Gruma Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

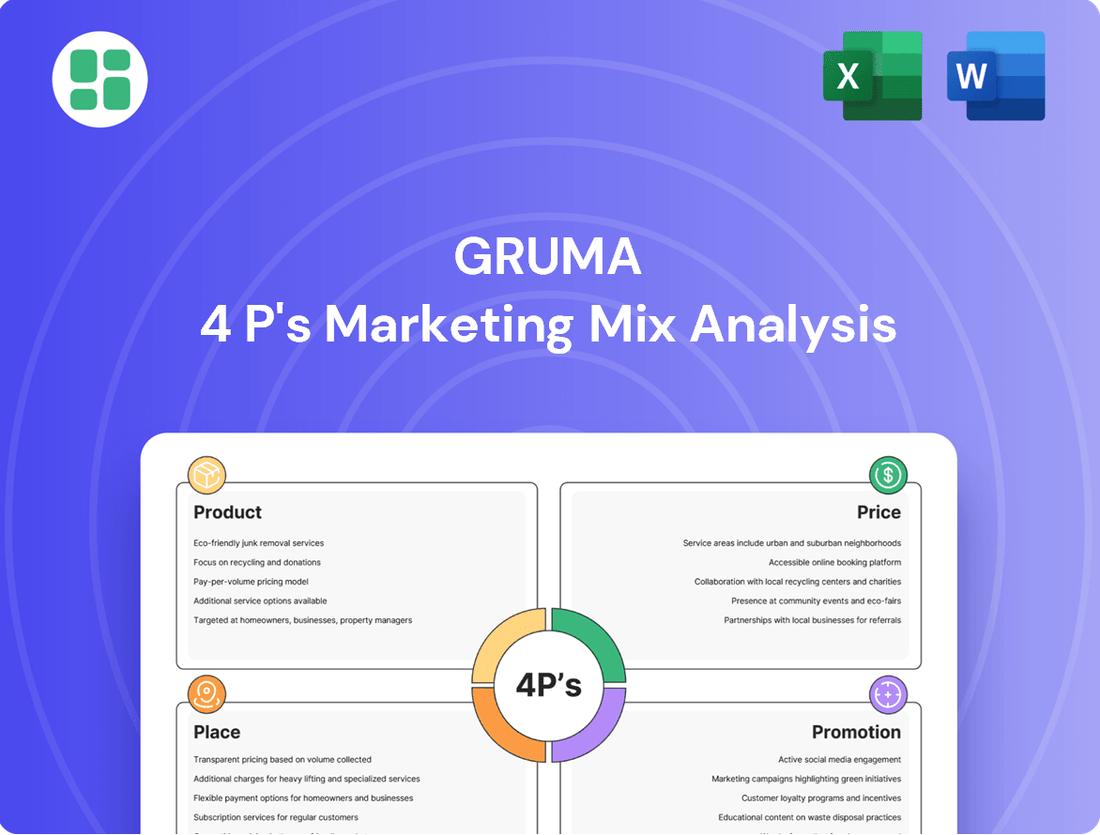

Discover how Gruma masterfully leverages its Product, Price, Place, and Promotion strategies to dominate the global tortilla and corn flour market. This analysis reveals the intricate connections between their diverse product portfolio, competitive pricing, extensive distribution networks, and impactful promotional campaigns.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Gruma’s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Gruma's staple foods portfolio is anchored by its flagship corn flour, Maseca, and a diverse range of tortillas under brands like Mission and Guerrero. These products form the bedrock of its global presence, serving as essential ingredients and meal components for millions. In 2024, Gruma's corn flour and tortilla segments continued to demonstrate robust demand, reflecting their indispensable role in consumer diets worldwide.

Gruma's 'Better For You' innovation is a key driver of its marketing mix, with a notable surge in performance, especially within the United States during 2024 and the first quarter of 2025. This strategic emphasis taps directly into growing consumer demand for healthier options.

The company is actively expanding its portfolio to include products with improved nutritional profiles. Examples include healthier wraps and snack options that are lower in fat and sodium, directly addressing consumer health consciousness. This focus is proving to be a significant growth area for Gruma.

Gruma excels at tailoring its product offerings to local preferences, a key aspect of its marketing strategy. This means developing items that resonate with the specific tastes and culinary traditions of consumers in different countries. For instance, the launch of Maseca Antojitos in Mexico caters directly to the demand for popular Mexican snacks.

In Costa Rica, Gruma introduced homestyle tortillas, demonstrating a deep understanding of regional food habits and a commitment to providing culturally relevant options. This localized approach ensures that Gruma's products feel familiar and appealing to consumers in diverse markets, driving market penetration and brand loyalty.

