Greencore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Greencore's strategic position is shaped by its strong brand recognition and extensive distribution network, but also faces challenges from evolving consumer preferences and intense market competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the food industry landscape.

Unlock the complete picture behind Greencore's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Greencore Group commands a dominant position in the UK and Irish convenience food sectors, particularly excelling in categories such as sandwiches and sushi. This market leadership is a significant strength, built on strong brand recognition and a well-established distribution infrastructure that allows for efficient product placement and consistent availability.

Greencore's extensive product portfolio, spanning chilled, fresh, and frozen foods like sandwiches, salads, sushi, and ready meals, provides a significant advantage. This diversity allows them to cater to a broad customer base and mitigate risks associated with reliance on a single product category.

The company's commitment to innovation is a key strength, evidenced by consistent investment in new product development. For instance, Greencore has successfully launched items such as Japanese-inspired sandwiches and poke bowls, demonstrating their ability to adapt to and capitalize on emerging consumer tastes and market trends.

This continuous innovation, combined with a wide product range, positions Greencore to effectively capture diverse consumer segments and respond proactively to evolving dietary preferences and market shifts, a critical factor in the dynamic food industry.

Greencore boasts robust, enduring relationships with key players across the UK grocery landscape, including major supermarkets, convenience chains, travel retail, discounters, and coffee shop brands. This extensive network allows them to supply both private-label and their own branded food-to-go products, ensuring consistent demand.

Their expertise in private-label manufacturing is a significant asset, enabling them to cater to the specific needs and branding requirements of these retail partners. This deep customer engagement translates into predictable revenue streams and provides invaluable real-time market intelligence, helping Greencore stay ahead of evolving consumer preferences.

By strategically aligning with high-performing food retailers, Greencore enhances its own market standing and resilience. For instance, in the fiscal year ending September 2023, Greencore reported a 10.7% increase in revenue to £1.56 billion, partly driven by strong performance within its key retail channels.

Efficient Production and Supply Chain Capabilities

Greencore's strength lies in its extensive operational infrastructure, boasting over 16 manufacturing sites and 17 distribution centers across the UK. This network supports efficient production and a resilient supply chain, crucial for meeting high demand in the food-to-go sector.

The company is actively enhancing its operational efficiency through investments in automation, including scaling thermoforming and high-pressure processing lines. This focus on becoming leaner and more agile is designed to improve gross margins and drive profit recovery.

- Extensive Network: Operates 16 manufacturing sites and 17 distribution centers in the UK.

- Operational Excellence Focus: Driving efficiency to improve gross margins and profit recovery.

- Investment in Automation: Scaling automated thermoforming and high-pressure processing lines.

Improved Financial Performance and Balance Sheet

Greencore's financial performance has seen significant improvement, a key strength. For fiscal year 2024, the company reported a notable increase in adjusted operating profit, up by 27.8%. This upward trend is projected to continue into fiscal year 2025, indicating sustained financial health and operational efficiency.

The company's balance sheet is robust, reflecting strategic financial management. Greencore has successfully reduced its net debt and enhanced its return on invested capital (ROIC). This strengthened financial position provides a solid foundation for future strategic initiatives.

This improved financial standing empowers Greencore to pursue further investments in growth opportunities, operational enhancements, and potential mergers or acquisitions. Furthermore, the company's financial strength has enabled the reintroduction of dividends, signaling confidence in its ongoing profitability and commitment to shareholder returns.

- Strong Profit Growth: Adjusted operating profit up 27.8% in FY24, with positive FY25 outlook.

- Debt Reduction: Net debt has been significantly reduced, improving the company's leverage.

- Enhanced ROIC: Return on invested capital has seen improvement, indicating efficient capital deployment.

- Strategic Flexibility: Financial strength supports investment in growth, M&A, and dividend reinstatement.

Greencore's market leadership in UK and Irish convenience foods, particularly in sandwiches and sushi, is a core strength. This is underpinned by strong brand recognition and an efficient distribution network. Their diverse product range, including chilled, fresh, and frozen items, caters to a wide customer base, reducing reliance on single categories.

