Grupo Casas Bahia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Casas Bahia Bundle

Grupo Casas Bahia, a dominant force in Brazilian retail, leverages its extensive physical presence and strong brand recognition as key strengths. However, the company faces significant challenges from increasing competition and evolving consumer preferences, impacting its market position.

Want the full story behind Grupo Casas Bahia’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grupo Casas Bahia's extensive omnichannel presence is a significant strength, combining a vast physical store network throughout Brazil with strong e-commerce operations via Casas Bahia, Ponto, and Extra.com. This integrated approach ensures broad market reach and caters to diverse consumer shopping habits, whether online or in brick-and-mortar locations.

Grupo Casas Bahia boasts nearly seven decades of history, forging deep connections and robust brand recognition across Brazilian households. Its signature installment plan, known as crediário, has been a cornerstone of customer loyalty and a significant driver of consolidated gross revenue, demonstrating its enduring appeal and competitive edge.

Grupo Casas Bahia's strength lies in its broad product and service portfolio. Beyond traditional consumer goods like furniture, appliances, and electronics, the company has expanded into financial services. This includes offering credit cards and various insurance products, which directly supports customer purchasing power.

This strategic diversification creates a significant advantage. It not only makes it easier for customers to buy, but it also opens up new avenues for revenue. These financial services are becoming increasingly profitable, bolstering the company's overall financial health and solidifying its standing in the market.

Operational Efficiency and Cost Discipline

Grupo Casas Bahia's dedication to operational efficiency and cost discipline, a cornerstone of its Transformation Plan, is yielding tangible results. The company has actively pursued cost-cutting measures, leading to notable reductions in administrative expenses. For instance, reports from early 2024 highlighted a significant decrease in these costs, contributing to a more streamlined operation.

This focus on internal efficiency directly translates to improved financial performance, as evidenced by enhancements in adjusted EBITDA margins. By tightening its belt and optimizing its internal processes, Grupo Casas Bahia is better positioned to weather economic headwinds and bolster its profitability. This disciplined approach is crucial for sustainable growth in a competitive retail landscape.

- Reduced Administrative Expenses: Significant cuts in overhead and administrative costs were reported in early 2024, enhancing operational leverage.

- Improved EBITDA Margins: The focus on efficiency has led to a noticeable improvement in adjusted EBITDA margins, signaling better profitability from core operations.

- Resilience in Challenging Markets: Cost discipline provides a buffer against economic volatility, allowing the company to maintain financial stability and pursue strategic objectives.

Successful Debt Restructuring and Improved Liquidity

Grupo Casas Bahia successfully navigated a critical debt restructuring in 2024. This initiative involved extending repayment timelines and securing more favorable interest rates, significantly easing its financial burden.

The reprofiling of its debt obligations in 2024 was a pivotal move. It allowed the company to retain substantial cash reserves, bolstering its liquidity and providing much-needed breathing room for operational stability and future planning.

This improved liquidity is crucial, as it alleviates immediate financial pressures. It also grants Casas Bahia greater flexibility to pursue strategic investments and growth opportunities it might otherwise have deferred.

- Debt Restructuring Success: Completed significant debt restructuring in 2024, extending repayment terms and lowering interest costs.

- Improved Liquidity: Preserved substantial cash reserves, enhancing the company's short-term financial flexibility.

- Strategic Flexibility: Gained capacity for strategic investments and growth initiatives due to eased financial pressures.

Grupo Casas Bahia's extensive omnichannel presence, blending a vast physical store network with robust e-commerce platforms like Casas Bahia and Ponto, ensures broad market reach and caters to diverse consumer preferences.

The company's nearly seven-decade history has fostered deep brand recognition and customer loyalty, particularly through its signature installment plan, crediário, a key driver of revenue.

Its diversified product and service portfolio, extending from consumer goods to financial services like credit cards and insurance, enhances customer purchasing power and creates new revenue streams.

