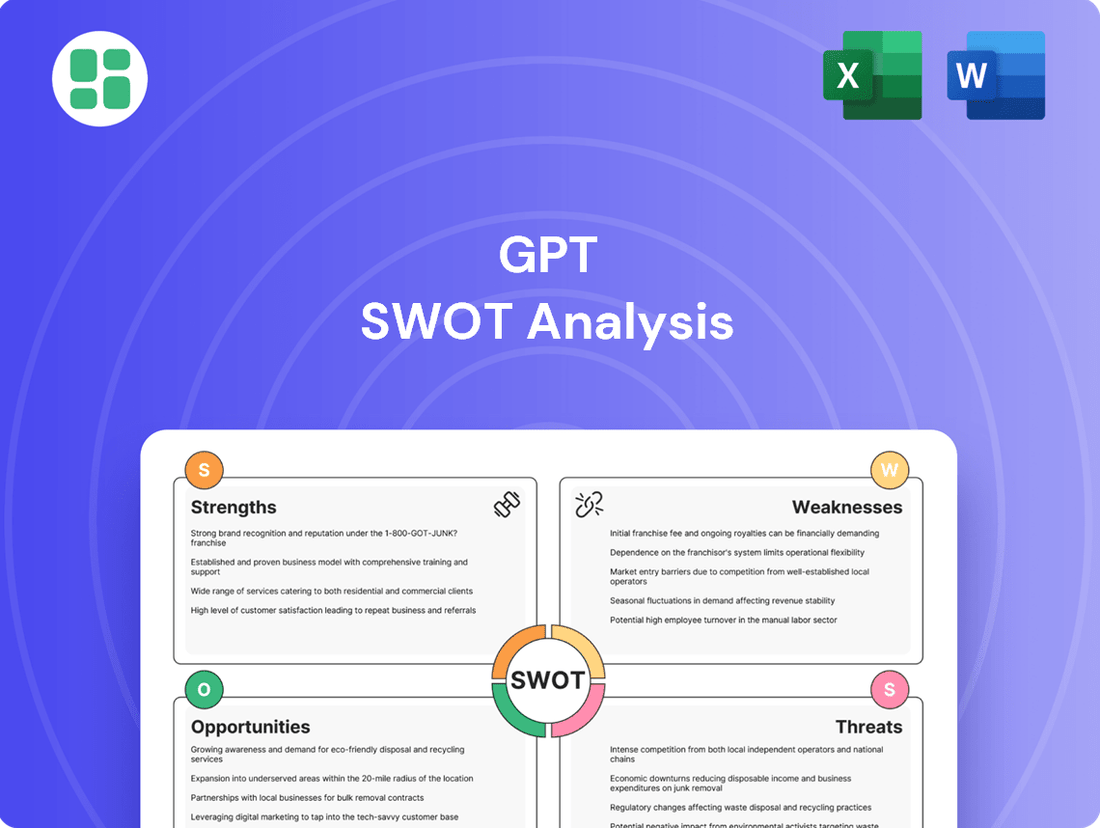

GPT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GPT Bundle

GPT's immense potential lies in its advanced natural language processing capabilities, offering unparalleled opportunities for innovation across industries. However, navigating its ethical considerations and potential for misuse requires careful strategic planning.

Want to fully understand GPT's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

GPT Group's strength lies in its widely spread property holdings, encompassing retail, office, and logistics sectors throughout Australia. This broad diversification acts as a buffer against downturns in any single market segment, ensuring a more consistent flow of income and a wider reach across different economic conditions.

As of December 31, 2024, the company reported an impressive occupancy rate of 98.6% across its diverse portfolio. This high level of utilization underscores the desirability and strong demand for GPT's properties, contributing significantly to its financial stability and revenue generation.

GPT Group demonstrates a strong financial foundation, evidenced by its net gearing of 28.7% as of December 2024, comfortably within its target range of 25% to 35%. This healthy leverage position is further supported by $1.1 billion in available liquidity, providing significant financial flexibility.

The company's robust financial health is recognized by leading credit rating agencies. GPT Group holds an investment-grade credit rating of A- from S&P and A2 from Moody's. These ratings are crucial as they grant GPT Group favorable access to global capital markets, enabling efficient and cost-effective funding for its operations and growth initiatives.

GPT's strategic emphasis on expanding its investment management arm positions it as a key player in Australia's diversified real estate investment landscape. This focus is designed to boost capital efficiency and unlock significant growth potential.

As of March 2025, the platform oversees an impressive $34.7 billion in assets under management. A substantial portion, $22.6 billion, originates from third-party capital, highlighting strong client trust and market demand for GPT's expertise.