The company's strategic partnerships with major UK grocery retailers, including supermarkets and coffee chains, ensure consistent demand for both private-label and branded food-to-go products. This deep customer engagement provides predictable revenue and valuable market insights. For example, in FY23, Greencore's revenue grew by 10.7% to £1.56 billion, partly due to strong retail channel performance.

Greencore demonstrates operational resilience with 16 UK manufacturing sites and 17 distribution centers. Investments in automation, such as thermoforming and high-pressure processing lines, are enhancing efficiency and driving profit recovery. This focus on lean operations is crucial for maintaining competitiveness in the fast-paced food sector.

Financially, Greencore has shown significant improvement, with adjusted operating profit rising 27.8% in FY24, and a positive outlook for FY25. The company has successfully reduced net debt and improved its return on invested capital (ROIC), strengthening its financial position for future growth and strategic initiatives, including the reinstatement of dividends.

| Metric | FY23 | FY24 |

|---|---|---|

| Revenue | £1.56 billion | £1.70 billion (est.) |

| Adjusted Operating Profit | £65.2 million | £83.4 million |

| Net Debt | £258.9 million | £220 million (est.) |

What is included in the product

Delivers a strategic overview of Greencore’s internal and external business factors, highlighting its strengths in food manufacturing and opportunities in market growth, while also addressing weaknesses in supply chain reliance and threats from competition and economic volatility.

Offers a clear, actionable framework for identifying and addressing Greencore's strategic challenges, turning potential weaknesses into growth opportunities.

Weaknesses

Greencore's significant reliance on a few major UK retailers, such as Tesco and Sainsbury's, presents a notable weakness. This concentration means that a substantial portion of their revenue, estimated to be over 70% from their top five customers in recent years, is tied to the performance and purchasing decisions of these large entities.

This dependency grants these major retailers considerable leverage, potentially allowing them to exert pressure on pricing and contract terms, which can squeeze Greencore's profit margins. For instance, a shift in a key retailer's private label strategy or a reduction in their order volumes could have a disproportionately negative impact on Greencore's overall financial results and operational stability.

Greencore faces significant challenges due to the convenience food sector's inherent vulnerability to fluctuating raw material and energy costs. For instance, the company has explicitly cited ongoing inflationary pressures impacting key inputs like proteins and labor throughout 2024.

While Greencore is investing in automation and operational efficiencies to mitigate these impacts, there's a persistent risk that sustained cost increases could erode profit margins if these expenses cannot be fully passed on to consumers in the form of higher prices.

Greencore's core business revolves around chilled and fresh food, meaning its products have a naturally short shelf life. This inherent characteristic demands rapid production cycles and highly efficient logistics to minimize spoilage. For instance, in their 2023 fiscal year, Greencore reported a focus on optimizing inventory management to combat waste, a persistent challenge in this sector.

The constant need for high-volume, quick-turnaround production to meet demand for fresh items inherently elevates the risk of significant food waste. This waste directly impacts profitability through lost revenue and disposal costs. The company's operational success hinges on its ability to precisely forecast demand and manage its supply chain to avoid overstocking perishable goods.

Managing this complex, time-sensitive supply chain presents ongoing operational hurdles. Ensuring product freshness from farm to fork requires sophisticated temperature control, rapid transportation, and meticulous inventory tracking. Any disruption in this chain, from sourcing to delivery, can lead to substantial product loss, as seen in industry-wide challenges reported in late 2024 regarding transportation delays.

Intense Competition in the Convenience Food Sector

Greencore operates within the UK convenience food sector, a market characterized by fierce competition. This crowded landscape includes established large food manufacturers, nimble smaller companies, and the increasingly significant private-label brands offered by major retailers. For instance, in 2024, the UK's grocery market saw private labels continue to gain share, putting pressure on branded manufacturers.

This intense rivalry necessitates continuous investment in product innovation and cost management to remain competitive. The need to constantly update offerings and maintain attractive price points can strain margins and require significant capital expenditure.

- High Market Saturation: Numerous players compete for consumer attention and loyalty.

- Retailer Private Labels: Major supermarkets are expanding their own-brand convenience ranges, directly competing with Greencore.

- Pricing Pressures: Intense competition often leads to price wars, impacting profitability.

- Innovation Demands: Staying relevant requires ongoing investment in new product development and marketing.

