GR Infraprojects Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GR Infraprojects Bundle

GR Infraprojects navigates a landscape shaped by intense competition, moderate buyer power, and significant supplier influence within the infrastructure sector. The threat of new entrants is present, while the availability of substitutes presents a dynamic challenge. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GR Infraprojects’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Indian infrastructure sector, including road construction, depends on a wide array of suppliers for essential materials like cement, steel, and bitumen, as well as heavy machinery. This broad supplier base, while featuring some major players, is largely fragmented for basic commodities and standard equipment. This fragmentation inherently limits the bargaining power of any single supplier when dealing with a significant entity like GR Infraprojects.

Commodity price volatility significantly impacts GR Infraprojects' supplier bargaining power. Fluctuations in the cost of essential materials such as steel, cement, and bitumen, often driven by market dynamics and government regulations, directly affect project expenses. For instance, a surge in steel prices, which saw significant upward movement in early 2024 due to global supply chain issues and increased demand, could empower suppliers and squeeze GR Infraprojects' profit margins if not mitigated through strategic procurement or robust contract terms.

The availability of skilled labor, such as experienced engineers, project managers, and specialized technicians, is paramount for the successful execution of GR Infraprojects' complex infrastructure endeavors. India's vast labor pool is a strength, but a scarcity of highly specialized skills or proprietary construction techniques can significantly shift bargaining power towards those suppliers.

This dynamic can translate into increased labor costs or demanding licensing fees for GR Infraprojects, impacting project profitability. For instance, in 2023, the construction sector in India faced a shortage of skilled labor, with reports indicating a deficit of over 5 million skilled workers across various trades, a trend likely to persist into 2024.

Dependence on Equipment Manufacturers

GR Infraprojects relies heavily on specialized construction equipment, often procured from a select group of prominent manufacturers. This dependence can grant these equipment suppliers significant leverage, particularly when GR Infraprojects requires advanced machinery or critical spare parts.

The bargaining power of these equipment manufacturers is often moderate to high. For instance, in 2023, major global players in the construction equipment market continued to see strong demand, which can translate to less flexibility for buyers on pricing and delivery terms. This directly impacts GR Infraprojects' capital expenditure plans and the overall efficiency of its operations.

- Limited Supplier Options: The specialized nature of some heavy construction machinery means fewer manufacturers can meet GR Infraprojects' specific needs.

- High Switching Costs: Transitioning to different equipment suppliers can involve substantial costs and operational disruptions.

- Impact on Capital Expenditure: Supplier pricing power can inflate the cost of acquiring essential machinery, affecting GR Infraprojects' investment decisions.

- Influence on Operational Efficiency: Availability and pricing of spare parts from original equipment manufacturers directly influence maintenance schedules and downtime.

Impact of Regulatory and Environmental Compliance

Suppliers in the construction sector, including those providing materials and services to GR Infraprojects, face increasing pressure to comply with environmental and quality regulations. This adherence can sometimes narrow the field of qualified suppliers, thereby strengthening the position of those who consistently meet these rigorous standards. GR Infraprojects, committed to project specifications and environmental stewardship, often finds itself reliant on these compliant suppliers.

The impact of these regulations can directly influence supplier pricing and availability. For instance, new environmental standards for asphalt or concrete production might require significant capital investment from suppliers, which they may pass on to GR Infraprojects. In 2024, the Indian government continued to emphasize sustainable construction practices, potentially increasing the cost of compliance for many material providers.

- Increased Compliance Costs: Suppliers investing in environmentally friendly production methods or quality certifications may pass these costs to GR Infraprojects, potentially raising material prices.

- Limited Supplier Pool: Stringent regulations can reduce the number of eligible suppliers, giving the remaining compliant ones greater leverage in negotiations.

- Focus on Quality Assurance: GR Infraprojects' commitment to quality means prioritizing suppliers with proven track records and certifications, further enhancing the bargaining power of such suppliers.

- Potential for Higher Material Prices: The combined effect of compliance and a smaller supplier base can lead to upward pressure on the cost of essential construction materials and services.

