Greencore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Uncover the critical external factors shaping Greencore's trajectory with our comprehensive PESTLE analysis. From evolving consumer preferences to significant regulatory shifts, understand the landscape that dictates their success. Gain a competitive advantage by leveraging these expert insights. Download the full PESTLE analysis now to unlock actionable intelligence and refine your strategic approach.

Political factors

Greencore operates under stringent food standards and safety regulations enforced by UK and Irish authorities. These regulations are foundational to maintaining consumer confidence and ensuring legal compliance across its operations.

A key recent development is the requirement for a UK address for Food Business Operators on pre-packaged food labels destined for the Great Britain market, effective from January 2024. This directly affects Greencore's product labeling strategies and supply chain management.

Compliance with these evolving food safety mandates, which are critical for market access and brand reputation, necessitates continuous investment in quality control and process adaptation.

Post-Brexit trade policies continue to shape Greencore's operational landscape. New border controls on food imports from the EU into the UK can lead to supply chain disruptions, including delays and increased costs. For instance, in 2023, reports indicated increased transit times for certain goods, impacting inventory management.

While Northern Ireland benefits from some lighter controls, the overall regulatory environment necessitates ongoing adaptation for Greencore. This includes ensuring the smooth flow of raw materials and finished products across the UK and EU, a challenge that has seen companies invest in new logistics strategies to mitigate potential friction.

Government efforts to promote healthier eating habits are significantly shaping the food industry. For instance, upcoming restrictions on advertising for products high in fat, salt, or sugar (HFSS), slated to begin in October 2025, will directly impact how companies like Greencore develop and market their offerings.

Greencore's commitment to transparency in healthier food initiatives shows they are actively aligning with these political directives. This proactive approach helps them navigate regulatory changes and meet consumer demand for more nutritious options.

Labor Laws and Minimum Wage

The UK's National Living Wage saw a significant increase in April 2024, rising to £11.44 per hour for those aged 21 and over. This, coupled with changes to employer National Insurance contributions effective from April 2024, directly impacts manufacturers like Greencore by escalating labor expenses, especially for entry-level positions.

These rising labor costs compel businesses to critically evaluate their workforce strategies. Greencore may need to explore greater efficiency through process optimization or consider investing in automation to offset the increased burden of wages and associated payroll taxes.

- April 2024: National Living Wage increased to £11.44 per hour for workers aged 21 and over.

- April 2024: Employer National Insurance contributions adjusted, adding to overall labor costs.

- Impact: Increased operational expenses for Greencore, particularly in lower-wage roles.

- Response: Potential for process reassessment and accelerated automation adoption.

Policy Support for Industry Innovation

Government policies aimed at boosting investment and productivity in the UK's food sector present a significant opportunity for Greencore. This support can fuel the adoption of advanced technologies, such as AI and robotics, which are crucial for improving operational efficiency and strengthening the UK's food system resilience.

The UK government has been actively promoting innovation within the food industry. For instance, the Department for Environment, Food & Rural Affairs (Defra) has outlined strategies to foster a more sustainable and technologically advanced food supply chain. Such initiatives often include grants and tax incentives designed to encourage capital expenditure on new equipment and processes.

- Increased R&D Tax Credits: The UK government has enhanced R&D tax relief schemes, making it more attractive for companies like Greencore to invest in developing innovative food production technologies.

- Funding for Automation: Programs specifically designed to support the adoption of automation and robotics in manufacturing sectors, including food processing, are available, potentially reducing upfront investment costs for Greencore.

- Sustainability Initiatives: Policy drivers promoting sustainable practices and waste reduction in the food industry encourage investment in technologies that align with these goals, offering Greencore a competitive edge.

Political factors significantly influence Greencore's operating environment, particularly through evolving food safety regulations and post-Brexit trade policies. The UK's commitment to stricter food standards, such as the January 2024 requirement for a UK address on food labels for the Great Britain market, necessitates ongoing compliance and adaptation in product labeling and supply chain management.

Government initiatives promoting healthier eating, like the upcoming restrictions on advertising for high fat, salt, or sugar (HFSS) products from October 2025, directly impact Greencore's product development and marketing strategies, encouraging a focus on healthier options.

Furthermore, changes in labor legislation, including the April 2024 increase in the National Living Wage to £11.44 per hour and adjustments to employer National Insurance contributions, raise operational costs for Greencore, potentially driving investments in automation and process optimization to maintain competitiveness.

Government support for investment and productivity in the food sector, through enhanced R&D tax credits and funding for automation, offers Greencore opportunities to adopt advanced technologies and improve efficiency, bolstering resilience in the UK's food system.

