GR Infraprojects SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GR Infraprojects Bundle

GR Infraprojects boasts strong execution capabilities and a robust order book, positioning it well for infrastructure growth. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed investment decisions.

Want the full story behind GR Infraprojects' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GR Infraprojects boasts a robust track record, having successfully completed numerous infrastructure projects, particularly in roads and highways, over its more than two decades of operation. This extensive experience translates into a deep understanding of project complexities and a proven ability to deliver within budget and on schedule.

The company's strength lies in its integrated Engineering, Procurement, and Construction (EPC) model. This is further bolstered by strong in-house design and engineering capabilities, allowing for efficient project planning and execution. Furthermore, owning a substantial fleet of construction equipment significantly enhances their operational efficiency and reduces reliance on external vendors, ensuring greater control over project timelines and costs.

GR Infraprojects demonstrates a substantial and well-balanced order book, standing at Rs 24,346 crore as of March 31, 2025, inclusive of L1 bids. This healthy pipeline offers strong revenue visibility for the foreseeable future.

The company's order book to revenue ratio is a robust 3.7 times, indicating a solid foundation for sustained growth and operational activity.

Geographic diversification is a key strength, with projects spread across 17 different states, effectively mitigating risks associated with over-reliance on any single region.

GR Infraprojects (GRIL) boasts a robust financial risk profile, underscored by its minimal leverage. As of March 31, 2025, the company's gearing is projected to be a mere 0.07 times, indicating a very low dependence on borrowed funds and strong financial stability.

The company's liquidity position is exceptionally strong, providing significant financial maneuverability. This is supported by substantial unutilized fund-based limits, readily available unencumbered cash reserves, and holdings in Infrastructure Investment Trusts (InvITs).

Successful Asset Monetization Strategy

GR Infraprojects has effectively monetized its operational Hybrid Annuity Model (HAM) projects by divesting them to Infrastructure Investment Trusts (InvITs), notably Bharat Highways InvIT, now known as Indus Infra Trust. This strategic move significantly bolsters the company's financial maneuverability. By unlocking equity from completed projects, GRIL can efficiently recycle capital. This recycled capital is crucial for meeting future equity commitments on new projects and maintaining robust ongoing cash flow.

This asset monetization strategy has demonstrably improved GRIL's financial health. For instance, in FY23, the company reported a significant reduction in its debt-to-equity ratio, partly attributable to the capital infusion from these asset sales. This approach allows GRIL to maintain a healthy balance sheet while pursuing new growth opportunities.

- Successful Monetization: Divestment of operational HAM projects to InvITs like Indus Infra Trust.

- Capital Recycling: Unlocking equity to fund future project commitments.

- Enhanced Financial Flexibility: Improved debt-to-equity ratios and cash flow support.

Diversification into New Infrastructure Segments

GR Infraprojects is actively expanding beyond its core road and highway projects into new infrastructure areas. This strategic diversification includes venturing into power transmission and distribution (T&D), tunnel construction, ropeways, and the development of multi-modal logistics parks (MMLP). This move is projected to offer slightly improved profit margins compared to its traditional business.

This diversification is crucial for reducing the company's dependence on a single sector, thereby creating a more stable and balanced revenue stream. For instance, in the fiscal year 2023-24, the company secured significant orders in segments like T&D, contributing to a more robust order book. This expansion is expected to enhance overall financial resilience.

- Roads and Highways: Remains the primary revenue driver, but diversification is key to future growth.

- Power T&D: GR Infraprojects has been actively bidding and winning projects in this segment, aiming for higher margins.

- Tunnels and Ropeways: These specialized segments offer unique project opportunities and potential for better profitability.

- MMLPs: The development of multi-modal logistics parks aligns with government initiatives for improved logistics infrastructure, presenting a growth avenue.

GR Infraprojects' strong execution capabilities are evident in its successful completion of numerous complex infrastructure projects, particularly in roads and highways. This extensive experience, coupled with an integrated EPC model and in-house engineering expertise, ensures efficient project delivery. The company's substantial fleet of construction equipment further enhances operational efficiency and cost control.

