Grupo Casas Bahia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Casas Bahia Bundle

Grupo Casas Bahia operates within a dynamic Brazilian market, significantly influenced by political shifts, economic volatility, and evolving social consumer behaviors. Understanding these external forces is crucial for strategic planning and identifying potential growth avenues. Unlock a deeper understanding of these critical factors and how they shape Grupo Casas Bahia's future.

Political factors

Brazil's political landscape directly shapes the retail environment for companies like Grupo Casas Bahia. A stable government fosters consumer confidence, which is crucial for discretionary spending. For instance, the Brazilian government's focus on economic reforms and fiscal responsibility throughout 2024 aims to create a more predictable business climate.

Shifts in government policy can have a substantial effect. Changes to consumer protection regulations or tax incentives, for example, can alter operating costs and revenue streams. The government's approach to trade agreements also influences the cost of imported goods, impacting pricing strategies for retailers.

Economic policies enacted by the government are particularly impactful. In 2024, the Central Bank of Brazil's monetary policy decisions, including interest rate adjustments, directly influence credit availability for consumers, a key driver for large purchases at stores like Casas Bahia. A supportive economic policy environment can boost sales volumes.

Brazil's regulatory landscape presents significant complexities for large retailers such as Grupo Casas Bahia, particularly concerning taxes and licensing. The nation's intricate tax system, often characterized by multiple levels and frequent changes, directly impacts operational costs and pricing strategies. For instance, the average tax burden in Brazil can be substantial, influencing consumer purchasing power and the retailer's profit margins.

The ease or difficulty of obtaining and maintaining operational licenses also plays a critical role. Bureaucratic inefficiencies or delays in licensing processes can hinder expansion plans and increase the time-to-market for new stores or product lines. This can impact Grupo Casas Bahia's ability to respond swiftly to market demands and maintain its competitive edge.

Changes in regulatory frameworks, whether they lead to streamlined processes or increased bureaucratic hurdles, directly affect the overall ease of doing business. In 2024, efforts to simplify business regulations in Brazil were ongoing, aiming to reduce red tape. However, the sheer volume and complexity of existing rules mean that navigating them efficiently remains a paramount challenge for large-scale retail operations like Grupo Casas Bahia.

Brazil's trade relations significantly impact Grupo Casas Bahia, especially concerning tariffs on imported electronics and home appliances. For example, in 2023, Brazil maintained a relatively stable tariff structure for many imported goods, but potential shifts, particularly with major trading partners like China, could alter sourcing costs.

Grupo Casas Bahia's strategy of increasing partnerships with Chinese manufacturers means that any changes in import duties or trade agreements between Brazil and China could directly affect their product costs and, consequently, their pricing and consumer demand.

Anti-Corruption Measures

Brazil's ongoing commitment to anti-corruption measures, exemplified by the Lava Jato (Car Wash) operation which, as of early 2024, has led to numerous convictions and significant asset seizures, aims to create a more stable and predictable business landscape. While these efforts are designed to curb illicit practices and promote fair competition, companies like Grupo Casas Bahia may face increased compliance costs and potential temporary disruptions during periods of heightened scrutiny and regulatory adjustments.

The effectiveness of these anti-corruption initiatives directly influences investor confidence and the overall ease of doing business. For instance, Transparency International's 2023 Corruption Perception Index ranked Brazil at 104 out of 180 countries, showing a slight improvement but highlighting persistent challenges. This environment necessitates robust internal controls and ethical governance frameworks for businesses operating within the country.

- Increased Compliance Burden: Companies must invest more in legal, auditing, and compliance departments to navigate evolving regulations.

- Market Transparency: Reduced corruption can lead to a more level playing field, benefiting companies with strong ethical practices.

- Investor Confidence: Successful anti-corruption drives can attract foreign investment by signaling a commitment to rule of law.

Government Support for Retail Sector

Government initiatives aimed at stimulating retail sales, such as credit incentive programs or tax breaks for specific consumer goods, can provide a significant boost to Grupo Casas Bahia. For instance, the Brazilian government's "Desenrola Brasil" program, launched in 2023 and extended into 2024, offered debt renegotiation and incentives for low-income consumers, directly impacting the purchasing power for durable goods sold by Casas Bahia. This program saw significant participation, with millions of Brazilians renegotiating their debts, potentially freeing up funds for new purchases.

