Groupe LDLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe LDLC Bundle

Navigate the dynamic external forces shaping Groupe LDLC's future with our comprehensive PESTLE analysis. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors influencing their operations and market position. Gain a crucial competitive advantage by leveraging these insights to refine your own strategic planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence that empowers smarter business moves.

Political factors

The French government's 2025 budget signals a tightening of fiscal policy, with planned reductions in tax incentives for startups. This move, aimed at curbing the national deficit, could diminish the financial support available for nascent tech companies, a segment crucial to the ecosystem in which Groupe LDLC operates.

Furthermore, the budget outlines a decrease in public investment dedicated to technological innovation. This reduction might translate to fewer government-backed R&D programs or grants, potentially impacting the pace of digital transformation and the development of new technologies that could benefit Groupe LDLC's various business lines.

The French Competition Authority's 2024-2025 roadmap highlights a strong emphasis on digital market competition and consumer welfare, directly impacting e-commerce players like LDLC. This suggests a heightened regulatory environment with increased oversight on platforms to ensure fair practices and prevent monopolistic tendencies.

France's push for stricter enforcement of the Digital Services Act (DSA) against major online platforms signals a broader EU-wide effort to level the playing field. For LDLC, this could translate into a more regulated digital marketplace, demanding greater transparency and adherence to consumer protection standards, potentially affecting how they operate and compete.

The EU Digital Services Act (DSA), fully effective for most platforms since February 2024, introduces significant new responsibilities for online intermediaries, including e-commerce operations like Groupe LDLC. This legislation mandates enhanced content moderation, greater transparency regarding algorithmic processes and advertising, and increased accountability for products sold by third-party vendors on Groupe LDLC's marketplaces.

Non-adherence to these DSA regulations carries the risk of substantial financial penalties, potentially reaching up to 6% of a company's global annual revenue, as stipulated by the act. Such fines could directly affect Groupe LDLC's operational expenditures and necessitate adjustments to its established business methodologies.

National AI Strategy and Support

France is actively advancing its national artificial intelligence strategy, with a focus on fostering innovation while ensuring ethical considerations and maximizing economic advantages. This strategic direction, emphasizing AI integration across diverse industries, directly impacts Groupe LDLC's potential to implement cutting-edge AI technologies.

The government’s commitment to AI development, particularly within the retail technology landscape, could significantly influence LDLC's capacity to enhance customer experiences, optimize logistics, and streamline operational efficiencies through advanced AI solutions. For instance, the French government announced plans to invest €1.5 billion in AI research and development by 2027 as part of its broader digital transformation agenda.

- Government Investment: France's commitment to AI funding, such as the €1.5 billion allocated by 2027, signals a supportive environment for AI adoption.

- Ethical Frameworks: The national strategy's emphasis on ethical AI development provides guidelines that LDLC must navigate when implementing new technologies.

- Sectoral Focus: Specific government initiatives targeting AI in retail could offer LDLC opportunities for tailored support and collaboration.

Geopolitical and Macroeconomic Stability

The intricate economic and political landscape in France during 2024 and projected into 2025 has prompted a more cautious consumer approach and a tendency for businesses to delay capital expenditures. This caution directly influences Groupe LDLC's operational performance, particularly affecting sales volumes for technology goods across both individual and corporate client bases.

Political uncertainty or substantial alterations in government policy can erode consumer sentiment and curb business investment. For Groupe LDLC, this translates to a potential slowdown in demand for its diverse range of high-tech products and services, impacting both its retail and business-to-business (B2B) channels.

For instance, the French government's 2024 budget, passed in late 2023, included measures that could affect disposable income and business operating costs, creating an environment where consumers might prioritize essential spending over discretionary tech purchases.

- Consumer Spending Caution: French consumer confidence indices, such as those reported by INSEE, have shown fluctuations, indicating a general hesitancy influenced by economic outlook and political stability.

- Business Investment Hesitation: Data from the Banque de France on business investment intentions for 2024/2025 reflects a similar cautious stance, with companies potentially deferring upgrades or new technology acquisitions.

- Impact on Tech Sector: The high-tech retail sector, including companies like LDLC, is particularly sensitive to shifts in consumer and business confidence due to the discretionary nature of many technology purchases.

- Policy Sensitivity: Changes in tax policies, import/export regulations, or digital infrastructure investment plans by the French government can have a direct bearing on Groupe LDLC's cost structure and market opportunities.

