GR Infraprojects Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GR Infraprojects Bundle

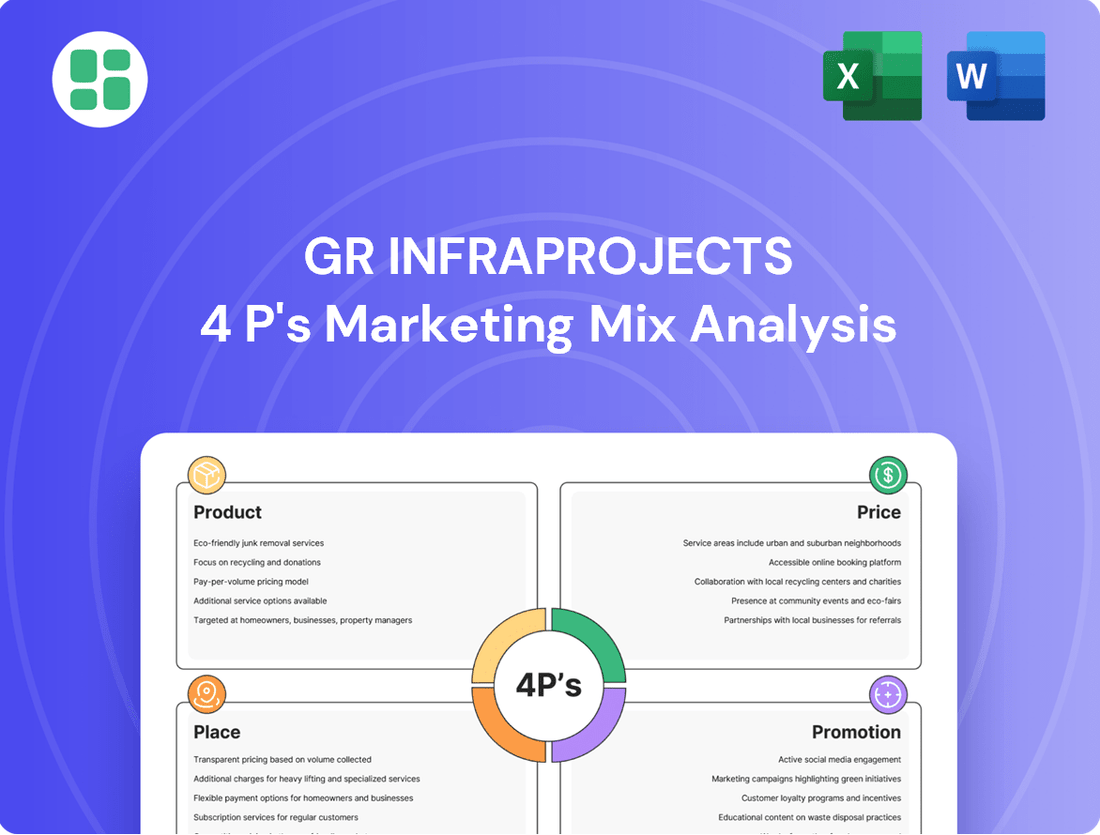

GR Infraprojects leverages a robust marketing mix, focusing on its diverse project portfolio (Product), competitive bidding strategies (Price), extensive geographical reach (Place), and strong government and stakeholder relations (Promotion). Understanding these elements is key to grasping their market dominance.

Go beyond this glimpse and unlock the full, in-depth 4Ps Marketing Mix Analysis for GR Infraprojects. Ideal for business professionals, students, and consultants seeking strategic insights into their success.

Product

GR Infraprojects' Product strategy revolves around its robust integrated Engineering, Procurement, and Construction (EPC) services. This comprehensive offering covers the entire project lifecycle, from conceptualization and design to procurement of materials and final construction. This end-to-end approach simplifies project management for clients and allows GR Infraprojects to maintain strict quality control and accountability throughout the process.