Grupo Casas Bahia demonstrated strong operational efficiency through its Transformation Plan, reporting significant reductions in administrative expenses in early 2024, which bolstered adjusted EBITDA margins.

| Metric | Value (Early 2024) | Impact |

|---|---|---|

| Administrative Expenses | Reduced | Improved operational leverage |

| Adjusted EBITDA Margins | Improved | Enhanced profitability from core operations |

| Debt Restructuring | Completed (2024) | Extended repayment terms, lowered interest costs, improved liquidity |

What is included in the product

This SWOT analysis offers a comprehensive view of Grupo Casas Bahia's internal strengths and weaknesses, alongside external opportunities and threats, to understand its strategic positioning and future potential.

Offers a clear, actionable framework for addressing Grupo Casas Bahia's competitive challenges and leveraging its market strengths.

Weaknesses

Grupo Casas Bahia continues to grapple with a significant debt burden, with its net debt standing at R$12.83 billion as of the first quarter of 2025. This substantial leverage remains a key weakness, even after recent restructuring initiatives.

The company's financial expenses are heavily impacted by Brazil's high interest rate environment. These costs have escalated considerably, directly contributing to the company's persistent net losses and posing a continuous threat to its financial health.

Grupo Casas Bahia has been grappling with persistent net losses, a significant concern for its financial health. In the first quarter of 2025, the company reported a net loss of R$408 million. This figure represents a considerable deterioration compared to the same period in the prior year, signaling ongoing financial challenges.

Despite efforts to improve operational performance and achieve revenue growth, the company's substantial debt burden and the prevailing high interest rate environment continue to exert downward pressure on its profitability. These factors are directly contributing to the sustained net losses, making it difficult for the business to achieve positive earnings.

The continuation of these losses poses a serious risk to investor confidence, potentially deterring new investment and making it harder for Grupo Casas Bahia to secure the capital needed for future growth and operational improvements. This can create a challenging cycle for the company's long-term viability.

Grupo Casas Bahia's direct online sales saw a dip in the first quarter of 2025. This decline occurred even as the company focused on selling products with better profit margins. It suggests a challenge in growing its direct e-commerce business while also ensuring profitability.

This strategic shift could potentially lead to a loss of market share in the very competitive online retail environment if it isn't carefully managed. The company needs to find a way to boost direct online sales without sacrificing its margin goals.

Vulnerability to Economic Headwinds

Grupo Casas Bahia, like much of the Brazilian retail sector, is particularly susceptible to economic downturns. High interest rates, which reached 11.25% annually by mid-2024, significantly dampen consumer spending, especially on big-ticket items such as furniture and appliances that form a core part of Casas Bahia's offerings. This economic pressure directly impacts the company’s sales volumes and profitability.

Fragile consumer confidence, a persistent issue in Brazil, further exacerbates these challenges. When consumers feel uncertain about their financial future, they tend to cut back on non-essential purchases. This directly affects demand for Casas Bahia's product lines, leading to reduced sales and potentially higher inventory levels.

Inflationary pressures also play a crucial role, eroding purchasing power. As prices for goods rise, consumers have less disposable income for discretionary purchases. This dynamic directly impacts Casas Bahia's ability to drive sales volumes, particularly in categories sensitive to price changes.

- Economic Headwinds: High interest rates and inflation in Brazil impact consumer spending.

- Consumer Confidence: Fragile confidence leads to reduced demand for durable goods.

- Sales Impact: Macroeconomic factors directly limit discretionary spending and purchasing power.

Intense Competition in Retail and E-commerce

Grupo Casas Bahia faces a formidable challenge from both established domestic retailers and rapidly growing international e-commerce giants. Competitors such as Magazine Luiza, Mercado Livre, AliExpress, Shopee, Shein, and Temu are intensely vying for market share. This crowded landscape intensifies pressure on pricing strategies and profit margins, demanding constant adaptation and unique value propositions to stand out.

