Grupo Elektra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Elektra Bundle

Grupo Elektra's diverse portfolio presents a fascinating case study for the BCG Matrix. Are their retail operations a booming Star or a stable Cash Cow? Where do their financial services fit in this strategic framework?

Uncover the full picture and gain actionable insights by purchasing the complete Grupo Elektra BCG Matrix. This detailed analysis will illuminate each product's position, guiding your investment and resource allocation decisions for maximum impact.

Stars

Banco Azteca's digital offerings, including its mobile app and the Baz super app, are truly shining stars for Grupo Elektra. In 2024, these platforms saw remarkable expansion, boasting 25.2 million digital accounts and facilitating over 6.1 billion transactions. This surge highlights their dominance in the digital financial space.

This digital push is transforming how customers interact with financial services. A substantial portion of operations, from credit payments to cash credit processing, now happens digitally, showcasing the apps' market-leading capabilities. The banking sector has also recognized this innovation, further cementing their status as high-growth, high-share assets.

Grupo Elektra's consumer credit portfolio, largely driven by Banco Azteca México, firmly positions itself as a Star within the BCG matrix. This segment experienced a significant 14% surge in its consolidated gross loan portfolio during the first quarter of 2025, underscoring robust expansion and high market demand.

The strong performance is fueled by the consistent need for accessible credit solutions among Elektra's core customer base in the middle and lower-income demographics. Elektra’s dominant market share in serving these segments ensures sustained growth and revenue contribution.

Italika, Grupo Elektra's own motorcycle brand, is a significant Star in their portfolio. It holds a dominant market share, estimated between 54% and 60% within Mexico. This strong position is further bolstered by impressive sales figures, with 1.3 million units sold in 2024 alone.

The company's strategy of focusing on this high-margin product line, which includes the introduction of many new models, ensures Italika remains a key player in a market that continues to expand. This segment directly contributes to enhancing Grupo Elektra's overall retail sales performance and profitability.

Financial Services Revenue Growth

The financial services segment is a shining star for Grupo Elektra. In the first quarter of 2025, its revenue experienced an impressive surge of 23%, positioning it as the main engine driving the company's overall growth. This significant boost in financial income, largely attributable to the robust performance of Banco Azteca, clearly demonstrates Elektra's dominant market share and leading position within the financial industry. The segment's ongoing expansion across crucial markets further solidifies its considerable growth potential.

Key performance indicators for the financial services segment in Q1 2025 highlight its star status:

- Revenue Growth: A remarkable 23% increase, underscoring its role as the primary growth driver.

- Banco Azteca's Contribution: The bank's strong performance is a significant factor behind the segment's substantial financial income.

- Market Position: Elektra's leadership and strong market share in the financial sector are evident through this segment's success.

- Expansion: Continued footprint expansion in key markets signals high future growth potential.

Purpose Financial (US Cash Advance Services)

Purpose Financial, Grupo Elektra's U.S. cash advance service, is classified as a Star in the BCG Matrix. It stands as the largest provider within its specific market segment, demonstrating significant growth and market penetration. This unit's performance is a key driver for Elektra's expanding financial services portfolio.

The growth observed in Purpose Financial's contribution to Grupo Elektra's consolidated gross loan portfolio highlights its strong position in the short-term, non-bank lending sector. This niche market, while specific, is experiencing expansion, and Purpose Financial is capitalizing on this trend.

- Market Leadership: Purpose Financial is the largest player in the U.S. non-bank cash advance market.

- Growth Indicator: Its increasing share in the consolidated gross loan portfolio signals robust expansion.

- Strategic Importance: This business unit enhances the overall dynamism and reach of Grupo Elektra's financial services division.

Banco Azteca's digital platforms, including its mobile and Baz super apps, are key Stars for Grupo Elektra, demonstrating significant growth and market dominance. In 2024, these platforms saw 25.2 million digital accounts and facilitated over 6.1 billion transactions, highlighting their leading position in digital finance.

The financial services segment, driven by Banco Azteca, is a significant Star, with Q1 2025 revenue up 23%, making it the primary growth engine for Grupo Elektra. This segment benefits from Elektra's strong market share and leadership in serving middle and lower-income demographics, further solidified by continuous expansion in crucial markets.