Strong Brand Recognition

Strong brand recognition is a cornerstone of Gruma's product strategy. Leveraging well-established names like Maseca, Mission, Robin Hood, and Guerrero, the company cultivates significant brand awareness and fosters deep consumer loyalty. These brands are not just product lines; they are integral to Gruma's global identity as a premier producer of essential food items.

This brand strength translates into tangible market advantages. For instance, Maseca, a leading corn flour brand, consistently dominates its category, contributing significantly to Gruma's overall sales volume. In 2024, Gruma reported that its branded products accounted for a substantial portion of its revenue, underscoring the power of its brand portfolio. This recognition allows Gruma to command premium pricing and maintain market share even in competitive environments.

- Maseca: Dominant market share in corn flour across North America and Latin America.

- Mission: Leading brand in tortillas and related products, particularly in the U.S.

- Robin Hood: Strong presence in the flour market, especially in Canada.

- Guerrero: Significant player in the Mexican and U.S. tortilla markets.

Continuous Enhancement

Gruma consistently invests in continuous enhancement, a key element of its marketing strategy. This focus is fueled by evolving market trends and consumer desires for greater convenience and novel product offerings. For instance, Gruma has actively developed pre-mixed ingredient solutions for popular traditional dishes, significantly simplifying home cooking for busy consumers.

The company's product line expansion is another testament to this commitment. Gruma aims to cater to a wider array of lifestyle needs and dietary preferences, ensuring its brands remain relevant and appealing across diverse demographics. This approach is crucial in a dynamic food industry where consumer tastes can shift rapidly.

Gruma's dedication to innovation is reflected in its financial performance. In 2024, the company reported a net sales increase, partly attributed to the successful introduction of new and improved product lines. This demonstrates a direct correlation between product enhancement efforts and tangible business growth, underscoring the effectiveness of this marketing pillar.

- Product Innovation: Gruma actively develops new product formulations and convenient meal solutions.

- Market Responsiveness: Enhancements are driven by consumer demand for new tastes and easier preparation methods.

- Portfolio Expansion: Gruma broadens its offerings to accommodate diverse lifestyles and dietary requirements.

- Sales Impact: Continuous product improvement contributes directly to Gruma's revenue growth, as seen in its 2024 sales figures.

Gruma's product strategy centers on its core offerings of corn flour and tortillas, bolstered by a commitment to health-focused innovations and localized flavor profiles. The company leverages strong brand equity in Maseca, Mission, and Guerrero to maintain market leadership. Continuous product enhancement, driven by consumer trends and a desire for convenience, fuels Gruma's sales growth and market relevance.

| Brand | Primary Product Category | Key Markets | 2024 Performance Highlight |

|---|---|---|---|

| Maseca | Corn Flour | North America, Latin America | Continued dominance in corn flour segment, driving significant sales volume. |

| Mission | Tortillas & Wraps | United States | Strong performance in the U.S. tortilla market, with growth in healthier options. |

| Guerrero | Tortillas | Mexico, United States | Maintained significant market share in key tortilla markets. |

| Robin Hood | Flour | Canada | Solid presence in the Canadian flour market. |

What is included in the product

This Gruma 4P's Marketing Mix Analysis offers a comprehensive examination of the company's Product, Price, Place, and Promotion strategies, providing actionable insights for strategic decision-making.

It delivers a professionally written, company-specific deep dive into Gruma's marketing positioning, grounded in actual brand practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering Gruma's market positioning.

Place

Gruma's extensive global footprint is a cornerstone of its marketing strategy, reaching consumers in over 100 countries across America, Europe, Asia, and Oceania. This vast network solidifies its leadership in corn flour and tortillas by tapping into diverse consumer preferences and market demands.

Gruma's strategic manufacturing network is a cornerstone of its global operations, encompassing roughly 75 plants positioned worldwide to optimize distribution. This extensive footprint ensures products reach consumers efficiently across diverse markets.

In 2024, Gruma reinforced this network by investing in capacity expansions, particularly in high-growth regions such as Europe, China, and Guatemala. These investments aim to bolster production capabilities and streamline supply chain logistics, anticipating increased demand and improving operational resilience.

Gruma leverages a diversified distribution strategy, effectively reaching consumers through a robust network of retail outlets, including supermarkets and convenience stores. This multi-channel approach ensures broad market penetration.

