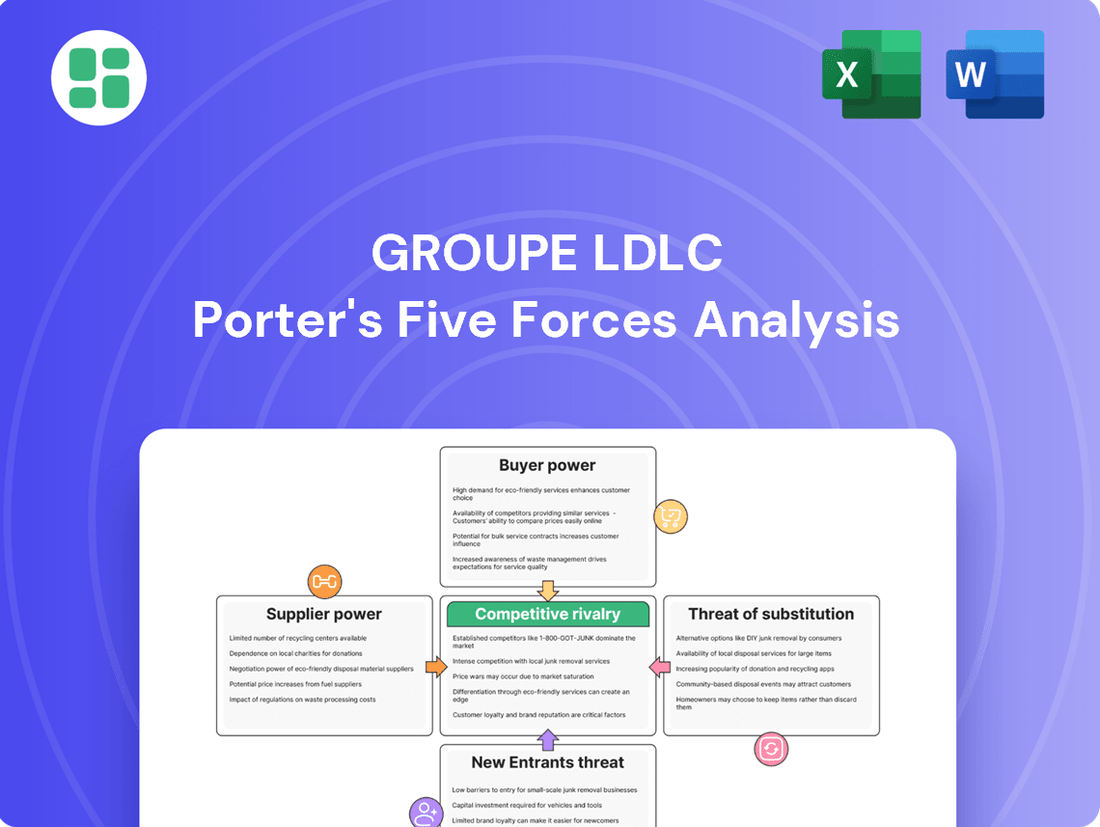

Groupe LDLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe LDLC Bundle

Groupe LDLC navigates a competitive e-commerce landscape where buyer power and the threat of substitutes are significant considerations. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic positioning.

The complete report reveals the real forces shaping Groupe LDLC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for essential computer components like CPUs and GPUs is heavily concentrated, with a few dominant manufacturers holding significant sway. This limited supplier base grants them considerable bargaining power over retailers such as Groupe LDLC.

This concentration means LDLC has fewer alternative sources for critical, high-demand products. Consequently, these suppliers can dictate terms and influence pricing, potentially impacting LDLC's profitability and inventory management.

Groupe LDLC's reported gross margin rate of 21-22% in recent years suggests they are managing these supplier relationships effectively. This could be through securing favorable terms or successfully passing on increased component costs to their customer base.

