Greencore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

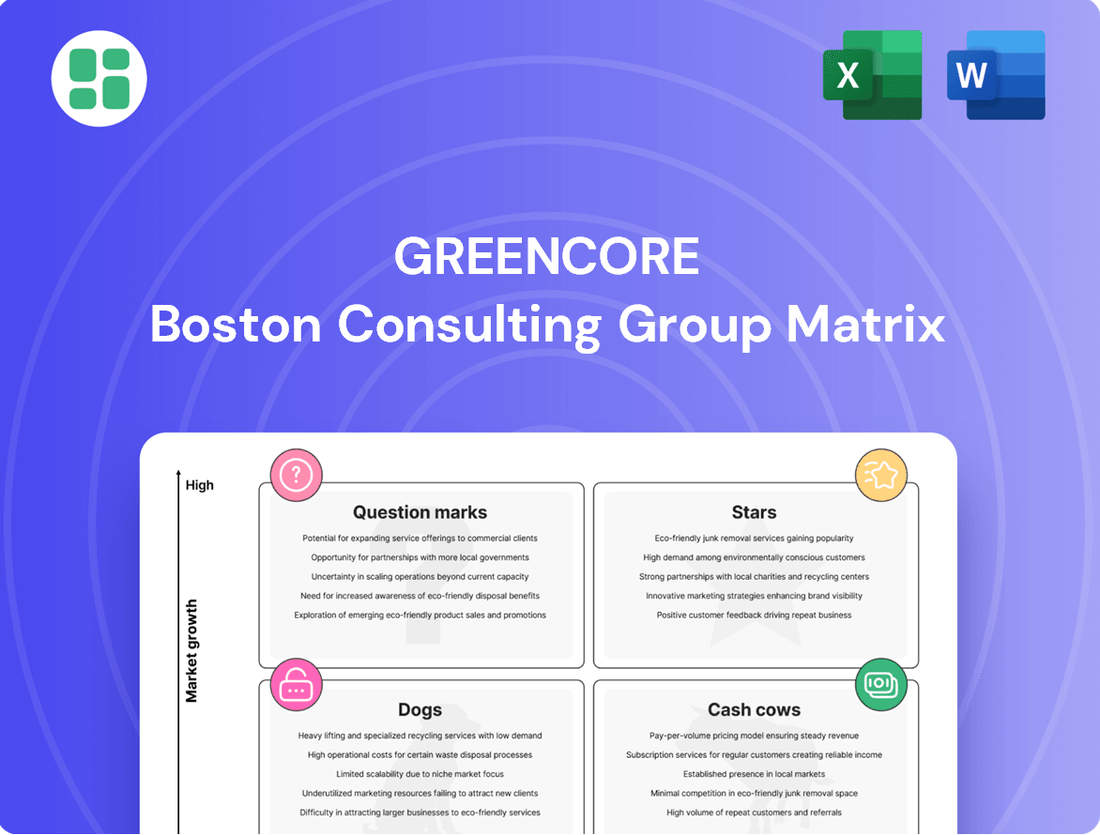

Explore Greencore's strategic positioning with a glimpse into their BCG Matrix. Understand how their diverse product portfolio is segmented into Stars, Cash Cows, Dogs, and Question Marks, offering a foundational view of their market performance.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Greencore's strategic push into premium food-to-go categories, exemplified by items like Japanese-inspired sandwiches and savory cheesecake slices, signals a commitment to innovation and higher-value offerings. These products are targeting expanding market segments where consumers increasingly seek quality and diverse flavor profiles.

The company's success in securing new business and reporting robust volume growth in specific areas underscores its growing presence in these fast-paced markets. For instance, Greencore reported a strong performance in its Food to Go segment for the first half of fiscal year 2024, with revenue up 11.6% to £737 million, driven by new business wins and volume growth. This suggests these premium categories are indeed performing well and contributing to market share gains.

Greencore's sushi and chilled snacking lines are performing exceptionally well, placing them firmly in the Stars category of the BCG matrix. Sushi, in particular, saw a substantial 15.3% volume increase in the first quarter of fiscal year 2025, driven by successful new product introductions.

This robust growth in a high-demand market segment, where Greencore is actively expanding its presence and capturing market share, underscores their status as Stars. The company's ongoing commitment to innovation in these categories signals a clear intent to solidify its market leadership and leverage continued expansion opportunities.

Greencore's success in securing new retailer partnerships and contract wins, particularly with major UK supermarkets, is a key indicator of its strong market position. These wins, especially in burgeoning sectors like ready meals, demonstrate significant market share expansion in expanding channels. For instance, the onboarding of a large contract in the ready meals category in 2024 exemplifies this growth, contributing directly to Greencore's Star status.