The French government's 2024-2025 fiscal policies, including a €1.5 billion AI investment by 2027, aim to foster technological innovation while navigating deficit reduction. Stricter enforcement of the EU's Digital Services Act (DSA) since February 2024 imposes significant compliance burdens and potential fines of up to 6% of global revenue on e-commerce platforms like LDLC, demanding greater transparency and consumer protection.

| Policy Area | 2024/2025 Impact on Groupe LDLC | Key Data/Regulation |

|---|---|---|

| Fiscal Policy | Reduced tax incentives for startups, decreased public investment in tech innovation. | French Government 2025 Budget |

| Digital Market Regulation | Increased oversight on e-commerce, enhanced transparency, and consumer protection mandates. | EU Digital Services Act (DSA), French Competition Authority Roadmap |

| AI Strategy | Opportunities for AI integration in retail, logistics, and customer experience. | France's National AI Strategy, €1.5 billion AI investment by 2027 |

| Consumer & Business Confidence | Potential slowdown in demand due to cautious spending and delayed capital expenditures. | INSEE Consumer Confidence Indices, Banque de France Business Investment Intentions |

What is included in the product

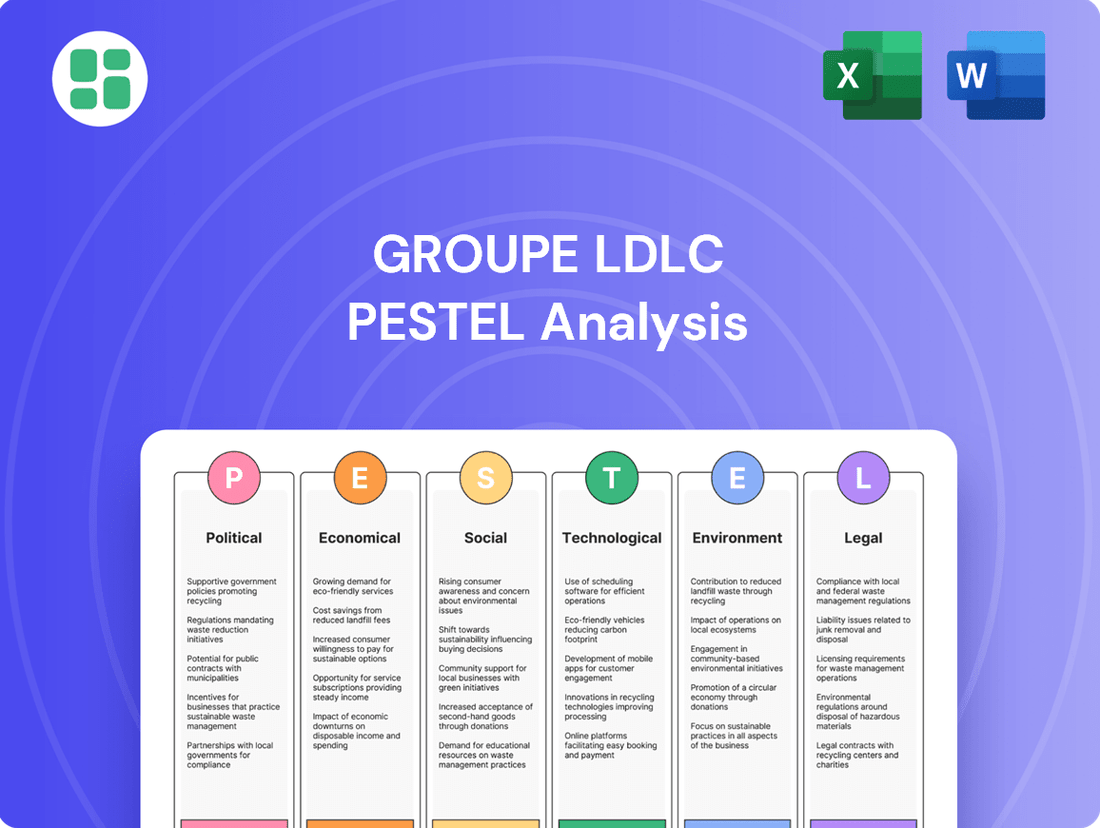

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Groupe LDLC, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by highlighting potential threats and opportunities within Groupe LDLC's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring everyone grasps Groupe LDLC's external landscape without getting bogged down in detail.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal factors impacting Groupe LDLC.

Economic factors

The French e-commerce sector demonstrated robust expansion in 2024, with total online sales hitting €175.3 billion, marking a substantial 9.6% year-over-year increase. This growth was fueled by a rise in transaction volumes and moderating inflation, suggesting a generally positive consumer spending environment.

