Grupo Casas Bahia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Casas Bahia Bundle

Unlock the strategic blueprint behind Grupo Casas Bahia's expansive retail empire. This comprehensive Business Model Canvas details their customer-centric approach, innovative credit solutions, and robust logistics network that fuels their market dominance. Discover how they consistently deliver value and capture market share.

Dive deeper into the operational genius of Grupo Casas Bahia with their complete Business Model Canvas. This professionally crafted document breaks down their key partners, revenue streams, and cost structures, offering a clear roadmap to their success. Ideal for anyone seeking to understand and replicate their growth.

Want to see exactly how Grupo Casas Bahia thrives in the competitive Brazilian market? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for strategic planning and competitive analysis. Download it now to gain actionable insights.

Partnerships

Grupo Casas Bahia's business model is deeply intertwined with its key partnerships with financial institutions and banks, most notably Bradesco and Banco do Brasil. These collaborations are the backbone for providing essential credit solutions to customers, enabling widespread use of installment payment plans, and effectively managing the company's overall debt. For instance, in 2024, the company continued to leverage these relationships for its ongoing financial strategy.

These strategic alliances are not merely transactional; they are vital for Grupo Casas Bahia's financial health and operational liquidity. The company's ability to offer flexible payment options, a cornerstone of its retail strategy, is directly supported by the financial backing and credit facilities provided by these partners. Recent debt re-profiling efforts in 2024 underscore the critical nature of these banking relationships in navigating financial challenges and ensuring continued business operations.

Grupo Casas Bahia heavily relies on partnerships with technology and digital transformation providers. Collaborations with firms like CI&T are crucial for advancing their digital strategy, focusing on areas like AI and cloud infrastructure.

These alliances are instrumental in developing innovative solutions, such as the AI-powered virtual assistant BahIA, which aims to enhance customer interaction and support across their digital channels. Such technological integrations are key to modernizing their operations and customer engagement.

Furthermore, partnerships with cloud service providers like Google Cloud empower Grupo Casas Bahia to build robust and scalable e-commerce platforms, improve data analytics capabilities, and ultimately optimize the digital customer experience. This focus on digital enhancement is a core component of their business model for remaining competitive.

Grupo Casas Bahia's strategic relationships with suppliers and manufacturers are crucial for its operations. These partnerships ensure a steady flow of diverse products, from furniture and appliances to electronics, directly impacting the company's ability to meet customer demand. The group's ownership of the Bartira furniture factory, for example, highlights a vertically integrated approach that enhances control over quality and supply chain efficiency.

These collaborations are vital for maintaining a competitive edge. By fostering strong ties with manufacturers, Grupo Casas Bahia can negotiate favorable pricing and ensure the quality of its extensive product assortment. In 2024, the company continued to leverage these relationships to manage inventory effectively and offer a wide range of goods to its customer base across Brazil, a key factor in its retail strategy.

Logistics and Delivery Partners

Grupo Casas Bahia relies on a robust network of logistics and delivery partners to ensure efficient product distribution across its vast physical store footprint and burgeoning e-commerce channels. These collaborations are crucial for managing the complexities of reaching a wide customer base, especially in a country as geographically diverse as Brazil.

The company's strategic move to integrate its own logistics under the CB Full brand further underscores the importance of these partnerships. CB Full not only serves Grupo Casas Bahia's internal needs but also extends its services to third-party clients, demanding strong alliances for seamless last-mile delivery and optimized warehousing solutions.

- Extensive Network: Partnerships with national and regional carriers are vital for covering Brazil's diverse geography.

- CB Full Integration: Internal logistics capabilities are enhanced by external partnerships for specialized delivery and warehousing needs.

- Third-Party Services: Collaborations enable CB Full to offer competitive logistics solutions to external businesses, expanding its service reach.

- Efficiency Focus: The company continuously seeks partners that can improve delivery times and reduce operational costs, a key factor in customer satisfaction and competitive pricing.

Marketplace Sellers and Partners

Grupo Casas Bahia's marketplace thrives on its extensive network of third-party sellers. These partners are crucial, utilizing Casas Bahia's established platform and logistics infrastructure to enhance their sales reach. This symbiotic relationship allows Casas Bahia to significantly broaden its product offerings and generate substantial marketplace revenue.

The company's strategy involves empowering these sellers, providing them with the tools and reach to succeed. For instance, in 2023, the marketplace segment of Casas Bahia demonstrated strong growth, contributing significantly to the company's overall performance by offering a wider variety of goods than the company could manage on its own.

- Expanded Product Assortment: Third-party sellers dramatically increase the variety of goods available on the Casas Bahia platform, from electronics to furniture and beyond.

- Revenue Generation: Marketplace commissions and fees are a vital revenue stream, directly tied to the sales volume of these partner sellers.

- Logistics and Platform Leverage: Sellers benefit from Casas Bahia's established distribution network and customer-facing platform, reducing their operational overhead and increasing sales efficiency.

- Marketplace Growth Driver: The active participation of a diverse seller base is fundamental to the continued expansion and success of Casas Bahia's e-commerce marketplace.

Grupo Casas Bahia's financial partnerships are critical, with entities like Bradesco and Banco do Brasil providing the credit backbone for customer installment plans. These relationships are essential for managing debt and ensuring liquidity, as highlighted by ongoing debt re-profiling efforts in 2024.

Technology partnerships, such as with CI&T, are driving digital transformation, powering initiatives like the AI assistant BahIA and enhancing e-commerce platforms through cloud services like Google Cloud. These collaborations are key to modernizing customer engagement and operations.

Strong supplier and manufacturer relationships, including the internal Bartira furniture factory, ensure a diverse product flow and quality control. In 2024, these ties were crucial for effective inventory management and offering a wide product range.

Logistics partners and the integrated CB Full brand are vital for efficient distribution across Brazil. These alliances support last-mile delivery and warehousing, enabling CB Full to extend services to third parties.

The marketplace model thrives on third-party sellers who leverage Casas Bahia's platform and logistics. This expands product variety and generates revenue through commissions, with the marketplace showing strong growth in 2023.

What is included in the product

This Business Model Canvas provides a strategic overview of Grupo Casas Bahia's operations, detailing its customer segments, value propositions, and channels to serve a broad consumer base through a mix of physical stores and online platforms.