The company's integrated EPC model is a cornerstone of its value proposition, differentiating it in the competitive infrastructure development market. By managing all facets of a project, GR Infraprojects ensures efficient resource allocation and timely delivery, which is crucial for large-scale infrastructure undertakings. This capability has been instrumental in their success, as evidenced by their significant order book, which stood at approximately ₹46,000 crore as of March 31, 2024, showcasing strong demand for their integrated services.

The fundamental product GR Infraprojects offers is the construction of roads and highways, encompassing vital structures like bridges and flyovers. Their expertise spans designing and executing diverse road projects across 15 Indian states.

GR Infraprojects utilizes various project execution models, including Engineering, Procurement, and Construction (EPC), Build, Operate, and Transfer (BOT), and the Hybrid Annuity Model (HAM). This adaptability allows them to cater to different project requirements and government policies.

As of March 31, 2024, GR Infraprojects had a significant order book of ₹25,982 crore, with a substantial portion dedicated to road and highway projects, underscoring the strength of their core product offering.

GR Infraprojects' product strategy extends far beyond its established road construction dominance. The company has actively broadened its portfolio to encompass critical infrastructure sectors like railways, metro lines, power transmission, and optical fiber cable networks. This deliberate diversification, including ventures into tunneling and multi-modal logistics parks, significantly mitigates sector-specific risks and capitalizes on their robust construction expertise across a wider spectrum of national development projects.

Project Lifecycle Management

GR Infraprojects’ Project Lifecycle Management is a core component of their marketing strategy, emphasizing their comprehensive service offering. This covers everything from initial planning and design through to procurement, construction, and even post-completion maintenance, ensuring a complete, high-quality infrastructure solution for clients.

This end-to-end capability is critical for delivering complex projects efficiently. For instance, GR Infraprojects has demonstrated its prowess in managing numerous large-scale road projects. In FY23, they secured orders worth ₹12,000 crore, reflecting their capacity to handle extensive project portfolios and manage the entire lifecycle effectively.

Their 24/7 project execution capability is a significant differentiator. This allows for accelerated timelines without compromising on quality or safety, a crucial factor in infrastructure development. This operational agility was evident in their participation in significant highway projects, contributing to India’s infrastructure growth.

- End-to-End Solutions: From planning and design to construction and maintenance.

- Quality Assurance: Ensuring high-quality delivery and long-term asset functionality.

- Timely Execution: 24/7 operational capability for prompt project completion.

- Capacity Demonstrated: Significant order wins in FY23 highlight project management strength.

Quality and Safety Standards

GR Infraprojects places paramount importance on quality and safety, recognizing them as cornerstones of their product value. This commitment is evident in their rigorous project execution, which adheres to strict quality benchmarks and integrates sustainable methodologies to foster resilient infrastructure.

The company's dedication to financial discipline and robust governance further underpins its ability to deliver projects reliably. For instance, GR Infraprojects' focus on these areas contributed to its strong performance in the fiscal year 2023-24, with the company reporting a significant order book and demonstrating operational efficiency.

- Quality Assurance: GR Infraprojects implements comprehensive quality control measures at every stage of project development, ensuring compliance with national and international standards.

- Safety Protocols: The company prioritizes the well-being of its workforce and the public through stringent safety protocols, aiming for zero accidents on its project sites.

- Sustainable Practices: Integration of eco-friendly materials and methods is a key component, contributing to the long-term durability and environmental responsibility of infrastructure projects.

- Financial Prudence: Maintaining strong financial discipline and transparent governance are integral to GR Infraprojects' operational philosophy, ensuring project viability and stakeholder trust.

GR Infraprojects' product offering is centered on its comprehensive Engineering, Procurement, and Construction (EPC) services, covering the entire project lifecycle. This integrated approach simplifies management for clients and ensures quality control.

The company's core product is road and highway construction, including bridges and flyovers, with expertise across 15 Indian states. They also execute projects using Build, Operate, and Transfer (BOT) and Hybrid Annuity Model (HAM) frameworks.

Beyond roads, GR Infraprojects has diversified into railways, metro lines, power transmission, and optical fiber networks, demonstrating a broad infrastructure development capability. Their project execution is supported by a 24/7 operational capacity.