GR Infraprojects faces moderate bargaining power from its suppliers, particularly for specialized equipment and raw materials like steel and cement where price volatility is a key factor. While the broad base of commodity suppliers limits individual power, stringent quality and environmental regulations, coupled with the need for specialized machinery, can shift leverage towards compliant and technologically advanced providers. This dynamic can influence GR Infraprojects' capital expenditure and operational costs.

| Supplier Type | Bargaining Power Factor | Impact on GR Infraprojects | 2024 Data/Trend |

|---|---|---|---|

| Commodity Suppliers (Cement, Bitumen) | Fragmentation, Price Volatility | Moderate; price fluctuations impact project costs. | Steel prices saw significant volatility in early 2024; continued upward pressure on cement prices expected due to demand. |

| Specialized Equipment Manufacturers | Limited Options, High Switching Costs | Moderate to High; can dictate terms and pricing for machinery. | Strong demand for advanced construction equipment in 2023-2024; potential for longer lead times and less negotiation flexibility. |

| Skilled Labor Providers | Scarcity of Specialized Skills | Moderate to High; can lead to increased labor costs. | India's construction sector faced a deficit of over 5 million skilled workers in 2023, a trend projected to continue into 2024. |

| Environmentally Compliant Suppliers | Narrowed Supplier Pool, Increased Compliance Costs | Moderate; can increase material prices due to added costs. | Government emphasis on sustainable practices in 2024 may increase compliance costs for suppliers, potentially passed on. |

What is included in the product

This Porter's Five Forces analysis for GR Infraprojects meticulously examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes within the infrastructure development sector.

GR Infraprojects' Porter's Five Forces analysis provides a clear, actionable roadmap to navigate competitive pressures, offering a strategic advantage in a dynamic infrastructure sector.

Customers Bargaining Power

GR Infraprojects' primary clientele consists of government entities, most notably the National Highways Authority of India (NHAI) and various state road development corporations. These substantial, institutional buyers wield considerable influence.

Their significant bargaining power stems from the immense volume of contracts they issue and their capacity to set project specifications, contractual terms, and pricing through rigorous competitive bidding. For instance, in FY23, GR Infraprojects secured orders worth ₹15,900 crore, with a substantial portion likely originating from these government bodies, highlighting the scale of their engagement.

GR Infraprojects operates in a tender-based environment for project awards, including EPC, HAM, and BOT models. This competitive landscape means numerous companies are vying for the same contracts. In 2023, the Indian infrastructure sector saw significant government spending, with the Ministry of Road Transport and Highways awarding projects worth over ₹2 lakh crore, highlighting the intense competition for these opportunities.

The tender system inherently empowers the customer. They have the ability to choose the bidder offering the lowest price along with technical compliance. This dynamic puts considerable pressure on GR Infraprojects' profit margins, as winning bids often requires aggressive pricing strategies to secure contracts in this highly competitive market.

While individual project bids are highly competitive, the substantial scale and enduring nature of infrastructure development projects often lead clients to prioritize dependable, long-term partners. This dynamic can temper the bargaining power of customers.

GR Infraprojects' consistent performance in delivering complex infrastructure projects within stipulated timelines and budgets, as evidenced by their consistent project execution, has cultivated a reputation for reliability. This track record is crucial in securing repeat business and establishing preferred bidder status for future large-scale projects, thereby somewhat diminishing the leverage of individual customers.

Hybrid Annuity Model (HAM) and Monetization

The government's adoption of models like the Hybrid Annuity Model (HAM) for infrastructure projects, such as those undertaken by GR Infraprojects, strategically distributes risk between the developer and the contracting authority. This balanced approach can be a significant draw for customers, including government bodies and investors, who prioritize project viability and financial predictability. GR Infraprojects' proactive management of these assets, exemplified by their capacity to transfer operational HAM assets to infrastructure investment trusts like Indus Infra Trust, showcases a robust capital and risk management framework. This capability assures customers of the company's financial stability and its ability to deliver projects efficiently, even in the face of evolving market conditions.

For instance, GR Infraprojects has been a significant player in HAM projects. As of March 31, 2024, the company had a substantial portfolio of HAM projects, demonstrating their experience and commitment to this model.

- Risk Mitigation: HAM structures, by design, share construction and operational risks, making them more palatable for developers and thus indirectly benefiting the end-customers by ensuring project continuity.