It highlights key resources like its extensive retail network and financial services, along with revenue streams derived from product sales and credit operations, all within a framework designed for investor clarity.

Grupo Casas Bahia's Business Model Canvas acts as a pain point reliever by clearly defining customer segments and value propositions, simplifying complex operations for better customer understanding.

The canvas streamlines Grupo Casas Bahia's approach to key resources and activities, offering a structured solution to operational complexities and improving efficiency.

Activities

Grupo Casas Bahia's retail sales operations are centered on selling a wide array of consumer goods, from furniture and appliances to electronics and general household items. This core activity is supported by a vast physical store network and a growing e-commerce presence, ensuring products are accessible and sales are efficiently managed across all customer touchpoints.

In 2024, the company continued to focus on optimizing its omnichannel strategy. For instance, in the first quarter of 2024, Casas Bahia reported a net revenue of R$6.3 billion, demonstrating the scale of its sales operations. This revenue was driven by efforts to integrate online and offline shopping experiences, making it easier for customers to browse, purchase, and receive goods.

Grupo Casas Bahia's key activities prominently feature the provision of financial services and credit solutions. This includes offering installment plans, known as crediário, which are vital for enabling customer purchases, especially for a broad customer base in Brazil.

The company also leverages co-branded credit cards and digital financial services through its platform, banQi. These offerings not only facilitate sales but also foster customer loyalty and act as a significant differentiator in the competitive Brazilian retail landscape.

In 2023, the financial services segment of Casas Bahia, which includes credit operations, contributed significantly to the company's overall performance, demonstrating the strategic importance of these solutions in driving sales and customer engagement. The focus on financially inclusive solutions through banQi further solidifies its competitive edge.

Grupo Casas Bahia actively manages and expands its robust e-commerce ecosystem, encompassing its own banners like Casas Bahia and Ponto, alongside the Extra.com.br platform. This critical activity focuses on optimizing online sales channels to capture a wider customer base.

A significant part of this strategy involves the seamless integration and management of its third-party marketplace (3P). This expansion allows for a broader product offering and increased sales volume, leveraging external sellers to enhance the platform's appeal.

Enhancing the user experience through advanced AI tools is paramount for driving engagement and conversion. For instance, in 2023, the company saw a substantial increase in digital sales, with its e-commerce channels contributing significantly to overall revenue, reflecting the success of these management efforts.

Logistics and Supply Chain Management

Grupo Casas Bahia's logistics and supply chain management is a cornerstone of its operations, encompassing warehousing, distribution, and the crucial last-mile delivery across Brazil's vast territory. This intricate network ensures products reach customers efficiently, a vital component for a retail giant. In 2024, the company continued to refine these processes to meet growing demand and maintain competitive delivery times.

Beyond serving its own retail needs, Grupo Casas Bahia leverages its logistical prowess through its CB Full service, offering logistics solutions to external clients. This strategic move not only generates additional revenue but also highlights the company's commitment to optimizing its extensive and robust logistics infrastructure. The company's investment in technology and fleet management plays a key role in the success of both internal and external logistics operations.

- Extensive Network: Operates a widespread distribution and delivery system covering all of Brazil.

- CB Full Service: Provides third-party logistics services, monetizing its operational capabilities.

- Efficiency Focus: Continuous investment in technology and process optimization for warehousing, distribution, and last-mile delivery.

Omnichannel Experience Development

Grupo Casas Bahia focuses on continuously enhancing its omnichannel experience, integrating physical stores as crucial logistical hubs. This strategy aims to improve the entire customer journey, seamlessly connecting online and offline touchpoints.

Leveraging advanced technology, such as artificial intelligence, is central to personalizing customer interactions and streamlining the shopping process across all channels. This commitment to an integrated experience is a key driver for customer engagement and satisfaction.

- Omnichannel Integration: Physical stores are increasingly used as fulfillment centers, supporting online orders and customer pickups, thereby reducing delivery times and costs.

- AI-Powered Personalization: AI is employed to offer tailored product recommendations and personalized promotions, enhancing the customer's shopping journey.

- Customer Journey Optimization: Efforts are concentrated on creating a frictionless experience, from initial browsing to post-purchase support, ensuring consistency across all platforms.

Grupo Casas Bahia's key activities revolve around its extensive retail operations, offering a wide range of consumer goods through both physical stores and a robust e-commerce platform. The company also provides crucial financial services, including credit and installment plans, to facilitate customer purchases and foster loyalty. Furthermore, it actively manages and expands its digital marketplace, integrating third-party sellers to broaden its product catalog and sales reach.

Logistics and supply chain management are central to ensuring efficient product delivery across Brazil, with the company also offering these services externally through its CB Full service. Continuous enhancement of the omnichannel experience, utilizing AI for personalization, is paramount to optimizing the customer journey. In the first quarter of 2024, Casas Bahia reported R$6.3 billion in net revenue, underscoring the scale of its sales activities.

| Key Activity Area | Description | 2023/2024 Data/Focus |

|---|---|---|

| Retail Sales | Selling diverse consumer goods (furniture, appliances, electronics) | Focus on omnichannel integration; R$6.3 billion net revenue in Q1 2024. |

| Financial Services | Offering credit, installment plans (crediário), and digital financial services (banQi) | Financial services segment significantly contributed to overall performance in 2023; banQi promotes financial inclusion. |

| E-commerce & Marketplace | Managing own banners (Casas Bahia, Ponto) and Extra.com.br, plus a third-party marketplace (3P) | Substantial increase in digital sales in 2023; expansion of 3P marketplace for broader offerings. |

| Logistics & Supply Chain | Warehousing, distribution, and last-mile delivery; offering CB Full service to external clients | Refinement of logistics processes in 2024 to meet demand; investment in technology and fleet management. |

