Gruma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Understand how political stability, economic fluctuations, and evolving social trends are shaping Gruma's global operations. This comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces. Download the full version to gain a strategic advantage and make informed decisions for Gruma's future.

Political factors

Changes in agricultural policies and subsidies, such as those impacting corn and wheat prices, directly influence Gruma's primary raw material costs. For instance, the U.S. Farm Bill and similar agricultural support programs in Mexico and other operating countries can create cost volatility. Furthermore, international trade agreements like the United States-Mexico-Canada Agreement (USMCA) shape market access and tariff structures for Gruma's products and inputs.

Political stability in Gruma's key markets, including Mexico, the United States, and Central America, is crucial for maintaining reliable supply chains and attracting ongoing investment. Unforeseen political shifts or instability can disrupt operations, increase security costs, and deter capital expenditures. Gruma's global operations necessitate careful navigation of diverse and evolving regulatory environments, from food safety standards to labor laws.

Gruma, as a global food producer, must navigate a complex web of food safety and quality control regulations. These rules, enforced by bodies like the U.S. Food and Drug Administration (FDA) and equivalent international agencies, dictate everything from ingredient sourcing to manufacturing practices. For instance, in 2024, the FDA continued its focus on preventing foodborne illnesses, with ongoing initiatives like the New Era of Smarter Food Safety Blueprint impacting how companies like Gruma operate and innovate.

Adherence to these diverse national and international standards is not merely a procedural requirement but a critical factor for market access and consumer trust. Failure to comply can result in severe consequences, including costly product recalls, significant fines, and lasting damage to Gruma's brand reputation. In 2023, the U.S. saw numerous food recalls impacting various product categories, underscoring the financial and reputational risks associated with non-compliance.

Global geopolitical tensions, including ongoing conflicts in Eastern Europe and the Middle East, continue to pose significant risks to supply chains. For Gruma, this translates to potential disruptions in sourcing key ingredients like corn, a staple for its tortilla and corn flour products. For instance, the Black Sea Grain Initiative, which facilitated grain exports from Ukraine, faced significant challenges and eventual collapse in mid-2023, impacting global grain flows and contributing to price volatility.

These geopolitical instabilities directly affect Gruma's operational costs. Increased energy prices due to conflicts can drive up transportation expenses for raw materials and finished goods, impacting profit margins. Furthermore, consumer demand in regions experiencing heightened conflict or political uncertainty can decrease, affecting Gruma's sales performance in those specific markets.

Agricultural Subsidies and Tariffs

Government subsidies for corn production, particularly in key regions like the United States, significantly influence global corn prices, a crucial factor for Gruma’s cost of goods. For instance, the U.S. Department of Agriculture reported that corn received substantial support through direct payments and crop insurance programs in recent years, bolstering supply and stabilizing prices, which benefits Gruma's procurement strategy.

Conversely, import tariffs on corn flour and finished products like tortillas can create market access challenges and necessitate adjustments to Gruma's pricing and distribution models. For example, in 2024, ongoing trade discussions and potential tariff adjustments in certain Latin American or European markets could impact Gruma's ability to compete on price, requiring agile market entry strategies and localized production.

- Subsidies Impact: Government support for corn farmers, such as those in the U.S., can lead to lower and more stable raw material costs for Gruma.

- Tariff Effects: Import duties on corn-based products can increase Gruma's operational costs in specific markets or necessitate higher consumer prices.

- Market Adaptation: Gruma must continually adapt its pricing and sourcing strategies to navigate fluctuating subsidy programs and trade policies globally.

- Competitiveness: Tariffs can directly affect Gruma's price competitiveness against local producers in markets where such duties are applied.

Political Risk in Emerging Markets

Gruma's strategic focus on emerging markets, while offering significant growth potential, inherently exposes the company to heightened political risks. These can range from unexpected government interventions like expropriation or nationalization to more subtle but impactful shifts in regulatory frameworks or trade policies. For instance, in 2024, several emerging economies experienced significant political transitions, leading to policy uncertainties that could affect foreign direct investment.

Mitigating these political risks is paramount for Gruma's long-term success. This involves thorough due diligence, understanding local political landscapes, and potentially diversifying operations across a wider array of emerging markets to avoid over-reliance on any single region. Gruma's investment decisions in 2025 will likely be heavily influenced by ongoing geopolitical developments and the stability of governance in its target expansion territories.

Key political factors Gruma must monitor include:

- Government Stability: The likelihood of coups, civil unrest, or frequent changes in leadership can disrupt operations and investment security.

- Regulatory Environment: Sudden changes in taxation, labor laws, environmental regulations, or food safety standards can impact profitability.

- Trade Policies: Protectionist measures, tariffs, or import/export restrictions can affect Gruma's supply chain and market access.