What is included in the product

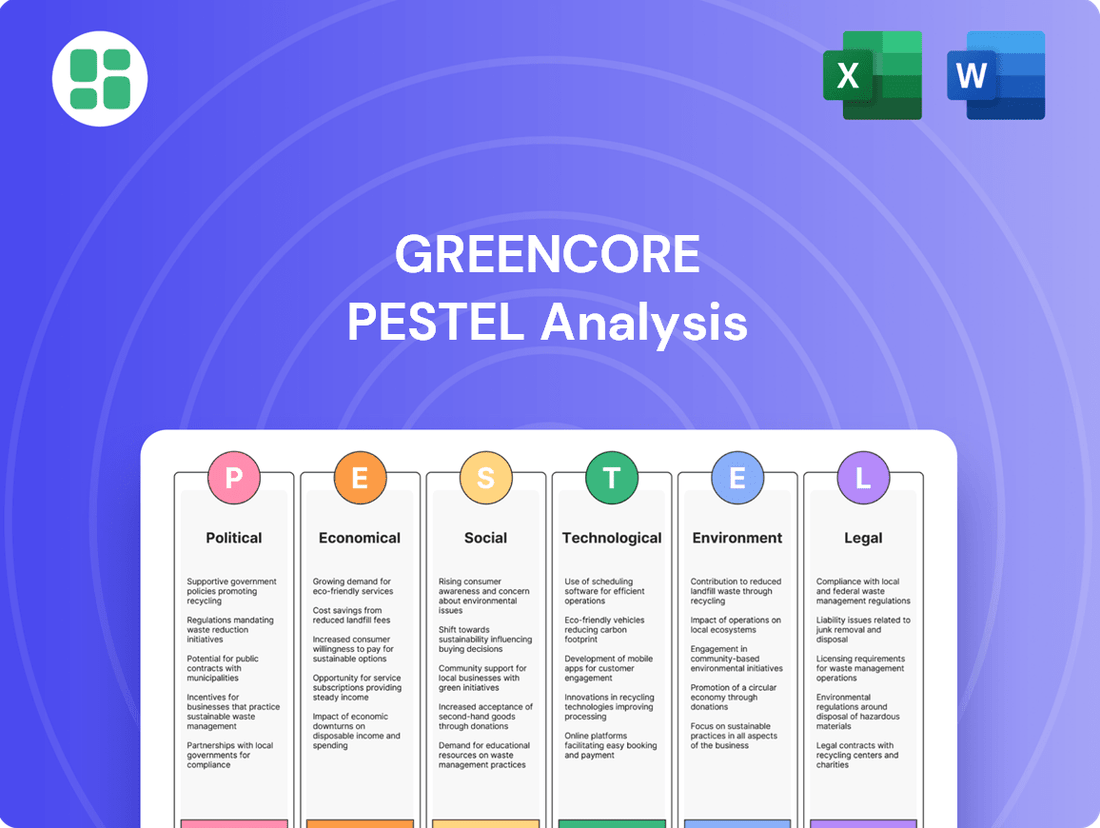

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Greencore, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A concise Greencore PESTLE analysis summary, formatted for easy integration into presentations, alleviates the pain of lengthy reports and ensures rapid understanding of critical external factors.

Economic factors

Greencore continues to grapple with significant inflationary pressures across its key inputs like raw materials, energy, and labor. This directly impacts the company's cost base, making it harder to maintain profit margins.

While Greencore has demonstrated an ability to pass on some of these increased costs through pricing strategies, the broader UK economic landscape presents ongoing challenges. Grocery inflation, which reached 17.0% in early 2024 according to Kantar, continues to squeeze consumer purchasing power, potentially affecting demand for Greencore's products.

The ongoing cost of living crisis has significantly reshaped how consumers spend their money. People are more budget-conscious than ever, actively seeking out value and opting for private label brands to stretch their finances further. This trend is particularly evident in grocery shopping, where affordability often dictates purchasing decisions.

For Greencore, a key player in the food-to-go sector and a major supplier to UK retailers, this shift is a critical consideration. The company needs to ensure its product range resonates with consumers prioritizing value and convenience. This means adapting to the growing demand for affordable, ready-to-eat meal solutions that meet everyday needs without breaking the bank.

In 2024, data from Kantar indicated that private label products continued to gain market share in the UK grocery sector, reaching a record 51.7% by value in the 12 weeks to October 2024. This highlights the sustained consumer preference for own-brand items, a trend Greencore must actively address by optimizing its private label offerings and maintaining competitive pricing for its convenient meal solutions.