Preview Before You Purchase

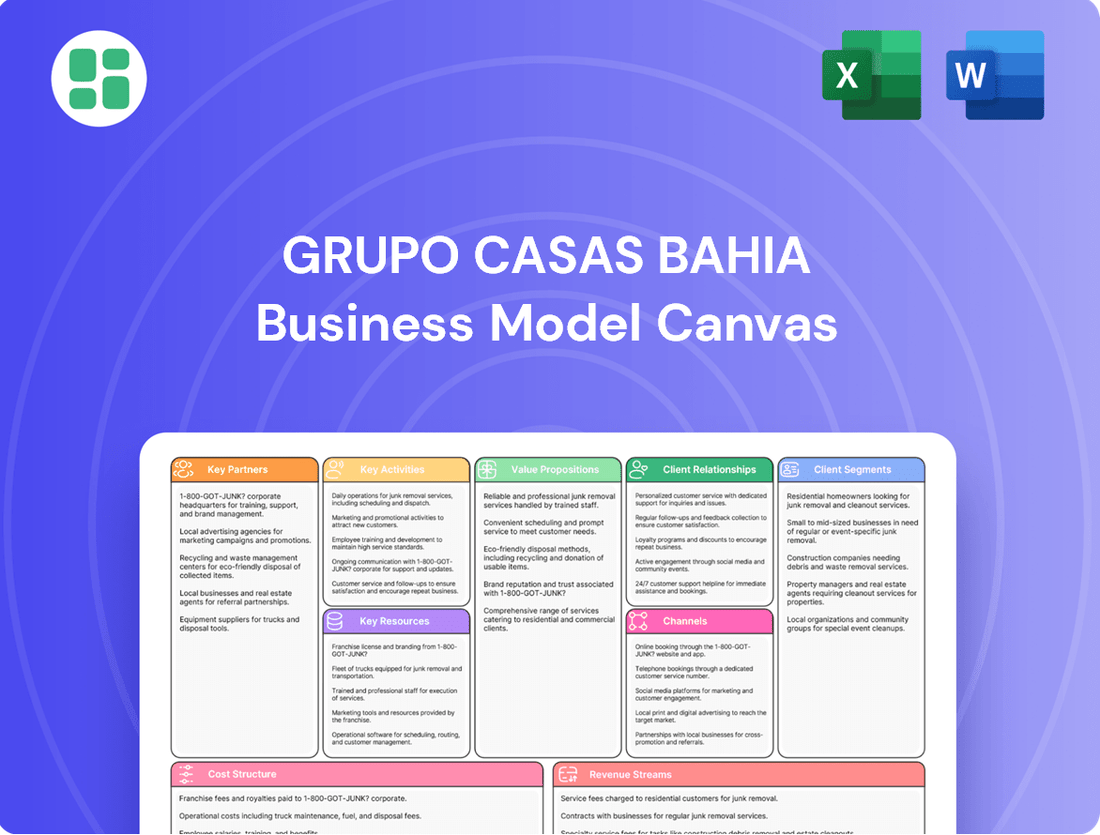

Business Model Canvas

The preview you see of the Grupo Casas Bahia Business Model Canvas is the actual document you will receive upon purchase. This means you are viewing a direct snapshot of the complete, ready-to-use file, ensuring no surprises in content or formatting. Once your order is processed, you'll gain full access to this exact same professional document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Grupo Casas Bahia leverages an extensive physical store network, boasting over 1,000 locations spread across more than 400 municipalities in Brazil. This widespread presence is a cornerstone of its business model, facilitating direct customer interaction and sales.

These physical stores are not merely sales channels; they function as vital customer service hubs, offering support and fostering brand loyalty. Furthermore, they are increasingly integrated into the company's omnichannel strategy, supporting services like Click&Collect.

Grupo Casas Bahia's robust e-commerce platforms and digital infrastructure are foundational. This includes their flagship websites, CasasBahia.com.br and Ponto.com.br, alongside the digital presence of Extra.com.br. These digital storefronts, supported by sophisticated IT systems, are essential for driving online sales and managing a vast product catalog.

The underlying technology stack, featuring SAP S/4HANA for enterprise resource planning and Google Cloud for scalable cloud services, empowers these platforms. This digital backbone facilitates seamless online transactions, efficient inventory management, and the expansion of their marketplace model, enabling a wider reach for sellers and buyers.

In 2023, Grupo Casas Bahia reported significant growth in its digital channels, with online sales representing a substantial portion of its total revenue. The company's investment in these digital resources directly correlates with its ability to serve a broad customer base across Brazil, adapting to evolving consumer shopping habits.

Grupo Casas Bahia's financial capital is a cornerstone of its operations, featuring significant cash reserves and a robust credit portfolio, often referred to as crediário. This financial muscle allows for extensive operations and strategic investments in expansion. For instance, in 2024, the company continued to leverage its financial strength to navigate market dynamics.

This substantial financial backing is crucial for managing debt obligations efficiently and, more importantly, for funding growth initiatives. It also underpins the company's ability to offer attractive financial solutions, like extended credit terms, directly to its customer base, a key differentiator in the retail sector.

Human Capital and Brand Recognition

Grupo Casas Bahia's extensive human capital, boasting approximately 40,000 employees, is a cornerstone of its operations. This vast workforce is crucial for delivering customer service and managing the extensive retail network.

The company benefits immensely from the strong brand recognition of Casas Bahia and Ponto. These brands have cultivated deep trust and loyalty among Brazilian consumers over decades, representing a significant intangible asset.

- Human Capital: Approximately 40,000 employees across various functions.

- Brand Recognition: Strong equity for Casas Bahia and Ponto, built over many years.

- Consumer Trust: Long-standing relationships fostering loyalty and repeat business.

- Market Presence: Established reputation contributing to competitive advantage.

Logistics Network and Distribution Centers

Grupo Casas Bahia's extensive logistics network is a cornerstone of its business model, ensuring efficient product flow across Brazil. This network includes 29 strategically located distribution centers and delivery hubs.

This robust infrastructure is vital for managing inventory and fulfilling orders for both its own inventory (1P) and third-party sellers (3P). The scale of this operation is significant, enabling the company to reach a broad customer base throughout the country.

In 2024, the company continued to optimize its logistics, aiming for faster delivery times and reduced operational costs. This network is crucial for maintaining customer satisfaction and supporting the company's e-commerce growth.

- 29 Distribution Centers: The backbone of Casas Bahia's supply chain, enabling widespread product availability.

- Efficient Movement of Goods: Facilitates timely storage, handling, and delivery across Brazil's diverse geography.

- Support for 1P and 3P Sales: Crucial for managing inventory and fulfilling orders from both internal stock and marketplace partners.