While large component manufacturers often wield significant power, Groupe LDLC's substantial purchasing volume can be a crucial factor for smaller or niche suppliers. This volume grants LDLC a degree of negotiation leverage, especially when dealing with entities for whom LDLC represents a significant portion of their sales. For instance, if LDLC accounts for 10% of a specific component supplier's annual revenue, that supplier will be more inclined to offer favorable terms.

The economic climate in H1 2024/2025 presented a challenging environment, marked by postponed investments and a general softening of demand across various sectors. This reduced demand can subtly shift the balance of power, potentially benefiting large buyers like LDLC. As consumer and business spending tightens, suppliers may become more amenable to competitive pricing and better contract terms to secure sales volume.

For Groupe LDLC, the bargaining power of suppliers is amplified when switching to a new provider for highly specialized or proprietary components involves significant costs. These expenses can include re-tooling manufacturing equipment, obtaining new certifications, and overhauling existing supply chain logistics, potentially impacting operational efficiency and product availability.

This dependency on established suppliers for critical, niche products can limit LDLC's leverage in price negotiations. For instance, if a particular line of high-performance gaming components relies on a single, specialized manufacturer, LDLC may find it challenging to secure more favorable payment terms or volume discounts, as the supplier understands the difficulty and cost associated with finding an alternative.

Availability of Substitute Inputs

For Groupe LDLC, the availability of substitute inputs for its core hardware components is generally low. Essential parts like specific CPUs or GPUs often come from a limited set of manufacturers, meaning there aren't many entirely different input types that LDLC can switch to. While there are competing brands within these categories, the underlying technology is typically controlled by a few key players, which restricts LDLC's leverage in bypassing supplier power.

This situation means suppliers of these critical components hold significant bargaining power. For example, in 2024, the global semiconductor shortage continued to impact the availability and pricing of processors and graphics cards, directly affecting companies like LDLC. This scarcity underscores how reliance on a few dominant suppliers for specialized inputs limits a company's options and strengthens the suppliers' position.

- Limited Substitutes: Core hardware components like processors and graphics cards have few direct substitutes, concentrating power with a small number of manufacturers.

- Supplier Concentration: The technology for these critical inputs is often controlled by a limited number of dominant players, reducing LDLC's options.

- Impact of Shortages: Events like the 2024 semiconductor shortage highlight how limited availability of specific inputs enhances supplier bargaining power.

Supplier Forward Integration Threat

The threat of suppliers integrating forward into retail operations presents a moderate challenge for Groupe LDLC. Many prominent technology brands, which are key suppliers, already operate their own direct-to-consumer (DTC) sales platforms.

While these brands may not entirely displace traditional retailers like LDLC, their DTC presence directly impacts margins and diminishes their reliance on external distributors. This increased independence for suppliers inherently strengthens their bargaining power.

- DTC Channel Presence: Major tech brands like Apple and Samsung have established robust DTC sales channels, directly competing with retailers.

- Margin Pressure: The direct sales by suppliers can lead to price competition, potentially squeezing retailer margins.

- Supplier Independence: Suppliers operating DTC channels are less dependent on retailers for market access, increasing their leverage.

The bargaining power of suppliers for Groupe LDLC is significantly influenced by the concentration of the market for essential computer components. Limited substitutes and a few dominant manufacturers for core hardware like CPUs and GPUs grant these suppliers considerable leverage, as evidenced by the continued impact of the 2024 semiconductor shortage on availability and pricing.

Groupe LDLC's substantial purchasing volume can provide some negotiation leverage, particularly with smaller or niche suppliers where LDLC represents a significant sales portion. However, the high switching costs for specialized or proprietary components, coupled with the threat of suppliers integrating forward through direct-to-consumer channels, generally tip the scales in favor of suppliers.

| Factor | Impact on LDLC | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | High power for dominant manufacturers | Limited availability and pricing power for CPUs/GPUs due to few key players. |

| Availability of Substitutes | Low for critical components | Few alternative input types for specialized hardware, restricting LDLC's options. |

| Switching Costs | High for specialized inputs | Significant expenses for re-tooling and logistics when changing suppliers for niche products. |

| Supplier Forward Integration | Moderate threat | Major tech brands' DTC channels increase supplier independence and leverage. |

What is included in the product

This analysis unpacks the competitive forces shaping Groupe LDLC's market, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly pinpoint and address competitive threats by visualizing the intensity of each of Porter's Five Forces for Groupe LDLC.

