Grupo Elektra Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Elektra Bundle

Discover the strategic engine behind Grupo Elektra's success with its comprehensive Business Model Canvas. This detailed analysis unpacks how they serve diverse customer segments, leverage key partnerships, and deliver unique value propositions. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

Grupo Elektra relies on strategic partnerships with a diverse array of suppliers and manufacturers to stock its extensive product catalog. These collaborations are fundamental to providing customers with a broad selection of goods, from essential household appliances and cutting-edge electronics to stylish furniture, reliable motorcycles, and the latest mobile phones.

The company's commitment to offering value is further solidified through its exclusive brand partnerships, notably for its popular motorcycle lines such as Italika, Hero, and Benelli. These alliances ensure consistent quality and availability, directly contributing to Elektra's competitive edge in the market.

In 2024, the strength of these supplier relationships was evident as Grupo Elektra continued to navigate a dynamic retail landscape, maintaining robust inventory levels and offering attractive pricing strategies that resonated with its customer base across Latin America.

Grupo Elektra leverages strategic alliances beyond its core Banco Azteca operations, fostering collaborations with other financial institutions. These partnerships are crucial for facilitating interbank transactions and broadening the distribution of its diverse financial product offerings, thereby enhancing customer convenience and service accessibility.

A prime example of these key collaborations is the long-standing relationship with Western Union. This alliance is instrumental in strengthening Grupo Elektra's money transfer services, a significant revenue driver. In 2023, Western Union reported facilitating over $100 billion in cross-border transactions globally, underscoring the scale and importance of such partnerships for entities like Grupo Elektra.

Grupo Elektra's strategic alliances with technology and digital platform providers are crucial for its business model. These partnerships enable the development and upkeep of its integrated omnichannel sales channels, including its popular mobile apps like Baz and Elektra. This focus on digital infrastructure underpins its digital transformation efforts, aiming to provide a seamless and advanced customer journey.

These collaborations are vital for enhancing digital support in critical areas such as credit origination and payment processing. For instance, in 2024, digital transactions processed through its platforms are expected to see a significant year-over-year increase, reflecting the growing reliance on these technological partnerships. This allows Grupo Elektra to offer more efficient and accessible financial services to its customer base.

Logistics and Distribution Networks

Grupo Elektra leverages key partnerships in logistics and distribution to ensure timely product delivery, especially for bulky items like appliances and motorcycles. These collaborations are crucial for maintaining operational efficiency and customer satisfaction.

The company utilizes a mix of third-party freight transportation providers and optimizes its own internal logistics capabilities for both direct-to-consumer home deliveries and efficient store replenishment.

- Third-Party Logistics Providers: Partnerships with specialized freight companies are essential for managing the complex transportation needs across Grupo Elektra's extensive network, ensuring products reach customers and stores effectively.

- Internal Logistics Optimization: Grupo Elektra continuously refines its in-house logistics model to enhance delivery speed and reduce costs, particularly for last-mile deliveries to homes, a critical touchpoint for customer experience.

- Distribution Network Efficiency: The strength of these partnerships directly impacts the speed and reliability of product availability in stores, supporting sales and inventory management across its various brands.

Marketing and Promotion Agencies

Grupo Elektra collaborates with marketing and advertising agencies to ensure its message resonates with its core customer base, primarily in the middle and lower-income segments. These partnerships are crucial for building brand recognition and effectively communicating the value proposition of its diverse retail offerings and financial services.

These collaborations are instrumental in driving customer acquisition across a variety of media platforms, from traditional advertising to digital campaigns. For instance, in 2024, Grupo Elektra continued its robust marketing efforts, leveraging these agencies to highlight promotions and new product launches.

- Brand Awareness: Agencies help craft campaigns that enhance Grupo Elektra's visibility and recall among target demographics.

- Customer Acquisition: Targeted advertising strategies implemented by these partners directly contribute to attracting new customers to both retail and financial services.

- Promotional Campaigns: Marketing agencies are key in developing and executing campaigns for specific product launches and seasonal sales events, a significant driver of revenue.

Grupo Elektra's key partnerships are a cornerstone of its operational success, enabling it to offer a wide array of products and financial services. These alliances span suppliers, financial institutions, technology providers, logistics firms, and marketing agencies, all contributing to its extensive reach and customer value proposition.

The company's strategic alliances with technology and digital platform providers are crucial for its business model, supporting integrated omnichannel sales channels and digital transformation efforts. These collaborations are vital for enhancing digital support in areas like credit origination and payment processing, with digital transactions expected to see significant growth in 2024.

Furthermore, partnerships with logistics providers ensure efficient product delivery, while marketing agencies help drive customer acquisition and brand awareness. In 2023, Grupo Elektra's net revenue reached approximately $8.4 billion, underscoring the broad impact of these diverse collaborations.

| Partner Type | Key Contribution | Example/Impact | 2023/2024 Relevance |

|---|---|---|---|

| Suppliers & Manufacturers | Product sourcing and inventory | Italika, Hero, Benelli motorcycle brands | Maintained robust inventory in a dynamic retail landscape |

| Financial Institutions | Transaction facilitation, product distribution | Western Union, other financial entities | Strengthened money transfer services; facilitated interbank transactions |

| Technology Providers | Digital platform development and maintenance | Baz, Elektra mobile apps | Underpinned digital transformation and enhanced customer journey |

| Logistics Providers | Product delivery and distribution | Third-party freight carriers | Ensured timely delivery and store replenishment efficiency |

| Marketing Agencies | Brand awareness and customer acquisition | Various media platforms | Drove customer acquisition and highlighted promotions in 2024 |

What is included in the product

Grupo Elektra's business model canvas focuses on serving the underserved mass market in Latin America with affordable consumer durables and financial services, leveraging a vast network of physical stores as a key channel.

It details customer segments, value propositions like credit access and product variety, and revenue streams from product sales and financial commissions.

Grupo Elektra's Business Model Canvas offers a clear, structured approach to understanding how they alleviate financial access pain points for underserved populations through accessible credit and a diverse product offering.

It provides a concise, one-page snapshot of their strategy to address the pain of limited financial options, making it ideal for quickly grasping their customer-centric solutions.

Activities

Grupo Elektra's primary activity revolves around the retail sale of a broad spectrum of consumer goods. This encompasses everything from essential household appliances and the latest electronics to comfortable furniture and vital mobile phones, catering to diverse customer needs.

