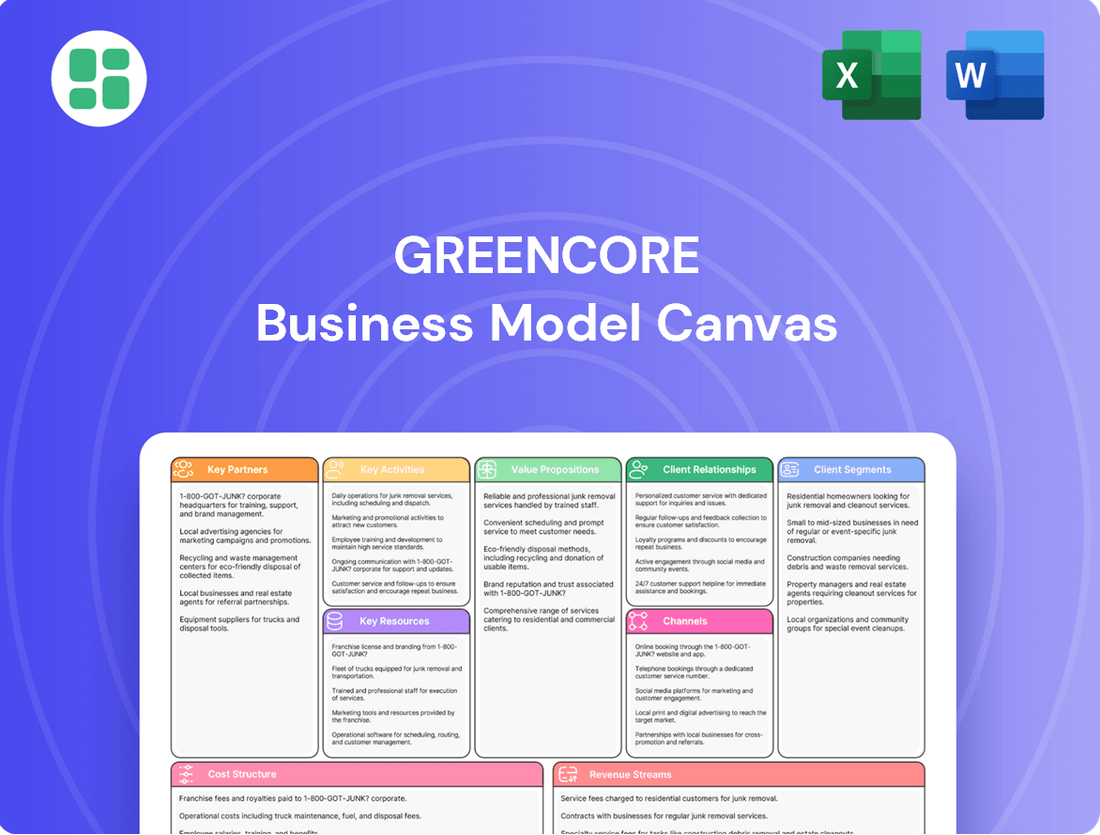

Greencore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Unlock the full strategic blueprint behind Greencore's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Greencore cultivates enduring relationships with major UK supermarkets and other prominent retailers, a cornerstone of its business model. These partnerships are vital for co-creating private-label goods, ensuring that product development closely mirrors retailer objectives and evolving consumer preferences. For instance, in 2023, Greencore reported that over 70% of its revenue was derived from its top 10 customers, highlighting the significance of these deep collaborations.

Greencore cultivates robust relationships with a wide array of raw material suppliers to guarantee the consistent quality and availability of ingredients for its diverse chilled, fresh, and frozen food offerings. This network is crucial for maintaining supply chain resilience and effectively managing costs across its operations.

By fostering these partnerships, Greencore aims to secure a stable supply of essential components, from fresh produce to proteins, which are fundamental to its extensive product portfolio. The company's ability to source reliably impacts its production efficiency and its capacity to meet consumer demand.

In 2024, Greencore continued to emphasize sustainable sourcing practices within its supplier relationships, aligning with growing consumer and regulatory expectations for environmental responsibility. This focus includes efforts to trace the origin of key ingredients and promote ethical farming methods.

Greencore's robust supply chain relies heavily on its logistics and distribution partners. With 17 of its own distribution centers strategically located across the UK, the company ensures products reach customers efficiently. This network is crucial for maintaining the freshness of their food items, a key differentiator in their business model.

These partnerships are vital for Greencore's ability to deliver perishable goods on time, contributing to their reputation for industry-leading supply chain management. As of 2024, the company continues to leverage these relationships to optimize delivery routes and minimize spoilage, a testament to their commitment to operational excellence.

Technology and Innovation Partners

Greencore actively partners with technology providers to boost efficiency. For instance, in 2024, they continued to implement advanced automation in their food manufacturing processes, aiming to streamline production and reduce labor costs. They also enhanced their food waste tracking systems through collaborations, contributing to their sustainability goals.

Innovation is a core focus, driven by partnerships with both customers and suppliers. These collaborations are vital for developing novel food products and refining existing recipes and packaging. In 2024, a significant portion of their innovation efforts were directed towards creating more sustainable packaging solutions, with a particular emphasis on increasing the recyclability of their materials.

- Technology Integration: Collaborations with tech firms for automation and supply chain visibility.

- Product Development: Joint ventures with customers and suppliers for new food offerings and recipe enhancements.

- Sustainability Focus: Partnerships driving advancements in recyclable packaging and healthier product options.

