Grupo Casas Bahia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Casas Bahia Bundle

Grupo Casas Bahia's BCG Matrix offers a crucial snapshot of its product portfolio's market performance. Understand which segments are driving growth and which require strategic re-evaluation to optimize resource allocation.

Uncover the detailed quadrant placements and strategic recommendations for Grupo Casas Bahia's products. Purchase the full BCG Matrix to gain a comprehensive understanding and actionable insights for your business strategy.

Stars

Grupo Casas Bahia's e-commerce marketplace is a star performer, demonstrating robust expansion. In the first quarter of 2025, this segment saw a substantial 17.5% revenue surge, driven by the successful onboarding of more third-party sellers. This growth underscores its strong footing within Brazil's dynamic online retail landscape.

Digital Financial Solutions, within Grupo Casas Bahia's BCG Matrix, stands out as a strong performer. Its financial services revenue saw a significant increase of 18.4% in the first quarter of 2025. This growth is fueled by high-margin products such as credit cards and insurance.

This segment capitalizes on Grupo Casas Bahia's vast customer network and existing credit infrastructure. The recovery in consumer credit demand further supports the expansion of these offerings, positioning Digital Financial Solutions for continued high-margin growth.

Grupo Casas Bahia is significantly bolstering its omnichannel approach, seamlessly blending its extensive physical store network with robust online platforms to elevate the customer journey. This integration aims to provide a consistent and convenient shopping experience across all touchpoints.

The company's strategic rollout of new "megalojas" is a testament to this commitment, featuring advanced technological integrations such as robotic assistance and AI-powered personalization. These innovations are designed to create engaging in-store experiences and cater to individual customer preferences.

Early results from these technologically enhanced stores are promising, with reports indicating a notable increase in both overall revenue and the average ticket size per customer. This suggests that the investment in a superior, technology-driven customer experience is directly translating into improved financial performance for Grupo Casas Bahia.

Core Electronics & Appliance Categories (Specific Growth Areas)

Despite a modest dip in overall direct online sales during the first quarter of 2025, Grupo Casas Bahia's physical stores have demonstrated remarkable resilience, particularly in their core electronics and appliance categories. Large home appliances, often referred to as white goods, and televisions, or brown goods, experienced notable sales surges throughout 2024. This performance aligns with broader market trends, as the Brazilian electronics industry reported an impressive 29% growth for the year.

The company's strategic emphasis on these high-demand product segments is a calculated move. Grupo Casas Bahia leverages its established market presence and strong brand recognition to capitalize on consumer interest in these essential household items.

- Large Home Appliances (White Goods): Saw significant sales increases in 2024.

- Televisions (Brown Goods): Also experienced notable sales growth in 2024.

- Brazilian Electronics Industry Growth: Reported 29% expansion in 2024.

- Strategic Focus: Company prioritizes these categories due to high demand and brand strength.

Logistics and Fulfillment Innovations

Grupo Casas Bahia's logistics and fulfillment innovations significantly bolster its position in the BCG matrix. The unification of logistics operations under CB Full in 2024 has been a game-changer, streamlining processes and boosting efficiency. This strategic move is vital for maintaining a competitive edge in Brazil's expanding e-commerce sector.

The introduction of the Full Cross service for its marketplace further enhances Casas Bahia's capabilities. This service is designed to optimize the delivery of a wide array of products, from light items to heavier goods, across the vast Brazilian territory. By improving delivery times and overall operational efficiency, these initiatives solidify the company's strong market presence.

Key logistical advancements include:

- CB Full unification (2024): Centralized logistics operations for improved control and efficiency.

- Full Cross service: Enhanced marketplace delivery capabilities for diverse product types.

- Nationwide reach: Efficient handling of light and heavy products across Brazil.

- Competitive advantage: Strengthening market position in the growing e-commerce landscape.

Grupo Casas Bahia's e-commerce marketplace is a star, showing significant growth with a 17.5% revenue increase in Q1 2025, driven by more third-party sellers. Digital Financial Solutions also shines, with an 18.4% revenue jump in the same quarter from high-margin products like credit cards and insurance, leveraging the company's customer base.