These sales are conducted through a robust omnichannel strategy, leveraging its physical footprint of Elektra and Salinas y Rocha stores alongside growing online channels, ensuring broad market reach and customer convenience.

In 2024, Grupo Elektra's consumer sales remained a cornerstone of its financial performance, with reports indicating continued strong demand across its product categories, contributing significantly to its overall revenue streams.

Grupo Elektra's core activity involves providing consumer finance and credit, primarily through Banco Azteca. This allows customers, especially those in lower and middle-income brackets, to acquire goods through installment plans, widening access to credit.

This focus on accessible credit is a cornerstone of their strategy, directly supporting sales of their wide range of products. For instance, in the first quarter of 2024, Banco Azteca's gross loan portfolio reached approximately MXN 119.8 billion, demonstrating significant growth and the scale of this consumer finance operation.

Grupo Elektra's key activities heavily involve operating its financial services arms: Banco Azteca, Afore Azteca, Seguros Azteca, and Punto Casa de Bolsa. These entities provide a wide array of banking and financial products, from basic deposits and loans to more complex insurance and investment solutions.

In 2024, Banco Azteca continued to be a significant player in Mexico's financial landscape, serving millions of customers. Its focus on financial inclusion means it often reaches segments of the population underserved by traditional banks, facilitating access to credit and savings.

Afore Azteca manages retirement savings for a substantial portion of the Mexican workforce, playing a crucial role in long-term wealth accumulation. Seguros Azteca offers various insurance products designed to protect individuals and families against financial risks.

The collective performance of these financial services is a primary revenue driver for Grupo Elektra, directly supporting its retail operations by offering accessible credit to its customer base, thereby fostering a symbiotic relationship within the group's business model.

Motorcycle Manufacturing and Distribution

Grupo Elektra's motorcycle manufacturing and distribution is a cornerstone of its operations, spearheaded by its popular brand, Italika. Italika commands a substantial portion of the Mexican motorcycle market, highlighting the company's success in this segment. This robust manufacturing and distribution capability directly fuels commercial business revenue.

Beyond its own brand, Grupo Elektra also secures exclusive distribution rights for other prominent motorcycle manufacturers, such as Hero and Benelli. This strategic approach expands its product portfolio and strengthens its market presence. The company effectively utilizes its extensive retail network to distribute these diverse motorcycle offerings, ensuring broad customer reach.

- Motorcycle Manufacturing: Primarily through its Italika brand, a leading player in the Mexican market.

- Exclusive Distribution: Partnering with brands like Hero and Benelli to broaden its product range.

- Revenue Contribution: A significant driver of commercial business revenue for Grupo Elektra.

- Network Leverage: Utilizes its established retail footprint for efficient distribution.

Digital Platform Development and Management

Grupo Elektra's digital platform development and management are central to its strategy, focusing on ongoing enhancement of its mobile applications like Baz and Elektra. This commitment aims to create a seamless omnichannel sales experience, facilitating digital payments and offering round-the-clock access to banking services.

This digital push is crucial for customer convenience and operational efficiency. For instance, by mid-2024, Grupo Elektra reported a significant increase in digital transactions, demonstrating the growing adoption of its platforms. The company continues to invest heavily in technology to bolster these capabilities.

- Omnichannel Enhancement: Continuously improving the integration between physical stores and digital channels to offer a unified customer journey.

- Digital Payment Facilitation: Expanding the capabilities of platforms like Baz to process a wider range of digital transactions securely and efficiently.

- 24/7 Banking Access: Ensuring customers can access banking services, including account management and transactions, anytime through the mobile apps.

- Technology Investment: Allocating resources to upgrade infrastructure and develop new features that drive customer engagement and operational streamlining.

Grupo Elektra's key activities are deeply intertwined, creating a powerful ecosystem. They excel in retail sales of diverse consumer goods, supported by robust financial services, particularly through Banco Azteca, which provides essential consumer credit. This credit offering is a critical enabler for their retail segment, allowing broader customer access to products. Furthermore, their significant presence in motorcycle manufacturing and distribution, notably with Italika, adds another substantial revenue stream and leverages their extensive retail network. Finally, continuous investment in digital platforms like Baz enhances customer experience and operational efficiency across all these activities.

| Activity | Description | 2024 Data/Significance |

|---|---|---|

| Retail Sales | Selling consumer goods (appliances, electronics, furniture, phones). | Remained a core revenue driver, showing sustained demand in 2024. |

| Consumer Finance | Providing credit via Banco Azteca for installment purchases. | Q1 2024 gross loan portfolio reached MXN 119.8 billion, highlighting significant reach. |

| Financial Services | Operating Banco Azteca, Afore Azteca, Seguros Azteca, Punto Casa de Bolsa. | Banco Azteca served millions, focusing on financial inclusion in 2024. |

| Motorcycle Operations | Manufacturing (Italika) and distributing motorcycles. | Italika holds a strong market share; exclusive distribution deals with Hero and Benelli expand offerings. |

| Digital Platform Development | Enhancing mobile apps (Baz, Elektra) for omnichannel sales and banking. | Significant increase in digital transactions reported by mid-2024, reflecting growing adoption. |

