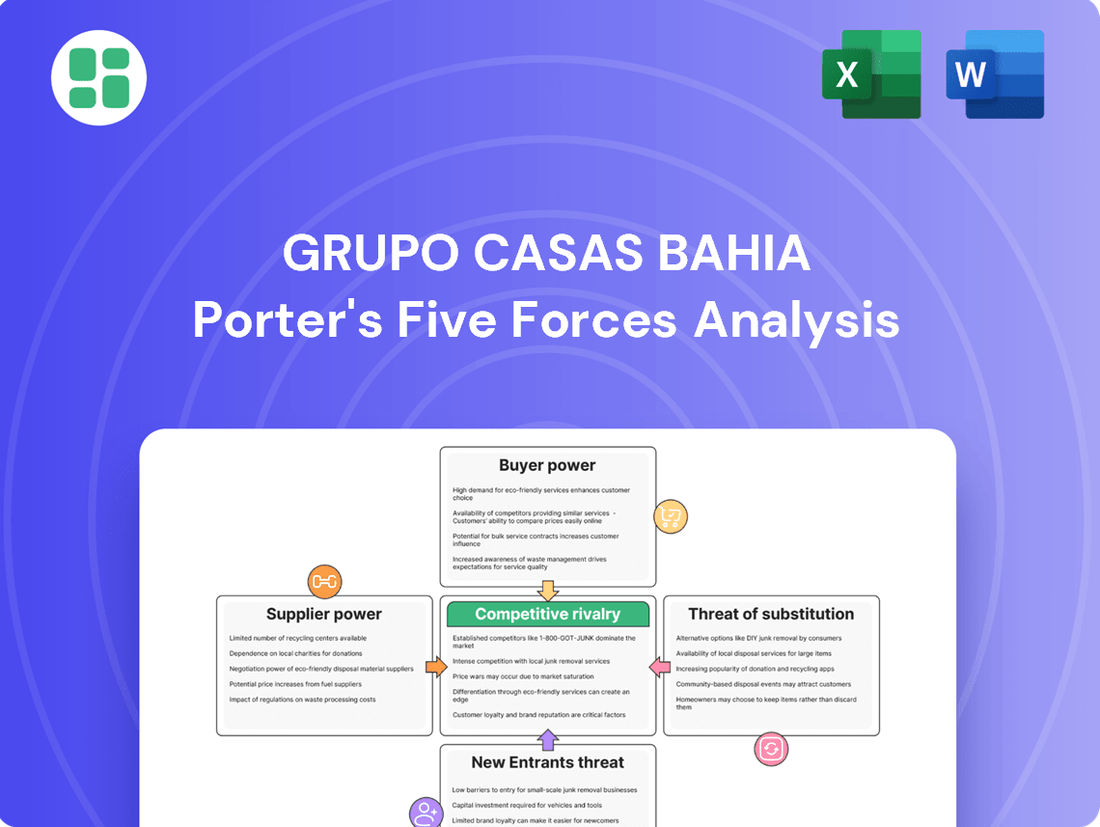

Grupo Casas Bahia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Casas Bahia Bundle

Grupo Casas Bahia navigates a retail landscape where buyer bargaining power is significant due to price sensitivity and readily available alternatives. The threat of new entrants, while moderate, is influenced by high capital requirements in physical retail. Understanding these dynamics is crucial for any player in this competitive sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Grupo Casas Bahia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Grupo Casas Bahia's bargaining power of suppliers is heavily influenced by supplier concentration in key product categories. For major electronics and appliances, where a few global brands often dominate, suppliers hold significant sway over pricing and delivery terms.

In 2023, for instance, the global semiconductor shortage, driven by concentrated production in a few regions, directly impacted the availability and cost of electronic components for retailers like Casas Bahia, highlighting the power of concentrated suppliers.

Conversely, for less specialized items such as furniture or general home goods, Casas Bahia likely benefits from a more fragmented supplier base, which dilutes individual supplier leverage and allows for more favorable negotiation on price and volume.

The ease with which Grupo Casas Bahia can shift between suppliers significantly impacts supplier bargaining power. If Casas Bahia faces high switching costs, such as those stemming from specialized product integration or lengthy contractual obligations with current suppliers, existing suppliers gain considerable leverage. For instance, if a supplier provides unique components for Casas Bahia's private label electronics, the cost and time to find and integrate an alternative supplier would be substantial, strengthening the original supplier's position.