- Expropriation Risk: The possibility of the government seizing company assets, though less common, remains a significant concern in some emerging markets.

Government stability in Gruma's operating regions directly impacts its supply chain reliability and investment security. For example, political transitions in emerging markets during 2024 can introduce policy uncertainties affecting foreign direct investment. Navigating diverse regulatory environments, including food safety standards and labor laws, is critical for Gruma’s global operations.

Trade policies and tariffs significantly influence Gruma's market access and competitiveness. In 2024, potential tariff adjustments in Latin American markets could affect pricing strategies for its corn-based products. Government subsidies for corn production, such as those in the U.S. reported by the USDA, can stabilize raw material costs, benefiting Gruma's procurement.

Geopolitical tensions, like those in Eastern Europe, can disrupt key ingredient supply chains, such as corn, impacting Gruma's production costs. For instance, the challenges faced by the Black Sea Grain Initiative in 2023 highlighted global grain flow vulnerabilities. Increased energy prices due to conflicts also raise transportation expenses for Gruma.

What is included in the product

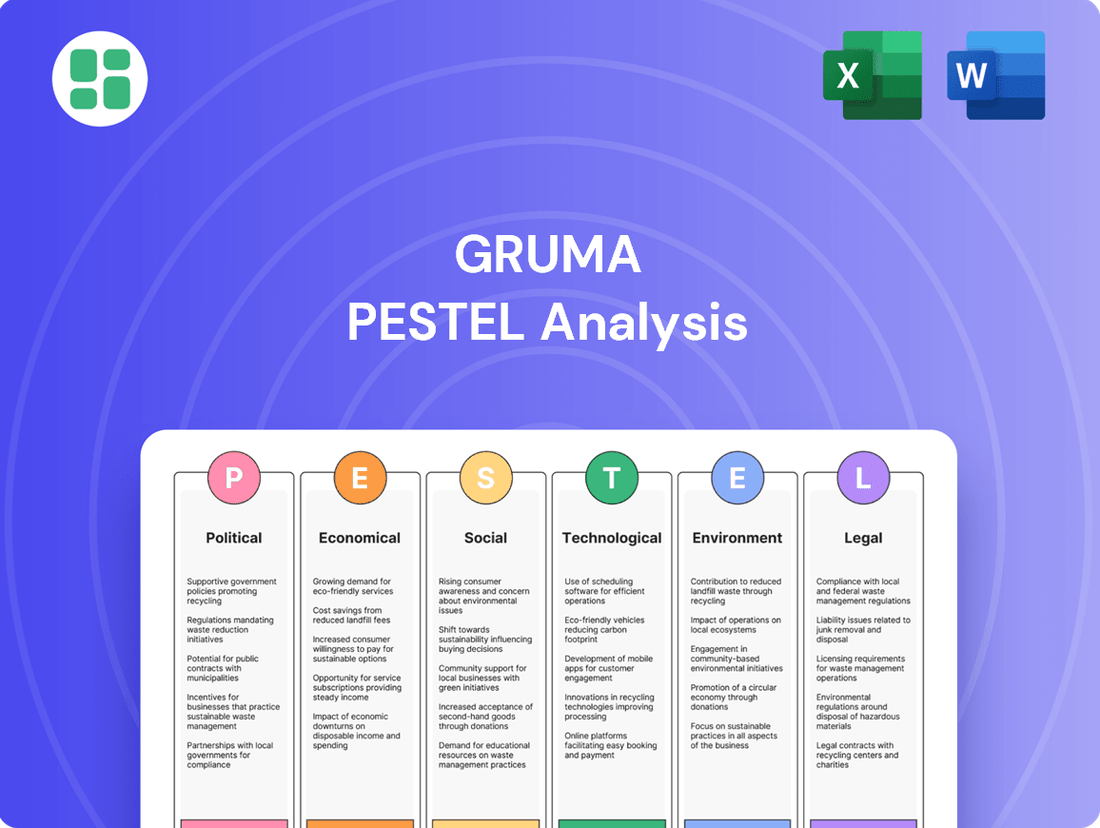

This Gruma PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering political, economic, social, technological, environmental, and legal influences.

A clear, actionable PESTLE analysis for Gruma, highlighting key external factors that can be leveraged to proactively address market challenges and capitalize on opportunities.

Economic factors

Global commodity prices, particularly for corn, are a critical factor for Gruma. Corn is Gruma's main ingredient, and its price is heavily influenced by things like how much is available globally, what people want, weather conditions, and even international relations. For example, in early 2024, corn prices saw volatility due to supply concerns in key producing regions, impacting Gruma's raw material costs.

These price swings directly affect Gruma's expenses and how much profit it can make. To manage this, Gruma likely uses advanced strategies to protect itself from price changes and carefully manages its supply chain to ensure a steady flow of corn.

