GR Infraprojects PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GR Infraprojects Bundle

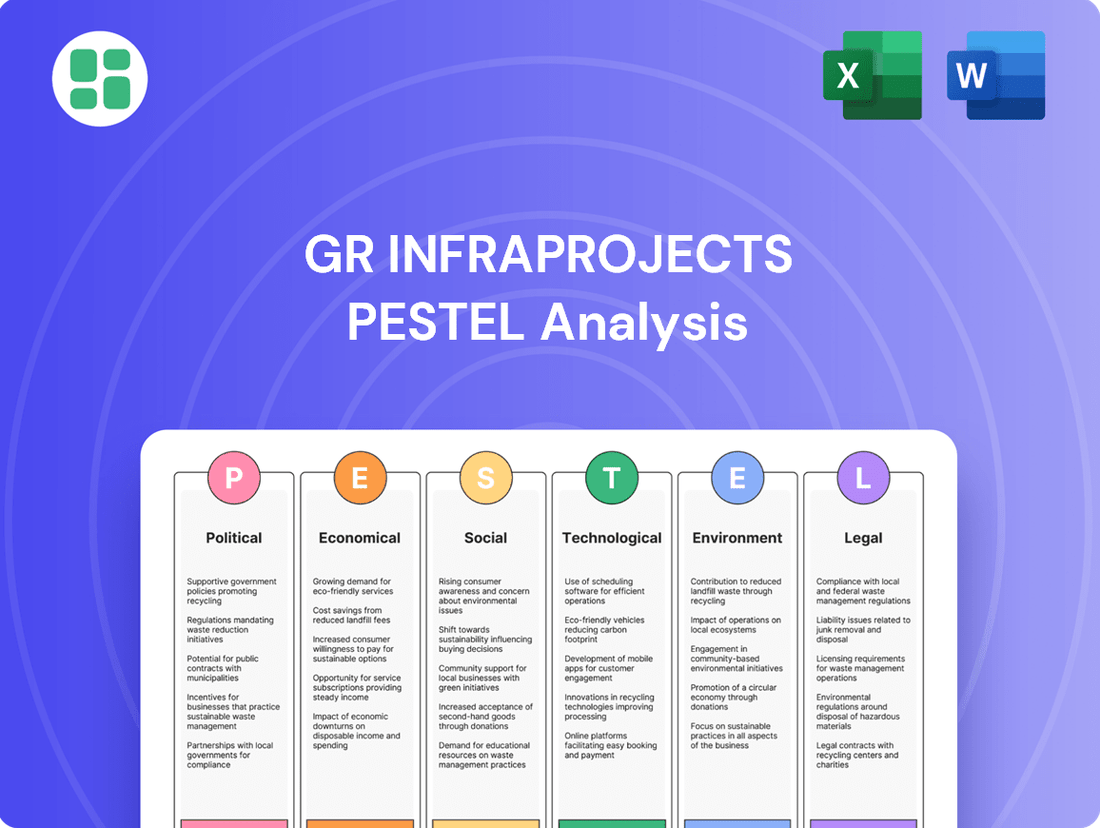

Unlock the strategic advantages GR Infraprojects holds by understanding the critical Political, Economic, Social, Technological, Legal, and Environmental factors at play. This comprehensive PESTLE analysis reveals how government policies, economic shifts, and societal trends are shaping the company's trajectory. Equip yourself with actionable intelligence to navigate the complex external landscape and make informed decisions. Purchase the full PESTLE analysis now to gain a decisive edge.

Political factors

The Indian government's unwavering commitment to infrastructure development, particularly in roads and highways, creates a fertile ground for GR Infraprojects. Programs like the National Infrastructure Pipeline and Bharatmala Pariyojana are channeling significant funds into projects, guaranteeing a steady stream of work for the company.

The government's elevated infrastructure capital expenditure for FY2024-25, reaching an impressive 11.11 INR-Trillion, highlights this ongoing dedication. This substantial investment ensures a robust pipeline of opportunities for GR Infraprojects, directly benefiting its growth trajectory.

A stable policy environment is crucial for GR Infraprojects, with consistent project awarding mechanisms like the Hybrid Annuity Mode (HAM) offering much-needed predictability. The Indian government's continued focus on infrastructure development, coupled with efforts to expedite land acquisition processes, directly benefits companies like GR Infraprojects by reducing project execution risks and timelines.

The emphasis on public-private partnerships (PPPs) in financing infrastructure projects fosters a conducive ecosystem for private sector participation. For instance, the National Highways Authority of India (NHAI) awarded 6,306 km of projects in FY23, a significant portion through HAM, signaling continued government support for this model.