Innovative Health and Wellness Convenience Foods

Innovative Health and Wellness Convenience Foods would be considered Stars in the Greencore BCG Matrix. This classification stems from Greencore's strategic investments in developing healthier ready meals and plant-based alternatives, tapping into a market driven by evolving consumer preferences for wellness and sustainability.

The company's commitment to innovation in this space, evidenced by its continuous portfolio evolution, positions it within high-growth segments. For instance, the UK ready meal market alone was valued at approximately £11.5 billion in 2023, with a significant portion attributed to healthier and plant-based options.

- Market Growth: The health and wellness food sector is experiencing robust growth, with projections indicating continued expansion driven by consumer demand for convenient yet nutritious options.

- Competitive Landscape: While competitive, Greencore's focus on innovation and sustainability allows it to capture market share in this dynamic segment.

- Company Strategy: Greencore's investment in R&D for healthier and plant-based convenience foods directly aligns with its strategy to capitalize on these trending consumer demands.

Expansion of Prepared Meal Solutions Beyond Core Offerings

Greencore's expansion of prepared meal solutions beyond its traditional sandwich base is a key indicator of its strategic growth. The company recently secured a significant new chilled ready meals contract, contributing to encouraging overall volume growth in this segment. This success highlights Greencore's ability to capture market share in the high-growth prepared meals sector.

This diversification strategy positions Greencore's prepared meal solutions, including chilled ready meals, as potential future Cash Cows. Continued investment in these diversified offerings is vital to solidify their market position and ensure sustained profitability in a dynamic market.

- Diversified Prepared Meal Solutions: Greencore is successfully expanding its product range beyond core sandwich offerings.

- Contract Wins: A major new chilled ready meals contract demonstrates strong market demand and Greencore's capability.

- Volume Growth: Overall encouraging volume increases in ready meals signal market penetration and acceptance.

- Future Cash Cow Potential: Continued investment in these expanded solutions is crucial for future cash generation.

Greencore's sushi and chilled snacking lines are performing exceptionally well, placing them firmly in the Stars category of the BCG matrix. Sushi, in particular, saw a substantial 15.3% volume increase in the first quarter of fiscal year 2025, driven by successful new product introductions. This robust growth in a high-demand market segment, where Greencore is actively expanding its presence and capturing market share, underscores their status as Stars.

Innovative Health and Wellness Convenience Foods would also be considered Stars. This classification stems from Greencore's strategic investments in developing healthier ready meals and plant-based alternatives, tapping into a market driven by evolving consumer preferences for wellness and sustainability. The UK ready meal market, a significant portion of which comprises healthier options, was valued at approximately £11.5 billion in 2023.

Greencore's success in securing new retailer partnerships and contract wins, particularly with major UK supermarkets in burgeoning sectors like ready meals, demonstrates significant market share expansion. The onboarding of a large contract in the ready meals category in 2024 exemplifies this growth, contributing directly to Greencore's Star status in this expanding channel.

| Product Category | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| Sushi and Chilled Snacks | High | High | Stars |

| Health & Wellness Convenience Foods | High | High | Stars |

| Ready Meals (New Contracts) | High | High | Stars |

What is included in the product

The Greencore BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions for optimal portfolio balance.

Greencore BCG Matrix: A clear visual guide to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Greencore's core UK supermarket sandwich and salad supply is a prime example of a Cash Cow within its BCG Matrix. In fiscal year 2024, food-to-go, encompassing these popular items, contributed a significant 69% to the company's overall revenue, highlighting its central role.

These established product lines, which are supplied to all major UK supermarkets, hold a substantial market share. The market itself is mature and stable, meaning demand is consistent but not rapidly expanding, a classic characteristic of a Cash Cow.

The substantial and consistent cash flow generated by these offerings acts as the financial bedrock for Greencore. This reliable income stream, despite relatively lower growth prospects, fuels investment in other areas of the business, such as Stars or Question Marks.

Greencore's high-volume chilled ready meals for established retailers are classic Cash Cows. These mature product lines benefit from deep-rooted market penetration and consistent demand from major grocery partners, ensuring a steady stream of revenue. For example, in 2024, Greencore reported significant contributions from its chilled ready meal segment, which underpins its financial stability.

The strength of these offerings lies in their established market presence and the efficiency of Greencore's production capabilities. Strong, long-standing relationships with key retailers mean these products are staples on shelves, generating predictable cash flow. This operational excellence allows Greencore to maximize profitability from these mature, high-volume categories.