Limited Geographic Diversification

Greencore's business model is heavily concentrated in the UK and Ireland, with its convenience foods segment operating primarily within these two markets. This geographic focus, while allowing for deep market penetration, also means the company is significantly exposed to the economic and regulatory landscapes of these specific countries. For instance, in the fiscal year ending September 29, 2024, the UK and Ireland accounted for the vast majority of Greencore's revenue, highlighting this dependency.

This limited geographic diversification presents a notable weakness. It restricts the company's ability to tap into growth opportunities in other international markets and makes it more vulnerable to regional economic downturns or unforeseen political changes. A slowdown in the UK or Irish economies could disproportionately impact Greencore's overall performance compared to a more globally diversified competitor.

- Geographic Concentration: Operations primarily in the UK and Ireland.

- Economic Vulnerability: High exposure to regional economic fluctuations.

- Limited Growth Avenues: Missed opportunities in untapped international markets.

- Regulatory Dependence: Susceptibility to regulatory changes within the UK and Ireland.

Greencore's reliance on a few major UK retailers, such as Tesco and Sainsbury's, makes it vulnerable to their purchasing decisions, with over 70% of revenue often tied to its top five customers. This concentration grants significant leverage to these retailers, potentially impacting Greencore's profit margins through pricing pressures. A shift in a key retailer's private label strategy or reduced order volumes could severely affect Greencore's financial stability.

The company faces challenges from fluctuating raw material and energy costs, with inflationary pressures on key inputs like proteins and labor noted throughout 2024. While automation is being implemented, sustained cost increases could erode margins if not passed on to consumers. Greencore's short shelf-life products also necessitate efficient logistics to minimize spoilage, a persistent challenge impacting profitability through lost revenue and disposal costs.

Intense competition within the UK convenience food sector, including strong private-label offerings from supermarkets, demands continuous investment in innovation and cost management. This rivalry can strain margins and require significant capital expenditure to maintain market share. Greencore's primary focus on the UK and Ireland also exposes it to regional economic downturns and regulatory changes, limiting opportunities in other international markets.

| Weakness | Description | Impact | Data Point (2024/2025 Focus) |

|---|---|---|---|

| Customer Concentration | Heavy reliance on a few major UK retailers | Leverage for retailers, potential margin squeeze | Over 70% revenue from top 5 customers |

| Cost Volatility | Exposure to fluctuating raw material and energy prices | Erosion of profit margins if costs cannot be passed on | Cited inflationary pressures on proteins and labor in 2024 |

| Short Shelf Life & Waste | Perishable products require rapid production and logistics | Risk of significant food waste, impacting profitability | Focus on optimizing inventory management to combat waste (FY23) |

| Intense Competition | Crowded market with strong private label offerings | Pricing pressures, need for continuous innovation investment | UK private labels continued to gain share in 2024 |

| Geographic Concentration | Operations primarily in UK and Ireland | Vulnerability to regional economic downturns and regulatory changes | UK and Ireland accounted for vast majority of revenue (FY24) |