Rising inflation is a significant concern for Gruma. For instance, in the US, a key market, inflation reached 3.4% in April 2024, impacting raw material costs and logistics. This means Gruma likely faces higher expenses for ingredients like corn and wheat, as well as for transporting its products.

Simultaneously, this inflation erodes consumer purchasing power. As households have less disposable income, they may cut back on non-essential items or seek cheaper alternatives. Gruma needs to carefully manage its pricing strategies for brands like Mission tortillas to remain competitive while absorbing some of these increased costs.

As a global food company, Gruma's financial performance is significantly influenced by currency exchange rate fluctuations. For instance, in 2024, the strengthening of the US dollar against currencies like the Mexican peso or the euro could impact Gruma's reported earnings when repatriated from its operations in those regions.

A robust local currency in a market where Gruma has a strong presence, such as Mexico or Europe, can lead to higher prices for its corn flour and tortilla products, potentially affecting sales volumes. Conversely, a depreciating currency can increase the cost of essential imported raw materials, squeezing profit margins.

For example, if Gruma imports significant amounts of wheat or specialized ingredients into Mexico, a weaker peso in 2024 would directly translate to higher input costs. This necessitates careful hedging strategies to mitigate the financial impact of these volatile exchange rates on Gruma's overall profitability.

Economic Growth and Consumer Spending

Gruma's performance is closely tied to the overall economic growth in its key markets, as this directly impacts consumer spending on food. For instance, in 2024, many economies are experiencing moderate growth, which generally supports increased demand for Gruma's diverse product portfolio, including value-added and convenience items. Conversely, economic slowdowns can lead consumers to prioritize more basic food staples, potentially affecting sales of premium products.

Consumer spending patterns are a critical indicator for Gruma. In 2024, reports suggest a continued resilience in food spending, even amidst inflationary pressures in some regions. This trend benefits Gruma as consumers maintain their purchasing habits for essential and convenient food options. However, significant shifts in disposable income, influenced by factors like inflation or employment rates, can rapidly alter demand for Gruma's offerings.

- Economic Growth Influence: In 2024, countries like Mexico and the United States, Gruma's primary markets, are projected to see GDP growth in the range of 2-3%, supporting consumer purchasing power for food products.

- Spending Shifts: During economic downturns, there's a noted tendency for consumers to trade down to private label brands or less processed goods, which Gruma strategically addresses through its broad product range.

- Demand for Convenience: As economies strengthen, demand for convenient and ready-to-eat food items, a key segment for Gruma, typically rises, reflecting busy lifestyles and increased disposable income.

Interest Rates and Access to Capital

Changes in interest rates directly impact Gruma's financial flexibility. For instance, if the U.S. Federal Reserve raises its benchmark rate, as it has done significantly in 2022-2023 to combat inflation, Gruma's costs for new loans or refinancing existing debt will likely increase. This rise in borrowing costs can make large-scale expansion projects, such as building new tortilla plants or acquiring smaller food companies, more expensive, potentially slowing down strategic growth initiatives.

Access to affordable capital is crucial for Gruma's continued investment in innovation and market expansion. In 2024, many emerging markets where Gruma operates may still face higher interest rate environments compared to developed economies, affecting the cost of capital. Gruma's ability to secure favorable financing terms for its capital expenditures, which were around $700 million in 2023 for growth and modernization, is directly tied to the prevailing interest rate landscape.

- Impact of Rising Rates: Higher interest rates increase Gruma's expense for servicing its debt, affecting profitability.

- Capital Investment Sensitivity: Gruma's planned capital expenditures, vital for maintaining competitiveness, become more costly with elevated interest rates.

- Debt Refinancing Challenges: Refinancing existing debt at higher rates can strain cash flow, especially for a company with significant global operations.

- Access to Funds: The overall availability and cost of capital in markets like Mexico and the U.S. in 2024 will dictate the pace of Gruma's strategic acquisitions and organic growth projects.

Gruma's profitability is significantly influenced by global economic conditions, particularly in its key markets like Mexico and the United States. For instance, in 2024, projected GDP growth in these regions, estimated between 2-3%, generally supports consumer spending on food products, benefiting Gruma's sales volumes. However, shifts towards value-oriented brands or private labels during economic slowdowns require Gruma to strategically leverage its diverse product portfolio to maintain market share.

Consumer spending resilience on food, even amid inflation in 2024, is a positive indicator for Gruma. This trend highlights consistent demand for convenient and essential food items. Yet, fluctuations in disposable income, driven by inflation or employment, can quickly alter purchasing behavior, necessitating agile pricing and product strategies for brands like Mission tortillas.