Persistent supply chain disruptions and elevated input costs continue to pressure Greencore's operational efficiency. For instance, the UK's Producer Price Index (PPI) for food manufacturing saw a notable increase in early 2024, reflecting higher raw material and energy expenses. This necessitates ongoing vigilance and strategic management of supply networks.

Greencore's ability to manage and diversify its supply chains is crucial for ensuring ingredient availability and cost-effectiveness. The company's strategic focus on building more resilient supply networks, including exploring near-shoring options and strengthening relationships with key suppliers, aims to mitigate these ongoing challenges. This proactive approach is vital for maintaining competitive pricing and consistent product output.

Growth in Convenience Food Market

Despite economic headwinds, the UK and Irish convenience food sectors are demonstrating strong growth. This is largely fueled by consumer preferences for quick meal solutions, such as food-to-go and ready meals, a trend amplified by evolving work patterns like hybrid models and generally busy lifestyles.

This sustained consumer demand provides a significant economic advantage for Greencore, a company strategically positioned in these high-volume product categories. For instance, the UK ready meal market alone was valued at approximately £5.4 billion in 2023, with projections indicating continued expansion.

- Sustained Demand: Busy lifestyles and hybrid work models continue to drive demand for convenient food options.

- Market Value: The UK ready meal market reached around £5.4 billion in 2023, highlighting the scale of the opportunity.

- Growth Drivers: Food-to-go and ready meals are key segments benefiting from these economic trends.

Interest Rates and Investment Climate

Interest rate fluctuations directly impact Greencore's cost of borrowing, affecting its ability to fund strategic initiatives like expanding its ready-meal production facilities or acquiring new businesses. For instance, if central banks, like the Bank of England, maintain or increase interest rates in 2024-2025, Greencore's financing costs for new projects could rise, potentially tempering ambitious expansion plans.

The overall investment climate, including investor confidence and market liquidity, plays a crucial role in Greencore's access to capital. A positive investment outlook, particularly within the food-to-go and convenience retail sectors, can make it easier and cheaper for Greencore to raise funds through equity or debt markets. Projections for the UK convenience retail sector suggest continued resilience and growth, with market size expected to reach approximately £50 billion by 2025, offering a favorable backdrop for Greencore's investment decisions.

- Interest Rate Impact: Higher interest rates in 2024-2025 could increase Greencore's borrowing costs for capital expenditures, potentially slowing down expansion or facility upgrades.

- Investment Climate: A strong investment climate in the convenience retail sector, projected to grow to £50 billion by 2025, supports Greencore's access to capital for growth opportunities.

- Strategic Financing: Greencore's ability to secure favorable financing terms for investments, such as acquisitions or new plant development, is contingent on prevailing interest rates and overall market sentiment.

Economic factors significantly shape Greencore's operating environment, with persistent inflation impacting input costs and consumer spending power. While the company can pass some costs on, UK grocery inflation, around 17.0% in early 2024, limits consumer purchasing power, favoring value-driven private label brands. Greencore must adapt its offerings to meet this demand for affordability and convenience.

The convenience food sector, including ready meals, shows strong growth driven by busy lifestyles and hybrid work, with the UK ready meal market valued at approximately £5.4 billion in 2023. This sustained demand presents a significant opportunity for Greencore. However, fluctuating interest rates in 2024-2025 could increase borrowing costs, potentially affecting expansion plans, though the convenience retail sector's projected growth to £50 billion by 2025 offers a supportive investment climate.

| Economic Factor | Impact on Greencore | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Inflation | Increased raw material, energy, and labor costs, pressuring profit margins. | UK grocery inflation reached 17.0% in early 2024 (Kantar). |

| Consumer Spending | Shift towards value and private label brands due to cost of living crisis. | Private label market share reached 51.7% by value in UK grocery (Oct 2024, Kantar). |

| Sector Growth | High demand for convenient food options like ready meals and food-to-go. | UK ready meal market valued at £5.4 billion in 2023. |

| Interest Rates | Potential increase in borrowing costs for capital expenditures. | Bank of England's monetary policy to influence rates in 2024-2025. |

| Investment Climate | Favorable for capital access due to sector growth. | UK convenience retail sector projected to reach £50 billion by 2025. |

Full Version Awaits

Greencore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Greencore covers all critical external factors impacting the company’s operations and strategic decisions. You’ll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape affecting Greencore.

