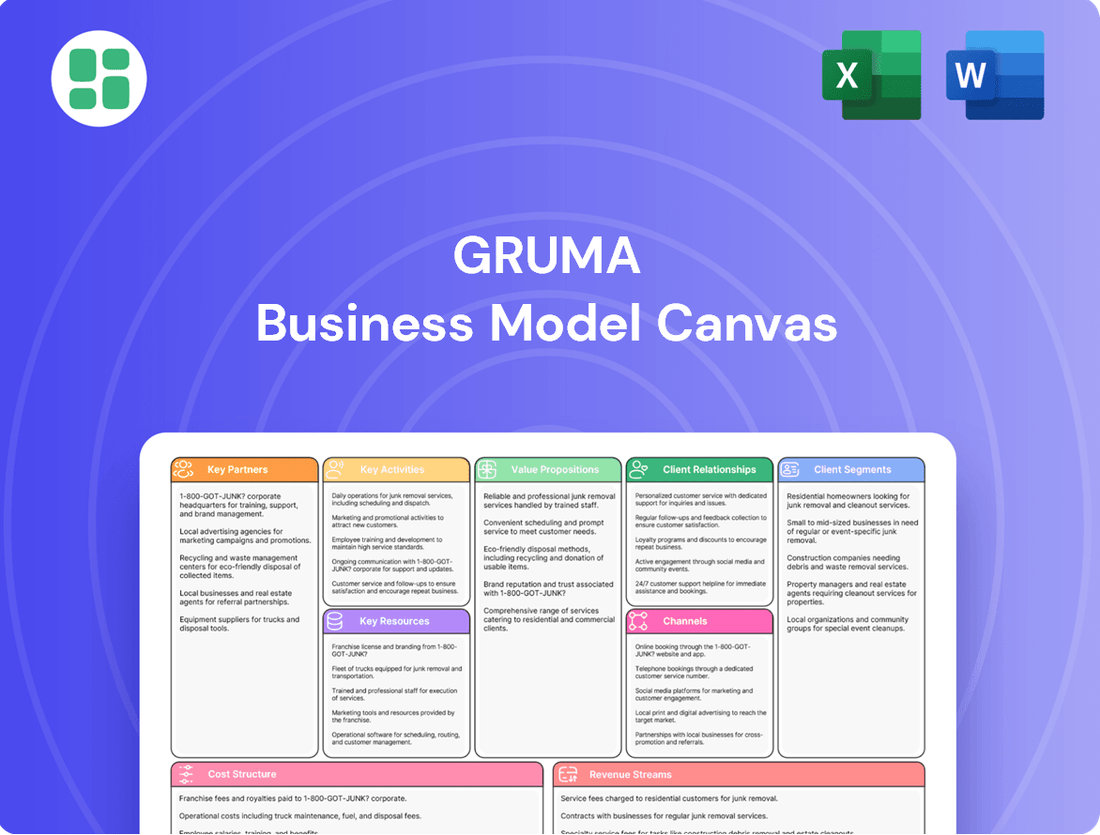

Gruma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Discover the strategic genius behind Gruma's dominant position in the food industry. This comprehensive Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Partnerships

Gruma’s business model hinges on strong relationships with agricultural suppliers, particularly for corn and wheat, its foundational ingredients. These partnerships are vital for guaranteeing the quality, quantity, and cost-effectiveness of its raw materials, which directly influences Gruma's production consistency and overall efficiency. For instance, in 2024, Gruma continued to emphasize securing stable supplies amidst fluctuating global commodity prices, a strategy that underpins its competitive edge in the tortilla and corn flour markets.

Gruma's strategic alliances with major retail chains and supermarkets globally are fundamental to its widespread distribution and market reach. These partnerships secure prime shelf space for its popular brands, such as Mission and Maseca, making its corn flour and tortilla products readily available to a vast consumer base. For instance, in 2024, Gruma's strong presence in key North American grocery chains contributed significantly to its revenue, with Mission tortillas being a top-selling item in many stores.

Gruma collaborates with foodservice distributors worldwide to ensure its products reach restaurants, hotels, and institutional clients. These partnerships are crucial for a substantial part of Gruma's revenue, especially for its tortilla segment, even though recent market conditions have seen some volume decline due to price sensitivity.

Technology and Equipment Providers

Gruma's strategic alliances with technology and equipment providers are fundamental to its operational excellence and growth. These collaborations ensure access to cutting-edge machinery for milling, tortilla production, and advanced automation, directly boosting productivity and maintaining high product standards.

These partnerships are crucial for Gruma's capacity expansion and innovation efforts. For instance, investments in new production lines and facility modernizations across various global markets, including significant upgrades in China, Europe, and Guatemala, underscore the importance of these technological collaborations in driving efficiency and quality.

- Advanced Milling Technology: Securing state-of-the-art milling equipment to optimize corn processing and enhance flour quality.

- Automated Production Lines: Partnering for automated machinery in tortilla and snack production to increase output and reduce labor costs.

- Innovation in Packaging: Collaborating with providers of advanced packaging solutions to improve product shelf-life and consumer appeal.

- Efficiency Upgrades: Implementing new technologies for energy efficiency and waste reduction in manufacturing plants, as seen in recent investments.

Logistics and Transportation Companies

Gruma relies heavily on logistics and transportation companies to maintain its global supply chain, ensuring raw materials reach its production facilities and finished goods arrive at consumer tables efficiently. These partnerships are critical for managing the freshness and timely delivery of products across Gruma's extensive international operations.

The company's commitment to product quality and availability directly hinges on the performance of its freight and distribution partners. For instance, in 2024, Gruma continued to optimize its logistics networks to mitigate the impact of potential disruptions in commercial freight channels, which can affect distribution timelines and costs.

- Global Reach: Partnerships with international logistics providers enable Gruma to serve markets across North America, Europe, Central America, and Asia.

