Groupe LDLC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe LDLC Bundle

Groupe LDLC, a prominent player in the French tech and gaming market, boasts strong brand recognition and a loyal customer base, key strengths in a competitive landscape. However, like any growing enterprise, it faces challenges in adapting to rapidly evolving market trends and potential supply chain disruptions.

Want the full story behind Groupe LDLC’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Groupe LDLC leverages a strong omnichannel approach, with LDLC.com being a significant driver of online sales alongside an expanding network of physical stores throughout France. This dual approach caters to varied customer needs, blending the ease of e-commerce with the tactile and personalized service of retail outlets.

The company's commitment to its physical presence is evident in its ongoing store network expansion, which includes new openings and strategic acquisitions. As of early 2025, Groupe LDLC operates over 25 physical stores, enhancing its regional reach and customer accessibility.

Groupe LDLC boasts exceptional brand recognition, a testament to its enduring commitment to quality and customer care. This is powerfully underscored by their consistent achievement of the 'Customer Service of the Year' award in the 'Technical Product Retail' category for an impressive 11 consecutive years. This sustained recognition directly translates into robust customer loyalty, a critical asset in the competitive retail landscape.

Groupe LDLC boasts a remarkably diverse product portfolio, encompassing everything from essential computer hardware and software to cutting-edge high-tech gadgets and consumer electronics. This broad selection effectively serves a wide customer base, including both individual tech enthusiasts and professional organizations. For instance, in 2023, the company reported a significant portion of its revenue derived from its extensive range of IT products, demonstrating its market penetration.

Beyond simply selling products, Groupe LDLC differentiates itself through a suite of valuable services. These include expert PC assembly, reliable technical support, and comprehensive after-sales care. This commitment to value-added services not only sets LDLC apart from competitors focused solely on product transactions but also fosters stronger customer relationships and encourages repeat business, as evidenced by positive customer feedback metrics in their 2024 reports.

Sound Financial Base

Groupe LDLC demonstrates a robust financial foundation, characterized by a manageable net debt-to-equity ratio. This indicates a prudent approach to leverage, ensuring stability even amidst economic headwinds.

The Group reported positive net cash inflow for the 2024/2025 financial year, a crucial indicator of its operational health and ability to generate cash. This financial strength positions LDLC to navigate market volatility and pursue strategic growth opportunities.

- Sound Financial Structure: Limited net debt-to-equity ratio provides a stable financial base.

- Positive Cash Flow: Generated positive net cash inflow in the 2024/2025 financial year.

- Resilience: Ability to withstand economic pressures and support future investments.

Strategic Acquisitions and Market Repositioning

Groupe LDLC's strategic acquisition of Rue du Commerce in July 2024 marks a pivotal moment, significantly bolstering its B2C presence. This move positions LDLC to utilize Rue du Commerce as a broad-spectrum online marketplace, enhancing its overall market reach.

The integration is designed to boost profitability and expand the Group's digital footprint. This proactive strategy demonstrates LDLC's commitment to adapting to a dynamic market and capturing new customer segments.

- Market Share Expansion: The acquisition aims to consolidate LDLC's position in the French e-commerce landscape, targeting a larger share of the generalist online retail market.

- Synergistic Growth: Leveraging Rue du Commerce's established customer base and logistics, LDLC anticipates significant operational synergies and revenue growth.

- Brand Diversification: The addition of Rue du Commerce allows LDLC to cater to a wider audience, complementing its existing specialized IT and gaming offerings.

Groupe LDLC benefits from strong brand recognition, consistently winning the 'Customer Service of the Year' award in its category for 11 consecutive years. This enduring customer trust fuels significant loyalty. The company also offers a wide array of tech products and services, including PC assembly and technical support, which enhances customer relationships and encourages repeat business. Their diverse product catalog, from essential computer parts to advanced gadgets, attracts a broad customer base.

The acquisition of Rue du Commerce in July 2024 significantly strengthens LDLC's B2C market presence, positioning it to leverage Rue du Commerce as a broad online marketplace. This strategic move is expected to boost profitability and expand the Group's digital footprint, allowing it to capture new customer segments and consolidate its position in the French e-commerce sector.