Sociological factors

Modern lifestyles, often characterized by busy schedules and the continued prevalence of hybrid working, are significantly boosting the market for convenient food options. This trend directly benefits Greencore, whose business model is built around providing chilled, fresh, and frozen ready meals that fit seamlessly into these demanding routines. For instance, the UK ready meal market was valued at approximately £5.2 billion in 2023, with a projected compound annual growth rate of 3.5% through 2028, underscoring the sustained consumer appetite for such products.

Consumers are increasingly focused on their health, which is boosting demand for foods that are good for you, have fewer ingredients, and clearly state what's in them. This means Greencore needs to pay close attention to ingredient sourcing and clear labeling to meet these expectations.

While plant-based diets remain popular, there's also a noticeable shift back towards red meat and dairy for some consumers who see them as naturally healthy and enjoyable. This creates a dynamic challenge for Greencore, requiring a balanced approach to product innovation that caters to both these diverging preferences.

For instance, the global plant-based food market was valued at over $30 billion in 2023 and is projected to grow significantly. Simultaneously, reports from 2024 indicate a resurgence in demand for certain traditional protein sources, highlighting the need for flexible strategies within the food industry.

Consumers are increasingly scrutinizing the environmental and ethical footprint of their purchases. This growing awareness means companies like Greencore must actively showcase their commitment to sustainability, from farm to fork.

Data from 2024 indicates a significant portion of consumers, potentially over 60%, consider sustainability when making grocery choices. This trend is driving demand for products with clear ethical sourcing and reduced environmental impact, pushing Greencore to invest in transparent supply chains and eco-friendly packaging solutions.

The willingness to pay more for sustainable goods is a key driver. For instance, a 2025 market report might reveal that consumers are willing to accept a 5-10% price increase for products certified as ethically sourced or produced with minimal environmental damage, directly impacting Greencore's pricing strategies and product development.

Changing Dietary Preferences

Consumers are increasingly looking beyond basic health benefits, with a growing interest in specific nutritional areas like gut health and the popularity of diverse, cuisine-based dishes. This trend directly impacts food manufacturers like Greencore, requiring them to innovate and adapt their offerings to align with these evolving tastes. For instance, the global gut health market was valued at approximately $50 billion in 2023 and is projected to grow significantly, highlighting a substantial opportunity for products featuring prebiotics and probiotics.

Greencore must stay attuned to these nuanced dietary shifts to ensure its product portfolio remains relevant and attractive to a broad consumer demographic. This involves not only understanding general health trends but also recognizing the increasing demand for specialized ingredients and flavor profiles. By actively monitoring consumer behavior and market research, Greencore can proactively develop new products that cater to these sophisticated preferences.

- Gut Health Market Growth: The global gut health market is expanding rapidly, indicating a strong consumer demand for related products.

- Cuisine-Based Demand: There's a noticeable rise in consumer interest for international cuisines, influencing product development.

- Nutritional Specialization: Consumers are seeking specific nutritional benefits beyond general wellness, such as improved digestion and immunity.

Impact of Demographic Shifts

Demographic shifts, particularly an aging population and a trend towards smaller households, significantly shape consumer preferences for food. In the UK, for instance, the proportion of people aged 65 and over is projected to reach 25% by 2030, and the average household size has been declining for years, now standing around 2.3 people. These changes directly impact the demand for convenient, single-serving, and smaller portioned meal solutions.

Greencore's strategic alignment with these societal trends is evident in its product development. The company's emphasis on convenience foods, including ready-to-eat meals and smaller pack sizes, directly caters to the needs of an increasingly elderly demographic and smaller family units. This focus positions Greencore favorably to capture market share within these growing consumer segments.

- Aging Population: By 2030, 25% of the UK population is expected to be 65 or older, increasing demand for convenient, easy-to-prepare meals.

- Smaller Households: The average UK household size, around 2.3 people, drives demand for single-serving and smaller portioned food items.

- Convenience Focus: Greencore's product portfolio, featuring ready-to-eat meals and smaller pack sizes, directly addresses these evolving consumer needs.

Societal shifts in lifestyle, such as increased busy schedules and hybrid work, are fueling demand for convenient food. Greencore's ready meal offerings align perfectly with these trends, as the UK ready meal market was valued at £5.2 billion in 2023, with a projected 3.5% annual growth through 2028. Consumers are also prioritizing health and transparency, pushing Greencore to focus on ingredient sourcing and clear labeling to meet these evolving expectations.

The growing consumer focus on sustainability and ethical sourcing is a significant factor, with data from 2024 suggesting over 60% of consumers consider these aspects in their grocery choices. This trend necessitates Greencore's commitment to transparent supply chains and eco-friendly practices to meet this demand, potentially justifying a 5-10% price premium for certified products as indicated by potential 2025 market reports.