What You See Is What You Get

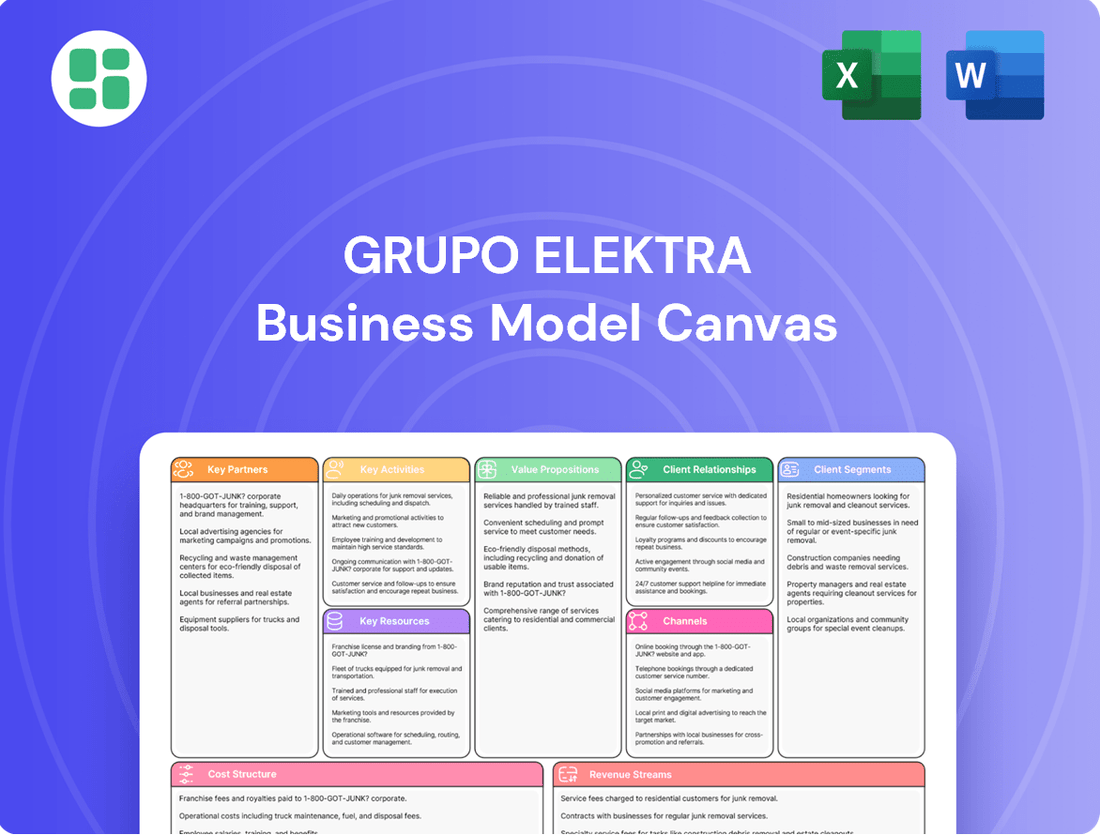

Business Model Canvas

The Grupo Elektra Business Model Canvas preview you're viewing is the authentic document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use Business Model Canvas, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this same comprehensive analysis of Grupo Elektra's strategic framework.

Resources

Grupo Elektra leverages an extensive physical store and branch network, boasting over 6,000 points of contact. This includes its well-known Elektra and Salinas y Rocha stores, alongside Banco Azteca branches, strategically located across Mexico, the United States, and Central America.

This substantial physical footprint is a cornerstone of Grupo Elektra's strategy, enabling broad customer reach and efficient product distribution. It's particularly vital for providing accessible financial services, especially in areas that may be underserved by traditional banking institutions.

Grupo Elektra's financial capital and deposits are a cornerstone of its operations, primarily fueled by Banco Azteca. This robust financial base, characterized by significant liquidity and a strong foundation of customer deposits, is essential for powering its extensive credit operations and ambitious expansion plans.

The company's success in attracting and retaining customer deposits provides a crucial low-cost funding source. For instance, as of the first quarter of 2024, Grupo Elektra reported total deposits of approximately MXN 209.4 billion, a testament to the trust and loyalty Banco Azteca has cultivated with its client base, enabling the company to efficiently fund its lending activities.

Grupo Elektra's brand, encompassing subsidiaries like Banco Azteca and Italika, boasts significant recognition and trust among its core customer base. This strong reputation, cultivated over seven decades, acts as a crucial intangible asset, driving customer loyalty and aiding in attracting new clientele.

Proprietary Digital Platforms and Technology

Grupo Elektra's proprietary digital platforms, including its mobile applications like Baz and Elektra, are fundamental to its business model. These platforms, supported by robust technological infrastructure, facilitate omnichannel sales strategies, allowing customers to engage seamlessly across physical and digital touchpoints. In 2024, the company continued to invest in these digital assets to enhance user experience and expand its reach.

The underlying technology powering these applications is a key resource, enabling efficient digital banking services and direct customer interactions. This focus on digital infrastructure is vital for modernizing Grupo Elektra's offerings and capturing a growing segment of digitally active consumers.

- Omnichannel Sales: Baz and Elektra apps enable integrated online and in-store purchasing.

- Digital Banking: Facilitates financial services through mobile technology.

- Customer Interaction: Direct engagement and service delivery via digital channels.

- Technological Infrastructure: The backbone supporting these digital capabilities.

Human Capital and Expertise

Grupo Elektra's extensive workforce, encompassing dedicated sales associates, skilled credit analysts, knowledgeable financial advisors, and efficient logistics personnel, forms a cornerstone of its business model. This human capital is crucial for executing the company's integrated retail and financial services strategy.

The collective expertise of this team in areas like retail operations, consumer finance, and customer service directly underpins Grupo Elektra's ability to offer comprehensive solutions. Their proficiency ensures smooth day-to-day operations and fosters strong customer relationships.

- Workforce Size and Distribution: As of the first quarter of 2024, Grupo Elektra employed approximately 73,000 individuals across its various business units and geographies, with a significant portion dedicated to customer-facing roles.

- Expertise in Consumer Finance: The company's credit analysts and financial advisors possess deep knowledge of the Latin American consumer credit landscape, enabling them to manage risk effectively and provide tailored financial products.

- Retail and Logistics Proficiency: Sales and logistics teams are integral to the efficient functioning of over 6,000 points of sale, ensuring product availability and timely delivery, which is vital for customer satisfaction.

- Customer Service Excellence: A strong emphasis on customer service training for all front-line employees helps maintain high levels of client engagement and loyalty, a key differentiator in the competitive markets Elektra serves.

Grupo Elektra's key resources include its vast physical store network and its strong financial capital, primarily from Banco Azteca's deposits. The company also relies on its recognized brands, proprietary digital platforms like Baz and Elektra, and a large, skilled workforce. These elements collectively support its integrated retail and financial services model.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Physical Network | Over 6,000 points of contact (Elektra, Banco Azteca) across Mexico, US, Central America. | Enables broad customer reach and accessible financial services. |

| Financial Capital | Customer deposits from Banco Azteca. | MXN 209.4 billion in total deposits (Q1 2024), funding credit operations. |

| Brand Equity | Recognized brands like Banco Azteca and Italika. | Cultivates customer loyalty and trust over seven decades. |

| Digital Platforms | Baz and Elektra mobile apps, robust tech infrastructure. | Facilitates omnichannel sales and digital banking services. |

| Human Capital | Approx. 73,000 employees (Q1 2024) with expertise in retail, finance, and service. | Drives operations, risk management, and customer relationships. |

Value Propositions

Grupo Elektra's value proposition centers on providing accessible credit and financial services, particularly to middle and lower-income individuals often overlooked by traditional financial institutions. This commitment fosters financial inclusion, empowering millions of families to acquire essential goods and services. For instance, in 2023, Grupo Elektra reported serving over 23 million customers across Latin America, a testament to its reach in these underserved segments.

