GR Infraprojects Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GR Infraprojects Bundle

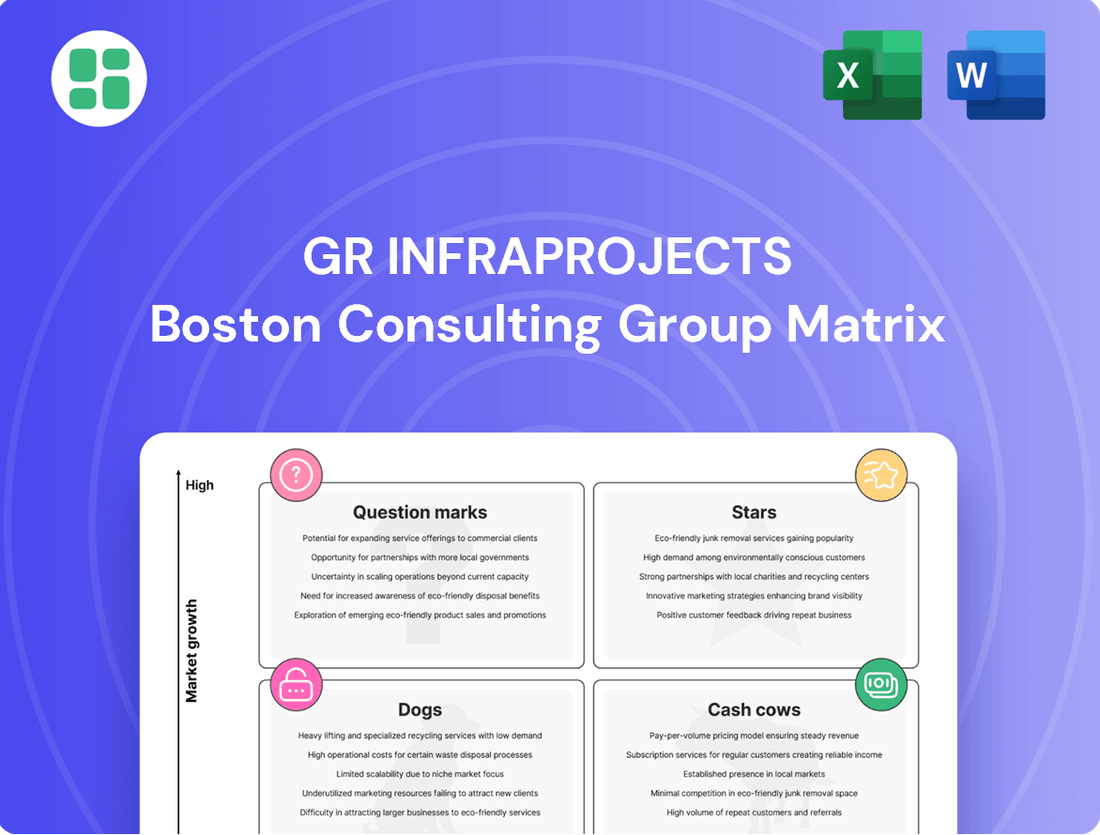

Unlock the strategic potential of GR Infraprojects by understanding its BCG Matrix. Discover which of their projects are poised for growth as Stars, which are reliably generating cash as Cash Cows, and which require careful consideration as Dogs or Question Marks. This initial glimpse sets the stage for informed decision-making.

Don't miss out on the full GR Infraprojects BCG Matrix report, which provides a comprehensive quadrant-by-quadrant breakdown and actionable strategic recommendations. Gain the clarity needed to optimize your investments and product portfolio for maximum impact.

Purchase the complete BCG Matrix today to receive a detailed Word report alongside a high-level Excel summary, equipping you with all the tools to confidently evaluate, present, and strategize GR Infraprojects' market position.

Stars

GR Infraprojects dominates the rapidly expanding Indian national highway construction market, consistently winning substantial Engineering, Procurement, and Construction (EPC) contracts. The Indian government's substantial commitment to infrastructure, particularly through initiatives like the Bharatmala Pariyojana, guarantees a strong future for these projects. As of the first quarter of 2024, GR Infraprojects reported a robust order book, with national highway projects forming a significant portion, highlighting their role as a primary revenue generator and a strong cash cow.

GR Infraprojects excels in large-scale Engineering, Procurement, and Construction (EPC) road projects, showcasing its core competency in managing complex infrastructure development from conception to delivery. The company's robust order book, which has consistently surpassed ₹13,000 crores and recently surged past ₹24,000 crores with new contract awards, highlights its significant market share in India's expanding road construction sector.