Interest rate environments in 2024 directly impact Gruma's cost of capital for investments. For example, higher rates in emerging markets can increase the expense of servicing debt and financing capital expenditures, which were around $700 million in 2023. This makes strategic acquisitions and organic growth projects more costly, potentially moderating expansion pace.

| Economic Factor | 2024 Projection/Data | Impact on Gruma |

| GDP Growth (Mexico & US) | 2-3% | Supports consumer spending and demand for Gruma's products. |

| Inflation (US) | 3.4% (April 2024) | Increases raw material, logistics, and operational costs; necessitates careful pricing. |

| Interest Rates (Global) | Varies by region, generally higher in emerging markets | Increases borrowing costs for capital expenditures and debt servicing. |

| Currency Exchange Rates | Fluctuating (e.g., USD vs. MXN, EUR) | Affects reported earnings from international operations and cost of imported materials. |

Preview Before You Purchase

Gruma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gruma PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into Gruma's strategic landscape and potential future challenges and opportunities.

Sociological factors

Consumers are increasingly prioritizing health and wellness, boosting demand for healthier foods like whole grains, gluten-free options, and items with fewer artificial ingredients. This shift is evident in the U.S. market where sales of plant-based foods, often perceived as healthier, reached $8 billion in 2023, according to the Plant Based Foods Association.

Gruma must adapt its product offerings to align with these evolving consumer preferences. This could involve fortifying existing products, such as corn tortillas, with added nutrients or expanding into organic and non-GMO product lines, mirroring the growth seen in the organic food sector which was valued at over $270 billion globally in 2023.

Gruma's deep roots in corn flour and tortilla production highlight the profound cultural significance of these staples, especially in Latin America and the growing US Hispanic market. For instance, in 2023, the US tortilla market alone was valued at over $10 billion, demonstrating the substantial consumer base for Gruma's core products.

Successfully navigating these markets requires a keen understanding of diverse regional and cultural food preparation methods and consumption patterns. Gruma's ability to adapt its product offerings, such as offering different tortilla sizes or corn flour types, directly impacts product acceptance and market penetration, as seen in their continued growth within these demographics.

Global urbanization continues to accelerate, with projections indicating that by 2050, 68% of the world's population will reside in urban areas, a significant jump from 56% in 2021. This shift fosters a faster-paced lifestyle, naturally boosting the demand for convenient, ready-to-eat food options. Gruma is well-positioned to meet this growing need by expanding its range of easily prepared tortillas, innovative pre-packaged meal kits, and other convenient formats designed for busy urban consumers.

Demographic Shifts and Population Growth

Gruma's business is intrinsically linked to population dynamics. The United Nations projects global population to reach 9.7 billion by 2050, with significant growth concentrated in Africa and Asia. This expansion, especially in regions where corn flour and tortilla-based products are staples, offers a substantial organic demand increase for Gruma's offerings.

Understanding generational preferences is also key. For instance, younger consumers in the US, a significant market for Gruma, are increasingly seeking convenient, plant-based, and globally inspired food options. Gruma's ability to adapt its product portfolio to these evolving tastes, perhaps through innovation in its Mission or Guerrero brands, will be crucial for sustained growth. In 2023, the global food market was valued at over $8.5 trillion, underscoring the immense scale of opportunity tied to demographic trends.

- Population Growth: Global population is expected to reach 9.7 billion by 2050, with developing nations driving much of this increase, creating natural demand for Gruma's core products.

- Emerging Market Focus: Gruma's presence in Mexico and Latin America, areas experiencing robust population growth, directly benefits from these demographic tailwinds.

- Consumer Preferences: Shifting dietary habits, particularly among younger demographics in key markets like the United States, necessitate product innovation and marketing adjustments for Gruma.

Ethical Consumption and Brand Image

Consumers are increasingly scrutinizing the ethical dimensions of their food choices, focusing on ingredient sourcing, labor conditions, and the environmental footprint of food production. This trend is particularly strong among younger demographics, with studies in 2024 indicating that over 60% of Gen Z consumers consider a brand's ethical practices when making purchasing decisions.

Gruma's proactive stance on sustainability, such as its investments in water conservation technologies which reduced water usage by 15% across its Mexican operations in 2023, and its commitment to fair trade principles, can significantly bolster its brand image. This resonates with a growing segment of socially conscious consumers who are willing to pay a premium for products aligned with their values.

For instance, Gruma's "Sembrando Oportunidades" (Sowing Opportunities) program, which supports smallholder farmers in Mexico, not only enhances its ethical credentials but also builds a more resilient and transparent supply chain. This focus on corporate social responsibility is becoming a key differentiator in the competitive food industry.

- Growing Consumer Demand: Over 60% of Gen Z consumers consider ethical practices in purchasing decisions (2024 data).

- Sustainability Investments: Gruma achieved a 15% reduction in water usage in Mexican operations in 2023 through technological upgrades.