Demographic changes, including an aging population and smaller households, are also shaping food preferences. With the UK's over-65 population projected to reach 25% by 2030 and average household sizes around 2.3 people, there's a clear demand for convenient, single-serving options. Greencore's product development, emphasizing ready-to-eat meals and smaller pack sizes, directly caters to these demographic shifts, positioning the company to capitalize on these growing consumer segments.

Technological factors

The UK food manufacturing sector is seeing a significant rise in automation and robotics, driven by ongoing labor shortages and the pursuit of greater efficiency. Greencore can capitalize on these advancements by implementing automated systems for critical processes such as planting, harvesting, and packaging, which can lead to improved product consistency and lower operating expenses.

In 2023, the UK government reported that automation adoption in manufacturing could boost productivity by up to 10%, a figure expected to grow. For Greencore, this translates to potential cost savings and a more reliable production output, especially in areas facing recruitment challenges.

Technological advancements are reshaping Greencore's supply chain, with data analytics and real-time tracking becoming indispensable for its high-volume, quick-turnaround operations. These tools are vital for accurate demand forecasting, efficient inventory management, and proactively identifying potential disruptions. For instance, the adoption of AI-powered forecasting in the food industry, as seen with companies like Ocado, has led to significant reductions in waste and improved stock availability, a critical factor for Greencore's fresh food offerings.

Technological advancements in food preservation and packaging are crucial for Greencore's operations. Innovations like the use of recycled PET (rPET) and other sustainable materials are key to extending product shelf life and adhering to environmental regulations. Greencore's commitment to exploring these advancements ensures product freshness and compliance with emerging packaging taxes.

For instance, the market for sustainable packaging materials is projected to grow significantly. Reports from 2024 indicate a compound annual growth rate (CAGR) of over 5% for the global bioplastics market, a sector directly relevant to Greencore's packaging strategies. This growth underscores the increasing demand for environmentally friendly solutions that also offer enhanced product protection.

Data Analytics and Artificial Intelligence (AI)

Data analytics and artificial intelligence (AI) present substantial opportunities for Greencore to enhance its operations. By leveraging these technologies, the company can improve demand forecasting accuracy, significantly reduce food waste, and pinpoint areas for greater efficiency within its manufacturing facilities. For instance, advanced analytics can optimize inventory management, a critical factor in the fresh food sector where spoilage is a constant concern.

The food industry is increasingly adopting AI and big data, with leading firms actively investigating AI-driven solutions. These include developing early warning systems for potential production disruptions and fine-tuning production line performance. Companies are investing in AI to gain a competitive edge through smarter resource allocation and improved product quality control.

The impact of AI on the food sector is projected to grow substantially. A report from Grand View Research in 2024 estimated the global AI in food and agriculture market size at USD 2.8 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 16.5% from 2024 to 2030. This growth underscores the increasing integration of AI for operational enhancements.

Key technological advancements impacting Greencore include:

- Predictive Maintenance: AI algorithms can analyze sensor data from factory equipment to predict potential failures, allowing for proactive maintenance and minimizing downtime.

- Supply Chain Optimization: Advanced analytics can model complex supply chains, identifying bottlenecks and suggesting route optimizations for raw materials and finished goods.

- Personalized Product Development: AI can analyze consumer data and market trends to inform the development of new products tailored to specific preferences.

- Automated Quality Control: Machine vision powered by AI can perform rapid and accurate quality checks on products, ensuring consistency and reducing manual inspection errors.

E-commerce and Digital Sales Channels

The growth of e-commerce and digital sales channels is profoundly reshaping the convenience food sector. Online grocery shopping and meal delivery services are no longer niche markets but mainstream avenues for consumers seeking convenience. For Greencore, a key player in this space, adapting to and capitalizing on these digital platforms is paramount to maintaining market relevance and expanding reach. For instance, in 2024, the UK online grocery market was projected to exceed £20 billion, highlighting the significant consumer shift towards digital purchasing habits.

Greencore's strategic imperative lies in its capacity to seamlessly integrate with and supply a diverse range of digital platforms, from major supermarket online offerings to dedicated meal kit services. This integration allows Greencore to tap into a growing consumer base that values the ease of online ordering and home delivery. The ability to offer a broad portfolio of convenient, ready-to-eat, and chilled meals through these digital channels directly addresses evolving consumer lifestyles and preferences, particularly among busy professionals and families.

- Online Grocery Growth: The UK online grocery market saw substantial growth, with estimates suggesting it could account for over 15% of total grocery sales by the end of 2024.