- Cost Management: Efficient transportation networks are key to controlling operational expenses, a significant factor in Gruma's profitability.

- Supply Chain Resilience: Reliable logistics partners help Gruma navigate challenges, ensuring a consistent flow of goods even amidst market volatility.

Gruma's agricultural supplier relationships are foundational, ensuring consistent quality and cost-effectiveness for corn and wheat. These partnerships are critical for maintaining production efficiency, especially as Gruma navigated fluctuating global commodity prices in 2024, reinforcing its market position.

Strategic alliances with major retailers are essential for Gruma's extensive market reach and brand visibility. These collaborations secure prominent shelf space for brands like Mission and Maseca, contributing significantly to revenue, as demonstrated by Mission tortillas' top-selling status in many North American stores in 2024.

Partnerships with foodservice distributors are vital for Gruma's B2B segment, supplying restaurants and institutions. While this channel contributes substantially to revenue, recent market conditions have introduced price sensitivity, impacting volume in some areas.

What is included in the product

A detailed breakdown of Gruma's operations, outlining its customer segments, value propositions, and revenue streams in the corn flour and tortilla industry.

Gruma's Business Model Canvas effectively addresses the pain point of strategic complexity by providing a clear, visual representation of their entire operation.

It simplifies understanding by condensing Gruma's intricate value proposition, customer segments, and revenue streams into a single, actionable page.

Activities

Gruma's central operations revolve around the efficient, large-scale production of corn flour, famously known as Maseca, and wheat flour. These flours are the bedrock of their extensive range of food products, from tortillas to baked goods.

The company meticulously manages the entire process, beginning with the sourcing of high-quality raw materials, followed by sophisticated milling and processing techniques. This ensures consistent product quality and the capacity to satisfy substantial global demand.

In 2023, Gruma's corn flour production was a significant driver of its revenue, contributing to its strong market position. The efficiency of these milling operations is directly tied to the company's profitability and its ability to maintain leadership in the global food industry.

Gruma's core operations revolve around the large-scale manufacturing of a diverse range of tortillas, encompassing both corn and wheat varieties. This extends to other popular flatbreads such as naan, pita, wraps, and pizza bases, catering to varied consumer preferences.

Beyond flatbreads, the company actively produces an assortment of other food items, including snacks, pasta, rice, and condiments. This product diversification helps Gruma capture a broader market share and appeal to different dietary needs and occasions.

Gruma operates a network of strategically positioned production facilities across the globe. For instance, in 2024, the company continued to optimize its manufacturing footprint, aiming for efficient distribution and reduced logistical costs in key markets like North America and Europe.

Gruma's commitment to Research and Development (R&D) and Innovation is central to its business model, focusing on creating healthier options and responding to changing consumer demands. This dedication allows them to introduce new product categories such as gluten-free and low-carbohydrate tortillas, alongside refining current offerings.

In 2023, Gruma's investment in R&D and innovation was a significant driver for its growth, contributing to its ability to stay ahead in a competitive market. For instance, the company's Mission Foods brand has seen success with its expanded range of healthier tortilla options, catering to a growing segment of health-conscious consumers.

This strategic focus on innovation not only helps Gruma maintain its competitive advantage but also fuels retail expansion by meeting the evolving preferences of consumers seeking nutritious and convenient food choices.

Global Marketing and Brand Management

Gruma's global marketing and brand management are essential for its success, focusing on promoting brands like Maseca, Mission, and Guerrero worldwide. This strategy involves targeted advertising and consistent messaging to foster consumer loyalty and increase market penetration. For instance, Gruma’s marketing expenses have seen fluctuations, with a notable increase in recent periods reflecting significant investment in brand building and consumer engagement across diverse international markets.

The company actively engages in promotional activities tailored to local preferences, ensuring brand relevance and resonance. This approach helps Gruma maintain a strong presence and competitive edge in various regional economies. In 2024, Gruma continued to invest heavily in marketing initiatives, aiming to solidify its brand equity and capture greater market share in both established and emerging markets.

- Brand Visibility: Gruma's marketing efforts aim to enhance the visibility of its core brands, such as Maseca and Mission, in key international markets.

- Consumer Engagement: The company utilizes a mix of advertising, digital campaigns, and in-store promotions to connect with consumers and build lasting relationships.

- Market Share Growth: Effective brand management is directly linked to Gruma's objective of expanding its market share in the global tortilla and corn flour industry.

- Marketing Investment: Gruma’s financial reports often highlight significant allocations towards marketing and advertising, underscoring its commitment to brand development.

Supply Chain and Distribution Management

Gruma's key activities center on expertly managing its intricate global supply chain and distribution network. This involves everything from sourcing raw materials to getting finished products onto shelves across numerous markets.

The company focuses heavily on optimizing these operations to ensure products are always available, keeping costs down, and minimizing disruptions from supply or demand shifts. For instance, Gruma's commitment to efficiency in 2024 continues to be a core operational pillar, aiming to streamline logistics and inventory.

- Procurement and Raw Material Sourcing: Securing consistent and high-quality corn and wheat, Gruma's primary inputs, is fundamental.

- Inventory Management: Balancing stock levels across its vast network to meet demand without excessive carrying costs.

- Logistics and Transportation: Efficiently moving goods from production facilities to distribution centers and retailers.

- Distribution Channel Management: Ensuring timely delivery to a wide array of sales channels, from large supermarkets to smaller local stores.

Gruma's key activities are centered on the large-scale production of corn and wheat flour, forming the base for its diverse food product portfolio. This includes meticulous raw material sourcing and sophisticated milling processes to ensure consistent quality and meet global demand.

The company also focuses on manufacturing a wide array of flatbreads, such as tortillas, wraps, and pizza bases, alongside other food items like snacks and pasta, catering to varied consumer preferences and expanding market reach.