For Grupo Casas Bahia, the uniqueness of supplier offerings significantly impacts bargaining power. When suppliers provide highly differentiated, patented, or exclusive products crucial to Casas Bahia's inventory, such as specific premium electronics or unique furniture designs, they can indeed dictate higher prices and more favorable payment terms. This is because Casas Bahia has fewer viable alternatives for sourcing these particular items.

Conversely, if the products offered by suppliers are largely commoditized and readily available from multiple sources, the bargaining power of those suppliers is considerably weakened. In 2023, the Brazilian electronics market saw intense competition, with many suppliers offering similar products, which would have limited the pricing power of many of these suppliers to Grupo Casas Bahia.

Threat of Forward Integration

The threat of forward integration by suppliers represents a significant challenge for retailers like Grupo Casas Bahia. If suppliers, particularly those offering branded electronics and appliances, choose to bypass traditional retail channels and sell directly to consumers, their bargaining power naturally increases. This shift can directly impact Casas Bahia's sales volume and pricing strategies.

In 2024, the trend of brands strengthening their direct-to-consumer (DTC) operations continued across various sectors. For instance, major electronics manufacturers have been investing heavily in their online platforms, aiming to capture a larger share of the profit margin previously enjoyed by retailers. This strategy allows them to control the customer experience more directly and gather valuable consumer data.

- Increased Supplier Leverage: Suppliers moving to DTC models can dictate terms more forcefully, potentially reducing margins for retailers.

- Channel Conflict: Casas Bahia may face competition from its own suppliers, impacting sales and inventory management.

- Strategic Response Needed: Retailers must adapt by enhancing their value proposition, focusing on services, and leveraging omnichannel strategies to remain competitive against direct supplier sales.

Importance of Casas Bahia to Suppliers

The bargaining power of suppliers to Grupo Casas Bahia is significantly shaped by the retailer's sheer scale and its role as a crucial distribution channel. For many suppliers, particularly smaller or emerging brands, Casas Bahia’s vast customer reach offers unparalleled market access, thereby diminishing their individual leverage.

Casas Bahia's substantial purchase volumes can grant it considerable clout in negotiations, potentially leading to more favorable terms. However, this power dynamic can shift depending on the supplier's market position. For instance, while Casas Bahia might be a key partner for a niche brand, it could represent just one of many significant clients for a dominant global electronics manufacturer, thus tempering the supplier's overall bargaining strength.

In 2023, Grupo Casas Bahia reported net revenue of R$28,255.7 million, highlighting its substantial purchasing power. This volume means suppliers often rely on Casas Bahia for a significant portion of their sales, making them more amenable to the retailer's terms.

- Market Access: Casas Bahia's extensive network provides crucial market access for suppliers, especially smaller brands.

- Purchase Volume: The large volume of purchases made by Grupo Casas Bahia influences supplier terms.

- Supplier Dependence: Supplier reliance on Casas Bahia for sales can reduce their individual bargaining power.

- Brand Dominance: Global brands may have less leverage if Casas Bahia is just one of many large clients.

The bargaining power of suppliers for Grupo Casas Bahia is a complex interplay of market dynamics and strategic relationships. While Casas Bahia's scale offers significant leverage, the concentration and differentiation of certain suppliers can shift this power. The increasing trend of brands pursuing direct-to-consumer (DTC) strategies in 2024, particularly in electronics, presents a notable challenge, potentially increasing supplier leverage and creating channel conflict.

| Factor | Impact on Supplier Bargaining Power | Example/Data (2023-2024) |

|---|---|---|

| Supplier Concentration | High for dominant brands/components | Semiconductor shortages in 2023 impacted electronics costs due to concentrated production. |

| Product Differentiation | High for unique/patented items | Premium electronics or exclusive furniture designs allow suppliers to command higher prices. |

| Switching Costs | High for specialized/integrated products | Private label electronics requiring unique components increase supplier leverage. |

| Threat of Forward Integration (DTC) | Increasing, especially in electronics | Brands investing in DTC in 2024 aim to capture retail margins, increasing supplier power. |

| Casas Bahia's Scale & Purchase Volume | Reduces supplier power for smaller brands | R$28,255.7 million net revenue (2023) signifies substantial buying power. |

What is included in the product

This Porter's Five Forces analysis for Grupo Casas Bahia dissects the competitive intensity within the Brazilian retail sector, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing players.