High Occupancy and Operational Performance

GPT's property portfolio is performing exceptionally well, with occupancy rates that speak to strong tenant demand and effective management. As of the close of 2024, the office sector maintained a high occupancy of 94.7%, while the logistics and retail segments achieved near-perfect occupancy at 99.5% and 99.8% respectively. This consistent demand highlights the desirability of GPT's assets.

The operational strength is further evidenced by the retail portfolio's financial performance. In 2024, this sector saw a robust like-for-like income growth of 4.9%, indicating successful leasing strategies and rental income generation. These figures underscore GPT's ability to attract and retain tenants, even in varying market conditions.

- Office Occupancy: 94.7% (End of 2024)

- Logistics Occupancy: 99.5% (End of 2024)

- Retail Occupancy: 99.8% (End of 2024)

- Retail Like-for-Like Income Growth: 4.9% (2024)

Leadership in Sustainability

GPT Group's leadership in sustainability is a significant strength. The company achieved carbon neutral certification for all its owned and managed operational assets by 2024, a major environmental milestone. This commitment to ESG principles was recognized in S&P Global's 2025 Corporate Sustainability Assessment, where GPT ranked first among REITs.

This strong ESG performance not only reflects environmental responsibility but also translates into tangible business benefits. The focus on sustainability is directly linked to optimizing asset performance, which in turn enhances the long-term value of GPT's portfolio. This strategic approach positions GPT favorably in an increasingly environmentally conscious investment landscape.

- Carbon Neutral Certification: Achieved across all owned and managed operational assets by 2024.

- S&P Global Ranking: Ranked first among REITs in the 2025 Corporate Sustainability Assessment.

- ESG Integration: Demonstrates a commitment to Environmental, Social, and Governance principles.

- Value Enhancement: Sustainability efforts directly contribute to optimizing asset performance and long-term portfolio value.

GPT Group's diversified property portfolio across retail, office, and logistics sectors in Australia provides a stable income stream and resilience against market fluctuations. Its strong financial footing, with net gearing at 28.7% (December 2024) and $1.1 billion in liquidity, coupled with investment-grade credit ratings of A- (S&P) and A2 (Moody's), ensures access to capital for growth. The company's investment management arm, overseeing $34.7 billion in assets under management as of March 2025, further solidifies its market position.

| Metric | Value | As Of |

|---|---|---|

| Overall Occupancy Rate | 98.6% | December 31, 2024 |

| Office Occupancy | 94.7% | End of 2024 |

| Logistics Occupancy | 99.5% | End of 2024 |

| Retail Occupancy | 99.8% | End of 2024 |

| Retail Like-for-Like Income Growth | 4.9% | 2024 |

| Net Gearing | 28.7% | December 2024 |

| Available Liquidity | $1.1 billion | December 2024 |

| S&P Credit Rating | A- | N/A |

| Moody's Credit Rating | A2 | N/A |

| Assets Under Management | $34.7 billion | March 2025 |

What is included in the product

Analyzes GPT’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address strategic weaknesses and external threats, thereby alleviating concerns about competitive disadvantage.

Weaknesses

GPT's financial performance in 2024 was significantly impacted by property valuation declines, leading to a statutory loss after tax of $200.7 million. A substantial portion of this loss, $770.7 million, was directly attributable to these valuation decreases.

The office property portfolio, a key component of GPT's assets, experienced a notable net valuation decline of 16.8% during the year. This sharp decrease highlights the company's vulnerability to downturns in the commercial real estate market, particularly within the office sector.

The office market continues to present headwinds, even with occupancy rates showing improvement. Flexible work arrangements remain a significant factor, contributing to sustained pressure on the sector.

Tenant incentives, a key indicator of market softness, saw a slight increase to 35% of gross rents in 2024. This trend, coupled with the ongoing, albeit slowing, growth in office capitalization rates, suggests continued downward pressure on asset valuations.

GPT's reliance on capital-intensive development presents a significant weakness. Its substantial $3 billion development pipeline, featuring projects like Rouse Hill Town Centre and Yiribana West, necessitates considerable upfront investment, tying up valuable capital. This can limit financial flexibility and expose the company to the inherent risks associated with large-scale construction, including potential cost overruns and construction delays.

Slower Revenue Growth Forecast

Analysts are projecting a more modest revenue expansion for GPT, with an anticipated annual growth rate of 1.5%. This figure trails the broader Australian market, which is expected to see a more robust 5.6% annual growth. This disparity indicates that while GPT might see improvements in its profitability, its ability to increase overall sales may not keep pace with the wider economic environment.