Grupo Casas Bahia's key resources include its vast physical store network, robust e-commerce platforms powered by sophisticated IT systems like SAP S/4HANA, and significant financial capital including cash reserves and a strong credit portfolio. The company also relies on its approximately 40,000 employees, strong brand recognition for Casas Bahia and Ponto, and an extensive logistics network with 29 distribution centers.

| Resource Category | Key Components | Significance |

| Physical Infrastructure | Over 1,000 stores across Brazil | Direct customer interaction, service hubs, omnichannel support |

| Digital Infrastructure | CasasBahia.com.br, Ponto.com.br, Extra.com.br, SAP S/4HANA, Google Cloud | Online sales, vast product catalog management, efficient transactions |

| Financial Capital | Cash reserves, crediário (credit portfolio) | Operational funding, growth initiatives, customer credit offerings |

| Human Capital | Approx. 40,000 employees | Customer service, network management |

| Brand & Reputation | Casas Bahia, Ponto brand equity, consumer trust | Customer loyalty, competitive advantage |

| Logistics Network | 29 distribution centers | Efficient product flow, inventory management, order fulfillment |

Value Propositions

Grupo Casas Bahia's value proposition centers on making credit accessible to a broad segment of the Brazilian population. Their signature 'crediário' system, a traditional installment plan, has long been a cornerstone, allowing customers to purchase appliances and furniture even without traditional bank accounts.

This commitment to accessibility is further amplified by banQi, their digital financial services platform. banQi provides a digital wallet and other financial tools, significantly boosting financial inclusion. By offering these services, Grupo Casas Bahia enables millions of Brazilians, many of whom are underserved by conventional banking, to participate more fully in the economy and acquire essential consumer goods.

Grupo Casas Bahia offers a vast selection of consumer goods, encompassing everything from furniture and major home appliances to electronics and everyday household essentials. This wide assortment ensures customers can find a broad spectrum of products to meet their needs.

Further bolstering this extensive catalog is the company's marketplace, which significantly expands the variety of goods available. This allows Grupo Casas Bahia to cater to a much wider range of consumer preferences and demands.

In 2024, the company continued to leverage this broad product strategy. For instance, its furniture segment remained a key driver, with sales in this category showing consistent demand throughout the year, reflecting the appeal of its comprehensive offering.

Grupo Casas Bahia offers customers a unified shopping journey, blending its extensive network of physical stores with a powerful e-commerce presence. This integration ensures a consistent and convenient experience, whether a customer is browsing online or visiting a brick-and-mortar location.

The company's omnichannel strategy provides significant flexibility, enabling shoppers to buy online and collect their purchases at a nearby store, a popular service known as Click&Collect. This approach caters to diverse customer preferences and enhances accessibility.

In 2023, Grupo Casas Bahia reported that its digital channels played a crucial role in its sales strategy, with a notable percentage of transactions initiated or completed online, demonstrating the success of its omnichannel investments.

Competitive Pricing and Promotions

Grupo Casas Bahia leverages competitive pricing and aggressive promotions, particularly during peak sales periods like Black Friday, to capture a significant share of the price-conscious consumer market. This strategy is crucial for driving sales volume and customer acquisition.

In 2024, the company continued its focus on accessible purchasing. For instance, Casas Bahia's promotional activities are designed to make a wide range of products, from electronics to furniture, attainable for a broader customer base. This often involves offering installment plans and discounts that appeal to consumers managing tighter budgets.

- Price Competitiveness: Grupo Casas Bahia actively monitors market prices to ensure its offerings are attractive, especially for high-demand categories.

- Promotional Events: Major sales events, such as Black Friday, are key drivers, with significant price reductions and special offers.

- Flexible Payment Options: To further enhance affordability, the company provides various payment terms, including interest-free installments, making larger purchases manageable.

- Customer Loyalty: These pricing and promotion strategies are integral to building and maintaining a loyal customer base in a competitive retail landscape.

Reliable Delivery and After-Sales Support

Grupo Casas Bahia prioritizes dependable product delivery through its extensive logistics infrastructure. This ensures customers receive their purchases promptly and efficiently. In 2023, the company continued to invest in its distribution network to enhance reach and speed.

Beyond delivery, robust after-sales support is a cornerstone of their value proposition. This includes crucial services like product installation, making the customer experience seamless. The availability of extended warranties further solidifies this commitment.

These efforts directly translate into increased customer trust and satisfaction. By consistently meeting delivery expectations and providing reliable post-purchase assistance, Grupo Casas Bahia fosters loyalty. This focus on the complete customer journey is vital for long-term success.

- Logistics Network: Extensive infrastructure for timely delivery.

- After-Sales Services: Installation and extended warranties offered.

- Customer Trust: Built through reliable delivery and support.

- Satisfaction: Enhanced by a seamless post-purchase experience.

Grupo Casas Bahia's value proposition is built on making essential consumer goods accessible through flexible credit options, notably its traditional 'crediário' installment plan. This is significantly enhanced by banQi, a digital financial platform that promotes financial inclusion for underserved Brazilians. The company offers a wide array of products, from furniture to electronics, further broadened by its marketplace, ensuring a comprehensive selection for diverse consumer needs.

The integration of physical stores and a robust e-commerce platform provides a seamless omnichannel experience, allowing for services like Click&Collect. This strategy proved effective in 2023, with digital channels contributing significantly to sales. In 2024, Casas Bahia maintained its focus on affordability through competitive pricing and promotions, particularly on furniture and electronics, making purchases attainable for budget-conscious consumers.

Reliable delivery, supported by an extensive logistics network, coupled with dependable after-sales support like installation and extended warranties, builds customer trust and satisfaction. This commitment to the entire customer journey fosters loyalty and repeat business.

| Value Proposition Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Credit Accessibility | Traditional 'crediário' and digital financial services via banQi | Continues to be a core differentiator, enabling purchases for millions. |

| Product Assortment | Wide range of consumer goods, expanded by a marketplace | Furniture sales remained strong in 2024, indicating sustained demand for their broad catalog. |

| Omnichannel Experience | Integrated physical and online stores with Click&Collect | Digital channels were crucial to sales in 2023; strategy drives convenience. |

| Price & Promotions | Competitive pricing and aggressive sales events | Key strategy in 2024 to make electronics and furniture affordable through installments and discounts. |

| Logistics & After-Sales | Dependable delivery and post-purchase support (installation, warranties) | Investment in distribution network in 2023 aimed to enhance delivery efficiency and customer satisfaction. |

Customer Relationships

Grupo Casas Bahia's customer relationships are built on a foundation of personalized credit management, with its signature 'crediário' system being central. This system allows for direct engagement with customers to tailor payment plans, fostering a sense of tailored service.

