GPT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GPT Bundle

A Porter's Five Forces analysis of GPT reveals a dynamic landscape shaped by intense rivalry, significant buyer power, and the looming threat of substitutes. Understanding these forces is crucial for navigating the rapidly evolving AI market.

The complete report unlocks a comprehensive strategic breakdown of GPT’s market position, competitive intensity, and external threats—all in one powerful analysis. Gain actionable insights to drive smarter decision-making and secure your competitive edge.

Suppliers Bargaining Power

The bargaining power of construction companies and skilled labor is a significant factor for GPT. In 2024, Australia saw rising homebuilding costs, with projections indicating further increases into 2025. This upward trend highlights the strong position of suppliers in the construction sector.

Labor shortages are a persistent issue, directly contributing to these escalating construction expenses. This scarcity means GPT could encounter higher project costs and potential delays for its development endeavors.

The competition for skilled labor is fierce, stemming from both the residential building sector and large-scale public infrastructure projects. This intense demand further amplifies the bargaining power of construction firms and their workforces, impacting GPT's project timelines and budgets.

While some material costs have shown mixed trends, overall prices for electrical and plumbing fixtures, landscaping products, kitchen joinery, and specialized timber have seen increases. For instance, lumber prices, a key component in construction, experienced significant volatility throughout 2023 and early 2024, with some periods seeing double-digit percentage increases year-over-year.

Lingering supply chain pressures and global shortages of specific components, such as advanced electrical components and certain microchips, continue to grant suppliers leverage over GPT. This can directly translate to higher procurement costs for GPT's development and renovation projects, impacting project budgets and potentially profit margins.

Suppliers of capital, like banks and institutional lenders, possess moderate bargaining power over GPT. While projections for 2025 suggest interest rate reductions could ease borrowing costs for commercial property, GPT’s significant capital requirements for its projects mean these financial institutions can still influence loan terms and conditions.

Technology and Service Providers

GPT's increasing reliance on specialized technology providers for smart building solutions, property management software, and advanced data analytics grants these suppliers significant bargaining power. As the demand for integrated and efficient property operations grows, providers offering unique or highly effective platforms can command better terms. For instance, the global smart building market was projected to reach over $100 billion by 2024, indicating substantial investment and dependence on these technology vendors.

Furthermore, specialized service providers in areas like property maintenance, sustainability consulting, and energy management also wield considerable influence. Their ability to demonstrably improve asset performance and operational efficiency, particularly in niche or highly regulated areas, strengthens their negotiating position. Companies that can offer proprietary solutions or achieve measurable cost savings for GPT, such as reducing energy consumption by 15-20% through smart systems, are highly valued.

- Technology Providers: Increased reliance on smart building and data analytics platforms boosts their power, especially with the smart building market exceeding $100 billion in 2024.

- Specialized Service Providers: Niche expertise in property management, maintenance, and sustainability offers leverage, particularly when delivering measurable improvements like significant energy cost reductions.

- Differentiation: Suppliers offering unique, highly effective solutions that directly enhance GPT's portfolio value and operational efficiency gain a stronger bargaining position.

Land Owners and Site Acquisition

The bargaining power of landowners, particularly concerning site acquisition for logistics and office properties in prime locations, can be substantial. When suitable land is scarce and development approvals are slow, this scarcity directly translates into increased leverage for landowners, potentially driving up acquisition costs for companies like GPT. For instance, in 2024, major metropolitan areas continued to experience high demand for industrial and commercial land, with limited new supply coming online due to zoning restrictions and environmental reviews.

This situation can significantly impact GPT's ability to secure new development sites at favorable prices. The constrained supply of developable land in sought-after urban and suburban areas means that landowners can often command premium prices. This upward pressure on land acquisition costs is a direct reflection of the bargaining power held by these landowners, especially when their properties are strategically positioned to meet the growing demand for logistics hubs and modern office spaces.

- Land Scarcity: Limited availability of prime development land, especially for logistics facilities, increases landowner leverage.