Furthermore, Gruma prioritizes innovation and R&D to develop healthier product options and respond to evolving consumer needs, evidenced by the success of brands like Mission Foods with its expanded healthier tortilla range.

Global marketing and brand management are crucial, with Gruma promoting brands like Maseca and Mission through targeted advertising and promotional activities to foster consumer loyalty and increase market penetration.

Finally, Gruma excels at managing its global supply chain and distribution network, optimizing operations for product availability, cost efficiency, and minimizing disruptions, with a continued focus on streamlining logistics and inventory in 2024.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Flour Production | Large-scale milling of corn and wheat into Maseca and wheat flour. | Foundation for all food products; significant revenue driver. |

| Food Product Manufacturing | Production of tortillas, wraps, pizza bases, snacks, pasta, and condiments. | Diversifies revenue streams and caters to broad consumer preferences. |

| Research & Development | Focus on healthier options, gluten-free, and low-carb products. | Drives product innovation and competitive advantage; Mission Foods' success highlights this. |

| Marketing & Brand Management | Promoting brands like Maseca and Mission globally through advertising and promotions. | Enhances brand visibility and consumer loyalty; significant investment in brand building. |

| Supply Chain & Distribution | Managing global sourcing, logistics, inventory, and distribution channels. | Ensures product availability and cost efficiency; optimization is a core pillar for 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Gruma Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, professionally structured content and formatting that will be delivered to you, ensuring there are no surprises. You’ll gain full access to this exact file, ready for your immediate use and customization.

Resources

Gruma operates a vast global manufacturing footprint, boasting roughly 75 production facilities strategically positioned across the Americas, Europe, Asia, and Oceania. This extensive network is the backbone of its operations, enabling the efficient, large-scale production of its core products like corn flour and tortillas.

These facilities are not just numerous; they are crucial for Gruma's ability to serve diverse markets and maintain a significant global presence. The company consistently invests in upgrading and expanding these plants, ensuring they remain at the forefront of production technology and capacity to meet growing demand.

Gruma's powerhouse brands, Maseca and Mission, are cornerstones of its business, acting as significant intangible assets that drive consumer preference and market dominance. Maseca, a leading corn flour brand, and Mission, a globally recognized tortilla producer, have cultivated deep consumer loyalty over decades.

These brands provide Gruma with a substantial competitive edge, enabling easier market entry and sustained market share. For instance, Gruma's net sales reached approximately $5.4 billion in 2023, a testament to the strength and reach of its brand portfolio.

Gruma's proprietary technology, honed by its dedicated technology division, is a cornerstone of its operations, particularly in corn milling and tortilla production. This includes specialized machinery and unique processing techniques that significantly boost manufacturing efficiency and product quality.

These technological advancements, coupled with distinct recipes, create a significant competitive advantage for Gruma. This intellectual property acts as a substantial barrier, making it difficult for new entrants to replicate their success and market position.

For instance, Gruma's investment in R&D is reflected in its continuous innovation. In 2024, the company continued to leverage its advanced milling technologies to optimize corn flour yield and quality, directly impacting the cost-effectiveness and sensory attributes of its tortilla products.

Extensive Distribution Network

Gruma's extensive distribution network is a cornerstone of its business model, acting as a critical resource to ensure its diverse product portfolio reaches consumers worldwide. This network is not just about getting products to shelves; it's about efficient market penetration and maintaining product freshness. By the end of 2024, Gruma's reach extended to over 100 countries, a testament to the strength and breadth of this vital asset.

The network operates through a multi-faceted approach, combining direct sales channels with robust partnerships. These collaborations span across major retailers, smaller convenience stores, and the foodservice sector, including restaurants and institutional catering. This diversified approach allows Gruma to cater to a wide array of consumer needs and purchasing habits, ensuring consistent availability of its products.

- Global Reach: Gruma's distribution network operates in over 100 countries, facilitating broad market access.

- Channel Diversity: The network effectively utilizes direct sales, retail partnerships, and foodservice channels.

- Operational Efficiency: Timely product delivery and market penetration are directly supported by the network's efficiency.

- Market Penetration: The established infrastructure is key to Gruma's ability to introduce and sustain its brands in new and existing markets.

Skilled Workforce and Management Expertise

Gruma's operational strength hinges on its substantial human capital. With a workforce numbering around 25,000 individuals, the company benefits from a broad base of skilled labor. This extensive team is complemented by experienced management, whose strategic direction and operational oversight are critical for Gruma's global success.

This skilled workforce and expert management are the engines driving Gruma's core functions. They are instrumental in fostering product innovation, ensuring the consistent quality that consumers expect, and navigating the complexities of global supply chains. Their collective expertise is vital for Gruma's ability to respond effectively to evolving market demands and to pursue its growth objectives efficiently.

- Workforce Size: Approximately 25,000 employees globally.

- Management Expertise: Experienced leadership team guiding operations and strategy.

- Key Contributions: Driving innovation, maintaining product quality, managing logistics, and executing growth plans.

- Adaptability: Crucial for navigating market dynamics and achieving operational efficiencies.

Gruma's key resources include its extensive global manufacturing facilities, its powerful brands like Maseca and Mission, proprietary milling and production technology, a vast distribution network reaching over 100 countries, and its skilled workforce of approximately 25,000 employees. These assets collectively enable Gruma to produce and deliver its products efficiently and maintain a strong market position.

| Resource Category | Specific Asset | Key Impact/Data Point |

|---|---|---|

| Manufacturing | Production Facilities | ~75 facilities globally |

| Brands | Maseca, Mission | Drove $5.4 billion in net sales (2023) |

| Technology | Proprietary Corn Milling & Tortilla Tech | Enhances efficiency and product quality |

| Distribution | Global Network | Reaches over 100 countries |

| Human Capital | Workforce & Management | ~25,000 employees; drives innovation and operations |

Value Propositions

Gruma's commitment to authenticity and traditional quality is a cornerstone of its value proposition. The company deeply roots its product offerings in the rich culinary heritage of corn flour and tortillas, directly addressing a growing consumer demand for genuine flavors and ingredients. This focus ensures a strong connection to cultural roots.