This personalized approach extends beyond just payments; it often includes financial education and support, helping customers navigate their purchases and build trust. This dedication to customer financial well-being is a key driver of long-term loyalty and repeat business.

In 2024, Casas Bahia continued to leverage its extensive physical store network to facilitate these direct customer interactions, a critical component of its credit management strategy. This hands-on approach differentiates them in a competitive retail landscape.

Grupo Casas Bahia excels at maintaining strong customer relationships through a seamlessly integrated omnichannel approach. This means customers can interact with the brand consistently across various touchpoints, whether they prefer the personal touch of a physical store or the convenience of digital channels.

The company leverages advanced digital tools to enhance this experience. For instance, their AI-powered virtual assistant, BahIA, provides instant support and information, while the 'Me chama no Zap' initiative offers humanized assistance for online sales, bridging the gap between digital efficiency and personalized service. This commitment to accessible and varied support channels is key to fostering loyalty.

Grupo Casas Bahia strengthens customer relationships by integrating loyalty programs with its expansive financial services ecosystem, notably through banQi. This digital wallet and banking service goes beyond basic transactions, fostering a deeper, more integrated relationship with Brazilian consumers.

By offering a comprehensive platform for both consumption and financial management, Grupo Casas Bahia aims to become an indispensable part of its customers' lives. This strategy is crucial for retention and increasing customer lifetime value.

Community Engagement and Social Responsibility

Grupo Casas Bahia actively cultivates strong customer relationships through its commitment to community engagement and social responsibility. Initiatives like the Casas Bahia Foundation and the REVIVA recycling program are central to this strategy.

- Casas Bahia Foundation: This foundation focuses on educational and social development projects, directly impacting communities where the company operates.

- REVIVA Recycling Program: By promoting recycling, the company not only addresses environmental concerns but also involves customers in a shared mission, fostering a sense of collective impact.

- Brand Image and Emotional Connection: These efforts build a positive brand image, creating emotional connections with customers who increasingly prioritize companies demonstrating genuine social and environmental commitments. This resonates particularly well in Brazil, where social impact is a significant factor in consumer choices.

Data-Driven Personalization

Grupo Casas Bahia is deeply invested in data-driven personalization to enhance customer relationships. By utilizing tools like Google Analytics and Retail Search, they gain insights into what customers want and how they shop. This allows for highly customized product suggestions and marketing efforts, making the entire shopping journey feel more relevant.

The company's commitment to understanding customer behavior is evident in its use of AI-powered recommendation engines. This technology helps them anticipate needs and offer products that are more likely to appeal to individual shoppers. For instance, in 2024, Casas Bahia continued to refine its algorithms to improve conversion rates through personalized offers.

- Leveraging Data Analytics: Grupo Casas Bahia employs platforms like Google Analytics to track user behavior, identify trends, and understand purchase patterns.

- AI-Powered Recommendations: The implementation of Recommendations AI enables hyper-personalized product suggestions, boosting engagement and sales.

- Tailored Marketing Campaigns: Insights from data analytics allow for the creation of specific marketing messages and promotions that resonate with different customer segments.

- Enhanced Shopping Experience: The ultimate goal is to provide a more relevant and satisfying shopping experience, fostering stronger customer loyalty.

Grupo Casas Bahia cultivates deep customer loyalty through a blend of personalized credit, omnichannel engagement, and financial inclusion via banQi. Their strategy emphasizes building trust and offering tailored support, making them a consistent presence in customers' financial lives.

In 2024, Casas Bahia continued to strengthen these bonds by leveraging data analytics for personalized recommendations and marketing, ensuring a relevant and engaging customer journey. This focus on understanding and meeting individual needs drives repeat business and customer lifetime value.

Community engagement and social responsibility initiatives further solidify these relationships, creating emotional connections and aligning with customer values. This holistic approach, from financial services to social impact, is central to their customer relationship strategy.

| Customer Relationship Aspect | Key Initiatives/Tools | 2024 Focus/Impact |

|---|---|---|

| Personalized Credit | Crediário system, tailored payment plans | Continued direct engagement, fostering trust and repeat purchases. |

| Omnichannel Experience | Physical stores, digital channels, AI virtual assistant (BahIA), ‘Me chama no Zap’ | Seamless customer journey across touchpoints, bridging digital and humanized service. |

| Financial Inclusion & Loyalty | banQi digital wallet and banking | Deeper integration into customers' financial lives, increasing retention. |

| Data-Driven Personalization | Google Analytics, Retail Search, AI recommendation engines | Enhanced shopping relevance, tailored offers, improved conversion rates. |

| Social Responsibility | Casas Bahia Foundation, REVIVA Recycling Program | Building emotional connection, positive brand image, aligning with customer values. |

Channels

The extensive physical store network, comprising over 1,000 Casas Bahia and Ponto stores throughout Brazil, remains the company's primary sales channel. These locations are vital for showcasing products, facilitating direct sales, and offering essential customer service. In 2024, these stores also played a critical role in supporting the company's e-commerce strategy by acting as convenient pickup points for online orders, enhancing the omnichannel experience.

Grupo Casas Bahia's e-commerce websites, such as casasbahia.com, pontofrio.com, and extra.com.br, are central to its digital sales strategy. These platforms showcase a vast array of products, catering to a wide customer base and enabling convenient online transactions.

In 2024, the company continued to leverage these digital channels to drive revenue, with online sales representing a significant portion of its overall performance. For instance, during the first quarter of 2024, the company reported a net revenue of R$5.8 billion, with digital channels playing a crucial role in achieving this figure.

Mobile applications serve as a crucial touchpoint for Grupo Casas Bahia, offering customers a seamless way to explore a vast product catalog, complete purchases, and manage their accounts. The banQi app, for instance, exemplifies this by facilitating credit management, a key aspect of their customer engagement strategy.