- Approval Delays: Lengthy and complex approval processes for new developments further restrict supply, empowering landowners.

- Cost Impact: These factors can lead to higher land acquisition costs for GPT, impacting project feasibility and profitability.

- Market Dynamics: In 2024, strong demand in key markets like Sydney and Melbourne saw land values for industrial sites increase by an average of 15-20% year-on-year, highlighting landowner bargaining power.

The bargaining power of suppliers significantly impacts GPT, particularly in construction and technology. Rising homebuilding costs in Australia, projected to continue into 2025, and persistent labor shortages amplify the leverage of construction companies and skilled workers. This means GPT faces higher project expenses and potential delays.

Furthermore, GPT's increasing reliance on specialized technology providers for smart building solutions and data analytics grants these vendors considerable power. The global smart building market, exceeding $100 billion by 2024, underscores this dependence, allowing tech suppliers to negotiate favorable terms. Similarly, specialized service providers in areas like property maintenance and sustainability consulting can command strong positions by offering demonstrable improvements in asset performance and operational efficiency.

| Supplier Type | Bargaining Power Factors | Impact on GPT | Relevant Data (2024) |

|---|---|---|---|

| Construction Companies & Skilled Labor | Rising material costs, labor shortages, competition for talent | Increased project costs, potential delays | Australian homebuilding costs up; lumber prices volatile (e.g., double-digit % increases YoY in early 2024) |

| Technology Providers (Smart Building, Data Analytics) | Unique/effective platforms, growing market demand | Higher procurement costs, favorable contract terms for suppliers | Smart building market projected over $100 billion |

| Specialized Service Providers (Maintenance, Sustainability) | Niche expertise, demonstrable performance improvements | Stronger negotiating position for providers offering measurable benefits | Providers achieving 15-20% energy cost reductions valued |