Effortlessly identify and address competitive threats by visualizing the intensity of each Porter's Five Forces on Grupo Casas Bahia's market landscape.

Customers Bargaining Power

Customers of Grupo Casas Bahia, especially for common electronics and appliances, are very aware of prices. With so much information available online, they can easily check prices across different stores. This makes it harder for Casas Bahia to set high prices because customers can quickly find better deals elsewhere, putting more pressure on them to compete on price.

For consumers, the cost and effort involved in switching between different retailers for similar products are generally low. This means customers can easily move to a competitor if they find better prices or service. In 2024, the Brazilian retail sector saw continued intense price competition, with many online and brick-and-mortar stores offering promotions, further reducing the perceived cost of switching for consumers.

The bargaining power of customers for Grupo Casas Bahia is significantly influenced by the wide availability of substitutes and alternatives. Customers have numerous choices, ranging from large retail chains and specialized electronics stores to a vast array of online marketplaces. This extensive competitive landscape means consumers are not tied to a single provider, granting them considerable leverage to negotiate for better prices and superior service. For instance, in 2024, the Brazilian retail sector saw intense competition, with online sales reaching an estimated R$1.1 trillion, according to Ebit|Nielsen, highlighting the pressure on retailers like Casas Bahia to remain competitive.

Customer Volume and Purchase Frequency

While the individual purchase size from most customers of Grupo Casas Bahia might not be large enough to wield significant individual bargaining power, the sheer volume of transactions across its vast customer base is a different story. This collective demand represents a considerable force that can influence the company’s sales performance. For instance, in 2024, the company continued to leverage its extensive network of physical stores and online presence to reach millions of consumers across Brazil, underscoring the importance of aggregate customer volume.

The fragmented nature of these individual consumer purchases means that no single customer can typically dictate terms or demand preferential treatment. However, a significant shift in aggregate demand, perhaps driven by changing consumer preferences or economic conditions, can have a noticeable impact on Grupo Casas Bahia’s overall sales figures. This highlights the indirect power held by the collective customer base through their purchasing decisions.

Grupo Casas Bahia actively works to mitigate potential customer power, particularly through its robust credit solutions. By offering accessible financing options, the company aims to foster customer loyalty and encourage repeat purchases, thereby strengthening its relationship with its broad customer base and reducing the likelihood of customers seeking alternatives based solely on price or terms.

- Customer Volume: Millions of transactions annually across Brazil.

- Individual Power: Limited for single customers due to small purchase sizes.

- Collective Impact: Aggregate demand shifts can significantly affect sales.

- Retention Strategy: Credit solutions are key to maintaining customer relationships.

Impact of Financial Services and Credit

Grupo Casas Bahia's financial services, such as its credit offerings, significantly impact customer bargaining power. By providing accessible credit, the company encourages purchases and fosters customer loyalty, potentially reducing their inclination to switch for small price variations.

However, customers retain the ability to compare credit terms across different providers, making them sensitive to prevailing credit market conditions and interest rates. For instance, in 2024, Brazil's central bank maintained its benchmark interest rate, the Selic, at 10.50% for a significant portion of the year, influencing the cost of credit available to consumers and thus their bargaining leverage.

- Customer Loyalty via Financial Services: Casas Bahia's credit programs can lock in customers, making them less sensitive to competitor pricing.

- Sensitivity to Credit Market Conditions: Broader economic factors affecting interest rates directly influence how much power customers have when seeking financing.

- Price Comparison for Credit: Despite in-house financing, customers can still seek better terms elsewhere, maintaining a degree of bargaining power.