- Financial Stability Assurance: GR Infraprojects' ability to monetize assets through trusts signals financial health and operational efficiency, which reassures customers about the long-term viability of their partnerships.

- Project Execution Track Record: The company's consistent performance in executing HAM projects provides a tangible demonstration of their capability, reducing perceived risk for customers.

Strict Performance and Quality Requirements

Government clients, a significant customer base for GR Infraprojects, impose exceptionally strict performance and quality mandates. These requirements often encompass rigorous safety standards and tight project timelines, with substantial penalties for any deviation or non-compliance.

This elevated demand for high performance and meticulous quality control inherently grants these government customers considerable bargaining power. They can effectively leverage these stringent conditions to ensure that all infrastructure projects not only meet but exceed national standards and contribute effectively to broader infrastructure development goals.

- Stringent Mandates: Government contracts typically include detailed specifications for materials, construction methods, and final output quality.

- Performance Penalties: Non-adherence to agreed-upon timelines or quality benchmarks can result in significant financial penalties, impacting profitability.

- National Standards: Projects must align with national infrastructure plans and safety regulations, giving clients a basis for exacting requirements.

- Leverage in Negotiations: The critical nature of infrastructure projects and the potential for public scrutiny empower government entities in their negotiations with contractors like GR Infraprojects.

GR Infraprojects' primary customers are government bodies like NHAI, which have substantial bargaining power due to the sheer volume and specifications of contracts they issue. This power is amplified by the tender system, where price and technical compliance are key, pressuring GR Infraprojects' margins.

While the tender process favors customers seeking the lowest compliant bid, GR Infraprojects' strong track record and reliability in executing complex projects can mitigate this power by fostering repeat business and preferred bidder status.

The company's adoption of models like HAM, which share risks and assure financial stability through asset monetization, further strengthens its position by offering customers project viability and predictability.

Government clients also exert significant influence through stringent performance and quality mandates, backed by penalties for non-compliance, ensuring projects meet national standards.

| Customer Type | Bargaining Power Drivers | Impact on GR Infraprojects |

|---|---|---|

| Government Entities (e.g., NHAI) | Volume of contracts, setting specifications, competitive bidding, stringent quality mandates, penalty clauses | Pressure on pricing and profit margins, need for high performance and compliance |

| Investors (in HAM projects) | Risk-sharing models (HAM), financial stability of developer, project viability | Need for robust financial management and project execution capabilities |