Despite this broader market uplift, Groupe LDLC experienced a downturn in its consolidated full-year revenues for the 2024/2025 period. This divergence highlights that while overall consumer spending online is strong, the specific market segment for high-tech products, where LDLC operates, might be facing unique challenges such as intense competition or shifting consumer preferences.

While inflation eased in France, contributing to e-commerce expansion, consumers remain highly price-sensitive, favoring value-oriented purchases. This trend directly impacts Groupe LDLC, as inflationary pressures on its operational costs weighed on earnings during the 2024/2025 period.

Consumers' heightened caution, a direct result of persistent inflation, led to a noticeable deferral of significant investments and a reduction in spending on high-tech goods. This creates a difficult landscape for Groupe LDLC to sustain profitability while simultaneously addressing consumer demand for competitive pricing in the tech sector.

Groupe LDLC's 2024/2025 financial year saw a notable downturn in its B2B segment, with revenues dropping by 13.0%. This decline is largely attributed to the prevailing macroeconomic and political climate, which has led many businesses to delay crucial investment decisions.

Conversely, the B2C segment demonstrated greater resilience, experiencing a less pronounced decrease in performance. This divergence highlights differing economic sensitivities between corporate clients and individual consumers.

To navigate these economic headwinds and bolster overall profitability, Groupe LDLC is focusing on reinforcing its B2C market presence, with a particular emphasis on expanding its reach within the mass market segment.

Competitive Intensity in E-commerce

The French e-commerce landscape is experiencing a significant surge in competitive intensity, largely driven by the aggressive expansion of Chinese cross-border platforms. These international players are introducing substantial price pressure, forcing domestic companies like Groupe LDLC to re-evaluate their strategies.

In response, French e-commerce businesses are increasingly emphasizing their 'Made-in-France' credentials and bolstering their service-oriented offerings. This differentiation aims to attract customers who value local sourcing and superior customer support over purely price-driven decisions. For instance, in 2023, the French e-commerce market saw a 10.8% increase in sales volume, reaching €151.7 billion, with a growing consumer interest in local brands and specialized services.

- Price Wars: Chinese platforms often leverage lower production costs and efficient logistics to offer highly competitive prices, impacting margins for established players.

- Service Differentiation: Companies like LDLC are investing in customer service, technical support, and faster delivery options to create a distinct value proposition.

- Market Adaptation: The need for constant strategic recalibration is paramount, requiring agility in pricing, product assortment, and marketing to retain and grow market share.

- Consumer Loyalty: Building brand loyalty through quality, reliability, and personalized experiences is crucial in an environment where price comparison is effortless.

Average Basket Size and Profitability

Groupe LDLC observed a positive trend in its average basket value, reaching €498 excluding VAT in the 2024/2025 period. This contrasts with a broader French e-commerce market trend of stable or slightly decreasing basket sizes as consumers prioritize value.

Despite the increase in average basket value, the group's overall profitability was challenged. This was primarily due to a decrease in sales volume and the impact of inflationary pressures on operating expenses, which ultimately resulted in a net loss for the fiscal year.

- Groupe LDLC Average Basket Value (Excl. VAT): €498 (2024/2025)

- Market Trend: Stable to slightly declining average basket sizes in French e-commerce.

- Profitability Impact: Decline in sales volume and inflationary expenses affected earnings.

- Financial Outcome: Net loss reported for the year.

The French economy showed resilience in 2024, with e-commerce sales reaching €175.3 billion, a 9.6% increase. However, Groupe LDLC faced revenue declines, indicating sector-specific challenges despite overall market growth.

Inflationary pressures continued to impact consumer spending, leading to a focus on value and a deferral of high-tech purchases, which negatively affected LDLC's profitability despite an increased average basket value of €498 (excluding VAT) in 2024/2025.

Groupe LDLC's B2B segment saw a significant 13.0% revenue drop in 2024/2025 due to businesses delaying investments amid economic uncertainty, while the B2C segment showed more resilience.

| Economic Factor | Impact on Groupe LDLC | Data Point |

|---|---|---|

| E-commerce Growth | Overall market expansion, but LDLC faced specific segment challenges. | €175.3 billion total French e-commerce sales in 2024 (+9.6%). |

| Inflation & Consumer Spending | Heightened price sensitivity and delayed tech purchases impacted sales volume and profitability. | Average basket value increased to €498 (excl. VAT) in 2024/2025, but overall profitability was challenged. |

| B2B Investment Climate | Macroeconomic and political climate led businesses to postpone investments, hurting LDLC's B2B segment. | B2B segment revenues decreased by 13.0% in 2024/2025. |

Preview Before You Purchase

Groupe LDLC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Groupe LDLC covers political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It delves into the intricacies of Groupe LDLC's operational landscape, providing actionable insights for strategic decision-making.