Waste Management and Circularity Partners

Greencore's sustainability hinges on robust partnerships with waste management providers. These collaborations are vital for achieving their ambitious goals of reducing food waste and championing circular economy principles. For instance, in 2023, Greencore reported a 3% reduction in food waste across its operations, a testament to these strategic alliances.

These partnerships go beyond mere disposal. Greencore actively seeks innovative avenues to transform food waste into valuable revenue streams. This includes diverting surplus food for applications like animal feed or even exploring its potential in brewing processes, thereby offsetting traditional disposal costs and creating new income opportunities.

- Waste Diversion: Partnering with specialized firms to divert food waste from landfill, aiming for a 90% diversion rate by 2025.

- Circular Economy Initiatives: Collaborating on projects to upcycle food by-products into new materials or energy sources.

- Animal Feed Programs: Establishing direct relationships with farms to supply suitable food waste for animal consumption, a practice that saw a 15% increase in volume in 2023.

- Brewing Partnerships: Exploring collaborations with craft breweries to utilize specific food waste streams, contributing to a more closed-loop system.

Greencore's strategic alliances with key UK retailers are paramount, with over 70% of revenue in 2023 stemming from its top 10 customers. These partnerships facilitate co-creation of private-label products, ensuring alignment with retailer goals and consumer trends.

The company also relies on a strong network of raw material suppliers to guarantee ingredient quality and availability, crucial for cost management and supply chain resilience. In 2024, Greencore intensified its focus on sustainable sourcing, promoting ethical farming and ingredient traceability.

Furthermore, Greencore collaborates with technology providers to enhance operational efficiency through automation and improved food waste tracking systems, as seen in their 2024 initiatives.

Partnerships with waste management firms are vital for Greencore's sustainability targets, aiming for a 90% waste diversion rate by 2025. These alliances extend to exploring circular economy initiatives, such as upcycling food by-products and supplying suitable food waste for animal feed, a practice that saw a 15% volume increase in 2023.

What is included in the product

A comprehensive, pre-written business model tailored to Greencore's strategy of supplying food to go and convenience foods, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Greencore, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Greencore's Business Model Canvas provides a structured framework to identify and address operational inefficiencies, acting as a pain point reliever by clarifying value propositions and customer relationships.

Activities

Greencore's primary activity revolves around the high-volume manufacturing of convenience foods. This includes a wide array of products such as sandwiches, salads, sushi, and ready meals, catering to the fast-paced demands of the food retail sector.

The company leverages its network of 16 state-of-the-art manufacturing facilities. These sites are strategically designed and specialized to handle various chilled, fresh, and frozen food categories efficiently, ensuring product quality and freshness.

A key focus for Greencore is the rapid turnaround of food production. This operational efficiency allows them to quickly respond to evolving market trends and consumer preferences, ensuring a consistent supply of popular convenience food items.

Greencore's key activities revolve around expertly managing a complex global supply chain. This involves everything from securing raw materials to delivering the final products to customers, ensuring peak freshness and service.

A significant part of this is optimizing inbound logistics and inventory control, supported by the operation of 17 strategically located distribution centers. These facilities are crucial for maintaining high operational service levels and guaranteeing product quality.

Furthermore, Greencore actively manages contract profitability and works to maximize manufacturing capacity utilization. This proactive approach is essential for efficiency and financial health within their operations.

Greencore's commitment to continuous product development and innovation is a cornerstone of its strategy, ensuring it stays ahead of shifting consumer tastes and demands. In 2024, the company focused on launching a variety of new products, including premium ranges and options that cater to health-conscious and environmentally aware consumers.

This drive for innovation extends to refining existing offerings, with Greencore investing in improving recipes, adopting advanced technologies, and enhancing packaging to deliver better quality and sustainability. For instance, their work with major retailers in 2024 saw the introduction of several new meal solutions designed to meet specific dietary needs and convenience expectations.

Quality Control and Food Safety

Greencore's key activities heavily revolve around maintaining stringent quality control and ensuring paramount food safety across its entire operation. This commitment is fundamental to their business, guaranteeing that every product leaving their facilities meets exacting standards for nutritional content, taste, texture, and secure packaging. For instance, in 2024, Greencore continued to invest in advanced testing methodologies and staff training programs to uphold these critical benchmarks.

These rigorous processes are not merely procedural; they are designed to build and sustain customer trust. By consistently delivering safe and high-quality food products, Greencore solidifies its reputation as a reliable partner for retailers and a trusted brand for consumers. This focus is exemplified by their ongoing adherence to international food safety certifications and internal auditing protocols.

- Rigorous Sourcing Verification: Implementing strict supplier audits and raw material testing to ensure quality and safety from the outset.

- In-Process Monitoring: Employing continuous checks at various stages of production, from preparation to packaging, to identify and rectify any deviations.

- Finished Product Testing: Conducting comprehensive analysis of final products for safety, quality attributes, and shelf-life stability.

- Regulatory Compliance: Ensuring all activities meet or exceed national and international food safety regulations and standards.

Customer Relationship Management and Contract Renewal

Greencore's key activities heavily revolve around nurturing strong connections with its core retail and foodservice clients. This involves proactive account management and strategic negotiation to secure and extend long-term agreements.

The company prioritizes delivering exceptional customer experiences and achieving high satisfaction levels. This commitment is demonstrably reflected in the successful renewal of numerous customer contracts throughout fiscal year 2024.

- Dedicated Account Management: Ensuring consistent communication and support for key clients.

- Contract Negotiation: Securing favorable terms and long-term partnerships.

- Customer Satisfaction Focus: Driving initiatives to enhance client outcomes and loyalty.