What You See Is What You Get

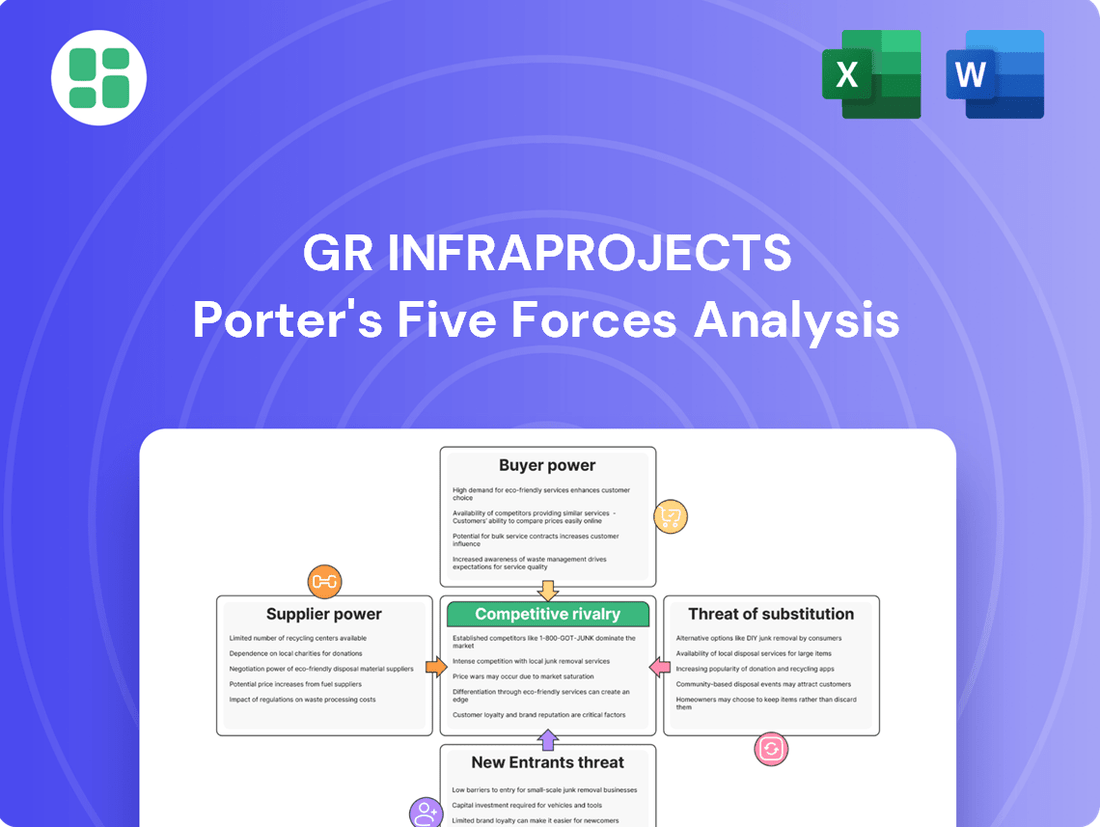

GR Infraprojects Porter's Five Forces Analysis

This preview showcases the complete GR Infraprojects Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the infrastructure sector. You're viewing the actual document, ensuring that the detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry are precisely what you'll receive. Once your purchase is complete, you'll gain instant access to this professionally formatted and ready-to-use analysis.

Rivalry Among Competitors

The Indian infrastructure sector, especially road and highway construction, is a crowded arena with many domestic companies vying for business. GR Infraprojects frequently finds itself competing against well-established firms and newer contractors for significant government-backed projects.

This fierce competition often translates into aggressive bidding strategies, which can put considerable pressure on profit margins for all involved. For instance, in the fiscal year 2023, the Ministry of Road Transport and Highways (MoRTH) awarded contracts worth over ₹2 lakh crore, a substantial portion of which was secured through competitive bidding processes.

GR Infraprojects operates within a highly competitive landscape, characterized by a fragmented market structure. While GR Infraprojects stands as a prominent entity, it shares the stage with numerous other substantial and mid-tier construction firms. This diffusion of market power prevents any single company from asserting outright dominance.

The ongoing rivalry among these players is intense, fueled by a constant pursuit of market share and the acquisition of new projects. This competition is particularly pronounced given the substantial capital expenditure that governments are channeling into infrastructure development, creating a high-stakes environment for all participants.

GR Infraprojects faces intense rivalry as companies vie for project backlogs, crucial for predictable revenue. In fiscal year 2023, GR Infraprojects reported a robust order book of ₹25,500 crore, highlighting its strong position but also the competitive landscape it operates within. The constant need to secure new projects, particularly from entities like the National Highways Authority of India (NHAI), drives aggressive bidding and price competition among major infrastructure players.

Differentiation Through Execution and Technology

Competitive rivalry in the Engineering, Procurement, and Construction (EPC) sector, particularly for infrastructure projects, is intense. Differentiation is difficult, often coming down to how well companies execute their projects, meet deadlines, and integrate cutting-edge construction technologies. GR Infraprojects leverages its integrated EPC model and expertise in complex projects, like elevated corridors and bridges, to stand out. However, competitors are continuously working to replicate or surpass these strengths, keeping the pressure high.

The ability to deliver projects on time and within budget is a critical differentiator. Companies that can consistently achieve this, often through advanced project management and technology adoption, gain a significant edge. GR Infraprojects' track record in completing projects efficiently is a key aspect of its competitive positioning.

- Execution Excellence: GR Infraprojects' success hinges on its operational efficiency and ability to manage complex projects effectively, a key differentiator in a crowded market.

- Technological Adoption: The company's investment in and application of advanced construction technologies, such as precast construction and advanced surveying tools, helps it achieve better project outcomes and cost efficiencies.

- Integrated Model: GR Infraprojects' in-house capabilities across various stages of the project lifecycle, from engineering to construction, provide greater control and potential for differentiation through streamlined execution.

- Project Pipeline: As of March 2024, GR Infraprojects had a significant order book of approximately ₹27,000 crore, indicating strong execution capabilities that are vital for maintaining a competitive edge.

