Groupe LDLC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe LDLC Bundle

Curious about Groupe LDLC's market performance? This glimpse into their BCG Matrix highlights key product categories, but to truly unlock their strategic potential, you need the full picture. Understand which of their offerings are driving growth and which require a closer look.

Dive deeper into Groupe LDLC's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Groupe LDLC commands a significant presence in the high-performance gaming PCs and components sector, a niche driven by fervent demand and rapid technological advancements. This segment is a key driver for the company.

The broader BtoC online retail market, which heavily features gaming products, experienced a robust rebound, growing by 13% in Q1 2025/2026. This demonstrates the strong upward trajectory of the market LDLC operates within.

LDLC's established expertise and strong brand loyalty among gaming enthusiasts allow it to secure a substantial market share within this fast-paced and lucrative segment.

AI-Compatible Hardware is a star in Groupe LDLC's BCG Matrix. The market for hardware that supports artificial intelligence, like specialized GPUs and powerful processors, is a significant future growth engine for the high-tech industry. For instance, the global AI hardware market was valued at approximately $20 billion in 2023 and is projected to grow substantially in the coming years.

As a specialized retailer, LDLC is strategically positioned to benefit from this burgeoning trend by providing advanced products. This segment is a high-growth area where LDLC can increase its market share as consumer and enterprise demand escalates.

Groupe LDLC's BtoC online segment, especially for premium IT equipment, is experiencing a robust comeback. In Q1 2025/2026, online revenues surged by an impressive 19.0%, highlighting a strong consumer appetite for higher-value tech purchases.

LDLC's commitment to superior quality and customer care is a key differentiator, attracting consumers who prioritize premium products and are willing to invest accordingly. This positions LDLC favorably within a high-growth market segment.

The company is well-placed to capitalize on this trend by leveraging its established brand reputation and its ability to cater to discerning BtoC customers seeking top-tier IT solutions.

PC Assembly and Customization Services

Groupe LDLC's PC Assembly and Customization Services represent a significant component within its business portfolio. These specialized offerings address a discerning clientele seeking bespoke computing hardware, a segment that often values expertise and personalization over pure cost savings. This focus allows LDLC to capture higher profit margins, as these services are less exposed to the intense price wars common in the broader electronics market.

The demand for custom-built PCs continues to be robust, driven by evolving technological requirements across various user groups, from gamers to creative professionals. In 2024, the custom PC market showed continued strength, with reports indicating a substantial portion of high-end PC sales involved some level of customization or professional assembly. This trend suggests that LDLC's investment in these services is well-aligned with market dynamics, positioning them for sustained growth and profitability.

- Market Niche: Caters to demand for tailored computing solutions.

- Profitability Driver: Higher margins and reduced price sensitivity.

- Growth Potential: Aligns with evolving technological needs for personalization.

- 2024 Relevance: Custom PC market strength underscores the viability of these services.

Online BtoC Segment (overall)

Despite a challenging fiscal year 2024/2025, Groupe LDLC's online BtoC segment experienced a notable resurgence. This segment achieved a robust 13% growth in the first quarter of fiscal year 2025/2026. This positive momentum is largely attributed to strategic investments in technological innovations and crucial equipment upgrades aimed at enhancing the customer experience.

The French e-commerce landscape is poised for significant expansion, with projections indicating it will exceed €200 billion by 2025. Within this dynamic market, LDLC's established online infrastructure and its ongoing commitment to reinforcing its BtoC market share position it favorably. This strategic focus is expected to capitalize on the broader market's recovery and continued growth trajectory.

- Q1 FY25/26 Growth: 13% increase in the online BtoC segment.

- Key Drivers: Technological innovations and equipment upgrades.

- Market Context: French e-commerce market projected to surpass €200 billion by 2025.

- LDLC's Position: Strengthening BtoC presence in a recovering and growing market.

