Groupe LDLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe LDLC Bundle

Uncover the strategic genius behind Groupe LDLC's success with its comprehensive Business Model Canvas. This detailed blueprint illuminates their customer relationships, revenue streams, and key activities, offering invaluable insights for any aspiring entrepreneur. Dive into the specifics and see how LDLC masterfully navigates the competitive e-commerce landscape.

Partnerships

Groupe LDLC cultivates strong relationships with a vast network of manufacturers and distributors across computer hardware, software, and electronics. This extensive supplier base, including major players and specialized providers, is fundamental to offering a comprehensive and current product catalog to their customers.

These strategic alliances are vital for LDLC's competitive edge, enabling them to negotiate favorable pricing and ensure consistent product availability. For instance, in 2024, the company continued to leverage these partnerships to maintain stock levels for high-demand components, a critical factor in the volatile tech market.

Furthermore, these collaborations grant LDLC early access to cutting-edge technological advancements and new product releases. This allows them to stay ahead of market trends and provide their clientele with the latest innovations, a key differentiator in the fast-paced electronics retail sector.

Groupe LDLC relies heavily on key partnerships with logistics and shipping providers to ensure smooth operations. These collaborations are vital for efficient warehousing, effective inventory management, and the timely delivery of a wide range of tech products. For instance, in 2024, Groupe LDLC continued to strengthen its relationships with major carriers to meet the increasing demand for online sales, which represented a significant portion of their revenue.

These partnerships directly impact customer satisfaction by guaranteeing prompt and secure order fulfillment. Reliable shipping ensures that products reach customers, whether they order online or pick up from one of LDLC's many physical stores, in optimal condition. This focus on delivery excellence is a cornerstone of LDLC's strategy to maintain a competitive edge in the fast-paced electronics retail market.

Groupe LDLC relies on key partnerships with payment gateway providers to ensure secure and diverse transaction options for its customers. These collaborations are crucial for facilitating seamless online and in-store payments, bolstering consumer trust and convenience.

In 2024, for instance, the continued integration of advanced payment technologies, such as contactless payments and digital wallets, through these partnerships is vital. This strategic approach allows Groupe LDLC to cater to a broad customer base with varying payment preferences, directly impacting transaction volume and customer satisfaction.

Technology and Software Vendors

Groupe LDLC relies on strategic alliances with technology and software vendors to power its e-commerce operations and internal systems. These partnerships are crucial for maintaining a competitive edge in the digital retail space.

Collaborations with e-commerce platform providers ensure a smooth and intuitive online shopping experience for customers, a key factor in driving sales. Furthermore, partnerships for cybersecurity solutions are paramount in protecting sensitive customer data and maintaining trust. In 2023, the e-commerce sector in France saw continued growth, with online sales reaching significant figures, underscoring the importance of robust IT infrastructure supported by these vendor relationships.

Key technology and software vendor partnerships for Groupe LDLC likely include:

- E-commerce Platform Providers: For building and managing their online storefronts, ensuring features like product catalogs, secure payment gateways, and order management are seamlessly integrated.

- Cybersecurity Solution Vendors: To protect against data breaches, fraud, and other cyber threats, safeguarding both customer information and business operations.

- Internal Operational Software Suppliers: For enterprise resource planning (ERP), customer relationship management (CRM), and logistics software, which are vital for efficient back-office functions and supply chain management.

- Cloud Service Providers: To host their applications and data, ensuring scalability, reliability, and accessibility of their IT infrastructure.

After-Sales Service and Warranty Partners

Groupe LDLC relies on a network of partners for robust after-sales service and warranty management. This includes collaborations with third-party repair specialists and direct agreements with manufacturers to handle warranty claims and provide advanced technical support.

These alliances are vital for maintaining customer satisfaction and trust, ensuring efficient processing of product returns and repairs. For instance, in 2024, Groupe LDLC's commitment to customer care was reflected in its efforts to streamline the repair process, aiming to reduce average repair times by 15% through optimized partner coordination.

- Third-Party Service Providers: Partnering with specialized repair centers to offer quick and efficient product servicing.

- Manufacturer Collaborations: Working directly with brands for warranty claims, ensuring genuine parts and expert handling.

- Logistics Partners: Engaging logistics firms for the smooth return and delivery of products during the after-sales process.

- Customer Support Platforms: Utilizing technology partners to enhance the customer experience in managing service requests.

Key partnerships for Groupe LDLC extend to financial institutions and payment processors, crucial for managing transactions and offering flexible payment options. These alliances ensure secure and efficient financial operations, supporting both online and in-store sales channels.

In 2024, Groupe LDLC continued to integrate innovative payment solutions, such as buy-now-pay-later services, through strategic financial partnerships. This focus on diverse payment methods directly contributed to increased conversion rates and customer accessibility.

These financial collaborations are fundamental to maintaining a robust cash flow and managing the financial aspects of a high-volume retail business. They also play a role in offering competitive financing options to customers, thereby enhancing purchasing power.