This slower revenue growth forecast presents a notable weakness for GPT.

- Lagging Market Growth: GPT's projected 1.5% annual revenue growth is significantly lower than the Australian market's estimated 5.6% growth.

- Top-Line Expansion Concerns: The company's ability to expand its sales volume may not be as strong as its competitors or the market average.

- Potential for Market Share Erosion: If market dynamics favor faster-growing entities, GPT could face challenges in maintaining or increasing its market share.

Increased Volatility from Funds Management Focus

GPT's strategic pivot to boost earnings from its funds management arm, while promising growth, inherently brings a higher degree of cash flow volatility. This contrasts with the more predictable income streams typically generated from directly owned real estate assets.

The resulting shift in the revenue composition can lead to more pronounced fluctuations in overall earnings. For instance, in the first half of 2024, GPT's funds management segment contributed a significant portion of its operating profit, but this segment's performance is more susceptible to market sentiment and asset performance compared to its property portfolio.

- Funds Management Revenue: This segment's income is tied to management fees and performance incentives, which can vary significantly with market conditions.

- Property Income Stability: Rental income from directly owned properties generally offers a more stable and predictable revenue base.

- Earnings Fluctuation: The increased reliance on funds management introduces greater potential for year-on-year earnings variability.

- Market Sensitivity: Funds management performance is directly correlated with broader economic and financial market trends.

GPT's significant exposure to the office property sector, which saw a 16.8% net valuation decline in 2024, represents a core weakness. This sector faces ongoing challenges from flexible work arrangements, contributing to increased tenant incentives of 35% of gross rents in 2024.

The company's substantial $3 billion development pipeline, while aiming for growth, ties up considerable capital and exposes GPT to construction risks. Furthermore, its projected 1.5% annual revenue growth lags behind the Australian market's 5.6% forecast, raising concerns about top-line expansion and potential market share erosion.

| Weakness | Description | Impact |

|---|---|---|

| Office Property Exposure | 16.8% net valuation decline in 2024; ongoing headwinds from flexible work. | Vulnerability to commercial real estate downturns, pressure on asset values. |

| Development Pipeline Risk | $3 billion pipeline requiring significant upfront investment. | Limited financial flexibility, exposure to cost overruns and delays. |

| Lagging Revenue Growth | Projected 1.5% annual growth vs. Australian market's 5.6%. | Slower top-line expansion, potential market share challenges. |

| Funds Management Volatility | Increased reliance on funds management for earnings. | Higher cash flow volatility compared to directly owned property income. |

Full Version Awaits

GPT SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the exact content that will be yours to download, ensuring you know precisely what you're getting.

Opportunities

GPT's strategic focus on expanding its funds management platform is a significant opportunity, particularly through capital partnering. This approach aims to leverage external capital to fuel growth and enhance its investment management capabilities.

The modernization of the GPT Wholesale Shopping Centre Fund, for example, demonstrates a commitment to optimizing existing assets and attracting further investment. This initiative underpins the strategy to bolster its AUM.

Furthermore, the new joint venture with Perron Group is a prime example of successfully increasing third-party capital under management. This partnership is expected to contribute significantly to the growth of GPT's funds management business in the coming years.

Anticipated interest rate cuts in Australia during 2025 present a significant opportunity for the commercial property market. These reductions in borrowing costs are expected to stimulate investment and boost property valuations.

For Real Estate Investment Trusts (REITs), lower interest rates directly translate to reduced financing expenses, potentially improving their net operating income. This financial relief can also lead to higher asset valuations, making REITs more attractive to investors.

The Reserve Bank of Australia's monetary policy stance will be a key indicator; if rates fall as predicted, it could unlock pent-up demand and increase transaction volumes, particularly in sectors like office and retail.

GPT's strategic development pipeline, valued at $3 billion, presents a significant opportunity to enhance its existing portfolio and unlock new value. The commencement of the Rouse Hill Town Centre expansion in H1 2025 and the completion of new logistics facilities at Yiribana West in H2 2025 are prime examples of this forward-looking approach, focusing on high-growth sectors.

Recovery and Demand for Quality Office Assets

The Australian office market is experiencing a notable recovery, with investment sentiment improving and transaction volumes increasing, particularly for prime assets in central business districts. GPT's portfolio of high-quality office spaces is strategically positioned to capitalize on this trend, often referred to as a 'flight to quality,' and the constrained supply of new office developments.

This recovery is underpinned by robust leasing demand. For instance, in the first half of 2024, GPT reported strong leasing activity across its office portfolio, achieving a 98.5% occupancy rate for its prime assets. This indicates a clear preference from tenants for modern, well-located, and amenity-rich office environments.

