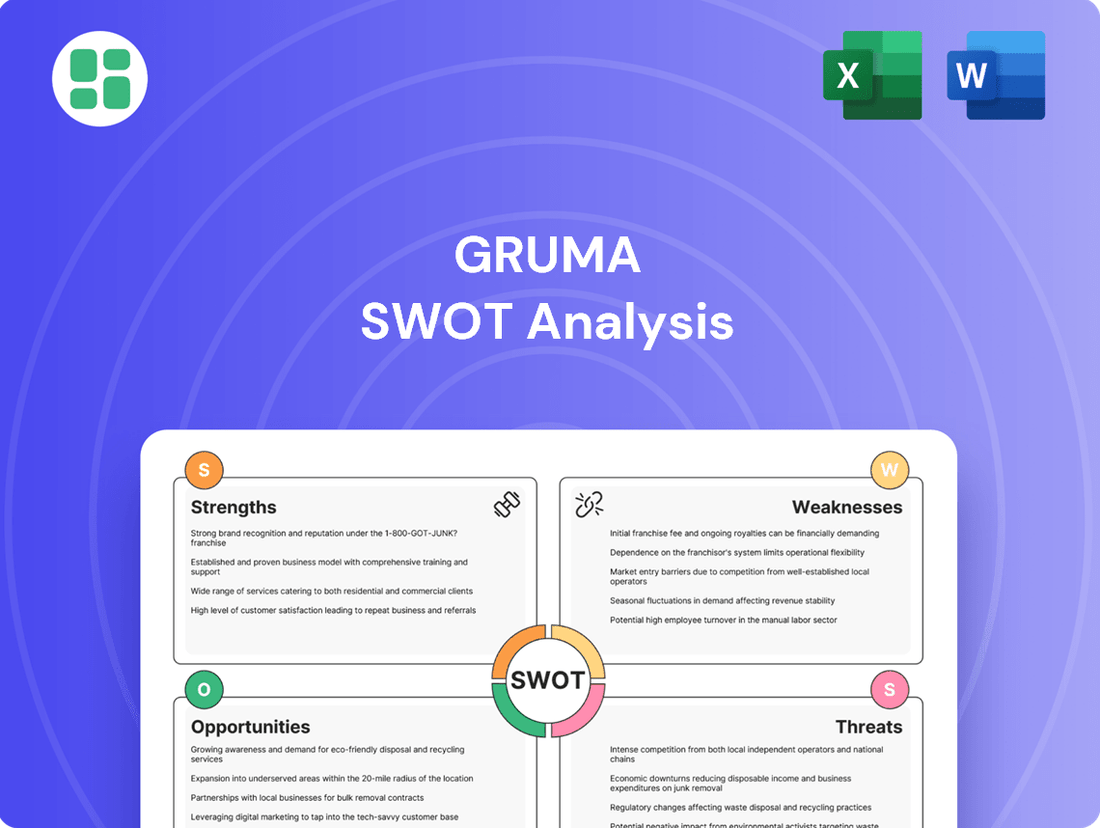

Gruma SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Gruma's strong brand recognition and extensive distribution network are significant strengths, but the company also faces challenges from fluctuating commodity prices and intense competition. Our comprehensive SWOT analysis delves into these critical factors, providing you with the complete picture needed to understand Gruma's market position and future trajectory.

Want to move beyond these highlights and truly grasp Gruma's strategic landscape? Purchase the full SWOT analysis to unlock detailed insights, actionable recommendations, and an editable format perfect for your planning and investment decisions.

Strengths

Gruma's global market leadership in corn flour and tortillas is a formidable strength, giving it a substantial competitive edge. This dominance is evident in its extensive operations spanning America, Europe, Asia, and Oceania, reaching over 100 countries.

The company's strong brand portfolio, featuring globally recognized names like Maseca and Mission, cultivates significant brand equity and deep consumer trust. For instance, Maseca is a household name in many Latin American countries, representing a significant portion of the corn flour market.