- Fair Trade Appeal: Commitment to fair trade principles enhances brand trust and market appeal.

- Supply Chain Transparency: Programs like "Sembrando Oportunidades" improve ethical sourcing and build consumer confidence.

Sociological factors significantly influence Gruma's market position, driven by evolving consumer health consciousness and a growing demand for convenient, health-oriented food options. The increasing urbanization trend, with 68% of the global population projected to live in urban areas by 2050, further fuels the need for ready-to-eat and easily prepared food products, a segment where Gruma is strategically expanding its offerings.

Population growth, particularly in developing regions, presents a substantial opportunity for Gruma, as corn flour and tortillas are staple foods in many of these areas. Understanding and adapting to generational preferences, such as younger consumers' inclination towards plant-based and globally inspired foods, is crucial for Gruma's continued success and product innovation within its key markets.

Consumers are increasingly prioritizing ethical sourcing and sustainability, with over 60% of Gen Z consumers considering a brand's ethical practices in 2024. Gruma's investments in water conservation, achieving a 15% reduction in water usage in its Mexican operations in 2023, and its commitment to fair trade principles through programs like Sembrando Oportunidades, directly address these concerns, enhancing brand trust and appeal.

| Sociological Factor | Impact on Gruma | Supporting Data (2023-2025) |

|---|---|---|

| Health and Wellness Trends | Increased demand for healthier food options. | Plant-based food sales reached $8 billion in the U.S. (2023). Global organic food market valued over $270 billion (2023). |

| Urbanization | Boosts demand for convenient, ready-to-eat foods. | 68% of the world's population projected to be urban by 2050. |

| Population Growth | Creates organic demand for staple products. | Global population projected to reach 9.7 billion by 2050. |

| Generational Preferences | Requires product innovation for younger consumers. | Global food market valued at over $8.5 trillion (2023). |

| Ethical Consumerism | Enhances brand image and consumer loyalty. | Over 60% of Gen Z consider ethical practices (2024). Gruma reduced water usage by 15% in Mexican operations (2023). |

Technological factors

Advancements in automation and robotics are poised to significantly boost Gruma's production efficiency. By integrating sophisticated machinery in its corn flour and tortilla manufacturing, the company can expect improved output consistency and reduced labor expenses. For instance, the global industrial robotics market is projected to reach over $100 billion by 2025, highlighting the increasing adoption of such technologies across industries.

Advancements in food processing, like precision milling and natural preservation techniques, are crucial for Gruma's innovation. These technologies enhance product quality and safety, extending shelf life and allowing for novel product development. For instance, the global food processing market was valued at approximately $670.5 billion in 2023 and is projected to reach $998.7 billion by 2030, indicating significant growth driven by technological adoption.

Gruma can leverage these evolving technologies to create a more diverse portfolio, meeting consumer demand for healthier and more convenient options. Innovations in extrusion, for example, enable the creation of snacks with improved textures and nutritional profiles, a key area for growth in the food industry. The market for extruded snacks alone was estimated to be worth over $30 billion in 2023, showcasing the potential for companies like Gruma.

Gruma's integration of digital technologies like IoT, AI, and blockchain is set to revolutionize its global supply chain. These advancements can significantly boost traceability, minimize waste, and streamline logistics, from acquiring raw materials to delivering finished goods. For instance, by 2024, the global supply chain management market is projected to reach $34.1 billion, highlighting the increasing investment in such digital solutions.

This digital transformation directly translates to tangible benefits for Gruma, including substantial cost savings and a more agile response to market demands. By optimizing inventory management and predicting potential disruptions, Gruma can enhance its operational efficiency. Reports indicate that companies leveraging AI in their supply chains can see a reduction in operational costs by up to 15%.

E-commerce and Digital Distribution

The burgeoning e-commerce landscape offers Gruma significant opportunities to directly engage with consumers and broaden its market presence. By leveraging digital platforms and optimizing online distribution, Gruma can tap into new customer segments and expand sales beyond conventional retail channels. This shift is particularly impactful for reaching niche markets or introducing specialized product lines. For instance, global e-commerce sales were projected to reach $6.3 trillion in 2024, a figure expected to climb further. This growth underscores the potential for Gruma to enhance its market penetration through robust digital strategies.

Investing in direct-to-consumer (DTC) models and enhancing online sales capabilities are crucial for Gruma's future growth. This approach allows for greater control over the customer experience and can foster stronger brand loyalty. As of early 2025, a significant portion of consumer packaged goods (CPG) sales are increasingly influenced by online research and purchasing. This trend necessitates a strong digital infrastructure for Gruma to remain competitive.

- E-commerce Growth: Global e-commerce is a rapidly expanding sector, presenting a vast digital marketplace for Gruma's products.