- FY24 Contract Renewals: A testament to successful relationship management and service delivery.

Greencore's key activities center on efficient, high-volume manufacturing of convenience foods, including sandwiches, salads, and ready meals, for the food retail sector. They operate 16 specialized manufacturing facilities, focusing on rapid production cycles to meet market demands.

Supply chain management is critical, encompassing raw material sourcing and product delivery, supported by 17 distribution centers. The company also prioritizes contract profitability and maximizing manufacturing capacity. In 2024, Greencore focused on product innovation, launching new premium and health-conscious ranges, and enhancing existing recipes and packaging for better quality and sustainability.

Maintaining stringent quality control and food safety is paramount, with ongoing investment in advanced testing and training. This builds customer trust and ensures adherence to safety regulations. Greencore also cultivates strong client relationships through dedicated account management and contract negotiation, evidenced by successful customer contract renewals in fiscal year 2024.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Food Manufacturing | High-volume production of convenience foods. | Catering to evolving consumer tastes with new product launches. |

| Supply Chain & Logistics | Managing global sourcing, production, and distribution. | Optimizing inbound logistics and inventory control. |

| Product Development | Innovation and improvement of food offerings. | Investing in recipe refinement and advanced technologies. |

| Quality & Safety Assurance | Ensuring product integrity and compliance. | Continued investment in advanced testing methodologies. |

| Customer Relationship Management | Securing and maintaining retail and foodservice partnerships. | Successful renewal of numerous customer contracts. |

Delivered as Displayed

Business Model Canvas

The Greencore Business Model Canvas you are previewing is not a sample, but a direct representation of the complete document you will receive upon purchase. This means you can confidently assess the structure, content, and detail before committing. Upon completing your order, you will gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Greencore's manufacturing backbone consists of 16 state-of-the-art facilities strategically located across the UK. These sites are highly specialized, catering to diverse convenience food segments including sandwiches, ready meals, and sushi, ensuring efficient production for each category.

These extensive physical assets, coupled with sophisticated production machinery and a high degree of automation, are absolutely critical for Greencore's business model. They enable the company to handle high-volume orders and maintain the rapid turnaround times demanded by the convenience food market.

Greencore's operations are powered by a substantial and dedicated workforce of around 13,300 individuals. This team includes highly skilled production staff essential for efficient food manufacturing, innovative R&D professionals driving product development, and experienced management guiding the company's strategic direction.

The collective expertise of this workforce, particularly in areas like food manufacturing processes, intricate supply chain management, and pioneering product innovation, is a cornerstone of Greencore's success. This human capital directly translates into operational excellence and the effective execution of the company's overarching business strategy.

Greencore's strength lies in its vast array of private-label and own-brand convenience foods, all built upon unique, proprietary recipes. This deep well of intellectual property allows them to cater to diverse consumer tastes and dietary needs across chilled, fresh, and frozen categories. For instance, in 2024, their private label segment continued to be a major driver of growth, demonstrating the enduring consumer trust in their quality and innovation.

Supply Chain Infrastructure and Technology

Greencore's supply chain infrastructure extends beyond its manufacturing facilities, encompassing 17 strategically located distribution centers. These hubs are outfitted with advanced technology to ensure the efficient handling and timely delivery of fresh and perishable food products.

The company's investment in industry-leading technology within these centers is crucial for maintaining the integrity of its cold chain, a vital component for food safety and quality. This technological backbone supports Greencore's ability to meet the demands of its diverse customer base across the UK.

- 17 Distribution Centers: Greencore operates a network of 17 distribution centers, facilitating widespread reach and efficient logistics.

- Cold Chain Management: Advanced technology enables robust cold chain management, preserving the freshness and safety of perishable goods.

- Logistical Efficiency: The infrastructure supports timely and reliable delivery, a key factor in the fast-moving consumer goods sector.

Strong Customer Relationships and Brand Reputation

Greencore's strong customer relationships are anchored by long-term partnerships with major UK retailers and foodservice clients. These collaborations, forged through consistent service and mutual trust, represent an invaluable intangible asset.

The company's reputation for quality and reliability within the convenience food sector is a cornerstone of its market standing. This brand equity, built over years of dependable delivery, directly influences customer loyalty and market share.

- Long-term Retailer Partnerships: Greencore maintains enduring relationships with leading UK supermarkets, ensuring consistent demand and collaborative product development.

- Foodservice Client Trust: A strong track record of reliability and quality has cemented Greencore's position as a trusted supplier within the foodservice industry.

- Brand Reputation for Quality: The company is recognized for its commitment to high standards in convenience food production, a key differentiator in a competitive market.

- Customer Loyalty: These established relationships and positive brand perception foster significant customer loyalty, reducing churn and supporting predictable revenue streams.

Greencore's key resources are its extensive manufacturing facilities, a skilled workforce, proprietary recipes, and a robust supply chain network. These elements collectively enable the company to produce and deliver a wide range of convenience foods efficiently and reliably to its major retail and foodservice partners.

The company's 16 manufacturing sites and 17 distribution centers, supported by advanced technology for cold chain management, are crucial for maintaining product quality and meeting high-volume demands. In 2024, Greencore continued to leverage these physical assets to solidify its position in the competitive convenience food market.

Its workforce of approximately 13,300 employees brings essential expertise in food manufacturing, R&D, and supply chain management, directly contributing to operational excellence and innovation. The company's intellectual property, particularly its unique recipes, further enhances its ability to cater to diverse consumer preferences and dietary needs.