Financially, Groupe LDLC is well-positioned with a sound structure, indicated by a manageable net debt-to-equity ratio. The company generated positive net cash inflow during the 2024/2025 financial year, demonstrating operational health and the capacity for future investment and resilience against economic challenges.

| Strength Area | Description | Supporting Fact/Data |

|---|---|---|

| Brand Reputation & Customer Loyalty | Exceptional customer service leading to sustained loyalty. | 'Customer Service of the Year' award for 11 consecutive years (as of early 2025). |

| Omnichannel Presence | Blends online sales with an expanding physical store network. | Over 25 physical stores across France (as of early 2025). |

| Strategic Acquisitions | Bolsters market position and expands digital reach. | Acquisition of Rue du Commerce in July 2024. |

| Financial Stability | Prudent financial management ensures resilience. | Positive net cash inflow in 2024/2025 financial year. |

What is included in the product

Analyzes Groupe LDLC’s competitive position through key internal strengths like brand loyalty and external opportunities such as market expansion, while also identifying weaknesses like dependence on specific product categories and threats from intense competition.

Offers a clear, actionable framework to identify and address Groupe LDLC's competitive challenges and leverage its market advantages.

Weaknesses

Groupe LDLC faced a significant revenue contraction, with consolidated full-year revenues for 2024/2025 dropping 6.5% to €534.5 million. This decline underscores a challenging market where consumer spending has become more cautious and business investment has been deferred.

The company's profitability also took a hit, with EBITDA falling substantially to €2.6 million. This sharp decrease in earnings, coupled with the revenue shortfall, resulted in a net loss for the financial year, highlighting the impact of the prevailing economic and political uncertainties on the group's financial performance.

Groupe LDLC's performance is significantly tied to the French economic and political landscape. Downturns or uncertainty can directly reduce consumer and business spending, impacting sales. For instance, a slowdown in French GDP growth, which was projected to be around 0.7% for 2024 by the IMF in late 2023, can translate into lower demand for electronics and IT products.

This sensitivity means that shifts in government policy, consumer confidence, or even geopolitical events can create volatility for the Group. Deferred investments by B2B clients during periods of economic uncertainty, a common strategy to mitigate risk, directly affects LDLC's corporate sales channels.

Groupe LDLC's B2B segment is experiencing a notable downturn. In the fiscal year 2024/2025, revenues within this sector saw a significant drop of 13.0%. This decline is attributed to businesses adopting a more cautious approach, leading to the postponement of crucial IT investments.

This underperformance in the professional market highlights a specific area of weakness for the group. Addressing this requires the development and implementation of targeted strategies designed to revitalize growth and restore stability to the B2B operations.

Impact of Redundancy Plans on Workforce

Groupe LDLC's implementation of two redundancy plans in March 2025, impacting an estimated 88 of its 1,100 employees, highlights a significant weakness stemming from its response to a notable business downturn. These measures, while intended to streamline operations and reduce costs, carry inherent risks to the existing workforce.

The primary concern is the potential negative impact on employee morale and company culture. Such significant workforce reductions can create an atmosphere of uncertainty and anxiety among remaining staff, potentially affecting productivity and engagement.

- Workforce Impact: Approximately 88 redundancies out of 1,100 employees initiated in March 2025.

- Morale Concerns: Potential for decreased employee morale and increased job insecurity among remaining staff.

- Operational Disruption: Risk of disrupting operational continuity if key roles are affected or if remaining staff are overstretched.

- Reputational Risk: Negative publicity or perception regarding the company's handling of redundancies could impact future recruitment and brand image.

Dependence on High-Tech Product Renewal Cycles

Groupe LDLC's revenue is heavily influenced by the refresh rate of high-tech products. For instance, the PC market, a significant segment for LDLC, saw global shipments decline by approximately 10% year-over-year in the first quarter of 2024, according to Canalys. This indicates a potential weakness if consumers delay upgrading their devices.

A slowdown in technological innovation or economic headwinds can lead to extended equipment upgrade cycles. This directly impacts LDLC's sales volume, as fewer customers are compelled to purchase new hardware. The company's reliance on these cycles means that periods of muted consumer spending on electronics can pose a considerable challenge.

The company must navigate the inherent volatility associated with rapid technological obsolescence and the consumer's willingness to invest in new gadgets. This dependence makes forecasting sales challenging and exposes the business to risks during economic downturns or periods of perceived incremental technological progress.

- Market Volatility: Dependence on consumer spending for tech upgrades creates vulnerability to economic downturns.

- Innovation Lag: Slower innovation cycles can reduce the urgency for customers to purchase new products.