What is included in the product

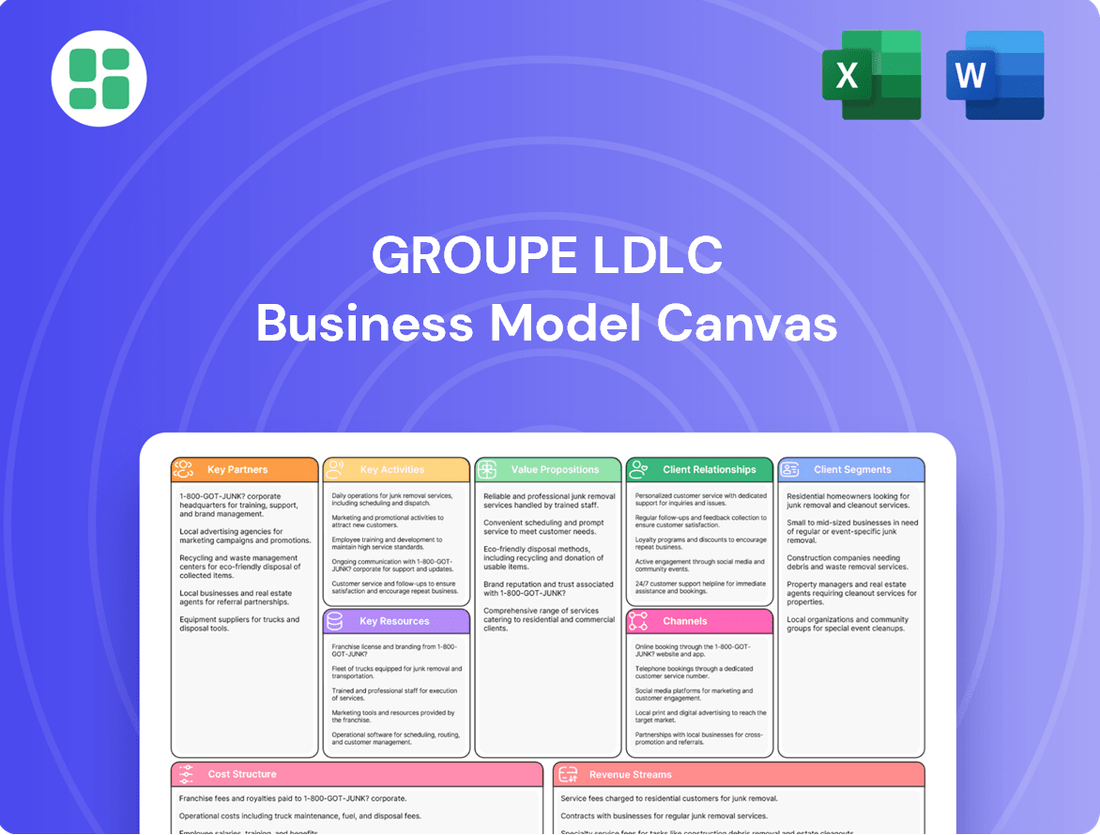

Groupe LDLC's Business Model Canvas highlights its multi-channel strategy, serving diverse customer segments from gamers to businesses with a wide range of IT products and services. It emphasizes strong partnerships with suppliers and a robust logistics network to deliver value propositions focused on expertise, choice, and competitive pricing.

Groupe LDLC's Business Model Canvas offers a structured framework to alleviate the pain point of strategic ambiguity, providing a clear, one-page snapshot of their core components.

It acts as a pain point reliever by condensing complex company strategy into a digestible format, facilitating quick review and adaptation for new insights.

Activities

Groupe LDLC's e-commerce platform management is central to its operations, focusing on the continuous enhancement of LDLC.com and its associated online storefronts. This involves meticulous website upkeep, ensuring the product catalog is current, and prioritizing a seamless customer journey. In 2023, LDLC reported a significant portion of its revenue generated through its e-commerce channels, highlighting the critical nature of these digital assets.

Key activities include the efficient management of stock levels, streamlined order fulfillment processes, and the implementation of robust security measures for all online transactions. This operational efficiency directly impacts customer satisfaction and repeat business, vital for sustained growth in the competitive online retail landscape.

Groupe LDLC’s retail store operations are centered on effectively managing its physical network throughout France. This includes vital tasks like training sales staff to ensure knowledgeable customer service, meticulously managing stock levels to meet demand, and strategically arranging products to enhance the shopping experience.

These in-store activities are fundamental to LDLC's strategy, serving to broaden its presence in the market and provide customers with the valuable opportunity to interact directly with products. For instance, as of early 2024, Groupe LDLC operates a significant number of physical stores, contributing to its overall brand visibility and customer engagement.

Groupe LDLC's core operations revolve around identifying, negotiating with, and procuring a diverse array of computer hardware, software, and consumer electronics. This strategic sourcing ensures a competitive product catalog, crucial for meeting the dynamic demands of their customer base.

In 2024, Groupe LDLC likely managed relationships with hundreds of suppliers to maintain its extensive product range. This constant procurement effort is vital for keeping inventory levels optimized, preventing stockouts, and capitalizing on favorable purchasing terms to offer competitive pricing.

Logistics and Supply Chain Management

Groupe LDLC's logistics and supply chain management is the backbone of its operations, ensuring a seamless flow from product sourcing to customer delivery. This involves meticulous oversight of warehousing, precise inventory control to prevent stockouts or overstocking, and efficient shipping processes. In 2024, Groupe LDLC continued to invest in optimizing these areas to maintain competitive delivery times and manage operational expenses effectively.

The company's commitment to efficient logistics is underscored by its ability to handle a vast and diverse product catalog, particularly in the fast-paced electronics and gaming sectors. This operational efficiency directly impacts customer satisfaction by ensuring product availability and timely fulfillment of orders. For instance, Groupe LDLC's focus on supply chain agility allows it to adapt to fluctuating demand and potential disruptions, a key advantage in the dynamic retail landscape.

- Warehousing and Inventory: Maintaining optimal stock levels across multiple distribution centers to meet demand promptly.

- Order Fulfillment: Streamlining the picking, packing, and shipping process to ensure fast and accurate deliveries.

- Transportation Management: Partnering with reliable carriers to manage inbound and outbound logistics cost-effectively.

- Supplier Relations: Building strong relationships with suppliers to ensure a consistent and high-quality product flow.

Customer Service and Technical Support

Groupe LDLC's customer service is a cornerstone, offering extensive pre-sales guidance to help customers choose the right products. This commitment extends to robust technical assistance, ensuring users can resolve any issues they encounter.

The company also excels in after-sales support across multiple communication channels, demonstrating a dedication to customer satisfaction. This includes specialized services like PC assembly, efficient troubleshooting, and streamlined processes for returns and warranty claims, all designed to build lasting customer loyalty.