Italika, Grupo Elektra's motorcycle brand, is a strong Star, holding a dominant market share of 54% to 60% in Mexico and selling 1.3 million units in 2024. Its focus on high-margin products and new model introductions ensures continued market expansion and profitability.

Purpose Financial, a U.S. cash advance service, is also a Star, leading its specific market segment and contributing to Elektra's financial services growth. Its increasing share in the consolidated gross loan portfolio underscores its strong performance in the expanding short-term lending sector.

| Business Unit | BCG Category | Key Performance Indicator (2024/Q1 2025) | Market Position | Growth Driver |

| Banco Azteca Digital | Star | 25.2M digital accounts, 6.1B transactions (2024) | Dominant in digital finance | Digitalization of services |

| Financial Services (Overall) | Star | +23% revenue growth (Q1 2025) | Market leader in financial sector | Banco Azteca's performance |

| Italika | Star | 1.3M units sold (2024), 54-60% market share (Mexico) | Dominant motorcycle brand | High-margin products |

| Purpose Financial | Star | Largest U.S. non-bank cash advance provider | Leading niche player | Expansion in short-term lending |

What is included in the product

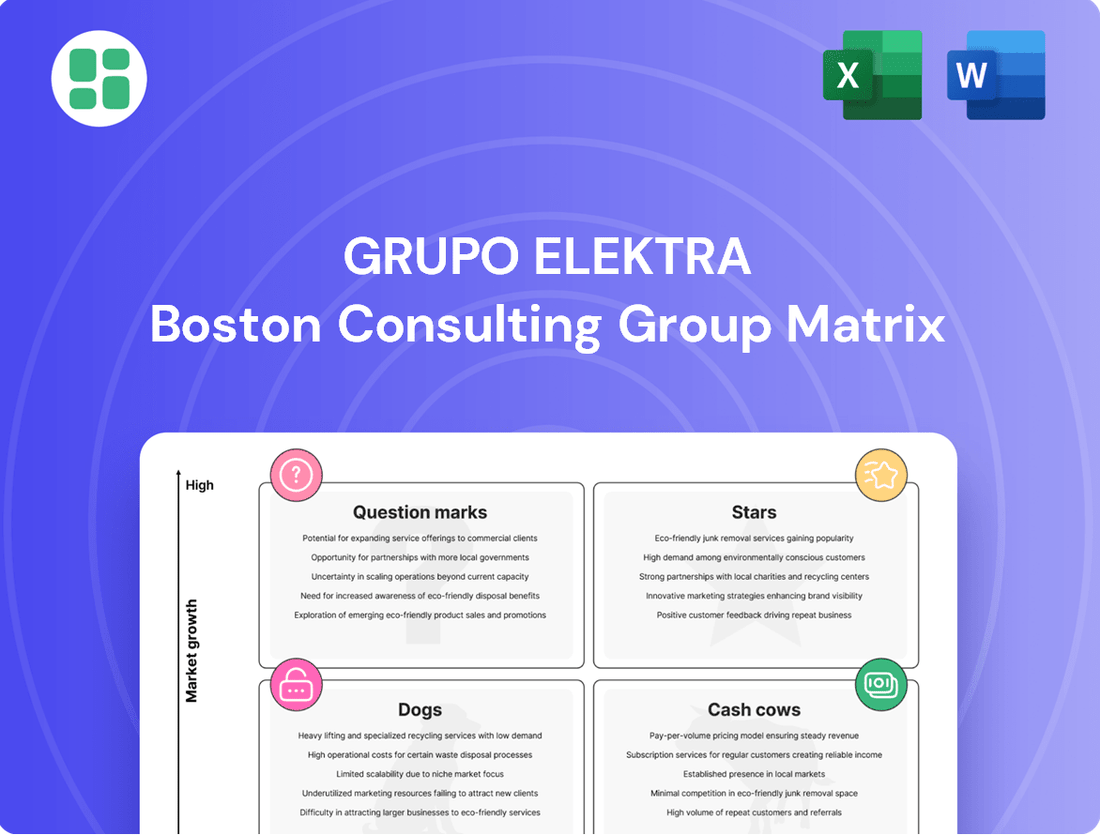

Grupo Elektra's BCG Matrix offers a tailored analysis of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest for optimal resource allocation and growth.