The company's commitment to enhancing these digital channels is evident in their continuous investment in app development and user experience. This focus ensures that customers can easily access personalized offers and manage their financial interactions, fostering loyalty and driving sales.

In 2024, Casas Bahia reported a significant increase in digital sales, with mobile channels playing a pivotal role. This growth underscores the effectiveness of their strategy to leverage technology for customer convenience and broader market reach.

Marketplace Platform (3P)

Grupo Casas Bahia's Marketplace Platform (3P) is a crucial component, significantly broadening its product assortment by enabling third-party sellers to list their items. This strategy capitalizes on the company's robust digital presence and extensive logistical network, allowing it to offer a far wider range of goods than its own inventory alone could support.

The marketplace model enhances customer choice and drives sales volume. By Q1 2024, Casas Bahia reported a net revenue of R$6.7 billion, with its digital channels, including the marketplace, playing an increasingly vital role in this performance. This expansion allows the company to tap into new market segments and cater to a more diverse customer base.

- Expanded Product Catalog: Access to a vast array of products from third-party sellers, far exceeding Casas Bahia's own stock.

- Leveraging Infrastructure: Utilization of existing digital platforms and logistics to onboard and serve marketplace sellers efficiently.

- Revenue Diversification: Contribution to overall revenue through commissions and fees from marketplace transactions.

- Customer Reach: Attracting a broader customer segment by offering a comprehensive one-stop shopping experience.

Direct Sales via Social Media/Messaging (e.g., 'Me chama no Zap')

Grupo Casas Bahia leverages direct sales through social media and messaging platforms, famously using the phrase 'Me chama no Zap,' which translates to 'Call me on WhatsApp.' This strategy connects customers with a vast network of sellers, offering personalized support and facilitating transactions directly. It creates a more humanized digital sales experience, blending the ease of online shopping with the crucial personal touch often missing in e-commerce.

This approach is particularly effective in the Brazilian market, where WhatsApp is a dominant communication tool. For Grupo Casas Bahia, it means:

- Direct Customer Engagement: Thousands of sellers can directly interact with potential buyers, answering questions and guiding them through the purchase process in real-time.

- Personalized Sales Experience: Customers receive tailored advice and recommendations, mimicking an in-store consultation, which can significantly boost conversion rates.

- Bridging Digital and Physical: It offers a seamless transition for customers who prefer human interaction even when shopping online, enhancing trust and convenience.

- Sales Channel Expansion: This method expands the company's reach beyond traditional retail stores and its main e-commerce platform, tapping into a highly accessible communication channel.

Grupo Casas Bahia utilizes a multi-channel approach, blending its extensive physical store network with robust digital platforms like its e-commerce websites and mobile applications. The company also actively engages customers through social media and messaging apps, notably WhatsApp, with its 'Me chama no Zap' initiative. This strategy is further amplified by its Marketplace Platform, which expands product variety through third-party sellers. In Q1 2024, the company reported R$6.7 billion in net revenue, underscoring the significant contribution of these diverse channels to its overall performance.

| Channel | Description | Key Features | 2024 Impact |

|---|---|---|---|

| Physical Stores | Over 1,000 Casas Bahia and Ponto stores | Product showcase, direct sales, customer service, online order pickup | Crucial for omnichannel experience |

| E-commerce Websites | casasbahia.com, pontofrio.com, extra.com.br | Vast product assortment, online transactions | Significant revenue driver |

| Mobile Applications | banQi app, etc. | Product exploration, purchases, account management, credit management | Enhanced customer engagement and sales |

| Marketplace Platform (3P) | Third-party seller integration | Expanded product catalog, revenue diversification | Broadened customer reach and sales volume |

| Social Media/Messaging | WhatsApp ('Me chama no Zap') | Direct customer engagement, personalized sales, real-time interaction | Humanized digital sales, increased conversion |

Customer Segments

Grupo Casas Bahia's primary customer base is comprised of lower to middle-income households throughout Brazil. These families frequently depend on readily available credit options, such as installment plans, to purchase essential consumer goods and appliances, making affordability a key purchasing driver.

The company's longstanding 'crediário,' or in-house credit system, is specifically designed to serve this demographic. This system provides a vital channel for these households to access desired products, fostering loyalty and repeat business. For instance, in 2023, Casas Bahia reported a significant portion of its sales were financed through its own credit facilities, underscoring its importance to this segment.

Grupo Casas Bahia's core customer base includes first-time buyers of home appliances and electronics, often individuals and families embarking on establishing their households. This segment is crucial for driving initial sales and building long-term customer loyalty.

Furthermore, the company actively serves financially underserved populations who might lack access to conventional banking facilities. These customers often rely on alternative financial solutions for purchases, making Casas Bahia's integrated approach particularly impactful.

Through its digital banking platform, banQi, launched in 2019, Grupo Casas Bahia directly addresses the needs of these underserved segments, offering accessible financial services and credit options. By late 2023, banQi had already surpassed 10 million customers, demonstrating significant reach within this target market.

Grupo Casas Bahia actively courts digital-savvy urban consumers who prioritize convenience and a broad online selection. These customers expect seamless integration between online browsing and in-store pickup or delivery, a key aspect of the company's digital transformation. In 2024, e-commerce continued to be a dominant channel, with platforms like Casas Bahia's website and app offering a vast array of products, from electronics to furniture, catering to the fast-paced urban lifestyle.

Small and Medium-Sized Businesses (Marketplace Sellers)

Grupo Casas Bahia also caters to small and medium-sized businesses (SMBs) through its marketplace platform and CB Full logistics services. These SMBs gain access to Casas Bahia's extensive customer network, significantly expanding their market reach.

In 2024, the company’s marketplace continued to be a vital channel for these smaller enterprises. By leveraging Casas Bahia's established brand and customer trust, SMBs can more effectively compete and grow their sales. For instance, the platform provides these businesses with the infrastructure to reach millions of consumers without the need for substantial individual investment in marketing or logistics.

- Expanded Market Access: SMBs on the Casas Bahia marketplace benefit from direct access to a vast consumer base, a key advantage for businesses looking to scale.

- Logistical Support: The CB Full service offers these businesses integrated logistics solutions, handling everything from warehousing to last-mile delivery, streamlining their operations.