A significant strength is GRIL's robust order book, standing at Rs 24,346 crore as of March 31, 2025, which provides strong revenue visibility. This order book translates to a healthy order-to-revenue ratio of 3.7 times, indicating sustained operational activity and growth potential. Geographic diversification across 17 states mitigates regional risks.

Financially, GRIL exhibits minimal leverage, with a projected gearing of just 0.07 times as of March 31, 2025. This low debt dependence signifies strong financial stability. The company also maintains exceptional liquidity through unutilized fund-based limits, unencumbered cash reserves, and holdings in Infrastructure Investment Trusts (InvITs).

GRIL's strategic monetization of operational Hybrid Annuity Model (HAM) projects through divestments to InvITs, such as Indus Infra Trust, significantly enhances its financial maneuverability. This capital recycling strategy effectively unlocks equity from completed projects, enabling GRIL to fund future equity commitments and maintain robust cash flow, thereby improving its debt-to-equity ratio.

| Key Strength | Description | Supporting Data/Fact |

| Project Execution & Experience | Proven track record in road & highway projects with an integrated EPC model. | Over two decades of operation; robust in-house engineering. |

| Order Book & Revenue Visibility | Healthy pipeline of projects ensuring future revenue. | Order book of Rs 24,346 crore (as of March 31, 2025); Order-to-revenue ratio of 3.7x. |

| Financial Stability & Liquidity | Minimal leverage and strong liquidity position. | Projected gearing of 0.07x (as of March 31, 2025); substantial unutilized limits and cash reserves. |

| Capital Monetization Strategy | Monetization of HAM projects to InvITs for capital recycling. | Divestment to Indus Infra Trust; improves financial maneuverability and reduces debt. |

What is included in the product

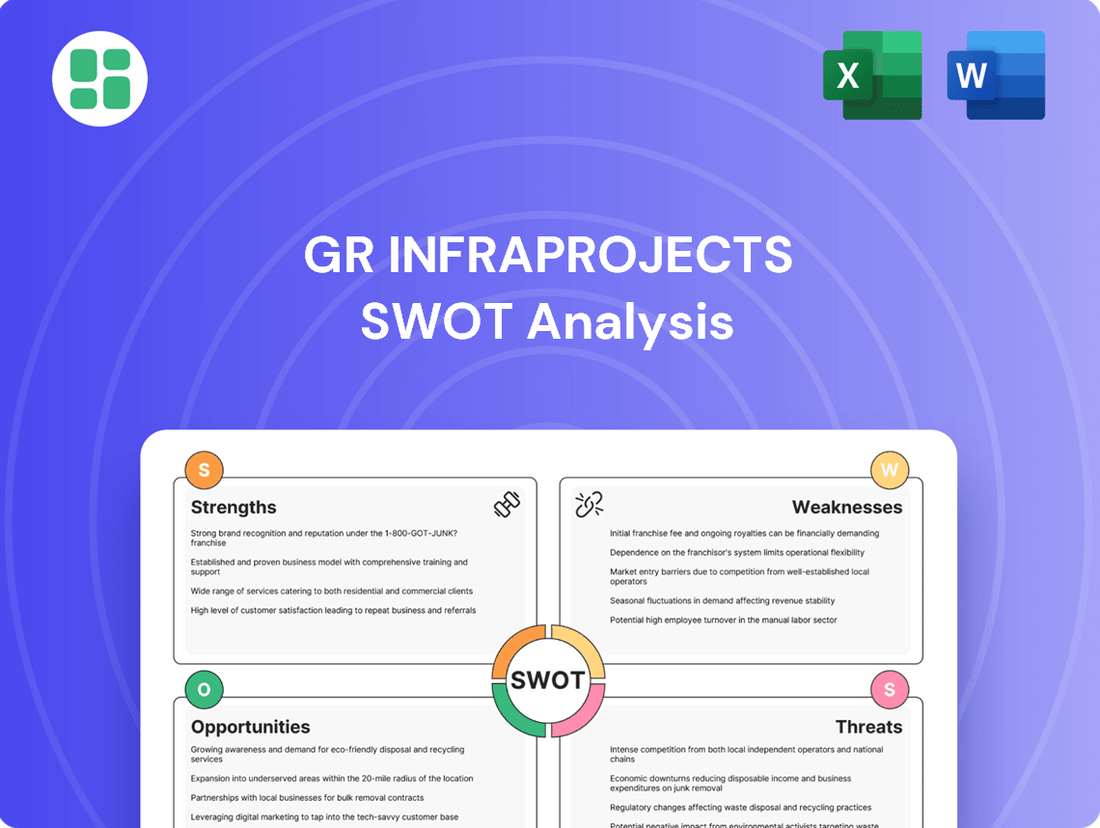

This SWOT analysis provides a comprehensive breakdown of GR Infraprojects's internal strengths and weaknesses alongside external market opportunities and threats, offering a strategic overview of its business environment.