Grupo Elektra's BCG Matrix offers a clear, one-page overview, alleviating the pain of strategic uncertainty by pinpointing each business unit's position.

This optimized layout provides a distraction-free view, relieving the pain of complex data overload for C-level executives.

Cash Cows

Grupo Elektra's traditional retail appliance and furniture sales are a prime example of its cash cows within the BCG Matrix. These segments benefit from Elektra's vast and established retail footprint, catering to a wide customer base.

While commercial retail sales in these categories have seen more modest growth, typically in the 5-8% range in recent quarters, they operate within a mature market. This maturity suggests Elektra likely commands a substantial and stable market share, particularly among its core demographic.

The consistent cash flow generated from these appliance and furniture sales, requiring relatively low promotional investment, significantly bolsters the company's overall profitability. This reliable income stream is crucial for funding other ventures within Elektra's portfolio.

Banco Azteca's extensive physical branch network, boasting over 2,000 locations and more than 6,000 points of contact across several countries, firmly positions it as a Cash Cow within Grupo Elektra's BCG Matrix. This significant infrastructure in a well-established banking market ensures broad customer accessibility, especially for those who might be overlooked by conventional financial institutions.

The sheer scale of this network translates into consistent customer engagement for deposits and loan servicing. This reliability makes it a dependable source for low-cost funding and a steady generator of predictable cash flow, a hallmark of a mature and profitable business unit.

Banco Azteca's core deposit-taking and basic banking services represent a significant Cash Cow for Grupo Elektra. This segment benefits from a high market share within a mature banking environment, indicating established customer loyalty and a strong brand presence.

The robust growth in consolidated deposits, exemplified by a 12% increase in the first quarter of 2025, underscores the stability and cost-effectiveness of these services as a funding source. This consistent inflow of low-cost capital is crucial for supporting the company's broader financial activities and investments.

These fundamental banking operations are characterized by their ability to generate reliable and steady cash flow with minimal need for substantial new capital expenditure. This makes them a foundational element of Grupo Elektra's profitability, providing a predictable revenue stream.

Remittance Services

Grupo Elektra's remittance services, especially along the busy US-Mexico route, are a definite Cash Cow. This market is well-established and sees steady demand, with a compound annual growth rate of 8.0% from 2010 through 2024.

Elektra's strong foothold in this sector means they have a reliable and predictable income. This segment generates substantial cash flow, and importantly, doesn't need a lot of extra money to keep growing.

- Stable Revenue Stream: The consistent demand for remittances, particularly in the US-Mexico corridor, provides a predictable and ongoing income for Grupo Elektra.

- Mature Market Dominance: Operating in a well-established market allows Elektra to leverage its existing infrastructure and brand recognition for consistent performance.

- Low Investment Needs: As a Cash Cow, this segment requires minimal new capital expenditure, allowing it to generate significant free cash flow for the company.

- Historical Growth: The 8.0% CAGR from 2010-2024 highlights the sustained and robust nature of this remittance business.

Core Consumer Finance Operations

Grupo Elektra's core consumer finance operations, primarily focused on credit for purchases within its extensive retail network, are firmly positioned as a Cash Cow in its BCG Matrix. This segment, distinct from newer digital initiatives, leverages a deeply entrenched customer base and Elektra's unique integrated retail and financial services model. Its consistent profitability stems from a high market share in a mature, yet stable, market.

This established segment benefits from Elektra's significant physical presence, which underpins its strong market position. The company reported that its financial services segment, which includes these core operations, generated revenue of MXN 26,865 million in 2023, underscoring its substantial contribution to the group's overall financial health.

- Established Customer Base: Serves a large and loyal customer demographic who rely on Elektra for credit.

- Integrated Model Advantage: Synergies between retail sales and financing drive consistent demand and profitability.

- Mature Market Dominance: Holds a high market share in a stable, well-understood consumer finance segment.

- Consistent Cash Flow Generation: Provides reliable profits and cash flow, supporting other business ventures.

Grupo Elektra's established consumer finance segment, particularly its credit offerings for purchases within its vast retail network, stands as a strong Cash Cow. This core business benefits from a high market share in a mature, yet stable, consumer finance environment, leveraging Elektra's integrated retail and financial services model.