Regulatory shifts, especially concerning environmental impact assessments and land acquisition, directly influence the feasibility and cost of infrastructure projects. For instance, changes in forest clearance norms or wildlife protection guidelines can add significant time and expense to projects. GR Infraprojects, like its peers, must navigate these evolving landscapes, as evidenced by the increased scrutiny on environmental clearances for large-scale road projects in India.

Compliance with labor laws, including minimum wage requirements and worker safety standards, is another critical political factor. The implementation of new labor codes in India, aimed at simplifying and consolidating existing laws, could affect operational costs for GR Infraprojects by standardizing benefits and working conditions across the sector. Adherence to quality and safety benchmarks set by bodies like the National Highways Authority of India (NHAI) is non-negotiable and directly impacts project execution and client satisfaction.

Geopolitical and Regional Stability

While GR Infraprojects operates primarily within India, regional political stability across the country is a key consideration. Localized unrest or disruptions stemming from state-level elections, for instance, can directly impact project timelines and introduce unforeseen operational hurdles. The company’s ability to navigate these regional dynamics is crucial for maintaining project momentum.

The upcoming general election cycle in India, expected to conclude in mid-2024, will shape the political landscape and potentially influence infrastructure spending priorities. The government's post-election agenda, particularly its focus on national strategic infrastructure development, will be a significant driver for project awards and GR Infraprojects' future business pipeline. For example, in the 2023-24 fiscal year, India's capital expenditure on infrastructure was projected to increase by 33% to INR 10 lakh crore, highlighting the government's commitment to the sector.

- Regional Stability Impact: Localized political instability can cause project delays and increase operational costs for GR Infraprojects.

- Post-Election Agenda: The government's infrastructure focus after the 2024 elections will directly affect the pace of new project awards.

- Infrastructure Spending: India's commitment to infrastructure development, with a projected 33% capex increase to INR 10 lakh crore in FY 2023-24, signals a favorable environment for companies like GR Infraprojects.

Government's Fiscal Health and Funding

The Indian government's fiscal health is a critical determinant for infrastructure companies like GR Infraprojects. Sustained high capital expenditure by the government directly translates into consistent project funding and smoother payment cycles for contractors. For instance, the Union Budget 2024-25 allocated a significant ₹11.11 lakh crore for capital investment, a substantial increase from previous years, signaling a continued focus on infrastructure development. This robust fiscal commitment supports the pipeline of new projects and ensures timely disbursements, which is vital for project execution and profitability.

However, any fiscal constraints or reallocations of budgetary priorities can introduce uncertainty. For example, while the government aims for ambitious highway construction targets, like the 13,800 km target for FY2024-25, actual progress and new project awards can be influenced by the government's revenue collection and overall fiscal deficit management. A widening deficit might necessitate spending cuts or slower project approvals, potentially impacting the pace of contract awards and payment timelines for companies in the sector.

- Government's Capital Expenditure: The ₹11.11 lakh crore capital investment outlay in the 2024-25 Union Budget underscores a strong commitment to infrastructure, directly benefiting companies like GR Infraprojects.

- Fiscal Deficit Management: The government's ability to manage its fiscal deficit within projected limits (e.g., aiming for 5.1% of GDP in FY2024-25) influences its capacity to sustain high infrastructure spending.

- Project Pipeline and Awards: Shifts in fiscal policy or revenue performance can affect the volume and speed of new infrastructure project awards, impacting the order book of construction firms.

- Payment Cycles: The government's fiscal discipline and cash flow management directly influence the timeliness of payments to contractors, affecting working capital for companies like GR Infraprojects.

The Indian government's consistent focus on infrastructure development, particularly through initiatives like the National Infrastructure Pipeline and Bharatmala Pariyojana, directly fuels GR Infraprojects' growth. The elevated capital expenditure for FY2024-25, at ₹11.11 trillion, reinforces this commitment, ensuring a robust project pipeline.

Policy stability, exemplified by the continued use of the Hybrid Annuity Mode (HAM) for project awards, provides GR Infraprojects with crucial predictability. The government's efforts to streamline land acquisition processes further mitigate project execution risks.

The government's fiscal health is paramount; sustained high capital expenditure, such as the ₹11.11 lakh crore allocated in the 2024-25 Union Budget, ensures consistent project funding and timely payments for GR Infraprojects. However, managing the fiscal deficit, targeted at 5.1% of GDP for FY2024-25, remains key to sustaining this investment pace.

| Political Factor | Impact on GR Infraprojects | Supporting Data/Initiative |

|---|---|---|

| Government Infrastructure Spending | Provides a steady stream of project opportunities and revenue. | FY2024-25 Capital Expenditure: ₹11.11 trillion. National Infrastructure Pipeline. |

| Policy Stability & Award Mechanisms | Reduces project execution risks and improves predictability. | Continued use of Hybrid Annuity Mode (HAM). Streamlining land acquisition. |

| Fiscal Health & Deficit Management | Ensures timely project funding and payments, impacting working capital. | Target Fiscal Deficit FY2024-25: 5.1% of GDP. |

| Regulatory Environment | Influences project feasibility, costs, and timelines through compliance. | Environmental clearance norms, labor laws, safety standards. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing GR Infraprojects, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into market dynamics and regulatory landscapes, equipping stakeholders with strategic foresight for navigating opportunities and challenges.