- Cost-Effective Growth: Partnering with Casas Bahia allows SMBs to reduce overhead costs associated with building their own distribution and marketing channels.

Consumers Seeking Value and Flexible Payment Options

Grupo Casas Bahia's core customer base includes a wide array of consumers who are highly attuned to value and need adaptable payment solutions. This segment actively seeks products that offer the best bang for their buck, often coupled with the ability to spread costs over time. For instance, in 2023, the Brazilian retail sector saw a significant increase in consumer credit utilization, with installment plans remaining a dominant payment method, especially for durable goods, directly reflecting the needs of this segment.

The company's strategic focus on competitive pricing, alongside robust credit facilities, is precisely engineered to capture and retain these price-sensitive yet credit-dependent shoppers. This approach allows individuals to acquire essential household items and electronics without the immediate burden of a large upfront payment. Data from late 2023 indicated that a substantial portion of retail sales in Brazil, particularly in the furniture and electronics categories, were facilitated through these extended payment terms, underscoring their importance.

- Value-Conscious Shoppers: Customers prioritizing affordability and seeking the best deals on a wide range of products.

- Installment Plan Users: A significant portion of the customer base relies on extended payment options to manage their purchases.

- Credit Accessibility: The company's in-house credit and financing options are a primary draw for consumers who may have limited access to traditional banking credit.

- Essential Goods Procurement: This segment often uses Casas Bahia to purchase necessary household appliances, furniture, and electronics.

Grupo Casas Bahia's customer segments are diverse, ranging from lower to middle-income Brazilian households seeking accessible credit for essential goods, to digitally-savvy urban consumers prioritizing convenience and online selection. The company also serves financially underserved populations through its digital banking platform, banQi, and supports small and medium-sized businesses (SMBs) via its marketplace and logistics services.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Lower to Middle-Income Households | Credit-dependent, value-conscious, seeking installment plans for appliances and electronics. | Significant portion of sales financed through in-house credit; installment plans remain dominant for durable goods. |

| Digitally-Savvy Urban Consumers | Prioritize convenience, broad online selection, seamless online-to-offline experience. | E-commerce is a dominant channel; continued growth in online sales and app usage expected. |

| Financially Underserved | Limited access to traditional banking, rely on alternative financial solutions. | banQi platform surpassed 10 million customers by late 2023, demonstrating strong reach. |

| Small and Medium-sized Businesses (SMBs) | Seek expanded market access and logistical support for their products. | Marketplace provides access to millions of consumers; CB Full logistics streamlines operations for these businesses. |

Cost Structure

Grupo Casas Bahia's Cost of Goods Sold (COGS) is a major component of its expenses, directly tied to the merchandise it sells. This includes the cost of acquiring furniture, appliances, electronics, and other household items. In 2024, the company's focus on expanding its product mix and managing inventory efficiently directly impacts this cost category.

Grupo Casas Bahia's extensive physical store network, numerous distribution centers, and substantial delivery fleet contribute significantly to its logistics and distribution costs. These operational necessities involve considerable expenses in warehousing, managing inventory, and the transportation of goods throughout Brazil.

The company's commitment to reaching customers across the vast Brazilian territory means substantial investment in its large delivery fleet and the complex operations of last-mile delivery. This includes fuel, vehicle maintenance, and personnel costs, all crucial for fulfilling customer orders efficiently.

In 2023, the company reported significant investments in its logistics infrastructure, aiming to optimize delivery times and reduce operational expenses. For instance, the company has been actively working on improving its supply chain efficiency, with a focus on reducing transportation costs per unit delivered.

Selling, General, and Administrative (SG&A) expenses represent a significant portion of Grupo Casas Bahia's cost structure. These costs include the operational expenses of their extensive retail network, such as rent and utilities for stores, as well as the salaries of sales and administrative staff. In 2023, the company reported R$ 3.6 billion in SG&A expenses, highlighting the scale of these outlays.

Marketing and advertising are also key components of SG&A, crucial for driving sales and brand visibility in a competitive retail landscape. Administrative salaries and corporate overhead, covering functions like finance, human resources, and executive management, further contribute to this expense category. The company's ongoing transformation plan has placed a strong emphasis on optimizing and reducing these SG&A costs to improve overall profitability.

Financial Expenses and Debt Servicing

Financial expenses are a major cost driver for Grupo Casas Bahia, largely due to its extensive credit operations and recent debt restructuring. The company's business model relies heavily on providing financing to its customers, which incurs significant interest expenses. For instance, in the first quarter of 2024, the company reported financial expenses of R$ 890.4 million, a substantial portion of which is attributable to interest on its debt. This figure underscores the impact of Brazil's prevailing interest rate environment on its cost structure.

The costs associated with managing credit solutions, including provisions for potential defaults and the operational costs of credit administration, also contribute to this category. Given the economic climate and the company's financial position, these expenses are closely monitored. The company's efforts to re-profile its debt in late 2023 aimed to alleviate some of this pressure, but the ongoing cost of servicing its obligations remains a critical factor.

- Interest Expenses: In Q1 2024, financial expenses reached R$ 890.4 million, heavily influenced by interest payments on outstanding debt.

- Credit Solution Costs: Expenses related to managing customer credit, including potential loan losses, are a significant component.

- Debt Servicing: The cost of servicing its restructured debt obligations continues to be a material factor in the company's financial outlays.

- Impact of Interest Rates: High interest rates in Brazil directly increase the cost of borrowing and credit operations for Grupo Casas Bahia.

Technology and Digital Investment Costs

Grupo Casas Bahia’s commitment to its digital future translates into significant ongoing investments in technology. These expenditures cover the continuous development and enhancement of its e-commerce platforms, ensuring a seamless online shopping experience for customers.

The company is also channeling resources into advanced technologies like artificial intelligence to personalize customer interactions and optimize operations. Furthermore, robust cybersecurity measures and the upkeep of essential cloud infrastructure, such as Google Cloud and SAP S/4HANA, are critical components of this cost structure.

These technological outlays are not merely operational expenses but strategic imperatives. They are fundamental to maintaining Grupo Casas Bahia’s competitive edge in the evolving retail landscape and directly contribute to elevating the overall customer journey.

- E-commerce Platform Development: Continuous upgrades and feature additions to the online sales channels.