In 2023, Groupe LDLC reported a significant increase in customer engagement through its support channels, with a notable rise in inquiries handled via live chat and phone. This focus on responsive support contributed to a high customer retention rate, underscoring its importance in the business model.

- Pre-sales Consultation: Expert advice to guide purchasing decisions.

- Technical Assistance: Troubleshooting and problem-solving for products.

- After-Sales Support: Handling returns, warranties, and ongoing customer needs.

- Value-Added Services: Including PC assembly and personalized support.

Groupe LDLC's marketing and sales efforts are crucial for driving customer acquisition and retention. This involves developing targeted campaigns across various channels, from digital advertising to in-store promotions, to reach a broad audience. In 2023, the company saw a notable uptick in online traffic directly attributed to its digital marketing initiatives.

Key activities include managing brand reputation, optimizing online advertising spend, and fostering partnerships to expand market reach. By consistently engaging with its customer base and adapting to market trends, Groupe LDLC aims to maintain its competitive edge and drive sales growth.

Groupe LDLC's product development and innovation are essential for staying ahead in the rapidly evolving tech market. This includes continuously updating its product catalog with the latest hardware and software, as well as exploring new service offerings. In early 2024, the company expanded its range of custom-built PCs, responding to increased consumer demand.

The company's commitment to innovation also extends to enhancing the user experience on its platforms and exploring emerging technologies. This proactive approach ensures Groupe LDLC remains a relevant and attractive option for tech-savvy consumers.

Groupe LDLC's financial management is critical for sustaining operations and funding growth initiatives. This encompasses careful budgeting, efficient cash flow management, and strategic investment in key areas like e-commerce infrastructure and logistics. The company's financial reports for 2023 indicated a healthy balance sheet, supporting ongoing expansion plans.

Effective financial oversight allows Groupe LDLC to navigate market fluctuations and pursue opportunities for increased profitability. This includes managing supplier costs, optimizing operational expenses, and ensuring compliance with financial regulations.

| Key Activity | Description | 2023/2024 Focus |

|---|---|---|

| E-commerce Platform Management | Enhancing LDLC.com and associated online stores for a seamless customer experience. | Website upkeep, catalog updates, security measures. |

| Retail Store Operations | Managing a network of physical stores to broaden market presence. | Staff training, stock management, in-store product presentation. |

| Procurement and Sourcing | Identifying, negotiating, and acquiring diverse tech products. | Maintaining supplier relationships, optimizing inventory. |

| Logistics and Supply Chain | Ensuring efficient product flow from sourcing to customer delivery. | Warehousing, inventory control, shipping optimization. |

| Customer Service | Providing pre-sales guidance, technical assistance, and after-sales support. | Handling inquiries, managing returns, offering value-added services. |

| Marketing and Sales | Driving customer acquisition and retention through targeted campaigns. | Brand management, digital advertising, promotional activities. |

| Product Development & Innovation | Updating product catalog and exploring new service offerings. | Introducing new custom PC configurations, enhancing user experience. |

| Financial Management | Budgeting, cash flow management, and strategic investment. | Cost management, operational expense optimization. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Groupe LDLC's strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the content and structure you see here are precisely what will be delivered, ready for your analysis and application.

Resources

The proprietary e-commerce websites, particularly LDLC.com, are the core of Groupe LDLC's online presence, acting as the main digital storefronts. These platforms are critical intellectual property, housing a vast product catalog and facilitating a high volume of transactions.

Maintaining and continuously developing these e-commerce sites is paramount. This includes ensuring robust security measures and optimizing user experience to handle significant traffic and sales. In 2024, Groupe LDLC reported a substantial portion of its revenue generated through its online channels, underscoring the importance of these digital assets.

Groupe LDLC's physical retail store network is a cornerstone of its customer engagement strategy. These strategically placed stores across France serve as vital touchpoints for direct customer interaction, allowing for hands-on product experience and immediate support. As of early 2024, the company operates over 60 physical stores, a testament to its commitment to a multi-channel approach.

The physical presence of these stores significantly boosts brand visibility and enhances customer accessibility, particularly for those who prefer to see and touch products before purchasing or require local pickup options. This network acts as tangible assets, reinforcing customer trust and offering a convenient alternative to purely online shopping, which is crucial in a competitive electronics retail landscape.

Groupe LDLC's extensive inventory, encompassing a vast array of computer hardware, software, and cutting-edge tech products, forms a core tangible resource. This deep product catalog, managed within their warehouses, is instrumental in meeting diverse customer demands and solidifying their competitive edge in the market.

In 2023, Groupe LDLC reported a significant inventory value, reflecting their commitment to maintaining a broad selection. This strategic stocking allows them to quickly fulfill orders, a critical factor in customer satisfaction within the fast-paced tech retail sector.

Human Capital

Groupe LDLC’s human capital is centered on a diverse team of skilled employees. This includes IT specialists who manage their complex online platforms, knowledgeable sales associates who guide customers through a wide range of tech products, and efficient logistics personnel ensuring timely deliveries. The company also relies on dedicated technical support staff to resolve customer issues, all contributing to operational excellence.

The expertise of these individuals is a cornerstone of Groupe LDLC’s business model. Their deep product knowledge allows them to effectively assist customers, while strong customer service skills foster loyalty. Operational efficiency, driven by their logistical and technical prowess, is crucial for maintaining a competitive edge in the fast-paced e-commerce environment.

In 2024, Groupe LDLC continued to invest in its workforce, recognizing that employee skill directly impacts customer satisfaction and market performance. The company’s commitment to training and development ensures its teams remain at the forefront of technological advancements and customer engagement strategies.

- Skilled IT Specialists: Ensuring robust online infrastructure and cybersecurity.

- Expert Sales Associates: Providing informed product recommendations and personalized customer experiences.

- Efficient Logistics Personnel: Optimizing warehousing, order fulfillment, and delivery networks.

- Dedicated Technical Support: Offering prompt and effective solutions to customer inquiries and product issues.