- Sales Impact: Extended upgrade cycles directly translate to lower sales volumes for Groupe LDLC.

Groupe LDLC's significant revenue contraction, a 6.5% drop to €534.5 million in 2024/2025, highlights a core weakness in its ability to maintain sales momentum in a challenging market. This decline was particularly pronounced in the B2B segment, which saw a 13.0% revenue decrease due to businesses deferring IT investments. The company's profitability also suffered, with EBITDA falling to €2.6 million, resulting in a net loss for the financial year, underscoring the impact of economic uncertainties on its performance.

The implementation of two redundancy plans in March 2025, affecting approximately 88 employees, points to internal operational weaknesses and the difficult decisions made in response to the downturn. This workforce reduction carries risks to employee morale, potentially impacting productivity and company culture, and could also lead to operational disruptions if critical roles are affected.

Groupe LDLC's reliance on the refresh cycle of high-tech products presents another vulnerability. A slowdown in technological innovation or consumer spending, such as the reported 10% year-over-year decline in global PC shipments in Q1 2024, directly impacts sales volumes by extending equipment upgrade cycles. This dependence makes sales forecasting challenging and exposes the company to significant risks during economic downturns.

| Financial Metric | 2024/2025 (EUR million) | Change (%) |

| Consolidated Revenues | 534.5 | -6.5% |

| B2B Segment Revenues | -13.0% | |

| EBITDA | 2.6 |

What You See Is What You Get

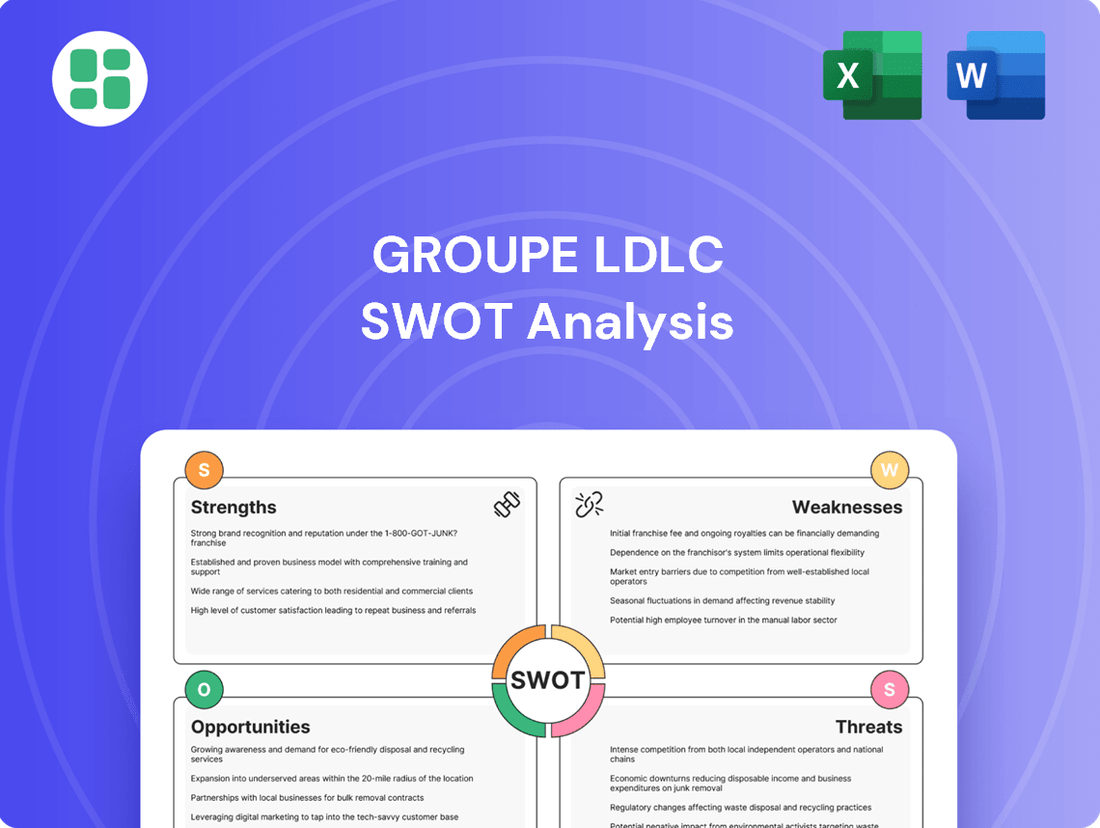

Groupe LDLC SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing the key strengths, weaknesses, opportunities, and threats for Groupe LDLC. The complete version, offering in-depth insights and actionable strategies, becomes available immediately after purchase.