What is included in the product

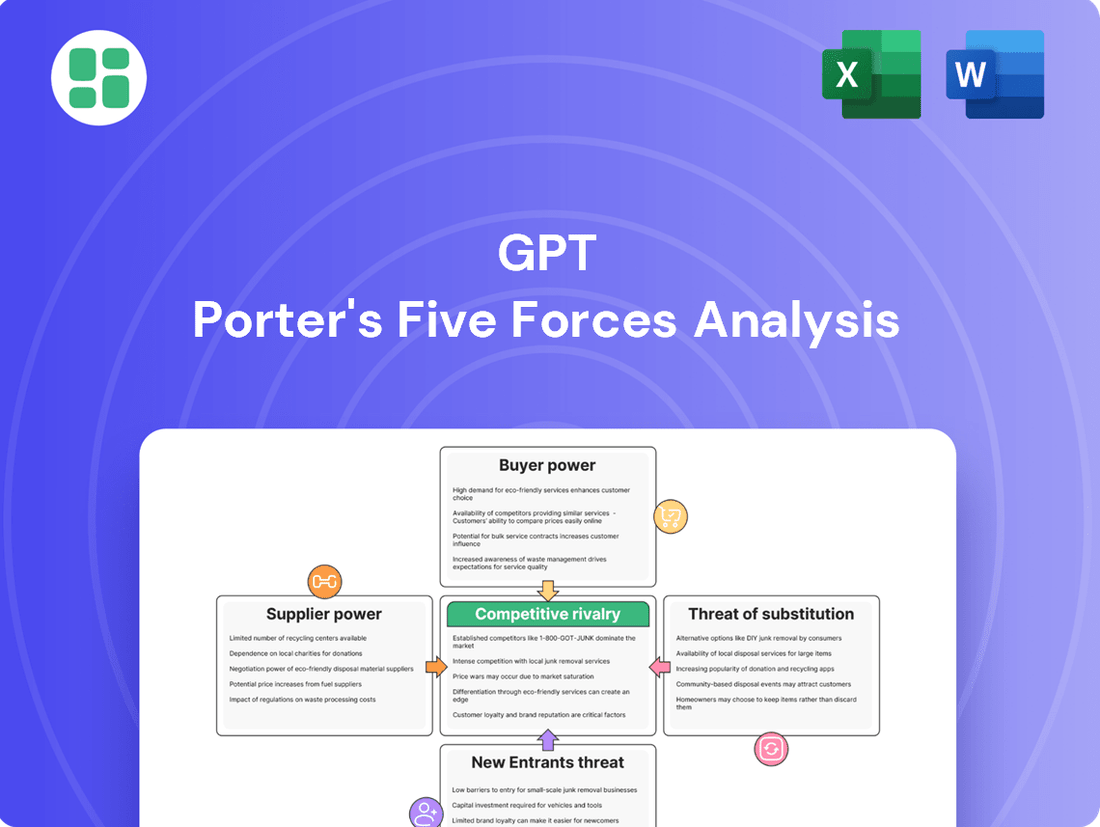

Analyzes the competitive landscape for GPT by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the AI industry.

Effortlessly identify and quantify competitive threats with dynamic scenario modeling, allowing you to proactively address market pressures.

Customers Bargaining Power

The bargaining power of office tenants in Australia is currently moderate. This is largely due to the persistent shift towards remote and hybrid work arrangements, which has altered traditional demand patterns.

While the Australian office market is showing signs of recovery, with demand for prime, well-located assets strengthening, the rise of flexible office solutions also empowers tenants. These alternatives provide greater choice and can enhance their leverage when negotiating terms for conventional office leases.

The bargaining power of retail tenants within GPT's portfolio is a significant factor, especially considering the dynamic retail environment. The ongoing shift towards e-commerce continues to influence tenant leverage.

While retail property, including GPT's assets, has demonstrated a notable rebound in 2024 and is projected to outperform other commercial sectors in 2025, tenants situated in less prime locations or those heavily impacted by online competition can exert greater influence during lease negotiations. For instance, a retail tenant in a secondary mall facing declining foot traffic might demand lower rents or more favorable lease terms from GPT.

The bargaining power of logistics tenants within the Australian industrial and logistics sector, particularly concerning landlords like GPT, is currently on the lower side. This is largely due to robust market fundamentals. For instance, vacancy rates in the Australian industrial property market remained exceptionally low, hovering around 1.0% in the first half of 2024, a testament to sustained demand.

Resilient occupier demand, fueled significantly by the ongoing surge in e-commerce, continues to bolster the sector. This sustained demand for warehouses and distribution centres directly translates into a reduced capacity for tenants to negotiate substantial rent reductions or other concessions from property owners. In 2024, e-commerce penetration in Australia continued its upward trajectory, further solidifying the need for efficient logistics infrastructure.

Tenant Concentration

Tenant concentration significantly impacts GPT's bargaining power with its customers. If a large portion of GPT's revenue, across its office, retail, or logistics segments, comes from just a few major tenants, those key clients gain considerable leverage. This means they could negotiate for lower rents or more favorable lease terms, directly affecting GPT's profitability.

Conversely, a widely diversified tenant base, with many smaller clients rather than a few dominant ones, dilutes the bargaining power of any single customer. GPT's operational performance in 2024 highlights this advantage, with high occupancy rates across its varied property portfolio, indicating a robust and broad tenant structure that limits individual tenant influence.

- Diversified Tenant Base: GPT's portfolio in 2024 demonstrates a broad spread of tenants, reducing reliance on any single entity.

- Reduced Individual Leverage: A large number of smaller tenants limits the ability of any one customer to exert significant bargaining power.

- Impact on Lease Negotiations: This diversification strengthens GPT's position when negotiating lease renewals and new agreements.

Switching Costs and Lease Terms

The bargaining power of customers, particularly tenants in commercial real estate like GPT, is influenced by switching costs. High costs and disruption associated with relocating operations generally diminish a tenant's leverage. For instance, in 2024, the average cost for a business to relocate its office space could range from $100 to $200 per square foot, encompassing moving expenses, IT setup, and potential downtime.