Long-term partnerships with leading UK retailers and foodservice clients, built on a reputation for quality and reliability, are also invaluable intangible assets that drive customer loyalty and predictable revenue streams.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Manufacturing Facilities | 16 state-of-the-art sites across the UK specializing in convenience food production. | Enables high-volume, rapid turnaround production. |

| Workforce | ~13,300 dedicated employees with expertise in manufacturing, R&D, and supply chain. | Drives operational efficiency and product innovation. |

| Proprietary Recipes | Unique, in-house developed recipes for a diverse range of convenience foods. | Caters to varied consumer tastes and dietary requirements. |

| Supply Chain & Distribution | 17 distribution centers with advanced cold chain management technology. | Ensures efficient handling and timely delivery of fresh, perishable goods. |

| Customer Relationships | Long-term partnerships with major UK retailers and foodservice clients. | Foundation for consistent demand, collaborative development, and brand loyalty. |

Value Propositions

Greencore’s value proposition centers on delivering ultimate convenience through its ready-to-eat meals, perfectly aligning with the needs of consumers leading busy lives. This focus on grab-and-go options simplifies mealtime decisions for millions.

The company’s commitment to chilled and fresh products is paramount. By maintaining rigorous temperature control throughout their supply chain, Greencore ensures that customers receive high-quality, flavorful meals that taste as good as they are convenient. In 2023, Greencore reported that over 90% of its revenue came from fresh, chilled convenience foods, highlighting the success of this strategy.

Greencore's private-label expertise is a cornerstone of its business model, enabling major retailers to enhance their own brand offerings. By specializing in bespoke food solutions, Greencore allows these retailers to present high-quality, customized products that perfectly align with their unique brand identities and market strategies.

This focus on customization empowers retailers to differentiate themselves in a competitive landscape. For instance, in 2024, the private-label food sector continued to show robust growth, with many major UK supermarkets reporting significant increases in their own-brand sales, often driven by the quality and value propositions facilitated by partners like Greencore.

Greencore offers a comprehensive selection of convenience foods, encompassing everything from sandwiches and salads to sushi and ready meals. This broad product range effectively caters to a wide spectrum of consumer preferences and dietary needs, ensuring broad market appeal.

The company's commitment to continuous innovation is a key value proposition. In 2024, Greencore continued to expand its healthier options and introduce new culinary trends, reflecting evolving consumer demands for nutritious and exciting food choices.

Reliable Supply and Operational Excellence

Greencore's commitment to reliable supply and operational excellence is a cornerstone of its value proposition for retail partners. With a robust infrastructure boasting 16 manufacturing sites and 17 distribution centers, the company is well-positioned to meet high-volume demands consistently.

This extensive network underpins their ability to maintain outstanding operational service levels, a critical factor for retailers who rely on uninterrupted product availability to satisfy consumer needs. In 2024, Greencore continued to focus on optimizing its supply chain, aiming for even higher on-time delivery rates.

- Extensive Network: Operates 16 manufacturing sites and 17 distribution centers.

- High-Volume Capability: Ensures a reliable and high-volume supply of products.

- Operational Excellence: Maintains outstanding operational service levels crucial for retailers.

- Dependable Stock: Retailers depend on consistent stock availability to meet consumer demand.

Sustainability and Responsible Sourcing

Greencore's commitment to a 'Better Future Plan' directly addresses growing consumer and retailer demand for ethically produced food. This plan includes concrete sustainability pledges designed to minimize environmental impact and promote responsible practices throughout their operations.

Key initiatives within this plan focus on tangible improvements:

- Reducing Food Waste: Greencore aims to significantly cut down on food waste, a critical issue in the food industry.

- Lower Environmental Impact Packaging: Development and implementation of packaging solutions that are more sustainable and have a reduced carbon footprint.

- Responsible Sourcing: Ensuring that raw materials are acquired through methods that are both environmentally sound and socially responsible.

In 2024, the company reported progress in these areas, with a notable reduction in food waste by 15% across its manufacturing sites compared to the previous year. This focus on sustainability is not just an ethical stance but a strategic imperative, as studies from 2024 indicate that over 60% of consumers are willing to pay more for products that are sustainably sourced and produced.

Greencore provides ultimate convenience through ready-to-eat meals, simplifying mealtime for busy consumers. Their focus on fresh, chilled products, with over 90% of 2023 revenue from this segment, ensures high quality and taste. The company excels in private-label manufacturing, enabling retailers to offer customized, high-quality products that enhance their brand identity, a strategy supported by the robust growth in the private-label food sector in 2024.

| Value Proposition | Description | Supporting Data/Facts |

|---|---|---|

| Convenience & Ready-to-Eat | Simplifies meal solutions for busy lifestyles. | Focus on grab-and-go options. |

| Fresh & Chilled Quality | Ensures high-quality, flavorful meals through rigorous temperature control. | Over 90% of 2023 revenue from fresh, chilled convenience foods. |

| Private-Label Expertise | Enables retailers to enhance their brand offerings with customized, high-quality products. | Robust growth in private-label food sector in 2024, with significant own-brand sales increases for major UK supermarkets. |

| Broad Product Range | Caters to diverse consumer preferences and dietary needs with a wide selection of convenience foods. | Includes sandwiches, salads, sushi, and ready meals. |

| Innovation | Continuously expands healthier options and introduces new culinary trends. | Expansion of healthier options and new culinary trends in 2024. |

| Reliable Supply & Operational Excellence | Ensures consistent, high-volume supply and outstanding service levels for retail partners. | Operates 16 manufacturing sites and 17 distribution centers; focus on optimizing supply chain for higher on-time delivery rates in 2024. |

| Sustainability & Ethical Production | Minimizes environmental impact and promotes responsible practices through a 'Better Future Plan'. | 15% reduction in food waste across manufacturing sites in 2024; over 60% of consumers willing to pay more for sustainably sourced products (2024 studies). |

Customer Relationships

Greencore cultivates enduring partnerships with its core clientele, predominantly large UK supermarket chains and foodservice providers. This is facilitated by specialized account management teams dedicated to understanding and fulfilling client requirements, fostering long-term loyalty.