By offering tailored credit solutions and a broad range of banking products, Grupo Elektra significantly enhances the purchasing power and financial well-being of its customer base. This focus on accessibility and affordability is a key differentiator, enabling economic participation for those who might otherwise be excluded. Their extensive network of over 7,000 points of sale across multiple countries facilitates this widespread access.

Grupo Elektra distinguishes itself by providing a wide array of consumer goods, encompassing everything from essential home appliances and the latest electronics to comfortable furniture and reliable motorcycles. This extensive selection is carefully curated to meet the varied needs of its customer base.

What truly sets Elektra apart is its commitment to affordability. The company consistently offers these diverse products at accessible price points, making them attainable for a broad segment of the population. For instance, in 2023, Grupo Elektra reported sales of approximately 173 billion Mexican pesos, demonstrating the significant demand for its product range.

This strategy of offering a comprehensive product mix at competitive prices directly addresses the core needs and desires of its target demographic. By providing both variety and value, Elektra empowers consumers to make choices that align with their budgets and lifestyle aspirations.

Grupo Elektra's unique value proposition is the seamless integration of retail sales with financial services, allowing customers to purchase goods on credit directly at the point of sale. This simplifies the buying process and makes products immediately attainable for customers who might not qualify for traditional bank loans.

This model is particularly impactful in markets where access to credit is limited. For instance, in 2024, Grupo Elektra continued to serve millions of unbanked and underbanked individuals across Latin America, providing them with essential goods and financial tools.

By offering credit at the point of sale, the company bridges the gap between consumer desire and purchasing power, fostering financial inclusion and driving sales for its diverse product catalog, which ranges from electronics to appliances and motorcycles.

Convenient Omnichannel Shopping Experience

Grupo Elektra's convenient omnichannel shopping experience allows customers to engage through a vast network of physical stores and sophisticated digital platforms, including its website and mobile applications. This dual approach ensures accessibility, letting customers choose their preferred method for purchases and financial services.

This strategy caters to diverse customer needs, offering the tangible experience of in-store browsing alongside the ease of online transactions. For instance, in 2024, Grupo Elektra continued to enhance its digital offerings, aiming to mirror the in-store product availability and customer service online.

- Seamless Integration: Customers can browse online and pick up in-store, or vice versa, creating a fluid shopping journey.

- Extended Reach: Digital channels broaden the customer base beyond immediate geographic proximity to physical stores.

- Personalized Engagement: Data from online interactions can inform personalized offers and customer support across all touchpoints.

- Financial Services Access: This omnichannel model also extends to financial services, making banking and credit accessible through both physical branches and digital tools.

Reliable and Accessible Banking Services

Grupo Elektra, through Banco Azteca, provides dependable banking services designed for broad accessibility. This includes extended operating hours and a vast network of branches, ensuring customers can access cash and conduct transactions conveniently. In 2024, Banco Azteca continued to serve millions of unbanked and underbanked individuals across Latin America, reinforcing its commitment to financial inclusion.

The value proposition centers on offering flexible and convenient banking solutions. Customers benefit from not only physical branch access but also 24/7 digital platforms, allowing them to manage their finances anytime, anywhere. This dual approach addresses the diverse needs of a customer base that often requires immediate access to funds and services outside traditional banking hours.

- Extended Hours and Branch Network: Banco Azteca operates branches with hours that often exceed standard banking times, coupled with a significant physical footprint across its operating regions.

- Cash Availability: Ensuring customers have ready access to cash is a core component, vital for many transactions in the markets served.

- 24/7 Digital Access: Robust mobile and online banking platforms provide continuous service, enabling account management, transfers, and payments at any time.

- Financial Inclusion Focus: By targeting underserved populations, Grupo Elektra's banking services play a crucial role in bringing more people into the formal financial system.

Grupo Elektra's value proposition is built on empowering its customers through accessible credit and a wide range of essential goods and financial services. This focus on financial inclusion allows millions to purchase items like appliances, electronics, and motorcycles, often on credit, directly at the point of sale. In 2023, the company served over 23 million customers, highlighting its significant reach into underserved markets across Latin America.

The company bridges the gap between consumer needs and purchasing power by integrating retail with financial services, making products attainable for individuals who may not qualify for traditional loans. This seamless model, bolstered by an extensive network of over 7,000 points of sale, ensures convenience and affordability. In 2024, Grupo Elektra continued to expand its digital offerings, aiming to provide an omnichannel experience that mirrors its in-store accessibility and customer service.

Through Banco Azteca, Grupo Elektra offers dependable banking services with extended hours and a vast branch network, ensuring convenient access to cash and transactions. This commitment to financial inclusion is evident in 2024, where Banco Azteca continued to serve millions of unbanked and underbanked individuals, providing them with essential financial tools and services.

Grupo Elektra's strategy combines a diverse product catalog with competitive pricing and integrated financial solutions, directly addressing the core needs of its target demographic. This approach not only drives sales but also fosters economic participation for a broad segment of the population.

| Value Proposition Component | Description | Key Data/Facts (2023-2024) |

| Accessible Credit & Financial Services | Providing credit and banking to underserved middle and lower-income individuals. | Served over 23 million customers in 2023. Continued focus on unbanked/underbanked in 2024. |

| Integrated Retail & Financial Services | Seamlessly combining product sales with point-of-sale credit. | Over 7,000 points of sale across multiple countries. Digital enhancements in 2024 to mirror in-store experience. |

| Wide Product Range & Affordability | Offering diverse consumer goods (appliances, electronics, motorcycles) at accessible prices. | Reported sales of approximately 173 billion Mexican pesos in 2023. |

| Omnichannel Shopping Experience | Providing access through a vast network of physical stores and digital platforms. | Continued enhancement of digital platforms in 2024 to ensure broad accessibility. |

| Dependable Banking Services (Banco Azteca) | Offering extended hours, a large branch network, and 24/7 digital access. | Banco Azteca continued to serve millions of unbanked/underbanked individuals in 2024. |

Customer Relationships

Grupo Elektra's personalized in-store assistance is a cornerstone of its customer relationships. In 2024, with over 6,000 points of sale across Latin America, the company leverages its physical presence to offer direct, face-to-face support. This approach is vital for building trust, particularly when customers are engaging with financial services like credit and insurance, ensuring they feel understood and supported throughout their purchase journey.