The company's physical stores, particularly in electronics and appliances, demonstrated resilience in 2024, with large home appliances and televisions seeing notable sales surges. This performance aligns with the Brazilian electronics industry's 29% growth for the year, highlighting strategic focus on high-demand categories.

Logistics, unified under CB Full in 2024, and the Full Cross service for the marketplace are strengthening Casas Bahia's competitive position. These innovations enhance efficiency and nationwide delivery capabilities for a wide range of products.

| Segment | Q1 2025 Revenue Growth | Key Drivers | 2024 Performance Highlight |

|---|---|---|---|

| E-commerce Marketplace | 17.5% | Onboarding third-party sellers | N/A |

| Digital Financial Solutions | 18.4% | Credit cards, insurance, consumer credit recovery | N/A |

| Physical Stores (Electronics/Appliances) | Resilient performance | High demand for white and brown goods | 29% growth in Brazilian electronics industry |

What is included in the product

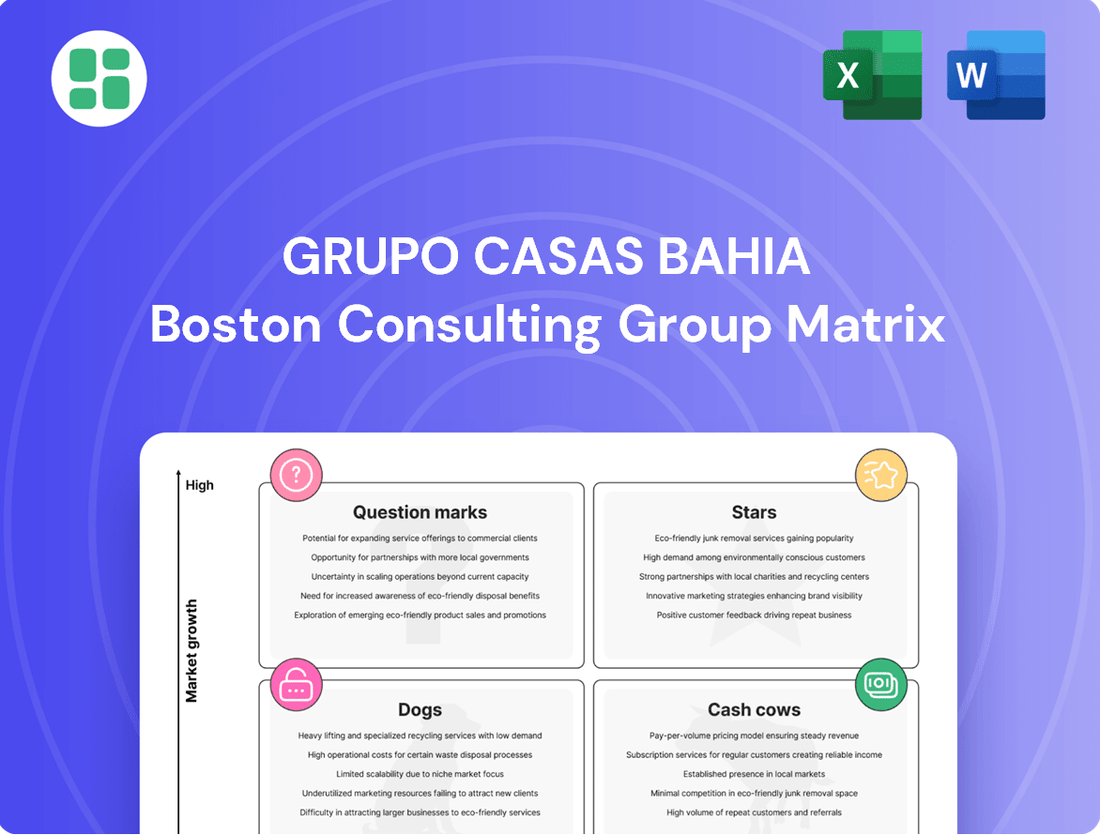

The Grupo Casas Bahia BCG Matrix analyzes its diverse business units, identifying Stars for growth and Cash Cows for stable returns.

It strategically guides investment in promising Question Marks and potential divestment of underperforming Dogs.