Gruma exhibits robust financial performance, underscored by a net income of US$531.9 million in fiscal year 2024, marking a significant 24% increase year-over-year. This financial strength is further evidenced by a 7% EBITDA growth in the fourth quarter of 2024 and a substantial 12% EBITDA growth for the entire 2024 fiscal year. These impressive results point to exceptionally efficient operations and astute cost management strategies that are driving profitability.

Gruma's strength lies in its extensive global presence, operating approximately 75 plants and employing around 25,000 individuals across the world. This vast network allows for significant market penetration and efficient distribution of its products.

With operations spanning multiple continents, Gruma effectively caters to diverse regional tastes and consumer preferences. This broad reach is instrumental in their strategic approach to developing new products tailored to specific markets.

Diversified Product Portfolio

Gruma's strength lies in its extensive product portfolio, extending well beyond its foundational corn flour and tortillas. The company offers a wide array of wheat-based products such as naan, pita bread, flatbreads, wraps, and chapatti, alongside pizza bases and other food items like snacks, pasta, rice, condiments, and even palm hearts. This broad offering significantly reduces the risk of being overly dependent on any single product line.

This diversification strategy allows Gruma to tap into a wider consumer base and adapt to evolving market demands. For instance, in 2023, Gruma's international sales contributed a substantial portion of its revenue, highlighting the success of its diversified product strategy in various global markets.

- Broad Product Range: Includes corn flour, tortillas, wheat flour, naan, pita bread, flatbreads, wraps, chapatti, pizza bases, snacks, pasta, rice, condiments, and palm hearts.

- Risk Mitigation: Diversification reduces reliance on single product categories, enhancing stability.

- Market Reach: Caters to a broader consumer base across different culinary preferences.

- Revenue Contribution: International sales in 2023 demonstrated the effectiveness of its diverse product offerings in global markets.

Commitment to Innovation and Sustainability

Gruma's commitment to innovation is evident in its consistent investment in research and development. This focus allows them to introduce new, nutritious products that cater to changing consumer tastes and regional demands, particularly in the growing 'Better For You' segment. For instance, in 2024, Gruma continued to expand its portfolio of healthier options, responding to a global trend towards wellness.

Furthermore, the company's 'For a Better Tomorrow' sustainability program underscores its dedication to environmental responsibility. This initiative targets a reduced environmental footprint through strategic energy management, the adoption of sustainable packaging solutions, and robust water conservation efforts. By 2025, Gruma aims to have achieved significant milestones in reducing its carbon emissions and water usage across its global operations.

These strengths are crucial for Gruma's long-term success:

- Product Development: Ongoing R&D supports the creation of products that meet evolving consumer health and lifestyle preferences.

- Sustainability Focus: The 'For a Better Tomorrow' program addresses environmental concerns, enhancing brand reputation and operational efficiency.

- Market Responsiveness: Innovation allows Gruma to adapt quickly to regional tastes and the increasing demand for healthier food options.

- Resource Management: Investments in smart energy, sustainable packaging, and water conservation contribute to cost savings and environmental stewardship.

Gruma's market leadership in corn flour and tortillas, supported by brands like Maseca and Mission, provides a significant competitive advantage. Its robust financial health, demonstrated by a 24% year-over-year net income increase to US$531.9 million in 2024 and 12% EBITDA growth for the year, highlights operational efficiency and strong profitability.

The company's extensive global footprint, with approximately 75 plants and around 25,000 employees across over 100 countries, facilitates broad market penetration and effective distribution. Gruma's diverse product portfolio, encompassing wheat-based items, snacks, and more, mitigates reliance on single product lines and caters to varied consumer preferences, as evidenced by substantial international sales contributions in 2023.