The company is also a significant player in the foodservice sector, supplying products to restaurants and other food service providers. While retail channels have demonstrated strong performance, Gruma is focusing on strategies to revitalize and stabilize volumes within its foodservice operations, aiming for a full recovery of this important segment.

Efficient Logistics and Supply Chain

Gruma's commitment to an efficient global logistics network is paramount for consistent product availability across its diverse markets. The company’s strategic focus on optimizing its supply chain ensures that products reach consumers precisely when and where they are desired, a key element in its marketing strategy.

Gruma's investments in operational infrastructure and plant modernization directly support this efficient logistics. These upgrades are designed to streamline processes, reduce lead times, and ultimately enhance the convenience offered to Gruma's broad customer base, from individual households to large food service providers.

- Global Reach: Gruma operates in over 110 countries, necessitating a robust and adaptable supply chain.

- Investment in Infrastructure: In 2023, Gruma continued its investment in plant upgrades and logistics optimization, aiming to improve efficiency by an estimated 5-7% by the end of 2024.

- Reduced Lead Times: The company targets a 10% reduction in average product lead times by mid-2025 through enhanced warehousing and transportation strategies.

- Customer Convenience: Focus on last-mile delivery improvements to ensure timely and convenient access to Gruma's product portfolio.

Market Penetration and Expansion

Gruma employs a dual strategy of deepening its presence in existing markets and venturing into new territories. This approach is evident in its efforts to secure new distributors across Europe, a key move to bolster its tortilla segment and broaden its product portfolio.

The company's market penetration is supported by a robust distribution network. For instance, Gruma's Maseca brand is a household name in many Latin American countries, demonstrating significant market share. In 2023, Gruma reported that its tortilla and corn flour business represented approximately 70% of its total sales, highlighting its success in penetrating core markets.

Gruma's expansion strategy is geographically diverse. The company has been actively investing in markets like China and India, recognizing their long-term growth potential. This expansion is not just about volume but also about introducing Gruma's core products and adapting them to local tastes, a strategy that has proven successful in various international markets.

- Deep Market Penetration: Gruma maintains a strong focus on increasing market share in its established regions, particularly with its tortilla and corn flour products.

- Strategic Geographic Expansion: The company actively seeks to enter and grow in new and emerging markets, diversifying its global footprint.

- Distribution Network Enhancement: Gruma consistently works to add and strengthen distributor relationships, as seen with its European expansion efforts for the tortilla business.

- Product Diversification: Expansion is often coupled with introducing a wider range of products to cater to new consumer preferences and capture additional market segments.

Gruma's place strategy centers on its vast global presence, reaching over 110 countries with a network of approximately 75 plants designed for efficient distribution. This extensive operational footprint ensures product availability across diverse markets. In 2024, Gruma continued to bolster this by investing in capacity expansions, particularly in growing regions like China and Europe, to meet anticipated demand and enhance supply chain resilience.

| Market Presence | Manufacturing Footprint | Key Expansion Investments (2024) |

|---|---|---|

| Over 110 countries | Approx. 75 plants globally | Europe, China, Guatemala |

Full Version Awaits

Gruma 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gruma 4P's Marketing Mix Analysis details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain immediate access to this fully completed analysis, ready for your strategic insights.

Promotion

Gruma's strategic marketing investment is a key component of its promotional strategy, evident in its elevated marketing expenses within selling, general, and administrative costs. For instance, in Q4 2024, these expenditures were notable, underscoring the company's dedication to brand visibility and consumer engagement.

This financial commitment allows Gruma to effectively communicate the value proposition of its diverse product portfolio and to carve out distinct brand identities in highly competitive food industry landscapes. Such investments are crucial for maintaining market share and driving future growth.

Gruma's promotional strategies are deeply rooted in understanding consumer behavior, employing creative campaigns that connect with their target markets. For instance, their 2024 initiatives likely leveraged digital platforms and social media to engage directly with consumers, a trend that saw significant growth in advertising spend across the food industry.

The company emphasizes tailoring messages to specific regions and cultural nuances, a crucial element for a global brand like Gruma. This localized approach enhances product relevance and appeal, particularly in diverse markets where consumer preferences can vary significantly. This strategy aligns with broader marketing trends showing increased effectiveness of personalized campaigns.

Brand building and awareness are vital for Gruma, particularly for its well-established brands like Maseca and Mission. Marketing efforts focus on showcasing the rich history, consistent quality, and diverse uses of their products. This strategy aims to cultivate enduring consumer confidence and a loyal customer base.

Emphasis on Health and Wellness Benefits

Gruma's promotional efforts frequently spotlight the health and wellness advantages of its diverse product portfolio. This strategy directly addresses the growing consumer demand for nutritious food options, a trend that has significantly shaped the food industry in recent years.