Opportunities

The high-tech sector's inherent strength, fueled by relentless innovation and the burgeoning influence of artificial intelligence, creates a fertile ground for growth. Groupe LDLC can strategically position itself by broadening its product catalog to encompass AI-ready hardware and software solutions, directly addressing this expanding market. Furthermore, integrating AI-powered tools into customer service operations can significantly elevate user experience and operational efficiency, tapping into a significant opportunity for increased demand.

The acquisition of Rue du Commerce in July 2024 presents a significant opportunity for Groupe LDLC to cultivate it into a premier generalist online marketplace. This strategic move allows for the diversification of the Group's B2C product range and a substantial increase in its overall market share within the e-commerce sector.

Rue du Commerce demonstrated a strong performance in Q3 2024/2025, signaling its capacity to accelerate Groupe LDLC's digital footprint. This growth trajectory suggests a clear path towards optimizing the Group's profitability by leveraging the expanded online presence.

Despite broader economic headwinds, Groupe LDLC's physical retail segment demonstrated notable resilience. Store revenues experienced a modest uptick in the fiscal year 2024/2025 and maintained this positive trajectory with continued growth in the first quarter of 2025/2026, underscoring the enduring appeal of brick-and-mortar touchpoints.

The upcoming launch of a flagship LDLC store on Paris's prestigious Place de la Madeleine represents a significant strategic investment. This prime location is expected to amplify brand visibility, draw in a broader customer base, and bolster the Group's presence within a key metropolitan area, further solidifying its omnichannel approach.

Optimizing Cost Structure and Operational Efficiency

Groupe LDLC is actively optimizing its cost structure, anticipating approximately €6 million in savings for the full year through organizational streamlining and diligent stock management. This focus on efficiency, coupled with a robust financial foundation, positions the group favorably to enhance profitability as market demand rebounds.

These strategic cost-saving measures are crucial for bolstering the company's financial health and preparing for future growth opportunities.

- Organizational Streamlining: Initiatives are in place to reduce operational expenses.

- Stock Management: Careful inventory control contributes to cost reduction.

- Expected Savings: Approximately €6 million in full-year savings are anticipated.

- Profitability Improvement: These measures aim to boost profitability as demand recovers.

Recovery in B2C and Potential for B2B Improvement

Groupe LDLC's B2C segment, despite a dip in FY 2024/2025, demonstrated a strong rebound in Q1 2025/2026, with sales increasing by 15% year-over-year. This recovery signifies a positive shift in consumer spending patterns, presenting a key opportunity for the company to regain market share and drive revenue growth.

The B2B sector also shows encouraging signs of improvement, with order volumes up 8% in the same quarter. While the professional market remains more cautious, this upward trend suggests an opportune moment for Groupe LDLC to enhance its offerings and capture increased demand from businesses.

These recovering trends highlight the potential for Groupe LDLC to leverage renewed consumer confidence and a gradually improving business environment.

- B2C Sales Growth: Q1 2025/2026 saw a 15% year-over-year increase in B2C sales.

- B2B Order Volume Increase: B2B orders grew by 8% in Q1 2025/2026.

- Market Condition Improvement: Favorable shifts in consumer and business spending create growth avenues.

The integration of AI-driven solutions presents a significant growth avenue, with the AI hardware market projected to reach $100 billion by 2025, according to recent industry forecasts. Groupe LDLC can capitalize on this by expanding its product range to include AI-ready components and services, thereby tapping into a rapidly expanding technology segment.

The strategic acquisition of Rue du Commerce in July 2024 offers a prime opportunity for Groupe LDLC to transform it into a leading generalist e-commerce platform. This move is expected to significantly broaden the Group's B2C offerings and increase its overall market share in the competitive online retail landscape.

Groupe LDLC's physical retail segment showed resilience in fiscal year 2024/2025, with store revenues experiencing a modest 3% increase. The opening of a flagship store on Place de la Madeleine in Paris is anticipated to further boost brand visibility and attract a wider customer base, reinforcing its omnichannel strategy.