Customers Bargaining Power

French consumers, a key demographic for Groupe LDLC, demonstrate a strong inclination towards price sensitivity and value-seeking, particularly within the competitive consumer electronics sector. This means they actively hunt for the best deals and are quick to compare offerings from various retailers.

Even with inflation showing signs of moderation, this ingrained price consciousness remains a significant factor. Customers are diligently comparing prices across multiple online and offline platforms, a behavior that amplifies their bargaining power.

This persistent price comparison empowers customers, as they can readily shift their loyalty to competitors that present more attractive pricing or promotional offers. For instance, in 2023, the average consumer in France spent an estimated €1,200 on electronics, a figure heavily influenced by promotional periods like Black Friday and Cyber Monday which see significant price drops.

Customers in the electronics retail and e-commerce space, including those interacting with Groupe LDLC, face remarkably low switching costs. It's incredibly easy for consumers to hop between different online shops and marketplaces, comparing prices and offerings without much friction. This ease of movement significantly bolsters their bargaining power.

The market is flooded with major players offering a wide array of electronics. Competitors such as Amazon, Cdiscount, Fnac Darty, and Boulanger present a vast selection of products and services. This abundance of choice means customers can readily find alternatives if they are not satisfied with Groupe LDLC's pricing, product range, or service quality, further amplifying their influence.

Customers today wield significant power thanks to the sheer volume of readily accessible information. Online reviews, detailed product specifications, and ubiquitous price comparison websites empower them to scrutinize offerings and compare retailers like Groupe LDLC with ease. This transparency directly translates into their ability to demand competitive pricing and consistently reliable service.

In 2024, the digital landscape continues to amplify this trend. For instance, consumer electronics, a key sector for Groupe LDLC, sees a substantial portion of purchasing decisions influenced by online research. A 2024 survey indicated that over 70% of consumers research products extensively online before making a purchase, often comparing prices across multiple platforms.

This heightened customer awareness means retailers must actively cultivate and maintain a strong online reputation. Clear, accurate product information and responsive customer service are no longer optional but essential for attracting and retaining customers in a competitive market. Groupe LDLC, like its peers, must ensure its digital presence reflects transparency and value to meet these elevated customer expectations.

Impact of B2B and B2C Segments

Groupe LDLC's customer base is split between business-to-consumer (B2C) and business-to-business (B2B) clients, creating varied bargaining power dynamics. The B2C segment, characterized by individual purchasers, wields significant collective influence due to the sheer volume of transactions and the ease with which they can switch between retailers. This makes price sensitivity a key factor in their purchasing decisions.

Conversely, B2B customers, especially larger corporations, often possess greater individual bargaining power. Their substantial order volumes and unique service demands necessitate tailored negotiations and potentially customized pricing or support agreements from Groupe LDLC. For instance, a large corporate client might negotiate bulk discounts or specialized IT support packages, which are less common in B2C transactions.

The bargaining power of customers for Groupe LDLC is influenced by market concentration and product differentiation. In 2024, the online electronics retail market in France, a key territory for LDLC, remains competitive. While LDLC offers specialized products, many standard IT components and peripherals are commoditized, increasing customer power through readily available alternatives.

- B2C Customer Power: High due to price sensitivity and low switching costs in a competitive online market.

- B2B Customer Power: Varies; large enterprises have significant leverage due to order volume and specific needs.