The Maseca brand exemplifies this dedication, becoming a globally recognized symbol of traditional corn flour. Consumers worldwide associate Maseca with trusted quality, fostering a powerful sense of cultural connection and reliability. In 2023, Maseca continued to be a leading brand in the corn flour market, contributing significantly to Gruma's overall revenue growth.

Gruma's global reach ensures its essential products, like tortillas and corn flour, are accessible in over 100 countries, offering unparalleled convenience to consumers and businesses alike.

This extensive distribution network means Gruma's high-quality staples are readily available, catering to the fast-paced lifestyles of modern consumers and the operational needs of foodservice establishments worldwide.

Gruma's diverse product portfolio is a cornerstone of its business model, encompassing a wide array of corn flour and tortilla varieties. This extensive offering extends to other related food items, ensuring they cater to a broad spectrum of tastes and culinary requirements across different regions.

The company's product range includes various flatbreads and snacks, providing consumers with options suitable for diverse meal occasions and preferences. For instance, in 2024, Gruma continued to emphasize its core tortilla and corn flour products while also exploring new snack innovations to capture evolving consumer demands.

This commitment to variety is supported by ongoing innovation, as Gruma consistently works to expand its product lines. This strategic approach ensures they remain relevant and competitive in the dynamic food market, meeting the needs of a global customer base with a variety of choices.

'Better-for-you' and Health-Conscious Options

Gruma is actively cultivating a 'better-for-you' product portfolio, emphasizing options like low-carb, high-fiber, and gluten-free tortillas. This strategic pivot directly addresses the escalating consumer demand for healthier food alternatives, a trend that has significantly shaped the food industry.

This commitment to health and wellness is a key differentiator, exemplified by products such as Mission Foods' Carb Balance tortillas. These offerings are not just meeting consumer needs but are actively driving substantial retail growth and reinforcing Gruma's competitive standing in the marketplace.

Key aspects of this value proposition include:

- Product Innovation: Development of specialized tortillas catering to specific dietary needs and preferences.

- Market Responsiveness: Aligning product offerings with evolving consumer health consciousness.

- Brand Strengthening: Enhancing brand perception and loyalty through health-focused initiatives.

- Sales Growth Driver: Utilizing healthier options to capture market share and boost revenue.

Reliability and Consistency for Industrial and Retail Clients

Gruma's value proposition centers on unwavering reliability and consistency, a critical factor for its diverse clientele. For industrial partners, this translates into a dependable supply of high-quality ingredients, crucial for maintaining their own production schedules and product integrity. This is underscored by Gruma's significant operational scale; for instance, in 2024, the company continued to invest in optimizing its extensive network of corn and wheat mills, ensuring consistent output and ingredient specifications that food manufacturers rely on daily.

Retail consumers also benefit directly from this commitment. They can consistently trust the familiar taste, texture, and performance of Gruma's branded products, whether it's tortillas or corn flour. This predictability builds strong brand loyalty and repeat purchases, a testament to the company's rigorous quality control across its manufacturing processes. Gruma's ability to maintain these standards across its vast product lines solidifies its reputation as a trusted name in households and commercial kitchens alike.

The company's robust supply chain infrastructure is the backbone of this reliability. By managing its operations from grain sourcing to final product delivery, Gruma minimizes disruptions and ensures a steady flow of goods to both its B2B and B2C customers. This integrated approach is particularly vital in the dynamic food industry, where supply chain resilience is paramount for sustained success and customer satisfaction.

- Consistent Ingredient Quality: Gruma ensures that industrial clients receive ingredients meeting precise specifications, crucial for product formulation and manufacturing.

- Dependable Supply Chain: The company's extensive logistics network guarantees timely delivery, allowing businesses to manage inventory and production efficiently.

- Brand Trust for Consumers: Retail customers rely on the consistent taste and quality of Gruma's branded products, fostering brand loyalty and repeat business.

- Operational Scale: Significant investments in production facilities and technology in 2024 reinforce Gruma's capacity to deliver reliably at scale.

Gruma's value proposition centers on providing authentic, high-quality corn flour and tortilla products, deeply rooted in culinary heritage. The Maseca brand, a global leader, embodies this commitment, offering consumers worldwide a trusted symbol of traditional flavor and reliability, contributing significantly to Gruma's market presence.

Customer Relationships

Gruma cultivates direct sales and account management for its industrial clientele, including major food manufacturers and foodservice operators. This approach facilitates customized product offerings and streamlined bulk purchasing processes, solidifying robust business-to-business alliances.

Dedicated teams engage directly with these large clients, enabling negotiation of terms and the development of solutions precisely matching their operational requirements. This direct interaction is vital for securing substantial sales volumes and understanding evolving market demands within the B2B sector.

Gruma cultivates robust relationships with its retail partners, such as major supermarket chains and smaller convenience stores, by providing dedicated promotional support and engaging in joint marketing initiatives. This collaborative approach ensures Gruma products receive prime shelf placement and benefit from eye-catching in-store displays, directly boosting sales volumes.

In 2024, Gruma's focus on efficient supply chain management further solidified these partnerships, guaranteeing product availability and freshness. This operational excellence is crucial for navigating the competitive retail landscape and maintaining strong sales momentum for brands like Mission and Guerrero.

Gruma builds strong brand loyalty and consumer trust by consistently offering high-quality products under established names like Maseca and Mission. Consumers recognize these brands for their authentic flavors and dependable quality, driving repeat business and organic growth through recommendations. This unwavering commitment to quality is a cornerstone of their customer retention strategy.