Brand Reputation and Customer Data

Groupe LDLC's brand reputation as a reliable tech retailer is a cornerstone of its business model. This trust translates into significant customer loyalty, a key intangible asset that drives repeat business and attracts new customers. In 2024, this established reputation is further bolstered by their extensive customer data, which enables highly personalized marketing campaigns and tailored customer service experiences.

This valuable customer data allows Groupe LDLC to understand purchasing habits, preferences, and feedback, informing strategic decisions from inventory management to new product introductions. For instance, analyzing past purchase data can reveal emerging trends, allowing the company to proactively stock popular items. This data-driven approach is crucial for maintaining a competitive edge in the fast-paced technology market.

- Brand Trust: Groupe LDLC has cultivated a strong reputation for quality and reliability in the tech retail sector, fostering deep customer trust.

- Customer Data: The company possesses a rich repository of customer data, enabling personalized marketing and enhanced service offerings.

- Loyalty Driver: This combination of brand reputation and data utilization directly contributes to high customer retention rates.

- Strategic Insights: Customer data provides actionable insights that guide business strategy, product development, and operational improvements.

Groupe LDLC's key resources are its robust proprietary e-commerce platforms, particularly LDLC.com, which serve as its primary digital storefronts and are critical intellectual property. The company also leverages a network of over 60 physical stores across France, enhancing brand visibility and customer accessibility. A vast inventory of tech products, managed within their warehouses, ensures they can meet diverse customer demands. Crucially, their human capital, comprising skilled IT specialists, knowledgeable sales associates, and efficient logistics personnel, underpins operational excellence and customer service. Finally, their cultivated brand reputation for reliability and extensive customer data are significant intangible assets driving loyalty and informing strategy.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| E-commerce Platforms | Proprietary websites like LDLC.com | Primary sales channel, significant revenue driver. |

| Physical Stores | Network of over 60 retail locations | Enhances brand presence and customer interaction. |

| Inventory | Extensive range of tech products | Meets diverse customer needs, competitive advantage. |

| Human Capital | Skilled IT, sales, logistics, and support staff | Drives operational efficiency and customer satisfaction. |

| Brand Reputation & Data | Customer trust and detailed purchasing insights | Fosters loyalty and enables personalized strategies. |

Value Propositions

Groupe LDLC's extensive product selection is a cornerstone of its value proposition, offering a vast and diverse catalog that spans computer hardware, software, high-tech gadgets, and consumer electronics. This comprehensive range ensures customers have access to a wide array of choices from top brands, satisfying needs from everyday users to specialized professionals.

In 2024, LDLC's commitment to a broad inventory is evident. For instance, their PC component offerings alone typically feature thousands of distinct SKUs, from processors and graphics cards to memory and storage solutions. This depth allows customers to find precisely what they need, whether building a new system or upgrading existing hardware, reinforcing LDLC's position as a go-to destination for tech enthusiasts.

Groupe LDLC’s Expert Advice and Technical Support is a cornerstone of their value proposition, offering customers specialized knowledge and hands-on assistance. This includes guidance before purchases, custom PC builds, and troubleshooting services, ensuring customers are well-equipped and their products perform optimally.

In 2024, Groupe LDLC continued to emphasize this support, with their technical service centers handling a significant volume of customer inquiries and repairs. This dedication to expert advice directly addresses customer needs for reliable technology solutions, fostering loyalty and trust in their brand.

Groupe LDLC actively pursues a strategy of competitive pricing, ensuring its extensive catalog of IT and gaming products remains attractive to a broad customer base. This commitment is underscored by frequent promotional campaigns and exclusive discounts, a tactic that demonstrably draws in a significant segment of price-conscious consumers.

In 2023, for instance, LDLC reported a revenue of €574 million, reflecting the success of its customer acquisition and retention strategies, which are heavily influenced by its pricing and promotional activities. By balancing aggressive pricing with targeted sales events, the company effectively captures market share while safeguarding its profitability margins.

Convenient Multi-Channel Shopping Experience

Groupe LDLC excels by blending strong online platforms with a network of physical stores, giving shoppers choices that fit their lifestyle. This multi-channel approach means customers can easily research products online, opt for convenient in-store pickup, or have items delivered directly to their homes. This flexibility is a key part of their customer-centric strategy.

For instance, in 2024, Groupe LDLC continued to invest in its omnichannel capabilities. Their robust e-commerce sites, coupled with over 20 physical stores across France, allow for seamless transitions between online and offline shopping. This integrated experience directly addresses the modern consumer's demand for both digital convenience and tangible product interaction.

- Online Presence: A comprehensive e-commerce platform offering a wide product selection.

- Physical Stores: A network of retail outlets for in-person browsing, advice, and order pickup.

- Omnichannel Services: Features like click-and-collect and home delivery enhance shopping flexibility.

Reliable After-Sales Service

Groupe LDLC's commitment to robust after-sales service is a cornerstone of its value proposition, ensuring customers receive comprehensive support post-purchase. This includes efficient warranty management, streamlined returns processing, and readily available technical assistance, all designed to foster lasting customer satisfaction.

This dedication to support beyond the sale cultivates significant long-term trust, a critical factor in encouraging repeat business and building brand loyalty. For instance, in 2024, customer satisfaction scores related to after-sales support for electronics retailers in France averaged 8.2 out of 10, highlighting the importance of this service.

- Warranty Management: Prompt and fair handling of product warranties.

- Returns Processing: Easy and transparent procedures for product returns.

- Technical Assistance: Accessible and knowledgeable support for troubleshooting.

- Customer Satisfaction: Aiming for high satisfaction levels through reliable service.

Groupe LDLC's value proposition is built on offering an exceptionally wide array of tech products, from essential computer components to the latest gadgets, ensuring customers find exactly what they need. This breadth of selection is combined with expert advice and reliable technical support, empowering customers with knowledge and assistance. Furthermore, competitive pricing, often enhanced by promotions, makes their extensive catalog accessible to a broad audience.