A clear BCG Matrix for Grupo Casas Bahia simplifies strategic decisions, acting as a pain point reliever by highlighting which business units need investment or divestment.

Cash Cows

Grupo Casas Bahia's extensive physical store network, boasting over 1,000 locations throughout Brazil, firmly anchors its position as a Cash Cow. These stores are not just points of sale but crucial pillars of brand visibility and customer engagement, consistently generating substantial revenue. In the first quarter of 2025, physical store sales saw a robust increase of 15.8%, underscoring their continued dominance and reliable cash-generating capabilities in established markets.

The sale of furniture and traditional home appliances forms a robust Cash Cow for Grupo Casas Bahia. This segment boasts a high market share, reflecting its established presence and consumer trust in Brazil. The demand for these essential household items remains consistently strong.

The white goods sector, a key component of this category, experienced significant growth, with a 17% increase reported in 2024. This upward trend underscores the enduring appeal and necessity of appliances like refrigerators and stoves, contributing to stable and predictable revenue streams for the company.

Grupo Casas Bahia's established crediário, or installment plan system, is a cornerstone of its business, acting as a powerful driver of customer loyalty and a significant competitive edge. This mature financial service has consistently been a substantial contributor to the company's consolidated gross revenue, demonstrating its enduring value even amidst a challenging Brazilian credit landscape.

In 2024, the crediário portfolio continued to be a stable income generator for Grupo Casas Bahia. While specific figures for the crediário's direct contribution to revenue are often embedded within broader financial reporting, the company’s reliance on this segment for sales financing underscores its importance. For instance, in the first quarter of 2024, Grupo Casas Bahia reported net revenue of R$6.4 billion, with credit operations playing a vital role in facilitating consumer purchases across its retail network.

Strong Brand Recognition and Loyalty

The Casas Bahia and Ponto brands are cornerstones of Grupo Casas Bahia's portfolio, demonstrating exceptional brand recognition and loyalty among Brazilian consumers. For years, these brands have consistently held 'Top of Mind' status in the furniture and electronics sectors, a testament to their deep integration into the daily lives of Brazilians.

This powerful brand equity directly fuels a consistent flow of customer traffic and encourages repeat purchases, establishing a reliable and predictable revenue stream for the group. In 2024, the company continued to leverage this strength, with its brands remaining highly visible and sought after in the competitive retail landscape.

- Brand Equity: Casas Bahia and Ponto consistently rank as 'Top of Mind' in furniture and electronics.

- Customer Loyalty: Deep consumer trust translates into sustained customer traffic and repeat business.

- Revenue Stability: Strong brand recognition provides a predictable and steady income source.

- Market Position: In 2024, these brands maintained their significant presence and consumer preference in Brazil.

Operational Efficiencies and Cost Discipline

Grupo Casas Bahia's focus on operational efficiencies and cost discipline, driven by its Transformation Plan, has been a key factor in its financial recovery. By implementing measures such as reducing administrative expenses, the company successfully improved its profitability. This strategic approach led to a positive free cash flow in late 2023 and Q4 2024, demonstrating the effectiveness of its cost-cutting initiatives.

These efficiencies directly translate into high profit margins for its established business units, reinforcing their position as Cash Cows within the BCG Matrix. The disciplined approach to managing costs ensures that these mature segments continue to generate substantial returns, providing the financial stability needed for broader company strategies.

- Reduced administrative expenses contributed to improved profitability.

- Positive free cash flow achieved in late 2023 and Q4 2024.

- High profit margins maintained from established business units.

- Transformation Plan emphasizes ongoing cost discipline.

Grupo Casas Bahia's extensive physical store network, a significant driver of its Cash Cow status, saw a robust 15.8% increase in sales in the first quarter of 2025. The company's core offerings, furniture and home appliances, particularly white goods, continue to perform strongly, with the white goods sector alone growing by 17% in 2024. This consistent demand, coupled with strong brand recognition for Casas Bahia and Ponto, solidifies these segments as reliable revenue generators.