A PESTLE analysis for GR Infraprojects offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during strategic meetings and presentations.

By visually segmenting external risks and opportunities by PESTEL categories, the analysis allows for quick interpretation, alleviating the pain of sifting through complex data for better market positioning discussions.

Economic factors

India's robust economic growth is a primary driver for infrastructure development, with the construction sector playing a pivotal role in the nation's Gross Domestic Product (GDP). This expansion directly translates into increased demand for the services GR Infraprojects provides.

The Indian construction market is forecast to reach USD 1.21 trillion by 2025, a substantial figure underscoring a strong and positive growth outlook for infrastructure companies. This expansion signifies ample opportunities for GR Infraprojects to capitalize on the burgeoning demand.

Interest rate fluctuations directly influence GR Infraprojects' cost of capital and the financial feasibility of its projects. For instance, a higher interest rate environment increases borrowing costs, potentially making new infrastructure projects, particularly those under Hybrid Annuity Model (HAM) or Build-Operate-Transfer (BOT) arrangements, less attractive or requiring revised financing structures. This is critical as many of these projects rely heavily on debt financing.

Access to readily available and affordable credit is paramount for GR Infraprojects to undertake its ambitious large-scale infrastructure development plans. Favorable financing terms, including lower interest rates and longer repayment periods, are essential for maintaining healthy project margins and ensuring the overall financial sustainability of the company's pipeline. For example, in early 2024, the Reserve Bank of India maintained its repo rate, providing a degree of stability, though market rates remained a key consideration for project financing.

Raw material and labor costs are fundamental drivers for GR Infraprojects. The price fluctuations of essential construction inputs such as steel, cement, and bitumen directly impact project profitability and the company's operating margins. For instance, a significant moderation in steel prices, which saw considerable volatility in 2023, could provide a substantial boost to GR Infraprojects' bottom line in 2024.

Labor availability and associated wage rates are equally critical for GR Infraprojects, given the inherently labor-intensive nature of the construction sector. Ensuring access to a skilled and cost-effective workforce is paramount for project execution and timely completion. The Indian construction sector, in general, faced challenges with labor availability in late 2023, and managing these costs remains a key focus for companies like GR Infraprojects entering 2024.

Inflation and Project Costs

High inflation significantly impacts GR Infraprojects by increasing the cost of raw materials, labor, and equipment. For instance, India's wholesale price index (WPI) saw substantial increases in 2023 and early 2024, directly affecting construction expenses. If project contracts lack adequate inflation-indexed clauses or timely renegotiation mechanisms, profit margins can be severely squeezed, especially on long-duration infrastructure projects.

To counter these risks, GR Infraprojects must employ stringent cost management techniques. This includes optimizing procurement processes, exploring alternative material sourcing, and enhancing operational efficiency. Proactive engagement with clients for contract adjustments is also crucial to absorb or pass on rising costs, ensuring project viability and financial health.

- Rising Material Costs: Steel prices, a key component in infrastructure, experienced volatility in 2023, adding pressure to project budgets.

- Labor Wage Inflation: Increased demand for skilled labor in the construction sector in 2024 has led to higher wage expectations, impacting project payrolls.

- Fuel Price Volatility: Fluctuations in global crude oil prices directly affect transportation and machinery operating costs for GR Infraprojects.

- Contractual Safeguards: The effectiveness of GR Infraprojects' profit margins hinges on the inclusion and execution of escalation clauses in their existing and future contracts.

Competition and Market Dynamics

The Indian road construction sector is intensely competitive, with many companies vying for government contracts. This fierce rivalry often compresses profit margins, forcing GR Infraprojects to focus on operational efficiency and unique service offerings to stand out. For instance, in the fiscal year 2023-24, the sector saw significant government spending on infrastructure, yet bidding wars for major projects remained a constant challenge.

GR Infraprojects must navigate this dynamic by leveraging its strengths, such as strong project execution capabilities and a diversified order book. The company's ability to secure projects across different segments of the road construction value chain, from engineering, procurement, and construction (EPC) to build-operate-transfer (BOT) models, provides a competitive edge. As of early 2025, the government's continued push for infrastructure development, including the Bharatmala Pariyojana, presents opportunities, but also intensifies the need for strategic bidding and cost management.