Impact of Government Policies and Funding

Government policies, like the National Infrastructure Pipeline, are a significant driver for the infrastructure sector, including companies like GR Infraprojects. This pipeline, aiming for substantial capital expenditure, naturally stimulates growth but also intensifies competition as more players are drawn to the opportunities. For instance, the Indian government's increased capital expenditure in FY2024, projected at ₹10 lakh crore, signals a robust environment that attracts both established and new entrants.

Changes in how projects are bid for, allocated, or funded can dramatically reshape the competitive scene. For example, modifications in e-bidding platforms or the introduction of new financing models can create advantages for firms that adapt quickly. GR Infraprojects must remain agile, continuously assessing how shifts in government strategy, such as evolving public-private partnership (PPP) models or changes in tolling policies, impact their market position and operational approach.

- Government Initiatives: The National Infrastructure Pipeline and increased capital expenditure by the government are key growth catalysts.

- Competitive Response: These policies attract new competitors, intensifying rivalry within the sector.

- Policy Impact: Changes in bidding norms, project allocation, and funding availability significantly alter the competitive landscape.

- Adaptability: Companies like GR Infraprojects need to be agile to navigate these policy-driven shifts effectively.

The Indian road construction sector is highly competitive, with GR Infraprojects facing numerous domestic players for government contracts. This intense rivalry often leads to aggressive bidding, impacting profit margins for all participants. For instance, in FY2023, over ₹2 lakh crore in road projects were awarded through competitive bidding, underscoring the crowded market.

GR Infraprojects, despite its strong order book of approximately ₹27,000 crore as of March 2024, operates in a fragmented market where no single entity dominates. Differentiation relies heavily on execution excellence, technological adoption, and an integrated business model, as competitors strive to match these strengths.

The government's push for infrastructure development, exemplified by the National Infrastructure Pipeline and a projected ₹10 lakh crore capital expenditure in FY2024, fuels this competition by attracting more players. GR Infraprojects must remain adaptable to evolving bidding processes and policy changes to maintain its competitive edge.

| Metric | FY2023 (₹ Lakh Crore) | FY2024 Projection (₹ Lakh Crore) | Significance |

|---|---|---|---|

| MoRTH Contract Awards | > 2.00 | N/A | Indicates market size and competitive bidding volume. |

| GR Infraprojects Order Book | 25.50 (FY23) | ~27.00 (Mar 2024) | Demonstrates GR Infra's market position and execution capability amidst competition. |

| Govt. Capital Expenditure (Infrastructure) | N/A | 10.00 | Highlights government commitment, attracting more players and intensifying rivalry. |

SSubstitutes Threaten

For GR Infraprojects, the threat of substitutes for its core business of road and highway construction is quite low. Physical road infrastructure is essential for a vast range of transportation needs, especially for last-mile connectivity.

While railways, waterways, and air travel are alternative transportation modes, they don't directly substitute for roads in many critical functions. For instance, the Indian road transport sector carried approximately 3.5 trillion passenger-kilometers and 1.2 trillion tonne-kilometers of freight in 2023, highlighting the indispensable role of roads.

These alternative modes often serve different purposes or complement road networks rather than replace them entirely. Railways are efficient for bulk freight over long distances, and air travel is for passenger speed, but roads remain crucial for the initial pickup and final delivery of goods.

Shifts in government infrastructure spending priorities can indirectly substitute for road construction. For instance, increased investment in railways, urban development projects, or the renewable energy sector might divert crucial government funding and skilled labor away from road building. This reallocation of resources could directly impact the pipeline of road projects available for companies like GR Infraprojects.

Technological advancements present a potential threat by offering alternative construction methods. Innovations like pre-fabricated modular building or advanced composite materials could provide faster and more economical solutions for certain infrastructure projects. For instance, the increasing adoption of modular construction in residential and commercial sectors, which saw significant growth in 2024, highlights a shift towards off-site fabrication that could eventually impact traditional on-site road building approaches if efficiency gains are substantial enough.

Digital Infrastructure as a Partial Substitute

The increasing reliance on digital infrastructure, including advanced optical fiber networks, presents a potential, albeit partial, substitute. For instance, high-speed internet connectivity can reduce the necessity for physical travel for meetings or certain business operations.