- Increased Tenant Demand: Businesses are actively seeking premium office spaces that enhance employee experience and productivity, driving leasing activity for GPT's high-quality assets.

- Limited New Supply: The pipeline for new office construction remains subdued in key markets, further strengthening the value proposition of existing, well-maintained properties like those in GPT's portfolio.

- Investment Rebound: The Australian office sector saw a significant increase in investment volumes in late 2023 and early 2024, with well-capitalized players like GPT well-placed to benefit from this renewed investor interest.

Resilient and Growing Retail Sector

The retail property sector is showing robust signs of recovery and growth, with expectations for strong performance in 2025. Retail income returns have reached their highest point since 2016, signaling increased investor confidence and a growing appetite for quality retail assets.

GPT's own retail portfolio is a testament to this trend, exhibiting impressive comparable income growth and maintaining high occupancy rates. This sustained performance underscores the favorable market conditions and the sector's resilience.

- Retail income returns are at their peak since 2016.

- Investor demand for quality retail properties is on the rise.

- GPT's retail portfolio achieved strong comparable income growth.

- High occupancy rates in GPT's retail assets highlight sector strength.

GPT's strategic expansion of its funds management platform, bolstered by capital partnering and joint ventures like the one with Perron Group, presents a significant avenue for growth. The anticipated interest rate cuts in Australia during 2025 are poised to invigorate the commercial property market, potentially increasing property valuations and reducing financing costs for REITs. GPT's development pipeline, valued at $3 billion, including projects like the Rouse Hill Town Centre expansion and logistics facilities at Yiribana West, offers substantial opportunities for portfolio enhancement and value creation.

The Australian office market is experiencing a resurgence, driven by a flight to quality and constrained new supply, with GPT's prime assets well-positioned to benefit from increased leasing demand. Similarly, the retail property sector is demonstrating robust recovery, with retail income returns at their highest since 2016, indicating strong investor interest and sustained performance in GPT's retail portfolio.

| Opportunity Area | Key Driver | GPT Relevance | Data Point |

|---|---|---|---|

| Funds Management Expansion | Capital Partnering & JV | Increase AUM & Capabilities | New JV with Perron Group |

| Interest Rate Environment | Anticipated Rate Cuts (2025) | Boost Property Valuations & Reduce Financing Costs | Potential for increased transaction volumes |

| Strategic Development Pipeline | $3 Billion Pipeline | Portfolio Enhancement & Value Creation | Rouse Hill Town Centre expansion (H1 2025) |

| Office Market Recovery | Flight to Quality & Limited Supply | Capitalize on strong leasing demand | 98.5% occupancy in prime assets (H1 2024) |

| Retail Sector Growth | Peak Income Returns & Investor Demand | Leverage strong performance and resilience | Retail income returns highest since 2016 |

Threats

While the Federal Reserve has signaled potential interest rate cuts, a persistent environment of high rates, even if slightly reduced from peak 2023 levels, continues to challenge REITs. For instance, if rates remain near 4.5% to 5.0% through 2024 and into 2025, as some forecasts suggest, the cost of capital for property acquisitions and development will stay elevated. This directly impacts net operating income (NOI) growth and can put downward pressure on property valuations, especially for those REITs with significant upcoming debt maturities that will need refinancing at these higher costs.

The operating environment for GPT remains susceptible to macroeconomic volatility and economic uncertainty, including significant geopolitical risks. For instance, the Australian economy experienced a slowdown in early 2024, with GDP growth projected at a modest 1.8% for the fiscal year ending June 2024, according to the Reserve Bank of Australia. This slowdown directly impacts consumer spending, business confidence, and consequently, the demand for commercial properties which are key to GPT's portfolio.

The enduring shift to flexible and remote work continues to challenge office occupancy, potentially capping rental growth and asset values, especially for older, less desirable buildings. For instance, in Q1 2024, U.S. office vacancy rates hovered around 19.6%, a figure that remains significantly elevated compared to pre-pandemic levels.

This persistent trend forces a strategic reevaluation of office portfolios, as landlords must adapt to tenant demands for more dynamic and amenity-rich spaces to attract and retain occupants.

The pressure on secondary office assets is particularly acute, with many facing obsolescence if not repositioned or repurposed to meet evolving workplace needs.

Increased Competition for Quality Assets

As investment sentiment brightens and interest rates show signs of easing, the competition for prime commercial real estate is expected to intensify. This increased demand puts pressure on acquisition costs and can shrink investment returns, making it harder for GPT to find and secure new properties that will add significant value.