The company actively promotes 'Better For You' attributes across its brands, resonating with consumers seeking healthier alternatives. For instance, in 2023, the global market for healthy foods was valued at over $1 trillion, with a projected compound annual growth rate (CAGR) of 7.5% through 2030, underscoring the significant market opportunity Gruma is tapping into.

This emphasis on health aligns with evolving dietary preferences and a greater awareness of the link between food and well-being. Gruma's communication often features:

- Reduced sodium and fat content in specific product lines.

- Inclusion of whole grains and fiber in baked goods and snacks.

- Marketing campaigns that educate consumers on the nutritional benefits of corn-based products.

- Partnerships with health and wellness influencers to amplify messaging.

Partnerships and Sponsorships

Gruma leverages partnerships and sponsorships to extend its market reach beyond conventional advertising. A prime example is the multi-year IndyCar partnership between Arrow McLaren SP and Mission Foods, which significantly boosts brand visibility. This collaboration taps into the passion of motorsports fans, aligning Mission Foods with a dynamic and engaged audience.

These strategic alliances are designed to create deeper connections by associating Gruma brands with shared interests and values. For instance, Mission Foods' involvement in motorsports allows it to connect with a demographic that appreciates performance and excitement, translating into enhanced brand recall and affinity.

The financial impact of such partnerships is substantial. While specific figures for the Arrow McLaren SP deal are not publicly disclosed, similar high-profile sponsorships in motorsports can cost millions annually, indicating a significant investment by Gruma. This investment aims to yield returns through increased brand equity and market penetration.

- Brand Visibility: Partnerships like the Arrow McLaren SP deal expose Gruma brands to millions of IndyCar fans globally.

- Audience Engagement: Aligning with motorsports allows Gruma to connect with a passionate and dedicated consumer base.

- Market Penetration: Strategic sponsorships can open doors to new demographic segments and geographic markets.

- Brand Association: Associating with successful teams and events can positively influence consumer perception of Gruma's products.

Gruma's promotional strategy centers on robust marketing investments, as seen in its elevated SG&A expenses, particularly in Q4 2024, to boost brand visibility and consumer engagement. This financial commitment supports the communication of its diverse product value and the establishment of distinct brand identities in competitive markets.

The company's campaigns are informed by consumer behavior, often utilizing digital and social media to connect directly with audiences, a strategy that saw increased ad spend across the food sector in 2024. Gruma also tailors messaging to regional and cultural nuances, enhancing product appeal and aligning with the proven effectiveness of personalized campaigns.

Brand building for flagship products like Maseca and Mission focuses on heritage, quality, and versatility to foster consumer confidence. Furthermore, Gruma actively promotes health and wellness attributes, tapping into the over $1 trillion global healthy foods market, which is projected to grow at a 7.5% CAGR through 2030.

Strategic partnerships, such as the multi-year Arrow McLaren SP and Mission Foods IndyCar deal, significantly enhance brand visibility and audience engagement. These alliances, while costly, aim to build brand equity and penetrate new markets by associating Gruma with shared values and dynamic events.

| Promotional Tactic | Objective | Example/Data Point |

|---|---|---|

| Marketing Investment | Brand Visibility & Engagement | Elevated SG&A expenses in Q4 2024 |

| Digital & Social Media | Direct Consumer Connection | Increased ad spend across food industry in 2024 |

| Health & Wellness Focus | Tap into Growing Market | Global healthy foods market >$1 trillion (2023), 7.5% CAGR |

| Strategic Partnerships | Brand Equity & Market Reach | Arrow McLaren SP & Mission Foods IndyCar Deal |

Price

Gruma’s value-based pricing strategy aligns its product costs with the perceived worth to consumers, acknowledging its consistent quality and strong brand recognition. This approach underpins its market standing as a premier global provider of staple food products.

For instance, in 2023, Gruma reported net sales of approximately $5.5 billion, reflecting consumer willingness to pay a premium for their trusted brands like Mission and Guerrero, which are synonymous with reliability and quality in the tortilla and corn flour markets.

Gruma's dynamic pricing strategy is crucial for managing profitability, especially given the volatility in corn prices, a key ingredient. For instance, in early 2024, corn futures saw significant fluctuations due to weather patterns and global supply concerns, directly impacting production costs.

The company actively adjusts pricing to reflect these shifts, ensuring that revenue streams remain aligned with escalating raw material expenses. This approach is vital for maintaining healthy profit margins in a competitive market, as Gruma navigates the economic landscape of 2024 and beyond.