Sociological factors

French consumers are deeply entrenched in online shopping, with a staggering 43 million individuals making regular online purchases, representing approximately 85% of all internet users. This widespread adoption highlights a fundamental shift in how people acquire goods and services.

Mobile commerce is a dominant force in this digital landscape, with 55% of all online transactions occurring via mobile apps. Furthermore, marketplaces have captured a significant share of the market, accounting for 45% of total online sales, demonstrating their crucial role in the e-commerce ecosystem.

For Groupe LDLC, these evolving habits necessitate a strategic focus on optimizing its mobile platforms and enhancing its presence within key marketplaces. Aligning with these dominant consumer behaviors is paramount for continued growth and relevance in the French online retail sector.

Even with some economic uncertainty, the desire for the latest technology continues to fuel sales in the high-tech sector. Consumers consistently look to upgrade their devices, creating a steady demand for new products.

This persistent need for renewal is a significant long-term advantage for Groupe LDLC. For instance, in 2024, the global PC market saw shipments increase by 3.1% year-over-year, reaching 65.3 million units in the first quarter, indicating a strong consumer appetite for updated hardware.

Groupe LDLC is well-positioned to benefit from this ongoing technological upgrade cycle, capturing growth as consumers seek out the newest innovations.

Consumers in France are showing a noticeable shift towards value-driven purchases, even as online activity remains robust. This means that while people are still comfortable buying things on the internet, they're paying much closer attention to price. This is especially true in the electronics and high-tech sectors, where Groupe LDLC operates. For instance, reports from early 2024 indicated that while consumer spending was recovering, a significant portion of that recovery was driven by demand for more affordable options, as inflation, though easing, had impacted purchasing power.

Importance of After-Sales Service and Support

Groupe LDLC's focus on PC assembly, technical support, and after-sales service aligns perfectly with a growing consumer demand for holistic support. This trend is particularly strong in the tech sector where product longevity and user experience are paramount. For instance, in 2024, customer reviews frequently highlight the importance of responsive technical assistance when making purchasing decisions, directly impacting brand perception and loyalty.

Robust after-sales support acts as a significant differentiator for LDLC in a competitive landscape. Customers increasingly seek reassurance and assistance post-purchase, moving beyond simple transactional relationships. This is evidenced by the continued growth of subscription-based support services, indicating a societal shift towards valuing ongoing engagement and problem resolution.

- Customer Loyalty: Strong after-sales service fosters repeat business and positive word-of-mouth referrals, crucial for sustained growth.

- Brand Reputation: Excellent support enhances LDLC's image as a reliable and customer-centric provider in the tech market.

- Competitive Edge: Differentiates LDLC from competitors who might offer lower initial prices but lack comprehensive support infrastructure.

Growing Awareness of Sustainability and Ethics

Consumers are increasingly prioritizing sustainability, with a noticeable shift towards eco-friendly and energy-saving products. This is partly driven by stringent European Union regulations and a general societal move towards more responsible consumption. For instance, a 2024 survey indicated that 65% of French consumers consider a product's environmental impact when making purchasing decisions.

Retailers like Groupe LDLC are responding by emphasizing their commitment to sustainability. This includes highlighting product reparability and implementing responsible waste management practices. In 2024, LDLC reported a 15% increase in the sale of refurbished electronics, demonstrating a tangible consumer preference for sustainable options.

- Growing consumer demand for eco-friendly electronics.

- Impact of EU regulations on product design and marketing.

- Increased sales of refurbished and repairable products.

- Retailers focusing on transparent sustainability reporting.

French consumers are increasingly prioritizing value, seeking out deals and discounts even as online shopping remains popular. This trend is particularly evident in the tech sector, where Groupe LDLC operates. In early 2024, consumer spending recovery was notably driven by more affordable options, reflecting the impact of inflation on purchasing power.

The demand for technical support and after-sales service is also a significant sociological factor influencing purchasing decisions. Customers in 2024 frequently highlighted the importance of responsive technical assistance, directly impacting brand loyalty and perception. Groupe LDLC’s focus on PC assembly and comprehensive support aligns well with this growing consumer expectation for product longevity and user experience.