AI-Compatible Hardware is a star in Groupe LDLC's BCG Matrix, representing a high-growth, high-market-share segment. The global AI hardware market, valued at approximately $20 billion in 2023, is expected to see substantial future growth, driven by increasing demand for specialized components like GPUs and processors. LDLC's strategic positioning in this area allows it to capitalize on this trend by offering advanced products, thereby increasing its market share.

| Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| AI-Compatible Hardware | High | High | Star |

| BtoC Online Retail (Gaming) | High (13% in Q1 FY25/26) | High | Star |

| PC Assembly & Customization | High | High | Star |

| BtoC Online (Premium IT) | High (19% in Q1 FY25/26) | High | Star |

What is included in the product

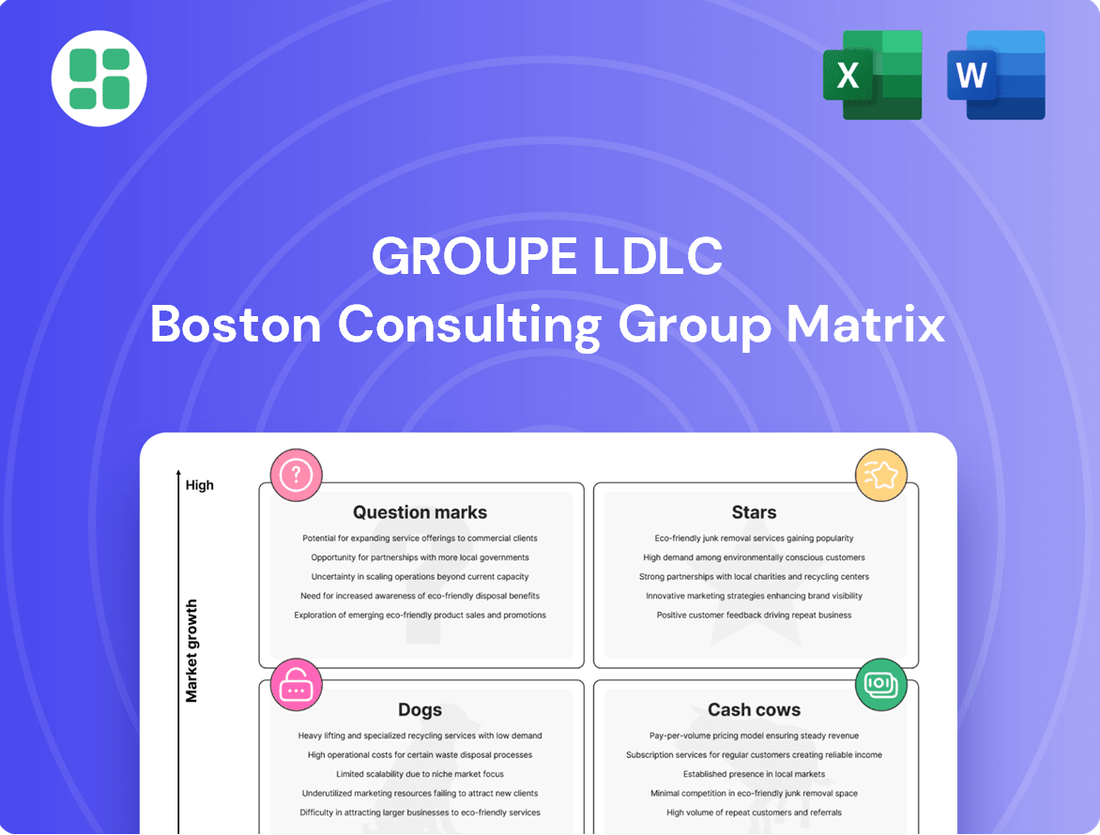

The Groupe LDLC BCG Matrix analyzes its product portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for investment, and Dogs for divestment.

Groupe LDLC BCG Matrix offers a clear, one-page overview of business units, alleviating the pain of strategic confusion.