Conversely, a lack of supportive policies or the withdrawal of existing incentives could challenge the company's growth trajectory. For example, any future tightening of credit regulations or removal of consumption-boosting tax measures could dampen demand for the products Grupo Casas Bahia offers. The retail sector's reliance on consumer spending means that shifts in government fiscal policy or economic stimulus measures can have a pronounced effect on sales volumes and profitability.

The political landscape also influences consumer confidence, which is a key driver for retail purchases. Stability and predictable economic policies foster a more optimistic consumer outlook, encouraging spending on items like appliances and electronics. Conversely, political uncertainty or unexpected policy changes can lead to consumer caution, impacting sales for companies like Grupo Casas Bahia.

- Government credit incentive programs: Initiatives like Desenrola Brasil in 2023-2024 directly boosted consumer spending power.

- Tax breaks on consumer goods: Potential future government policies could reduce the cost of products, increasing demand.

- Regulatory environment: Changes in credit access or consumer protection laws can impact sales and operational costs.

- Political stability: A stable political climate generally correlates with higher consumer confidence and spending.

Government policies directly influence consumer spending power and market stability for Grupo Casas Bahia. For instance, Brazil's "Desenrola Brasil" program, active through 2024, helped millions renegotiate debts, potentially increasing disposable income for purchases. Political stability is also key; a predictable environment fosters consumer confidence, crucial for sales of durable goods. Conversely, policy shifts or political uncertainty can dampen demand.

| Political Factor | Impact on Grupo Casas Bahia | 2023-2024 Data/Trend |

|---|---|---|

| Consumer Stimulus Programs | Boosts purchasing power for credit-sensitive consumers. | Desenrola Brasil program saw significant consumer participation in debt renegotiation. |

| Political Stability | Influences consumer confidence and investment. | Brazil's political landscape showed signs of stabilization in early 2024, though vigilance remains. |

| Regulatory Changes (e.g., credit) | Affects credit availability and operational costs. | Central Bank of Brazil's monetary policy decisions continue to shape credit conditions. |