The financial services segment, a key contributor, reported revenues of MXN 26,865 million in 2023, highlighting its significant role in the group's profitability. This segment's ability to generate consistent cash flow with minimal need for new capital investment makes it a vital engine for Grupo Elektra.

These operations are characterized by a deeply entrenched customer base, ensuring predictable demand and profitability. The reliable income stream from these credit services is crucial for funding other strategic initiatives within the company's diverse portfolio.

| Business Segment | BCG Category | Key Characteristics | Financial Highlight (2023) |

| Consumer Finance (Retail Credit) | Cash Cow | High market share, mature market, integrated model, established customer base | Financial Services Revenue: MXN 26,865 million |

Preview = Final Product

Grupo Elektra BCG Matrix

The Grupo Elektra BCG Matrix you are currently previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, created by strategy experts, is ready for immediate download and integration into your business planning, offering clear strategic insights without any watermarks or demo content.

Dogs

Certain less profitable or strategically less relevant physical retail stores within Grupo Elektra's extensive network could be classified as Dogs. The company's strategic efforts to maximize the profitability of its contact points, which included a slight reduction in the total number of points in 2024, suggest the divestiture or downscaling of underperforming locations. These stores likely have low market share in their immediate vicinity and contribute minimally to overall growth.

Within Grupo Elektra's broader general merchandise segment, categories such as basic apparel, low-end electronics, and household goods often fall into the "Dogs" quadrant. These items typically face fierce competition and have thin profit margins, contributing minimally to the company's overall market share growth. For instance, in 2024, the discount apparel sector, a key area for such general merchandise, saw an average gross margin of only 22%, significantly lower than the 35% observed in major appliances.

Grupo Elektra's legacy IT systems and outdated operational infrastructure represent a potential 'Dogs' category within its business portfolio. These systems, often costly to maintain, can drain resources without providing a significant competitive edge or contributing to market share growth. For instance, in 2024, many traditional retail and financial service companies reported substantial IT maintenance costs, with some dedicating over 70% of their IT budgets to simply keeping existing systems running, according to industry reports.

The continued reliance on such legacy assets can hinder Grupo Elektra's agility and its ability to innovate in a rapidly evolving digital landscape. This inefficiency directly impacts operational performance and can slow down the adoption of new technologies crucial for maintaining a competitive advantage. The company's stated commitment to digital transformation underscores a strategic imperative to move beyond these resource-intensive, low-return infrastructure components.

Non-Performing Loan (NPL) Portfolios

Segments of Grupo Elektra's loan portfolio with persistently high non-performing loan (NPL) ratios, particularly those proving difficult to recover, would be classified as Dogs in the BCG Matrix. These are loans that are not generating adequate returns and are consuming valuable resources.

While Banco Azteca typically demonstrates robust asset quality, a modest uptick in its consolidated NPL ratio during the first and second quarters of 2025 indicates specific loan segments that are proving challenging. For instance, reported NPLs for certain consumer credit products may have risen, requiring significant collection efforts without a commensurate recovery rate.

- High NPL Segments: Portions of the loan book exhibiting NPL ratios exceeding established internal benchmarks, indicating underperformance.

- Resource Drain: These loans act as cash traps, diverting capital and management attention away from more profitable ventures.

- Collection Costs: The expense associated with recovering these loans often outweighs the potential recovery value, impacting profitability.

- Strategic Review: Such segments necessitate a thorough review for potential write-offs, restructuring, or sale to mitigate further losses.

Niche or Less Adopted Financial Products

Grupo Elektra's portfolio may include niche financial products that haven't achieved widespread adoption. These could be specialized credit lines or insurance policies with limited appeal, resulting in a low market share and stagnant growth. For instance, a product like a micro-loan specifically for artisanal craftspeople might have only a few thousand active users across all of Mexico, representing a tiny fraction of the total potential market.

These less successful offerings often fail to generate substantial cash flow, acting as a drag on the financial services division's overall performance. Their minimal contribution to dynamism means they might be candidates for discontinuation to streamline operations. In 2023, such a product might have shown a net profit of less than $1 million USD, while other core offerings contributed tens or hundreds of millions.

- Limited Market Traction: Products with low customer engagement and minimal market share.

- Stagnant Growth Prospects: Little to no anticipated increase in customer base or revenue.