Digital Engagement and Information Dissemination

Gruma leverages digital platforms to connect with consumers, even with its primary focus on B2B and retail. Brand websites and social media channels serve as key touchpoints for disseminating product information, sharing recipes, and telling brand stories, fostering a direct connection with end-users.

This digital engagement is crucial for gathering valuable consumer feedback, which can inform product development and marketing strategies. Furthermore, it plays a significant role in reinforcing brand image and loyalty among a broad audience.

Investor relations also heavily rely on digital channels. Gruma provides comprehensive financial information and updates through its investor relations website, ensuring transparency and accessibility for stakeholders.

- Digital Touchpoints: Gruma utilizes brand websites and social media to share product details, recipes, and brand narratives, directly engaging consumers.

- Consumer Feedback Loop: Digital platforms enable Gruma to collect consumer insights, aiding in product innovation and marketing refinement.

- Brand Reinforcement: Consistent online presence helps build and maintain a strong brand image and customer connection.

- Investor Communication: Gruma's investor relations website serves as a primary digital hub for financial data and corporate announcements.

Community Engagement and Corporate Social Responsibility

Gruma actively cultivates strong customer relationships by embedding corporate social responsibility (CSR) into its operations. This commitment is evident through its dedication to environmental stewardship, upholding human rights, and prioritizing community well-being, all of which resonate with an increasingly socially conscious consumer base.

These initiatives not only bolster Gruma's brand reputation but also foster a sense of loyalty among customers who value ethical business practices. For instance, in 2024, Gruma continued its focus on sustainable agriculture, aiming to reduce water usage by 15% across its key corn-growing regions by 2025, a target that directly impacts the environmental footprint of its products.

- Community Investment: Gruma's programs often involve direct investment in local communities, such as supporting educational initiatives and infrastructure development, fostering goodwill and a shared sense of progress.

- Sustainable Sourcing: The company's commitment to responsible sourcing, including fair labor practices and environmental protection in its supply chain, builds trust with consumers who are mindful of the origins of their food.

- Brand Perception: By aligning with values of social responsibility, Gruma enhances its brand image, making it more attractive to a wider demographic and strengthening the emotional connection with its customers.

- Long-Term Value: These CSR efforts contribute to long-term customer loyalty and can translate into increased market share, as consumers increasingly factor a company's social and environmental impact into their purchasing decisions.

Gruma's customer relationships are multifaceted, encompassing direct engagement with industrial clients, strategic partnerships with retailers, and building brand loyalty with end consumers. This comprehensive approach ensures consistent product availability and tailored solutions, driving sales across diverse market segments.

The company prioritizes direct sales and account management for its B2B customers, fostering tailored product development and efficient bulk purchasing. For retail partners, Gruma offers dedicated promotional support and joint marketing, securing prime shelf space and driving sales volumes for brands like Mission and Guerrero.

Gruma also cultivates consumer loyalty through consistent product quality under established brands such as Maseca and Mission, and utilizes digital platforms for engagement, feedback, and brand storytelling.

In 2024, Gruma's commitment to Corporate Social Responsibility, including environmental stewardship and community well-being, further strengthened customer loyalty, with initiatives like a 15% water usage reduction target in corn-growing regions by 2025 demonstrating this dedication.

Channels

Supermarkets and grocery stores are Gruma's main retail avenues, making their packaged corn flour and tortilla products readily available to everyday shoppers. This channel encompasses everything from massive national supermarket chains to smaller, neighborhood grocery stores, which is key for reaching a wide customer base.

Brands such as Mission and Maseca are consistently found on the shelves of these retail locations, signifying their status as household staples. In 2024, the U.S. grocery retail market alone was valued at over $900 billion, with supermarkets and hypermarkets accounting for the largest share, highlighting the critical importance of this channel for Gruma's sales volume.

Gruma's foodservice channel is a vital distribution pathway, supplying essential ingredients like corn flour and tortillas to a wide array of establishments, including restaurants, fast-food chains, and large institutional kitchens.

While this segment has faced headwinds, it continues to represent a substantial portion of Gruma's revenue, especially for bulk orders and niche product lines tailored for culinary professionals. For instance, in 2023, the foodservice sector contributed significantly to the company's overall sales volume.

Effective partnerships with specialized foodservice distributors are crucial for Gruma to successfully reach and serve this diverse customer base, ensuring consistent product availability and efficient logistics across the market.

Gruma's wholesale and industrial sales channel is a cornerstone of its operations, supplying essential ingredients like Maseca corn flour to other food manufacturers. This business-to-business segment is critical for driving volume and ensuring consistent demand for Gruma's core products.

This channel is particularly important for Maseca, Gruma's flagship corn flour brand, which is a key ingredient for many food producers. The company's success in this area relies heavily on cultivating and maintaining robust relationships with its industrial clientele, fostering long-term partnerships that guarantee predictable sales volumes.

In 2024, Gruma's industrial segment continued to be a significant revenue driver, underscoring the importance of these B2B relationships. The company's ability to reliably supply high-quality ingredients directly to other businesses solidifies its position as a vital link in the global food supply chain.

Convenience Stores and Specialty Shops

Convenience stores and specialty shops are crucial distribution channels for Gruma, catering to consumers seeking immediate consumption or specific ethnic food requirements. These outlets are particularly effective for Gruma's snack portfolio and specialized tortilla products, ensuring broad accessibility across varied retail settings.

These channels allow Gruma to tap into the growing demand for convenient, ready-to-eat options and authentic ethnic foods. For instance, the U.S. convenience store market alone generated over $710 billion in sales in 2023, highlighting the significant reach these locations offer for impulse purchases and on-the-go snacking.

- Convenience Stores: Provide high-traffic locations for impulse buys of Gruma's snack brands like Mission Tortillas and Cheetos (through its joint venture with Frito-Lay).

- Specialty Ethnic Shops: Cater to specific cultural demands, ensuring availability of authentic Mexican food products, including a wider variety of masa-based tortillas and related ingredients.