For instance, in late 2024, major global real estate markets saw a notable uptick in transaction volumes for core assets, with cap rates compressing by an average of 25-50 basis points in prime segments. This trend suggests that GPT will need to be highly strategic and potentially more aggressive in its bidding to secure desirable properties in the coming year.

- Intensified Bidding Wars: Expect more competition for well-located, high-quality assets, potentially leading to higher purchase prices.

- Yield Compression: As prices rise, the income generated relative to the asset's cost (yield) is likely to decrease, impacting profitability.

- Strategic Sourcing: GPT may need to explore off-market deals or develop stronger relationships with sellers to gain an edge.

- Focus on Value-Add: Opportunities might shift towards assets requiring repositioning or development, where GPT can create value rather than just acquiring existing quality.

Property Valuation Declines and Capitalization Rate Expansion

The threat of further property valuation declines persists, especially if market conditions deteriorate or capitalization rates (cap rates) continue to widen across various real estate sectors. This is a significant concern for investors holding physical assets.

For instance, a notable statutory loss was recorded in 2024 directly attributable to these valuation decreases, underscoring the inherent volatility within the real estate investment landscape. This demonstrates a tangible impact of such market shifts.

The expansion of capitalization rates signifies that investors are demanding higher returns for the same level of risk, which directly translates to lower property values. This trend can be exacerbated by factors like rising interest rates or economic uncertainty.

- Continued Cap Rate Expansion: If cap rates, which represent the unleveraged rate of return on a property, continue to rise, property valuations will likely fall further. For example, if a property generating $100,000 in net operating income was valued at a 5% cap rate ($2 million), an expansion to a 6% cap rate would reduce its value to approximately $1.67 million.

- Sector-Specific Vulnerabilities: Certain real estate sectors, such as office or retail, may be more susceptible to valuation declines due to structural changes like remote work trends or e-commerce growth, leading to higher cap rates in these segments.

- Impact of Interest Rates: Rising interest rates increase the cost of borrowing, making it more expensive to acquire properties. This can lead investors to demand higher cap rates to compensate for the increased financing costs, thereby pressuring valuations downwards.

- Economic Slowdown: A broader economic downturn can reduce rental income and increase vacancy rates, negatively impacting a property's profitability and, consequently, its valuation. This can also lead to a general widening of cap rates as investors become more risk-averse.

The persistent threat of higher-than-anticipated interest rates through 2024 and into 2025 remains a significant challenge, increasing the cost of capital for acquisitions and refinancing. This directly impacts GPT's ability to grow net operating income and can depress property valuations, particularly for assets with upcoming debt maturities that will need to be refinanced at elevated rates.

The ongoing structural shifts in the office market, driven by flexible work arrangements, continue to pressure occupancy rates and rental growth. Assets that do not adapt to tenant demands for modern, amenity-rich spaces face obsolescence, potentially leading to further valuation declines.

Increased competition for prime real estate assets, fueled by improving market sentiment and potential interest rate easing, will likely drive up acquisition costs and compress investment yields. GPT will need to be highly strategic in sourcing and bidding for properties to maintain attractive returns.

Economic volatility and geopolitical risks pose a continuous threat, impacting consumer spending, business confidence, and ultimately, the demand for commercial properties within GPT's portfolio. A slowdown in key markets could negatively affect rental income and occupancy.

| Threat Category | Specific Risk | Potential Impact on GPT | Example Data/Context (2024-2025 Forecasts) |

|---|---|---|---|

| Interest Rate Environment | Sustained High Interest Rates | Increased cost of capital, reduced property valuations, higher refinancing costs | Interest rates remaining near 4.5%-5.0% through 2024-2025, impacting borrowing costs. |

| Market Dynamics | Office Sector Weakness | Lower occupancy, capped rental growth, potential asset devaluation | Elevated U.S. office vacancy rates around 19.6% in Q1 2024, indicating ongoing demand challenges. |

| Competition | Intensified Bidding for Assets | Higher acquisition costs, compressed investment yields | Anticipated 25-50 basis point cap rate compression in prime segments in late 2024, signaling increased competition. |

| Economic Conditions | Macroeconomic Volatility | Reduced tenant demand, impact on rental income and cash flow | Projected Australian GDP growth of 1.8% for FY24, suggesting a potentially subdued economic environment. |

SWOT Analysis Data Sources

The foundation of this GPT SWOT analysis is built upon a robust blend of publicly available data, including OpenAI's official research papers, reputable technology news outlets, and analyses from leading AI industry experts. This ensures a comprehensive understanding of GPT's current capabilities and market positioning.