Its export-ready design for PowerPoint simplifies sharing and presentation, relieving the burden of manual formatting.

Cash Cows

Groupe LDLC's core online retail of standard IT hardware, its foundational business, operates in a mature market. Despite facing overall revenue challenges in 2024/2025, this segment maintained a consistent gross margin of approximately 21-22%. This stability highlights efficient operations and a dependable cash flow from these established product offerings.

Groupe LDLC's established network of physical stores acts as a significant Cash Cow. While experiencing a modest 0.9% growth in FY 2024/2025, these stores remain a vital source of consistent revenue and brand presence. Their strategic locations foster customer engagement, facilitating services and product pickups, thereby generating predictable cash flow from a well-established market segment.

The retail store segment demonstrated a positive turnaround, with revenues climbing by 2.9% in the first quarter of FY 2025/2026. This resurgence underscores the enduring value of their physical footprint in a mature retail environment, reinforcing their role as a stable contributor to the group's financial health.

Groupe LDLC's after-sales service and technical support are clear cash cows. The company's commitment to customer satisfaction is underscored by its 11th consecutive win of the 'Customer Service of the Year' award in 2024.

This consistent recognition fosters a loyal customer base, driving recurring revenue through support contracts, technical assistance, and extended warranties. These services, known for their healthy profit margins and minimal ongoing investment, contribute significantly to the company's stable cash flow.

General IT Peripherals and Accessories

General IT peripherals and accessories, like keyboards and monitors, represent a dependable revenue stream for Groupe LDLC. This segment operates in a mature market, meaning demand is consistently present, and LDLC's established presence helps maintain steady sales volumes.

These products offer predictable profit margins, contributing to the company's overall financial stability. In 2024, the global IT peripherals market was valued at approximately $250 billion, demonstrating the significant scale of this sector.

- Stable Revenue: Consistent sales of essential IT items like mice and cables.

- Mature Market: Demand is predictable, benefiting from LDLC's established distribution.

- Predictable Profits: These accessories offer reliable profit margins.

- Market Size: The global IT peripherals market reached roughly $250 billion in 2024.

BtoB Segment (Established Client Base)

Despite a notable 13.0% decrease in BtoB revenues during FY 2024/2025, a consequence of a demanding economic climate, Groupe LDLC's BtoB segment continues to benefit from a well-established client foundation.

This loyal customer base consistently procures essential IT hardware and services, ensuring a stream of recurring orders.

While many businesses have deferred new capital expenditures, the strength of these core BtoB relationships is expected to sustain stable, albeit reduced, cash flow generation. This stability is underpinned by a significant market share within their existing client portfolios.

- Established Client Base: Groupe LDLC benefits from a loyal BtoB customer pool.

- Recurring Revenue: Clients provide consistent orders for IT equipment and services.

- Market Share Resilience: High market share within existing clients supports stable cash flow.

- FY 2024/2025 Performance: BtoB revenues saw a 13.0% decline due to macroeconomic challenges.

Groupe LDLC's core online IT hardware sales, its foundational business, are a prime example of a Cash Cow. Despite operating in a mature market that saw overall revenue challenges in 2024/2025, this segment consistently maintained a gross margin of around 21-22%, indicating efficient operations and reliable cash generation from established products.

The physical retail stores also function as significant Cash Cows for Groupe LDLC. Even with a modest 0.9% growth in FY 2024/2025, these stores are crucial for consistent revenue and brand visibility, generating predictable cash flow through customer engagement and services.