The company's established crediário system remains a vital component, facilitating sales and fostering customer loyalty. Despite the competitive credit landscape, this financial service consistently contributes to gross revenue, as evidenced by the R$6.4 billion in net revenue reported in Q1 2024, where credit operations played a crucial role. Operational efficiencies, including reduced administrative expenses, have bolstered profitability, leading to positive free cash flow in late 2023 and Q4 2024, further cementing the Cash Cow status of these mature business units.

| Segment | 2024 Performance Indicator | Cash Cow Strength |

| Physical Stores | +15.8% Q1 2025 Sales Growth | High (Extensive Network, Brand Visibility) |

| Furniture & Appliances | +17% White Goods Growth (2024) | High (Market Share, Consumer Trust) |

| Crediário (Installment Plan) | Vital for Sales Financing, Consistent Revenue Contribution | High (Customer Loyalty, Competitive Edge) |

| Brand Equity (Casas Bahia & Ponto) | 'Top of Mind' Status, Sustained Consumer Preference | High (Repeat Business, Predictable Revenue) |

What You’re Viewing Is Included

Grupo Casas Bahia BCG Matrix

The Grupo Casas Bahia BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete strategic analysis ready for your immediate use. You can confidently assess the insights and actionable recommendations contained within, knowing the downloaded version will be precisely the same. This ensures you get exactly what you need to understand Casas Bahia's product portfolio positioning and inform your business strategy without any surprises.

Dogs

Grupo Casas Bahia has strategically closed underperforming physical store locations as part of its ongoing transformation. This move is aimed at improving overall profitability and streamlining operations. For instance, in 2023, the company reported a reduction in its physical store footprint, a key step in optimizing its retail network.

These closed locations typically exhibited characteristics such as operating in low-growth geographic areas or demonstrating consistently weak sales performance, signifying a low market share. Such units can become a significant drain on resources, impacting the company's ability to invest in more promising ventures.

In Q1 2025, Grupo Casas Bahia's direct online sales (1P) experienced a 2.1% decline. This strategic shift prioritized higher-margin items, indicating that some low-margin products previously sold directly online were not proving efficient for profitability.

These underperforming low-margin products are now categorized as 'dogs' within the company's BCG matrix. Their de-emphasis reflects a focus on optimizing the product portfolio for better financial returns, moving away from sales that did not contribute effectively to the bottom line.

Outdated inventory or product lines represent Grupo Casas Bahia's Dogs in the BCG matrix. These are items with declining consumer demand or those that have become obsolete, no longer aligning with the company's strategic focus on high-demand categories. For instance, in 2023, the Brazilian retail sector saw shifts in consumer preferences towards digital and sustainable products, potentially impacting older electronics or appliance models.

The strategy for these Dogs is to optimize inventory levels, which might involve aggressive markdowns or liquidation to free up capital. Grupo Casas Bahia's focus would then shift to a more assertive product mix, concentrating resources on categories showing stronger growth potential and customer interest, thereby improving overall profitability and operational efficiency.

Inefficient Legacy IT Infrastructure

Grupo Casas Bahia's legacy IT infrastructure presented significant hurdles, particularly before its move to Google Cloud. The sheer volume of products made data accuracy and timely item updates a constant struggle. This inefficiency, if not thoroughly addressed, positions such systems as potential 'dogs' in a BCG matrix context, characterized by low market share and low growth prospects, coupled with substantial operational costs.

The maintenance burden and lack of agility in these older systems can drain resources that could otherwise be invested in growth areas. For instance, in 2023, companies often reported that maintaining outdated IT systems consumed a significant portion of their IT budgets, sometimes upwards of 60-70%, hindering innovation.

- Legacy systems struggle with data integrity and real-time updates, impacting operational efficiency.

- High maintenance costs associated with outdated infrastructure divert capital from strategic investments.

- Inefficient IT can lead to a competitive disadvantage, especially in fast-paced retail environments.

- The potential for 'dog' classification arises from low growth and market share, amplified by operational drag.

Niche, Low-Volume Product Categories

Within Grupo Casas Bahia's product portfolio, niche categories with minimal sales volume and subdued growth prospects often fall into the 'dog' quadrant of the BCG matrix. These are typically items that lie outside the company's primary focus areas, such as consumer electronics, appliances, and furniture. For instance, by the end of 2024, the company's strategic realignment has seen a deliberate move to concentrate resources on its high-demand core offerings. This has led to certain less popular or specialized products being relegated to the marketplace channel, indicating a reduced emphasis on their direct sales performance.