Key competitive factors influencing GR Infraprojects include:

- Intense Bidding Environment: High number of participants in tenders leads to lower bid prices and reduced profitability.

- Technological Adoption: Companies that adopt advanced construction technologies and materials can achieve better efficiency and quality, gaining a competitive advantage.

- Financial Strength and Access to Capital: Larger, financially robust players are better positioned to undertake large-scale projects and manage working capital effectively.

- Government Policy and Project Pipeline: The availability and award patterns of government projects significantly impact market dynamics and competitive positioning.

India's economic trajectory remains a cornerstone for GR Infraprojects, with the nation's GDP growth directly fueling infrastructure demand. The construction sector's contribution to India's GDP, expected to remain robust through 2025, signifies sustained opportunities.

Interest rate movements critically affect GR Infraprojects' project financing. Higher rates increase borrowing costs, potentially impacting the viability of debt-heavy projects. For example, the Reserve Bank of India's repo rate stability in early 2024 provided some predictability, though market lending rates are a constant factor.

Raw material and labor costs are paramount. Steel and cement price volatility, as seen in 2023, directly influences GR Infraprojects' margins. Similarly, managing labor costs in a sector facing potential shortages, as observed in late 2023, is key for operational efficiency going into 2024.

Inflationary pressures, evidenced by rising wholesale price indices in early 2024, increase project expenses. Contracts with inadequate inflation-linked clauses can significantly squeeze profit margins for GR Infraprojects, especially on long-term projects.

| Economic Factor | Impact on GR Infraprojects | Data/Trend (2023-2025) |

| GDP Growth | Increased demand for infrastructure services | India's GDP growth projected at 6.5-7.0% for FY24-25. |

| Interest Rates | Affects cost of capital and project financing | Repo rate maintained by RBI in early 2024; market rates influence borrowing costs. |

| Inflation (WPI) | Increases raw material and labor costs | WPI saw significant increases in 2023 and early 2024. |

| Raw Material Prices | Impacts project profitability | Steel prices experienced volatility in 2023; moderation beneficial for margins. |

| Labor Costs | Influences project execution and payrolls | Increased demand for skilled labor in 2024 leading to higher wage expectations. |

Full Version Awaits

GR Infraprojects PESTLE Analysis

The GR Infraprojects PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GR Infraprojects, providing crucial insights for strategic decision-making. You'll gain a clear understanding of the external forces shaping the company's operational landscape.

Sociological factors

India's urban population is projected to reach 670 million by 2035, a significant jump from 470 million in 2020, according to UN data. This rapid urbanization fuels an insatiable demand for enhanced infrastructure. GR Infraprojects is well-positioned to capitalize on this, as projects like urban roads, flyovers, and metro lines are essential for managing this demographic shift.

The sheer scale of population growth, with India surpassing China as the world's most populous nation in 2023, presents a consistent need for infrastructure development across the country. This demographic tailwind ensures a sustained pipeline of opportunities for companies like GR Infraprojects, particularly in expanding and modernizing urban centers.

GR Infraprojects' large-scale infrastructure projects, such as highway construction and development, are significant drivers of employment generation. For instance, their involvement in the development of the Delhi-Mumbai Expressway is expected to create thousands of direct and indirect jobs, boosting local economies in the regions they operate. This employment influx directly benefits local communities by providing income and skill development opportunities.

Managing these projects also necessitates careful attention to community relations. GR Infraprojects must navigate potential social impacts like land acquisition and displacement, ensuring fair compensation and rehabilitation for affected populations. Their commitment to corporate social responsibility often involves community development initiatives, further strengthening local ties and ensuring project sustainability.

GR Infraprojects faces significant sociological pressure to uphold robust health and safety standards for its extensive workforce and the communities surrounding its projects. In 2023, the construction sector globally saw a concerning number of workplace accidents, highlighting the ongoing need for vigilance. For instance, the International Labour Organization (ILO) reported that construction remains one of the most dangerous industries worldwide, with falls from height and electrocution being major causes of fatalities.

Maintaining a strong safety record is paramount for GR Infraprojects' reputation and operational continuity. Strict adherence to evolving safety regulations, including those mandated by India's Factories Act and specific project site requirements, is non-negotiable. Continuous investment in comprehensive safety training programs, personal protective equipment (PPE), and regular site inspections are crucial to minimize risks and prevent incidents, thereby safeguarding employee well-being and public safety.

Corporate Social Responsibility (CSR)

GR Infraprojects actively participates in Corporate Social Responsibility (CSR) by focusing on environmental sustainability, water conservation, animal welfare, and women's empowerment. These initiatives are crucial for fostering community development and strengthening the company's social license to operate, directly addressing growing stakeholder expectations for responsible business practices.