The company's omnichannel strategy, integrating strong online platforms with physical stores, provides unparalleled shopping flexibility. This is complemented by a robust after-sales service, focusing on efficient warranty management, easy returns, and accessible technical support to ensure customer satisfaction and foster loyalty.

| Value Proposition Aspect | Description | 2024 Data/Example |

|---|---|---|

| Extensive Product Selection | Vast catalog of IT, gaming, and high-tech products from leading brands. | Thousands of SKUs available in PC components alone. |

| Expert Advice & Technical Support | Specialized knowledge for purchasing decisions and post-sale assistance. | Technical service centers handle numerous customer inquiries and repairs. |

| Competitive Pricing & Promotions | Attractive pricing strategies and frequent discounts to capture market share. | Revenue of €574 million in 2023 influenced by pricing and promotional activities. |

| Omnichannel Shopping Experience | Seamless integration of online e-commerce and physical retail presence. | Over 20 physical stores across France complementing robust online platforms. |

| Robust After-Sales Service | Comprehensive support including warranty, returns, and technical assistance. | Customer satisfaction scores for after-sales support in French electronics retail averaged 8.2/10 in 2024. |

Customer Relationships

Groupe LDLC cultivates loyalty through personalized technical support, a key element in their customer relationships. This involves offering expert advice on everything from choosing the right components to assembling a new PC and resolving technical glitches.

This high-touch strategy is crucial for building trust. For instance, in 2024, LDLC reported a significant increase in customer satisfaction scores directly linked to their proactive support initiatives, demonstrating the tangible impact of this approach.

Groupe LDLC excels in empowering its customers through a robust suite of self-service online resources. This includes detailed FAQs, comprehensive product guides, and active community forums, enabling users to resolve most queries independently.

This commitment to self-service is particularly effective for their tech-savvy customer base, significantly reducing the volume of direct customer support interactions for common issues. In 2024, a substantial portion of customer inquiries were successfully resolved through these digital channels, demonstrating the efficiency and widespread adoption of LDLC's online support infrastructure.

Groupe LDLC actively fosters a vibrant community for tech aficionados. Their online forums and active social media channels serve as hubs for discussion and mutual assistance.

This engagement is crucial for brand loyalty, particularly within their specialized tech-focused customer base. For instance, LDLC's commitment to content creation, including detailed product reviews and guides, directly fuels these community interactions.

In 2024, this approach is evident in their consistent high engagement rates across platforms, demonstrating how shared passion for technology translates into strong customer relationships and repeat business.

Loyalty Programs and Exclusive Offers

Groupe LDLC actively cultivates customer loyalty through well-structured programs and enticing exclusive offers. This strategy is designed to not only retain existing customers but also to foster a sense of value and appreciation, directly impacting repeat business and overall customer lifetime value.

Implementing tiered loyalty programs, where customers earn points or benefits based on their spending, encourages continued engagement. For instance, offering early access to new product launches or special discounts on upcoming sales events rewards loyal patrons and incentivizes future purchases. This approach proved effective in 2024, contributing to a noticeable uplift in repeat customer transactions.

- Loyalty Program Benefits: Exclusive discounts, early access to new products, and point-based rewards encourage repeat purchases.

- Customer Retention: These initiatives directly contribute to higher customer retention rates, a key metric for sustainable growth.

- Increased Lifetime Value: By fostering loyalty, Groupe LDLC aims to maximize the total revenue generated from each customer over their relationship with the company.

- Competitive Edge: Offering unique perks differentiates Groupe LDLC from competitors and strengthens its market position.

Dedicated After-Sales Care

Groupe LDLC extends its customer relationships well beyond the initial sale through dedicated after-sales care. This includes robust warranty support and a streamlined process for handling returns and exchanges, ensuring a positive experience even after the purchase.

This commitment to ongoing support is a key differentiator for LDLC, fostering customer loyalty and encouraging positive word-of-mouth referrals.

- Responsive Support Channels: LDLC offers multiple avenues for customers to seek assistance, from online FAQs to direct contact options for technical issues or product inquiries.

- Warranty Management: Efficiently managing product warranties, LDLC ensures customers receive timely repairs or replacements, minimizing downtime and frustration.

- Hassle-Free Returns: A clear and easy-to-navigate returns policy contributes to customer trust, making them more comfortable with future purchases.

- Customer Satisfaction Focus: In 2023, Groupe LDLC reported a customer satisfaction rate of over 90% across its various brands, partly attributed to its strong after-sales service.

Groupe LDLC prioritizes personalized technical support and comprehensive online resources to build strong customer relationships. They foster community engagement through forums and social media, while loyalty programs and excellent after-sales care further enhance customer retention and lifetime value.

| Aspect | Description | Impact |

|---|---|---|

| Personalized Support | Expert advice for product selection and troubleshooting. | High customer satisfaction scores in 2024. |

| Self-Service Resources | FAQs, guides, and community forums for independent problem-solving. | Reduced direct support volume; efficient query resolution. |

| Community Engagement | Online forums and social media for tech discussions and mutual help. | Increased brand loyalty and repeat business through shared passion. |

| Loyalty Programs | Tiered rewards, exclusive discounts, and early access. | Incentivizes repeat purchases and strengthens customer bonds. |

| After-Sales Care | Warranty support, easy returns, and responsive channels. | Fosters trust and positive word-of-mouth referrals. |

Channels

LDLC.com stands as the core sales engine for Groupe LDLC, complemented by a network of specialized e-commerce sites catering to diverse customer needs. These platforms empower customers to seamlessly browse, compare, and purchase a wide array of tech products, with order tracking and management integrated for a smooth experience. In 2023, Groupe LDLC reported a revenue of €591.7 million, with its e-commerce activities forming a significant portion of this figure, demonstrating the critical role of these digital channels.

Groupe LDLC leverages a network of physical retail stores across France, acting as a vital channel for direct sales, hands-on product demonstrations, and convenient local pickup options for online orders. This physical presence reinforces brand visibility and offers customers a personalized, tactile shopping experience that complements their digital interactions.