The strategic decision to prioritize core product categories reflects a broader trend in retail to streamline operations and maximize returns on investment. In 2024, Grupo Casas Bahia's financial reports highlighted a significant increase in sales for its main product lines, underscoring the success of this focus. Conversely, the contribution from these niche, low-volume segments remained marginal, reinforcing their classification as dogs. This approach allows the company to allocate capital more effectively towards areas with greater potential for growth and profitability.

- Focus on Core: Grupo Casas Bahia has strategically narrowed its focus to electronics, appliances, and furniture, its strongest performing categories.

- Marketplace Shift: Non-core or low-volume items are increasingly being offered exclusively through the company's marketplace, reducing direct inventory and marketing costs.

- Limited Growth Potential: These niche categories exhibit very low sales volumes and are not expected to contribute significantly to future revenue growth.

- Capital Allocation: The company is prioritizing investment in its core products, where it sees higher returns and greater market demand, as evidenced by 2024 sales performance data.

Grupo Casas Bahia's 'dogs' represent product lines or business units with low market share and low growth prospects. These are often characterized by declining consumer demand or obsolescence, such as older inventory or niche categories outside the company's core offerings. For example, by the end of 2024, the company's strategic shift to focus on high-demand categories like electronics and appliances meant that less popular items were relegated to the marketplace channel, indicating a reduced emphasis on their direct sales performance.

The strategy for these 'dogs' involves minimizing investment and optimizing inventory, potentially through markdowns or liquidation, to free up capital. This allows Grupo Casas Bahia to reallocate resources towards its more promising core products, where it sees higher returns and greater market demand. The company's 2024 financial reports showed increased sales in its main product lines, underscoring the success of this focused approach.

Legacy IT infrastructure, if not updated, can also be classified as 'dogs' due to high maintenance costs and lack of agility, hindering innovation. In 2023, it was common for companies to spend 60-70% of their IT budgets on maintaining outdated systems, a significant drain on resources that could be invested in growth areas.

Grupo Casas Bahia's approach to these 'dogs' is to streamline operations and maximize returns by concentrating on its strongest performing categories, such as consumer electronics, appliances, and furniture. This strategic realignment, evident by the end of 2024, has led to a deliberate move to concentrate resources on its high-demand core offerings, with less popular or specialized products being offered exclusively through the company's marketplace.

| Category | Market Share | Growth Rate | Strategy |

|---|---|---|---|

| Outdated Inventory/Obsolete Products | Low | Low (Declining) | Liquidation/Markdown |

| Niche Product Lines (Non-Core) | Low | Low | Marketplace Channel/De-emphasis |

| Legacy IT Systems | Low (Operational Efficiency) | Low | Modernization/Phased Retirement |

Question Marks

Grupo Casas Bahia is actively exploring new fintech ventures and strategic partnerships to broaden its financial services and marketplace offerings. This strategic pivot targets the high-growth consumer credit sector, which saw demand recovery in 2024, but these new ventures may currently represent a small market share for the company. Significant investment is anticipated to scale these initiatives effectively.

Grupo Casas Bahia is heavily investing in AI to revolutionize customer interactions and streamline operations. This includes advanced AI for personalized, contextual recommendations, aiming to boost engagement and sales. In 2024, the company is focusing on these high-growth AI segments, recognizing their potential to significantly enhance customer experience and operational efficiency.

The integration of generative AI for product catalogs and AI-powered financial solutions represents a strategic move into promising territories. While these AI-driven tools offer substantial growth potential, their current market share impact is still emerging, necessitating ongoing investment to fully capitalize on their capabilities.

Grupo Casas Bahia's expansion into less established markets presents a significant opportunity, potentially fitting into the 'Question Marks' category of the BCG Matrix. These regions, whether new geographic areas within Brazil or untapped demographics, offer high growth potential where the company's market share is currently minimal.

For instance, while Casas Bahia has a strong foothold in major urban centers, exploring the vast interior of Brazil or specific underserved populations could unlock substantial revenue streams. This strategy requires careful market research and tailored penetration efforts to overcome potential infrastructure or logistical challenges.