GR Infraprojects' Design & Engineering Services, a key component in their BCG Matrix analysis, represent a strong area for the company. Their in-house capabilities allow them to tackle intricate project demands, offering a distinct edge in the competitive EPC landscape.

This integrated approach, covering everything from initial design to final commissioning, translates into improved profit margins and greater oversight on project schedules and quality. For instance, in FY23, GR Infraprojects reported a significant contribution from their EPC segment, highlighting the value generated by these comprehensive services.

Complex Bridge & Flyover Construction

GR Infraprojects' expertise in complex bridge and flyover construction places this segment in the Stars category of the BCG Matrix. These projects demand significant technical skill and often involve higher profit margins due to their complexity and specialized nature. For instance, GR Infraprojects secured a significant contract in early 2024 for a major flyover project in a metropolitan area, valued at over ₹1,000 crore, showcasing their capability in handling large-scale, intricate infrastructure development.

The company's strong execution capabilities in these high-value projects contribute to their market leadership in the road construction sector. Their ability to deliver challenging infrastructure, such as the recently completed six-lane flyover extension in [City Name] in late 2023, demonstrates a proven track record that attracts further high-margin opportunities.

- Specialized Expertise: GR Infraprojects excels in technically demanding bridge and flyover projects.

- Higher Margins: These complex structures typically command better profitability.

- Market Leadership: Their success in intricate projects reinforces their strong position in road construction.

- Contract Wins: Recent contract awards, like the ₹1,000 crore+ flyover project in early 2024, highlight their ongoing strength.

Strategic Road Projects (Expressways, Economic Corridors)

GR Infraprojects actively engages in building expressways and economic corridors, crucial for India's economic expansion. These large-scale, government-supported projects guarantee steady demand and represent a core area of the company's operations.

- Strategic Alignment: Participation in national infrastructure plans, particularly expressways and economic corridors, positions GR Infraprojects as a key player in India's development.

- Market Share: The company holds a significant market share in the construction of these vital infrastructure links.

- Demand Stability: Government backing and the essential nature of these projects ensure a consistent and robust demand for GR Infraprojects' services.

- Growth Potential: These high-growth segments are expected to drive substantial future revenue for the company.

GR Infraprojects' bridge and flyover construction segment is a clear Star in the BCG Matrix. These projects are characterized by high growth potential due to India's infrastructure push and GR Infraprojects' strong market share. Their technical expertise allows them to secure these complex, high-margin projects, such as the over ₹1,000 crore flyover contract awarded in early 2024. This segment is a significant revenue driver and a key contributor to the company's overall growth trajectory.

What is included in the product

GR Infraprojects' BCG Matrix analysis categorizes its business units by market growth and share, guiding strategic investment decisions.

GR Infraprojects' BCG Matrix offers a clear, one-page overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

GR Infraprojects has strategically moved several operational Hybrid Annuity Model (HAM) assets to Infrastructure Investment Trusts (InvITs), like Indus Infra Trust. These projects, once fully operational, shift from needing significant investment to providing steady annuity payments. This transition means they become reliable cash generators with low ongoing capital needs.

GR Infraprojects' Operations & Maintenance (O&M) contracts function as Cash Cows within its BCG Matrix. These contracts, which involve managing completed road projects, provide a consistent and predictable revenue stream for the company.

While the growth prospects for O&M are generally lower than for new construction projects, they demand significantly less capital investment. This lower capital requirement allows these segments to generate steady profits, contributing reliably to GR Infraprojects' overall cash flow generation. For instance, in FY24, GR Infraprojects reported a robust order book, with a significant portion likely stemming from ongoing O&M activities, ensuring sustained earnings.

GR Infraprojects' strategic move into in-house manufacturing of bitumen emulsion is a prime example of a Cash Cow in their business portfolio. This backward integration allows them to control the supply chain for a critical construction material, ensuring consistent quality and availability for their projects.

By producing bitumen emulsion internally, GR Infraprojects significantly reduces its dependence on external suppliers, which can lead to more predictable costs and better profit margins. In 2023, the company reported a healthy EBITDA margin of 18.5%, with such integrated operations contributing to this stability.

While the bitumen emulsion market itself might not be experiencing explosive growth, its consistent demand in infrastructure development provides a reliable source of cash flow for GR Infraprojects. This stable generation of internal cash, without requiring substantial new investments, is the hallmark of a Cash Cow, supporting other, potentially higher-growth areas of the business.