However, the market's provision of flexible lease terms can significantly shift this dynamic. When landlords offer shorter lease durations, break clauses, or options for expansion/contraction, tenants gain greater negotiation power. This is especially relevant in sectors like office space, where market conditions in 2024 saw increased vacancy rates in certain urban centers, prompting landlords to offer more accommodating lease structures to attract and retain tenants.

- Switching Costs: High relocation expenses and operational disruption typically reduce tenant bargaining power.

- Lease Flexibility: Shorter terms and break clauses empower tenants to negotiate better terms.

- Market Conditions: Increased office vacancy rates in 2024 incentivized landlords to offer more flexible leases.

- Tenant Leverage: Flexible lease options increase a tenant's ability to negotiate favorable arrangements with GPT.

The bargaining power of customers, primarily tenants within GPT's property portfolio, is a key consideration in the competitive landscape. Factors such as the availability of substitutes, switching costs, and the concentration of buyers significantly shape this power. In 2024, the Australian commercial real estate market saw varied tenant leverage across different sectors, influenced by economic trends and evolving workplace strategies.

| Sector | Tenant Bargaining Power (2024) | Key Influencing Factors |

|---|---|---|

| Office | Moderate | Hybrid work trends, availability of flexible office spaces |

| Retail | Significant (especially in secondary locations) | E-commerce competition, foot traffic levels |

| Logistics | Low | Robust demand, low vacancy rates (approx. 1.0% H1 2024) |

Full Version Awaits

GPT Porter's Five Forces Analysis

This preview shows the exact GPT Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. The document details the competitive landscape of AI language models, examining threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products. You're looking at the actual, comprehensive analysis, ready for download and strategic application the moment you buy.

Rivalry Among Competitors

The Australian real estate sector is a crowded arena. GPT Group faces formidable competition from other large Australian REITs such as Stockland and Mirvac, alongside numerous private developers and unlisted investment funds.

This intense rivalry spans diverse property types, from large-scale office buildings and shopping centers to industrial warehouses and residential developments.

In 2024, the Australian REIT market capitalization reached approximately AUD 130 billion, highlighting the sheer scale and number of entities vying for market share.

The Australian commercial property market is poised for significant growth in 2025, with investor confidence on the rise and demand strengthening across various sectors. This expansion, especially in industrial and logistics, could potentially ease competitive pressures by creating more space for various participants.

While growth areas may dilute some rivalry, more established segments like office and retail continue to see intense competition. For instance, the Sydney CBD office market vacancy rate was around 13.5% in early 2024, indicating a substantial supply that fuels competition for prime tenancies and quality buildings.

In the property sector, differentiation hinges on factors like asset quality, prime locations, and advanced sustainability features, alongside superior tenant services. GPT Group actively pursues this strategy by cultivating high-quality, diverse portfolios and championing sustainability. For instance, GPT's commitment to net-zero emissions by 2030 is a key differentiator.

However, this pursuit of differentiation intensifies competitive rivalry. Competitors are also channeling significant investment into enhancing their properties and services, creating a crowded marketplace. This means GPT faces robust competition for both high-value tenants and attractive investment prospects, as rivals like Stockland and Mirvac also focus on premium offerings and ESG credentials.

Exit Barriers

High capital intensity and the illiquid nature of real estate assets significantly elevate exit barriers in the property market. This means that even when market conditions deteriorate, companies are often disinclined to sell their assets quickly due to potential losses, leading them to remain invested and actively compete. For instance, in 2024, the global real estate market continued to grapple with higher interest rates, making it more challenging and costly for developers and investors to divest properties, thereby solidifying existing players' presence and intensifying competition.

These elevated exit barriers foster a scenario where competitors are more likely to persevere through economic downturns, rather than exiting the market. This commitment to remaining in the industry, even during challenging periods, means companies will fight more aggressively to protect their existing market share and ongoing development projects. This dynamic directly fuels competitive rivalry as businesses focus on retaining value and operational capacity.