Grupo Elektra strengthens customer relationships by offering robust digital self-service through its Baz and Elektra mobile applications. These platforms empower customers with convenient access to manage accounts, process payments, and find product information 24/7, enhancing accessibility and user experience.

In 2024, Grupo Elektra continued to invest in its digital infrastructure, aiming to increase app adoption and engagement. While specific user numbers for 2024 are proprietary, the broader trend in the financial services sector shows a significant shift towards digital channels, with many institutions reporting double-digit percentage increases in mobile banking transactions year-over-year.

Customers seeking credit and financial advisory services from Grupo Elektra receive personalized guidance during loan applications and when selecting banking products. This process implicitly includes financial advice, helping them navigate their options and secure solutions suited to their financial capacity and specific needs.

In 2024, Grupo Elektra continued to focus on these relationships, with its financial services segment reporting significant customer engagement. For instance, the company’s banking arm, Banco Azteca, served millions of customers across Latin America, many of whom rely on these advisory touchpoints for their financial decisions.

Loyalty and Retention Programs

Grupo Elektra actively cultivates customer loyalty, especially among its credit clientele, by providing attractive terms and ensuring continued access to financing for future purchases. This strategy is designed to encourage repeat business and build enduring relationships.

The company's integrated approach, seamlessly blending retail sales with financial services, naturally draws customers back for both their product and financial requirements. This synergy strengthens the bond and encourages sustained engagement.

- Favorable Credit Terms: Offering competitive interest rates and flexible repayment plans for existing credit customers incentivizes repeat purchases.

- Integrated Ecosystem: The convenience of accessing both retail goods and financial services within the same group encourages customers to consolidate their spending.

- Loyalty Programs: While specific details of 2024 programs are proprietary, the general strategy involves rewarding consistent patronage to enhance retention.

- Customer Data Utilization: Leveraging customer purchase history and credit behavior allows for personalized offers and improved relationship management.

Remittance Services and Community Trust

Grupo Elektra's remittance services are a cornerstone of its customer relationships, fostering deep community trust. By reliably facilitating the transfer of funds from family members abroad, the company provides a vital lifeline, particularly for underserved populations. This consistent delivery of essential financial support positions Banco Azteca as a trusted and indispensable partner in the daily lives of its customers.

The company's commitment to dependable remittance operations directly strengthens community bonds. Families rely on these services to meet basic needs, and Grupo Elektra's consistent performance builds a reputation for dependability. This trust is not just transactional; it's built on the tangible impact of providing financial stability to households across its operating regions.

- Remittance Volume: In 2024, Grupo Elektra reported significant growth in its remittance business, handling billions of dollars in transfers, underscoring its crucial role in connecting families globally.

- Customer Trust: Surveys consistently show high levels of customer satisfaction and trust in Banco Azteca's remittance services, with a notable percentage of users citing reliability as the primary reason for choosing the bank.

- Community Impact: The accessibility and affordability of Elektra's remittance services have a direct positive impact on local economies, enabling families to invest in education, housing, and small businesses.

Grupo Elektra fosters robust customer relationships through a multi-faceted approach, blending personalized in-store support with accessible digital platforms. The company's extensive network of over 6,000 points of sale in 2024 facilitated direct, face-to-face interactions, crucial for building trust, especially within its financial services offerings. Simultaneously, digital channels like the Baz and Elektra mobile apps provided 24/7 self-service options, enhancing convenience and user engagement.

| Customer Relationship Aspect | Description | 2024 Relevance/Data |

|---|---|---|

| Personalized In-Store Assistance | Direct, face-to-face support at physical locations. | Crucial for building trust in financial services; over 6,000 points of sale across Latin America. |

| Digital Self-Service | Mobile apps (Baz, Elektra) for account management and payments. | Enhances accessibility and user experience, supporting a broader digital shift in financial services. |

| Financial Advisory | Guidance during loan applications and product selection. | Helps customers navigate financial options, with Banco Azteca serving millions across Latin America. |

| Customer Loyalty Initiatives | Favorable credit terms and integrated ecosystem for repeat business. | Designed to encourage repeat purchases and build enduring relationships through continued financing access. |

| Remittance Services | Reliable facilitation of fund transfers, building community trust. | Billions of dollars handled in 2024, providing a vital lifeline and establishing Banco Azteca as a trusted partner. |

Channels

Grupo Elektra leverages its extensive physical store network, comprising Elektra and Salinas y Rocha locations, as a cornerstone of its business model. These stores are not just points of sale but crucial touchpoints for customer engagement, offering a tangible shopping experience and direct interaction with knowledgeable staff. As of the first quarter of 2024, Grupo Elektra operated over 7,000 points of contact across Latin America, underscoring the significant reach and importance of this channel.

Banco Azteca branches, frequently found within Elektra retail locations, are crucial for distributing financial services. In 2024, Grupo Elektra reported a significant network of these combined locations, offering convenient access to banking for millions. This synergy leverages existing foot traffic and brand recognition.

These branches act as vital touchpoints for a broad customer base, particularly those underserved by traditional banking. They facilitate essential transactions like deposits, withdrawals, and loan processing, making financial inclusion a core component of their strategy.

Grupo Elektra's proprietary mobile applications, Baz and Elektra, are central to its digital strategy, facilitating an omnichannel sales approach and expanding its digital banking capabilities. These platforms allow customers to shop online, make payments, and access a suite of financial services around the clock, significantly broadening the company's reach and enhancing customer convenience.

In 2023, Grupo Elektra reported that its digital channels, including these apps, played a crucial role in its growth. While specific user numbers for Baz and Elektra aren't always broken out separately in public reports, the company has consistently highlighted the increasing transaction volumes and customer engagement through its digital ecosystem, contributing to a substantial portion of its overall sales and financial service offerings.