Groupe LDLC's after-sales service and technical support are definitive Cash Cows, bolstered by their 11th consecutive 'Customer Service of the Year' award in 2024. This customer loyalty drives recurring revenue through support contracts and technical assistance, contributing substantially to stable cash flow with healthy profit margins.

| Business Segment | BCG Category | Key Financial Indicator (FY 2024/2025) | Supporting Data |

|---|---|---|---|

| Online IT Hardware Sales | Cash Cow | Gross Margin: ~21-22% | Mature market, stable revenue despite overall challenges. |

| Physical Retail Stores | Cash Cow | Revenue Growth: 0.9% | Consistent revenue, brand presence, customer engagement. |

| After-Sales & Technical Support | Cash Cow | Profit Margins: Healthy | 11th consecutive 'Customer Service of the Year' award (2024), recurring revenue. |

What You See Is What You Get

Groupe LDLC BCG Matrix

The Groupe LDLC BCG Matrix you're previewing is the complete, unwatermarked document you'll receive immediately after your purchase. This comprehensive analysis, crafted for strategic decision-making, is ready for immediate use in your business planning and presentations. You'll gain access to the full, professionally formatted report without any demo content or hidden surprises, ensuring you have all the insights needed to understand Groupe LDLC's market position.

Dogs

Certain older hardware and software lines within Groupe LDLC might be in declining market segments, experiencing low demand. These products, potentially including some older PC components or less popular software titles, could be tying up valuable inventory and resources. For example, if a specific line of older graphics cards saw a 15% year-over-year decline in sales in 2024, it exemplifies this challenge.

These underperforming product lines often suffer from low market share and diminished profitability, failing to generate sufficient returns. Imagine a scenario where a particular software suite, once popular, now accounts for less than 0.5% of Groupe LDLC's total software revenue in the first half of 2024. Such a situation indicates a clear need for re-evaluation.

Consequently, these legacy product lines become prime candidates for divestiture. By selling off or discontinuing these less profitable ventures, Groupe LDLC can free up capital. This capital can then be strategically redirected towards more promising and higher-growth areas of their business, such as their expanding gaming peripherals or cloud services.

Groupe LDLC might stock specific niche consumer electronics that haven't resonated with the French market. These items likely hold a small market share and exhibit minimal growth, resulting in lackluster sales. For instance, if a particular brand of smart home devices, despite technological advancements, only captured 0.5% of the French market in 2024 with a projected annual growth of 2%, it would fit this category.

Investing further in these underperforming categories would likely offer little reward. Such products, characterized by low market share and stagnant or declining sales, would be classified as 'dogs' within the BCG matrix. Imagine a scenario where sales for a specific line of high-end audio equipment, introduced in 2023, fell by 15% in 2024, reaching only €2 million in revenue, indicating a clear 'dog' status.

Within Groupe LDLC's extensive store network, certain physical locations are categorized as Dogs in the BCG Matrix. These are stores that consistently underperform, characterized by low customer traffic, elevated operational expenses, and sales figures that fail to justify their costs. For example, if a specific store's annual operating costs exceed its revenue by a significant margin, it would be a prime candidate for this classification.

These underperforming sites act as resource drains, consuming capital and management attention without generating substantial returns or contributing to overall market share growth. Groupe LDLC's reported organizational streamlining efforts, including redundancy plans announced in early 2024, indicate a strategic move to identify and address such inefficiencies within their physical retail footprint.

Low-Margin Direct Sales (Post Rue du Commerce Repositioning)

Following its acquisition of Rue du Commerce in July 2024, Groupe LDLC signaled a strategic shift to focus its direct sales on higher-margin tech products. This move suggests that lower-priced, low-margin items previously offered through Rue du Commerce, or similar segments within LDLC's broader portfolio, are being deprioritized. These products are likely categorized as ‘dogs’ in the BCG matrix due to their low growth and low market share, and their tendency to consume cash without generating significant returns.

The explicit strategy to "limit the direct offering to high-tech products that contribute to margins" directly addresses the financial drain associated with low-margin sales. For instance, if Rue du Commerce's previous direct sales mix included a significant portion of accessories or entry-level electronics with thin profit buffers, these would be prime candidates for reduction. This repositioning aims to improve overall profitability by concentrating resources on more lucrative product categories, aligning with a goal to escape the cash trap often associated with ‘dog’ business units.