In 2024, the retail sector in Brazil continued to show resilience, with e-commerce penetration reaching new heights. For a company like Casas Bahia, focusing on regions with growing disposable incomes but lower brand saturation could yield impressive market share gains, mirroring the dynamic growth observed in emerging markets globally.

Specialized High-Tech Product Offerings

Casas Bahia's specialized high-tech product offerings, like JOVI smartphones, are positioned in a dynamic, high-growth segment. These products, often targeting the medium to high-end market, require substantial investment in marketing and strategic placement to capture market share. The company's focus here aims to diversify its portfolio beyond traditional appliances and electronics, tapping into evolving consumer demand for advanced technology.

These high-tech items, including smart home devices and premium mobile technology, represent a strategic push into newer, potentially more profitable niches. For instance, in 2024, the Brazilian market for smartphones saw continued growth, with high-end devices representing a significant portion of sales value. Casas Bahia's partnerships, such as with JOVI, are crucial for building credibility and offering competitive products in this space.

- High-Tech Segment Growth: The market for smart home devices and advanced mobile technology is expanding rapidly, presenting a key opportunity for Casas Bahia.

- Strategic Partnerships: Collaborations with brands like JOVI are vital for offering competitive, high-quality smartphones in the medium to high-end segments.

- Marketing and Placement Support: Success in this category hinges on dedicated marketing campaigns and prominent in-store and online placement to attract target consumers.

- Portfolio Diversification: Expanding into specialized tech products allows Casas Bahia to reduce reliance on traditional product categories and capture new revenue streams.

Subscription-based Services and Extended Warranties

Grupo Casas Bahia's focus on subscription-based services and extended warranties represents a strategic move to bolster its offerings. The company has experienced a notable uptick in revenue derived from these services, indicating a growing customer appetite.

These services, currently integrated within broader financial solutions, possess significant potential as standalone, scalable subscription models. This pivot could unlock a high-growth avenue, especially considering the potentially low current penetration rates for these specific offerings.

Capturing a larger share of this market will necessitate targeted strategic investments. For instance, in 2023, the Brazilian retail sector saw a 5.4% increase in service revenue for electronics retailers, a trend Casas Bahia is likely aiming to capitalize on further.

- Revenue Growth: Services like insurance and extended warranties have shown increasing revenue contributions.

- Subscription Potential: Developing these into distinct subscription models could be a significant growth driver.

- Market Penetration: Current penetration for these specific services may be relatively low, offering expansion opportunities.

- Strategic Investment: Capturing market share will require focused investment in these service areas.

Grupo Casas Bahia's ventures into emerging markets and specialized high-tech products, like JOVI smartphones, can be categorized as Question Marks in the BCG Matrix. These areas exhibit high growth potential but currently hold a low market share for the company.

The company's strategic focus on expanding into less established regions within Brazil and targeting underserved demographics represents a classic Question Mark scenario. In 2024, Brazil's e-commerce growth, particularly in developing regions, offers a fertile ground for Casas Bahia to increase its market share.

Similarly, the high-tech segment, including smart home devices and premium mobile technology, is a high-growth area where Casas Bahia is investing to build its presence. For instance, the Brazilian smartphone market saw continued growth in 2024, with high-end devices contributing significantly to sales value.

These initiatives require substantial investment and careful strategic planning to convert potential into market leadership, mirroring the inherent risk and reward of Question Mark products.

| BCG Category | Grupo Casas Bahia Initiatives | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | Fintech ventures & marketplace expansion | High | Low | Requires significant investment to gain market share |

| Question Marks | AI integration for customer experience | High | Emerging | Focus on scaling to capitalize on growth |

| Question Marks | Expansion into new geographic/demographic markets | High | Low | Potential for substantial revenue, needs tailored penetration |

| Question Marks | High-tech products (e.g., JOVI smartphones) | High | Low to Moderate | Needs strong marketing and placement to compete |

| Question Marks | Subscription-based services & extended warranties | High | Low | Opportunity for scalable growth with targeted investment |

BCG Matrix Data Sources

Our BCG Matrix for Grupo Casas Bahia is built on robust financial disclosures, including sales figures and profitability metrics, alongside comprehensive market research and industry growth forecasts.