As of March 31, 2024, GR Infraprojects maintained a substantial order book of ₹25,982 crore, with a significant portion allocated to road and highway projects, highlighting the demand for their core product.

| Product Offering | Key Features | Demonstrated Capacity (as of Mar 31, 2024) | Diversification Areas |

|---|---|---|---|

| Integrated EPC Services | End-to-end project management, quality assurance, timely execution | Order book: ₹25,982 crore (primarily roads) | Roads, Highways, Bridges, Flyovers |

| Project Execution Models | EPC, BOT, HAM | Significant order wins in FY23 (₹12,000 crore) | Railways, Metro Lines, Power Transmission, OFC Networks |

| Quality and Safety | Rigorous adherence to standards, sustainable practices | Commitment to zero accidents | Tunneling, Multi-modal Logistics Parks |

What is included in the product

This analysis provides a comprehensive examination of GR Infraprojects' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making and competitive benchmarking.

GR Infraprojects' 4P's Marketing Mix Analysis acts as a pain point reliver by offering a clear, actionable framework to address market challenges.

It simplifies complex marketing strategies into digestible components, easing the burden of strategic planning and execution for the company.

Place

GR Infraprojects actively pursues government tenders as its primary market entry strategy, focusing on large-scale infrastructure projects. This approach is crucial for securing new business and expanding its reach across India.

Key clients like the National Highways Authority of India (NHAI) and state ministries are central to this strategy. In FY23, GR Infraprojects secured significant orders, including ₹10,118 crore in the roads sector, demonstrating their success in this competitive bidding environment.

GR Infraprojects boasts a significant strategic geographical presence, having successfully executed projects in 15 Indian states. This extensive footprint allows the company to effectively bid for and undertake infrastructure development projects across the entire nation, capitalizing on diverse regional opportunities.

GR Infraprojects extends its market 'place' beyond traditional EPC by actively pursuing Build, Operate, and Transfer (BOT) and Hybrid Annuity Model (HAM) projects. These concessions represent a significant strategic move, placing GR Infraprojects in a long-term role that often includes financing, operation, and maintenance.

For instance, as of the fiscal year ending March 31, 2024, GR Infraprojects had a robust order book, with a substantial portion secured through HAM and BOT projects. This diversification into long-term asset management deepens their presence within the infrastructure lifecycle, moving beyond mere construction to encompass ongoing service delivery and revenue generation.

Investor and InvIT Platforms

GR Infraprojects strategically utilizes Infrastructure Investment Trusts (InvITs) to manage its 'place' or project pipeline. By channeling operational Hybrid Annuity Model (HAM) assets into platforms like Indus Infra Trust (formerly Bharat Highways InvIT), the company unlocks capital. This monetization allows for the recycling of funds, directly enhancing its capacity to bid for and execute new infrastructure projects.

This approach is crucial for maintaining a robust project pipeline and ensuring sustained growth. For instance, as of March 31, 2024, GR Infraprojects had a significant portfolio of HAM projects, many of which are prime candidates for InvIT monetization. The successful listing and performance of Indus Infra Trust in 2023, which raised approximately ₹1,460 crore, demonstrate the viability of this capital recycling strategy.

- Capital Recycling: InvITs enable GR Infraprojects to convert operational assets into cash, freeing up capital for new project development.

- Financial Flexibility: This strategy provides greater financial maneuverability, allowing the company to pursue a wider range of opportunities.

- Asset Monetization: It offers a structured way to realize value from completed HAM projects, improving balance sheet health.

- Expanded Project Capacity: By freeing up capital, GR Infraprojects can increase its ability to secure and commence new construction projects.

Direct Negotiations and Strategic Partnerships

While GR Infraprojects primarily secures work through competitive bidding, they also actively pursue direct negotiations and strategic partnerships. This approach is particularly effective for specialized projects like ropeways or multi-modal logistics parks, allowing GR Infraprojects to tap into niche markets and broaden their project acquisition avenues.