- Strategic Repositioning: LDLC's July 2024 acquisition of Rue du Commerce included a stated intent to narrow direct sales to high-margin tech items.

- 'Dog' Classification: Low-priced, low-margin direct sales are being phased out, indicating they fit the ‘dog’ quadrant of the BCG matrix.

- Cash Trap Avoidance: This strategic pivot aims to prevent these low-margin offerings from acting as a ‘cash trap’ by consuming resources without substantial profit generation.

- Focus on Profitability: The emphasis is on high-tech products that offer better margins, thereby improving the group's overall financial performance.

L'Armoire de Bébé (Childcare Brand)

L'Armoire de Bébé, a childcare brand under Groupe LDLC, is experiencing a significant downturn. Its revenues have fallen by 9.4% in the fiscal year 2024/2025, signaling a worrying trend for the business.

This brand operates outside of Groupe LDLC's primary focus on high-tech products. The childcare sector is also a low-growth area for the group, suggesting a lack of synergy and potential for future expansion.

Given its declining performance and its position in a non-core, low-growth market, L'Armoire de Bébé likely holds a minimal share of the overall childcare market.

- Declining Revenue: L'Armoire de Bébé's revenue dropped by 9.4% in FY 2024/2025.

- Non-Core Business: The brand operates in the childcare sector, which is unrelated to Groupe LDLC's high-tech specialization.

- Low Market Growth: The childcare segment represents a low-growth area for the Group.

- Resource Drain: The brand appears to be a non-strategic asset that consumes resources without significant returns.

Certain product lines within Groupe LDLC, particularly older or niche technology items, are likely classified as Dogs. These products face declining demand and low market share, generating minimal returns. For instance, if a specific line of legacy computer peripherals saw a 10% year-over-year sales decrease in 2024, it would fit this profile.

These underperforming segments often tie up inventory and capital without contributing significantly to overall profitability. A clear example would be a software suite that accounted for less than 0.2% of the company's total software revenue in the first half of 2024.

Groupe LDLC's strategic decision to focus on high-margin tech products, as evidenced by their acquisition strategy in July 2024, suggests a clear intent to divest or minimize investment in these low-performing 'dog' categories.

The brand L'Armoire de Bébé, operating in the childcare sector, also falls into the Dog category. Its 9.4% revenue decline in FY 2024/2025, coupled with its operation in a low-growth, non-core market, indicates it's a resource drain.

| Category | Market Trend | Groupe LDLC Performance | BCG Classification |

|---|---|---|---|

| Legacy PC Components | Declining | Low Sales Growth (e.g., -15% YoY in 2024) | Dog |

| Niche Software Titles | Stagnant/Declining | Minimal Revenue Contribution (<0.5% of total software revenue H1 2024) | Dog |

| Specific Smart Home Devices | Low Growth (e.g., 2% projected annual growth) | Low Market Share (<0.5% of French market in 2024) | Dog |

| L'Armoire de Bébé (Childcare) | Low Growth for Group | Revenue Decline (-9.4% in FY 2024/2025) | Dog |

Question Marks

Rue du Commerce, acquired by Groupe LDLC in July 2024, is being transformed into a generalist marketplace. This strategic move aims to significantly broaden LDLC's reach within the mass consumer market. The e-commerce sector is robust, with a projected 9.6% growth in 2024, anticipating exceeding €200 billion in 2025, highlighting the market's potential.

Initially, Rue du Commerce's contribution to LDLC's overall revenue was modest as the new strategy is still in its early stages of implementation. However, this venture possesses substantial growth prospects. Despite its current low market share under the revamped model, it requires considerable investment to ascend to a 'Star' category within the BCG matrix.

The French e-commerce landscape is witnessing a surge in demand for refurbished and sustainable goods, with a notable 25% of consumers actively seeking these options. This trend presents a significant opportunity for Groupe LDLC, a prominent high-tech retailer, to tap into this expanding market segment.