What is included in the product

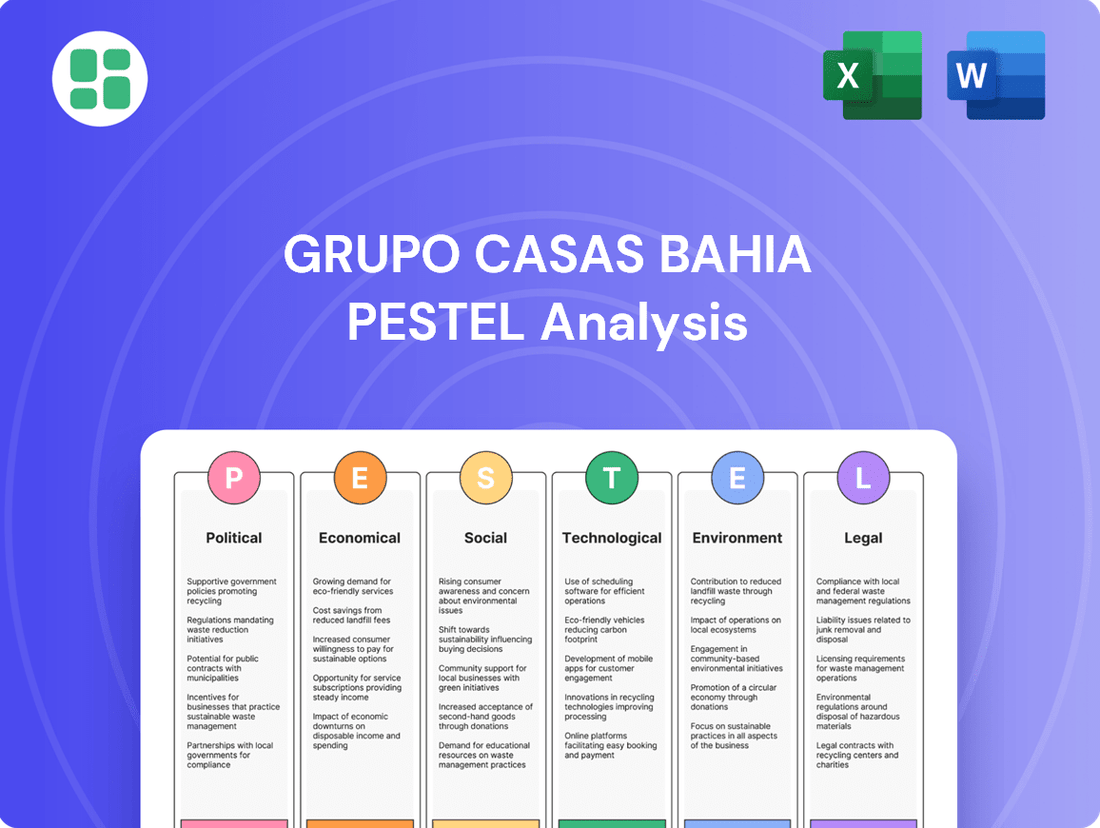

This PESTLE analysis examines the external forces impacting Grupo Casas Bahia, covering political stability, economic trends, social shifts, technological advancements, environmental concerns, and legal frameworks within its operating markets.

A concise PESTLE analysis of Grupo Casas Bahia serves as a pain point reliever by offering a clear, summarized overview of external factors impacting the business, facilitating quicker strategic decision-making and risk mitigation.

Economic factors

Brazil's persistent high inflation significantly curtails consumer purchasing power, a critical factor for Grupo Casas Bahia, as it directly impacts demand for its core products like appliances and furniture. For instance, inflation in Brazil reached 4.62% in the twelve months ending April 2024, according to the IPCA index, impacting the affordability of big-ticket items.

Furthermore, elevated interest rates, exemplified by the Selic rate, which stood at 10.50% as of May 2024, increase the cost of credit for both Casas Bahia and its customers. This makes financing purchases more expensive, potentially dampening sales and increasing the burden of the company's own debt servicing.

The economic health of Brazilian households is paramount for Grupo Casas Bahia, directly influencing their sales through disposable income and employment levels. Brazil's retail sector, particularly for furniture and appliances, has shown a notable resilience in consumer spending, even when facing economic headwinds.

For instance, in early 2024, Brazil's unemployment rate hovered around 7.8%, indicating a relatively stable labor market that supports consumer confidence. This stability, coupled with moderate inflation figures, has helped sustain household purchasing power, allowing for continued demand for durable goods that Casas Bahia specializes in.

Grupo Casas Bahia has historically leveraged its strong presence in financial services, particularly through its digital credit card and FIDC, to drive sales. This integrated approach has been a cornerstone of its business model, allowing it to reach a broad customer base.

The availability and cost of credit are critical determinants of consumer spending, especially for big-ticket items that Casas Bahia specializes in. For instance, in late 2024 and early 2025, rising interest rates in Brazil, as indicated by the Selic rate hovering around 11.75% in early 2025, could tighten credit availability and increase borrowing costs for consumers, potentially impacting demand for Casas Bahia's products.

GDP Growth and Economic Forecasts

Brazil's economic trajectory significantly influences consumer spending and the retail sector, directly impacting companies like Grupo Casas Bahia. Positive GDP growth generally translates to higher consumer confidence, encouraging more spending on durable goods and appliances, which are core to Casas Bahia's offerings.

Looking ahead, the Brazilian retail market is expected to experience robust expansion. Forecasts suggest a Compound Annual Growth Rate (CAGR) of approximately 5.40% for the period spanning 2025 to 2034. This upward trend signals a favorable environment for increased sales volumes and revenue growth for Grupo Casas Bahia.

- GDP Growth Correlation: Stronger GDP expansion in Brazil typically boosts consumer sentiment, leading to increased demand in the retail sector.

- Retail Market Forecast: The Brazilian retail market is projected to grow at a CAGR of 5.40% between 2025 and 2034, presenting a positive outlook for sales.

- Impact on Casas Bahia: This growth signifies potential for Grupo Casas Bahia to capitalize on increased consumer purchasing power and market opportunities.

- Economic Stability: Stable or growing GDP figures are crucial for the company's ability to forecast demand and manage inventory effectively.

Exchange Rate Fluctuations

Fluctuations in the Brazilian Real's exchange rate significantly affect Grupo Casas Bahia's operational costs. A weaker Real, for instance, directly increases the cost of imported electronics and components, which are crucial for the company's product offerings. This can squeeze profit margins or necessitate price increases for consumers.

For example, in early 2024, the Brazilian Real experienced volatility against the US Dollar. This trend continued into mid-2024, with the Real trading around R$5.00 to R$5.30 per US Dollar at various points. Such movements directly translate to higher landed costs for imported goods, impacting Grupo Casas Bahia's inventory valuation and pricing strategies.