- Minimal Cash Flow Generation: Failing to contribute significantly to the company's financial health.

- Portfolio Optimization: Potential candidates for phasing out to improve overall product mix.

Certain less profitable or strategically less relevant physical retail stores within Grupo Elektra's extensive network could be classified as Dogs. The company's strategic efforts to maximize the profitability of its contact points, which included a slight reduction in the total number of points in 2024, suggest the divestiture or downscaling of underperforming locations. These stores likely have low market share in their immediate vicinity and contribute minimally to overall growth.

Within Grupo Elektra's broader general merchandise segment, categories such as basic apparel, low-end electronics, and household goods often fall into the "Dogs" quadrant. These items typically face fierce competition and have thin profit margins, contributing minimally to the company's overall market share growth. For instance, in 2024, the discount apparel sector, a key area for such general merchandise, saw an average gross margin of only 22%, significantly lower than the 35% observed in major appliances.

Grupo Elektra's legacy IT systems and outdated operational infrastructure represent a potential 'Dogs' category within its business portfolio. These systems, often costly to maintain, can drain resources without providing a significant competitive edge or contributing to market share growth. For instance, in 2024, many traditional retail and financial service companies reported substantial IT maintenance costs, with some dedicating over 70% of their IT budgets to simply keeping existing systems running, according to industry reports.

The continued reliance on such legacy assets can hinder Grupo Elektra's agility and its ability to innovate in a rapidly evolving digital landscape. This inefficiency directly impacts operational performance and can slow down the adoption of new technologies crucial for maintaining a competitive advantage. The company's stated commitment to digital transformation underscores a strategic imperative to move beyond these resource-intensive, low-return infrastructure components.

Segments of Grupo Elektra's loan portfolio with persistently high non-performing loan (NPL) ratios, particularly those proving difficult to recover, would be classified as Dogs in the BCG Matrix. These are loans that are not generating adequate returns and are consuming valuable resources. While Banco Azteca typically demonstrates robust asset quality, a modest uptick in its consolidated NPL ratio during the first and second quarters of 2025 indicates specific loan segments that are proving challenging. For instance, reported NPLs for certain consumer credit products may have risen, requiring significant collection efforts without a commensurate recovery rate.

Grupo Elektra's portfolio may include niche financial products that haven't achieved widespread adoption. These could be specialized credit lines or insurance policies with limited appeal, resulting in a low market share and stagnant growth. For instance, a product like a micro-loan specifically for artisanal craftspeople might have only a few thousand active users across all of Mexico, representing a tiny fraction of the total potential market. These less successful offerings often fail to generate substantial cash flow, acting as a drag on the financial services division's overall performance. Their minimal contribution to dynamism means they might be candidates for discontinuation to streamline operations. In 2023, such a product might have shown a net profit of less than $1 million USD, while other core offerings contributed tens or hundreds of millions.

| Category | Example within Grupo Elektra | Market Share | Growth Rate | Profitability |

| Physical Retail Stores | Underperforming regional branches | Low | Low/Declining | Low/Negative |

| General Merchandise | Discount apparel, basic electronics | Low | Low | Low |

| IT Infrastructure | Legacy operating systems | N/A | N/A | Low (high maintenance costs) |

| Loan Portfolio | Segments with high NPL ratios | N/A | N/A | Low/Negative |

| Financial Products | Niche credit lines with low adoption | Low | Low | Low |

Question Marks

Banco Azteca's foray into AI for banking services positions it as a Question Mark. While these AI-driven product and operational enhancements are nascent, they target a rapidly expanding technological landscape, suggesting high future growth potential.

Currently, these digital innovations likely represent a small slice of Banco Azteca's overall market share. However, the inherent scalability of AI in financial services means they could pivot to become Stars if they capture significant customer adoption and market traction.

The development and implementation of these advanced digital tools necessitate substantial capital investment. For instance, global banks are projected to spend over $200 billion on AI by 2025, highlighting the scale of resources needed for such ventures to succeed.

Grupo Elektra's venture into electric motorcycles positions them in a Question Mark category within their overall motorcycle business, which is a Star. While the global electric motorcycle market is experiencing robust growth, projected to reach over $20 billion by 2027, Elektra's presence in this nascent segment is likely still developing. This means they have the potential for significant expansion, but also carry higher risk and require careful strategic investment to gain traction.

