. |

| US Court Contempt Rulings | Escalating daily fines, potential asset seizure. | Fines reaching tens of thousands of dollars daily by early 2024. |

| Consumer Credit Regulations | Dictates lending practices, requires transparency. | Increased focus on consumer protection in 2024; evolving digital lending laws anticipated for 2025. |

Environmental factors

Grupo Elektra is actively integrating sustainability into its core strategy, a move that aligns with the growing global emphasis on Environmental, Social, and Governance (ESG) principles. This commitment is evident in their concrete actions to reduce their environmental footprint.

A significant step is the company's pledge to have 205 of its stores certified by 2029, specifically targeting a reduction in Greenhouse Gas (GHG) emissions. This initiative underscores Grupo Elektra's dedication to embedding environmental responsibility directly into its operational framework, reflecting a proactive approach to climate change mitigation.

Grupo Elektra's vast retail and financial network, encompassing thousands of locations across Latin America, inherently leads to substantial energy consumption. This is a critical environmental consideration, as the company's operational footprint directly impacts its carbon emissions.

In 2023, the company reported a total electricity consumption of approximately 450,000 MWh across its operations. Investing in energy-efficient technologies, such as LED lighting and modern HVAC systems, can significantly mitigate this impact. For instance, a widespread LED retrofitting program could reduce lighting energy usage by up to 60%.

Furthermore, exploring renewable energy sources, like solar power installations at its larger facilities, offers a dual benefit: reducing environmental impact and lowering long-term operational expenditures. This strategic shift not only addresses environmental concerns but also enhances cost-efficiency in an era of fluctuating energy prices.

As a significant retailer of electronics and appliances, Grupo Elektra faces increasing pressure to manage electronic waste (e-waste) responsibly. Globally, e-waste generation is a major environmental challenge, with projections indicating a continued rise. For instance, the Global E-waste Monitor 2020 reported that the world generated 53.6 million metric tonnes of e-waste in 2019.

Grupo Elektra should focus on implementing robust product recycling programs and ensuring the proper disposal of discarded electronics. This includes establishing collection points and partnering with certified recycling facilities. As of 2023, many regions are strengthening e-waste regulations, pushing retailers to take greater producer responsibility.

Promoting product longevity through repair services and encouraging trade-in programs can also significantly reduce environmental impact. By extending the lifespan of appliances and electronics, Grupo Elektra can contribute to a more circular economy and meet evolving consumer expectations regarding sustainability.

Climate Change Impact on Supply Chains

Climate change presents significant risks to Grupo Elektra's supply chains, potentially disrupting the production and distribution of its wide range of retail goods. Extreme weather events, such as hurricanes or prolonged droughts, can directly impact manufacturing facilities and transportation networks across Latin America, where Elektra primarily operates. For instance, a severe drought in a key agricultural region could affect the availability of raw materials for certain products, leading to increased costs and potential shortages. This volatility can strain inventory management and logistics, ultimately influencing product availability and pricing for consumers.

The company's reliance on global and regional sourcing means that disruptions in one area can have ripple effects. For example, increased shipping costs due to climate-related port closures or altered trade routes could directly translate into higher prices for electronics and appliances. Grupo Elektra's ability to adapt its supply chain strategies to mitigate these environmental factors will be crucial for maintaining operational efficiency and customer satisfaction. In 2024, global supply chain disruptions, partly exacerbated by climate events, continued to be a major concern for retailers worldwide, with some sectors experiencing an average increase of 10-15% in logistics costs compared to pre-pandemic levels.

- Supply Chain Vulnerability: Extreme weather events can damage manufacturing sites and disrupt transportation, impacting product availability.

- Resource Scarcity: Climate change can lead to shortages of raw materials, driving up production costs for Elektra's diverse product lines.

- Logistical Challenges: Altered weather patterns and potential infrastructure damage can increase shipping times and costs, affecting final product prices.

- Inventory Management Strain: Unpredictable disruptions necessitate more robust inventory planning and potentially higher safety stock levels.

Compliance with Environmental Regulations

Grupo Elektra's adherence to environmental regulations concerning waste management, emissions, and resource consumption is a critical operational factor. Failure to comply can result in significant financial penalties, damage to its brand image, and interruptions to its business activities. For instance, in 2023, Mexico, where Grupo Elektra has a substantial presence, saw increased enforcement of environmental laws, with the National Environmental Protection Agency (PROFEPA) conducting numerous inspections across various sectors.

The company must consistently track and adjust its environmental practices to meet evolving local and national standards. This includes investing in cleaner technologies and sustainable resource management. As of early 2024, many Latin American countries, including those where Grupo Elektra operates, are strengthening their environmental reporting requirements, pushing companies to demonstrate robust sustainability initiatives.

- Waste Management: Implementing efficient waste reduction and recycling programs to minimize landfill impact.

- Emissions Control: Investing in technologies to reduce air and water pollution from operations.

- Resource Efficiency: Optimizing energy and water usage across all facilities.

- Regulatory Monitoring: Proactively staying updated on and complying with all environmental legislation.

Grupo Elektra's commitment to sustainability is evident in its goal for 205 stores to be certified by 2029, focusing on reducing greenhouse gas emissions. The company's extensive network consumes significant energy, with around 450,000 MWh used in 2023, highlighting the potential for savings through energy-efficient upgrades like LED lighting, which can cut usage by up to 60%.

The growing challenge of electronic waste (e-waste) requires Grupo Elektra to implement robust recycling programs, especially as regulations tighten. Promoting product longevity through repair services and trade-ins also aligns with circular economy principles and consumer expectations for sustainability.

Climate change poses risks to Grupo Elektra's supply chains, with extreme weather potentially disrupting manufacturing and logistics, as seen in 2024 with increased logistics costs impacting retailers globally.

Compliance with environmental regulations is crucial, with Mexico increasing enforcement in 2023. Grupo Elektra must adapt to evolving standards and invest in cleaner technologies to maintain operational efficiency and brand reputation.

PESTLE Analysis Data Sources

Our PESTLE analysis for Grupo Elektra is built on a comprehensive review of official government publications, financial market data, and reputable industry analysis reports. We integrate insights from economic indicators, regulatory updates, and technological advancements to provide a robust understanding of the external environment.