However, this digital shift is largely complementary to, rather than a direct replacement for, the fundamental need for physical transportation networks that GR Infraprojects specializes in building. The demand for physical infrastructure remains robust.

- Digitalization Impact: While digital tools can substitute for some travel, they don't replace the core need for physical movement of goods and people.

- Complementary Nature: Digital infrastructure often enhances the efficiency of physical infrastructure, rather than replacing it.

- Infrastructure Investment: India's commitment to infrastructure development, including digital networks, signifies continued demand for physical construction. For example, the National Broadband Mission aims to connect all villages by 2023, requiring extensive physical cable laying.

Maintenance and Upgrades vs. New Construction

A significant shift in government infrastructure spending from new road construction to extensive maintenance and upgrades of existing networks could act as a substitute for new project awards. This pivot means that while GR Infraprojects does engage in maintenance, a substantial reallocation of public funds could directly impact its traditional project pipeline, favoring repair over new builds.

For instance, if the Indian government were to significantly increase its allocation towards road rehabilitation and modernization programs, as opposed to awarding new highway construction contracts, this would present a direct substitution threat. This trend was already observable in budget allocations leading up to 2024, with a growing emphasis on asset lifecycle management.

- Maintenance vs. New Construction: A government decision to prioritize upgrading existing highways over building new ones directly substitutes new project opportunities.

- Impact on Project Pipeline: This shift could reduce the volume of large-scale new construction projects available, potentially impacting GR Infraprojects' revenue streams from its core business.

- GR Infraprojects' Dual Capability: While GR Infraprojects also undertakes maintenance, a pronounced shift towards this segment would require strategic adaptation to capitalize on the changing market dynamics.

The threat of substitutes for GR Infraprojects' road construction business is generally low, as physical roads are fundamental for transportation. While alternative transport modes like railways and air travel exist, they often complement rather than replace road networks for last-mile connectivity, as evidenced by the massive volumes handled by road transport in India.

However, shifts in government infrastructure spending priorities, such as increased investment in railways or digital infrastructure, could indirectly substitute for road construction projects by diverting funds and resources. Furthermore, technological advancements in construction methods or the rise of digital solutions that reduce the need for physical travel pose potential, albeit limited, substitution threats.

A significant shift towards maintenance and upgrades of existing road networks over new construction could also act as a substitute for GR Infraprojects' traditional project pipeline, requiring strategic adaptation to focus on rehabilitation services.

| Substitute Type | Description | Impact on GR Infraprojects | 2023/2024 Relevance |

|---|---|---|---|

| Alternative Transport Modes | Railways, waterways, air travel | Low; complement road networks for specific needs. | Indian road freight: 1.2 trillion tonne-km; passenger: 3.5 trillion km (2023). |

| Government Spending Shifts | Increased investment in railways, digital infra, etc. | Moderate; diverts funding and skilled labor from road projects. | Government focus on multi-modal connectivity and digital India initiatives. |

| Technological Advancements | Modular construction, advanced materials | Low to Moderate; could offer faster/cheaper solutions for specific segments. | Modular construction growth in 2024 highlights potential for off-site efficiencies. |

| Digitalization | Reduced need for physical travel | Low; primarily complementary, doesn't replace physical movement needs. | Continued expansion of digital networks requires physical infrastructure for installation. |

| Maintenance Focus | Prioritizing upgrades over new builds | Moderate; shifts focus from new project awards to rehabilitation. | Increasing emphasis on asset lifecycle management in infrastructure budgets (pre-2024). |

Entrants Threaten

The infrastructure construction sector, particularly for large projects like roads and highways, presents a formidable barrier to entry due to immense capital requirements. Companies need significant upfront investment for specialized heavy machinery, advanced construction equipment, and robust working capital to manage project timelines and material procurement.

For instance, a typical large-scale highway project can easily require hundreds of crores in capital expenditure for equipment alone. This substantial financial commitment acts as a strong deterrent for new players, effectively safeguarding the market position of established firms such as GR Infraprojects, which possess the financial muscle to undertake such ventures.