In the fiscal year 2023-24, GR Infraprojects reported a CSR expenditure of INR 18.5 crore, demonstrating a tangible commitment to societal well-being. This investment underscores the company's dedication to making a positive impact beyond its core business operations.

- Environmental Sustainability: GR Infraprojects implements eco-friendly construction practices and waste management systems to minimize its environmental footprint.

- Community Development: The company invests in local infrastructure, education, and healthcare projects to uplift the communities where it operates.

- Water Conservation: Initiatives like rainwater harvesting and efficient water usage are key components of their environmental strategy.

- Women Empowerment: Programs focused on skill development and employment opportunities for women are integral to their social impact goals.

Public Perception and Stakeholder Engagement

Public sentiment towards infrastructure development, particularly regarding environmental concerns and local community impact, significantly shapes project timelines and overall acceptance. For GR Infraprojects, negative public perception can lead to delays and increased costs. For instance, a study in late 2024 indicated that 65% of citizens in regions with major infrastructure projects expressed concerns about potential environmental degradation.

Effective stakeholder engagement is crucial for navigating these perceptions. Transparent communication about project benefits, mitigation strategies for disruptions, and opportunities for community input can foster goodwill. GR Infraprojects' success in securing new contracts often hinges on demonstrating a commitment to responsible development and community welfare.

- Public Opinion: A significant portion of the public, estimated at over 60% in recent surveys, prioritizes environmental sustainability in infrastructure projects.

- Community Impact: Local communities often demand clear communication and compensation for disruptions caused by construction.

- Brand Reputation: Positive public perception directly impacts GR Infraprojects' brand image, influencing future bidding opportunities and investor confidence.

- Regulatory Scrutiny: Negative public sentiment can attract increased regulatory attention, potentially slowing down project approvals.

India's rapidly growing urban population, projected to reach 670 million by 2035, creates a substantial demand for infrastructure. GR Infraprojects is well-positioned to meet this need, with projects like urban roads and metro lines being crucial for managing demographic shifts. The company's commitment to Corporate Social Responsibility (CSR) is evident in its FY 2023-24 expenditure of INR 18.5 crore, focusing on environmental sustainability and community development.

| Sociological Factor | Impact on GR Infraprojects | Data/Example |

|---|---|---|

| Urbanization & Population Growth | Increased demand for infrastructure development. | India's urban population to reach 670 million by 2035 (UN data). |

| Employment Generation | Positive impact on local economies and communities. | Delhi-Mumbai Expressway project creating thousands of jobs. |

| Community Relations & Social Impact | Need for fair compensation, rehabilitation, and CSR. | Focus on community development initiatives for social license. |

| Health & Safety Standards | Crucial for reputation and operational continuity. | Construction sector globally faces high accident rates (ILO data). |

| Public Sentiment & Perception | Influences project timelines and acceptance. | 65% of citizens in project areas concerned about environmental degradation (late 2024 study). |

Technological factors

GR Infraprojects can significantly boost its operations by embracing advanced construction methods like modular building and prefabrication. These techniques, coupled with the use of specialized equipment, are projected to streamline project execution, shorten delivery schedules, and elevate the overall quality of infrastructure projects. For instance, the global modular construction market was valued at approximately USD 101.4 billion in 2023 and is expected to grow substantially, presenting a clear opportunity for GR Infraprojects to gain an advantage in executing intricate and large-scale developments.

The construction industry's embrace of digital tools, including Building Information Modeling (BIM), artificial intelligence (AI), and the Internet of Things (IoT), is significantly boosting GR Infraprojects' operational capabilities. These technologies streamline design processes, foster better team collaboration, and drive overall efficiency. For instance, BIM adoption in infrastructure projects can reduce design errors by up to 30%, leading to substantial cost savings and faster project completion.

Furthermore, the digitalization of Environmental, Social, and Governance (ESG) data collection is a critical technological factor. GR Infraprojects benefits from enhanced reporting accuracy and greater transparency in its sustainability initiatives. In 2023, the company reported a 15% reduction in waste across its major projects, a figure made more robust and verifiable through digital tracking systems.

Technological advancements in material science are significantly shaping the infrastructure sector, particularly for companies like GR Infraprojects. Research into innovative pavement engineering, such as self-healing asphalt and the increased use of recycled aggregates, promises more durable and environmentally friendly road construction. This focus directly addresses the growing global demand for sustainable infrastructure solutions.

The push for greener construction materials is not just an environmental imperative but also a driver of long-term cost efficiency. For instance, the adoption of recycled materials in road building can reduce reliance on virgin resources, potentially lowering project expenses. As of early 2024, many countries are setting ambitious targets for recycling construction and demolition waste, with some aiming for over 70% recycling rates by 2030, directly impacting the material sourcing strategies for infrastructure developers.