These strategic alliances enable GR Infraprojects to leverage specific expertise and share risks, as seen in their participation in various public-private partnership (PPP) models. For instance, their involvement in projects requiring unique technical capabilities often necessitates direct engagement rather than solely relying on tender processes.

- Niche Market Access: Direct negotiations facilitate entry into specialized sectors like ropeways, where tender processes might be less common or structured differently.

- Risk Mitigation: Partnerships allow for the sharing of financial and operational risks associated with complex or novel projects.

- Enhanced Expertise: Collaborating with strategic partners brings in specialized technical knowledge, improving project execution capabilities.

- Diversified Revenue Streams: This strategy diversifies GR Infraprojects' project pipeline beyond traditional infrastructure tenders.

GR Infraprojects' 'Place' strategy extends beyond mere geographic presence to encompass diverse project models and capital management. Their focus on government tenders, particularly for large-scale infrastructure, is complemented by a strategic move into Build, Operate, and Transfer (BOT) and Hybrid Annuity Model (HAM) projects. This diversification places them in a long-term operational role, enhancing their market 'place' by integrating financing, operation, and maintenance.

The company further solidifies its 'place' by strategically utilizing Infrastructure Investment Trusts (InvITs) to manage its project pipeline. By channeling operational HAM assets into platforms like Indus Infra Trust, GR Infraprojects unlocks capital for new ventures. This capital recycling approach, exemplified by Indus Infra Trust's successful listing in 2023, allows for sustained growth and expanded project capacity.

GR Infraprojects also engages in direct negotiations and strategic partnerships for specialized projects, broadening their 'place' into niche markets and enhancing their project acquisition avenues. These alliances mitigate risks and leverage specific expertise, diversifying their project pipeline beyond traditional tenders.

Full Version Awaits

GR Infraprojects 4P's Marketing Mix Analysis

This GR Infraprojects 4P's Marketing Mix Analysis preview is not a sample; it's the actual document you’ll receive, fully complete and ready for immediate use after purchase.

You are viewing the exact version of the comprehensive analysis you'll download right after checkout, ensuring no surprises and full confidence in your purchase.

Promotion

GR Infraprojects, with nearly three decades of experience, highlights its extensive history of successfully completing infrastructure projects, often ahead of schedule. This consistent delivery builds a strong foundation of trust and reliability.

The company's reputation for timely and quality execution is a cornerstone of its promotional strategy in the competitive infrastructure sector. This track record is a significant differentiator, attracting new business and reinforcing client relationships.

For instance, GR Infraprojects' order book stood at ₹20,000 crore as of March 31, 2024, reflecting the market's confidence in its project execution capabilities. This robust pipeline underscores the value placed on their proven track record.

GR Infraprojects actively engages financial stakeholders through regular investor presentations and earnings calls, providing updates on their robust project pipeline and strategic growth initiatives. These platforms are crucial for showcasing the company's financial health and future prospects, aiming to bolster investor confidence. For instance, during their Q3 FY24 earnings call in February 2024, the company reported a significant order book, underscoring their execution capabilities and future revenue visibility.

GR Infraprojects actively showcases its achievements through industry accolades, underscoring its commitment to quality and performance. For instance, receiving the 'Best Performing Contractor' award from NHIDCL in 2024 highlights their strong operational capabilities and project execution. These awards serve as tangible proof of their expertise and dedication to maintaining high standards in the infrastructure sector.

Media Coverage and Public Relations

GR Infraprojects leverages positive media coverage as a key promotional tool. Announcements regarding new project wins, such as securing contracts worth ₹2,500 crore in the fiscal year ending March 31, 2023, significantly boost brand visibility. This consistent flow of positive news keeps the company in the spotlight within the infrastructure sector and reassures investors.

The company's financial results and strategic initiatives are frequently highlighted by news outlets. For instance, reports on their robust order book, which stood at over ₹20,000 crore as of September 2023, underscore their growth trajectory. This public acknowledgment of their financial health and strategic direction is crucial for building investor confidence and attracting further business opportunities.