Gruma's commitment to innovation, particularly in developing healthier options as seen in its 2024 product expansions, and its sustainability initiatives like the 'For a Better Tomorrow' program, which aims for reduced carbon emissions and water usage by 2025, further solidify its strengths by aligning with evolving consumer demands and environmental consciousness.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Leadership | Dominance in corn flour and tortillas globally. | Brands like Maseca and Mission are household names. |

| Financial Performance | Strong profitability and operational efficiency. | 2024 Net Income: US$531.9 million (+24% YoY). 2024 EBITDA Growth: 12%. |

| Global Presence | Extensive manufacturing and distribution network. | ~75 plants, ~25,000 employees, operations in over 100 countries. |

| Product Diversification | Wide range of food products beyond core offerings. | Includes wheat-based products, snacks, pasta, rice, etc. International sales significant contributor. |

| Innovation & Sustainability | Focus on R&D for healthier products and environmental responsibility. | 2024 expansion of healthier options. 2025 goals for carbon emission and water usage reduction. |

What is included in the product

Analyzes Gruma’s competitive position through key internal and external factors, highlighting its strong brand recognition and market leadership against potential supply chain disruptions and changing consumer preferences.

Gruma's SWOT analysis offers a clear, actionable framework for identifying and addressing competitive vulnerabilities, thereby alleviating the pain of strategic uncertainty.

Weaknesses

Gruma's significant reliance on corn as a primary raw material presents a considerable weakness. Fluctuations in corn prices, often driven by weather patterns, global demand, and geopolitical events, directly impact Gruma's cost of goods sold. For instance, in early 2024, concerns about drought conditions in key corn-producing regions led to price increases, squeezing profit margins for companies like Gruma.

Gruma's vast global operations, spanning numerous countries, expose it to significant supply chain vulnerabilities. Geopolitical tensions, extreme weather events, and unforeseen logistical breakdowns can disrupt the flow of essential raw materials like corn, directly impacting production and distribution.

In 2024, for instance, several regions experienced severe drought conditions, affecting corn yields and driving up input costs for Gruma. These disruptions can lead to shortages, increased transportation expenses, and ultimately, a reduction in sales volume and operational efficiency across its diverse markets.

While Gruma holds a commanding position globally, its strength is tested by formidable local and regional competitors. These rivals often leverage deep-rooted brand loyalty and can undercut Gruma on price, especially in established markets. This intense rivalry directly impacts Gruma's ability to expand its market share and protect its profit margins.

Exposure to Currency Fluctuations

Gruma's extensive international footprint and a significant portion of its debt held in U.S. dollars expose it to currency fluctuation risks. A weakening of currencies in its operating regions against the dollar can negatively affect its reported financial results and debt servicing capacity, even if underlying business operations are performing well.

For instance, as of the first quarter of 2024, Gruma's consolidated debt was approximately $2.7 billion, with a notable portion denominated in USD. This means that if local currencies like the Mexican Peso or the Euro weaken against the dollar, the real cost of servicing that debt increases, and the reported value of its assets in those regions decreases when translated back to USD.

- Exposure to USD Debt: Gruma's substantial U.S. dollar-denominated debt makes it vulnerable to adverse exchange rate movements.

- Impact on Earnings: Currency depreciation in operating countries can reduce the reported value of earnings when converted to U.S. dollars.

- Debt Servicing Costs: A stronger U.S. dollar can increase the local currency cost of repaying dollar-denominated debt.

- Financial Reporting Distortion: Fluctuations can distort the perception of operational performance by impacting translated financial statements.

Potential Slowdown in Foodservice Channel

Gruma has seen a contraction in its foodservice business, particularly in the United States. This is largely due to consumers feeling the pinch of inflation, leading to increased price sensitivity and a greater preference for preparing meals at home.

While the company's retail segment continues to perform well, a prolonged downturn in the foodservice sector could pose a challenge to Gruma's overall sales volume and revenue growth. For instance, in the first quarter of 2024, Gruma's foodservice segment in the US experienced a volume decline, contrasting with the robust growth seen in its retail operations.

- US Foodservice Volume Contraction: Gruma's U.S. foodservice segment faced volume challenges in early 2024.

- Inflationary Impact: Rising prices led to increased consumer price sensitivity and a shift towards home cooking.

- Retail Strength Offset: While retail demand remains a bright spot, a sustained foodservice slowdown presents a risk to overall volume.