- Impact on Import Costs: A depreciating Real raises the price of imported goods, affecting Grupo Casas Bahia's cost of goods sold.

- Pricing Strategy Challenges: The company must decide whether to absorb higher costs, impacting profitability, or pass them on to consumers, potentially reducing sales volume.

- Competitive Landscape: Competitors also face similar exchange rate pressures, influencing the overall market pricing and demand for electronics.

Brazil's economic performance, particularly its GDP growth and inflation rates, directly shapes consumer purchasing power for Grupo Casas Bahia. While forecasts indicate a positive CAGR of 5.40% for the Brazilian retail market from 2025 to 2034, persistent inflation, such as the 4.62% recorded in the twelve months ending April 2024, can erode affordability. Elevated interest rates, with the Selic rate around 10.50% in May 2024 and projected to be 11.75% in early 2025, also increase borrowing costs for both the company and its customers, potentially dampening sales of big-ticket items.

| Economic Indicator | Value/Projection | Impact on Grupo Casas Bahia |

|---|---|---|

| Brazilian GDP Growth | Positive trajectory expected | Increased consumer confidence and demand for durable goods |

| Inflation (IPCA) | 4.62% (12 months ending April 2024) | Reduced consumer purchasing power, impacting affordability of core products |

| Selic Rate | 10.50% (May 2024) / ~11.75% (Early 2025) | Higher credit costs for consumers and company, potentially dampening sales |

| Brazilian Real Exchange Rate | Volatile, R$5.00-R$5.30/USD (Early-Mid 2024) | Increased cost of imported goods, impacting profit margins and pricing |

| Retail Market CAGR (2025-2034) | Projected 5.40% | Favorable environment for sales volume and revenue growth |

Full Version Awaits

Grupo Casas Bahia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Casas Bahia delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of the external forces shaping Grupo Casas Bahia's business landscape. Understand the critical influences that drive market dynamics and competitive advantages.

Sociological factors

Brazil's demographic landscape is evolving, with a growing middle class and increasing urbanization presenting significant opportunities for Grupo Casas Bahia. As more Brazilians move to cities, particularly in the Centro-Oeste and Nordeste regions, the demand for household goods and financial services rises. The company is strategically targeting medium-sized cities in these areas, capitalizing on its established store presence to serve these expanding markets.

Brazilian consumers are increasingly embracing a blend of online and physical shopping, a trend Grupo Casas Bahia is actively addressing. The company's strategy to use its brick-and-mortar locations as logistical centers and to improve the overall customer experience, including options like buying online and picking up in-store, directly caters to this evolving behavior.

The growing digital and financial inclusion in Brazil is a significant sociological factor for Grupo Casas Bahia. The company's fintech, banQi, has been instrumental in bringing millions of Brazilians into the digital financial ecosystem. This expansion directly broadens the addressable market for Casas Bahia's online retail operations and its credit offerings, tapping into previously underserved populations.

As of late 2023, banQi reported over 10 million active users, demonstrating the scale of this digital and financial onboarding. This trend is crucial as it allows Grupo Casas Bahia to reach a wider demographic, including individuals who may have historically lacked access to formal banking services or online purchasing platforms, thereby increasing potential customer acquisition.

Lifestyle Changes and Product Demand

Shifting lifestyles are significantly impacting consumer spending. In Brazil, there's a noticeable trend towards prioritizing home improvement and embracing new technologies. This evolution means people are more inclined to invest in their living spaces, seeking out furniture, appliances, and electronics that enhance comfort and functionality.

Grupo Casas Bahia, with its core business in these very categories, is well-positioned to capitalize on these evolving consumer preferences. By understanding these lifestyle changes, the company can strategically adjust its product assortments and marketing campaigns to align with what consumers are actively seeking. For instance, an increased demand for smart home devices or energy-efficient appliances reflects this trend.

The Brazilian retail sector, including furniture and electronics, saw robust growth in early 2024. For example, retail sales in Brazil increased by 2.3% in the first quarter of 2024 compared to the same period in 2023, indicating a healthy consumer appetite for goods that improve daily living.

- Home Improvement Focus: Consumers are investing more in renovating and decorating their homes, driving demand for furniture and home decor.

- Technology Adoption: The uptake of smart home devices and advanced electronics continues to rise, creating opportunities for retailers specializing in these areas.

- Digital Integration: Consumers increasingly expect seamless online and offline shopping experiences, pushing companies to enhance their digital presence and omnichannel strategies.