- Direct-to-Consumer (DTC) Potential: DTC models allow Gruma to build direct relationships with customers, increasing engagement and potentially margins.

- Niche Market Access: Digital channels provide efficient pathways to reach specialized consumer groups interested in unique or regional Gruma offerings.

- Digital Distribution Optimization: Streamlining online logistics and delivery is key to capitalizing on the convenience consumers expect from e-commerce.

Research and Development in Ingredient Innovation

Gruma's commitment to continuous research and development in ingredient innovation is a significant technological driver. By focusing on areas like advanced corn varieties and novel fortification techniques, the company aims to create products that are not only healthier but also offer enhanced nutritional profiles. This innovation is crucial for adapting to changing consumer preferences for wellness and sustainability in the food sector.

This focus on R&D allows Gruma to develop functionally superior ingredients and finished goods, giving them a competitive advantage. For instance, advancements in processing technologies can lead to improved texture, shelf-life, or digestibility of their corn-based products. The company's investment in these areas directly impacts its ability to meet evolving market demands for convenience and health.

Gruma's R&D efforts in 2024 and projected into 2025 likely include exploring alternative ingredients and sustainable sourcing methods. Such initiatives are vital for staying ahead in an increasingly conscious consumer market. For example, research into plant-based protein sources or climate-resilient corn strains could yield significant breakthroughs.

- Corn Variety Advancements: Gruma invests in research to develop corn varieties with improved yields, nutritional content, and resistance to pests and diseases, crucial for consistent supply and quality.

- Fortification Technologies: Ongoing R&D focuses on effective methods for fortifying corn products with essential vitamins and minerals, addressing public health concerns and consumer demand for fortified foods.

- Alternative Ingredient Exploration: The company actively researches and tests alternative ingredients, including plant-based proteins and ancient grains, to diversify its product portfolio and cater to evolving dietary trends.

- Sustainable Processing Techniques: Gruma explores and implements technological advancements in processing to reduce environmental impact, improve efficiency, and enhance the nutritional value and shelf-life of its products.

Technological advancements are reshaping Gruma's operational landscape, from production floors to consumer engagement. The company's strategic embrace of automation and sophisticated food processing techniques directly enhances efficiency and product innovation. For instance, the global food processing market's projected growth to nearly $1 trillion by 2030 underscores the importance of adopting cutting-edge technologies for competitive advantage.

Digital transformation is another key technological factor, with Gruma leveraging IoT, AI, and blockchain to optimize its global supply chain. This digital integration promises improved traceability and reduced waste, mirroring the significant investments being made in the global supply chain management market, which is expected to reach $34.1 billion by 2024.

Furthermore, the expanding e-commerce sector presents Gruma with substantial opportunities for direct consumer engagement and market expansion. With global e-commerce sales anticipated to hit $6.3 trillion in 2024, Gruma's focus on digital platforms and direct-to-consumer models is crucial for capturing new market segments and fostering brand loyalty.

Gruma's commitment to research and development in ingredient innovation, particularly in advanced corn varieties and fortification, is a critical technological driver. This focus allows the company to develop healthier products with enhanced nutritional profiles, aligning with consumer demand for wellness and sustainability in the food industry.

Legal factors

Gruma operates under a web of diverse and intricate food labeling and packaging regulations globally. These rules dictate everything from nutritional information disclosure and allergen declarations to the country of origin labeling, presenting a constant compliance challenge. For instance, the European Union's Food Information to Consumers (FIC) regulation, fully implemented by December 2014, sets stringent standards for allergen visibility, which Gruma must adhere to across its European operations.

Failure to navigate these varied legal landscapes accurately can have severe repercussions. In 2023, the U.S. Food and Drug Administration (FDA) issued millions of dollars in fines for misbranded food products, a risk Gruma actively mitigates. Such violations not only incur substantial financial penalties but also trigger costly product recalls and, critically, erode hard-won consumer trust, impacting brand reputation and sales.

As a major global food producer, Gruma must navigate a complex web of antitrust and competition laws across the many countries where it operates. These regulations are designed to prevent market dominance and ensure a level playing field for all businesses. For instance, in 2024, regulatory bodies worldwide continue to scrutinize large-scale mergers and acquisitions, meaning Gruma's pursuit of growth through consolidating companies could face significant hurdles and require extensive approvals.

These laws directly influence Gruma's ability to expand its market share and acquire competitors, potentially limiting strategic consolidation opportunities. For example, if Gruma were to consider acquiring a significant player in a key market, it would need to demonstrate to regulators that the deal would not unduly harm competition, a process that can be lengthy and costly, impacting its strategic planning for 2025 and beyond.

Protecting its proprietary processes, product formulations, and brand trademarks is absolutely crucial for Gruma. Legal frameworks surrounding intellectual property rights are the bedrock that allows Gruma to safeguard its innovations and brand equity from infringement, thereby maintaining its hard-won competitive advantage in the global market.