- On-the-Go Consumption: These channels are vital for products designed for immediate consumption, aligning with busy consumer lifestyles.

- Market Reach: Expands Gruma's presence beyond traditional supermarkets, reaching diverse demographic groups and urban centers effectively.

International Distribution Networks

Gruma’s international distribution is a cornerstone of its business model, ensuring its products, like Maseca corn flour and Mission tortillas, are accessible globally. This network spans continents, including significant presence in Europe, Asia, Oceania, and Central America.

The company’s strategy involves a multi-faceted approach to distribution. It utilizes direct operations for key markets, establishes local subsidiaries to better understand and serve regional needs, and partners with third-party distributors to maximize reach and efficiency. This diversified strategy is crucial for maintaining its leadership in the global corn flour and tortilla market.

As of 2024, Gruma's global presence is substantial, with operations in over 110 countries. The company’s commitment to expanding its distribution capabilities is evident in its continuous investment in logistics and supply chain infrastructure, aiming to further penetrate emerging markets and strengthen its foothold in established ones.

- Global Reach: Operations in over 110 countries across Europe, Asia, Oceania, and Central America.

- Distribution Channels: Utilizes direct operations, local subsidiaries, and third-party distributors.

- Market Leadership: Supports its position as a world leader in corn flour and tortillas.

- Strategic Investment: Ongoing investment in logistics and supply chain to enhance market penetration.

Gruma's channels are multifaceted, ensuring its products reach consumers through various avenues. These include traditional supermarkets, a robust foodservice sector, industrial sales, convenience stores, specialty shops, and extensive international distribution networks.

The company's strategy leverages these diverse channels to maximize market penetration and cater to different consumer needs, from everyday grocery shopping to specialized culinary applications and global demand.

In 2024, Gruma's commitment to expanding its reach through these channels remained a key focus, supported by significant investments in logistics and strategic partnerships to maintain its leadership in the corn flour and tortilla markets worldwide.

| Channel Type | Primary Products | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Retail (Supermarkets/Grocery) | Corn Flour (Maseca), Tortillas (Mission) | Wide consumer access, high volume sales | U.S. grocery retail market valued over $900 billion in 2024 |

| Foodservice | Corn Flour, Tortillas (bulk/specialty) | Restaurants, fast-food, institutional kitchens | Significant contributor to overall sales volume in 2023 |

| Wholesale/Industrial | Corn Flour (Maseca) | B2B ingredient supply to food manufacturers | Continued significant revenue driver in 2024 |

| Convenience/Specialty | Snacks, ethnic food products | Impulse buys, on-the-go consumption, niche markets | U.S. convenience store market generated over $710 billion in sales in 2023 |

| International | Maseca, Mission products | Operations in over 110 countries | Global presence with strategic use of direct operations, subsidiaries, and distributors |

Customer Segments

Retail consumers, encompassing individual households, are a primary customer segment for Gruma. They are the end-users of staple products like Maseca corn flour and popular tortilla brands such as Mission and Guerrero. This segment's purchasing decisions are influenced by a blend of convenience for everyday meals, growing health consciousness leading to demand for fortified or whole-grain options, and deeply ingrained cultural preferences for corn-based foods.

In 2024, the U.S. tortilla market alone was valued at over $10 billion, with Gruma holding a significant market share through its brands. This demonstrates the substantial purchasing power and consistent demand from households seeking convenient and culturally relevant food options for their families.

Foodservice operators, including restaurants, cafes, and institutions, are a vital customer segment for Gruma, utilizing their corn flour and tortillas as core ingredients. Despite a recent contraction in foodservice volumes, this sector continues to be a significant driver for bulk purchases. For instance, in 2024, the U.S. foodservice industry experienced fluctuating demand, with casual dining restaurants showing resilience while quick-service restaurants adapted to changing consumer preferences.

Industrial food manufacturers are a crucial B2B customer base for Gruma, relying on its corn flour as a fundamental ingredient. These companies integrate Gruma's product into a wide array of their own offerings, from popular snacks and baked goods to various other processed food items.

These clients have stringent demands for unwavering quality, substantial order volumes, and a dependable supply chain. Consequently, establishing and maintaining long-term, stable partnerships is paramount for Gruma to effectively serve this segment.

International Markets and Diverse Cultures

Gruma's international market segment is extensive, reaching customers across North and South America, Europe, Asia, and Oceania. This broad geographic reach allows Gruma to tap into diverse culinary traditions and evolving consumer preferences worldwide.

The company caters to a wide array of clients within these international markets, encompassing both individual retail consumers and larger foodservice and industrial partners. This dual approach enables Gruma to capture market share across different distribution channels.

Growth in these international segments is significantly driven by the escalating global popularity of Mexican cuisine and a sustained demand for flatbread products. For instance, in 2024, Gruma reported continued strong performance in its international divisions, with specific growth figures tied to the increasing adoption of corn-based products in non-traditional markets.

- Geographic Reach: Operations spanning North America, South America, Europe, Asia, and Oceania.

- Customer Base: Serves both retail consumers and foodservice/industrial clients globally.

- Growth Drivers: Increasing popularity of Mexican cuisine and demand for flatbreads internationally.

- Market Penetration: Leveraging diverse culinary traditions and consumer preferences for product adaptation.

Health-Conscious Consumers

Health-conscious consumers are a rapidly expanding market for Gruma, actively seeking out their specialized product lines. This group prioritizes nutritional advantages, leading them to choose options like low-carb, high-fiber, and gluten-free tortillas. Their demand fuels innovation and boosts sales in Gruma's premium product categories.

This segment's preferences are directly impacting Gruma's performance. For instance, in 2024, Gruma reported a notable increase in sales for its healthier alternatives, reflecting a clear market trend. The company's investment in these "better-for-you" options is proving to be a strategic success.