The influx of global players, often with aggressive pricing and vast product selections, directly impacts Grupo Casas Bahia's ability to maintain its market position. For instance, by the end of 2023, platforms like Shein and Temu had significantly disrupted traditional retail models with their ultra-low-cost offerings and efficient logistics. This necessitates continuous investment in technology and customer experience to compete effectively.

- Intensified Price Wars: Global platforms frequently engage in aggressive discounting, forcing local players to match or risk losing customers.

- Market Share Erosion: The broad reach and diverse product catalogs of international e-commerce sites can dilute the market share of domestic retailers.

- Customer Loyalty Challenges: Consumers are increasingly drawn to the convenience and affordability offered by global online marketplaces, making customer retention a significant hurdle.

Grupo Casas Bahia's substantial debt load, R$12.83 billion in net debt as of Q1 2025, remains a critical weakness, despite restructuring efforts. This leverage, coupled with Brazil's high interest rates, significantly inflates financial expenses, directly contributing to persistent net losses, such as the R$408 million reported in Q1 2025.

The company's direct online sales experienced a decline in Q1 2025, even with a focus on higher-margin products, indicating challenges in growing its e-commerce segment profitably. This situation, combined with intense competition from both domestic and international e-commerce players like Mercado Livre, AliExpress, Shein, and Temu, puts pressure on pricing and market share.

| Metric | Value (Q1 2025) | Impact |

|---|---|---|

| Net Debt | R$12.83 billion | High financial expenses, profitability pressure |

| Net Loss | R$408 million | Deterioration from prior year, investor confidence risk |

| Direct Online Sales | Declined | E-commerce growth challenges, market share risk |