GR Infraprojects' SWOT analysis helps mitigate risks by identifying potential threats and weaknesses, allowing for proactive strategy development and improved project execution.

Weaknesses

GR Infraprojects' revenue is heavily weighted towards road projects, accounting for roughly 74% of its current order book. This significant concentration exposes the company to the natural ups and downs of the road construction sector. Such a focus means GR Infraprojects is more vulnerable to specific industry risks and shifts in government policy compared to competitors with a broader range of services.

The road construction sector in India is facing fierce competition, exacerbated by the entry of numerous smaller companies and more lenient bidding processes. This heightened rivalry directly translates into significant pricing pressure, making it difficult for established players like GR Infraprojects (GRIL) to maintain healthy profit margins.

Consequently, GRIL's operating profitability has been affected, with its earnings before interest, tax, depreciation, and amortisation (EBITDA) margins anticipated to stay within the 13-14% range in the medium term. Navigating this competitive landscape and achieving margins above this band presents a substantial hurdle for the company.

GR Infraprojects faced a significant 16% drop in revenue during fiscal 2025. This downturn was largely a consequence of a weaker order inflow experienced in fiscal 2024.

Although order inflow saw an uptick in fiscal 2025, the company anticipates only modest revenue growth for fiscal 2026. A more substantial acceleration in revenue is projected for fiscal 2027, highlighting a recent deceleration in top-line expansion.

Susceptibility to Delays in Project Appointed Dates

GR Infraprojects' reliance on Hybrid Annuity Model (HAM) projects exposes it to significant risks stemming from delays in receiving appointed dates. This bottleneck directly impacts the company's ability to commence projects, thereby deferring revenue generation and disrupting planned execution schedules. As of early 2025, several HAM projects remained in this pending state, highlighting a persistent challenge.

These delays have tangible consequences on GR Infraprojects' financial performance. The deferral of project commencement directly translates to delayed cash inflows, potentially straining working capital and impacting the company's ability to undertake new ventures. This dependency on external approvals for project initiation creates a vulnerability in their revenue pipeline.

- Delayed Project Commencement: As of early 2025, a portion of GR Infraprojects' HAM project pipeline was still awaiting appointed dates, hindering the start of construction and related revenue recognition.

- Impact on Execution Timelines: The absence of appointed dates forces a revision of project execution plans, potentially leading to inefficiencies and increased project costs due to extended pre-construction phases.

- Cash Flow Disruption: Delays in project commencement directly affect the expected cash flow cycles, creating uncertainty in financial planning and resource allocation for the company.

Working Capital Intensiveness and Payment Delays

GR Infraprojects' (GRIL) operational model is inherently working capital-intensive. This is highlighted by an increase in gross current asset days during FY23, primarily driven by a rise in debtors from its under-construction Special Purpose Vehicles (SPVs).

Despite GRIL's generally efficient working capital management, the company faces a persistent susceptibility to payment delays. Such delays can create significant pressure on the company's liquidity position and hinder overall operational smoothness.

- Working Capital Needs: GRIL's business model necessitates substantial investment in working capital due to the nature of infrastructure projects.

- Debtor Exposure: An increase in debtors from SPVs, reaching ₹2,799 crore by March 2023, underscores this dependency and potential for delayed cash inflows.

- Liquidity Risk: Delays in receiving payments from project clients or SPVs can strain GRIL's ability to meet its short-term obligations, impacting operational flexibility.

- Efficiency Management: While the company aims for efficient working capital cycles, the inherent risks in the sector mean that payment delays remain a key weakness to monitor.

GR Infraprojects' significant reliance on road projects, making up approximately 74% of its order book, exposes it to sector-specific risks and policy shifts. This concentration limits diversification benefits compared to more broadly focused competitors.