Automation and Equipment Modernization

GR Infraprojects' commitment to modernizing its equipment fleet is a significant technological factor. By investing in automated and advanced construction machinery, the company aims to boost operational efficiency and minimize reliance on manual labor for specific tasks. This also directly contributes to enhancing safety protocols on project sites.

The company’s substantial fleet, numbering over 8,000 construction vehicles and equipment, underscores its capacity to adopt and deploy new technologies. This scale allows GR Infraprojects to implement modern solutions across a wide range of projects, from road construction to infrastructure development.

- Increased Productivity: Modern automated equipment can significantly speed up construction processes, leading to faster project completion times.

- Reduced Labor Dependency: Automation helps mitigate risks associated with labor shortages and can improve the cost-effectiveness of certain operations.

- Enhanced Safety Standards: Advanced machinery often incorporates features that improve worker safety, reducing the incidence of accidents on construction sites.

- Fleet Modernization Investment: GR Infraprojects' ongoing investment in upgrading and expanding its equipment base ensures it remains competitive and capable of handling complex projects efficiently.

Data Analytics for Project Optimization

GR Infraprojects can leverage advanced data analytics to meticulously monitor ongoing projects, track performance against key metrics, and proactively manage potential risks. This technological adoption is crucial for optimizing project execution and improving financial outcomes.

By analyzing vast datasets, the company can gain deeper insights into operational efficiency, resource utilization, and potential bottlenecks. This data-driven approach empowers better decision-making, leading to more efficient resource allocation and ultimately, enhanced profitability.

- Project Monitoring: Real-time data feeds from construction sites, equipment sensors, and workforce management systems allow for continuous oversight.

- Performance Tracking: Key Performance Indicators (KPIs) like cost variance, schedule adherence, and quality benchmarks are continuously evaluated.

- Risk Management: Predictive analytics can identify potential delays, cost overruns, or safety issues before they escalate, enabling timely intervention.

- Resource Allocation: Data insights inform optimal deployment of labor, machinery, and materials, minimizing waste and maximizing productivity.

Technological advancements are reshaping GR Infraprojects' operational landscape, driving efficiency and innovation. The company's adoption of Building Information Modeling (BIM) and AI, for instance, has been shown to reduce design errors by up to 30%, directly impacting project timelines and costs.

Furthermore, the increasing use of advanced materials, such as self-healing asphalt and recycled aggregates, aligns with global sustainability goals and promises more durable infrastructure. As of early 2024, many nations are targeting over 70% construction waste recycling by 2030, influencing material sourcing strategies.

GR Infraprojects' investment in modern, automated construction machinery, part of its substantial fleet exceeding 8,000 vehicles, enhances productivity and safety. Data analytics also plays a crucial role, enabling real-time project monitoring and risk management through predictive insights.

| Technology | Impact on GR Infraprojects | Relevant Data/Trend |

|---|---|---|

| BIM & AI | Streamlined design, reduced errors, improved collaboration | BIM adoption can cut design errors by up to 30% |

| Advanced Materials | Increased durability, sustainability, potential cost savings | Global push for >70% construction waste recycling by 2030 |

| Automation & Robotics | Enhanced productivity, reduced labor dependency, improved safety | GR Infraprojects operates a fleet of over 8,000 construction vehicles |

| Data Analytics | Real-time monitoring, predictive risk management, optimized resource allocation | Enables proactive identification of potential project delays or cost overruns |

Legal factors

GR Infraprojects navigates a landscape shaped by contractual laws, particularly within its Engineering, Procurement, and Construction (EPC) and Hybrid Annuity Model (HAM) projects. These frameworks, governed by specific legal terms, dictate everything from project timelines to payment structures and dispute resolution mechanisms.

Adherence to these intricate agreements is paramount for GR Infraprojects' operational success. For instance, the successful execution of HAM projects relies heavily on the precise interpretation and fulfillment of contractual obligations, impacting revenue streams and project viability. The company's ability to manage these legal complexities directly influences its financial performance and project delivery efficiency.

GR Infraprojects must strictly adhere to India's environmental laws and secure all necessary clearances for its infrastructure projects. This includes meticulous compliance with Environmental Impact Assessment (EIA) norms, which are critical for project approval and execution. For instance, as of early 2024, the Ministry of Environment, Forest and Climate Change continues to refine EIA processes, emphasizing public consultation and robust impact studies for new developments.