Gruma's significant reliance on corn, a key ingredient, makes it susceptible to price volatility. For example, in early 2024, drought concerns in major corn-producing areas caused price hikes, impacting Gruma's profitability. This dependency on a single commodity creates a considerable weakness.

The company's extensive global operations, while a strength, also present a weakness through supply chain vulnerabilities. Disruptions from geopolitical issues, severe weather, or logistical failures can impede the flow of raw materials like corn, affecting production and distribution efficiency across its diverse markets.

Intense competition from local and regional players poses a challenge, as these rivals often benefit from established brand loyalty and can compete on price. This rivalry can limit Gruma's ability to grow its market share and maintain healthy profit margins in various territories.

Gruma's substantial U.S. dollar-denominated debt exposes it to currency exchange rate risks. A depreciation of local currencies against the dollar can increase debt servicing costs and negatively impact reported earnings when translated into U.S. dollars, as seen with its approximately $2.7 billion consolidated debt as of Q1 2024.

The foodservice segment, particularly in the U.S., has experienced a downturn due to inflation-driven consumer price sensitivity and a preference for home cooking. This contraction, evident in a volume decline in Q1 2024, presents a risk to Gruma's overall sales growth, even with strong retail performance.

Full Version Awaits

Gruma SWOT Analysis

You’re viewing a live preview of the actual Gruma SWOT analysis. The complete version, offering a comprehensive understanding of their strategic position, becomes available immediately after purchase.

Opportunities

Gruma has a significant opportunity to deepen its penetration in emerging markets, especially in Asia and Oceania, where its tortilla offerings are already gaining traction. The company's tortilla segment saw robust growth in these regions during 2024, driven by rising consumer spending power and a growing appetite for convenient, ready-to-eat food products.

The increasing consumer focus on health, particularly the demand for gluten-free and plant-based foods, presents a significant avenue for Gruma's product innovation. This trend aligns perfectly with Gruma's existing strengths and market positioning.

Gruma's 'Better For You' product category has already shown robust growth, indicating strong consumer acceptance. In 2023, this category saw a notable increase in sales, contributing to Gruma's overall revenue growth, and further investment here can solidify its market leadership.

By expanding its portfolio with innovative, health-conscious options, Gruma can tap into a larger segment of the market, driving both sales volume and brand loyalty in a rapidly evolving food landscape.

Gruma's robust financial standing, evidenced by its consistent revenue growth, positions it to actively seek strategic acquisitions. For instance, in 2023, Gruma reported net sales of approximately $5.3 billion, providing ample capital for expansion. This financial strength allows the company to target smaller regional players or form key partnerships to accelerate entry into untapped markets or new product segments.

These strategic moves can significantly bolster Gruma's competitive advantage. By integrating new entities or collaborating with established brands, Gruma can quickly gain market share and diversify its product offerings beyond its core tortilla and corn flour businesses. This diversification is crucial for long-term resilience and capturing broader consumer demand.

Increasing Global Demand for Tortillas and Corn Flour

The global tortilla market is experiencing robust expansion, with corn tortillas leading the charge. This is largely due to the increasing consumer preference for gluten-free alternatives and strong cultural ties to corn-based products. The nixtamalized corn flour market is also poised for significant growth, fueled by evolving culinary trends and a heightened focus on health and wellness.

This expanding market presents a significant opportunity for Gruma, as these trends directly align with its core product offerings. For instance, the global tortilla market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 37.8 billion by 2030, growing at a CAGR of 5.8% during the forecast period. This indicates a substantial tailwind for Gruma's established business.

- Growing Gluten-Free Demand: Consumers are increasingly seeking gluten-free food options, benefiting corn tortillas.

- Cultural Significance: Corn tortillas are deeply embedded in various cuisines, ensuring sustained demand.

- Gastronomic Trends: The rise of authentic and health-conscious food culture boosts nixtamalized corn flour consumption.

- Market Expansion: The overall market growth provides a favorable environment for Gruma's product sales.