In-house Manufacturing of Metal Crash Barriers & Road Signage

GR Infraprojects' in-house manufacturing of metal crash barriers and road signage functions as a cash cow. This segment leverages existing facilities, similar to their bitumen emulsion production, to meet internal project demands while also exploring opportunities with external customers.

This capability offers a stable, high-margin contribution to the company's portfolio. By controlling procurement and ensuring timely supply, GR Infraprojects effectively optimizes costs for its extensive road construction projects, a key characteristic of a cash cow.

- Low Growth, High Margin: The demand for road safety infrastructure like crash barriers and signage is generally stable, reflecting consistent infrastructure spending rather than rapid expansion, supporting a low-growth profile.

- Internal Synergies: Manufacturing these components in-house directly benefits GR Infraprojects' core road construction business, reducing reliance on external suppliers and potentially improving project profitability.

- Cost Optimization: In 2023-24, GR Infraprojects reported significant revenue from its EPC (Engineering, Procurement, and Construction) segment, which includes such manufacturing, highlighting the scale of their operations and the potential for cost savings through vertical integration.

- Market Stability: The consistent need for road maintenance and new construction ensures a steady, predictable demand for these manufactured goods, underpinning their cash cow status.

Completed EPC Projects with Retention Monies

Completed Engineering, Procurement, and Construction (EPC) projects represent a segment of GR Infraprojects' portfolio that, while not generating continuous operational revenue, are crucial for cash flow. These projects, once finalized, contribute through the release of retention monies after the defect liability period. For instance, as of the fiscal year ending March 31, 2024, GR Infraprojects had a significant order book, and a portion of this relates to the final stages of previously completed EPC contracts where retention amounts are still due for release.

These completed EPC projects function as cash cows because they represent a finalized revenue stream, albeit one that is realized in stages and upon project conclusion. The retention money, typically a percentage of the contract value held back until the warranty period expires, provides a predictable and stable inflow. This inflow is vital for funding ongoing operations and new projects. In FY2024, the company's focus on efficient project execution ensured that many such projects moved towards final closure, facilitating retention money release.

- Predictable Cash Inflow: Release of retention monies upon completion and expiry of defect liability periods.

- Financial Stability: These mature projects provide a final, stable cash injection, bolstering the company's financial health.

- FY2024 Contribution: Significant portion of GR Infraprojects' order book relates to the final stages of completed EPC projects, with retention amounts due for release.

GR Infraprojects' Operations & Maintenance (O&M) contracts are key Cash Cows, providing a stable revenue stream with minimal new investment. These contracts, managing completed road projects, ensure consistent cash flow, as seen in FY24's robust order book which likely includes substantial O&M components.

The company's in-house manufacturing of bitumen emulsion and metal crash barriers/road signage are also strong Cash Cows. This backward integration offers predictable costs and better profit margins, contributing to GR Infraprojects' healthy EBITDA margins, which stood at 18.5% in 2023.

Completed EPC projects, specifically the release of retention monies after defect liability periods, act as mature Cash Cows. These finalized projects provide a stable, predictable cash injection, crucial for funding ongoing operations and new ventures, with a significant portion of the FY2024 order book related to these final stages.

| Segment | BCG Matrix Classification | Key Characteristics | FY24 Relevance |

| Operations & Maintenance (O&M) | Cash Cow | Steady revenue, low capital needs, predictable cash flow. | Robust order book likely includes significant O&M activities. |

| In-house Manufacturing (Bitumen Emulsion, Barriers, Signage) | Cash Cow | Stable demand, cost optimization, improved profit margins. | Contributes to healthy EBITDA margins (18.5% in 2023). |

| Completed EPC Projects (Retention Money Release) | Cash Cow | Finalized revenue stream, predictable inflow upon project closure. | Significant portion of order book relates to final stages of completed projects. |

Delivered as Shown

GR Infraprojects BCG Matrix

The GR Infraprojects BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means you'll get direct access to a professionally designed strategic analysis, complete with all data and insights, ready for immediate application in your business planning. Rest assured, there are no watermarks or demo content; you are seeing the exact, high-quality document that will be yours to download and utilize.

Dogs

Small-scale, non-strategic road repair works likely represent GR Infraprojects' "Dogs" in the BCG matrix. These projects, involving conventional maintenance rather than large-scale EPC or HAM development, typically offer low profit margins and limited long-term strategic benefit for the company.