Online E-commerce Platforms

Grupo Elektra leverages online e-commerce platforms as a crucial component of its distribution strategy, mirroring the accessibility of its extensive physical store network. These digital storefronts provide customers with the convenience of exploring a wide product catalog and completing transactions from anywhere, enhancing the overall shopping experience. This digital presence is vital for capturing a broader customer base and supporting modern purchasing habits.

The company's e-commerce operations are designed to integrate seamlessly with its brick-and-mortar presence, offering a true omnichannel approach. This allows customers to research products online and pick them up in-store, or vice versa, providing flexibility and convenience. In 2023, Grupo Elektra reported significant growth in its digital sales channels, reflecting the increasing consumer preference for online shopping and the company's successful adaptation to these trends.

- Digital Sales Growth: Grupo Elektra's e-commerce platforms have seen a substantial uptick in transactions, contributing to its overall revenue diversification.

- Omnichannel Integration: The synergy between online and offline channels allows for enhanced customer service and sales opportunities, such as click-and-collect services.

- Customer Reach: Online platforms extend Grupo Elektra's market reach beyond its physical store locations, catering to a wider demographic.

- Technological Investment: Continued investment in user-friendly website design and secure payment gateways ensures a positive online customer journey.

Strategic Third-Party Distribution Partnerships

Grupo Elektra strategically utilizes third-party distribution partnerships to significantly expand its market reach and enhance service accessibility. These alliances are crucial for penetrating markets beyond its direct retail presence.

For instance, collaborations with money transfer services like Western Union allow Grupo Elektra to offer essential financial services to a wider customer base, particularly in regions where its physical footprint is limited. This is a key element in its strategy to be a financial services hub.

These partnerships extend beyond financial services. Aligning with retail partners such as Tiendas Neto further broadens the company's distribution network, enabling it to offer its products and services through established and trusted local channels. This approach amplifies its market penetration and customer engagement.

- Expanded Reach: Partnerships enable access to customers not directly served by Grupo Elektra's owned stores, boosting overall market penetration.

- Enhanced Service Offering: Collaborations with entities like Western Union integrate vital financial services, making them readily available to a broader demographic.

- Synergistic Growth: Aligning with retail partners like Tiendas Neto leverages existing customer traffic and trust, creating a mutually beneficial distribution ecosystem.

Grupo Elektra's channels are a robust mix of physical and digital touchpoints designed to maximize customer reach and service delivery. The extensive network of over 7,000 physical points of contact, including Elektra and Banco Azteca locations as of Q1 2024, forms the bedrock of its strategy, offering tangible experiences and convenient financial access.

Digital platforms, such as the Baz and Elektra mobile apps, are central to its omnichannel approach, facilitating online shopping and a comprehensive suite of financial services. These digital channels saw significant growth in transaction volumes throughout 2023, reflecting a strong customer shift towards online engagement.

Furthermore, strategic third-party partnerships, including those with money transfer services and retailers like Tiendas Neto, amplify Grupo Elektra's market penetration and service accessibility, extending its reach beyond its proprietary network.

| Channel Type | Key Features | 2024 Data/Trend |

|---|---|---|

| Physical Stores (Elektra, Salinas y Rocha) | Tangible shopping experience, direct customer interaction, sales and service points | Over 7,000 points of contact across Latin America (Q1 2024) |

| Banco Azteca Branches | Financial services distribution, banking transactions, financial inclusion | Integrated within many Elektra locations, significant network presence |

| Digital Apps (Baz, Elektra) | Online shopping, payments, digital banking, 24/7 access | Increasing transaction volumes and customer engagement (2023 trend) |

| E-commerce Platforms | Online catalog access, convenient transactions, omnichannel integration | Significant growth in digital sales (2023 trend) |

| Third-Party Partnerships | Expanded market reach, enhanced service accessibility (e.g., Western Union, Tiendas Neto) | Key for penetrating markets beyond direct retail presence |

Customer Segments

Grupo Elektra's core customer base comprises middle and lower-income households across Mexico and Latin America. These households often face limited access to conventional banking and financial services, making them highly receptive to Elektra's offerings.

For these segments, Elektra provides accessible and affordable consumer electronics, appliances, and motorcycles, often through flexible credit options. This strategy directly addresses the purchasing power and needs of a significant portion of the population.

In 2024, Elektra continued to serve this demographic, with its extensive store network acting as a crucial touchpoint for millions of customers seeking value and financing solutions. The company's success is deeply intertwined with its ability to cater to the specific economic realities of these income groups.

Grupo Elektra's business model significantly serves the unbanked and underbanked populations, a segment often excluded from traditional financial services. These individuals and families, who may not have access to conventional banks, rely on institutions like Banco Azteca, a key part of Grupo Elektra, for fundamental banking and credit. This focus addresses a critical gap in financial inclusion.

Banco Azteca, as of the first quarter of 2024, reported a substantial customer base, demonstrating its reach within these underserved communities. The bank's strategy involves offering accessible savings accounts, microloans, and payment services, directly catering to the financial realities of those with limited formal banking experience. This approach is vital for fostering economic participation.

Grupo Elektra's core customer base includes individuals who need adaptable credit solutions to acquire essential household items like appliances and electronics. The company's business model is built around making these purchases accessible to a wider demographic through its integrated credit system.

In 2024, Grupo Elektra continued to serve this segment by offering installment plans and credit lines tailored to the financial realities of many consumers, particularly in emerging markets where traditional banking access might be limited. This focus on flexible credit is a key differentiator.

Remittance Recipients and Senders

Remittance recipients and senders, especially those with ties between the United States and Mexico, are a crucial customer base for Grupo Elektra's financial offerings, particularly through Banco Azteca. These individuals rely on accessible and trustworthy channels for sending and receiving funds, a need Grupo Elektra directly addresses.

Banco Azteca plays a significant role in facilitating these cross-border money transfers, fostering a sense of security and reliability within the communities it serves. This focus on essential financial services for migrant populations builds strong customer loyalty.

- Key Segment: Individuals sending and receiving remittances, primarily between the US and Mexico.

- Service Offered: Facilitation of secure and reliable money transfers.

- Trust Factor: Building confidence within migrant and diaspora communities through accessible financial services.