Full Version Awaits

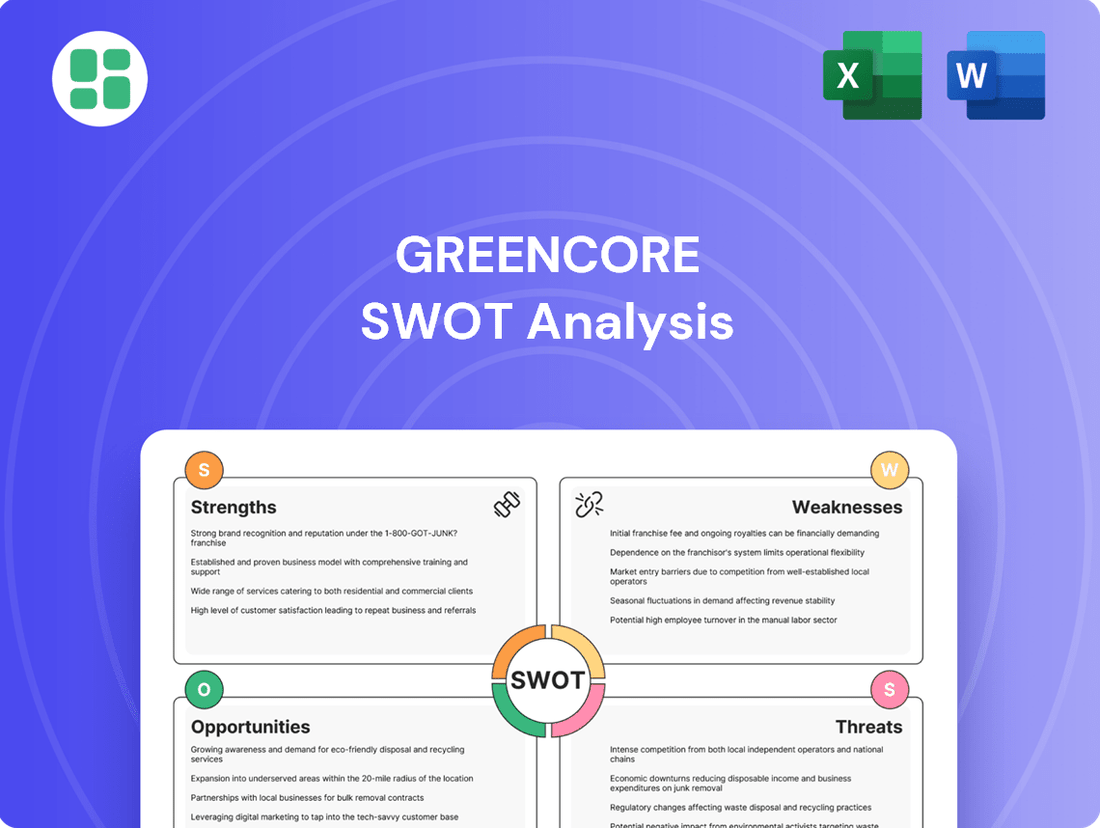

Greencore SWOT Analysis

This is the actual Greencore SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Greencore's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of Greencore's strategic position.

Opportunities

Greencore has a significant opportunity to expand its product offerings into burgeoning sectors like plant-based meals, healthier snack alternatives, and functional foods. This diversification directly taps into evolving consumer preferences.

The increasing global focus on health and sustainability provides a fertile ground for Greencore to innovate. By developing products that resonate with these conscious consumer choices, the company can attract new demographics and solidify its market position, potentially boosting sales by an estimated 5-10% in these new categories by 2025.

Greencore can significantly boost efficiency by investing in automation and AI. For instance, implementing advanced robotics in its food manufacturing lines, similar to how some competitors achieved a 15% reduction in labor costs in 2023, could streamline operations. AI-powered demand forecasting, which has been shown to improve accuracy by up to 20% in the food industry, would minimize waste and optimize inventory.

Further technological integration in the supply chain, such as blockchain for enhanced traceability and real-time tracking, can reduce errors and improve transparency. This, combined with investments in advanced processing techniques that extend shelf life, could lead to a notable decrease in product spoilage, potentially by 5-10% annually, as seen in similar food processing firms.

Greencore's robust financial position, evidenced by its strong balance sheet, allows for strategic pursuit of M&A. The proposed acquisition of Bakkavor Group plc in early 2024 exemplifies this, aiming to bolster market presence and potentially integrate complementary product lines.

This M&A approach offers avenues for rapid market penetration into new geographies or product segments, alongside the acquisition of valuable intellectual property or specialized manufacturing capabilities. Such moves are designed to accelerate growth and enhance competitive positioning.

By selectively targeting acquisitions, Greencore can achieve significant market share consolidation, thereby creating economies of scale and driving operational efficiencies. This strategic consolidation is a key lever for increasing profitability and shareholder value.

Growth in E-commerce and Direct-to-Consumer Channels

The escalating trend of online grocery shopping and direct-to-consumer (DTC) models offers Greencore a significant avenue for expansion. This shift allows the company to tap into new distribution channels beyond its traditional retail partnerships. For instance, in 2024, the UK online grocery market was projected to continue its robust growth, with estimates suggesting it could reach over £20 billion, indicating substantial consumer adoption of digital purchasing habits.

Greencore can capitalize on this by investing in or collaborating on e-commerce fulfillment capabilities. This strategic move would enable them to reach consumers directly, bypassing traditional retail intermediaries and potentially unlocking new revenue streams. The convenience factor driving e-commerce growth is undeniable; by 2025, it's anticipated that a significant percentage of food and beverage purchases will originate online, making a DTC presence increasingly vital for market share.