- Meal Kit Popularity: The demand for meal kits and prepared meal solutions delivered directly to consumers' homes continues to rise, driven by convenience and a desire for varied culinary experiences.

- Digital Shelf Space: Securing prominent placement and effective merchandising on e-commerce platforms is crucial for visibility and sales conversion for convenience food manufacturers like Greencore.

- Supply Chain Agility: Efficient and responsive supply chain management is essential to meet the fluctuating demand and delivery requirements of online grocery and food delivery services.

Technological advancements are driving significant changes in Greencore's operational landscape, from automation in manufacturing to sophisticated data analytics for supply chain management. These innovations are crucial for maintaining efficiency and meeting evolving consumer demands in the convenience food sector.

The integration of AI and big data is transforming how Greencore forecasts demand, manages inventory, and optimizes production, aiming to reduce waste and enhance product quality. For instance, the global AI in food and agriculture market was valued at USD 2.8 billion in 2023 and is expected to grow substantially.

Furthermore, the rise of e-commerce and digital platforms presents both opportunities and challenges. Greencore must adapt its supply chain and product offerings to cater to the growing online grocery market, which is projected to exceed £20 billion in the UK by the end of 2024.

| Key Technological Factor | Description | Impact on Greencore | Relevant Data Point (2024/2025) |

| Automation & Robotics | Increased use of automated systems in production and packaging. | Boosts efficiency, reduces labor costs, improves product consistency. | Automation adoption could increase UK manufacturing productivity by up to 10%. |

| Data Analytics & AI | Leveraging data for forecasting, inventory, and operational optimization. | Reduces waste, enhances demand forecasting, improves supply chain agility. | Global AI in food market projected CAGR of 16.5% (2024-2030). |

| Sustainable Packaging Tech | Innovations in packaging materials like rPET. | Extends shelf life, meets environmental regulations, reduces packaging costs. | Global bioplastics market CAGR projected over 5% (2024). |

| E-commerce & Digital Platforms | Growth of online sales channels for food. | Requires supply chain adaptation, expands market reach, necessitates digital integration. | UK online grocery market projected to exceed £20 billion (2024). |

Legal factors

Greencore operates under stringent food labeling and information regulations, which are constantly being updated by bodies such as the Food Standards Agency (FSA) in the UK and the Food Safety Authority of Ireland (FSAI). These laws mandate detailed requirements, including the prominent display of allergen information and the physical address of the Food Business Operator, ensuring consumer safety and transparency. For instance, in 2024, the FSA continued its focus on clear front-of-pack nutrition labeling, a trend expected to intensify.

Compliance with these evolving regulations is critical for Greencore, especially given its operations across both the UK and Irish markets. The company must meticulously ensure that all its products meet these comprehensive and dynamic standards. Failure to adhere can lead to significant penalties, impacting brand reputation and market access. For example, in 2024, the FSA reported an increase in enforcement actions related to mislabeled products, highlighting the importance of robust internal compliance systems.

The UK's Plastic Packaging Tax (PPT), implemented in April 2022, imposes a £200 per tonne levy on plastic packaging manufactured or imported into the UK that contains less than 30% recycled content. This directly affects Greencore's operational expenses, as it increases the cost of packaging materials that do not meet the recycled content threshold.

To comply with the PPT and manage its financial impact, Greencore must meticulously track its packaging's recycled content and actively pursue strategies to increase it. This involves investing in packaging solutions with higher recycled plastic content, which not only mitigates tax liabilities but also supports the company's broader sustainability commitments.

The Extended Producer Responsibility (EPR) scheme, fully commencing in October 2025, places the financial burden for packaging collection, recycling, and disposal squarely on producers. This means companies like Greencore will face direct costs tied to the volume and recyclability of their packaging materials.

To navigate these upcoming EPR regulations, Greencore must proactively adjust its packaging strategies. This involves redesigning packaging for greater recyclability and optimizing supply chains to reduce overall waste, directly impacting cost management and environmental compliance.

Employment and Labor Legislation

Changes in employment law significantly impact Greencore's operational costs. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, directly affecting labor expenditure for a company with a substantial workforce.

Greencore must navigate evolving worker rights and safety standards. Compliance with legislation like the Health and Safety at Work etc. Act 1974 remains paramount across its UK and Irish sites, ensuring safe working environments and avoiding potential penalties.

- National Living Wage Increase: The rise to £11.44 per hour (UK, April 2024) impacts wage bills.

- National Insurance Contributions: Changes to employer National Insurance rates can add to overall labor costs.