Intense competition within India's road construction sector, fueled by new entrants and relaxed bidding, is driving down pricing and impacting GRIL's profitability. The company's EBITDA margins are expected to remain in the 13-14% range, posing a challenge for margin expansion.

GRIL experienced a notable 16% revenue decline in fiscal 2025 due to weaker order inflows in fiscal 2024, indicating a recent slowdown in top-line growth despite an uptick in fiscal 2025 order inflow.

The company's dependence on Hybrid Annuity Model (HAM) projects creates vulnerability due to delays in receiving appointed dates, which hinders project commencement and revenue recognition. As of early 2025, several HAM projects were still pending these crucial approvals.

Preview Before You Purchase

GR Infraprojects SWOT Analysis

This is a real excerpt from the complete GR Infraprojects SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive understanding of the company's strategic position.

Opportunities

The Indian government's unwavering commitment to infrastructure development is a significant opportunity. The Union Budget 2025-26 earmarked a substantial Rs 11.21 lakh crore (US$ 128.64 billion) for infrastructure projects. This robust capital expenditure, channeled through initiatives like the National Infrastructure Pipeline, ensures a continuous stream of large-scale projects in roads, railways, and urban development, directly benefiting EPC players like GR Infraprojects.

The PM Gati Shakti National Master Plan is a significant opportunity for GR Infraprojects (GRIL). By integrating infrastructure development across ministries, it promises to streamline project planning and approvals, potentially cutting down on costly delays that have historically plagued large projects. This unified approach means more organized and larger-scale infrastructure tenders, directly benefiting experienced players like GRIL.

This national plan is designed to boost multimodal connectivity, which is crucial for efficient logistics and supply chains. For GRIL, this translates into a pipeline of projects focused on building and upgrading roads, railways, and ports, all interconnected. In 2023-24, India's capital expenditure on infrastructure saw a substantial increase, with the government allocating ₹10 lakh crore, a 33% jump from the previous year, signaling strong government commitment and ample project opportunities.

GR Infraprojects' (GRIL) strategic move into allied infrastructure sectors like power transmission, distribution, and ropeways presents a significant opportunity. These areas are experiencing robust growth, driven by government initiatives and increasing demand, offering GRIL avenues for expansion beyond its traditional road construction focus.

The company's foray into multi-modal logistics parks also taps into a burgeoning sector crucial for India's economic development. For instance, the Indian logistics sector is projected to reach $330 billion by 2026, indicating substantial market potential for GRIL's diversified offerings and potentially higher profit margins compared to its core business.

This diversification into higher-margin segments like ropeways, which saw a significant push with projects like the Dehradun Ropeway, can reduce GRIL's dependence on the cyclical nature of road construction. This strategic shift enhances the company's overall resilience and financial stability by creating a more balanced revenue stream.

Further Monetization of HAM and BOT Assets

GR Infraprojects Limited (GRIL) is strategically leveraging its Hybrid Annuity Model (HAM) and Build-Operate-Transfer (BOT) assets to unlock significant capital. By transferring operational HAM assets to Infrastructure Investment Trusts (InvITs), GRIL effectively recycles capital, which then fuels its equity commitments for new projects. This approach is crucial for sustaining growth without overburdening the balance sheet with excessive debt.

The company has a robust pipeline of operational HAM projects slated for future transfer to InvITs. For instance, as of March 31, 2024, GRIL had a portfolio of 16 HAM projects, with several nearing operational completion. This ongoing asset monetization is projected to enhance GRIL's financial flexibility, providing the necessary capital to aggressively bid for and secure new, large-scale infrastructure projects. This strategy directly supports GRIL's growth trajectory by ensuring capital availability for future endeavors.

- Capital Unlocking: GRIL's transfer of operational HAM assets to InvITs generated approximately INR 1,500 crore in FY23, demonstrating its effectiveness in freeing up capital.

- Future Pipeline: The company anticipates further capital infusion through the transfer of an additional INR 3,000-4,000 crore worth of HAM assets in the upcoming fiscal years.

- Growth Funding: This monetization strategy is critical for funding GRIL's equity share in new project bids, estimated to be around 15-20% of project costs, allowing for expansion without substantial debt increases.