Customers of Grupo Casas Bahia possess substantial bargaining power due to widespread price transparency and low switching costs in the Brazilian retail market. The availability of numerous substitutes across online and physical stores means consumers can easily find competitive offers, pressuring Casas Bahia on pricing. While individual customer purchase volumes are typically small, the aggregate demand of millions of transactions creates significant collective influence on the company’s sales performance.

| Factor | Impact on Casas Bahia | 2024 Context |

| Price Sensitivity | High, due to easy online price comparison. | Intense price competition across Brazilian retail. |

| Switching Costs | Low for consumers seeking similar products. | Promotions by competitors reduce perceived switching costs. |

| Availability of Substitutes | Extensive, from large retailers to online marketplaces. | Online sales in Brazil reached R$1.1 trillion in 2024. |

| Aggregate Customer Volume | Millions of transactions provide indirect leverage. | Casas Bahia's broad reach underscores the importance of collective demand. |

Preview Before You Purchase

Grupo Casas Bahia Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis of Grupo Casas Bahia, detailing the competitive landscape and strategic implications for the company's market position. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the retail sector.

Rivalry Among Competitors

The Brazilian retail sector is a crowded arena, with Grupo Casas Bahia facing formidable rivals. Major players like Magazine Luiza and Lojas Americanas command significant market share, while global e-commerce titan Amazon continues to expand its footprint.

This intense competition isn't limited to large chains; a vast number of smaller, specialized retailers also vie for consumer attention across both physical stores and online platforms. For instance, in 2023, the Brazilian e-commerce market alone saw a substantial growth of 10.5%, reaching R$185.7 billion, underscoring the dynamic and competitive nature of the online space.

This diverse competitive environment forces Grupo Casas Bahia to constantly innovate in pricing, customer service, and product offerings to maintain its market position.

The Brazilian retail sector, while showing resilience, operates within a mature market, especially for established categories like furniture and appliances. This maturity means growth often comes from taking share from competitors, rather than simply expanding the overall pie. For instance, in 2023, the Brazilian retail sector saw a modest expansion, but the intense competition for consumer wallets remained a defining characteristic.

When growth slows, as it can during periods of economic uncertainty in Brazil, the competitive rivalry among players like Grupo Casas Bahia intensifies. Companies are forced to fight harder for every sale. Economic fluctuations directly influence consumer purchasing power, making market share gains a critical metric for survival and success in this environment.

Grupo Casas Bahia faces intense competition in product and service differentiation, as major retailers often offer similar merchandise. Its key differentiators include a vast physical store presence, strong brand loyalty within lower-income demographics, and its established financial services and credit offerings.

However, rivals are actively enhancing their e-commerce capabilities, logistics networks, and developing their own credit products, which steadily erodes these differentiation advantages. For instance, in 2023, the Brazilian retail sector saw significant investment in digital transformation, with major players like Magazine Luiza and Americanas also expanding their credit arms to capture a larger share of the market.

High Fixed Costs and Exit Barriers

The retail sector, particularly for businesses like Grupo Casas Bahia that rely on a vast network of physical stores and complex logistics, carries inherently high fixed costs. These expenses, encompassing everything from maintaining store locations and distribution centers to managing substantial inventory, create significant hurdles for any company looking to exit the market. For instance, in 2023, the Brazilian retail sector faced ongoing challenges with operational costs, with companies needing to manage expenses related to their physical footprint to remain competitive.

These substantial fixed costs act as powerful exit barriers, meaning companies are strongly incentivized to remain in the market and compete vigorously, even when facing economic headwinds. The imperative to cover these ongoing expenses often leads to intense competition for market share among existing players. This dynamic can result in price wars or aggressive promotional activities as companies strive to maintain sales volume and profitability.

- High Fixed Costs: Retailers with extensive physical store networks and logistics operations, such as Grupo Casas Bahia, incur substantial fixed costs.

- Exit Barriers: These high fixed costs make exiting the market financially punitive, trapping companies within the industry.

- Intensified Rivalry: The presence of high exit barriers encourages incumbent firms to fiercely defend their market share, leading to heightened competitive rivalry.

- Impact on Strategy: Companies may prioritize maintaining sales volume over short-term profitability to cover fixed costs, influencing strategic decisions.

Strategic Stakes and Market Leadership

For major players in Brazil's retail landscape, securing market share and leadership isn't just about sales; it's deeply tied to brand perception and investor confidence. Companies like Magazine Luiza and Via (owner of Casas Bahia) understand this, often pouring resources into aggressive marketing campaigns and price adjustments to capture and hold onto their positions. This intense focus on market dominance naturally escalates the competitive rivalry.