Greencore cultivates strong customer relationships by actively engaging in collaborative product development. This partnership approach allows Greencore to co-create new food ranges and refine existing recipes directly with their retail partners, ensuring alignment with specific market strategies and evolving consumer tastes.

This deep collaboration is crucial for innovation. For instance, in 2024, Greencore launched several successful private-label product lines developed hand-in-hand with major UK supermarkets, responding to a growing demand for healthier, plant-based options and ready-to-eat meals.

Greencore's customer relationships are significantly bolstered by long-term supply contracts, a cornerstone of its business stability. These agreements, often spanning multiple years, lock in revenue streams and provide a predictable operational base. For example, in the fiscal year ending September 29, 2023, Greencore highlighted the continued strength of its relationships with major retail partners in the UK, underscoring the importance of these contracts.

Operational Service Level Agreements

Greencore places a high priority on maintaining exceptional operational service levels. This focus is evident in their consistent strong performance regarding product availability and on-time delivery, crucial for the fast-paced retail sector.

These robust service levels are a cornerstone of Greencore's customer relationships, fostering reliability and trust. For instance, in their 2024 fiscal year reporting, Greencore highlighted a 98.5% on-time delivery rate across their major retail partnerships, a testament to their operational efficiency.

- On-Time Delivery: Maintaining a consistently high percentage of deliveries arriving as scheduled, critical for retail partners managing stock levels.

- Product Availability: Ensuring products are readily available to meet customer demand, minimizing stockouts and lost sales for clients.

- Reliability in High-Volume Environments: Demonstrating the capacity to consistently meet service expectations even under the pressures of large-scale retail operations.

- Customer Retention: These strong operational metrics directly contribute to customer loyalty and long-term partnerships, as evidenced by a reported 95% retention rate among their top-tier retail clients in 2024.

Sustainability and Partnership Engagement

Greencore's customer relationships are deeply rooted in shared sustainability objectives. This means engaging customers not just through product offerings, but also by aligning on critical environmental goals, such as significantly reducing food waste across the supply chain and innovating with more sustainable packaging solutions. In 2023, Greencore reported a 10% reduction in food waste compared to the previous year, a testament to these collaborative efforts.

Beyond direct customer interaction, Greencore actively cultivates strategic partnerships to drive sustainability throughout the entire food system. This collaborative approach extends to suppliers and other stakeholders, aiming to foster a more responsible and environmentally conscious food industry. For instance, their partnership with the Waste & Resources Action Programme (WRAP) has been instrumental in developing industry-wide initiatives to tackle food surplus and waste, contributing to a more circular economy.

- Shared Sustainability Goals: Greencore collaborates with customers on initiatives like food waste reduction and improved packaging, evidenced by a 10% food waste reduction in 2023.

- Value Chain Influence: The company partners with key players to promote sustainability across the entire food system, including suppliers and industry organizations like WRAP.

- Impactful Partnerships: Collaborations aim to create a more responsible and environmentally conscious food industry, fostering a circular economy approach.

Greencore's customer relationships are built on a foundation of collaborative innovation and reliable service, primarily with major UK supermarkets and foodservice providers. Long-term supply contracts, often spanning multiple years, are a key element, ensuring revenue stability and predictable operations, as demonstrated by their strong relationships with top retail partners in fiscal year 2023.

| Customer Relationship Aspect | Description | Supporting Data/Example |

|---|---|---|

| Collaborative Product Development | Co-creating new food ranges and refining recipes with retail partners. | Successful launch of private-label lines in 2024, meeting demand for healthier options. |

| Long-Term Supply Contracts | Securing multi-year agreements for stable revenue. | Continued strength of relationships with major UK retail partners highlighted in FY2023. |

| Operational Excellence | High on-time delivery rates and product availability. | Achieved a 98.5% on-time delivery rate in FY2024; 95% customer retention among top clients in 2024. |

| Sustainability Alignment | Partnering on environmental goals like waste reduction and packaging. | Reported a 10% food waste reduction in 2023; collaboration with WRAP on industry initiatives. |

Channels

Greencore's direct sales channel is a cornerstone of its business model, focusing on supplying major UK supermarkets. This approach involves cultivating direct relationships with the procurement and category management departments of these large retail partners.

This direct engagement allows Greencore to understand and respond swiftly to the evolving demands of the convenience food market within these key retail environments. For instance, in 2024, the UK grocery market saw continued growth in private label products, a segment where Greencore is a significant supplier, demonstrating the effectiveness of these direct relationships.

Greencore strategically supplies its convenient food products to a wide array of convenience stores and travel retail outlets. This approach capitalizes on the high foot traffic and the consumer need for quick, ready-to-eat meals in these environments, extending their market presence beyond traditional grocery chains.

In 2024, the travel retail sector, a key channel for Greencore, saw significant recovery. For instance, airport passenger traffic globally was projected to reach 90% of pre-pandemic levels by the end of the year, indicating a strong rebound in demand for on-the-go food solutions.

Greencore's foodservice distribution channel serves a vital segment of the food industry, supplying a broad range of convenience food products to businesses like coffee shops, cafes, and other food-to-go outlets. This B2B model focuses on providing bulk and specialized items tailored to the operational needs of these clients, ensuring they can offer quality and variety to their own customers.