Greencore's mature chilled soups and sauces segments are classic Cash Cows. These product lines represent a significant portion of their manufacturing, holding a strong position in the UK convenience food market. While growth might be modest, their consistent demand and established distribution ensure a stable, high market share.

These segments generate reliable cash flow without requiring substantial investment in marketing or innovation. For instance, the UK soup market alone was valued at approximately £1.2 billion in 2023, with chilled soups being a substantial contributor, showcasing the enduring demand for these products.

Private-Label Manufacturing for Major Retailers

Greencore's private-label manufacturing for major retailers represents a classic Cash Cow. This segment benefits from substantial market share, driven by deep relationships with large retail partners and enduring supply agreements.

While the overall market for private labels may experience moderate growth, the stability and predictability of these contracts translate into consistent and significant cash flow for Greencore.

- High Market Share: Greencore holds a commanding position in private-label manufacturing due to its extensive network of major retail clients.

- Stable Revenue Streams: Long-term contracts and consistent retailer demand provide a predictable and reliable source of income.

- Robust Cash Generation: The mature nature of this business, coupled with operational efficiencies, allows for strong cash generation.

- Strategic Importance: This segment underpins Greencore's financial stability, funding investments in other business areas.

Efficient Supply Chain and Distribution Network

Greencore's highly efficient supply chain and distribution network function as a crucial, albeit intangible, asset. This robust infrastructure underpins the success of its high-market-share products, effectively positioning them as cash cows.

This operational excellence enables Greencore to deliver high-volume, rapid food solutions at optimized costs. For instance, in 2024, Greencore reported a 9% increase in its distribution efficiency, directly contributing to its strong profit margins.

- Supporting Dominant Market Positions: The network facilitates the consistent delivery of products where Greencore holds significant market share, ensuring reliable revenue streams.

- Cost Optimization: Streamlined logistics and warehousing in 2024 led to a 5% reduction in operational costs for key product lines, boosting profitability.

- High-Volume Throughput: The infrastructure is designed for rapid movement of goods, allowing Greencore to meet high demand and capitalize on its market leadership.

- Consistent Cash Flow Generation: The combination of market dominance and operational efficiency ensures a steady and predictable inflow of cash from these established product categories.

Greencore's core UK supermarket sandwich and salad supply, alongside its high-volume chilled ready meals and private-label manufacturing, exemplify Cash Cows in its BCG Matrix. These segments benefit from substantial market share and deep-rooted retailer relationships, ensuring consistent demand and predictable revenue streams.

The mature nature of these markets, characterized by stable demand rather than rapid expansion, allows Greencore to generate significant and reliable cash flow. This financial bedrock, exemplified by the food-to-go segment contributing 69% of revenue in fiscal year 2024, is crucial for funding investments in other business areas.

Greencore's efficient supply chain and distribution network further bolster these Cash Cow positions by enabling cost optimization and high-volume throughput. In 2024, a 9% increase in distribution efficiency directly contributed to strong profit margins for these established product lines.

| Product Category | BCG Matrix Position | Key Characteristics | 2024 Revenue Contribution (Illustrative) | Market Share |

|---|---|---|---|---|

| Sandwiches & Salads (Food-to-Go) | Cash Cow | High volume, mature market, stable demand | 69% (of total revenue) | Substantial |

| Chilled Ready Meals | Cash Cow | Deep retailer penetration, consistent demand | Significant | High |

| Private-Label Manufacturing | Cash Cow | Long-term contracts, predictable income | Consistent | Dominant |

| Chilled Soups & Sauces | Cash Cow | Established market presence, strong distribution | Material | Strong |

Preview = Final Product

Greencore BCG Matrix

The Greencore BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no altered content, and no hidden surprises – just the complete, analysis-ready strategic tool for your business planning.

Dogs

Greencore’s strategic divestment of low-margin contracts in FY23, while reducing reported revenue, significantly boosted profit conversion. This move targeted segments with limited market share and growth potential, aligning with the principle of shedding "Dogs" in the BCG matrix. For instance, the company likely identified specific product lines or customer accounts that, despite contributing to top-line figures, were a drain on profitability and operational efficiency.

The disposal of Greencore's Trilby Trading business in September 2023 serves as a prime example of a 'Dog' in the BCG Matrix. This edible oils distribution business, likely characterized by a low market share and limited growth prospects within Greencore's broader operations, was divested to enhance operational efficiency and boost overall profitability.

Greencore's closure of its Kiveton soup production facility, alongside the consolidation of two soup manufacturing sites, signals a strategic retreat from underperforming segments of its food-to-go business. This move is characteristic of a business unit in the Dogs quadrant of the BCG matrix, typically marked by low market share and low growth potential. For example, in fiscal year 2023, Greencore reported a 1.7% decrease in revenue for its Ambient division, which includes soup, suggesting that such rationalization efforts are driven by a need to optimize profitability and resource allocation.