- High Capital Investment: Real estate development requires substantial upfront capital, making it difficult to recoup investments quickly if a company needs to exit.

- Illiquidity of Assets: Unlike stocks or bonds, real estate cannot be sold instantaneously without significant price concessions, trapping capital.

- Specialized Nature of Assets: Many real estate properties are purpose-built, limiting their appeal to a narrow range of potential buyers and further hindering quick sales.

- Long-Term Commitments: Development projects and long-term leases create ongoing obligations that are hard to shed, compelling companies to stay engaged.

Strategic Partnerships and M&A Activity

The sector is characterized by a dynamic environment of strategic partnerships and mergers and acquisitions. A prime example is GPT's 2024 retail partnership with Perron Group, aimed at enhancing its property portfolio and market presence. These collaborations often signal a drive to consolidate market power and expand operational reach.

Such activities highlight the intense competition, as companies actively seek to strengthen their competitive positions. This ongoing consolidation and partnership formation can lead to shifts in market dynamics, influencing the bargaining power of suppliers and buyers.

- Strategic Partnerships: GPT's 2024 retail partnership with Perron Group.

- M&A Activity: Ongoing consolidation reflects a competitive drive for market share.

- Market Consolidation: These moves can concentrate market power among fewer entities.

- Competitive Landscape: Partnerships are a key strategy for expanding reach and capabilities.

Competitive rivalry in the Australian real estate sector is fierce, with GPT Group facing strong opposition from major REITs like Stockland and Mirvac, as well as numerous private developers. This competition spans all property types, from offices to industrial and residential. The Australian REIT market's AUD 130 billion capitalization in 2024 underscores the intense battle for market share.

The high capital intensity and illiquidity of real estate assets create significant exit barriers, compelling companies to remain invested and compete aggressively even during downturns. For instance, higher global interest rates in 2024 made property divestments more challenging, solidifying existing players' market presence and intensifying rivalry.

Companies differentiate through asset quality, prime locations, sustainability, and tenant services, but rivals are also investing heavily in these areas. GPT's net-zero emissions goal by 2030, for example, is a differentiator, but competitors like Stockland and Mirvac are also enhancing their ESG credentials, leading to a crowded marketplace for tenants and investment opportunities.

Strategic partnerships and mergers and acquisitions are common, as seen with GPT's 2024 retail partnership with Perron Group. These activities aim to consolidate market power and expand operational reach, further intensifying the competitive landscape and potentially shifting market dynamics.

| Competitor | Market Cap (AUD Billion, est. 2024) | Key Sectors | Differentiation Strategy Example |

|---|---|---|---|

| GPT Group | ~10-15 | Office, Industrial, Retail, Funds Management | Net-zero emissions by 2030, high-quality diverse portfolios |

| Stockland | ~10-15 | Resilience & Retirement Living, Communities, Workplace & Logistics | Focus on community development and sustainable living |

| Mirvac | ~8-12 | Office, Industrial, Retail, Build-to-Rent, Residential | Premium urban placemaking and integrated developments |

SSubstitutes Threaten

The ongoing shift towards remote and hybrid work models presents a substantial threat of substitution for traditional office space. Even as some businesses push for a return to the office, the persistence of flexible work arrangements means many companies will continue to require smaller, or even no, physical footprints. This directly reduces the demand for conventional office leases and associated services.

Data from 2024 indicates this trend is far from over. For instance, a significant percentage of U.S. employees, estimated to be around 30% or more, are still working remotely at least one day a week. This sustained reduction in the need for daily in-office presence directly substitutes the need for extensive, centralized office buildings. Consequently, the value proposition of traditional commercial real estate is challenged by these alternative work structures.

The relentless expansion of e-commerce presents a significant threat of substitution for traditional brick-and-mortar retail, directly impacting the demand for physical retail properties. As of early 2024, e-commerce sales continue their upward trajectory, with global online retail sales projected to reach trillions of dollars, demonstrating a clear consumer preference shift towards digital purchasing channels.