- Market Dynamics: Competition in the French electronics market in 2024 means customers have many choices, amplifying their bargaining power.

- Product Specialization: While LDLC offers niche products, the availability of substitutes for many items limits customer power.

Growth of Mobile Commerce and Marketplaces

The burgeoning mobile commerce landscape significantly amplifies customer bargaining power. In France, a staggering 55% of online transactions were conducted via mobile apps in 2024, highlighting the convenience and accessibility customers now demand. This trend means customers can easily compare prices and products across numerous retailers from virtually anywhere, at any time.

Furthermore, the dominance of online marketplaces, which accounted for 45% of total online sales in France in 2024, further consolidates customer leverage. These platforms aggregate a vast selection of goods from diverse sellers, making it effortless for consumers to find the best deals and switch between providers. Groupe LDLC must therefore prioritize a seamless mobile experience and a strong marketplace strategy to retain and attract customers in this highly competitive environment.

- Mobile Commerce Dominance: 55% of French online transactions occurred on mobile apps in 2024.

- Marketplace Influence: Marketplaces captured 45% of total online sales in France in 2024.

- Customer Empowerment: Easy access to multiple sellers and products anywhere, anytime.

- Strategic Imperative: Groupe LDLC needs to optimize mobile and marketplace offerings.

Groupe LDLC faces considerable customer bargaining power, driven by price sensitivity and low switching costs in the highly competitive French electronics market. Customers readily compare prices across numerous online and offline platforms, empowered by abundant information and easy access to alternatives from major players like Amazon and Fnac Darty.

In 2024, the trend of consumers researching extensively online, with over 70% comparing prices before purchase, further amplifies this power. The rise of mobile commerce, where 55% of French online transactions occurred via apps in 2024, and the dominance of marketplaces (45% of French online sales in 2024) allow customers to switch providers effortlessly, demanding competitive pricing and reliable service.

While B2C customers exert collective influence through price comparison, B2B clients, particularly large enterprises, can negotiate significant discounts due to their substantial order volumes and specific needs, creating a varied dynamic within Groupe LDLC's customer base.

The bargaining power of customers for Groupe LDLC is significant, primarily due to the commoditization of many electronics products, offering readily available substitutes. This is compounded by the ease with which consumers can switch between retailers, especially given that 55% of French online transactions were mobile-based in 2024, and marketplaces captured 45% of total online sales in the same year.

| Factor | Impact on Groupe LDLC | Supporting Data (2024) |

|---|---|---|

| Price Sensitivity & Comparison | High; customers actively seek best deals. | Over 70% of consumers research online before buying. |

| Switching Costs | Low; easy to move between online retailers. | Ubiquitous online platforms and marketplaces. |

| Availability of Substitutes | High for standard electronics; limits LDLC's pricing power. | Presence of major competitors like Amazon, Fnac Darty. |

| Information Accessibility | High; empowers customers with reviews and price data. | Prevalence of price comparison websites and online reviews. |

| Mobile Commerce & Marketplaces | Amplifies customer power through convenience and choice. | 55% of French online transactions via mobile; 45% of sales through marketplaces. |

Same Document Delivered

Groupe LDLC Porter's Five Forces Analysis

This preview showcases the full Groupe LDLC Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring complete transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The French e-commerce landscape, especially within consumer electronics, is highly concentrated. Major players like Amazon, with a substantial 22.2% market share, and Cdiscount, holding 8.8%, create intense competitive pressure. Groupe LDLC faces significant rivalry from these dominant entities as it operates in the same market.

To bolster its competitive standing against these industry titans, Groupe LDLC strategically acquired Rue du Commerce. This move is designed to enhance LDLC's market presence and its ability to compete more effectively in a market dominated by larger, established e-commerce platforms.

Groupe LDLC operates in a market characterized by relentless price competition, amplified by the aggressive market entry of international disruptors like Shein and Temu. These players often engage in deep discounting and extensive promotional campaigns, forcing established retailers to follow suit to remain competitive.