- AI and Machine Learning: Implementation for customer service, personalization, and operational efficiency.

- Cybersecurity: Investments in protecting customer data and digital assets.

- Cloud Infrastructure: Costs associated with platforms like Google Cloud and SAP S/4HANA for data management and business processes.

Grupo Casas Bahia's cost structure is heavily influenced by its extensive physical retail presence and the associated operational expenses. These include costs for store maintenance, utilities, and personnel across its vast network. The company's strategic focus in 2024 involves optimizing these costs while maintaining customer accessibility.

The cost of goods sold remains a primary expense, directly linked to the acquisition of a wide range of products like appliances and furniture. Efficient inventory management and supplier negotiations are key to controlling this significant cost driver.

Financial expenses, particularly interest on debt, represent another substantial outlay, exacerbated by Brazil's interest rate environment. In the first quarter of 2024, these expenses reached R$ 890.4 million, highlighting the impact of financing costs on profitability.

| Cost Category | Description | 2023/2024 Impact |

| Cost of Goods Sold (COGS) | Acquisition cost of merchandise. | Directly tied to sales volume and product mix. |

| Logistics & Distribution | Warehousing, transportation, fleet maintenance. | Significant due to Brazil's geography and delivery network. |

| Selling, General & Administrative (SG&A) | Store operations, salaries, marketing. | R$ 3.6 billion in 2023; ongoing optimization efforts. |

| Financial Expenses | Interest on debt, credit operations. | R$ 890.4 million in Q1 2024; sensitive to interest rates. |

| Technology Investments | E-commerce, AI, cybersecurity, cloud infrastructure. | Strategic investments for digital transformation and customer experience. |

Revenue Streams

Grupo Casas Bahia's primary revenue stream originates from the direct sale of a wide array of consumer goods. This encompasses essential items for the home, including furniture, major home appliances, and electronics, offered through its extensive network of physical retail stores and its dedicated e-commerce channels.

The company's 1P (first-party) retail model means it generates revenue from selling products directly from its own inventory. For instance, in the first quarter of 2024, Casas Bahia reported net revenue of R$5.6 billion, reflecting the significant volume of these direct sales.

Grupo Casas Bahia generates substantial revenue through its financial services and credit solutions. This includes earning interest on customer purchases made through their installment plan, known as crediário. In 2024, the company continued to leverage this core offering to drive sales and profitability.

Furthermore, fees collected from co-branded credit cards represent another key revenue stream within this segment. These cards offer customers convenience and loyalty benefits, while providing Casas Bahia with a consistent income source. The company also benefits from its digital financial solutions offered via banQi, further diversifying its revenue in this area.

Grupo Casas Bahia generates income from its marketplace by charging commissions, or take rates, on sales facilitated for third-party sellers. This strategy significantly broadens the company's product assortment without the need for direct inventory investment, thereby boosting both Gross Merchandise Volume (GMV) and overall revenue.

Logistics Services (CB Full)

Grupo Casas Bahia leverages its extensive logistics network, operating under the CB Full brand, to generate revenue by providing fulfillment, transportation, and logistics operator services to third-party businesses. This strategic move diversifies income beyond its core retail operations.

In 2024, the company aimed to capitalize on its established infrastructure. For instance, their fulfillment services handle inventory management, picking, packing, and shipping, offering a comprehensive solution for businesses looking to outsource their e-commerce operations. This segment is crucial for expanding their market reach and generating additional income streams.

The transportation services offered by CB Full include last-mile delivery, middle-mile logistics, and dedicated fleet solutions. By utilizing their own fleet and optimizing routes, they can provide cost-effective and efficient delivery options to clients. This not only generates revenue but also enhances the overall efficiency of their own retail operations.

- Fulfillment Services: Managing inventory, order processing, and shipping for external clients.

- Transportation Solutions: Offering last-mile delivery, middle-mile logistics, and fleet management.

- Logistics Operator Services: Providing end-to-end supply chain management and operational support.

Advertising and Retail Media Revenue

Grupo Casas Bahia leverages its digital presence for significant advertising and retail media revenue. This includes its proprietary 'Casas Bahia Ads' platform, developed in collaboration with Newtail. This strategic partnership allows brands to directly promote their products within Casas Bahia's extensive digital ecosystem, enhancing product visibility and driving sales for advertisers.

The company's retail media offerings are designed to create valuable touchpoints for brands seeking to reach a broad consumer base. By integrating advertising directly into the shopping journey, Casas Bahia provides a powerful channel for brand engagement and conversion.

- Advertising Revenue: Generated through the 'Casas Bahia Ads' platform, enabling brands to promote products.

- Retail Media Partnerships: Collaborations like the one with Newtail enhance the advertising capabilities.

- Increased Visibility: Brands benefit from direct access to Casas Bahia's customer base within its digital ecosystem.

- Sales Growth for Advertisers: The platform aims to drive product sales for participating brands.

Grupo Casas Bahia's revenue streams are diverse, spanning direct retail sales, financial services, marketplace commissions, logistics, and advertising. The company's core business remains the sale of consumer goods, but its expansion into other areas significantly bolsters its financial performance.

In the first quarter of 2024, Casas Bahia reported net revenue of R$5.6 billion, a testament to the volume of sales across its various channels. This figure highlights the continued strength of its traditional retail operations while underscoring the growing importance of its diversified income sources.

| Revenue Stream | Description | 2024 Relevance/Data |

| Direct Retail Sales | Sale of furniture, appliances, electronics via physical and online stores. | R$5.6 billion net revenue in Q1 2024. |

| Financial Services | Interest from installment plans (crediário) and credit card fees. | Key driver of profitability and sales. |

| Marketplace | Commissions on sales by third-party sellers. | Expands product assortment without inventory risk. |

| Logistics (CB Full) | Fulfillment, transportation, and logistics services for businesses. | Leverages existing infrastructure for additional income. |

| Advertising/Retail Media | Revenue from 'Casas Bahia Ads' platform and partnerships. | Enables brands to reach customers within the digital ecosystem. |

Business Model Canvas Data Sources

The Grupo Casas Bahia Business Model Canvas is informed by a blend of internal financial reports, extensive customer behavior analytics, and comprehensive market research on the Brazilian retail landscape. These diverse data sources ensure a robust and accurate representation of the company's strategic framework.