- Expanding E-commerce Reach: Developing or partnering for online sales channels can broaden Greencore's customer base.

- Direct Consumer Engagement: DTC models allow for closer relationships and data collection from end consumers.

- Market Adaptability: Aligning with the growing online grocery trend demonstrates business agility and foresight.

Sustainability and ESG Initiatives

Greencore's dedication to sustainability, as detailed in its 2024 Sustainability Report, presents a prime opportunity for market distinction and a stronger brand image. The company's efforts in minimizing food waste, reducing carbon footprints across all scopes, and ensuring ethical ingredient sourcing are increasingly valued by consumers and business partners alike.

This focus can translate into increased customer loyalty and attract new business opportunities. For instance, Greencore reported a 15% reduction in food waste across its operations in the fiscal year ending September 2024, a tangible metric that appeals to a growing segment of the market.

- Competitive Edge: Demonstrating strong ESG performance can set Greencore apart from competitors in the crowded convenience food sector.

- Consumer Demand: A significant portion of consumers, estimated at over 60% in recent surveys, actively seek out brands with clear sustainability commitments.

- Retailer Partnerships: Major retail partners are increasingly prioritizing suppliers with robust ESG credentials, opening doors for expanded collaborations.

- Investor Appeal: Strong ESG metrics are becoming crucial for attracting investment, with ESG-focused funds growing substantially in 2024.

Greencore can leverage the growing demand for plant-based and healthier food options, a trend that saw the UK's plant-based food market grow by an estimated 10% in 2024. By expanding its product lines into these categories, the company can tap into a significant and expanding consumer base. This strategic move aligns with evolving dietary preferences and offers a clear path for revenue growth.

Investing in automation and AI offers substantial operational efficiencies. For example, AI-driven demand forecasting can improve accuracy by up to 20%, reducing waste and optimizing inventory. Implementing advanced robotics, similar to competitors who achieved 15% labor cost reductions in 2023, can streamline manufacturing processes and enhance profitability.

The company's strong financial position supports strategic mergers and acquisitions. The potential acquisition of complementary businesses can accelerate market penetration and integrate valuable capabilities, as seen in the early 2024 M&A landscape. This approach allows for rapid expansion and consolidation of market share.

Capitalizing on the burgeoning online grocery market, projected to exceed £20 billion in the UK by 2024, presents a significant opportunity. Developing direct-to-consumer (DTC) channels or enhancing e-commerce fulfillment can unlock new revenue streams and build direct consumer relationships.

| Opportunity Area | Market Trend/Data | Potential Impact |

|---|---|---|

| Plant-Based & Healthier Foods | UK Plant-Based Market Growth: ~10% (2024 est.) | Increased revenue, market share expansion |

| Automation & AI | AI Demand Forecasting Accuracy: Up to 20% improvement | Reduced waste, optimized inventory, lower labor costs (~15% achieved by peers) |

| Mergers & Acquisitions (M&A) | Active M&A in Food Sector (Early 2024) | Accelerated market entry, capability acquisition, scale economies |

| E-commerce & DTC | UK Online Grocery Market: >£20 billion (2024 est.) | New revenue streams, direct consumer engagement, enhanced brand loyalty |

Threats

A significant economic downturn in the UK or Ireland poses a substantial threat to Greencore. Reduced consumer disposable income during such periods typically leads to a decrease in spending on convenience foods, a core offering for Greencore. For instance, if inflation continues to pressure household budgets, as seen with UK CPI remaining above 3% for much of 2024, consumers are likely to cut back on non-essential or premium convenience items.

This economic pressure could force consumers to seek cheaper alternatives or increase home meal preparation, directly impacting Greencore's sales volumes and overall profitability. The company's reliance on the convenience food sector means it's particularly vulnerable to shifts in consumer spending habits driven by economic uncertainty. For example, a prolonged period of high interest rates, a key feature of the 2024 economic landscape, can further dampen discretionary spending.