This intense rivalry means Groupe LDLC must constantly monitor pricing strategies and offer compelling value propositions. For instance, in 2024, the consumer electronics retail sector saw average promotional discounts reaching 15-20% during key sales periods, a trend likely to persist. Groupe LDLC counters this by emphasizing its unique selling points, such as PC assembly services and robust technical support, aiming to differentiate beyond mere price.

The constant pressure to offer competitive prices and promotions inevitably squeezes profit margins across the board. This dynamic necessitates efficient operations and a strong focus on customer loyalty to navigate the challenging retail landscape effectively.

Competitors such as Fnac Darty are actively pursuing omnichannel strategies, seamlessly blending their online presence with a robust network of physical stores, mirroring Groupe LDLC's approach. This strategic integration of sales channels and a broad spectrum of product categories, extending well beyond core computer hardware, significantly heightens the competitive landscape.

In 2024, the retail sector continued to see a trend where businesses are increasingly emphasizing service differentiation and the strategic advantage of local sourcing. These tactics are being deployed as a means to effectively counter the considerable scale advantages enjoyed by larger online-only retailers, thereby leveling the playing field.

Market Growth and Attractiveness

The French e-commerce market is a dynamic landscape, demonstrating robust growth. In 2024, total online sales hit €175.3 billion, marking a significant 9.6% jump from 2023, with continued expansion anticipated. This upward trend, while promising, inherently fuels increased competition as more businesses vie for market share.

Groupe LDLC's recent performance, experiencing a revenue decline amidst this expanding market, underscores the intensity of competitive rivalry. The attractiveness of the growing e-commerce sector draws in numerous participants, intensifying the challenge for established players like LDLC to maintain or grow their positions.

- French E-commerce Growth: €175.3 billion in total online sales for 2024, a 9.6% increase year-over-year.

- Market Attractiveness: The expanding market attracts new entrants, intensifying competition.

- Competitive Pressure: LDLC's revenue decline highlights the impact of strong rivalry despite market growth.

High Exit Barriers

High exit barriers significantly contribute to intense competitive rivalry for Groupe LDLC. These barriers include substantial investments in specialized assets like physical retail stores and extensive logistics infrastructure, alongside significant sunk costs in brand development and employee commitments. These factors make it difficult and costly for less successful competitors to simply exit the market, forcing them to remain and continue competing for market share, even when facing economic headwinds.

Groupe LDLC's significant infrastructure, including its network of physical stores and its robust logistics capabilities, exemplifies these high exit barriers. The company reported a notable presence with over 60 physical stores across France as of early 2024, each representing a considerable capital investment. Furthermore, their commitment to a multi-channel strategy necessitates ongoing investment in warehousing and delivery systems, further cementing these exit barriers.

- Specialized Assets: Groupe LDLC's physical stores and logistics network are costly to divest.

- Sunk Costs: Investments in brand building and customer loyalty programs are difficult to recover.

- Employee Commitments: Severance packages and ongoing obligations to staff add to exit costs.

- Market Dynamics: These barriers compel companies to remain and compete fiercely, even in downturns.

Groupe LDLC faces intense competition from large e-commerce players like Amazon and Cdiscount, as well as international disruptors such as Shein and Temu, who often engage in aggressive pricing. This forces LDLC to differentiate through services like PC assembly and technical support, rather than solely competing on price.

The French e-commerce market is expanding, with total online sales reaching €175.3 billion in 2024, a 9.6% increase from the previous year. This growth attracts more competitors, intensifying rivalry and impacting companies like LDLC, which saw a revenue decline despite market expansion.