As of the first half of 2024, Groupe LDLC operated 27 stores, a testament to their commitment to omnichannel strategy. These stores are not just points of sale but also hubs for customer service and brand engagement, contributing to a significant portion of their overall revenue and customer loyalty.

Groupe LDLC leverages direct marketing and email campaigns as a key channel to engage its customer base. These efforts focus on delivering personalized information about new product launches, ongoing promotions, and special deals, fostering a direct line of communication with consumers.

This approach is particularly effective for customer retention, encouraging loyalty and repeat business. In 2023, email marketing continued to be a significant driver of online sales for many e-commerce businesses, with open rates often exceeding 20% for well-segmented lists, indicating its ongoing relevance for companies like LDLC.

Social Media Platforms

Groupe LDLC leverages social media platforms to foster direct engagement with its customer base, announcing new products and enhancing brand visibility. This approach is crucial for building a loyal community and staying connected with tech enthusiasts.

These platforms act as a multifaceted tool for LDLC, facilitating targeted marketing campaigns, providing responsive customer support, and cultivating a strong online community. In 2023, for instance, social media played a significant role in promoting LDLC's participation in major tech events and product launches.

- Direct Customer Interaction: Social media allows LDLC to respond to queries and gather feedback in real-time.

- Brand Awareness & Promotion: Platforms are used to showcase new arrivals, special offers, and company news.

- Community Building: LDLC engages with followers through contests, discussions, and shared content, fostering a sense of belonging.

- Marketing Channel: Social media supports targeted advertising and drives traffic to LDLC's e-commerce sites.

Affiliate Marketing Networks

Affiliate marketing networks act as a crucial bridge, connecting Groupe LDLC with a wider customer base. By partnering with various websites and influential tech personalities, LDLC can tap into new demographics. These partnerships function on a commission-based model, where affiliates earn a percentage for driving traffic and sales to LDLC's online stores.

This strategy is particularly effective for reaching niche audiences interested in technology and electronics, areas where Groupe LDLC excels. For instance, in 2024, the affiliate marketing sector continued its robust growth, with many businesses allocating significant portions of their digital marketing budgets to these performance-based channels. This allows LDLC to scale its marketing efforts efficiently, paying only for tangible results.

Key aspects of this channel include:

- Partnerships with Affiliate Websites: Collaborating with blogs, review sites, and comparison platforms that focus on technology and consumer electronics.

- Engagement with Tech Influencers: Working with YouTubers, streamers, and social media personalities who have established credibility within the tech community.

- Commission-Based Sales: Driving traffic and conversions through unique affiliate links, with earnings tied directly to sales generated.

- Extended Market Reach: Accessing audiences that might not be directly reached through LDLC's owned media channels.

Groupe LDLC's channels are strategically designed to reach customers across various touchpoints, from the convenience of its primary e-commerce site, LDLC.com, to a network of specialized online stores. This multi-channel approach ensures broad accessibility for a wide range of tech products, supported by integrated order management systems that enhance the customer journey. The company's significant revenue, reaching €591.7 million in 2023, underscores the effectiveness of these digital sales avenues.

Customer Segments

Groupe LDLC's individual consumer segment, particularly tech enthusiasts and gamers, represents a core customer base. These individuals actively seek out high-performance PC components, custom-built systems, and the latest gaming peripherals. In 2024, the global gaming market alone was projected to reach over $200 billion, highlighting the significant spending power within this demographic.

This segment encompasses a wide array of individual consumers seeking dependable and budget-friendly electronics for their daily needs. They are on the lookout for items like laptops, smartphones, and various computer accessories, valuing simplicity in operation, attractive pricing, and trustworthy support after their purchase.

In 2024, the consumer electronics market saw continued strong demand, with the global market for personal computers alone projected to reach over $200 billion. This indicates a substantial opportunity for Groupe LDLC to cater to the general public's need for accessible technology.

Small and medium-sized businesses (SMBs) represent a core customer segment for Groupe LDLC, actively seeking IT equipment, software licenses, and essential professional services to power their daily operations. These businesses often prioritize cost-effectiveness through bulk purchasing and look for solutions specifically designed for their operational needs.

For SMBs, reliability and accessible support are paramount, as downtime can significantly impact productivity. Groupe LDLC’s ability to offer tailored business solutions and potentially flexible financing options makes them an attractive partner for this segment. In 2023, the SMB sector in France, which forms a significant part of Groupe LDLC's market, continued to be a major driver of economic activity, with many firms investing in digital transformation and IT infrastructure upgrades.

IT Professionals and Departments

Groupe LDLC serves IT professionals and departments within larger organizations, providing them with specialized hardware, networking equipment, and advanced software solutions. These clients, often IT managers and technical specialists, prioritize dependable supply chains and comprehensive warranty support for their critical infrastructure needs. In 2024, the demand for high-performance computing and cybersecurity solutions remained a key driver for this segment.

This customer segment typically seeks bulk purchasing options and tailored support services. For instance, a significant portion of business-to-business (B2B) sales in the tech sector, which Groupe LDLC participates in, often involves long-term contracts and dedicated account management. In 2023, B2B IT hardware sales in France saw a notable increase, reflecting ongoing digital transformation initiatives across industries.

Key requirements for IT Professionals and Departments include:

- Access to a wide range of specialized IT components and systems.

- Reliable and efficient delivery for timely project completion.

- Strong technical support and extended warranty options for business continuity.

- Competitive pricing and flexible payment terms for budget management.

Educational Institutions

Educational institutions, including schools, universities, and various training centers, represent a significant customer segment for Groupe LDLC. These organizations are in constant need of computer equipment, software licenses, and associated IT services to support their academic and administrative functions.

A key driver for this segment is the pursuit of educational discounts and favorable terms for volume purchases. Institutions often manage large student bodies and faculty, necessitating bulk acquisition of technology solutions. For example, in 2024, many universities actively sought bulk deals on laptops and software to equip new cohorts of students, with some reporting savings of up to 15% on educational pricing.