Sustainability is another key driver, with a growing number of consumers considering environmental impact. A 2024 survey found that 65% of French consumers factor a product's environmental footprint into their buying choices. This is leading to increased demand for refurbished and repairable electronics, with LDLC reporting a 15% rise in refurbished sales in 2024.

| Sociological Factor | Description | Impact on Groupe LDLC | Supporting Data (2024/2025) |

|---|---|---|---|

| Online Shopping Habits | Widespread adoption of online purchasing. | Necessitates optimized mobile platforms and marketplace presence. | 85% of internet users shop online; 55% of transactions via mobile. |

| Value-Driven Purchasing | Preference for affordable options due to economic factors. | Requires competitive pricing and value-added services. | Consumer spending recovery driven by affordable options. |

| Demand for Support | Importance of technical and after-sales service. | Strengthens brand reputation and customer loyalty. | Customer reviews emphasize responsive technical assistance. |

| Sustainability Concerns | Growing consumer consideration of environmental impact. | Drives demand for eco-friendly and refurbished products. | 65% of consumers consider environmental impact; 15% increase in refurbished sales. |

Technological factors

Artificial intelligence is a significant technological force shaping French e-commerce, with a notable trend towards generative AI adoption. Companies are actively exploring AI to personalize customer journeys, offering tailored product suggestions and improving support through intelligent chatbots. This focus on AI promises to enhance efficiency and customer engagement across the sector.

For Groupe LDLC, integrating AI can unlock substantial operational benefits. By leveraging AI for advanced demand forecasting and streamlined logistics, the company can optimize inventory levels and reduce fulfillment times. Furthermore, AI-powered customer service tools can lead to higher satisfaction rates, directly impacting LDLC's competitive edge in the market.

Mobile devices are now the primary gateway for online shopping in France, with a substantial portion of e-commerce sales happening through smartphones and dedicated mobile applications. This trend underscores the critical need for businesses like Groupe LDLC to prioritize their mobile presence.

Groupe LDLC's ongoing commitment to enhancing its mobile-first shopping experience is vital. Ensuring smooth, user-friendly functionality across a diverse range of devices is key to attracting and keeping the significant number of consumers who prefer mobile transactions.

In 2024, mobile commerce accounted for over 60% of all e-commerce sales in France, a figure expected to climb further. This highlights the imperative for Groupe LDLC to continue investing in its mobile platform to remain competitive and cater to evolving consumer habits.

Cybersecurity threats are evolving rapidly, forcing e-commerce businesses like Groupe LDLC to constantly upgrade their defenses. The digital landscape is becoming more complex, with sophisticated attacks targeting customer data and operational integrity.

New European Union regulations, such as the NIS2 Directive and the Cyber Resilience Act, are set to significantly impact digital operations. NIS2, with its phased implementation starting in late 2024 and continuing into 2025, and the Cyber Resilience Act, expected to be fully enforced by 2027, will mandate stricter cybersecurity practices, including mandatory incident reporting and enhanced risk management for digital products and services.

To comply with these upcoming EU mandates and safeguard its reputation, LDLC must maintain exceptionally strong security protocols. Protecting customer information and ensuring the reliability of its online platforms are paramount for maintaining customer trust and avoiding substantial penalties.

Omnichannel Retail Technology

Groupe LDLC's commitment to an omnichannel strategy demands sophisticated technology. This includes seamless integration between their extensive online presence and physical stores to ensure a unified customer journey. For instance, in 2024, retailers globally saw a significant uplift in customer loyalty when implementing robust omnichannel solutions, with some reporting up to a 15% increase in repeat purchases.

Key technological drivers for Groupe LDLC's omnichannel success involve real-time inventory synchronization across all channels, efficient click-and-collect systems, and the deployment of in-store digital tools. These elements are crucial for meeting customer expectations for convenience and speed in today's competitive retail environment. By 2025, it's projected that over 70% of retail sales will be influenced by digital interactions, highlighting the critical nature of these technological investments.

The effectiveness of this technological infrastructure can be measured by several factors:

- Customer Experience Consistency: Ensuring a smooth transition between online browsing and in-store purchasing, and vice versa.

- Operational Efficiency: Streamlining inventory management and order fulfillment to reduce costs and delivery times.

- Data Integration: Leveraging customer data from all touchpoints to personalize offerings and improve marketing efforts.

- In-Store Digitalization: Equipping physical stores with tablets for staff to access product information and customer history, enhancing service quality.