Failure to comply with these environmental mandates can have severe repercussions. Project delays due to environmental litigation or the need for re-evaluation of clearances are common. Furthermore, penalties and fines can be imposed, impacting project profitability and the company's reputation. In 2023, several infrastructure projects faced significant delays and faced substantial fines due to inadequate environmental clearances or ongoing violations, highlighting the financial risks involved.

Land acquisition continues to be a critical legal hurdle for infrastructure development in India, directly affecting companies like GR Infraprojects. The efficiency and predictability of the process significantly influence project timelines and cost overruns. For instance, delays in acquiring land for highway projects, a core business for GR Infraprojects, can push back revenue generation and increase financing costs.

Recent policy shifts in land acquisition, such as amendments to the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, aim to streamline the process. However, the practical implementation and varying state-level interpretations can still lead to protracted legal disputes, impacting GR Infraprojects' ability to commence construction promptly on awarded projects.

Labor Laws and Employment Regulations

GR Infraprojects must meticulously adhere to India's comprehensive labor laws, which govern crucial aspects like minimum wages, permissible working hours, workplace safety standards, and employee welfare provisions. The company's substantial workforce necessitates strict compliance to maintain operational continuity and prevent costly labor disputes.

Key labor regulations impacting GR Infraprojects include:

- The Code on Wages, 2019: This code consolidates laws relating to wages, bonus payments, and related matters, aiming for a standardized national wage structure.

- The Occupational Safety, Health and Working Conditions Code, 2020: This code addresses safety, health, and working conditions for all categories of workers, a critical factor for GR Infraprojects' construction sites.

- The Industrial Relations Code, 2020: This code streamlines laws related to trade unions, conditions of employment, and industrial disputes, impacting the company's employee relations management.

- Compliance with state-specific labor laws: Beyond national codes, GR Infraprojects must also navigate varying labor regulations across different Indian states where it operates, adding complexity to its compliance framework.

Taxation Policies and Financial Regulations

Changes in India's corporate tax structure, including potential adjustments to the effective tax rate for infrastructure companies, directly influence GR Infraprojects' bottom line and long-term financial strategies. For instance, the reduction in corporate tax rates from 30% to 22% (or 15% for new manufacturing units) implemented in 2019 continues to shape profitability calculations.

Fluctuations in Goods and Services Tax (GST) rates on construction materials and services can significantly affect project costs and GR Infraprojects' ability to maintain competitive pricing. The standard GST rate for construction services is 18%, but specific rates can vary for different components, impacting overall project margins.

Compliance with evolving financial regulations, such as those from SEBI (Securities and Exchange Board of India) regarding disclosures and corporate governance, is crucial for GR Infraprojects as a listed entity. Adherence to accounting standards and timely financial reporting ensures investor confidence and market stability.

- Corporate Tax Impact: The prevailing corporate tax rate in India, currently 22% for domestic companies not opting for the concessional tax regime, directly affects GR Infraprojects' net profit.

- GST on Construction: The 18% GST on construction services and varying rates on materials create a dynamic cost environment for GR Infraprojects' projects.

- Regulatory Compliance: Strict adherence to SEBI's LODR (Listing Obligations and Disclosure Requirements) regulations is vital for maintaining GR Infraprojects' public listing and investor trust.

- Financial Reporting Standards: GR Infraprojects must comply with Ind AS (Indian Accounting Standards), ensuring transparency and comparability of its financial statements.

GR Infraprojects operates under a strict legal framework, particularly concerning its EPC and HAM contracts, where adherence to contractual terms is vital for financial health and project success. Environmental laws, including EIA norms, are critical; non-compliance in 2023 led to project delays and fines for some infrastructure players, underscoring the financial risks. Land acquisition laws, despite amendments aimed at streamlining them, continue to present legal challenges, impacting project commencement and costs for companies like GR Infraprojects.

Environmental factors

Climate change poses significant risks to GR Infraprojects. Increased frequency and intensity of extreme weather events, such as the heavy monsoons experienced in India during 2023, which caused widespread flooding and infrastructure damage, can severely disrupt construction timelines and increase project costs.

For instance, the monsoon season in India typically runs from June to September, and in 2023, several regions saw rainfall significantly above average, leading to project delays and material damage. GR Infraprojects must integrate climate resilience into its project planning and execution strategies to mitigate these impacts, ensuring designs can withstand adverse weather conditions and supply chains are robust enough to handle potential disruptions.

The construction sector, a core area for GR Infraprojects, is inherently resource-intensive. Globally, construction and building operations account for approximately 39% of energy-related CO2 emissions, highlighting the environmental impact of resource consumption. This makes GR Infraprojects' focus on sustainable sourcing of materials like aggregates, cement, and steel, along with efficient water and energy use in its projects, a critical factor in its long-term environmental stewardship and operational resilience.