While the retail property sector is evolving by emphasizing experiential offerings and essential services, the underlying trend of consumers increasingly opting for online convenience means a diminished reliance on physical stores. This fundamental change in shopping behavior directly affects the occupancy rates and rental income potential for GPT's retail assets, as fewer shoppers may be drawn to traditional mall or street-front locations.

The proliferation of flexible workspaces, such as coworking and serviced offices, presents a significant threat of substitution for traditional, long-term office leases. These adaptable environments directly compete by offering businesses, especially startups and small to medium-sized enterprises (SMEs), alternatives to conventional office space arrangements. This trend is reshaping how companies approach their physical footprint, potentially fragmenting demand for traditional office providers.

By 2024, the flexible workspace sector has seen substantial growth. For instance, the global flexible office market was projected to reach over $60 billion in value, demonstrating a clear demand for these alternative solutions. This growth indicates that businesses are increasingly willing to opt for shorter commitments and more agile office arrangements, directly impacting the long-term lease models offered by traditional office providers.

In-house Logistics and Supply Chain Optimisation

While some businesses might consider optimising their in-house logistics or investing in proprietary solutions as a substitute for leasing third-party logistics properties, the significant capital outlay and operational complexity often make this impractical. For instance, developing and managing a nationwide distribution network requires substantial investment in warehousing, fleet management, and technology.

The sheer scale and expertise needed to run efficient logistics operations mean that many companies find it more cost-effective and operationally sound to partner with established providers. This is particularly true for businesses that are not primarily logistics-focused.

- Capital Intensity: Building and maintaining a modern logistics infrastructure can cost hundreds of millions, making it prohibitive for many.

- Operational Complexity: Managing a large fleet, optimizing routes, and ensuring timely deliveries require specialized knowledge and systems.

- Focus on Core Business: Outsourcing logistics allows companies to concentrate resources and management attention on their primary revenue-generating activities.

- Flexibility and Scalability: Third-party providers offer the flexibility to scale operations up or down based on demand, a capability difficult to replicate in-house.

Technological Advancements in Property Utilisation

Technological advancements are increasingly offering alternatives to traditional property utilization, thereby acting as a threat of substitutes. For instance, sophisticated space planning software and virtual collaboration platforms allow businesses to optimize their use of existing physical space, potentially reducing the demand for new or expanded real estate. This trend is particularly relevant as companies re-evaluate their office needs post-pandemic, with many adopting hybrid work models.

In 2024, the adoption of remote and hybrid work arrangements continued to influence commercial real estate demand. A report from JLL indicated that in Q1 2024, net absorption in the U.S. office market remained negative, suggesting that companies are still downsizing or consolidating their physical footprints. This efficiency gain, driven by technology, directly substitutes for the need for additional square footage.

- Virtual Collaboration Tools: Platforms like Microsoft Teams and Zoom have become integral to business operations, reducing the necessity for in-person meetings and thus, the office space required to accommodate them.

- Advanced Space Planning Software: Tools such as AutoCAD and specialized workplace analytics software enable businesses to design more efficient layouts, maximizing the utility of every square foot.

- Remote Work Adoption: By mid-2024, a significant percentage of the workforce, estimated by Pew Research Center to be around 40% in the US, were still working remotely at least part-time, a direct technological enabler that lessens reliance on physical offices.

- PropTech Innovations: The rise of Property Technology (PropTech) offers solutions for smart building management and flexible workspace solutions, which can substitute for traditional long-term lease commitments and larger office spaces.

The increasing availability and sophistication of alternative energy sources pose a significant threat of substitution for traditional fossil fuel-based energy providers. As of 2024, renewable energy technologies like solar and wind power are becoming increasingly cost-competitive, with global investment in renewables reaching record highs. This shift directly challenges the demand for conventional energy infrastructure.