Logistics Automation and Efficiency

Efficient logistics and supply chain management are absolutely crucial for e-commerce success, and Groupe LDLC is no exception. The company's investment in a state-of-the-art logistics facility, opened in 2022, underscores this commitment. This facility boasts advanced automation, aiming to significantly reduce costs and speed up delivery times, which directly impacts customer satisfaction.

The ongoing adoption of automation in warehousing and delivery processes offers a clear path to enhanced operational efficiency. For instance, automated sorting systems can process a much higher volume of packages per hour compared to manual methods. By continuing to integrate cutting-edge technologies, LDLC can solidify its competitive edge in the fast-paced online retail market.

Looking ahead, further technological advancements in logistics could unlock even greater benefits for Groupe LDLC. This includes exploring innovations like:

- Robotic process automation (RPA) for administrative tasks within the supply chain.

- AI-powered inventory management to optimize stock levels and reduce holding costs.

- Advanced route optimization software for delivery fleets, leading to fuel savings and faster deliveries.

- Drone or autonomous vehicle testing for last-mile delivery solutions, potentially disrupting traditional delivery models.

Technological advancements are rapidly reshaping the e-commerce landscape, with AI and mobile optimization being paramount. By 2025, mobile commerce is projected to capture an even larger share of French e-commerce sales, exceeding the 60% mark seen in 2024. This necessitates a continued focus on seamless mobile experiences for Groupe LDLC.

Cybersecurity is an increasingly critical concern, with new EU regulations like NIS2 (effective late 2024/2025) and the Cyber Resilience Act (fully enforced by 2027) mandating stricter protocols. Groupe LDLC must invest in robust security measures to protect data and maintain customer trust in this evolving digital environment.

Omnichannel integration, driven by real-time inventory synchronization and efficient click-and-collect systems, is key to customer loyalty. By 2025, over 70% of retail sales are expected to be influenced by digital interactions, underscoring the importance of Groupe LDLC's technological investments in unifying online and physical channels.

Automation in logistics, as exemplified by Groupe LDLC's 2022 facility, is crucial for efficiency. Further integration of technologies like RPA and AI-powered inventory management promises to reduce costs and accelerate delivery times, enhancing Groupe LDLC's competitive position.

| Technology Area | Key Trend | Impact on Groupe LDLC | 2024/2025 Data/Projection |

|---|---|---|---|

| Artificial Intelligence | Generative AI adoption, Personalization | Enhanced customer experience, operational efficiency | AI adoption increasing across e-commerce |

| Mobile Commerce | Dominant shopping channel | Need for optimized mobile-first experience | Over 60% of French e-commerce sales in 2024 |

| Cybersecurity | Evolving threats, new regulations | Mandatory enhanced security protocols | NIS2 Directive implementation late 2024/2025 |

| Omnichannel | Seamless integration of online/offline | Improved customer loyalty and data utilization | 70%+ sales influenced by digital interactions by 2025 |

| Logistics Automation | Robotics, AI in supply chain | Faster delivery, reduced operational costs | Investment in advanced logistics facilities |

Legal factors

The EU Digital Services Act (DSA), fully effective from February 2024, imposes substantial obligations on e-commerce platforms like those operated by Groupe LDLC. These rules cover the swift removal of illegal content, increased transparency in advertising and content moderation, and accountability for goods sold by third-party vendors.

Failure to comply with the DSA can result in significant penalties, with fines potentially reaching up to 6% of a company's annual global turnover. For Groupe LDLC, maintaining strict adherence is crucial not only to avoid these financial repercussions but also to ensure continued access to the vital EU single market.

The NIS2 Directive, with a transposition deadline of October 2024, and the upcoming Cyber Resilience Act, largely applicable from 2027, are set to significantly impact digital service providers like Groupe LDLC. These regulations mandate enhanced cybersecurity measures and prompt incident reporting, placing a direct onus on companies operating in the digital space.

For Groupe LDLC, an e-commerce entity, compliance means implementing rigorous risk management frameworks, conducting regular security audits, and establishing clear protocols for timely incident notification. Failure to adhere to these stringent requirements could result in substantial financial penalties, underscoring the critical need for proactive cybersecurity investment and strategy.

The EU General Product Safety Regulation (GPSR), effective from December 2024, mandates stringent safety standards for consumer products. Groupe LDLC, dealing in electronics, must ensure its offerings meet these requirements, including clear labeling and robust recall mechanisms, to safeguard consumers and prevent legal penalties.