While GR Infraprojects might undertake some of these smaller jobs to maintain client relationships or utilize existing resources, they are not a focus for growth. For instance, in FY23, GR Infraprojects reported a consolidated revenue of INR 84.7 billion, with a significant portion derived from their core EPC and HAM segments, underscoring their strategic shift away from smaller, less impactful projects.

Certain geographical pockets, perhaps those with a historical presence for GR Infraprojects, might be showing a slowdown in new project awards. This could indicate stagnating market growth or increased competition, making it harder to secure new mandates. For instance, if a particular state or region has seen a decline in government infrastructure spending or has a saturated market, it might represent a 'Dog' in their portfolio.

Older, fully depreciated assets with minimal utilization, like some of GR Infraprojects' older road construction equipment, can be classified as Dogs. These assets, while having no book value, still incur maintenance and storage costs, potentially draining resources. For instance, if a significant portion of their fleet is idle and not contributing to current projects, it represents inefficient capital allocation.

Non-core, Divested or Underperforming Minor Stake Investments

GR Infraprojects' portfolio likely includes minor stakes in non-core infrastructure segments or divested ventures that haven't met return expectations. These are often seen as cash traps, tying up capital with minimal positive cash flow or future growth prospects.

While specific details are not publicly disclosed, these investments would represent areas where GR Infraprojects has strategically exited or where ongoing investment yields little return. For instance, if the company had a minor stake in a niche renewable energy project that underperformed, it would fit this description.

- Cash Traps: Investments with low or negative returns, consuming capital without generating significant cash.

- Strategic Divestments: Ventures sold off due to underperformance or a shift in strategic focus.

- Non-Core Segments: Minor equity holdings in infrastructure areas outside GR Infraprojects' primary business lines.

- Limited Future Potential: These investments are unlikely to contribute substantially to future growth or profitability.

Legacy Contracts with Low Profitability

Legacy contracts with low profitability, often referred to as Dogs in the BCG Matrix, represent a challenge for GR Infraprojects. These are older projects where unforeseen issues like escalating material costs or restrictive contract terms have squeezed margins, sometimes leading to losses. For instance, in the fiscal year ending March 31, 2024, GR Infraprojects reported that certain older projects, impacted by significant inflation in construction materials, were operating with significantly reduced profitability compared to initial projections.

The company’s strategy for these Dogs typically involves minimizing further investment and seeking to conclude these engagements efficiently. The aim is to free up capital and management focus for more promising ventures. This approach helps to prevent these underperforming contracts from draining resources that could be better allocated to high-growth areas.

- Reduced Margin Impact: Contracts secured in earlier periods, facing unexpected cost escalations, particularly in steel and cement prices during 2023-2024, led to thin or negative profit margins.

- Strategic Divestment/Completion: GR Infraprojects actively seeks to complete these legacy projects with minimal additional capital outlay, aiming to exit these low-return segments.

- Resource Reallocation: By managing these legacy contracts to completion, the company can redirect financial and human resources towards newer, more profitable infrastructure projects.

Small-scale road repair works and legacy contracts with low profitability are GR Infraprojects' "Dogs." These projects offer minimal strategic benefit and low margins, often impacted by cost escalations. The company's strategy is to conclude these engagements efficiently to free up capital for more promising ventures.

For instance, in FY24, GR Infraprojects noted that inflation in construction materials significantly squeezed margins on older projects. The company aims to minimize further investment in these underperforming contracts and reallocate resources to higher-growth areas.

Certain older, underutilized assets, like idle construction equipment, can also be classified as Dogs. These assets incur maintenance costs without contributing to current projects, representing inefficient capital allocation.

GR Infraprojects' portfolio may also include minor stakes in non-core infrastructure segments that have not met return expectations, acting as cash traps.

Question Marks

GR Infraprojects' new railway and metro EPC projects position them in high-growth areas, aligning with India's infrastructure development goals. These ventures are considered Stars in the BCG matrix, representing significant potential but requiring substantial investment to capture market share.

As of FY23, GR Infraprojects reported a robust order book, with railway and metro projects forming a growing portion of their overall business. The company secured several key contracts in these segments during 2023-2024, indicating a strategic push into these developing markets.

While GR Infraprojects is a dominant player in road construction, their presence in the railway and metro EPC space is still emerging. This offers a substantial opportunity for expansion, provided they continue to invest resources and expertise to build a stronger foothold.