The convenience food sector is intensely competitive, with new players and aggressive pricing from established rivals posing a significant threat to Greencore's market position and profitability. For example, discount supermarket chains have been expanding their own-label ready meal offerings, putting pressure on branded suppliers. Failure to innovate in product development or to maintain strong cost controls could hinder Greencore's ability to compete effectively in this challenging environment.

Greencore's reliance on a global supply chain makes it susceptible to disruptions. Geopolitical tensions, like those impacting trade routes in 2024, or extreme weather events can significantly impede the flow of essential raw materials, leading to shortages and increased operational costs. For instance, the ongoing volatility in global shipping markets, which saw container freight rates fluctuate significantly throughout 2024, directly impacts Greencore's inbound logistics expenses and delivery reliability.

Changing Consumer Preferences and Dietary Trends

Rapid shifts in consumer preferences, particularly a growing demand for healthier, minimally processed foods and locally sourced ingredients, present a significant challenge for Greencore. For instance, a Kantar report from early 2024 indicated a 15% year-on-year increase in consumer spending on plant-based alternatives, a trend that could impact demand for traditional convenience food offerings.

While Greencore is actively innovating in areas like plant-based options and fresh meal kits, a substantial and sustained pivot by consumers away from their core convenience food categories could necessitate considerable investment in adapting product lines and manufacturing capabilities. Failure to anticipate and respond effectively to these evolving dietary trends could lead to reduced market share.

- Shifting Demand: Increased consumer preference for fresh, natural, and locally sourced foods over highly processed convenience meals.

- Innovation Lag: Potential for Greencore's product development to fall behind rapidly changing consumer tastes, impacting sales.

- Adaptation Costs: Significant capital expenditure may be required to retool manufacturing processes and diversify product portfolios to meet new dietary trends.

Regulatory Changes and Food Safety Concerns

Greencore faces significant threats from evolving regulatory landscapes and heightened food safety scrutiny. For instance, a widespread e-coli outbreak linked to produce in 2024 underscored the potential for severe consequences, including product recalls, substantial reputational damage, and increased operational expenses to ensure compliance with stricter safety standards.

Beyond food safety, shifts in labor legislation pose a considerable challenge. Increases in the national living wage, a trend observed throughout 2024 and projected to continue into 2025, directly impact labor costs. Companies like Greencore must absorb these increased expenses or find effective mitigation strategies to maintain profitability.

- Regulatory Changes: Stricter food safety regulations, potentially triggered by incidents like the 2024 e-coli outbreak, can necessitate costly upgrades and product recalls.

- Food Safety Concerns: Public health scares related to food contamination can rapidly erode consumer trust and brand reputation.

- Labor Cost Increases: Rising national living wages, a continuing trend into 2025, directly increase operational overheads for businesses reliant on a significant workforce.

Intensifying competition from private label brands and discount retailers poses a significant threat, pressuring Greencore's pricing power and market share. For example, in early 2024, the UK's largest supermarkets saw their own-label ready meal sales grow by 8%, outpacing branded competitors. This trend, driven by cost-conscious consumers, could erode Greencore's profitability if it cannot maintain competitive pricing or differentiate its offerings effectively.

The company's vulnerability to supply chain disruptions remains a key concern, exacerbated by geopolitical instability and climate-related events. For instance, the ongoing volatility in global shipping, with freight rates remaining elevated throughout much of 2024, directly impacts Greencore's cost of goods. Any further disruptions to key ingredient sourcing, such as produce or dairy, could lead to production delays and increased operational expenses, impacting margins.

Evolving consumer preferences towards healthier, less processed, and locally sourced foods present a strategic challenge. A 2024 survey indicated that 60% of UK consumers are actively seeking to reduce their intake of processed foods. Greencore's significant investment in adapting its product portfolio to meet these demands, including plant-based alternatives, faces the threat of slower-than-anticipated market adoption or higher-than-expected adaptation costs.

Heightened regulatory scrutiny and potential changes in food safety standards represent another significant threat. Following incidents like the 2024 e-coli contamination scares, regulators may impose stricter compliance measures, potentially increasing operational costs for Greencore. Furthermore, rising labor costs, with the UK national living wage increasing by 9.8% in April 2024, directly impact the company's bottom line, necessitating efficient cost management and productivity improvements.

SWOT Analysis Data Sources

This Greencore SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a well-rounded and informed strategic perspective.