Leveraging Technology for Operational Efficiency and Sustainability

Gruma can significantly boost its performance by adopting cutting-edge technologies. This strategic move allows for streamlined operations, leading to cost reductions and a stronger commitment to environmental responsibility. By integrating smart energy management systems and advanced water conservation techniques, Gruma can achieve radical resource efficiency throughout its manufacturing. For instance, in 2024, many food processing companies reported a 15-20% reduction in energy consumption through AI-driven optimization of production lines.

These technological investments offer a dual advantage: they support Gruma's sustainability goals while simultaneously enhancing its bottom line. The focus on efficiency in areas like smart energy use and water conservation directly translates to lower operational expenses. Furthermore, a 2025 industry outlook suggests that companies prioritizing resource efficiency are better positioned to navigate rising utility costs and regulatory pressures, ultimately improving long-term profitability.

Key areas for technological leverage include:

- Smart Energy Management: Implementing AI-powered systems to optimize energy consumption in baking and processing.

- Water Conservation Technologies: Utilizing advanced filtration and recycling systems to minimize water usage.

- Resource Efficiency Platforms: Deploying software for real-time monitoring and management of raw material utilization.

- Automation in Logistics: Enhancing supply chain efficiency through automated warehousing and transportation management.

Gruma has a significant opportunity to expand its reach in emerging markets, particularly in Asia and Oceania, where its tortilla products are gaining popularity. The company's tortilla segment experienced strong growth in these regions during 2024, supported by increased consumer spending and a growing demand for convenient food options.

The increasing consumer preference for healthier food choices, such as gluten-free and plant-based items, offers Gruma a prime chance for product innovation, aligning with its current strengths and market position. Gruma's 'Better For You' product line has already demonstrated substantial sales growth, underscoring its market acceptance and providing a solid foundation for further investment and market leadership.

By diversifying its product offerings with innovative, health-conscious alternatives, Gruma can capture a larger market share and foster brand loyalty in a dynamic food industry.

Gruma's solid financial health, marked by consistent revenue increases, enables strategic acquisitions. With net sales around $5.3 billion in 2023, the company has ample capital for expansion, allowing it to target regional competitors or forge partnerships to enter new markets or product categories.

| Opportunity Area | Rationale | Supporting Data/Trend |

|---|---|---|

| Emerging Market Expansion | Leverage growing consumer spending and demand for convenient foods. | Robust growth in Asia and Oceania tortilla segment in 2024. |

| Health & Wellness Product Innovation | Capitalize on demand for gluten-free and plant-based options. | Strong growth in Gruma's 'Better For You' category in 2023. |

| Strategic Acquisitions & Partnerships | Accelerate market entry and product diversification. | 2023 Net Sales: ~$5.3 billion, providing capital for expansion. |

| Technological Adoption | Enhance operational efficiency, reduce costs, and improve sustainability. | Potential 15-20% energy reduction via AI optimization (2024 industry reports). |

Threats

Fluctuations in the price of corn, Gruma's primary ingredient, present a significant threat to its profitability. For instance, in early 2024, corn prices saw considerable volatility due to weather patterns in key producing regions and ongoing global supply chain disruptions, directly impacting Gruma's cost of goods sold.

Geopolitical events and climate change further exacerbate this threat by creating unpredictable price spikes. These external factors can disrupt agricultural yields and international trade, leading to sharp increases in raw material expenses that squeeze Gruma's operating margins and necessitate difficult pricing adjustments for consumers.

The food industry presents a formidable competitive landscape, with global giants and nimble regional businesses constantly vying for consumer attention and shelf space. This intense rivalry means Gruma must continually innovate and optimize its operations to maintain its market position.

A significant challenge arises from the escalating growth of private label brands, especially within the crucial US market. As retailers expand their own-brand offerings, they often leverage lower price points, which can directly challenge Gruma's established brands and potentially impact its pricing power and sales volumes.

Shifting consumer preferences towards low-carb, gluten-free, or plant-based diets represent a significant threat to Gruma's core corn flour and tortilla business. For instance, a continued surge in popularity of ketogenic diets, which restrict carbohydrate intake, could directly impact demand for traditional corn-based products. While Gruma has been proactive with its 'better-for-you' product lines, a rapid or widespread adoption of such dietary trends could still challenge the long-term growth trajectory of its foundational offerings.