- Growing Demand: A significant portion of consumers now actively searches for products that align with specific dietary needs and health goals.

- Product Innovation Driver: The desire for low-carb, high-fiber, and gluten-free options encourages Gruma to develop and expand its product portfolio in these areas.

- Premium Category Growth: This customer segment is willing to pay a premium for products offering clear nutritional benefits, enhancing revenue for Gruma.

- Market Responsiveness: Gruma's focus on these health-conscious needs has resulted in positive sales figures and market reception throughout 2024.

Gruma’s customer segments are diverse, ranging from individual households seeking staple corn flour and tortillas to large-scale industrial food manufacturers requiring bulk ingredients. The company also serves the foodservice sector, supplying restaurants and institutions with essential components for their menus. International markets represent a significant and growing customer base, driven by the global appeal of Mexican cuisine.

In 2024, Gruma's retail segment, particularly in the U.S., demonstrated robust performance, with the tortilla market exceeding $10 billion. Health-conscious consumers represent a key growth area, with a notable increase in demand for specialized products like low-carb and gluten-free options, driving premium category sales.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Retail Consumers | Households seeking convenient, culturally relevant staples. | U.S. tortilla market > $10 billion; strong demand for Maseca, Mission, Guerrero. |

| Foodservice Operators | Restaurants, cafes, institutions using Gruma products as ingredients. | Fluctuating demand in 2024, with casual dining showing resilience. |

| Industrial Food Manufacturers | B2B clients needing bulk corn flour for snacks, baked goods, etc. | High demand for consistent quality and reliable supply chains. |

| International Markets | Global reach catering to diverse culinary traditions. | Growth fueled by Mexican cuisine popularity; strong performance in international divisions. |

| Health-Conscious Consumers | Seeking specialized, nutritious options (low-carb, gluten-free). | Notable sales increase for healthier alternatives in 2024. |

Cost Structure

The expense of acquiring corn and wheat, Gruma's foundational ingredients, represents a substantial element of its overall cost structure. For instance, in 2024, global corn prices saw volatility, impacting companies like Gruma that rely heavily on this commodity for tortilla and corn flour production.

Changes in the market prices of these agricultural goods directly influence Gruma's cost of goods sold. Effective sourcing and risk management techniques, such as futures contracts, are therefore vital for controlling this fluctuating expense and maintaining profitability.

Gruma's manufacturing and production expenses are a significant component of its cost structure, encompassing the day-to-day operations of its extensive network of factories. These costs include the essential elements of labor, the energy required to power the facilities, ongoing maintenance to keep equipment running smoothly, and the depreciation of valuable machinery over time.

Capital expenditures are also factored into this category, reflecting Gruma's commitment to growth and modernization. This means investments in expanding production capacity to meet rising demand and general upgrades to existing plants to enhance efficiency and incorporate new technologies are a regular part of their financial outlay. For instance, in 2023, Gruma reported capital expenditures of approximately $500 million, a substantial portion of which directly supports its manufacturing operations.

The company's focus on optimizing production efficiency is paramount to managing these costs effectively. By streamlining processes, reducing waste, and leveraging technology, Gruma aims to keep its manufacturing expenses in check, thereby improving its overall profitability. This strategic approach is crucial given the competitive nature of the global food industry, where cost control directly impacts market competitiveness.

Gruma's extensive global operations mean that logistics and distribution are significant cost drivers. These expenses encompass everything from shipping raw materials and finished goods across continents to managing warehouses and maintaining a vast distribution network to get products to consumers.

In 2024, Gruma, like many global food companies, faced upward pressure on these costs. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw significant fluctuations throughout the year, impacting Gruma's landed costs for imported ingredients and exported finished products. Efficient inventory management is crucial to mitigate these rising transportation expenses.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Gruma represent the costs of running the business beyond direct production. These include crucial elements like marketing campaigns to build brand awareness, sales commissions that incentivize revenue generation, salaries for administrative staff managing operations, and overall corporate overhead. For instance, Gruma’s SG&A expenses in 2023 were approximately $1.5 billion, reflecting significant investments in its global brand portfolio and distribution networks.

The company's commitment to expanding its market presence is evident in its SG&A. Increased spending on marketing and advertising is a direct strategy to capture consumer attention and loyalty for brands like Mission and Gruma. Similarly, higher sales commissions are a clear indicator of Gruma’s efforts to motivate its sales force and drive volume, particularly in key growth markets.

- Marketing and Advertising: Gruma allocated a substantial portion of its SG&A to promote its diverse product lines, including tortilla and corn flour brands, across various international markets.

- Sales Commissions: These variable costs are directly tied to sales performance, incentivizing the sales teams to achieve and exceed revenue targets.

- Administrative Salaries: This category covers compensation for essential support functions such as finance, human resources, and legal departments, ensuring smooth business operations.

- Corporate Overhead: Includes costs associated with managing the overall enterprise, such as executive salaries, office rent, and utilities for corporate headquarters.

Research and Development (R&D) Investment

Gruma's commitment to innovation is reflected in its significant Research and Development (R&D) investments, a crucial component of its cost structure. These expenditures are geared towards creating new products, especially within the growing 'better-for-you' segment, anticipating future market demands and ensuring sustained growth. This investment fuels the development, rigorous testing, and adoption of new technologies.

The company's R&D efforts translate into tangible costs that impact its overall financial outlay. For instance, in 2023, Gruma reported a notable increase in its investment in innovation and digitalization initiatives, which directly encompass R&D activities. These investments are vital for maintaining a competitive edge and developing differentiated product offerings.

- Product Development Expenses: Costs associated with conceptualizing, designing, and formulating new food products, particularly those focusing on health and wellness.

- Testing and Validation: Expenditures on sensory testing, nutritional analysis, shelf-life studies, and consumer trials to ensure product quality and market acceptance.