- Value and Durability: Amidst economic considerations, consumers are often seeking durable, long-lasting products that offer good value for money, influencing purchasing decisions in the appliance and electronics sectors.

Cultural Influences and Brand Loyalty

Casas Bahia's deep roots in Brazilian culture, spanning over six decades, have fostered a powerful sense of brand loyalty. This enduring connection allows the company to resonate with a broad spectrum of consumers, from those in lower-income brackets to higher earners, across the nation's diverse regions.

The brand's historical presence is a significant asset, translating into trust and familiarity that influences purchasing decisions. For instance, in 2024, Casas Bahia continued to leverage its established reputation to attract and retain customers, even amidst evolving retail landscapes.

- Brand Recognition: Casas Bahia is consistently ranked among the most recognized brands in Brazil, a testament to its long-standing cultural integration.

- Customer Loyalty: A significant portion of its customer base exhibits repeat purchasing behavior, driven by trust and perceived value.

- Cultural Embeddedness: The brand's messaging and product offerings often reflect Brazilian cultural nuances, strengthening its appeal.

- Regional Appeal: Casas Bahia maintains a strong presence and loyalty in various Brazilian states, adapting its approach to local preferences.

Brazil's evolving demographics, marked by a growing middle class and increasing urbanization, particularly in the Centro-Oeste and Nordeste regions, directly fuel demand for Grupo Casas Bahia's core products and financial services. The company's strategic focus on medium-sized cities within these expanding areas leverages its established store network to capture this rising consumer base.

The increasing digital and financial inclusion in Brazil, significantly driven by Grupo Casas Bahia's fintech arm, banQi, is a critical sociological enabler. By onboarding millions into the digital financial ecosystem, banQi expands the addressable market for both online retail and credit offerings, reaching previously underserved populations.

As of late 2023, banQi boasted over 10 million active users, highlighting its success in broadening financial access. This trend is vital for Casas Bahia, enabling it to connect with a wider demographic, including those historically excluded from formal banking and e-commerce.

Shifting consumer lifestyles, with a greater emphasis on home improvement and technology adoption, directly benefit Grupo Casas Bahia. Brazilians are increasingly investing in their living spaces, seeking furniture, appliances, and electronics that enhance comfort and functionality, aligning perfectly with the company's product portfolio.

This trend is supported by broader economic data; for instance, Brazilian retail sales saw a 2.3% increase in Q1 2024 compared to the same period in 2023, indicating strong consumer spending on goods that improve daily living.

| Sociological Factor | Impact on Grupo Casas Bahia | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Urbanization & Middle Class Growth | Increased demand for household goods and financial services in growing urban centers. | Focus on medium-sized cities in Centro-Oeste and Nordeste regions. |

| Digital & Financial Inclusion | Expansion of customer base for online retail and credit through banQi. | banQi exceeded 10 million active users by late 2023. |

| Lifestyle Shifts (Home Improvement & Tech) | Higher consumer spending on furniture, appliances, and electronics. | Brazilian retail sales up 2.3% in Q1 2024 YoY. |

| Brand Loyalty & Cultural Integration | Sustained customer trust and repeat purchasing behavior due to long-standing presence. | Casas Bahia consistently recognized as a top Brazilian brand. |

Technological factors

Brazil's e-commerce market is booming, positioning it as a powerhouse in Latin America. This rapid expansion demands that Grupo Casas Bahia master an integrated omnichannel approach, blending online and offline experiences seamlessly.

Grupo Casas Bahia is actively bolstering its digital presence, complementing its extensive network of physical stores. Initiatives like Casas Bahia Ads and enhancements to direct online sales underscore this commitment, aiming to capture a larger share of this growing digital market.

The increasing prevalence of digital payment methods, particularly Pix, is transforming Brazilian e-commerce. Pix, launched in late 2020, has seen rapid adoption, with over 150 million users by early 2024, facilitating instant, low-cost transactions that boost online sales.

Grupo Casas Bahia leverages this trend by incorporating a variety of payment options, including Pix, and its proprietary credit solutions. Their digital carnê, a modernized installment payment plan, remains a key enabler for customers, especially those with limited access to traditional credit, driving sales volume and accessibility for a broader consumer base.

Grupo Casas Bahia leverages advanced logistics and supply chain technology to navigate Brazil's extensive territory, ensuring efficient product delivery. Their strategic deployment of mini-hubs and Click&Collect options, integrated with the ASAPALog platform, directly addresses the challenge of reaching a dispersed customer base.