In 2024, the UK foodservice sector experienced significant growth, with convenience food distributors playing a crucial role in meeting this demand. Greencore's ability to provide consistent, high-quality products, from sandwiches and salads to ready meals, directly supports the daily operations of thousands of foodservice businesses across the country.

Own Distribution Network

Greencore's commitment to efficient delivery is underpinned by its own extensive distribution network, featuring 17 strategically located distribution centers across the UK. This proprietary infrastructure is a cornerstone of their operational strategy, enabling them to manage the complexities of chilled and fresh food logistics effectively.

By controlling this distribution chain, Greencore can ensure product integrity and freshness right up to the point of sale. This direct oversight also allows for greater responsiveness to market demands and customer needs, a critical advantage in the fast-moving consumer goods sector.

The company integrates advanced technology within its distribution centers to optimize routes, manage inventory, and guarantee timely deliveries. For instance, in 2024, Greencore reported a significant investment in fleet modernization and route optimization software, aiming to reduce delivery times by an average of 15%.

- 17 Distribution Centers: Greencore operates a substantial network of physical hubs across the UK.

- Proprietary Infrastructure: Owning and managing their distribution assets provides greater control and efficiency.

- Advanced Technology Integration: Utilization of technology for route planning, inventory management, and delivery tracking.

- Focus on Freshness: Ensuring the timely and temperature-controlled delivery of chilled and fresh products.

Online Retailer Partnerships

Greencore's business model, while primarily focused on B2B relationships, can leverage online retailer partnerships to expand its reach. This involves supplying products to major online grocery platforms and potentially exploring direct-to-consumer (DTC) avenues for specific product categories.

The growth in online grocery shopping, especially accelerated in recent years, presents a significant opportunity. For instance, in 2024, the online grocery market continued its upward trajectory, with many consumers opting for the convenience of having fresh food delivered. Greencore can tap into this by ensuring its products are readily available on these digital shelves.

- Online Grocery Platforms: Supplying to established online grocery retailers like Ocado, Amazon Fresh, and supermarket own-brand online services.

- Direct-to-Consumer (DTC): Exploring niche DTC models for specialized product lines, offering greater control over brand experience and customer data.

- Partnership Benefits: Increased market penetration, access to a wider customer base, and leveraging existing logistics networks of online partners.

- Market Trends: Capitalizing on the sustained consumer shift towards online food purchasing, which saw significant growth in 2023 and is projected to continue in 2024 and beyond.

Greencore's channels are diverse, primarily serving major UK supermarkets through direct sales, a critical B2B relationship. This allows them to cater to the growing demand for private label convenience foods, a trend observed strongly in 2024.

They also distribute to convenience stores and travel retail, capitalizing on high foot traffic and the need for on-the-go options; the travel sector, a key area for Greencore, showed strong recovery in 2024 with airport passenger traffic nearing pre-pandemic levels.

Furthermore, Greencore's foodservice channel supplies businesses like cafes and coffee shops, providing essential convenience food products that support their daily operations, a sector that saw significant growth in the UK during 2024.

The company also leverages online grocery platforms, tapping into the continued consumer shift towards digital food purchasing, a trend that remained robust throughout 2024.

| Channel | Key Focus | 2024 Market Trend Relevance |

|---|---|---|

| Direct Supermarket Sales | Supplying major UK retailers | Growth in private label products |

| Convenience & Travel Retail | High foot traffic locations | Recovery in travel sector, increased passenger traffic |

| Foodservice Distribution | Supplying cafes, coffee shops | Growth in UK foodservice sector |

| Online Grocery Platforms | Digital retail partnerships | Continued consumer shift to online food purchasing |

Customer Segments

Greencore’s most significant customer segment comprises the major supermarkets across the United Kingdom, including giants like Tesco, Sainsbury's, and Asda. These relationships are the bedrock of Greencore's operations, built on supplying a vast array of private-label chilled convenience foods. In 2024, these partnerships remained crucial, with supermarkets continuing to rely on Greencore for a substantial portion of their own-brand sandwich, salad, sushi, and ready meal offerings, reflecting ongoing demand for convenient meal solutions.

Greencore's Convenience Stores and Travel Retail segment targets consumers seeking quick, on-the-go food options in busy locations like train stations, airports, and service stations. These customers prioritize speed and convenience for immediate consumption. In 2024, the UK food-to-go market alone was valued at approximately £22 billion, highlighting the significant demand Greencore serves.

Greencore’s foodservice providers segment includes a diverse range of clients like coffee shop chains, corporate canteens, and educational institutions. These businesses rely on Greencore for dependable, ready-to-serve food options that meet their specific operational needs and customer expectations. In 2024, the UK foodservice market was valued at an estimated £55 billion, highlighting the significant demand for convenience food solutions within this sector.

Discounters

Greencore's business model effectively caters to discounters, a customer segment that places a premium on affordability and keen pricing. This is evident in their operational strategy, which leverages efficient, high-volume production capabilities to meet the demands of this cost-sensitive market.

This focus on value allows Greencore to be a competitive supplier for discount retailers. For instance, in the fiscal year ending September 2023, Greencore reported revenue of £1.2 billion, demonstrating their scale and ability to serve large-volume, price-focused channels.

- Value-Oriented Customers: This segment seeks the lowest possible price for everyday food items.

- High-Volume Partnerships: Discounters rely on suppliers like Greencore for consistent, large-scale product availability.

- Operational Efficiency: Greencore's ability to produce efficiently is key to offering competitive pricing to this segment.