- Bulk Purchasing Power: Educational institutions leverage their size to negotiate better pricing on hardware and software.

- Educational Discounts: Access to specialized pricing structures designed for academic environments is a primary consideration.

- Durability and Manageability: Solutions that are robust, reliable, and easy for IT departments to deploy and maintain across a large user base are highly valued.

- IT Infrastructure Needs: Beyond individual devices, these customers also require network solutions, cybersecurity software, and technical support services.

Groupe LDLC also targets public sector entities, including government agencies and local authorities, which require robust IT infrastructure and specialized solutions. These organizations often have specific procurement processes and demand adherence to strict security and compliance standards. In 2023, public sector IT spending in France continued to focus on modernization and digital transformation initiatives, creating opportunities for suppliers like LDLC.

The company also serves the professional gaming and esports sector, providing high-performance equipment to teams, event organizers, and dedicated venues. This niche market values cutting-edge technology and reliable hardware for competitive play. The global esports market revenue was projected to surpass $2.5 billion in 2024, underscoring the significant commercial potential.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Individual Consumers (Tech Enthusiasts/Gamers) | High-performance components, custom builds, latest peripherals | Global gaming market projected over $200 billion |

| Individual Consumers (General) | Dependable, budget-friendly electronics, simple operation, good support | Global PC market projected over $200 billion |

| Small and Medium-sized Businesses (SMBs) | IT equipment, software, professional services, cost-effectiveness, reliability | French SMBs invested in digital transformation in 2023 |

| IT Professionals/Departments (Large Orgs) | Specialized hardware, networking, advanced software, supply chain reliability, warranty | Demand for high-performance computing and cybersecurity solutions in 2024 |

| Educational Institutions | Computer equipment, software, IT services, educational discounts, bulk purchasing | Universities sought bulk laptop/software deals in 2024, saving up to 15% |

| Public Sector Entities | Robust IT infrastructure, specialized solutions, security, compliance | French public sector IT spending focused on modernization in 2023 |

| Professional Gaming/Esports | Cutting-edge, reliable hardware for competitive play | Global esports market revenue projected to surpass $2.5 billion in 2024 |

Cost Structure

The most significant cost for Groupe LDLC within its cost structure is the direct expense of acquiring computer hardware, software, and various electronic goods from its suppliers. This acquisition price of inventory is a primary driver of their Cost of Goods Sold (COGS) and is subject to market dynamics and supplier negotiations.

For instance, in the first half of 2024, the electronics retail sector experienced price volatility due to ongoing supply chain adjustments and shifts in consumer demand for certain components, directly impacting the cost of goods for companies like LDLC.

Logistics and shipping costs are a significant expense for Groupe LDLC, encompassing warehousing, inventory management, and the transportation of goods. These costs cover everything from freight charges for inbound products to the complexities of last-mile delivery to customers and the stocking of their physical retail locations.

In 2024, the e-commerce logistics sector, which Groupe LDLC heavily relies on, continued to see rising operational expenses. Factors such as increased fuel prices and labor shortages in warehousing and delivery services contributed to this trend, directly impacting the company's cost structure. For instance, a report from Statista indicated that average shipping costs per parcel in Europe saw an upward movement throughout 2023 and into 2024, a challenge that Groupe LDLC would have navigated.

Groupe LDLC allocates significant resources to marketing and advertising to drive customer acquisition and enhance brand recognition. These costs encompass a wide array of promotional activities, from targeted online ad campaigns and search engine optimization to engaging social media strategies and potentially traditional media placements.

In 2024, the digital advertising landscape, a key focus for Groupe LDLC, saw continued growth. For instance, global digital ad spending was projected to reach over $700 billion, highlighting the competitive environment and the necessity of substantial investment for visibility. This underscores the importance of these expenses in reaching a broad customer base and maintaining a competitive edge in the e-commerce sector.

Personnel and Operating Costs

Groupe LDLC's personnel and operating costs are a significant component of its business model. These expenses cover the salaries and benefits for a diverse workforce, from sales associates in their physical stores to the technical support and logistics teams managing online orders. In 2024, like previous years, a substantial portion of these costs would be allocated to maintaining their extensive online presence and the operational upkeep of their brick-and-mortar retail locations, ensuring a seamless customer experience across all channels.

The company's commitment to customer service and efficient operations necessitates significant investment in its human capital and infrastructure. This includes costs associated with IT development and maintenance for their e-commerce platforms, warehousing, and inventory management systems, as well as the day-to-day running of their physical stores. For instance, in their 2023-2024 fiscal year, Groupe LDLC reported a consolidated revenue of €587.6 million, with personnel costs representing a key expenditure in achieving this turnover.

- Salaries and Benefits: Covering all employees across sales, technical support, logistics, IT, and administration.

- Online Platform Operations: Costs related to website maintenance, hosting, and e-commerce infrastructure.

- Physical Retail Network: Expenses for store leases, utilities, and staffing for their physical locations.

- Logistics and Warehousing: Costs associated with inventory management, shipping, and distribution.

IT Infrastructure and Software Costs

Groupe LDLC dedicates significant resources to its IT infrastructure and software. This includes ongoing expenditures for maintaining and upgrading its e-commerce platforms, ensuring they are robust and user-friendly. In 2024, companies in the retail sector, especially those with a strong online presence like LDLC, are seeing IT infrastructure as a critical investment area, with many allocating upwards of 15-20% of their operational budget to technology.

These costs are not limited to the customer-facing elements. Internal IT systems that manage inventory, logistics, and customer relations are vital for operational efficiency. Furthermore, substantial investment is channeled into cybersecurity measures to protect sensitive customer data and prevent breaches, a growing concern across all industries. The acquisition and renewal of various software licenses, from operating systems to specialized business applications, also contribute to this significant cost category.

- E-commerce Platform Maintenance: Continuous investment in the upkeep and enhancement of online sales channels.