Same Document Delivered

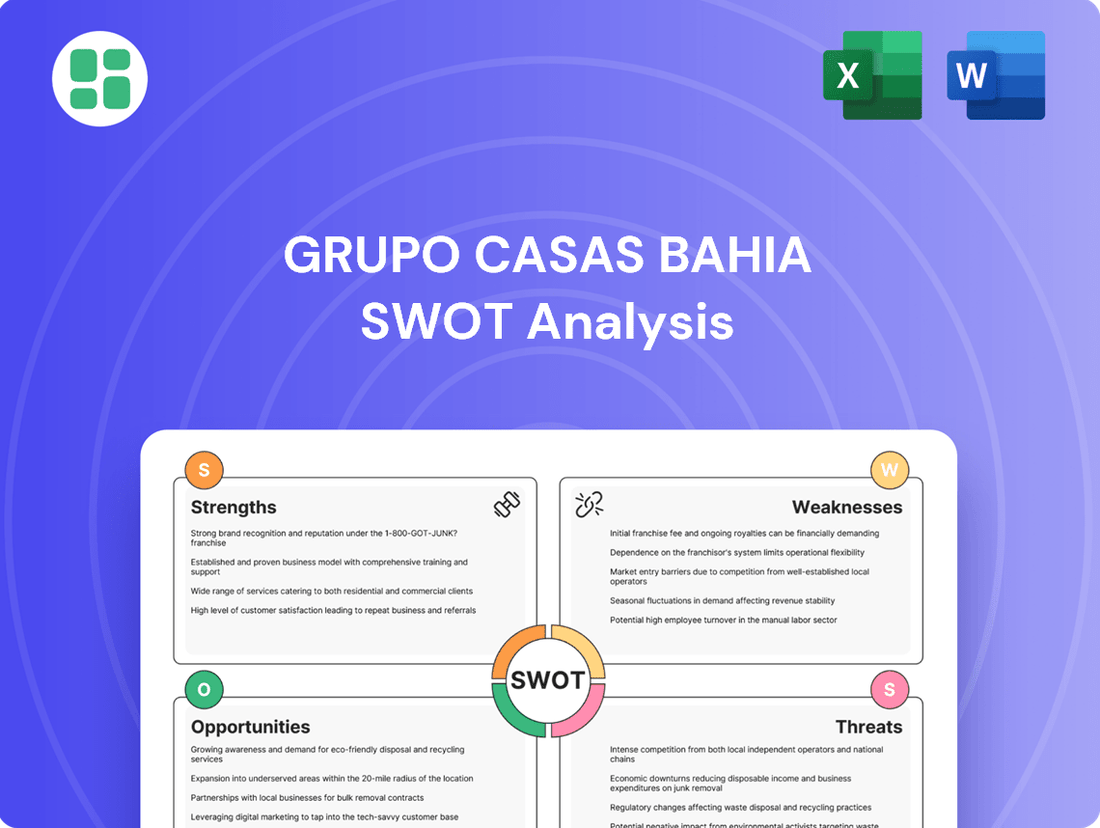

Grupo Casas Bahia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use for Grupo Casas Bahia's SWOT analysis.

You’re viewing a live preview of the actual SWOT analysis file for Grupo Casas Bahia. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, providing actionable insights for Grupo Casas Bahia.

Opportunities

Grupo Casas Bahia has a prime opportunity to grow its financial services, particularly credit cards and insurance. This segment is ripe for expansion and can become a significant profit driver.

Brazil's retail banking sector is experiencing robust growth, fueled by increasing digital engagement and a rising need for consumer credit. This trend presents a fertile ground for Casas Bahia to tap into.

By utilizing its extensive customer network and established credit knowledge, the company can enhance its profit margins and deepen customer relationships. For instance, in 2023, the financial services segment contributed significantly to the company's revenue, showing a clear path for further monetization.

Grupo Casas Bahia's marketplace segment is experiencing robust growth, driven by the increasing number of third-party sellers. This expansion allows the company to broaden its product assortment without the burden of managing extensive inventory, a key advantage in the dynamic retail landscape.

By further developing its marketplace, Casas Bahia can boost revenue through commission fees and attract a more diverse customer base. This strategy directly supports the company's 2024/2025 objectives for digital transformation and enhanced customer reach.

Grupo Casas Bahia's strategic investments in AI, exemplified by its BahIA virtual assistant and AI-driven product recommendations, are poised to revolutionize customer engagement. These digital transformation efforts aim to deliver highly personalized shopping experiences, a key differentiator in today's competitive retail landscape.

The implementation of AI and digital tools is projected to boost sales conversion rates by offering more relevant product suggestions and streamlining the customer journey. Furthermore, these advancements are expected to optimize inventory management and enhance overall operational efficiency, directly impacting the company's bottom line.

Strategic Use of Physical Stores as Logistics Hubs

Grupo Casas Bahia's vast physical store network presents a significant opportunity to transform into localized logistics hubs. This strategic move can drastically cut down delivery times for online purchases, especially in a geographically diverse nation like Brazil. By integrating online and offline operations, the company can offer a seamless omnichannel experience, a key differentiator in today's retail landscape.

Leveraging these stores as fulfillment centers for e-commerce orders can lead to substantial savings on last-mile delivery expenses. For instance, in 2024, the Brazilian e-commerce market continued its robust growth, with delivery costs remaining a critical factor in profitability. By utilizing its existing footprint, Casas Bahia can mitigate these rising costs and improve its competitive edge.

The strategic use of physical stores as logistics hubs offers several key advantages:

- Enhanced Delivery Speed: Enabling faster fulfillment for online orders by leveraging proximity to customers.

- Improved Omnichannel Experience: Bridging the gap between online and in-store shopping for greater customer convenience.

- Reduced Last-Mile Costs: Optimizing delivery routes and reducing reliance on external logistics providers.

- Competitive Advantage: Differentiating through efficient and cost-effective delivery in a large market like Brazil.