- Market Data: In 2023, remittances to Mexico reached an estimated $60 billion, with a significant portion originating from the US, highlighting the scale of this customer segment's needs.

Motorcycle Enthusiasts and Small Business Owners

Grupo Elektra's customer base prominently features motorcycle enthusiasts, particularly those drawn to Italika's accessible and economical two-wheelers. In 2024, Italika continued to be a leading brand in Mexico, with sales figures consistently demonstrating its appeal to individuals seeking efficient personal mobility solutions.

Small business owners represent another key segment, leveraging Grupo Elektra's financial services for their enterprises. These entrepreneurs often utilize the company's credit facilities to acquire assets, manage inventory, or cover operational expenses, thereby contributing to their business growth and the broader economy.

- Motorcycle Enthusiasts: Italika's strong market presence in 2024 underscores its appeal to individuals prioritizing affordable and reliable personal transportation.

- Small Business Owners: These clients benefit from Elektra's credit offerings, enabling them to invest in their businesses and enhance operational capabilities.

Grupo Elektra's primary customer segments are middle and lower-income households in Mexico and Latin America, often underserved by traditional banking. These individuals seek accessible credit for essential purchases like appliances and electronics, a need Elektra fulfills through flexible financing options. In 2024, the company's extensive store network remained a vital connection point for millions seeking value and credit solutions, reinforcing its deep connection to the economic realities of these demographics.

The unbanked and underbanked populations are a crucial segment, relying on services like Banco Azteca for basic financial needs, including savings and credit. This focus on financial inclusion is paramount, as demonstrated by Banco Azteca's substantial customer base in Q1 2024, offering accessible microloans and payment services to those with limited formal banking experience.

Remittance recipients and senders, particularly those with ties between the US and Mexico, form another key demographic, utilizing Banco Azteca for secure and reliable money transfers. The significant volume of remittances, estimated at $60 billion to Mexico in 2023, highlights the critical need for such services within migrant communities.

Motorcycle enthusiasts, especially those favoring Italika's affordable two-wheelers, and small business owners seeking credit for growth are also vital customer groups. Italika's strong market performance in 2024 underscores its appeal for personal mobility, while credit offerings empower entrepreneurs to invest in their businesses.

| Customer Segment | Key Needs | Elektra's Offering | 2024 Relevance/Data |

|---|---|---|---|

| Middle/Lower-Income Households | Accessible credit for appliances, electronics | Flexible financing, extensive store network | Millions served through stores; caters to economic realities |

| Unbanked/Underbanked | Basic banking, credit, savings | Banco Azteca services (microloans, accounts) | Substantial customer base in Q1 2024; promotes financial inclusion |

| Remittance Users (US-Mexico) | Secure, reliable money transfers | Banco Azteca remittance services | $60B remittances to Mexico in 2023; vital for migrant communities |

| Motorcycle Enthusiasts | Affordable personal transportation | Italika motorcycles | Leading brand in Mexico; strong sales in 2024 |

| Small Business Owners | Credit for assets, inventory, operations | Business credit facilities | Enables business growth and investment |

Cost Structure

Grupo Elektra's operating costs are heavily influenced by its vast retail and branch network. Maintaining this extensive physical presence across Latin America, with thousands of stores, incurs substantial expenses. These include rent for prime retail locations, utilities to power these branches, and general administrative overheads necessary for smooth operations.

In 2024, the company continued to invest in optimizing this network. For instance, the rental and maintenance of these numerous physical touchpoints represent a significant fixed cost. Utilities, from electricity to internet services, also contribute to the daily operational expenditure of each branch, impacting the overall cost structure.

Grupo Elektra's cost structure is significantly influenced by inventory and logistics expenses. These costs encompass the acquisition of a broad array of consumer goods, such as appliances, electronics, and motorcycles, along with their subsequent warehousing and distribution across its extensive network.

In 2024, managing these costs is crucial for maintaining competitive pricing and profitability. The company continually seeks to optimize its logistics model to ensure efficient and timely delivery to its diverse customer base, which is a key element in its operational strategy.

As a significant player in consumer finance, Grupo Elektra allocates substantial resources to credit risk provisions, reflecting the inherent risks in its extensive loan portfolio. For instance, in the first quarter of 2024, the company reported credit loss provisions amounting to MXN 4,305 million, highlighting a key cost driver.

Beyond managing potential defaults, Grupo Elektra also faces considerable financial costs stemming from interest expenses on its debt obligations and the general cost of funding its various financial operations. These interest payments are a direct consequence of its leveraged business model and its role as a financial intermediary.

Personnel and Administrative Expenses

Grupo Elektra’s cost structure is significantly impacted by personnel and administrative expenses. These include the salaries, benefits, and other associated costs for its extensive workforce, which comprises sales associates, financial advisors, and corporate staff. In 2024, the company’s employee-related expenses are a key component of its operational outlay, reflecting the large number of individuals supporting its retail and financial services operations.

Beyond direct employee compensation, administrative expenses also play a crucial role. This category encompasses a range of operational costs, notably marketing and promotional activities designed to drive sales and brand recognition across its diverse markets. These outlays are essential for maintaining market presence and attracting new customers to Elektra’s offerings.

- Salaries and Benefits: A substantial portion of Elektra’s costs is allocated to compensating its large workforce, including those in sales, customer service, and financial advisory roles.

- Administrative Costs: This includes general operating expenses and significant investments in marketing and promotion to support its retail and financial service segments.

- Workforce Size: The company’s extensive network of stores and service points necessitates a considerable personnel base, directly influencing these expenditure categories.

- 2024 Financial Impact: Personnel and administrative expenses remain a critical factor in Elektra's overall cost management strategy for the current fiscal year.

Technology and Digital Platform Investment

Grupo Elektra’s commitment to its digital future necessitates substantial and ongoing investment in technology and its digital platforms. This includes the continuous development, maintenance, and upgrading of its IT infrastructure, which is the backbone of its operations.

These technology expenditures are vital for strengthening its omnichannel presence and expanding its digital banking services, ensuring a seamless customer experience across all touchpoints. For instance, in 2023, Grupo Elektra reported significant investments in its digital transformation initiatives, aiming to enhance user experience and operational efficiency.

- Digital Platform Development: Costs associated with building and refining online portals and mobile applications.