Labor Laws and Employment Regulations

Gruma's global operations necessitate strict adherence to a complex web of labor laws and employment regulations across various jurisdictions. These laws dictate everything from minimum wages and working hours to employee benefits, safety standards, and the right to collective bargaining, all of which can significantly impact operational costs and human resource management strategies. For instance, in 2024, the average minimum wage in Mexico, where Gruma has a significant presence, was MXN 248.93 per day in the northern border zone and MXN 207.44 in the rest of the country, highlighting the regional variations Gruma must navigate.

Navigating these diverse legal landscapes is critical for Gruma to prevent costly legal challenges, maintain a stable workforce, and ensure uninterrupted production. For example, changes in labor laws, such as potential increases in minimum wages or new regulations on contract work, can directly affect Gruma's labor expenses and hiring practices. The International Labour Organization (ILO) reported in 2024 that global labor markets continue to face challenges, with many countries reviewing their labor legislation to adapt to evolving economic conditions and worker expectations.

- Compliance with varying minimum wage laws across Gruma's operating countries, such as Mexico and the United States, directly impacts payroll costs.

- Adherence to employee benefit mandates, including healthcare and retirement contributions, varies significantly by nation, affecting overall compensation packages.

- Understanding and managing union relations and collective bargaining agreements are crucial in countries with strong labor movements, influencing Gruma's industrial relations.

- Staying updated on evolving employment regulations, such as those related to remote work or gig economy workers, is essential for maintaining legal standing and operational flexibility.

Import/Export Regulations and Tariffs

Gruma's global operations are significantly shaped by import and export regulations, including customs duties and various trade barriers. These legal frameworks directly affect the cost and efficiency of moving raw materials like corn and wheat, as well as finished products, across international borders. For instance, the World Trade Organization (WTO) reported that global trade in goods saw a notable slowdown in 2023, with ongoing geopolitical tensions contributing to increased protectionist measures in some regions, potentially impacting Gruma's supply chain and market access strategies.

Navigating these complex legal landscapes is crucial for Gruma's supply chain management and market penetration. Changes in tariffs or non-tariff barriers can alter the landed cost of goods, influencing pricing strategies and profitability in different markets. For example, as of early 2024, the United States maintained tariffs on certain agricultural products from various countries, which could affect Gruma's sourcing or sales depending on specific product origins and destinations.

- Tariff Impact: Fluctuations in import tariffs can directly increase the cost of raw materials, impacting Gruma's cost of goods sold.

- Trade Agreements: Gruma benefits from trade agreements that reduce or eliminate tariffs, facilitating smoother cross-border trade.

- Regulatory Compliance: Adherence to diverse import/export laws, including labeling and food safety standards, is essential for market access.

- Market Access: Trade barriers can restrict Gruma's ability to enter or expand in certain international markets, affecting revenue potential.

Gruma must navigate a complex landscape of food safety regulations and product liability laws worldwide. These legal frameworks ensure consumer protection but require constant vigilance and investment in quality control to prevent costly lawsuits and recalls. For example, in 2023, the U.S. experienced a significant number of foodborne illness outbreaks, leading to increased scrutiny and potential liability for food manufacturers.

The company's commitment to adhering to these regulations is paramount, as evidenced by its investment in robust quality assurance systems. Failure to comply can result in substantial fines, as seen in various cases where companies faced penalties for mislabeling or contamination issues. Gruma's proactive approach aims to mitigate these risks, safeguarding its brand reputation and financial stability.

Intellectual property laws are critical for Gruma to protect its brand names, product formulations, and manufacturing processes. Safeguarding these assets ensures a competitive edge and prevents unauthorized use by rivals. For instance, trademark infringement cases can lead to significant legal battles and financial damages, underscoring the importance of strong IP protection strategies for Gruma's continued success in the global market.

Environmental factors

Climate change presents considerable risks to Gruma's core business, particularly impacting corn cultivation. Altered weather patterns, increased frequency of droughts, and severe flooding events can disrupt the supply of this essential raw material, leading to potential shortages and heightened price volatility. For instance, the U.S. Midwest, a key corn-producing region, experienced significant weather disruptions in 2023, impacting yields and futures prices.

Water scarcity is a significant environmental concern for Gruma, impacting both corn cultivation, a primary input, and its food processing operations. Regions where Gruma sources corn or has facilities are increasingly facing water stress, demanding robust management strategies. For instance, by 2023, several key corn-producing regions in North America experienced below-average rainfall, impacting yields and increasing the cost of water for irrigation.