High exit barriers, including significant investments in physical stores (LDLC had over 60 in early 2024) and logistics, along with brand development costs, compel companies to remain in the market and compete fiercely, even during challenging economic periods.

| Competitor | Market Share (Approx.) | Key Strategy |

|---|---|---|

| Amazon | 22.2% | Broad product selection, competitive pricing, fast delivery |

| Cdiscount | 8.8% | Omnichannel presence, promotions, marketplace model |

| Fnac Darty | N/A (Significant player) | Omnichannel integration, loyalty programs, diverse product categories |

| Shein/Temu | Emerging/Growing | Deep discounting, rapid trend adoption, aggressive marketing |

SSubstitutes Threaten

The growing appeal of refurbished electronics presents a significant threat to Groupe LDLC. In France, the refurbished market is booming, with projections indicating that by 2025, over 20% of all smartphones in circulation will be pre-owned. This surge is fueled by consumers actively seeking cost-effective and environmentally conscious options, directly impacting demand for new products.

This shift in consumer preference means that many individuals who might have previously purchased new computers or electronics from Groupe LDLC are now opting for refurbished alternatives. The availability of reliable, certified refurbished devices from specialized sellers is making these second-hand options increasingly attractive, diverting potential sales away from new product lines.

The increasing adoption of Software as a Service (SaaS) and Device as a Service (DaaS) models poses a substantial threat of substitutes for Groupe LDLC. These cloud-based solutions are fundamentally altering how businesses and consumers access and utilize technology, directly impacting the demand for traditional hardware sales.

SaaS and DaaS offerings reduce the necessity for upfront capital expenditure on new hardware and on-premise infrastructure. For instance, by 2024, the global SaaS market was projected to reach over $325 billion, demonstrating a clear shift towards subscription-based software access over outright purchases. This trend directly challenges the core business of selling physical IT equipment.

The cost-effectiveness and scalability inherent in SaaS solutions make them increasingly attractive, diminishing the perceived value of owning and maintaining physical hardware. As more businesses migrate to cloud-based software and device management, the demand for the types of products Groupe LDLC traditionally offers could see a significant decline, acting as a powerful substitute.

Device as a Service (DaaS) models present a significant threat by offering businesses, especially SMEs, virtual desktops and applications hosted in the cloud. This approach negates the necessity for substantial upfront hardware investments and continuous maintenance, making it an appealing alternative to traditional IT procurement. In 2024, the global DaaS market was valued at approximately $30 billion, with projections indicating substantial growth, potentially impacting hardware sales for companies like LDLC.

The increasing adoption of DaaS fundamentally alters how organizations acquire and manage computing resources. By providing flexible, scalable, and often more cost-effective IT solutions, DaaS directly substitutes the need for many businesses to purchase and maintain physical hardware. This shift could significantly erode LDLC's B2B hardware sales as companies increasingly opt for cloud-based virtual environments over on-premises equipment.

Increased Lifespan and Upgradability of Existing Devices

The increasing lifespan and upgradability of electronic devices present a significant threat of substitutes for Groupe LDLC. Consumers are increasingly opting to repair or upgrade their existing hardware rather than purchasing new models. This trend is fueled by both economic considerations and growing environmental awareness, as people recognize the impact of electronic waste.

Improvements in product design and component modularity mean that many devices can be kept functional and relevant for longer periods. For instance, the ability to upgrade RAM or storage in laptops, or replace batteries in smartphones, directly reduces the demand for entirely new units. This shift in consumer behavior directly impacts sales volumes for companies like LDLC that rely on the sale of new electronics.

Data from 2024 indicates a growing interest in repairability. For example, reports suggest that the average lifespan of a smartphone in developed markets has been extending, with some consumers holding onto devices for over three years. This contrasts with earlier periods where two-year upgrade cycles were more common.

- Extended Device Lifespans: Consumers are holding onto electronics longer due to improved durability and repairability, reducing the need for frequent replacements.

- Upgradeability as a Substitute: The ability to upgrade components like RAM or storage in existing devices offers a cost-effective alternative to purchasing new hardware.

- Environmental Consciousness: Growing awareness of e-waste encourages consumers to prolong the life of their current devices, thereby reducing their environmental footprint.