Grupo Elektra's strategy might involve cautious, small-scale entries into new geographic markets beyond its core operations in Mexico, the United States, and Central America. These ventures represent potential high-growth avenues, though they start with minimal market share. Such expansions require substantial investment and focused strategy to establish a foothold and achieve growth.

While Grupo Elektra has a significant presence in its existing markets, specific details on new country entries for 2024 and early 2025 are not publicly detailed. For instance, in 2023, the company continued to strengthen its existing network, with a focus on digital transformation and enhanced customer experience across its established territories rather than broad new geographic penetrations.

Expansion of WhatsApp-based Credit Transactions

Banco Azteca's ambitious plan to expand WhatsApp-based credit transactions by five times in 2025 places this initiative squarely in the Question Mark quadrant of the BCG Matrix. While WhatsApp boasts over 2 billion monthly active users globally, its penetration for direct credit origination is still nascent, representing a small fraction of overall transaction volume compared to established channels.

This strategy taps into a high-growth potential market, but it necessitates substantial investment in technology, user acquisition, and risk management to drive adoption and establish a robust revenue stream. For instance, in 2024, many financial institutions are exploring similar digital-first lending approaches, indicating a broader market trend but also increased competition.

Key considerations for this expansion include:

- User Adoption: Overcoming potential customer hesitancy to conduct financial transactions via messaging apps.

- Regulatory Compliance: Ensuring adherence to financial regulations for digital credit origination.

- Scalability: Developing the infrastructure to handle a significant increase in transaction volume.

- Competitive Landscape: Differentiating Banco Azteca's offering in an increasingly crowded digital lending space.

Specialized Microfinance or SME Loan Products

Grupo Elektra's specialized microfinance and SME loan products targeting underserved niches would likely be classified as Question Marks within the BCG Matrix. These offerings, while potentially having low current market share, are positioned in high-growth segments focused on financial inclusion. For instance, in 2024, the demand for tailored financial solutions for small businesses in emerging markets continued to rise, with many of these niches still exhibiting significant untapped potential.

These products require substantial investment in product development, risk assessment, and distribution channels to gain traction. Grupo Elektra's strategy would involve carefully nurturing these offerings, similar to how other financial institutions have invested in digital platforms to reach previously unbanked populations. The aim is to increase market share and eventually transition them into Stars.

- Targeting Niche Markets: Focus on specific sectors like women-led agricultural businesses or tech startups needing seed capital, which often have limited access to traditional banking.

- High Growth Potential: These segments are experiencing rapid expansion, driven by increasing digitalization and a growing need for flexible financing solutions.

- Investment Requirements: Significant capital is needed for customized underwriting, localized marketing campaigns, and building trust within these specialized communities.

- Path to Star Status: Successful scaling depends on adapting products to evolving customer needs and leveraging technology to reduce operational costs and improve reach.

Grupo Elektra's expansion into new, emerging markets represents a classic Question Mark scenario. These ventures, while offering the allure of high growth due to untapped customer bases, begin with a minimal market presence and require significant upfront investment to establish brand recognition and distribution networks.

The company's strategy in these regions likely involves a cautious, phased approach, mirroring investments seen globally in similar expansion efforts. For instance, many multinational corporations allocate substantial portions of their R&D and market entry budgets to these nascent opportunities, recognizing the long-term payoff despite initial uncertainty.

Success hinges on adapting existing business models to local economic conditions and consumer behaviors, a challenge that requires agility and deep market understanding. The path from Question Mark to Star is paved with strategic partnerships and a relentless focus on customer acquisition and retention in these new territories.

| Initiative | Current Market Share | Growth Potential | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| AI in Banking | Low | High | High | Customer Adoption, Scalability |

| Electric Motorcycles | Low | High | High | Market Penetration, Product Development |

| WhatsApp Credit Transactions | Low | High | High | User Acquisition, Regulatory Compliance |

| Niche Microfinance/SME Loans | Low | High | High | Product Customization, Distribution |

| New Geographic Market Entry | Low | High | High | Market Adaptation, Brand Building |

BCG Matrix Data Sources

Our Grupo Elektra BCG Matrix leverages a blend of financial statements, market research reports, and internal sales data to accurately assess business unit performance and market share.