Addressing this challenge requires Gruma to implement and enhance efficient water usage techniques throughout its supply chain. This includes investing in advanced irrigation methods for corn farmers and optimizing water consumption in its processing plants. Gruma's commitment to sustainability also extends to wastewater treatment, ensuring responsible discharge and minimizing environmental impact. By 2024, the company aimed to reduce water intensity by 5% across its global operations, a target driven by these environmental pressures.

Consumers and regulators are increasingly pushing for ethically sourced ingredients, putting pressure on companies like Gruma to ensure their corn supply chains are both sustainable and protective of biodiversity. This means actively working to minimize deforestation and promote farming methods that support healthy ecosystems.

For Gruma, maintaining a positive brand image and meeting evolving market demands hinges on demonstrating a commitment to these practices. For instance, by 2024, the company's efforts in sustainable agriculture, including water conservation and reduced pesticide use, are becoming key performance indicators for many investors and consumers alike.

Waste Management and Circular Economy

Gruma faces environmental scrutiny regarding food waste and packaging from its extensive production, particularly in corn flour and tortilla manufacturing. For instance, the food industry globally generates over 1.3 billion tonnes of food waste annually, a significant portion of which can be attributed to processing and distribution stages. Gruma's commitment to sustainability is increasingly tied to its ability to mitigate these impacts.

Adopting advanced waste reduction strategies and comprehensive recycling initiatives is crucial for Gruma. By embracing circular economy principles, the company can transform by-products and packaging materials into valuable resources, thereby enhancing operational efficiency and reducing its environmental footprint. This approach aligns with growing consumer and regulatory demands for greener business practices.

Gruma's efforts in waste management and circular economy are vital for its long-term viability. Consider these key areas:

- Food Waste Reduction: Implementing technology to minimize spoilage during processing and optimizing supply chain logistics to reduce waste before it reaches consumers.

- Packaging Innovation: Investing in biodegradable or easily recyclable packaging materials and exploring reusable packaging systems where feasible.

- By-product Valorization: Developing methods to convert production by-products, such as corn husks or processing residues, into animal feed, compost, or even bio-energy.

- Circular Economy Partnerships: Collaborating with other industries or organizations to create closed-loop systems for materials, ensuring that waste from one process becomes input for another.

Carbon Emissions and Energy Consumption

Gruma's extensive manufacturing and distribution network inherently contributes to greenhouse gas emissions due to significant energy consumption. For instance, in 2023, the company reported its Scope 1 and Scope 2 emissions, highlighting the direct impact of its operational energy use. Addressing this requires a strategic shift towards more sustainable practices.

To mitigate its environmental impact, Gruma is actively pursuing strategies to reduce its carbon footprint. This includes investing in renewable energy sources for its facilities and implementing energy efficiency measures across its plants. Optimizing logistics and transportation routes is also a key focus, aiming to minimize fuel consumption and associated emissions. These efforts are crucial for aligning with global sustainability targets and increasingly stringent environmental regulations expected to tighten further in 2024 and 2025.

- Renewable Energy Adoption: Gruma is exploring and implementing solar and wind power solutions for its production sites, aiming to increase the percentage of renewable energy in its overall consumption mix.

- Energy Efficiency Initiatives: Investments in modern, energy-efficient machinery and process improvements are ongoing to reduce the kWh per unit of production.

- Logistics Optimization: Utilizing advanced route planning software and exploring alternative fuel vehicles for its distribution fleet are key components of Gruma's strategy to lower transportation-related emissions.

- Sustainability Reporting: Gruma's commitment to transparency is demonstrated through its annual sustainability reports, which detail progress on emission reduction targets and energy consumption metrics.

Gruma's operations are significantly influenced by environmental factors, particularly climate change impacting corn yields and water scarcity affecting both agriculture and processing. The company is actively implementing water conservation techniques and investing in advanced irrigation for farmers, aiming for a 5% reduction in water intensity by 2024.

Consumer and regulatory pressure for sustainable sourcing is growing, pushing Gruma to address biodiversity and minimize deforestation in its corn supply chains. Efforts in sustainable agriculture, including water and pesticide management, are becoming key metrics for investors and consumers by 2024.

Food waste and packaging are also critical environmental concerns for Gruma, given the scale of its tortilla and corn flour production. The company is focusing on waste reduction strategies and circular economy principles, including packaging innovation and by-product valorization, to minimize its environmental footprint.

Gruma is actively working to reduce its carbon footprint by investing in renewable energy sources and improving energy efficiency across its plants. Logistics optimization and exploring alternative fuels are also key strategies to lower transportation emissions, aligning with global sustainability goals and anticipated tighter regulations in 2024-2025.

PESTLE Analysis Data Sources

Our Gruma PESTLE Analysis is meticulously constructed using data from reputable sources such as the Food and Agriculture Organization (FAO), national agricultural ministries, and leading market research firms specializing in the food industry. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Gruma's operations.