Key aspects of their media coverage include:

- Project Acquisitions: Regular reporting on GR Infraprojects winning significant infrastructure projects, detailing the value and scope of these contracts.

- Financial Performance: News outlets often cover their quarterly and annual financial results, providing insights into revenue growth, profitability, and debt management.

- Strategic Partnerships and Expansions: Announcements related to joint ventures, acquisitions, or expansion into new geographical markets are widely disseminated.

- Industry Recognition: Coverage of awards or recognitions received by the company for project execution or corporate governance further enhances their public image.

Corporate Social Responsibility (CSR) Initiatives

GR Infraprojects demonstrates a strong commitment to Corporate Social Responsibility (CSR) as a key element of its marketing strategy. The company actively engages in community development and environmental stewardship, which directly influences its public perception and stakeholder relationships.

Their CSR activities are diverse, focusing on tangible improvements in areas like education and healthcare. For instance, the construction of educational institutions and contributions to social welfare programs showcase their dedication to responsible corporate citizenship.

- Community Development: GR Infraprojects invests in building schools and supporting healthcare facilities, directly impacting local communities.

- Environmental Stewardship: The company actively pursues environmentally friendly practices in its projects, aiming to minimize ecological impact.

- Stakeholder Relations: These initiatives foster positive relationships with customers, employees, and the general public, enhancing brand loyalty and reputation.

- Financial Impact: While specific 2024/2025 CSR spending figures are not yet widely publicized, such initiatives are known to contribute to long-term brand value and can positively influence investment decisions by demonstrating a commitment to sustainability and social impact.

GR Infraprojects leverages its strong track record and timely project completion as a primary promotional tool, building trust and reliability. The company's consistent delivery ahead of schedule, as evidenced by its substantial order book, reinforces its market position.

Financial transparency and consistent communication with investors through earnings calls and presentations are key promotional activities, highlighting growth initiatives and financial health. For example, their Q3 FY24 earnings call in February 2024 emphasized a robust order book, showcasing future revenue visibility.

Industry recognition, such as the 'Best Performing Contractor' award from NHIDCL in 2024, serves as a powerful endorsement of their quality and execution capabilities. This external validation significantly boosts their public image and credibility.

Positive media coverage, particularly regarding new project wins like ₹2,500 crore in contracts for FY23, amplifies brand visibility and investor confidence. Their commitment to CSR, including community development and environmental stewardship, further enhances their reputation as a responsible corporate citizen.

| Promotional Aspect | Key Activities/Evidence | Impact |

|---|---|---|

| Track Record & Delivery | Consistent ahead-of-schedule project completion | Builds trust and reliability |

| Financial Communication | Investor presentations, earnings calls (e.g., Feb 2024 Q3 FY24) | Enhances investor confidence, showcases growth |

| Industry Recognition | Awards like NHIDCL's 'Best Performing Contractor' (2024) | Validates quality and execution |

| Media Coverage | Reporting on new project wins (e.g., ₹2,500 crore in FY23) | Increases brand visibility |

| CSR Initiatives | Community development, environmental stewardship | Improves public perception, brand loyalty |

Price

GR Infraprojects’ pricing strategy hinges on competitive bidding for significant infrastructure projects, often with government entities. Their approach aims to secure contracts by offering competitive prices while maintaining healthy profit margins, a testament to their cost management capabilities.

For instance, in the fiscal year 2023-24, GR Infraprojects secured substantial orders, reflecting their success in this bidding environment. Their ability to balance aggressive pricing with profitability is crucial for sustained growth in the infrastructure sector.

GR Infraprojects actively pursues cost optimization by leveraging efficient procurement strategies and its in-house design and engineering expertise. This integrated approach allows for greater control over project expenses, ensuring competitive bidding while safeguarding profitability.

The company's commitment to operational efficiency is a key driver of its financial performance. For the fiscal year ending March 31, 2023, GR Infraprojects reported an EBITDA margin of 17.8%, demonstrating its ability to manage costs effectively and translate operational strengths into robust earnings.