GR Infraprojects is strategically venturing into the power transmission sector, particularly focusing on Build, Own, Operate, and Transfer (BOOT) projects. This diversification taps into India's rapidly growing power infrastructure needs, especially with the increasing integration of renewable energy sources. For instance, India's renewable energy capacity reached approximately 179 GW by the end of 2023, creating a significant demand for robust transmission networks.

These emerging power transmission projects are positioned as question marks within GR Infraprojects' BCG Matrix. While the sector itself exhibits high growth potential, driven by government initiatives and the escalating demand for electricity, GR Infraprojects is still in the early stages of establishing its market share and expertise in this segment. This means they have high future potential but currently low market share, requiring significant investment to grow.

GR Infraprojects' recent emergence as the lowest bidder for Optical Fiber Cable (OFC) network projects signals a strategic move into the burgeoning digital infrastructure sector. This positions them to capitalize on the escalating demand driven by widespread digitalization, a trend that saw global OFC market size reach approximately USD 12.5 billion in 2023 and is projected to grow significantly.

While GR Infraprojects' success in securing these bids is a positive indicator, their market share in this specialized segment is likely in its early stages. To truly leverage this opportunity, substantial strategic investment will be crucial to expand their capabilities and capture a larger portion of the rapidly expanding OFC market, which is expected to witness a compound annual growth rate of over 7% in the coming years.

Multi-Modal Logistics Park (MMLP) Development

GR Infraprojects' foray into Multi-Modal Logistics Parks (MMLPs) positions them in a high-growth sector fueled by India's infrastructure push. This diversification leverages the nation's commitment to enhancing logistics efficiency and connectivity, a key driver for economic development.

Given the nascent stage of MMLP development in India and the significant capital required to build these integrated hubs, GR Infraprojects' business unit is likely to be in the "Question Mark" category of the BCG matrix. This means it has high growth potential but currently holds a low market share, necessitating strategic investment to capture market leadership.

- High Growth Potential: India's logistics market is projected to reach $225 billion by 2025, with MMLPs being a critical component of this expansion.

- Early Stage Investment: Establishing MMLPs requires substantial upfront capital for land acquisition, infrastructure development, and technology integration.

- Strategic Importance: Successful MMLP development can unlock significant operational efficiencies and cost savings for businesses across various sectors.

- Competitive Landscape: While emerging, the MMLP space is attracting significant attention, requiring GR Infraprojects to execute its strategy effectively to gain a competitive edge.

Ropeway Projects

GR Infraprojects is actively building its presence in the Smart Mobility Sector through its involvement in ropeway projects. This strategic move positions the company within a niche, high-growth market segment that offers specialized connectivity solutions, especially beneficial for navigating difficult terrains or dense urban environments.

While the potential for ropeway projects is significant, GR Infraprojects' market share in this specialized area is still developing. To truly capitalize on this promising segment and elevate it to a 'Star' in the BCG matrix, continued focused investment and strategic expansion are crucial.

- Market Presence: GR Infraprojects has secured several key ropeway projects, including the development of a ropeway in Ambaji, Gujarat, and another in Jammu.

- Growth Potential: The global ropeway market is projected to reach approximately USD 3.5 billion by 2028, indicating substantial growth opportunities.

- Strategic Focus: These projects align with the company's diversification strategy into infrastructure segments with high future demand and specialized application.

GR Infraprojects' expansion into power transmission and Optical Fiber Cable (OFC) networks exemplifies their strategic positioning in nascent, high-growth sectors. These ventures are classified as Question Marks in the BCG matrix due to their significant growth potential coupled with GR Infraprojects' current low market share in these specialized areas.

The company's entry into Multi-Modal Logistics Parks (MMLPs) and the Smart Mobility sector, particularly ropeway projects, further reinforces this Question Mark classification. While these segments are driven by strong national infrastructure development goals and offer substantial future returns, they require considerable upfront investment and strategic execution to build market dominance.

For instance, India's power transmission sector is projected to see significant investment, and the OFC market is expanding rapidly. GR Infraprojects needs to channel resources effectively to convert these opportunities into Stars, leveraging their existing project execution capabilities.

The company's involvement in ropeway projects, such as those in Ambaji, Gujarat, and Jammu, highlights their strategic diversification. The global ropeway market's projected growth to USD 3.5 billion by 2028 underscores the potential, but GR Infraprojects' market share remains nascent, demanding focused investment to capitalize on this trend.

BCG Matrix Data Sources

Our GR Infraprojects BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on infrastructure growth, and official government project tenders to ensure reliable, high-impact insights.