These technological investments are not just about speed; they are crucial for sustainability. By optimizing delivery routes and reducing unnecessary transit, Grupo Casas Bahia is actively working to lower its environmental footprint, aiming to decrease greenhouse gas emissions. This focus on efficiency and eco-friendliness directly translates to improved customer experience and satisfaction, a key differentiator in the competitive retail landscape.

Data Analytics and Artificial Intelligence (AI)

Grupo Casas Bahia is increasingly leveraging data analytics and artificial intelligence to refine its operations and customer engagement. This technological shift is crucial for personalizing the shopping journey, streamlining product assortments, and boosting overall efficiency. For instance, in 2023, the company announced a significant partnership with Google Cloud, focusing on AI and data solutions. This collaboration is designed to deliver more relevant product recommendations and enhance the financial services offered to their customer base.

The integration of AI and advanced analytics allows Grupo Casas Bahia to gain deeper insights into consumer behavior and market trends. This data-driven approach is instrumental in optimizing inventory management and marketing campaigns. By understanding customer preferences at a granular level, the company can tailor its offerings more effectively, leading to improved sales and customer loyalty. The strategic use of these technologies is a core component of their strategy to remain competitive in the evolving retail landscape.

- Personalized Customer Experiences: AI algorithms analyze purchasing history and browsing behavior to offer tailored product suggestions, increasing engagement.

- Optimized Product Catalogs: Data analytics helps identify best-selling items and predict demand, leading to more efficient inventory management and reduced waste.

- Enhanced Operational Efficiency: AI can automate tasks, optimize logistics, and improve decision-making processes across the organization.

- Strategic Partnerships: Collaborations like the one with Google Cloud in 2023 highlight the commitment to adopting cutting-edge AI for improved financial solutions and customer recommendations.

In-Store Technology and Customer Experience

Grupo Casas Bahia is actively integrating technology into its physical stores to elevate the customer experience. This includes implementing tools like contextual search and AI-powered assistance for sales associates, aiming to make shopping more efficient and personalized. For instance, by mid-2024, the company reported a significant increase in customer engagement in stores where these technologies were piloted.

This strategic modernization of brick-and-mortar operations is crucial for their omnichannel strategy. By blending the physical and digital, Casas Bahia seeks to create a seamless journey for customers, ultimately boosting sales. Their investment in these in-store technologies is a direct response to evolving consumer expectations for interactive and convenient retail environments.

- Contextual Search: Enhances product discovery within the store, providing relevant information instantly.

- AI Assistance for Salespersons: Equips staff with data to offer more informed and personalized recommendations.

- Omnichannel Integration: Connects online and offline experiences for a unified customer journey.

- Sales Drive: Aims to increase conversion rates and average transaction value through improved in-store engagement.

Grupo Casas Bahia's technological advancements are central to its strategy, particularly in leveraging AI and data analytics. Their 2023 partnership with Google Cloud signifies a commitment to enhancing customer recommendations and financial services through AI. This focus on data-driven insights is crucial for optimizing inventory and marketing, as evidenced by their efforts to understand consumer behavior at a granular level.

The company is also modernizing its physical stores with technologies like contextual search and AI-powered sales associate tools, aiming to boost in-store engagement and sales conversions. These digital integrations are key to their omnichannel approach, ensuring a seamless customer journey across all touchpoints.

Technological adoption, including the widespread use of Pix, a digital payment method with over 150 million users by early 2024, is reshaping Brazilian e-commerce. Grupo Casas Bahia integrates these payment solutions, alongside its own credit options like the digital carnê, to broaden customer accessibility and drive sales.

Grupo Casas Bahia is actively investing in technology to enhance its logistics and supply chain, utilizing platforms like ASAPALog for efficient delivery across Brazil. This includes deploying mini-hubs and Click&Collect options to better serve a dispersed customer base, while also focusing on sustainability by optimizing delivery routes to reduce environmental impact.

Legal factors

Brazil's robust consumer protection framework, particularly the Consumer Defense Code (CDC), mandates strict rules on product warranties, return policies, and customer service. For Grupo Casas Bahia, this means ensuring all sales, from electronics to furniture, adhere to these standards to prevent hefty fines and maintain brand reputation. In 2024, consumer complaints related to product quality and faulty warranties remained a significant area of focus for regulatory bodies.