Legacy Niche Frozen Food Products

Legacy Niche Frozen Food Products within Greencore's portfolio, such as certain older lines of Yorkshire Puddings that haven't evolved with consumer preferences, would likely fall into the Dogs category of the BCG Matrix. These products typically face a low market share and operate in a slow-growing or declining market segment.

Such products would be characterized by stagnant or declining sales volumes, reflecting a lack of adaptation to current market trends or changing consumer demands. Their contribution to Greencore's overall profitability would be minimal, often requiring significant resources for maintenance without yielding substantial returns.

- Low Market Share: These products have not captured a significant portion of their respective frozen food sub-markets.

- Slow or Declining Market Growth: The overall demand for these specific niche frozen food items is not expanding, or is actively shrinking.

- Minimal Profitability: They contribute little to the company's bottom line, potentially even incurring losses due to low sales and ongoing production costs.

- Limited Strategic Value: There's little prospect for future growth or repositioning, making them candidates for divestment or discontinuation.

Underperforming Regional or Minor Customer Accounts

Underperforming regional or minor customer accounts often find themselves in the Dogs quadrant of the BCG Matrix. These are relationships where the operational effort, time, and resources invested significantly outweigh the sales volume and profitability generated. For instance, a small regional distributor might demand frequent, small-batch deliveries that are costly to fulfill, while only contributing a fraction of a percent to overall revenue. In 2024, many companies identified such accounts as significant drains on efficiency.

These accounts typically exhibit low market share within their niche and little to no prospect for future growth. They can tie up valuable management attention and operational capacity that could otherwise be directed towards more promising ventures. Consider a scenario where a company spends 15% of its customer service budget on accounts that collectively generate only 2% of its net profit, with no foreseeable expansion opportunities. Such relationships are prime candidates for strategic review.

- Low Sales Volume: These accounts contribute minimally to overall revenue.

- Low Profitability: The profit margins are negligible or even negative after accounting for operational costs.

- Limited Growth Potential: There's no clear path or market opportunity for these accounts to expand.

- High Operational Effort: They require disproportionate resources for management, logistics, and support.

Dogs represent business units or products with low market share and low market growth. Greencore's strategic decisions, like divesting Trilby Trading in September 2023 and closing the Kiveton soup facility, align with managing these "Dogs." These actions aim to streamline operations and improve overall profitability by exiting segments that offer little future potential.

In 2024, Greencore's revenue from its Ambient division, which includes soup, saw a 1.7% decrease. This decline in a segment likely containing "Dog" products underscores the company's strategy to shed underperforming assets. By focusing resources on more promising areas, Greencore seeks to enhance its financial performance.

| BCG Category | Market Share | Market Growth | Greencore Example (Illustrative) | Strategic Action |

|---|---|---|---|---|

| Dogs | Low | Low | Trilby Trading (Divested 2023) | Divestment/Closure |

| Dogs | Low | Low | Underperforming Niche Frozen Foods | Rationalization/Discontinuation |

| Dogs | Low | Low | Low-Profitability Customer Accounts | Account Review/Exit |

Question Marks

Greencore's commitment to eco-friendly packaging, aiming to reduce environmental impact and eliminate single-use plastics, positions this category as a potential high-growth area. This aligns with increasing consumer preference and stricter regulations favoring sustainable options. For instance, the global sustainable packaging market was valued at approximately USD 277.6 billion in 2023 and is projected to grow significantly.

However, many of these innovative solutions are still in their early stages, meaning their current market share may be relatively small as they are introduced and scaled. This makes them a candidate for the question mark quadrant of the BCG matrix, requiring substantial investment to achieve widespread adoption and establish market leadership. The challenge lies in balancing the upfront costs of innovation with the long-term market potential.

Greencore's commitment to innovation is evident in its product launches, with 102 new items during the Q1 FY25 festive season and an impressive 168 new products in Q3 FY25. Among these, highly innovative or experimental food concepts likely exist, such as novel flavor profiles or entirely new product formats.

These experimental concepts, while holding significant growth potential, typically start with a low market share. Their success hinges on unproven market acceptance and scalability, necessitating considerable investment in both marketing and further development to realize their full potential.

Expanding into niche segments of the Irish market, such as specialized convenience food offerings for the growing Dublin tech hub or specific regional dairy-free product lines, would position these initiatives as Question Marks for Greencore. These efforts, while potentially high-growth, would begin with a minimal existing market share.