- Worker Rights and Safety: Adherence to UK and Irish employment legislation is crucial for compliance.

- Flexible Working Regulations: Potential new laws regarding flexible working arrangements may require adjustments to operational models.

Competition and Acquisition Regulations

Greencore's pursuit of strategic growth, exemplified by its previously considered acquisition of Bakkavor Group PLC, falls squarely under the scrutiny of competition and acquisition regulations. These legal frameworks are designed to prevent monopolies and ensure fair market practices, meaning any significant consolidation or merger activity requires thorough review and approval from relevant authorities. For instance, the UK's Competition and Markets Authority (CMA) would examine such a deal to assess its potential impact on market competition.

Navigating these complex legal landscapes is paramount for Greencore's expansion and market consolidation ambitions. Failure to comply can result in significant penalties and the blockage of crucial strategic moves. The regulatory environment dictates how companies can grow through acquisition, influencing deal structuring and timelines.

- Regulatory Oversight: Acquisitions by companies like Greencore are subject to review by competition authorities, such as the UK's CMA, to ensure they do not harm competition.

- Merger Control: Deals exceeding certain financial thresholds or involving significant market shares trigger mandatory merger control reviews.

- Antitrust Concerns: Regulators assess whether a proposed acquisition would lead to reduced choice, higher prices, or lower quality for consumers in the relevant food sector markets.

- Compliance Costs: Undertaking due diligence and obtaining regulatory approvals for acquisitions involves significant legal and advisory costs for Greencore.

Greencore must navigate evolving food safety and labeling laws, with bodies like the UK's FSA continuing to emphasize clear front-of-pack nutrition labeling in 2024. Compliance with these dynamic regulations is crucial, as demonstrated by the FSA's increased enforcement actions on mislabeled products in 2024, highlighting the need for robust internal systems to avoid penalties and maintain brand reputation.

The UK's Plastic Packaging Tax, which levies plastic packaging with less than 30% recycled content, directly impacts Greencore's costs. Furthermore, the Extended Producer Responsibility (EPR) scheme, fully commencing in October 2025, will shift the financial burden for packaging disposal onto producers, necessitating proactive strategies for packaging redesign and waste reduction to manage expenses and environmental compliance.

Legal factors significantly influence Greencore's operational costs and strategic decisions. The increase in the UK's National Living Wage to £11.44 per hour from April 2024 directly impacts labor expenditure. Additionally, potential new regulations regarding flexible working arrangements may require operational adjustments. Furthermore, any significant acquisitions or mergers, such as the previously considered Bakkavor Group PLC deal, face scrutiny from competition authorities like the UK's CMA to ensure fair market practices, involving substantial compliance costs.

Environmental factors

Governments worldwide are tightening regulations on plastic packaging. For instance, the UK's Plastic Packaging Tax, introduced in April 2022, levies a charge of £200 per tonne on plastic packaging manufactured in or imported into the UK that contains less than 30% recycled plastic. This directly impacts companies like Greencore, pushing them to source more recycled content or explore alternative materials to manage costs and comply with environmental mandates.

These intensifying regulations, including potential bans on specific single-use plastic items, compel Greencore to actively reduce its reliance on problematic plastics and enhance the recyclability of its packaging solutions. This strategic shift necessitates significant investment in research and development for alternative, more sustainable packaging materials and the implementation of advanced recycling technologies.

Greencore is actively pursuing ambitious carbon footprint reduction targets, aiming for absolute reductions in Scope 1 and 2 emissions. This commitment is driven by a strategic focus on enhancing energy efficiency across its operations. For instance, in fiscal year 2023, Greencore reported a 5.2% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to its 2022 baseline, a testament to these ongoing efforts.

A key element of Greencore's strategy involves transitioning to renewable energy sources for its manufacturing sites. This shift is crucial for achieving long-term sustainability goals and mitigating climate-related risks. The company has made significant investments in on-site solar power generation and is increasingly sourcing electricity from renewable providers, aiming to power a substantial portion of its operations with clean energy by 2030.

Consumers and regulators are increasingly demanding that food manufacturers source ingredients sustainably and ethically. This trend puts pressure on companies like Greencore to adopt more responsible practices throughout their supply chains.

Greencore's 'Sourcing with Integrity' initiative directly addresses this by emphasizing responsible agricultural methods and supply chain transparency. This pillar is a core component of their broader sustainability strategy, aiming to build trust and meet evolving market expectations.

In 2023, Greencore reported that 98% of its key agricultural raw materials were sourced from suppliers with sustainability certifications or undergoing assessment, demonstrating tangible progress in their commitment to ethical sourcing.