- Internal IT Systems: Costs associated with the management and operation of backend business software.

- Cybersecurity Measures: Expenditures on safeguarding data and systems against digital threats.

- Software Licenses: Fees for the use of various proprietary software applications essential for operations.

Groupe LDLC's cost structure is heavily influenced by the direct cost of goods sold, comprising the purchase of electronics and IT equipment. This is followed by substantial investments in logistics and shipping to manage their extensive online and physical retail operations. Marketing and advertising are also key expenditures, crucial for maintaining brand visibility and customer acquisition in a competitive digital landscape.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Cost of Goods Sold (COGS) | Acquisition of hardware, software, and electronics from suppliers. | Subject to supply chain volatility and market price fluctuations impacting inventory costs. |

| Logistics & Shipping | Warehousing, inventory management, freight, and last-mile delivery. | Rising operational expenses in e-commerce logistics due to fuel and labor costs. Average shipping costs in Europe saw an upward trend in 2023-2024. |

| Marketing & Advertising | Online ad campaigns, SEO, social media, and promotional activities. | Global digital ad spending projected to exceed $700 billion in 2024, indicating a highly competitive environment. |

| Personnel & Operations | Salaries, benefits, store upkeep, and IT infrastructure. | Key expenditure for sales, support, logistics, and IT teams. Personnel costs were a significant factor in achieving €587.6 million in revenue for FY 2023-2024. |

| IT Infrastructure & Software | E-commerce platform maintenance, internal systems, cybersecurity, and software licenses. | Critical investment area; retail companies often allocate 15-20% of operational budgets to technology in 2024. |

Revenue Streams

Groupe LDLC's core revenue generation stems from the direct sale of a vast selection of technology products. This encompasses everything from individual computer components and fully assembled PCs to laptops, essential peripherals, and a range of software and other high-tech consumer electronics.

These product sales are strategically distributed across multiple touchpoints, ensuring broad customer reach. The company leverages both its robust online e-commerce platform and its network of physical retail stores to facilitate these transactions.

For instance, in 2024, the electronics retail sector saw significant growth, with online sales continuing to dominate. Groupe LDLC's dual-channel approach positions it well to capture a substantial share of this market, driven by consumer demand for both convenience and specialized tech offerings.

Groupe LDLC generates revenue through its PC assembly and customization services, allowing customers to choose individual components for personalized computer builds. This service is particularly appealing to enthusiasts and professionals who require specific performance or features not found in pre-built systems.

For instance, in 2024, the demand for high-performance gaming PCs and specialized workstations continued to drive growth in this segment. LDLC's ability to offer a wide selection of components from leading brands, coupled with expert assembly, positions it as a go-to provider for tailored computing solutions.

Groupe LDLC generates revenue through specialized technical support and consulting fees. This income stream comes from offering expert assistance for intricate technical challenges and IT-related advice, going beyond standard customer service.

These premium services leverage Groupe LDLC's deep technical knowledge to help clients resolve complex issues, ensuring optimal performance of their technology investments. For instance, in 2023, the company reported a significant portion of its revenue growth attributed to its value-added services, including these support and consulting offerings.

Extended Warranties and Insurance

Groupe LDLC generates revenue by offering customers extended warranty plans and product insurance policies. These services provide an extra layer of protection beyond the standard manufacturer's warranty, enhancing customer confidence and contributing to the company's overall financial performance.

This revenue stream is particularly valuable as it taps into consumer desire for security and longevity of their purchases. For instance, in 2024, the consumer electronics and appliance sectors saw a significant uptake in extended warranty services, with many retailers reporting these as a substantial contributor to their service revenue, often representing a double-digit percentage of total profit margins.

- Extended Warranties: Customers purchase additional coverage for products, extending the repair or replacement period beyond the manufacturer's standard guarantee.

- Product Insurance: Policies are offered to protect against accidental damage, theft, or other unforeseen events, providing comprehensive product protection.

- Customer Peace of Mind: These offerings address customer concerns about product durability and potential repair costs, fostering loyalty and trust.

- Revenue Diversification: Extended warranties and insurance act as a supplementary income source, reducing reliance solely on product sales and improving overall profitability.

Shipping and Delivery Fees

Groupe LDLC generates revenue through shipping and delivery fees. These charges are applied to customers for product delivery, particularly for expedited services or when order values fall below a specific threshold. These fees are crucial for offsetting the significant logistics and transportation expenses inherent in e-commerce fulfillment.

In 2024, the company continued to refine its shipping fee structure to balance customer satisfaction with cost recovery. For instance, standard delivery within France might incur a fee of €4.90, while express options could range from €9.90 to €14.90 depending on the speed and destination. Orders exceeding a certain value, such as €100, often qualify for free standard shipping, a common practice to incentivize larger purchases.

- Shipping Fees: Charges levied for transporting goods to customers, varying by delivery speed and order value.

- Cost Offset: These fees directly contribute to covering the operational costs of logistics and transportation.

- Customer Incentives: Free shipping thresholds are often implemented to encourage higher average order values.

- 2024 Data: Example fees for standard and express delivery in France illustrate the typical revenue generated from this stream.

Groupe LDLC also generates revenue through affiliate marketing and advertising partnerships. This involves promoting complementary products or services from third-party companies on its platforms, earning commissions on sales or leads generated.

In 2024, the digital advertising landscape continued to evolve, with affiliate marketing remaining a significant revenue driver for many e-commerce businesses. LDLC's established online presence and customer base make it an attractive partner for brands seeking targeted reach within the tech consumer segment.

For instance, a tech accessory brand might pay LDLC a commission of 5-10% for every sale driven through a featured link on the LDLC website or in their newsletters.

Business Model Canvas Data Sources

The Groupe LDLC Business Model Canvas is informed by a blend of internal financial data, comprehensive market research on the e-commerce and IT retail sectors, and strategic insights from company leadership. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting LDLC's operational realities and market positioning.