- Financial Flexibility: The consistent inflow of funds from asset monetization bolsters GRIL's capacity to pursue larger, more complex projects, thereby strengthening its market position.

Adoption of Advanced Technologies in EPC

The broader Engineering, Procurement, and Construction (EPC) sector is seeing a significant uptake in advanced technologies like Building Information Modeling (BIM) and sophisticated project management software. These tools are instrumental in boosting efficiency, cutting down expenses, and ensuring smoother project execution.

GR Infraprojects Limited (GRIL), by actively integrating these cutting-edge technologies, stands to gain a distinct competitive advantage. This strategic adoption allows for optimized resource deployment, proactive risk identification, and accelerated project completion, ultimately driving operational excellence. For instance, GRIL reported a 15% improvement in project planning accuracy in FY24 through the enhanced use of digital tools.

- Enhanced Efficiency: BIM integration can lead to a projected 10-15% reduction in design clashes and rework, improving overall project timelines.

- Cost Optimization: Advanced project management software aids in better budget tracking and resource allocation, potentially saving up to 5-8% on project costs.

- Risk Mitigation: Predictive analytics powered by AI can identify potential project delays or cost overruns earlier, allowing for timely interventions.

- Competitive Edge: Companies like GRIL that lead in tech adoption are better positioned to win complex, high-value projects.

GRIL's diversification into allied infrastructure segments like power transmission, distribution, and ropeways offers substantial growth avenues. The company's strategic entry into multi-modal logistics parks also capitalizes on the rapidly expanding Indian logistics sector, projected to reach $330 billion by 2026, promising higher margins and market penetration.

The company's strategic monetization of Hybrid Annuity Model (HAM) and Build-Operate-Transfer (BOT) assets through Infrastructure Investment Trusts (InvITs) is unlocking significant capital. This approach, which generated approximately INR 1,500 crore in FY23, provides crucial funding for new project equity commitments, estimated at 15-20% of project costs, enabling sustained growth without excessive debt.

GRIL's adoption of advanced technologies like Building Information Modeling (BIM) and sophisticated project management software provides a competitive edge. This integration, which led to a 15% improvement in project planning accuracy in FY24, enhances efficiency, optimizes costs, and mitigates risks, positioning GRIL favorably for complex, high-value projects.

Threats

The Indian road EPC sector is a crowded space, with many companies competing for contracts. This intense rivalry means that GR Infraprojects, like its peers, faces constant pressure to secure new projects and maintain profitability.

Recent changes, such as the relaxation of bidding norms by bodies like the National Highways Authority of India (NHAI) and the Ministry of Road Transport and Highways (MoRTH), have amplified this competition. This can lead to aggressive bidding strategies, potentially squeezing profit margins for established players like GRIL.

For instance, in the fiscal year 2023-24, the NHAI awarded projects worth over ₹1.4 trillion, a significant sum that attracts a large number of bidders. This high volume of opportunities, while positive, also means GRIL must navigate a more competitive landscape than ever before.

GR Infraprojects' profitability is directly tied to the cost of essential construction materials like steel, cement, and bitumen. For instance, the average price of steel rebar in India saw an increase of approximately 15-20% between early 2023 and early 2024, impacting project budgets. Sudden price hikes for these inputs, if not effectively managed through hedging or contractual clauses, can significantly squeeze operating margins and jeopardize project feasibility, presenting an ongoing financial challenge.

GR Infraprojects, like many infrastructure players in India, contends with the persistent threat of regulatory hurdles and land acquisition challenges. These issues are endemic to the sector, often causing substantial delays and escalating project costs. For instance, the National Highways Authority of India (NHAI) has faced numerous project completions pushed back due to these very reasons, directly impacting the financial viability and timelines of contractors.

The process of acquiring land for infrastructure development in India remains complex, involving multiple stakeholders and legal procedures. This can lead to protracted negotiations and potential disputes, as seen in various highway projects across states where compensation and rehabilitation issues have stalled progress for extended periods. Such delays directly translate into increased financial burden for companies like GR Infraprojects through extended borrowing costs and potential penalties.