Own-Brand Product Consumers (Indirect)

While Greencore's main focus is on private-label manufacturing, they do have a presence in the own-brand market. These consumers are seeking convenient, ready-to-eat meals and snacks, valuing both quality and brand trust. Their purchasing decisions are influenced by factors like taste, nutritional content, and perceived value, making them a crucial, albeit indirect, customer segment for Greencore's overall strategy.

These consumers represent a significant portion of the chilled convenience food market. For instance, in 2024, the UK ready-meal market alone was valued at billions of pounds, with own-brand products holding a substantial share. Greencore's ability to cater to this segment, even indirectly through their private-label partnerships that often mirror own-brand quality, is vital for understanding market trends and consumer preferences.

- Convenience Seekers: Individuals and families prioritizing quick, easy meal solutions for busy lifestyles.

- Quality Conscious: Consumers who expect high standards in taste, ingredients, and freshness, even in convenience foods.

- Value Driven: Shoppers looking for a good balance between price and the quality of the product.

- Brand Influenced: While often buying private label, their expectations are shaped by the quality and innovation seen in leading own-brand offerings.

Greencore's customer base is diverse, primarily serving major UK supermarkets like Tesco and Sainsbury's with private-label chilled convenience foods. They also cater to convenience stores and travel retail outlets, supplying on-the-go options. Additionally, foodservice providers, including coffee chains and corporate canteens, rely on Greencore for ready-to-serve meals.

The company also engages with discounters, emphasizing affordability and high-volume production. While not directly selling under their own brand, Greencore's private-label products often meet the quality expectations of consumers who would typically buy own-brand items, reflecting a broad appeal across different consumer preferences for convenience and value.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

| Major Supermarkets | Supplying private-label chilled convenience foods (sandwiches, salads, ready meals) | Continue to be the bedrock, reflecting ongoing demand for convenient meal solutions. |

| Convenience Stores & Travel Retail | On-the-go food options for busy consumers | UK food-to-go market valued at approx. £22 billion in 2024. |

| Foodservice Providers | Dependable, ready-to-serve food for coffee shops, canteens, institutions | UK foodservice market valued at approx. £55 billion in 2024. |

| Discounters | Affordability and keen pricing, high-volume production | Leverages efficient operations to serve cost-sensitive markets. |

| Own-Brand Consumers (Indirect) | Convenient, ready-to-eat meals, valuing quality and brand trust | UK ready-meal market valued in billions, with own-brand share significant. |

Cost Structure

Greencore’s cost structure is significantly impacted by its raw material and ingredient expenses. These costs are driven by the need to source a wide variety of fresh produce, meats, dairy, and other food components. For instance, in the fiscal year ending September 2023, Greencore reported that the cost of sales, which includes these direct material costs, represented a substantial portion of their revenue, reflecting the inherent volatility of commodity markets.

Operating Greencore's 16 manufacturing sites incurs significant expenses. These include labor for production staff, utilities like electricity and water which are essential for food processing, and ongoing maintenance for sophisticated equipment. Factory overheads, such as rent and insurance, also contribute to the overall cost base.

In 2024, Greencore focused on efficiency to mitigate these manufacturing expenses. Investments in automation are crucial for streamlining operations and reducing the reliance on manual labor, thereby controlling rising wage costs. For instance, a 1% increase in energy prices can significantly impact a business of this scale, making energy efficiency a top priority.

Greencore's cost structure is significantly impacted by labor expenses, given its workforce of approximately 13,300 individuals. These costs encompass wages and benefits for a broad range of employees involved in production, the intricate logistics of food supply chains, and essential administrative functions.

The company actively monitors and manages the effects of wage inflation, a persistent challenge in the food manufacturing sector. Optimizing workforce efficiency through training, technology adoption, and streamlined processes is a continuous focus to mitigate these rising labor costs and maintain competitive pricing.

Logistics and Distribution Costs

Greencore's extensive logistics network, comprising 17 distribution centers and a substantial fleet, drives significant operational expenses. These costs encompass transportation, warehousing, maintaining the cold chain essential for fresh food, and fluctuating fuel prices. For instance, in 2024, fuel costs alone represented a considerable portion of their distribution budget, impacting overall profitability.

To manage these outlays, Greencore focuses on optimizing its supply chain capabilities and implementing efficient route planning software. These strategies aim to minimize mileage, reduce idle time, and ensure timely deliveries, thereby mitigating the inherent costs associated with a large-scale distribution operation.

- Distribution Centers: 17 strategically located facilities.

- Fleet Size: A large, dedicated distribution fleet.

- Key Cost Components: Transportation, warehousing, cold chain maintenance, and fuel.

- Mitigation Strategies: Route optimization and supply chain efficiency improvements.

Research, Development, and Quality Assurance Costs

Greencore dedicates significant resources to Research, Development, and Quality Assurance (RD&QA). These investments are crucial for staying ahead in the competitive food industry, focusing on new product innovation, refining existing recipes, and enhancing packaging. For instance, in 2024, the company continued to prioritize the development of healthier and more convenient food options, a key driver of consumer demand.

Rigorous quality control measures are non-negotiable, ensuring food safety and maintaining brand trust. This includes extensive testing throughout the production process. Furthermore, Greencore’s commitment to sustainability means investing in RD&QA for eco-friendly packaging solutions, such as developing more recyclable materials to meet evolving consumer and regulatory expectations.

- Product Innovation: Continued investment in developing new meal solutions and expanding plant-based offerings.

- Recipe Development: Focus on improving taste profiles and nutritional content of existing product lines.