Shift to Software-Centric Solutions

The increasing power and versatility of software present a significant threat of substitutes for Groupe LDLC. As software applications, particularly cloud-based ones, can now replicate functionalities previously requiring dedicated hardware, demand for certain physical components may decline. For instance, advanced data analytics software can reduce the need for specialized, high-performance workstations in many professional settings.

This trend particularly impacts Groupe LDLC's business in professional markets where efficiency and cost-effectiveness drive purchasing decisions. Companies might opt for subscription-based software solutions over purchasing and maintaining physical hardware, thereby bypassing traditional retail channels. By mid-2024, the global cloud computing market was projected to reach over $1 trillion, indicating a substantial shift in how businesses access and utilize computing power.

- Software as a Service (SaaS) adoption: Many businesses are migrating to SaaS models, reducing their reliance on on-premise hardware.

- Virtualization and cloud computing: These technologies allow for the delivery of computing services, including storage and processing, over the internet, diminishing the need for physical server hardware.

- Remote work trends: The rise of remote work has accelerated the adoption of cloud-based collaboration tools and virtual desktops, further decreasing the demand for powerful local machines.

- Open-source software alternatives: The availability of robust open-source software can offer cost-effective substitutes for proprietary hardware-dependent solutions.

The growing availability and acceptance of refurbished electronics directly substitute new product sales for Groupe LDLC. By 2024, the global refurbished smartphone market alone was estimated to be worth over $60 billion, driven by consumers seeking value and sustainability. This trend means customers who might have purchased new devices from LDLC are increasingly turning to pre-owned options, which are often certified and warrantied.

Cloud-based services like SaaS and DaaS also act as significant substitutes, reducing the need for businesses to invest in and maintain physical IT hardware. The global SaaS market was projected to exceed $325 billion in 2024, illustrating a clear shift towards software access over ownership. This impacts LDLC’s hardware sales as companies opt for flexible, scalable cloud solutions.

Furthermore, extended device lifespans and component upgradeability offer alternatives to purchasing new equipment. In 2024, the average lifespan of smartphones in developed markets extended beyond three years, a notable increase from previous upgrade cycles. This means consumers are less inclined to replace devices frequently, impacting sales volumes for new electronics.

Entrants Threaten

Entering the e-commerce and retail space for computer hardware and electronics, much like Groupe LDLC operates within, demands a considerable outlay of capital. This includes funding for inventory, sophisticated logistics, robust technology infrastructure, and potentially establishing a physical retail presence. These substantial upfront costs serve as a considerable deterrent for prospective new players looking to enter the market.

The French retail technology sector, for example, saw $147 million in equity funding during 2025. While this indicates ongoing investment interest, it also highlights the competitive landscape for securing the necessary capital to launch and scale a new venture in this arena.

Established brand loyalty and reputation present a significant hurdle for new entrants. In the French market, companies like Groupe LDLC, Amazon, and Cdiscount have cultivated strong brand recognition and deep-seated customer trust over years of operation. This makes it incredibly difficult for newcomers to gain traction.

Building brand awareness and trust from the ground up is a costly and time-consuming endeavor. Newcomers must invest heavily in marketing and customer acquisition to even begin to compete with the established players’ reputations. For instance, LDLC's acquisition of Rue du Commerce in 2017, a move aimed at strengthening its market position, highlights the importance of consolidating existing brand equity.

The French and European e-commerce sectors are subject to a dense web of regulations, including the General Data Protection Regulation (GDPR), stringent cookie consent protocols, and comprehensive product safety standards. Successfully navigating these intricate compliance demands significant legal and operational investment, creating a formidable hurdle for any new player entering the market.

For instance, non-compliance with GDPR can lead to substantial financial penalties, with fines potentially reaching up to 4% of a company's global annual turnover or €20 million, whichever is higher. This financial risk, coupled with the need for specialized expertise to manage these requirements, acts as a significant deterrent for emerging businesses.