Recovery in Consumer Spending and Economic Stability in Brazil

A significant opportunity for Grupo Casas Bahia lies in the potential recovery of consumer spending and overall economic stability in Brazil. As of early 2024, Brazil's economic outlook is showing signs of improvement, with inflation trending downwards and the Central Bank of Brazil (BCB) signaling potential interest rate cuts throughout the year. This stabilization is crucial for boosting consumer confidence and, consequently, discretionary spending, which directly impacts sales of durable goods like appliances and furniture, the company's core business.

The positive impact of an improving economic environment on Grupo Casas Bahia could be substantial. For instance, a sustained decrease in the Selic rate, Brazil's benchmark interest rate, would lower borrowing costs for consumers, making larger purchases more accessible. By mid-2024, the BCB has already implemented some rate reductions, and further cuts are anticipated, which should translate into increased demand for the credit-sensitive products offered by Casas Bahia.

- Economic Stabilization: Brazil's GDP growth is projected to be modest but positive in 2024, indicating a move away from recessionary pressures.

- Consumer Confidence: An uptick in consumer confidence indices, observed in late 2023 and early 2024, suggests a willingness to spend on non-essential items.

- Interest Rate Environment: Lower interest rates make financing more affordable for consumers purchasing big-ticket items, directly benefiting Casas Bahia's sales volume.

- Retail Sector Recovery: A strengthening retail sector, driven by these macroeconomic improvements, provides a more favorable operating landscape for the company.

Grupo Casas Bahia can significantly expand its financial services, particularly credit cards and insurance, capitalizing on Brazil's growing digital banking sector and consumer credit demand. Leveraging its extensive customer base and credit expertise, the company can boost profit margins and customer loyalty, as evidenced by the financial services segment's substantial revenue contribution in 2023.

The company's marketplace is poised for growth with an increasing number of third-party sellers, allowing for broader product offerings without inventory strain. This expansion into a more diverse marketplace, driven by commission fees, aligns with Casas Bahia's 2024/2025 digital transformation goals and enhanced customer reach.

Grupo Casas Bahia's strategic adoption of AI, including its BahIA virtual assistant and personalized recommendations, promises to transform customer engagement. These digital advancements are expected to improve sales conversion rates and operational efficiency, directly contributing to the company's financial performance.

Transforming its vast physical store network into localized logistics hubs offers a prime opportunity to reduce online order delivery times and last-mile costs. This integration of online and offline operations creates a seamless omnichannel experience, a critical advantage in Brazil's competitive retail market, especially given the continued growth of e-commerce in 2024.

Grupo Casas Bahia can benefit from Brazil's improving economic outlook and stabilizing inflation, projected for 2024. Lower interest rates, with the Central Bank of Brazil already initiating cuts in mid-2024, will make credit more accessible for consumers, directly boosting sales of the company's core products like appliances and furniture.

Threats

Persistent high interest rates, exemplified by Brazil's Selic rate which remained elevated in early 2024, significantly increase Grupo Casas Bahia's financial expenses. This environment also tightens consumer credit availability, directly hindering sales of larger, more expensive items like appliances and furniture, which are core to their business model.

Furthermore, ongoing inflation continues to erode consumer purchasing power across Brazil. This forces households to prioritize essential goods, leading to a noticeable reduction in discretionary spending on non-essential retail items. Such a shift presents a substantial threat to the company's overall sales volume and revenue generation.

The Brazilian e-commerce landscape is intensely competitive, with established giants like Mercado Livre and increasingly aggressive international entrants such as AliExpress, Shopee, and Shein. These digital-first competitors often leverage distinct cost structures and employ aggressive pricing tactics, directly challenging Casas Bahia's market position and profitability, particularly within the online sales channel.

Consumer confidence in Brazil has shown persistent fragility, with many families grappling with high levels of debt. As of early 2024, reports indicated that over 70% of Brazilian households were indebted, a significant portion of their income earmarked for debt servicing. This economic environment directly threatens Grupo Casas Bahia's business, as it can dampen consumer spending and increase the risk of defaults on credit sales, which are central to their operations.