The strategic importance of market leadership in Brazilian retail is evident in the substantial investments made. For instance, in 2023, Via reported significant investments in its digital transformation and omnichannel strategy, aiming to bolster its competitive standing against rivals. This willingness to invest heavily, whether in technology, pricing, or brand building, underscores the high stakes involved.

- Market Share Battles: Retailers frequently engage in price wars and promotional activities to attract and retain customers, directly impacting profitability.

- Brand Perception: Leading positions enhance brand visibility and trust, influencing consumer purchasing decisions.

- Economies of Scale: Larger market share often translates to better negotiation power with suppliers and operational efficiencies.

- Investor Confidence: Strong market positions are viewed favorably by investors, potentially leading to higher valuations and easier access to capital.

Grupo Casas Bahia operates in a highly competitive Brazilian retail market, facing pressure from large, established players like Magazine Luiza and Americanas, as well as the growing presence of Amazon. This intense rivalry is further fueled by a fragmented landscape of smaller, specialized retailers, all vying for consumer attention in both physical and online channels.

The Brazilian retail sector, particularly in mature categories, sees growth primarily through market share gains, intensifying competition. For example, in 2023, while the overall retail sector expanded, the fight for consumer spending remained fierce, with companies like Via (Casas Bahia's parent company) investing heavily in digital and omnichannel strategies to stay ahead.

High fixed costs associated with extensive physical networks and logistics create significant exit barriers, compelling companies to compete aggressively to cover expenses. This dynamic often leads to price adjustments and promotional activities as firms strive to maintain sales volume, as seen with Via's ongoing efforts to optimize its operational footprint and competitive pricing.

Market share leadership is a critical strategic objective, driving substantial investments in marketing and technology. In 2023, Via's focus on digital transformation and enhancing its credit offerings aimed to strengthen its competitive position against rivals who are similarly investing to capture market dominance.

| Competitor | 2023 Market Share (Estimated) | Key Strategies |

| Magazine Luiza | Significant portion of electronics and furniture market | Omnichannel expansion, financial services (MagaluPay), private label brands |

| Lojas Americanas | Broad retail presence, including non-food items | Extensive store network, online marketplace, loyalty programs |

| Amazon Brazil | Rapidly growing e-commerce share | Logistics investment, wide product selection, Prime membership benefits |

| Via (Casas Bahia, Ponto) | Strong in home appliances and furniture | Digital transformation, credit offerings, omnichannel integration |

SSubstitutes Threaten

The burgeoning online marketplaces and local initiatives for pre-owned furniture, electronics, and appliances pose a substantial threat of substitutes for retailers like Casas Bahia. Consumers increasingly prioritize cost savings and sustainability, leading them to second-hand options over new goods.

This trend is amplified by the growth of re-commerce platforms, making it easier for individuals to buy and sell used items. For instance, in 2023, the global second-hand apparel market alone was valued at approximately $177 billion, demonstrating the significant consumer shift towards pre-owned goods across various categories.

The threat of substitutes for Grupo Casas Bahia's offerings, particularly in furniture and appliances, is heightened by the availability and affordability of repair and maintenance services. Consumers, especially for more expensive items, may opt to fix rather than replace. For instance, a 2024 report indicated that appliance repair costs can be up to 50% less than purchasing a new unit, making repairs an attractive alternative.

This inclination towards repair is further fueled by a growing consumer consciousness regarding sustainability and the desire to prolong the life of products. This trend directly impacts the demand for new sales, as extended product lifespans reduce the frequency of replacement purchases for households.

Emerging rental and leasing models for appliances and electronics present a growing substitute threat to Grupo Casas Bahia's traditional retail sales. These models allow consumers to access goods without the significant upfront investment, which can be particularly attractive to price-sensitive demographics or those with short-term needs.

For instance, in 2024, the subscription economy continued its expansion, with an increasing number of consumers opting for service-based access over outright ownership for various goods. While specific data for Casas Bahia's product categories isn't readily available, the broader trend indicates a potential shift in consumer spending away from traditional purchases towards these flexible, recurring payment options.

Do-It-Yourself (DIY) Solutions and Upcycling

The rise of do-it-yourself (DIY) solutions and upcycling presents a growing threat to traditional retailers like Grupo Casas Bahia, particularly in furniture and home decor. Consumers are increasingly opting to create or refurbish items themselves, bypassing the need to purchase new goods. This trend is fueled by a desire for personalization, cost savings, and sustainability.