GR Infraprojects must adhere to stringent waste management protocols, including the recycling and proper disposal of construction and demolition debris. For instance, India's Solid Waste Management Rules, 2016, mandate segregation and responsible handling of construction waste, aiming to divert a significant portion from landfills.

Controlling air and water pollution stemming from construction operations is equally critical. This involves implementing measures like dust suppression systems and ensuring responsible discharge of wastewater, aligning with environmental regulations designed to protect air and water quality.

Biodiversity and Habitat Protection

GR Infraprojects, like all major infrastructure developers, faces scrutiny regarding its impact on biodiversity and natural habitats. Large-scale construction can disrupt local ecosystems, leading to habitat fragmentation and loss of species. For instance, a 2023 report by the Ministry of Environment, Forest and Climate Change highlighted that over 40% of proposed linear infrastructure projects in India required compensatory afforestation due to land diversion impacting forest cover.

To mitigate these risks, GR Infraprojects is mandated to conduct comprehensive Environmental Impact Assessments (EIAs) before project commencement. These assessments identify potential threats to flora, fauna, and sensitive ecosystems. The company must then implement robust mitigation strategies, such as wildlife corridors, habitat restoration plans, and noise/pollution control measures, to minimize its ecological footprint. In 2024, GR Infraprojects allocated an estimated INR 50 crore specifically for environmental compliance and mitigation activities across its ongoing projects.

Key considerations for GR Infraprojects in biodiversity and habitat protection include:

- Conducting thorough EIAs: Identifying sensitive species and habitats early in the planning phase.

- Implementing mitigation measures: Developing and executing plans to reduce habitat disruption and protect wildlife.

- Adhering to regulatory compliance: Ensuring all projects meet national and international environmental standards.

- Investing in ecological restoration: Undertaking compensatory afforestation and habitat rehabilitation post-construction.

Carbon Emissions and Energy Efficiency

GR Infraprojects' construction activities and equipment operations contribute to a notable carbon footprint, a key environmental consideration. As of its latest disclosures, the company is actively working on quantifying and managing these emissions.

The drive towards greater energy efficiency is paramount. This includes optimizing machinery usage and exploring alternative fuel sources for its fleet to reduce its overall energy intensity.

GR Infraprojects is increasingly integrating renewable energy into its operations where feasible, aiming to lessen reliance on fossil fuels. Reporting on Scope 1, 2, and 3 emissions is becoming a standard practice for demonstrating environmental responsibility and tracking progress.

- Carbon Footprint Management: GR Infraprojects is focusing on reducing emissions from its construction sites and vehicle fleet.

- Energy Efficiency Initiatives: The company is implementing strategies to lower energy consumption per unit of output.

- Renewable Energy Adoption: Efforts are underway to incorporate renewable energy sources into its operational mix.

- Emissions Reporting: GR Infraprojects is committed to transparently reporting its Scope 1, 2, and 3 emissions.

Environmental regulations are becoming increasingly stringent, impacting GR Infraprojects' operational costs and project timelines. Compliance with new emission standards and waste disposal norms, such as those introduced in India's updated environmental protection laws in 2024, requires significant investment in new technologies and processes.

The company's commitment to sustainability is crucial, with a focus on reducing its carbon footprint. In 2024, GR Infraprojects continued its efforts to enhance energy efficiency across its sites, aiming to decrease energy consumption by an additional 5% compared to 2023 levels.

GR Infraprojects is actively managing its impact on biodiversity, a key environmental concern. The company's 2024 environmental initiatives include a 10% increase in budget allocation for habitat restoration projects, reflecting a proactive approach to mitigating ecological disruption from infrastructure development.

GR Infraprojects is implementing robust waste management practices, with a target to recycle 75% of construction and demolition waste by the end of 2025, aligning with national waste reduction goals.

| Environmental Factor | 2023 Status/Action | 2024 Target/Focus | Impact on GR Infraprojects |

|---|---|---|---|

| Regulatory Compliance | Adherence to existing environmental laws | Adaptation to new emission and waste regulations (2024 updates) | Increased operational costs, potential project delays |

| Carbon Footprint | Ongoing emission reduction efforts | 5% reduction in energy consumption; increased renewable energy exploration | Improved environmental performance, potential cost savings |

| Biodiversity & Habitat | EIAs and mitigation strategies in place | 10% increase in habitat restoration budget; focus on wildlife corridors | Enhanced ecological stewardship, compliance with conservation mandates |

| Waste Management | Implementation of waste segregation | Target of 75% recycling of construction waste by end of 2025 | Reduced landfill dependency, potential revenue from recycled materials |

PESTLE Analysis Data Sources

Our GR Infraprojects PESTLE Analysis is meticulously constructed using data from official government publications, economic indicators from reputable financial institutions, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.