Data Privacy Regulations (GDPR)

The General Data Protection Regulation (GDPR) continues to shape how Groupe LDLC manages customer information across its e-commerce and physical stores. Strict adherence to GDPR is crucial for safeguarding sensitive data, ensuring customer confidence, and preventing substantial fines for any breaches or non-compliance. For instance, in 2023, the CNIL, France's data protection authority, issued significant fines for various data privacy violations, underscoring the regulatory landscape.

Groupe LDLC's commitment to data privacy involves robust security measures and transparent data handling practices. This includes obtaining explicit consent for data usage and providing clear avenues for customers to manage their personal information. The company actively invests in training its staff on GDPR compliance to mitigate risks associated with data processing.

Key aspects of GDPR compliance for Groupe LDLC include:

- Data Minimization: Collecting only the data necessary for specific purposes.

- Consent Management: Ensuring clear and affirmative consent for data processing activities.

- Data Subject Rights: Facilitating access, rectification, and erasure of personal data.

- Security Measures: Implementing technical and organizational safeguards to protect data.

Competition Law and Anti-competitive Practices

Groupe LDLC operates under the watchful eye of the French Competition Authority, which is increasingly focused on the digital sector. This means the company must be diligent about avoiding any practices that could stifle fair competition, such as predatory pricing or exclusive dealing arrangements. The Authority actively investigates potential abuses of dominant market positions, ensuring that smaller players have a chance to thrive. For instance, in 2023, the Authority imposed fines totaling over €100 million for various anti-competitive practices across different sectors, highlighting the seriousness of these regulations.

Key areas of scrutiny for Groupe LDLC include:

- Pricing Transparency: Ensuring pricing strategies do not unfairly disadvantage competitors or consumers.

- Market Dominance: Avoiding actions that could leverage a strong market position to block new entrants or competitors.

- Partnership Agreements: Reviewing any collaborations or distribution agreements to ensure they do not restrict competition.

Groupe LDLC faces evolving legal landscapes, particularly concerning digital services and consumer protection. The EU Digital Services Act (DSA), effective February 2024, mandates strict content moderation and advertising transparency, with non-compliance risking fines up to 6% of global turnover. Similarly, the NIS2 Directive, with an October 2024 deadline, and the upcoming Cyber Resilience Act will require enhanced cybersecurity measures and incident reporting, directly impacting Groupe LDLC's operations.

Further regulatory pressures include the EU General Product Safety Regulation (GPSR) from December 2024, demanding stringent safety standards for electronics sold by Groupe LDLC. The company must also navigate ongoing GDPR compliance, with French authorities issuing significant fines in 2023 for data privacy violations, emphasizing the need for robust data protection practices.

In terms of competition law, the French Competition Authority's increased focus on the digital sector means Groupe LDLC must avoid anti-competitive practices. Fines in 2023 exceeded €100 million for various sectors, highlighting the penalties for non-compliance in areas like pricing transparency and market dominance.

Groupe LDLC's legal compliance strategy must therefore prioritize data privacy, cybersecurity, and fair competition. The company's adherence to regulations like GDPR and the DSA will be critical for maintaining market access and avoiding substantial financial penalties.

Environmental factors

France's strict Waste Electrical and Electronic Equipment (WEEE) regulations, often referred to as the ADEME decree, place significant emphasis on managing and recycling electronic waste to minimize environmental harm. These rules are designed to push for greater collection and recycling rates across the country.

As a major electronics retailer, Groupe LDLC shoulders producer responsibility for the products it sells. This means the company is obligated to ensure that end-of-life electronics are properly collected and channeled into recycling streams, often through partnerships with approved recycling organizations.

Adhering to these WEEE directives is not just about avoiding potential fines, which can be substantial, but also about actively participating in the development of a circular economy. For instance, in 2023, France aimed to increase its WEEE collection rate, and companies like LDLC play a vital role in achieving these national targets.

France's new WEEE and Battery regulations, effective January 2025, mandate specific eco-modulation criteria for portable battery removability and replaceability. This legislation directly influences Groupe LDLC's product design and sourcing strategies, as non-compliant items could incur penalties or deter eco-conscious buyers.

For instance, products failing to meet these standards, which prioritize easier battery access and replacement, might see reduced market appeal. With the European Union aiming for a circular economy, such regulations are likely to become more stringent, pushing companies like LDLC to prioritize sustainable product lifecycles.

France's new Decree No. 2024-316, rolling out in early 2025, mandates a sustainability index for electronics, evolving from the current repairability index. This shift will require Groupe LDLC to prominently display this new metric, providing consumers with clear information on a product's environmental footprint and guiding purchasing decisions towards eco-friendlier choices.