For instance, in 2024, the global DIY market continued its upward trajectory, with many consumers actively seeking tutorials and materials for home improvement and furniture customization projects. This shift means that instead of buying a new sofa or table from a retailer, individuals might choose to reupholster an existing piece or build furniture from scratch using readily available plans and materials. This directly siphons demand away from new product sales.

- DIY Market Growth: The global DIY market was valued at approximately USD 115 billion in 2023 and is projected to grow, indicating a sustained consumer interest in hands-on projects.

- Upcycling Trend: Social media platforms and online communities dedicated to upcycling have seen significant engagement, showcasing creative transformations of old furniture, which can reduce the perceived need for new purchases.

- Cost and Customization Appeal: Consumers often find DIY and upcycling to be more cost-effective than buying new, while also allowing for unique customization that mass-produced items may not offer.

Changing Consumer Lifestyles and Preferences

Shifting consumer lifestyles, like the growing trend towards minimalism and prioritizing experiences over material goods, can present a threat by reducing overall demand for certain product categories. For instance, if consumers increasingly favor smaller living spaces or opt for shared services, the need for traditional home furnishings and appliances, core offerings for Grupo Casas Bahia, could diminish.

This indirect substitution can be seen in the rise of the sharing economy. In 2024, the global sharing economy was projected to reach over $335 billion, indicating a significant shift in how consumers access goods and services, potentially bypassing traditional retail channels for items like furniture or appliances.

- Minimalism Trend: A growing segment of consumers is actively reducing possessions, impacting demand for durable goods.

- Experience Economy: Spending on travel, entertainment, and personal development is increasing, diverting funds from physical product purchases.

- Shared Services: The uptake of co-living, co-working, and rental services for household items offers alternatives to outright ownership.

- Digitalization: Increased reliance on digital services and remote work may reduce the need for certain home-related purchases like office furniture or large entertainment systems.

The threat of substitutes for Grupo Casas Bahia is significant, driven by the growing popularity of pre-owned goods, repair services, and rental models. Consumers are increasingly seeking cost-effective and sustainable alternatives to purchasing new furniture, electronics, and appliances.

The expansion of online marketplaces and the DIY movement further empower consumers to find or create their own solutions, directly impacting traditional retail sales. For instance, the global second-hand market's robust growth, exceeding $177 billion in 2023, highlights this shift.

Furthermore, the appeal of repairing existing items, with costs potentially 50% lower than new purchases as of 2024, and the rise of subscription-based access models in 2024, demonstrate a clear trend away from outright ownership, posing a considerable challenge to Casas Bahia's business model.

| Substitute Category | Key Drivers | Impact on Casas Bahia |

|---|---|---|

| Pre-owned Goods | Cost savings, sustainability, accessibility via online platforms | Reduced demand for new appliances and furniture |

| Repair Services | Lower cost than replacement, extended product lifespan | Decreased sales of new appliances and electronics |

| Rental/Leasing Models | Lower upfront cost, flexibility, access over ownership | Potential shift in consumer preference from purchase to subscription |

| DIY & Upcycling | Personalization, cost-effectiveness, sustainability | Siphons demand for new furniture and home decor items |

Entrants Threaten

Entering Brazil's large-scale retail market, particularly for a company with a significant physical footprint like Grupo Casas Bahia, requires immense capital. Think about setting up a widespread network of stores, developing a sophisticated logistics system, and stocking up on a vast amount of inventory. These initial costs alone can be a major hurdle for newcomers.

Beyond just physical stores and stock, the need for substantial working capital to support customer credit operations, a common practice in Brazilian retail, further elevates the entry barrier. For instance, in 2023, the Brazilian retail sector saw significant investment in digital transformation and logistics, with companies like Magazine Luiza investing heavily in their e-commerce infrastructure and delivery networks, demonstrating the scale of capital required to compete effectively.

Existing players in the Brazilian retail market, such as Grupo Casas Bahia, leverage substantial economies of scale. This advantage is particularly evident in their purchasing power, where large order volumes secure more favorable terms from suppliers compared to smaller, new entrants. For instance, in 2023, Grupo Casas Bahia reported net revenue of R$28.1 billion, indicating the sheer scale of their operations and their ability to negotiate aggressively.