Brazilian labor laws, encompassing minimum wage, overtime, and mandatory benefits, significantly influence Grupo Casas Bahia's operational expenses and workforce strategies. For instance, the Brazilian minimum wage saw an increase to R$1,412 in January 2024, impacting payroll costs.

Adhering to these intricate regulations, which include provisions for vacation pay and 13th salary, is crucial for legal compliance and fostering positive employee relationships. The complexity of these laws necessitates robust HR departments to ensure adherence and avoid penalties.

Brazil's complex tax landscape, including potential reforms, directly impacts Grupo Casas Bahia's bottom line and strategic financial decisions. The company's ability to navigate these policies is crucial for sustained profitability.

Recent positive developments, like the successful recovery of ICMS-ST credits, have provided significant financial breathing room for Grupo Casas Bahia. This has bolstered liquidity and improved the overall financial health of the company, evidenced by the R$2.1 billion in tax credits recovered by the end of 2023.

Data Privacy Regulations (LGPD)

Brazil's Lei Geral de Proteção de Dados (LGPD) imposes stringent requirements on how personal data is handled, impacting Grupo Casas Bahia's extensive customer information and financial operations. Non-compliance can lead to significant penalties. For instance, fines can reach up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction, as stipulated by the LGPD.

Grupo Casas Bahia must invest in strong data security measures and transparent privacy policies to maintain customer trust and avoid reputational harm. The company's reliance on customer data for targeted marketing and its financial services arm make adherence to LGPD crucial. In 2023, data breaches globally led to an average cost of $4.45 million, highlighting the financial risks of inadequate data protection.

- LGPD mandates strict rules for data collection, processing, and storage.

- Grupo Casas Bahia faces potential fines up to 2% of revenue (R$50 million cap) for non-compliance.

- Robust data security and privacy compliance are essential to avoid reputational damage and financial losses.

- Global data breach costs averaged $4.45 million in 2023, underscoring the financial imperative of data protection.

Competition Law and Market Dominance

Grupo Casas Bahia, as a major player in Brazil's retail sector, must navigate a complex landscape of competition laws designed to foster fair market practices. These regulations are crucial for preventing monopolistic behavior and ensuring a level playing field for all businesses. The company's expansion strategies and collaborations are carefully scrutinized to ensure compliance with these legal frameworks, aiming to avoid any actions that could stifle competition.

The Brazilian antitrust authority, Conselho Administrativo de Defesa Econômica (CADE), actively monitors market concentration and potential anti-competitive conduct. For instance, in 2023, CADE reviewed numerous mergers and acquisitions across various sectors, underscoring the government's commitment to enforcing competition rules. Grupo Casas Bahia's operational decisions are therefore shaped by the need to adhere to these oversight mechanisms.

- Regulatory Scrutiny: Grupo Casas Bahia's market share and strategic alliances are subject to review by CADE to prevent undue market dominance.

- Compliance Measures: The company invests in legal and compliance teams to ensure all business activities align with Brazilian competition legislation.

- Market Dynamics: Adherence to competition law impacts pricing strategies, product offerings, and partnership opportunities for Grupo Casas Bahia.

Grupo Casas Bahia must navigate Brazil's evolving legal framework, including consumer protection laws like the CDC and data privacy regulations such as LGPD. The company's adherence to labor laws, which saw the minimum wage rise to R$1,412 in January 2024, directly impacts operational costs. Furthermore, the complex tax system and competition laws overseen by CADE necessitate robust compliance strategies to ensure sustained profitability and market integrity.

Environmental factors

Grupo Casas Bahia is actively integrating sustainability into its operations, with a strong emphasis on circular economy principles. This commitment is notably demonstrated through its REVIVA program, recognized as the largest recycling initiative within Brazilian retail. The program focuses on efficient package recycling and ensures responsible disposal of products, significantly reducing the company's overall environmental impact.

In 2023 alone, the REVIVA program successfully collected and recycled over 1.5 million kilograms of packaging materials, diverting them from landfills. This initiative not only supports environmental preservation but also contributes to a more resource-efficient business model for Grupo Casas Bahia, aligning with growing consumer and regulatory demands for eco-friendly practices.

Grupo Casas Bahia's environmental strategy heavily relies on its transition to renewable energy. By 2025, the company is targeting to source 90% of its energy from clean and renewable sources.