- Technological Advancements: Investment in new processing technologies, packaging innovations, and digital tools that enhance product development efficiency and product features.

Gruma's cost structure is heavily influenced by the procurement of raw materials, primarily corn and wheat, with global price fluctuations directly impacting its cost of goods sold. The company also incurs substantial manufacturing expenses, including labor, energy, and equipment maintenance, alongside significant capital expenditures for expansion and modernization, as evidenced by its approximately $500 million investment in manufacturing operations in 2023. Logistics and distribution costs are also considerable due to its global reach, with shipping expenses seeing upward pressure in 2024. Finally, Selling, General, and Administrative (SG&A) expenses, which totaled around $1.5 billion in 2023, cover marketing, sales, and administrative functions, while Research and Development (R&D) investments are crucial for innovation and product development.

| Cost Component | Key Drivers | 2023 Impact (Approx.) |

|---|---|---|

| Raw Materials (Corn, Wheat) | Global commodity prices, sourcing efficiency | Significant portion of Cost of Goods Sold |

| Manufacturing & Production | Labor, energy, maintenance, depreciation | Includes operational costs for extensive factory network |

| Capital Expenditures | Expansion, modernization, technology upgrades | ~$500 million invested in 2023 |

| Logistics & Distribution | Shipping, warehousing, network management | Upward cost pressures in 2024 |

| SG&A | Marketing, sales commissions, administration, overhead | ~$1.5 billion in 2023 |

| Research & Development | Product innovation, technology adoption | Increased investment in 2023 for digitalization |

Revenue Streams

Sales of corn flour, particularly under the well-recognized Maseca brand, form a core and substantial revenue generator for Gruma. This segment caters to a broad customer base, encompassing industrial clients who utilize the flour in their own manufacturing processes and individual consumers purchasing it for household consumption.

The corn flour division demonstrates resilience and growth potential, with industrial sales showing a clear trajectory toward recovery. Simultaneously, retail performance within this segment remains robust and positive, underscoring the continued demand for Maseca products at the consumer level.

Gruma's revenue from tortilla sales, particularly under its prominent Mission and Guerrero brands, forms a cornerstone of its financial performance. These sales span across various channels, including direct-to-consumer retail, partnerships with foodservice operators, and significant international market penetration.

The company has seen robust growth fueled by the increasing demand for healthier options, with its 'better-for-you' tortilla segment emerging as a key growth engine. For instance, in 2023, Gruma's sales reached approximately $5.5 billion, with its North American operations, heavily reliant on tortilla sales, showing strong performance.

Gruma's revenue streams extend beyond its core corn flour and tortilla products to include a variety of other food items. This diversification encompasses flatbreads like naan, pita, and chapatti, alongside pizza bases, snacks, pasta, rice, and condiments.

This broader product offering allows Gruma to capture a wider consumer base and tap into different market segments. For instance, in 2024, the company continued to see strong performance in its snack divisions, contributing significantly to its overall sales growth.

International Sales and Exports

International sales represent a substantial driver for Gruma, with a significant portion of its consolidated net sales originating from operations outside of Mexico. This global presence is crucial for diversifying revenue and mitigating risks associated with any single market's economic performance.

Gruma's extensive reach spans across America, Europe, Asia, and Oceania. This broad geographic footprint ensures that revenue streams are not overly dependent on one region, offering a buffer against localized economic downturns and currency fluctuations.

- International Sales Contribution: In 2023, Gruma's net sales from international operations accounted for a significant percentage of its total revenue, demonstrating the critical role of its global market presence.

- Geographic Diversification: The company's operations in over 100 countries across the Americas, Europe, Asia, and Oceania provide a robust diversification of its revenue base.

- Export Growth: Gruma actively engages in exports, contributing to its international sales figures and expanding its market reach beyond its physical production facilities.

- Market Penetration: The company's strategy involves deep penetration into key international markets, allowing it to capture market share and generate consistent revenue growth from these regions.

Licensing and Royalties (if applicable)

While Gruma's core business revolves around its extensive food product lines, the potential for revenue through licensing and royalties exists, particularly given its technological advancements. The company's expertise in large-scale corn flour and tortilla production, for instance, could be leveraged. While specific figures for 2024 are not publicly detailed for this revenue stream, Gruma's history of innovation suggests this as a viable, albeit perhaps secondary, income source.

Gruma's proprietary machinery, designed for efficient tortilla and corn flour manufacturing, presents an opportunity for licensing its technology. This could involve granting other companies the right to use Gruma's equipment designs or production processes in exchange for fees or royalties. This strategy is often employed by companies with specialized manufacturing capabilities.

- Licensing of Production Technology

- Brand Licensing for Niche Markets

- Royalties from Equipment Sales to Third Parties

Gruma's revenue is primarily driven by the sale of corn flour and tortillas, with its Maseca and Mission/Guerrero brands being key contributors. The company also generates income from a diverse range of other food products, including flatbreads, snacks, and pasta, broadening its market appeal. International operations are a significant revenue driver, with Gruma's presence across multiple continents diversifying its income streams and mitigating regional economic risks.

| Revenue Stream | Key Brands/Products | 2023 Net Sales (Approx.) | 2024 Outlook/Notes |

|---|---|---|---|

| Corn Flour | Maseca | Significant portion of total sales | Resilient industrial sales, robust retail performance |

| Tortillas & Flatbreads | Mission, Guerrero | Approximately $5.5 billion (total Gruma sales) | Strong growth in 'better-for-you' segment |

| Other Food Products | Snacks, Pasta, Rice, Condiments | Contributes to overall sales growth | Strong performance in snack divisions |

| International Sales | Global operations | Substantial percentage of consolidated net sales | Presence in Americas, Europe, Asia, Oceania |

Business Model Canvas Data Sources

Gruma's Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer preferences and competitor strategies, and operational data from its global supply chain. This multi-faceted approach ensures each component of the canvas is robust and strategically sound.