Gruma actively tracks competitor pricing, particularly against private label offerings, to safeguard its market position. For instance, in the highly competitive tortilla segment, Gruma has historically responded to aggressive private label pricing with targeted promotions and value packs to retain customer loyalty, a strategy likely to continue through 2024 and 2025.

Impact of Currency Fluctuations

The Mexican Peso's weakness against the US Dollar has directly affected Gruma's reported net sales from its Mexican operations. When Gruma translates these peso-denominated sales into US dollars for its financial reporting, a weaker peso means those sales are worth less in dollar terms. This currency effect is a significant consideration in understanding the company's overall revenue performance.

For instance, during the first quarter of 2024, Gruma reported that currency headwinds, primarily from the peso's depreciation, impacted its reported sales. While specific figures can fluctuate, this trend underscores how macroeconomic factors like exchange rates can influence a company's top-line results, even if underlying sales volumes remain strong in local currency.

- Currency Translation Impact: A weaker Mexican Peso reduces the USD value of Gruma's Mexican sales.

- Macroeconomic Influence: Exchange rate volatility directly affects reported financial outcomes.

- 2024 Observations: Early 2024 data indicated currency headwinds negatively influencing Gruma's reported sales.

Segmented and Mix-Driven Pricing

Gruma utilizes segmented pricing, tailoring approaches for distinct channels like retail and foodservice. This strategy acknowledges varying customer sensitivities and competitive landscapes in each segment, aiming to capture maximum value. For instance, pricing for bulk foodservice orders might differ significantly from individual retail unit prices.

The company also emphasizes a product mix strategy to enhance profitability. By focusing on higher-margin items within its portfolio, Gruma can effectively drive both revenue and EBITDA growth. This means strategically promoting and pricing products that contribute more significantly to the bottom line.

This dual approach of segmented and mix-driven pricing provides Gruma with considerable financial flexibility. It allows the company to adapt to market dynamics while optimizing its overall financial performance. For example, in its 2024 outlook, Gruma anticipated continued strength in its foodservice segment, which typically carries higher margins than retail.

- Retail vs. Foodservice Pricing: Gruma adjusts prices based on channel, recognizing different value perceptions and cost structures.

- Product Mix Optimization: Strategic emphasis on higher-margin products to boost overall profitability and EBITDA.

- Financial Flexibility: The combined strategies allow for dynamic pricing and revenue management.

- 2024 Projections: Anticipated continued margin advantages from the foodservice channel, supporting EBITDA growth targets.

Gruma's pricing strategy is a sophisticated blend of value-based, dynamic, and segmented approaches. This multi-faceted strategy allows them to capture diverse market segments effectively. For instance, their premium branding, exemplified by Mission tortillas, commands higher prices due to strong consumer trust and perceived quality, a factor evident in their 2023 net sales of approximately $5.5 billion.

The company adeptly navigates raw material cost fluctuations, particularly with corn. In early 2024, volatile corn futures necessitated price adjustments to maintain profitability, a direct response to production cost shifts. This dynamic pricing is critical for managing margins against an unstable cost base.

Gruma also employs segmented pricing, differentiating between retail and foodservice channels. This acknowledges varying price sensitivities and competitive pressures, with foodservice often offering higher margins. Their 2024 outlook highlighted expected continued strength in foodservice, reinforcing this margin-enhancing strategy.

Furthermore, Gruma actively monitors competitor pricing, especially against private labels, implementing targeted promotions to retain market share. This competitive pricing stance is crucial for defending their position in key markets like the tortilla segment.

| Pricing Strategy Component | Description | Example/Impact |

| Value-Based Pricing | Aligns price with perceived consumer value and brand strength. | Premium pricing for Mission tortillas, contributing to $5.5B in 2023 net sales. |

| Dynamic Pricing | Adjusts prices based on cost fluctuations, especially raw materials. | Responding to early 2024 corn futures volatility to protect profit margins. |

| Segmented Pricing | Tailors pricing for different channels like retail and foodservice. | Higher margins anticipated from foodservice in 2024 compared to retail. |

| Competitive Pricing | Monitors and responds to competitor pricing, including private labels. | Targeted promotions to counter aggressive private label pricing in the tortilla market. |

4P's Marketing Mix Analysis Data Sources

Our Gruma 4P's Marketing Mix Analysis is grounded in a robust combination of official company disclosures, including annual reports and investor presentations, alongside detailed industry research and competitive intelligence. We also leverage publicly available data on Gruma's product portfolio, pricing strategies, distribution networks, and promotional activities.