This ambitious goal is being achieved through various initiatives, including the installation of solar energy systems in its stores. Additionally, the company is actively acquiring incentivized energy from the free market, further bolstering its renewable energy portfolio.

Effective waste management and robust recycling initiatives are paramount for large-scale retail businesses like Grupo Casas Bahia. These programs not only address environmental concerns but also resonate with increasingly eco-aware consumers and stricter regulatory landscapes.

Grupo Casas Bahia's REVIVA program exemplifies its commitment to responsible waste handling. This initiative tackles waste generated from both its operational activities and the products it sells, directly responding to heightened environmental awareness and regulatory pressures. In 2023, the company reported a significant increase in the volume of materials collected and recycled through REVIVA, though specific figures for the program's impact on waste reduction are still being consolidated for the 2024 reporting period.

Supply Chain Environmental Impact

Grupo Casas Bahia's vast supply chain, particularly its logistics and transportation networks, carries a significant environmental footprint. The company recognizes this and is actively working to enhance efficiency to curb greenhouse gas emissions. For instance, in 2024, they continued to invest in expanding their network of mini-hubs, aiming to shorten delivery routes and reduce the carbon intensity per package. This strategy also involves a push towards utilizing lighter vehicles for last-mile deliveries, further contributing to emission reduction goals.

The environmental impact is directly tied to the scale of operations. In 2024, Grupo Casas Bahia managed millions of deliveries across Brazil, making logistics efficiency a critical lever for sustainability. Their efforts to optimize routes and vehicle usage are not just about cost savings but are increasingly driven by environmental responsibility. The company's commitment to reducing its carbon emissions is a key aspect of its environmental strategy, reflecting broader industry trends towards greener logistics solutions.

- Logistics Efficiency Focus: Grupo Casas Bahia is prioritizing the optimization of its supply chain to minimize environmental impact.

- Greenhouse Gas Emission Reduction: Actions like expanding mini-hubs and promoting lighter vehicle deliveries directly target a reduction in carbon emissions.

- Operational Scale: The sheer volume of deliveries handled by the company in 2024 underscores the importance of these environmental initiatives.

Climate Change Regulations and Reporting

Grupo Casas Bahia faces mounting pressure from stricter climate change regulations and growing public demand for corporate accountability. This necessitates adherence to evolving environmental standards and transparent reporting of its carbon footprint and sustainability initiatives. For instance, in 2023, Brazil's National Bank for Economic and Social Development (BNDES) announced new financing guidelines that prioritize projects with strong environmental, social, and governance (ESG) credentials, potentially impacting access to capital for companies not aligned with climate goals.

The company's proactive engagement with sustainability indices highlights its commitment to a low-carbon future. Grupo Casas Bahia's participation in B3's Corporate Sustainability Index (ISE) and the Efficient Carbon Index (ICO2) signals its dedication to reducing its environmental impact and aligning its operations with sustainable economic practices. As of the latest available data, companies within the ISE have demonstrated a tendency to outperform their peers in terms of operational efficiency and long-term value creation, suggesting a tangible benefit to such commitments.

- Regulatory Compliance: Grupo Casas Bahia must navigate and comply with an increasing number of national and international climate-related regulations.

- Transparency Demands: Stakeholders, including investors and consumers, expect clear and verifiable reporting on the company's environmental performance.

- Index Participation: Inclusion in indices like ISE and ICO2 underscores a strategic commitment to sustainability and low-carbon operations.

- Market Advantage: Adherence to climate standards can lead to improved access to capital and a stronger brand reputation in an increasingly ESG-conscious market.

Grupo Casas Bahia is actively addressing its environmental impact through ambitious sustainability goals. By 2025, the company aims to source 90% of its energy from renewable sources, a significant step towards reducing its carbon footprint.

The REVIVA program, its flagship recycling initiative, collected over 1.5 million kilograms of packaging in 2023, demonstrating a commitment to circular economy principles and responsible waste management.

Logistics efficiency is a key focus for environmental improvement, with investments in mini-hubs and lighter vehicles in 2024 to shorten delivery routes and lower emissions.

The company's participation in sustainability indices like B3's ISE and ICO2 reflects its dedication to low-carbon operations and adherence to growing ESG demands.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo Casas Bahia is meticulously crafted using data from official Brazilian government sources, including economic indicators from the IBGE and consumer price indices from the IPCA. We also incorporate insights from reputable financial news outlets and industry-specific reports to capture the dynamic Brazilian market.