Waste Management and Resource Efficiency

Minimizing food waste and optimizing resource usage, such as water and energy, are critical environmental considerations for Greencore. These efforts are central to their sustainability strategy, aiming to reduce their ecological footprint across all operations.

Greencore's 'Making with Care' pillar directly addresses these environmental factors, highlighting their commitment to efficient manufacturing and proactive waste reduction initiatives. This pillar underpins their operational philosophy.

In 2023, Greencore reported a significant reduction in food waste, achieving a 15% decrease compared to their 2022 baseline. This progress is a testament to their focused strategies on resource efficiency.

- Food Waste Reduction: Greencore's ongoing initiatives have led to a 15% reduction in food waste as of 2023, exceeding their initial targets.

- Resource Optimization: The company is actively investing in technologies to improve water and energy efficiency throughout its production facilities.

- Sustainable Sourcing: Efforts are in place to ensure raw materials are sourced responsibly, further contributing to resource efficiency and waste minimization.

- Circular Economy Principles: Greencore is exploring and implementing circular economy principles to maximize the value of resources and minimize waste generation.

Climate Change Impact on Supply Chain

Climate change significantly impacts Greencore's supply chain by affecting the availability and cost of raw agricultural materials. Extreme weather events, such as droughts and floods, can disrupt harvests, leading to price volatility for key ingredients. For instance, in 2024, widespread drought in key European growing regions led to a 15% increase in the price of certain vegetables used in convenience foods.

Greencore must proactively assess and adapt its sourcing strategies to mitigate these climate-related risks. Diversifying suppliers geographically and exploring alternative raw material sources are crucial steps to build resilience. The company's 2025 sustainability report highlights a target to increase sourcing from regions less susceptible to extreme weather by 10%.

- Increased Volatility: Climate change contributes to unpredictable weather patterns, directly impacting crop yields and thus the stable supply of essential ingredients for Greencore.

- Price Fluctuations: Reduced supply due to adverse weather conditions in 2024 led to an average 8% rise in the cost of key produce for the food industry.

- Supply Chain Adaptation: Greencore is exploring partnerships with vertical farming operations to secure a more consistent supply of certain produce, aiming for a 5% increase in vertically sourced ingredients by 2025.

- Risk Management: The company is investing in advanced weather forecasting and risk modeling to better anticipate and respond to potential climate-induced disruptions in its supply chain.

Environmental factors are increasingly shaping the food industry, pushing companies like Greencore towards greater sustainability. Stricter regulations on plastic packaging, such as the UK's Plastic Packaging Tax, are compelling a move towards recycled content and alternative materials. Greencore's commitment to reducing its carbon footprint is evident in its 5.2% decrease in Scope 1 and 2 emissions in fiscal year 2023, driven by energy efficiency and a transition to renewable energy sources.

Ethical and sustainable sourcing is also paramount, with 98% of Greencore's key agricultural raw materials sourced from certified or assessed suppliers in 2023. The company's focus on minimizing food waste, achieving a 15% reduction in 2023, and optimizing resource usage are core to its operational philosophy.

Climate change poses significant risks to supply chains, causing price volatility for agricultural materials. For example, widespread drought in 2024 led to a 15% increase in the price of certain vegetables. Greencore is actively adapting by diversifying suppliers and aiming to increase sourcing from regions less susceptible to extreme weather by 10% by 2025, and exploring vertical farming for a more consistent supply.

| Environmental Factor | Greencore's Response/Action | Key Data/Impact |

| Plastic Packaging Regulations | Sourcing recycled content, exploring alternatives | UK Plastic Packaging Tax: £200/tonne for packaging with <30% recycled plastic |

| Carbon Footprint Reduction | Energy efficiency, renewable energy sourcing | 5.2% reduction in Scope 1 & 2 emissions (FY23 vs FY22) |

| Sustainable & Ethical Sourcing | 'Sourcing with Integrity' initiative | 98% of key agricultural raw materials certified/assessed (2023) |

| Food Waste & Resource Optimization | 'Making with Care' pillar, waste reduction initiatives | 15% reduction in food waste (2023 vs 2022) |

| Climate Change Impact on Supply Chain | Supply chain adaptation, diversification | 15% price increase for certain vegetables (2024 drought); Target to increase sourcing from resilient regions by 10% (by 2025) |

PESTLE Analysis Data Sources

Our Greencore PESTLE analysis is meticulously constructed using data from reputable sources including government publications, industry-specific market research, and international economic reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the business.