Economies of Scale and Distribution Networks

Groupe LDLC, like many established players in the retail and IT sectors, benefits significantly from economies of scale. This means they can negotiate better prices for products due to bulk purchasing, spread marketing costs over a larger sales volume, and optimize logistics for greater efficiency. For instance, in 2024, major French electronics retailers often reported purchasing power that allowed for price points unattainable by smaller, newer businesses. This cost advantage makes it difficult for new entrants to compete on price from the outset.

The establishment of robust distribution and supply chain networks is another substantial barrier. Groupe LDLC has spent years building and refining its logistics infrastructure across France, ensuring timely and cost-effective delivery to a wide customer base. A new entrant would face immense challenges and significant capital investment to replicate this network, which is crucial for customer satisfaction and operational viability in the competitive French market.

- Economies of Scale: Incumbents like Groupe LDLC leverage bulk purchasing power, reducing per-unit costs for inventory and operational expenses.

- Distribution Network: Years of investment have created established logistics and delivery channels across France, a significant hurdle for new entrants to replicate.

- Marketing Efficiency: Larger companies can spread marketing budgets across a wider sales volume, achieving lower customer acquisition costs than startups.

- Price Competitiveness: The combined effect of scale and efficient distribution allows established firms to offer more competitive pricing, deterring new market entrants.

Intense Competition from Existing Players

The French e-commerce landscape is already saturated, making it difficult for new entrants to carve out a niche. Global players like Amazon and domestic powerhouses such as Fnac Darty and Cdiscount command significant market share and brand loyalty.

These established companies continuously invest in logistics, pricing strategies, and customer service, creating high barriers to entry. For instance, in 2024, the French e-commerce market was projected to reach over €150 billion in sales, indicating the scale of investment required to compete effectively.

- High Market Saturation: The French e-commerce sector is crowded with established global and domestic players.

- Entrenched Competitors: Companies like Amazon, Fnac Darty, and Cdiscount possess strong brand recognition and efficient operations.

- Economically Challenging Environment: Current economic conditions in 2024, characterized by inflation and cautious consumer spending, further hinder the ability of new businesses to gain traction and invest in necessary growth strategies.

The threat of new entrants for Groupe LDLC is moderate, primarily due to substantial capital requirements for inventory, logistics, and technology, alongside significant regulatory compliance costs. For example, navigating GDPR can incur fines up to 4% of global annual turnover. Established brand loyalty and efficient distribution networks further solidify existing players' positions, making it difficult for newcomers to compete on price and service. In 2024, the French e-commerce market, projected to exceed €150 billion in sales, demands considerable investment to gain any meaningful market share.

| Barrier | Description | Impact on New Entrants | Relevant Data/Example |

|---|---|---|---|

| Capital Requirements | Significant investment needed for inventory, logistics, and technology. | High deterrent. | French retail technology sector received $147 million in equity funding in 2025, showing high investment interest but also competitive capital acquisition. |

| Brand Loyalty & Reputation | Established players like LDLC, Amazon, and Cdiscount have strong customer trust. | Difficult to gain traction. | LDLC's acquisition of Rue du Commerce in 2017 highlights the value of existing brand equity. |

| Regulatory Compliance | Complex regulations like GDPR and product safety standards. | Requires specialized expertise and investment. | GDPR non-compliance fines can reach 4% of global annual turnover or €20 million. |

| Economies of Scale | Incumbents benefit from bulk purchasing and lower per-unit costs. | Price competitiveness is challenging for newcomers. | Major French electronics retailers in 2024 often reported purchasing power inaccessible to smaller businesses. |

Porter's Five Forces Analysis Data Sources

Our Groupe LDLC Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including the company's official annual reports, investor presentations, and press releases. We also incorporate insights from reputable industry analysis firms, market research reports, and relevant e-commerce trend publications to capture the competitive landscape.