Supply Chain Disruptions and Logistics Costs

Grupo Casas Bahia faces significant risks from supply chain disruptions and rising logistics costs, particularly within Brazil's vast territory. Despite ongoing investments in its logistics network, the company remains vulnerable to external shocks. For instance, a surge in diesel prices, a critical component of transportation costs in Brazil, could directly impact the company's bottom line. In early 2024, diesel prices saw fluctuations, adding pressure to operational expenses.

These challenges can lead to increased delivery times and reduced operational efficiency, affecting customer satisfaction and sales. The sheer scale of Brazil means that even localized transportation issues can have widespread consequences.

- Increased operational costs due to fuel price volatility: Brazil's fuel prices are subject to global oil market dynamics and domestic policy changes, directly impacting transportation expenses for deliveries across the country.

- Potential delays in product delivery: Disruptions, whether from infrastructure issues, labor strikes, or logistical bottlenecks, can significantly extend delivery timelines, affecting customer experience and sales conversion rates.

- Impact on inventory management: Unpredictable supply chains can complicate inventory planning, potentially leading to stockouts or excess inventory, both of which negatively affect profitability.

Regulatory and Tax Environment Changes

Changes in Brazil's regulatory and tax landscape present a significant threat. While recent initiatives like the recovery of tax credits might offer some relief, potential unfavorable shifts in consumer credit regulations could directly impact the financial services arm of Grupo Casas Bahia. For instance, stricter rules on interest rates or credit accessibility could dampen demand for financing, a key driver for retail sales.

Furthermore, alterations in import taxes on electronics and other goods are a constant concern. An increase in these taxes, especially for products sourced internationally, would directly raise the cost of goods for Casas Bahia, potentially squeezing profit margins or forcing price increases that could deter consumers. In 2024, Brazil's tax reform discussions continue to create uncertainty regarding future tax burdens on businesses.

- Potential for increased operational costs due to new compliance requirements.

- Risk of reduced consumer spending if credit regulations tighten significantly.

- Exposure to higher input costs if import tariffs on key merchandise are raised.

Grupo Casas Bahia faces substantial threats from Brazil's persistently high interest rates, which elevated financial costs and constrained consumer credit in early 2024. Inflation also continues to erode purchasing power, pushing consumers towards essential goods and away from discretionary items central to Casas Bahia's sales. The competitive e-commerce landscape, dominated by giants like Mercado Livre and aggressive international players, further pressures market share and profitability.

Fragile consumer confidence, exacerbated by high household debt levels—exceeding 70% in early 2024—directly impacts discretionary spending and increases the risk of credit defaults. Supply chain vulnerabilities and rising logistics costs, particularly with fuel price volatility in Brazil, threaten operational efficiency and customer satisfaction. Additionally, potential shifts in regulatory and tax landscapes, including changes to credit regulations and import tariffs, could significantly increase costs and dampen demand.

| Threat Category | Specific Threat | Impact on Casas Bahia | Relevant Data Point (Early 2024) |

|---|---|---|---|

| Economic Environment | High Interest Rates | Increased borrowing costs, reduced consumer credit | Selic rate remained elevated |

| Economic Environment | Inflation | Reduced consumer purchasing power, lower discretionary spending | Eroding consumer purchasing power |

| Competition | Intense E-commerce Competition | Market share erosion, pricing pressure | Presence of Mercado Livre, AliExpress, Shopee, Shein |

| Consumer Behavior | Low Consumer Confidence/High Debt | Decreased spending, increased default risk | Over 70% of Brazilian households indebted |

| Operational | Supply Chain & Logistics Costs | Higher operational expenses, delivery delays | Fuel price volatility impacting transportation |

| Regulatory & Tax | Unfavorable Regulatory Changes | Impact on credit sales, increased compliance costs | Uncertainty in tax reform discussions |

SWOT Analysis Data Sources

This SWOT analysis for Grupo Casas Bahia is built upon a foundation of credible data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the retail and e-commerce sectors.