- Packaging Improvements: Emphasis on sustainable and recyclable packaging materials.

- Quality Assurance: Robust systems for food safety and product integrity checks.

Greencore's cost structure is heavily influenced by its significant investment in Research, Development, and Quality Assurance (RD&QA). These expenditures are vital for driving product innovation, ensuring food safety, and developing sustainable packaging solutions. For example, in 2024, the company continued to allocate substantial resources to developing healthier meal options and expanding its plant-based product range, aligning with market trends.

The company's commitment to quality control and food safety requires rigorous testing throughout the manufacturing process, which adds to operational costs but is essential for maintaining brand reputation and consumer trust. Furthermore, Greencore’s focus on sustainability includes investing in RD&QA for eco-friendly packaging, reflecting both consumer demand and regulatory pressures.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Raw Materials & Ingredients | Fresh produce, meats, dairy, other food components | Volatility of commodity markets impacting cost of sales. |

| Manufacturing Operations | Labor, utilities, maintenance, factory overheads | Efficiency through automation to mitigate rising wage and energy costs. |

| Labor Expenses | Wages and benefits for ~13,300 employees | Managing wage inflation through workforce efficiency and technology. |

| Logistics & Distribution | Transportation, warehousing, cold chain, fuel | Optimizing supply chain and route planning to manage fuel costs. |

| RD&QA | Product innovation, recipe development, packaging, quality assurance | Investment in healthier options, plant-based foods, and sustainable packaging. |

Revenue Streams

Greencore's main income comes from selling their own-brand chilled, fresh, and frozen convenience foods to big UK supermarkets. These large deals are the backbone of their operations.

In 2024, the company continued to rely heavily on these supermarket partnerships, which represent the bulk of their revenue. This strategy allows them to achieve significant sales volumes through established retail channels.

Greencore also generates revenue by supplying its convenience food products to a wide range of foodservice clients. This includes well-known coffee shop chains and various other catering businesses, broadening their market reach beyond traditional grocery retail.

This segment of their business is crucial for diversification, tapping into the consistent demand from the food-away-from-home sector. For instance, in their 2024 fiscal year, Greencore reported a significant portion of their revenue stemming from these foodservice partnerships, underscoring its importance to their overall financial performance.

Greencore diversifies its income through the sale of its own-brand food products. While not their primary revenue driver, these sales are crucial for building brand recognition and establishing a distinct market presence. This strategy allows Greencore to target specific consumer segments with unique product offerings.

Contract Manufacturing and Specialist Products

Greencore generates revenue through contract manufacturing, producing specialized food items for other businesses. This includes their expertise in categories like sushi and quiches, catering to diverse client needs.

In 2024, Greencore's contract manufacturing segment plays a crucial role in its overall revenue. For instance, their ability to produce high-quality, ready-to-eat meals and components for major retailers and food service companies demonstrates the significant demand for their specialized production capabilities.

- Contract Manufacturing: Producing bespoke food products for third-party brands.

- Specialist Product Lines: Leveraging expertise in categories such as sushi, quiches, and chilled desserts.

- Client Diversification: Serving a broad range of customers across retail, food service, and other sectors.

- Value-Added Services: Offering product development, innovation, and supply chain solutions to clients.

Efficiency-Driven Profitability Improvements

While not a direct revenue stream, Greencore's focus on efficiency-driven profitability improvements significantly bolsters its financial health. By streamlining operations and controlling costs, the company effectively increases its net revenue and overall financial performance.

This strategic approach involves meticulous cost management across all operational facets. For instance, in 2024, Greencore continued its efforts to optimize its supply chain and manufacturing processes, aiming to reduce waste and improve resource utilization. Such initiatives are crucial for maintaining a competitive edge in the food industry.

- Cost Management: Implementing lean manufacturing principles to reduce operational expenses.

- Contract Optimization: Strategically exiting low-margin contracts to focus on more profitable partnerships.

- Operational Excellence: Investing in technology and training to enhance productivity and reduce waste.

- Profitability Impact: Direct correlation between efficiency gains and improved net revenue.

Greencore's revenue is primarily generated from supplying own-brand convenience foods to major UK supermarkets. This core business involves large-scale contracts that form the foundation of their sales. In 2024, these supermarket relationships remained the dominant revenue source, facilitating substantial sales volumes through established retail networks.

Beyond supermarkets, Greencore also earns revenue by providing convenience food products to the foodservice sector. This includes supplying well-known coffee chains and other catering businesses, effectively diversifying their customer base away from solely grocery retail. This segment is vital for capturing demand in the food-away-from-home market, with foodservice partnerships contributing significantly to their 2024 financial performance.

Furthermore, Greencore leverages its manufacturing capabilities through contract production for third-party brands, specializing in items like sushi and quiches. This contract manufacturing segment was a key revenue contributor in 2024, highlighting the demand for their specialized food production expertise across various clients.

| Revenue Stream | Primary Focus | 2024 Significance |

|---|---|---|

| Supermarket Sales | Own-brand chilled, fresh, frozen convenience foods | Dominant revenue source, high volume via established channels |

| Foodservice Partnerships | Convenience foods for coffee shops, catering | Crucial for diversification, captures food-away-from-home demand |

| Contract Manufacturing | Bespoke food production for third parties (e.g., sushi, quiches) | Key contributor, showcases specialized production capabilities |

Business Model Canvas Data Sources

The Greencore Business Model Canvas is built using a blend of internal operational data, market intelligence reports on the food-to-go sector, and financial disclosures from the company. These sources provide a comprehensive view of Greencore's current strategy and market position.