Regulatory Changes and Trade Policies

Gruma's global presence exposes it to a complex web of shifting regulatory landscapes. For instance, in 2024, the European Union continued to refine its stringent food safety and labeling requirements, impacting imported goods. These changes can necessitate costly product reformulation or packaging updates, directly affecting Gruma's profitability and market penetration strategies in key regions.

International trade policies, including tariffs and import/export restrictions, pose a significant threat. For example, ongoing trade discussions between major economic blocs in late 2024 and early 2025 could introduce new duties on key Gruma ingredients like corn or wheat, or on finished products. Such developments can disrupt supply chains and increase the cost of goods sold, potentially eroding Gruma's competitive pricing advantage.

- Evolving Food Safety Standards: Gruma must adapt to varying and increasingly strict food safety regulations across its operating markets, such as updated allergen labeling mandates in North America.

- Tariff Imposition Risks: The potential for new or increased tariffs on agricultural commodities or finished goods, as seen in past trade disputes, could significantly raise Gruma's cost of raw materials and finished product pricing.

- Trade Policy Volatility: Fluctuations in international trade agreements and protectionist measures can create uncertainty, impacting Gruma's ability to efficiently move products across borders and access key markets.

- Compliance Costs: Meeting diverse and often changing regulatory requirements across numerous countries adds substantial operational complexity and financial burden to Gruma's global operations.

Economic Downturns and Inflationary Pressures

Global and regional economic downturns pose a significant threat to Gruma by potentially curbing consumer spending on packaged foods. This reduced demand can directly impact the company's sales volumes, particularly in markets experiencing significant economic contraction. For instance, during periods of recession, consumers often prioritize essential goods and cut back on discretionary purchases, which can include branded food products.

Persistent inflationary pressures present another formidable challenge. As the cost of living rises, consumers' purchasing power diminishes, leading them to adopt more cost-conscious behaviors. This can manifest as trading down to cheaper alternatives or reducing overall consumption, making it difficult for Gruma to pass on its own rising input costs, such as those for corn flour and energy, without alienating price-sensitive customers.

- Reduced Consumer Spending: Economic slowdowns typically lead to lower disposable incomes, impacting demand for Gruma's products.

- Inflationary Impact: Rising prices erode consumer purchasing power, potentially forcing them to seek lower-cost alternatives.

- Cost Pass-Through Challenges: Gruma may struggle to fully offset increased operational costs due to consumer price sensitivity.

Intensifying competition from private label brands, particularly in the U.S. market, directly challenges Gruma's market share and pricing power. Additionally, evolving consumer dietary preferences, such as a growing interest in low-carb and gluten-free options, could negatively impact demand for Gruma's core corn-based products. The company also faces significant risks from volatile commodity prices, geopolitical instability affecting supply chains, and increasingly stringent global food safety regulations, all of which can impact profitability and operational costs.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024/2025) |

|---|---|---|---|

| Competition | Private Label Growth | Reduced market share, price pressure | Continued expansion of retailer-owned brands in U.S. grocery aisles. |

| Consumer Trends | Dietary Shifts (Low-Carb/Gluten-Free) | Decreased demand for core products | Ongoing popularity of ketogenic and gluten-free lifestyles impacting staple food consumption. |

| Input Costs | Corn Price Volatility | Increased cost of goods sold, margin erosion | Weather-related supply issues in early 2024 impacting corn futures prices. |

| Regulatory Environment | Food Safety & Labeling | Increased compliance costs, potential market access issues | New allergen labeling mandates implemented in North America in 2024. |

| Trade Policies | Tariffs and Restrictions | Higher raw material costs, disrupted supply chains | Potential for new trade duties on agricultural imports discussed in late 2024/early 2025. |

SWOT Analysis Data Sources

This Gruma SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on Gruma's operational landscape and strategic positioning.