The infrastructure sector, where GR Infraprojects operates, is characterized by stringent regulatory approvals and licenses. New companies must obtain numerous permits, clearances, and certifications, a process that is both time-consuming and resource-intensive. For instance, securing environmental impact assessments and land acquisition approvals can take years and significant capital investment.

Navigating this complex web of regulations presents a substantial barrier to entry for potential competitors. The need for specialized legal and technical expertise to manage these requirements effectively deters many new entrants. In 2024, the Indian government continued to emphasize compliance and transparency in infrastructure project approvals, further solidifying this barrier.

Established players like GR Infraprojects leverage deep-rooted relationships with government bodies and key suppliers, built over years of consistent performance. This network provides a significant advantage, making it challenging for newcomers to secure crucial partnerships and access necessary resources. For instance, GR Infraprojects' extensive experience in infrastructure development allows them to navigate complex regulatory landscapes more effectively than a nascent competitor.

Technical Expertise and Skilled Workforce

The threat of new entrants into the infrastructure sector, particularly for companies like GR Infraprojects, is significantly shaped by the need for specialized technical expertise and a skilled workforce. Building or acquiring the deep engineering, procurement, and construction (EPC) knowledge required for complex projects is a substantial hurdle.

New players must invest heavily in developing this human capital, mirroring the established capabilities of firms that have honed their skills over years of project execution. This barrier is amplified by the fact that the Indian infrastructure sector, as of 2024, continues to grapple with a shortage of highly specialized engineers and project managers, making it difficult for newcomers to quickly assemble a competent team.

- Specialized EPC Expertise: Newcomers must replicate the deep technical knowledge and project management capabilities developed by established players like GR Infraprojects.

- Skilled Workforce Acquisition: Accessing and retaining a highly skilled workforce, crucial for complex infrastructure projects, presents a significant challenge and cost for new entrants in 2024.

- High Initial Investment: The cost associated with training or acquiring a workforce with the necessary specialized skills acts as a substantial barrier to entry.

- Talent Scarcity: The ongoing shortage of specialized engineering and project management talent in India further complicates the ability of new firms to compete effectively.

Economies of Scale and Integrated Model

GR Infraprojects benefits from its integrated Engineering, Procurement, and Construction (EPC) model, which fosters significant economies of scale. This integration allows for better cost management and operational efficiencies that are difficult for new players to replicate without substantial upfront investment and volume.

New entrants would find it challenging to achieve comparable cost advantages and project execution speed. Building a similar vertically integrated structure and achieving the necessary scale to compete effectively on price and delivery timelines presents a considerable barrier.

- Economies of Scale: GR Infraprojects' large-scale operations, evident in its substantial order book, allow for bulk purchasing and optimized resource allocation, driving down per-unit costs. As of March 31, 2024, GR Infraprojects reported an order book of ₹44,478 crore.

- Integrated EPC Model: Control over multiple stages of the project lifecycle, from design to execution and maintenance, enhances efficiency and reduces reliance on external suppliers, thus improving margins and project predictability.

- Capital Intensity: The high capital required to establish a similar level of vertical integration and operational capacity acts as a significant deterrent for potential new entrants in the infrastructure sector.

The threat of new entrants for GR Infraprojects is considerably low due to the sector's high capital intensity and the need for specialized expertise. Established players benefit from significant economies of scale and strong government relationships, making it difficult for newcomers to compete. The ongoing shortage of skilled labor in India further exacerbates these entry barriers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Massive investment needed for machinery, equipment, and working capital. | Deters new firms due to high upfront costs. |

| Regulatory Hurdles | Complex and time-consuming process for permits and licenses. | Requires specialized knowledge and significant capital to navigate. |

| Established Relationships | Strong ties with government bodies and suppliers. | New entrants struggle to secure partnerships and resources. |

| Technical Expertise | Deep engineering, procurement, and construction (EPC) knowledge required. | Difficult and costly for new firms to build or acquire. |

| Economies of Scale | GR Infraprojects' large order book (₹44,478 crore as of March 31, 2024) allows for cost efficiencies. | New entrants cannot match cost advantages or project speed. |

Porter's Five Forces Analysis Data Sources

Our GR Infraprojects Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the Ministry of Corporate Affairs. We supplement this with industry-specific reports from reputable sources and market intelligence gathered from construction and infrastructure sector publications.