- IT Infrastructure Upgrades: Expenses for servers, cloud services, cybersecurity, and network enhancements.

- Omnichannel Integration: Investment in systems that connect online and physical store experiences.

- Digital Banking Services: Funding for the development and maintenance of financial technology solutions.

Grupo Elektra's cost structure is heavily influenced by its extensive retail and financial services network, encompassing significant expenses related to physical store maintenance, inventory management, and credit risk provisions. The company also incurs substantial costs from personnel, administrative functions, and ongoing investments in technology to support its digital transformation and omnichannel strategy.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Retail Network | Rent, utilities, and maintenance for thousands of stores. | Optimizing physical footprint and associated fixed costs. |

| Inventory & Logistics | Acquisition, warehousing, and distribution of consumer goods. | Ensuring competitive pricing and efficient delivery. |

| Credit Risk Provisions | Allocations for potential loan defaults. | MXN 4,305 million in Q1 2024 provisions highlights this key cost. |

| Personnel & Admin | Salaries, benefits, marketing, and promotional expenses. | Managing a large workforce and driving brand recognition. |

| Technology Investment | IT infrastructure, digital platforms, and cybersecurity. | Enhancing user experience and operational efficiency in digital services. |

Revenue Streams

Grupo Elektra's core revenue engine is the direct sale of a wide array of consumer goods. This includes everything from refrigerators and televisions to sofas and scooters, all available through their extensive network of physical stores and burgeoning e-commerce platforms. This commercial segment is a significant contributor to their overall financial performance.

In 2024, Grupo Elektra continued to see robust sales from its commercial product offerings. For instance, the company reported strong performance in its appliance and electronics categories, which are key drivers of this revenue stream. This segment’s consistent income generation is vital for the company’s operational funding and expansion efforts.

Grupo Elektra's financial services business model heavily relies on interest income generated from its extensive consumer credit operations. A significant portion of its revenue stems from the interest charged on loans provided to customers for purchasing appliances, electronics, and other goods through its retail channels.

The company's gross loan portfolio is a key indicator of its financial income potential. As of the first quarter of 2024, Grupo Elektra reported a consolidated gross loan portfolio of approximately MXN 251.7 billion, showcasing the substantial scale of its credit-granting activities and the resulting interest revenue.

Banco Azteca, a key component of Grupo Elektra, generates substantial income from banking fees and commissions. These include charges for domestic and international money transfers, often referred to as remittances, which are a vital service for many customers. In 2023, Grupo Elektra reported that its financial services segment, heavily influenced by Banco Azteca, saw robust growth in fee-based income.

Beyond remittances, Banco Azteca also earns revenue from account maintenance fees and a variety of other financial services offered to its broad customer base. These diverse fee structures are crucial for the profitability of the financial arm, contributing significantly to the overall revenue streams of Grupo Elektra.

Revenue from Non-Merchandise Services

Grupo Elektra diversifies its income beyond just selling products and core financial services by generating revenue from a range of non-merchandise services. These offerings are designed to enhance the customer experience and provide additional value, thereby creating new income streams.

These services often complement their primary product sales, such as electronics and appliances. For instance, customers can opt for extended warranties, which provide peace of mind and generate recurring revenue for Elektra. Installation services for larger items also contribute significantly, covering the setup and integration of purchased goods into the customer's home.

Other value-added services can include insurance products tied to purchases, repair services, and even digital services. In 2023, Grupo Elektra's financial services segment, which often bundles these non-merchandise offerings, reported significant growth, indicating the importance of these revenue streams.

- Extended Warranties: Offering protection beyond the standard manufacturer's warranty.

- Installation Services: Professional setup for appliances, electronics, and other large purchases.

- Value-Added Insurance: Insurance products often bundled with merchandise.

- Repair and Maintenance: Services for post-purchase product upkeep.

Insurance Premiums and Brokerage

Grupo Elektra, through its subsidiary Seguros Azteca, generates significant revenue by offering a diverse range of insurance policies. These include essential coverage like life, auto, and property insurance, catering to a broad customer base. This strategic offering not only diversifies the company's financial service portfolio but also strengthens its overall revenue streams.

In 2024, the insurance sector continued to be a vital contributor to Grupo Elektra's financial performance. The company actively promotes its insurance products across its extensive retail network, leveraging customer relationships to drive policy sales. This integrated approach allows them to capture a larger share of the market, as evidenced by the consistent growth in their insurance segment.

- Seguros Azteca's Product Range: Life, auto, and property insurance policies.

- Revenue Generation: Primarily through the sale of these insurance policies.

- Strategic Diversification: Enhances the company's financial service offerings and revenue base.

- Market Penetration: Leverages Grupo Elektra's retail network to reach customers.

Grupo Elektra's revenue streams are multifaceted, encompassing direct product sales, financial services, and ancillary services. The company's extensive retail network and growing e-commerce presence facilitate the sale of consumer goods like appliances and electronics. Simultaneously, Banco Azteca and Seguros Azteca are pivotal in generating income through interest, fees, commissions, and insurance policy sales.

In 2024, Grupo Elektra's consolidated gross loan portfolio reached approximately MXN 251.7 billion in Q1, highlighting the significant interest income from its credit operations. Furthermore, the company's financial services segment, including banking fees and insurance premiums, demonstrated robust growth, underscoring the diversification of its income base beyond merchandise sales.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Product Sales | Direct sale of consumer goods (appliances, electronics, furniture, etc.) | Strong performance in appliance and electronics categories. |

| Financial Services (Interest Income) | Interest earned on consumer credit and loans. | MXN 251.7 billion consolidated gross loan portfolio (Q1 2024). |

| Financial Services (Fees & Commissions) | Banking fees, money transfers (remittances), account maintenance. | Robust growth in fee-based income from Banco Azteca. |

| Insurance Premiums | Revenue from life, auto, and property insurance policies via Seguros Azteca. | Vital contributor with consistent growth, leveraging retail network. |

| Ancillary Services | Extended warranties, installation, repair, and value-added insurance. | Significant growth reported in financial services segment, often bundling these. |

Business Model Canvas Data Sources

The Grupo Elektra Business Model Canvas is constructed using extensive financial reports, detailed market research on consumer behavior in Latin America, and internal operational data. These sources provide a comprehensive view of the company's existing strengths and opportunities for growth.