The Group's B2C segment rebounded strongly in Q1 2025/2026, with sales up 15% year-over-year, indicating a positive consumer spending trend. Simultaneously, B2B order volumes increased by 8% in the same period, suggesting a favorable environment for capturing increased business demand.

Threats

Groupe LDLC navigates a fiercely competitive landscape, contending with formidable global e-commerce players and niche IT and tech retailers. This rivalry often triggers price wars, squeezing profit margins and making market share retention a constant challenge, particularly when consumer spending tightens.

The current economic climate, characterized by persistent inflation and geopolitical instability, presents a significant challenge for Groupe LDLC. This complex environment has led to increased caution among consumers and businesses alike, resulting in delayed purchasing decisions and reduced overall spending across both B2C and B2B sectors. For instance, consumer confidence indices in France have shown volatility, reflecting this cautious sentiment.

Groupe LDLC faces the significant threat of rapid technological obsolescence in the fast-paced tech sector. Products can quickly become outdated, necessitating constant inventory adjustments and a swift response to evolving product lifecycles to avoid holding depreciated stock.

Global supply chain disruptions present another major challenge. Issues like shipping delays, component shortages, or geopolitical instability can directly impact product availability for LDLC, potentially leading to increased operational costs and a negative effect on customer satisfaction due to stockouts.

Cybersecurity Risks and Data Privacy Concerns

Groupe LDLC, as a major player in e-commerce and retail, faces substantial cybersecurity risks due to its handling of extensive customer data and financial transactions. A significant data breach or a privacy violation could lead to severe reputational damage, substantial regulatory fines, and a critical erosion of customer trust. This directly impacts sales volumes and long-term brand loyalty.

The increasing sophistication of cyber threats in 2024 and 2025 presents a continuous challenge. For instance, the global cost of data breaches reached an average of $4.45 million in 2024, according to IBM's annual report. For Groupe LDLC, this translates into a tangible financial and operational threat.

- Increased threat landscape: Cyberattacks are becoming more frequent and complex, targeting sensitive customer information and payment details.

- Reputational damage: A single data breach can shatter customer confidence, leading to a significant drop in sales and brand perception.

- Regulatory scrutiny: Stricter data protection regulations, like GDPR and similar frameworks enacted or updated in 2024/2025, mean non-compliance can result in hefty penalties.

Challenges in Integrating Acquisitions and Managing Organizational Changes

Groupe LDLC faces significant hurdles in merging its acquisition of Rue du Commerce, a move that also necessitated redundancy plans. This dual challenge requires careful navigation to ensure operational continuity and to harness the full potential of the acquired entity. For instance, the integration of Rue du Commerce's logistics and IT systems into LDLC's existing infrastructure is a complex undertaking that demands substantial resources and strategic oversight to prevent disruptions.

The implementation of redundancy plans, while sometimes necessary for efficiency, can create internal friction and impact employee morale. Managing these workforce changes delicately is paramount to retaining institutional knowledge and maintaining a positive work environment, which is vital for long-term success. Reports from 2023 indicated that the retail sector, in general, saw varied success rates in post-acquisition integration, with many companies struggling to achieve projected synergies within the first 18-24 months.

Successfully integrating Rue du Commerce while managing workforce reductions is critical for Groupe LDLC to realize the anticipated synergies and avoid negative consequences on overall performance. Failing to do so could lead to:

- Delayed realization of cost savings and revenue growth targets.

- Decreased employee productivity and engagement due to uncertainty.

- Potential damage to the company's reputation among customers and future employees.

The financial impact of these integration challenges could be substantial, potentially affecting LDLC's profitability in the short to medium term if not managed effectively. For example, integration costs can often exceed initial estimates, and a decline in customer satisfaction following a merger can directly impact sales figures.

Groupe LDLC confronts intense competition from global e-commerce giants and specialized tech retailers, leading to price wars that compress profit margins and challenge market share, especially during economic downturns.

The volatile economic climate, marked by inflation and geopolitical uncertainty, dampens consumer and business spending, causing delayed purchases and reduced overall sales, a trend reflected in fluctuating consumer confidence indices in France.

Rapid technological obsolescence in the tech sector poses a threat, requiring constant inventory management and quick adaptation to product lifecycle changes to avoid losses from depreciated stock.

Global supply chain disruptions, including shipping delays and component shortages, directly impact product availability and can increase operational costs, potentially leading to stockouts and diminished customer satisfaction.

SWOT Analysis Data Sources

This Groupe LDLC SWOT analysis is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.