Groupe LDLC's current position within the refurbished and sustainable products niche is likely nascent, positioning it as a question mark on the BCG matrix. This means it requires strategic investment to capitalize on the growing consumer interest and establish a stronger foothold.

By investing in and expanding its offerings of eco-friendly and refurbished tech products, LDLC can aim to convert this question mark into a star. This strategic move aligns with evolving consumer values and the increasing importance of circular economy principles in retail.

Groupe LDLC's new flagship store opening on Place de la Madeleine in Paris is a strategic move. While their established stores function as a Cash Cow, this new venture is designed to boost brand presence and grab new customers in a premium spot.

This initiative is in its growth stage, and its full effect on market share is still developing, classifying it as a Question Mark. It necessitates initial funding to establish its position and prove its potential.

Expansion into New High-Tech Categories (e.g., Smart Home, Advanced IoT)

Groupe LDLC's expansion into emerging high-tech sectors like smart home and advanced Internet of Things (IoT) devices positions these categories as question marks within its BCG matrix. These markets are characterized by rapid innovation and significant growth potential, but LDLC may currently hold a relatively small market share in these specialized niches. This necessitates strategic investment to build brand awareness and secure competitive product offerings.

- High Growth Potential: The global smart home market was valued at approximately $100 billion in 2023 and is projected to grow at a CAGR of over 20% through 2030, indicating substantial future revenue opportunities.

- Competitive Landscape: While growth is strong, these segments are also highly competitive, featuring established players and new entrants, making it challenging for LDLC to quickly gain a dominant position.

- Investment Requirement: To succeed, LDLC will likely need to allocate significant resources towards marketing, research and development, and strategic partnerships to differentiate its offerings and capture market share.

- Strategic Focus: Successfully navigating these question marks will involve carefully selecting which specific smart home or IoT sub-segments to prioritize for investment and development.

BtoB Segment Recovery and Strategic Shift

Groupe LDLC's BtoB segment faced a challenging FY 2024/2025, with revenues dropping by 13.0%. However, the company observed an encouraging 'improved trend' in the first quarter of FY 2025/2026, signaling a potential turnaround.

Despite its current struggles, the broader market for corporate IT investments is anticipated to rebound as economic conditions stabilize and businesses pursue necessary technological upgrades. This presents a future opportunity for LDLC to regain market share.

- BtoB Segment Performance: Revenue decline of 13.0% in FY 2024/2025.

- Emerging Trend: Noted improvement in Q1 2025/2026.

- Market Outlook: Corporate IT investment expected to recover with economic stability and tech upgrades.

- Strategic Position: LDLC's efforts to capture future growth classify BtoB as a 'question mark' in the BCG matrix.

Groupe LDLC's foray into the refurbished and sustainable products market, alongside its strategic expansion into emerging high-tech sectors like smart home and IoT, currently positions these ventures as question marks. These areas exhibit high growth potential but require significant investment to establish market share against competitors. The company's BtoB segment, despite a recent revenue dip, shows signs of recovery, also fitting the question mark profile due to its need for strategic focus to capitalize on anticipated market rebounds.

| Business Unit/Initiative | BCG Category | Current Status/Potential | Strategic Imperative |

|---|---|---|---|

| Rue du Commerce Marketplace | Question Mark | Low current market share, high growth potential | Significant investment required to become a Star |

| Refurbished/Sustainable Products | Question Mark | Growing consumer demand, nascent market position | Investment to capitalize on circular economy trend |

| Smart Home/IoT Expansion | Question Mark | Rapid innovation, competitive landscape | Resource allocation for R&D and marketing |

| BtoB Segment | Question Mark | Recent revenue decline, signs of recovery | Strategic focus to regain market share post-rebound |

BCG Matrix Data Sources

Our Groupe LDLC BCG Matrix draws from a robust blend of internal financial statements, e-commerce sales data, and detailed market research reports to accurately position each business unit.