Carbon Footprint of Logistics and Operations

The environmental impact of logistics, particularly transportation and warehousing, is a significant concern for businesses like Groupe LDLC, an e-commerce and retail entity. Their carbon footprint, stemming from the extensive supply chain and physical retail presence, faces increasing scrutiny from consumers and regulators alike. For instance, the European Union's transport sector alone accounted for approximately 25% of total greenhouse gas emissions in 2022, highlighting the scale of the challenge.

Groupe LDLC's operations, involving the movement of goods and energy consumption in warehouses and stores, directly contribute to this environmental footprint. As of 2023, e-commerce logistics are estimated to be responsible for a substantial portion of retail's environmental impact, with last-mile delivery being a particularly carbon-intensive phase.

To address this, LDLC is likely focusing on key initiatives to mitigate its environmental impact. These include:

- Optimizing Delivery Routes: Implementing advanced route planning software can reduce mileage and fuel consumption.

- Sustainable Packaging: Shifting to recyclable, biodegradable, or reduced-material packaging minimizes waste and its associated environmental cost.

- Energy Efficiency in Operations: Investing in energy-efficient lighting, heating, and cooling systems for warehouses and stores reduces overall energy demand and associated emissions.

Circular Economy Principles and Product Lifespan

France's AGEC law, enacted to foster a circular economy, strongly emphasizes extending product lifespans through repair and reuse, directly targeting planned obsolescence. This legislation significantly influences Groupe LDLC by creating a market advantage for durable, easily repairable items. It also presents an opportunity to boost sales of essential spare parts and professional repair services, areas where LDLC already possesses considerable technical expertise.

The shift towards circularity is already showing tangible results. For instance, by 2023, the repairability index, a key component of the AGEC law, was applied to numerous product categories, including electronics, encouraging manufacturers to design for longevity. This regulatory environment directly supports LDLC’s business model, which thrives on providing technical solutions and extending the usability of consumer electronics.

Groupe LDLC is well-positioned to capitalize on these environmental trends. The company's established network for technical support and its commitment to offering a wide range of spare parts align perfectly with the AGEC law's objectives. This strategic alignment is anticipated to drive increased customer loyalty and revenue streams as consumers increasingly seek sustainable and repairable electronic goods.

- AGEC Law's Impact: Promotes product repair and reuse, combating planned obsolescence.

- Market Opportunity: Increased demand for durable, reparable products and associated services.

- LDLC's Strengths: Aligns with existing technical support and spare parts offerings.

- Consumer Behavior Shift: Growing consumer preference for sustainable and repairable electronics.

France's evolving environmental regulations, particularly concerning Waste Electrical and Electronic Equipment (WEEE) and battery management, directly impact Groupe LDLC's operational and product strategies. The upcoming 2025 WEEE and Battery regulations, focusing on battery removability and replaceability, will necessitate adjustments in product design and sourcing to avoid penalties and appeal to eco-conscious consumers.

The introduction of a mandatory sustainability index for electronics in early 2025, replacing the repairability index, requires Groupe LDLC to transparently communicate product environmental footprints, influencing consumer purchasing decisions.

Groupe LDLC's commitment to the circular economy, driven by laws like AGEC, positions it to benefit from increased demand for durable, repairable products and related services, leveraging its existing technical support infrastructure.

The environmental impact of logistics remains a critical concern, with e-commerce operations contributing to carbon emissions, prompting LDLC to focus on route optimization, sustainable packaging, and energy efficiency in its facilities.

| Environmental Factor | Regulation/Trend | Impact on Groupe LDLC | 2023/2024 Data Point |

|---|---|---|---|

| E-waste Management | WEEE Directives (France) | Producer responsibility for collection and recycling | France's WEEE collection rate target increase |

| Product Design | 2025 Battery Regulations | Prioritize battery removability/replaceability | EU aims for circular economy principles |

| Consumer Information | Sustainability Index (2025) | Mandatory display of environmental footprint | Shift from repairability to broader sustainability metrics |

| Circular Economy | AGEC Law | Promotes repair, reuse, combats obsolescence | Repairability index applied to electronics |

| Logistics Emissions | General Environmental Scrutiny | Need for route optimization, sustainable packaging | EU transport sector ~25% of GHG emissions (2022) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Groupe LDLC is meticulously constructed using a blend of publicly available data from official government statistics, reputable market research firms, and leading economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.