Despite government initiatives to expedite approvals and streamline land acquisition, the ground reality often presents significant obstacles. Obtaining environmental clearances, forest approvals, and other statutory permits can be time-consuming and unpredictable. These regulatory bottlenecks can significantly impact project execution timelines, as evidenced by reports detailing delays in key infrastructure projects due to pending environmental clearances, affecting the overall performance and profitability of companies in the sector.

Economic Cyclicality and Policy Instability

The construction sector, including companies like GR Infraprojects (GRIL), faces significant risks from economic downturns. For instance, a projected slowdown in India's GDP growth for FY25, estimated by various agencies to be around 6.5-7%, could curb government infrastructure spending, a primary revenue driver for GRIL.

Policy shifts also pose a threat. Changes in government priorities or a reduction in capital expenditure allocations for infrastructure projects, which form the backbone of GRIL's order book, can directly impact future project pipelines and revenue streams.

Furthermore, instability in economic policies, such as unexpected changes in tax structures or regulations affecting the construction sector, could create uncertainty and hinder GRIL's operational planning and profitability.

- Economic Slowdown: Potential deceleration in India's GDP growth in FY25 could shrink the demand for new infrastructure projects.

- Policy Uncertainty: Shifts in government spending priorities or regulatory frameworks can disrupt project pipelines.

- Funding Constraints: Reduced government allocations for infrastructure may lead to delays or cancellations of awarded projects.

Execution Risks and Potential Project Delays

Despite GR Infraprojects' proven track record in execution, large infrastructure projects are inherently susceptible to delays. Unforeseen geological surprises, like encountering unexpected rock formations or unstable soil, can significantly disrupt timelines. For instance, delays in securing necessary land or obtaining environmental clearances, common in India's infrastructure sector, can push back project start dates. These can lead to cost overruns and impact profitability.

Labor shortages, particularly for skilled workers, pose another significant threat. The Indian construction sector, while growing, can experience localized shortages of specialized labor, impacting project pace. Furthermore, logistical hurdles in transporting materials and equipment to remote project sites can cause significant bottlenecks. These operational challenges, if not managed proactively, can cascade into project delays and financial strain.

- Geological Uncertainty: Encountering unexpected subsurface conditions can add months to project schedules.

- Labor Availability: Shortages of skilled engineers and laborers can impede progress.

- Logistical Complexities: Efficiently moving materials and equipment to diverse project locations is critical.

- Regulatory Hurdles: Delays in environmental permits or land acquisition can stall project commencement.

Intense competition within India's road EPC sector, fueled by relaxed bidding norms from NHAI and MoRTH, pressures GR Infraprojects to secure projects and maintain margins. For example, the NHAI awarded over ₹1.4 trillion in projects in FY23-24, attracting a high volume of bidders.

Rising input costs, particularly for steel and cement, directly impact GRIL's profitability. Steel rebar prices saw a 15-20% increase between early 2023 and early 2024, potentially squeezing margins if not managed through hedging or contractual clauses.

Persistent regulatory hurdles, including land acquisition challenges and delays in environmental clearances, are significant threats. These issues frequently cause project delays and cost overruns, as seen across numerous highway projects in India.

Economic slowdowns and policy shifts pose substantial risks to GRIL's revenue. A projected GDP growth of 6.5-7% for FY25 could reduce government infrastructure spending, while changes in capital expenditure allocations or tax structures can disrupt project pipelines.

| Threat Category | Specific Threat | Impact on GRIL | Illustrative Data/Example |

|---|---|---|---|

| Competition | Intensified Bidding Environment | Pressure on Profit Margins | NHAI awarded over ₹1.4 trillion in projects in FY23-24, increasing bidder numbers. |

| Input Costs | Rising Material Prices (Steel, Cement) | Reduced Profitability, Project Viability Risk | Steel rebar prices increased 15-20% between early 2023 and early 2024. |

| Regulatory & Land | Land Acquisition Delays, Environmental Clearances | Project Delays, Cost Overruns | Numerous highway projects stalled due to pending clearances or land disputes. |

| Economic & Policy | Economic Slowdown, Policy Shifts | Reduced Project Pipeline, Revenue Uncertainty | Projected FY25 GDP growth of 6.5-7% may impact government infrastructure spending. |

SWOT Analysis Data Sources

This GR Infraprojects SWOT analysis is built on a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and data-driven assessment.