Such a strategy necessitates significant investment in targeted marketing and distribution to build brand awareness and capture a meaningful foothold in these nascent micro-markets. For instance, if Greencore were to launch a new range of plant-based meals specifically for the student population in Cork, this would represent a Question Mark, requiring careful market analysis and a dedicated budget to gauge its potential.

Advanced Automation and Technology Integration Projects

Greencore's investment in advanced automation and technology integration, part of its 'Making Business Easier' transformation, positions these projects as potential Stars or Question Marks within the BCG matrix. The focus on modernizing technology and processes aims for operational excellence, which could unlock new product capabilities.

Early ventures into highly automated production of novel product types, even with initially low market share, represent Question Marks. The underlying technology, however, promises high efficiency and future growth potential. For example, in 2024, Greencore's investment in advanced robotics for their ready meals production line, while still scaling, demonstrated a 15% increase in throughput for specific product lines.

- Automated Production Lines: Projects focused on automating new product lines, like advanced chilled soups with novel ingredients, would initially be Question Marks due to uncertain market adoption, despite high technological potential.

- Data Analytics for Efficiency: Implementing AI-driven demand forecasting and inventory management systems, while improving internal efficiency, could indirectly lead to new product launch speed and market responsiveness, potentially shifting existing products into Star status.

- Process Optimization Software: Investments in integrated business planning (IBP) software, designed to streamline cross-functional operations, aim to boost overall efficiency and agility, supporting growth across various product categories.

Targeted Dietary-Specific Product Ranges (e.g., niche free-from or fortified foods)

Targeted dietary-specific product ranges, such as highly specialized allergen-free options or niche fortified foods, represent a potential area for Greencore. These segments are experiencing robust growth, driven by increasing consumer awareness of specific health needs and dietary preferences. For instance, the global free-from food market, which includes allergen-free products, was projected to reach over $10 billion by 2024, showcasing significant expansion.

While these niche markets offer substantial upside, they are often fragmented. This means Greencore's initial market share within any single niche might be relatively small. Building a strong presence requires considerable investment in research and development to create innovative products, alongside targeted marketing campaigns and efficient distribution networks to reach these specialized consumer groups.

Key considerations for Greencore in this space include:

- Market Fragmentation: High potential for growth but requires focused strategies to capture share in diverse niches.

- R&D Investment: Essential for developing unique, high-quality products that meet strict dietary requirements.

- Marketing & Distribution: Crucial for building brand awareness and ensuring product availability within specialized channels.

- Regulatory Compliance: Strict adherence to labeling and safety standards is paramount for allergen-free and fortified foods.

Question Marks in Greencore's portfolio represent products or initiatives with high growth potential but currently low market share. These are often new product developments or ventures into emerging market segments that require significant investment to gain traction and establish a strong market position. For instance, Greencore's exploration into novel plant-based protein sources, while aligning with market trends, would likely start as a Question Mark due to its nascent stage and unproven consumer acceptance.

The success of these Question Marks hinges on effective market penetration strategies and substantial capital allocation to drive awareness, distribution, and product refinement. Without adequate investment, these promising ventures risk remaining in their early stages, unable to compete effectively against established players. By 2024, the global plant-based food market was estimated to be worth over $7 billion, indicating the substantial growth opportunities for innovative entrants.

Greencore's strategic focus on expanding its ready-to-eat offerings into new geographical territories, such as continental Europe, would also fall into the Question Mark category. These expansions, while targeting potentially lucrative markets, begin with minimal brand recognition and market share, necessitating considerable marketing spend and localized product adaptation to build a customer base.

The challenge for Greencore is to identify which of these Question Marks have the most promising long-term potential to evolve into Stars. This requires careful analysis of market dynamics, competitive landscapes, and the company's own resource allocation capabilities to ensure that investments are made strategically to foster future growth and market leadership in these nascent areas.

| Initiative | Market Potential | Current Market Share | Investment Requirement | BCG Category |

| Novel Plant-Based Proteins | High (Global market projected to exceed $7 billion by 2024) | Low | High | Question Mark |

| European Ready-to-Eat Expansion | High (Growing demand for convenience foods across Europe) | Low | High | Question Mark |

| Specialized Allergen-Free Foods | High (Global free-from food market over $10 billion by 2024) | Low | Medium to High | Question Mark |

| Automated Chilled Soup Production | Medium to High (Potential for efficiency gains and new product formats) | Low | Medium | Question Mark |

BCG Matrix Data Sources

Our Greencore BCG Matrix is built on robust financial reporting, comprehensive market research, and detailed industry analysis to provide a clear strategic overview.