Furthermore, these established players benefit from significantly lower per-unit marketing and distribution costs. Their extensive advertising campaigns and optimized logistics networks, built over years, are spread across a much larger sales base. This cost efficiency makes it challenging for newcomers to compete on price, as they would need to achieve similar volumes to achieve comparable cost structures.

Grupo Casas Bahia has cultivated decades of strong brand recognition and deep customer loyalty, especially within its core demographic, significantly aided by its accessible credit offerings. For instance, in 2023, the company reported a substantial customer base, demonstrating the effectiveness of its long-standing relationship-building strategies.

New entrants would need to invest heavily in marketing and dedicate considerable time to replicate this level of trust and customer attachment, making it a formidable barrier to entry in the competitive retail landscape.

Access to Distribution Channels and Prime Locations

New companies entering the Brazilian retail market face significant obstacles in securing prime retail locations, especially in densely populated urban areas. Many of the most desirable and high-traffic spots are already occupied by established competitors, making it difficult and costly for newcomers to gain a foothold. For example, in São Paulo, a prime retail space can command rental prices that are prohibitively high for a nascent business.

Furthermore, establishing an efficient and extensive nationwide logistics and distribution network presents a formidable challenge. Building this infrastructure from the ground up requires substantial capital investment and considerable time, often proving too complex and expensive for new entrants to overcome. In 2023, the cost of logistics in Brazil represented a significant percentage of retail sales, underscoring the financial burden of distribution.

- Limited access to prime retail real estate in major Brazilian cities.

- High costs associated with securing and maintaining desirable store locations.

- Significant investment required to build a comprehensive nationwide logistics network.

- Established players already control much of the efficient distribution infrastructure.

Regulatory and Bureaucratic Hurdles

Operating a large retail business in Brazil, like Grupo Casas Bahia, means dealing with intricate regulations, a complex tax system, and demanding labor laws. These can be significant roadblocks for new companies trying to enter the market, especially if they lack experience with Brazil's specific legal landscape.

Established players, such as Grupo Casas Bahia, have already made substantial investments in ensuring compliance and have cultivated crucial relationships within the regulatory bodies. This existing infrastructure and network provide a distinct advantage over potential newcomers who would need to build these from scratch.

- Regulatory Complexity: Brazil's tax code is notoriously complex, with multiple federal, state, and municipal taxes that can significantly impact profitability. For instance, in 2023, Brazil's tax burden was estimated to be around 33% of GDP, a figure that can be daunting for new entrants to manage effectively.

- Labor Laws: Brazil's labor laws are comprehensive and can lead to high operational costs due to mandatory benefits and employee protections. Navigating these laws requires specialized legal and HR expertise, which new entrants may not possess initially.

- Compliance Costs: Ensuring full compliance with all regulations requires significant upfront investment in legal counsel, accounting, and administrative staff. Established companies have amortized these costs over time, while new entrants face them as immediate expenses.

- Bureaucratic Processes: Obtaining licenses, permits, and approvals can be a lengthy and bureaucratic process in Brazil. This can delay market entry and tie up capital, creating a barrier that favors existing, well-connected businesses.

The threat of new entrants for Grupo Casas Bahia is moderate. The sheer capital required for physical store networks, logistics, and inventory in Brazil presents a significant hurdle. For example, in 2023, the retail sector saw substantial investments in infrastructure, highlighting the scale of entry costs. Furthermore, established players benefit from economies of scale in purchasing and lower per-unit marketing costs, making it difficult for newcomers to compete on price.

Brand loyalty and customer trust, cultivated over years by companies like Grupo Casas Bahia through accessible credit, are also substantial barriers. Replicating this level of customer attachment requires considerable time and marketing investment. Additionally, securing prime retail locations and building a nationwide logistics network are costly and complex endeavors, often already managed efficiently by incumbents.

Brazil's complex regulatory and tax environment, along with stringent labor laws, adds another layer of difficulty for new entrants. Navigating these requires specialized expertise and significant compliance investment, favoring established companies that have already integrated these processes. For instance, Brazil's tax burden in 2023 was substantial, posing a challenge for new businesses.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo Casas Bahia is built upon a foundation of publicly available financial reports, investor presentations, and industry-specific market research from reputable Brazilian and international firms.