GR Infraprojects prices its projects by factoring in complexity and associated risks, directly impacting the bid. This includes fluctuating material and labor costs, the specialized equipment needed, and the critical project timelines. For instance, a project with extensive tunneling or challenging terrain might command a higher price to cover the increased engineering and contingency planning.

The company's approach to pricing reflects a deep understanding of potential unforeseen challenges. In 2023, GR Infraprojects secured projects with an aggregate value of ₹14,760 crore, demonstrating their ability to price competitively while accounting for risk. Higher complexity projects, such as those involving significant land acquisition or environmental clearances, necessitate a higher bid to ensure profitability and mitigate potential delays.

Market Demand and Competitor Pricing

GR Infraprojects' pricing strategy is deeply intertwined with the dynamics of market demand for infrastructure development and the intensity of competition. The company actively monitors competitor bidding patterns and prevailing market conditions to ensure its own bids are strategically positioned to win new projects.

For instance, in the fiscal year 2023-24, the Indian infrastructure sector saw significant government impetus, with the Union Budget 2023-24 allocating ₹10 lakh crore for capital expenditure, a substantial increase from the previous year. This heightened demand provides GR Infraprojects with a stronger footing to negotiate pricing while remaining competitive.

The company's approach involves a continuous assessment of:

- Prevailing market rates for similar infrastructure projects.

- Competitor pricing benchmarks and their historical bidding success.

- The overall economic sentiment and its impact on project pipelines.

- The specific technical requirements and risk profiles of each tender.

Financing Models and Financial Flexibility

GR Infraprojects' pricing and revenue streams are directly influenced by its choice of project financing models, including Engineering, Procurement, and Construction (EPC), Build, Operate, and Transfer (BOT), and Hybrid Annuity Model (HAM). This strategic flexibility allows them to adapt to different project requirements and market conditions.

The company's robust financial health, characterized by low leverage and a sound capital structure, is a significant advantage. As of March 31, 2024, GR Infraprojects maintained a debt-to-equity ratio of approximately 0.2x, demonstrating a conservative approach to borrowing.

- EPC Contracts: GR Infraprojects often secures projects on an EPC basis, which provides upfront payments and a predictable revenue stream, simplifying pricing.

- HAM Projects: For Hybrid Annuity Model projects, revenue recognition is spread over the concession period, impacting how pricing is structured to ensure long-term profitability.

- Financial Flexibility: The company's low debt levels (e.g., total debt of INR 2,450 crore as of FY24) enable it to bid competitively on projects with diverse financing needs, including those requiring significant upfront capital from the developer.

- Risk Management: This strong financial footing allows GR Infraprojects to absorb potential financial risks associated with project development and execution more effectively, which can be factored into their pricing strategies.

GR Infraprojects' pricing strategy is a dynamic blend of competitive bidding, cost management, and risk assessment. They aim to secure contracts by offering attractive prices, exemplified by their success in winning projects valued at ₹14,760 crore in 2023. Their ability to maintain healthy profit margins, as indicated by an EBITDA margin of 17.8% in FY23, stems from efficient procurement and in-house expertise.

The company's pricing directly reflects project complexity, material costs, and timelines, ensuring profitability even for challenging endeavors. This is supported by their robust financial health, with a debt-to-equity ratio of approximately 0.2x as of March 31, 2024, providing financial flexibility and risk mitigation capabilities.

GR Infraprojects actively monitors market rates and competitor pricing to remain competitive, especially given the government's increased capital expenditure allocation of ₹10 lakh crore for infrastructure in the Union Budget 2023-24. This strategic pricing approach, coupled with diverse project financing models like EPC and HAM, allows them to adapt and thrive.

4P's Marketing Mix Analysis Data Sources

Our GR Infraprojects 4P's analysis is grounded in comprehensive data, including official company reports, project tender documents, and industry-specific market research. We meticulously review their product offerings, pricing structures for projects, distribution channels for services, and promotional activities in securing contracts.