Businesses and consumers are actively seeking cleaner and more sustainable energy options, driven by environmental concerns and government incentives. For example, by mid-2024, several countries reported that solar and wind power accounted for over 30% of their new electricity generation capacity. This transition away from fossil fuels directly impacts the market share and long-term viability of traditional energy companies.

| Energy Source | 2023 Global Investment (USD Billions) | Projected 2024 Growth (%) | Key Substitution Impact |

|---|---|---|---|

| Solar Power | 180 | 15 | Reduces demand for coal and natural gas power plants. |

| Wind Power | 150 | 12 | Decreases reliance on oil and gas for electricity generation. |

| Battery Storage | 70 | 20 | Enhances grid stability for renewables, further displacing fossil fuels. |

Entrants Threaten

The real estate investment and development sector, especially for large commercial properties like those GPT manages, demands immense capital. For instance, a major office building development can easily run into hundreds of millions of dollars, covering land acquisition, design, construction, and initial leasing costs. This substantial financial outlay significantly deters new entrants who lack the necessary funding or access to large-scale financing.

Navigating Australia's intricate regulatory landscape, encompassing zoning laws, environmental impact assessments, and development approvals, acts as a significant barrier for new entrants. The substantial time investment and associated costs for securing these permits can effectively discourage many potential competitors from entering the market.

GPT Group's established brand reputation and deep industry relationships present a significant barrier to new entrants. Building the same level of trust and recognition, which is vital for attracting anchor tenants and securing favorable financing, takes years of consistent performance and client engagement.

Access to Prime Locations and Development Pipelines

Securing prime locations for office, retail, and logistics properties is becoming a significant hurdle. Limited supply and fierce competition mean that desirable sites are hard to come by. For instance, in 2024, major metropolitan areas continued to see record low vacancy rates for prime office space, making new site acquisition particularly difficult.

Established entities, including GPT, frequently possess substantial existing land banks or enjoy preferential access to upcoming development projects. This pre-existing advantage creates a considerable barrier for newcomers attempting to secure the most sought-after locations, effectively limiting their ability to compete from the outset.

- Limited Supply: Prime commercial real estate availability remains constrained in many growth markets.

- Intense Competition: Numerous developers and investors vie for the same limited prime sites.

- Established Advantage: Existing players benefit from secured land banks and developer relationships.

Experience and Expertise in Property Management and Development

The threat of new entrants for GPT in property management and development is moderate. Success in this sector, especially with diversified portfolios and active management, demands significant experience across property types, market cycles, and sophisticated risk management. New players would need to build this extensive knowledge base to even begin competing with established entities.

New entrants face substantial hurdles in acquiring the necessary experience and expertise. This includes understanding complex lease agreements, navigating diverse regulatory environments, and mastering capital allocation strategies across different real estate asset classes. For instance, GPT, as a leading Australian real estate investment trust (REIT), has decades of experience managing a vast portfolio, including significant office, industrial, and healthcare assets, demonstrating a depth of knowledge that is difficult for newcomers to replicate quickly.

- Capital Intensity: Property development and management require massive upfront capital investment, creating a significant barrier for new, underfunded entrants.

- Established Relationships: Experienced players like GPT have built strong, long-term relationships with tenants, suppliers, and financial institutions, which are crucial for securing deals and favorable terms.

- Brand Reputation: A proven track record and strong brand reputation, built over years of successful property management and development, instill confidence in investors and tenants, a difficult asset for new entrants to gain.

- Regulatory Navigation: Understanding and complying with complex zoning laws, building codes, and environmental regulations across various jurisdictions is a steep learning curve for new market participants.

The threat of new entrants for GPT in the Australian real estate sector is generally considered moderate to low, primarily due to the high barriers to entry. These barriers include substantial capital requirements, the need for extensive industry experience, and the challenge of navigating complex regulatory frameworks. Established players like GPT benefit from existing relationships and brand recognition, making it difficult for newcomers to compete effectively.

In 2024, the Australian commercial real estate market continued to show resilience, with prime office vacancy rates in Sydney and Melbourne remaining low, around 7-8%. This scarcity of prime locations, coupled with the high cost of acquisition and development, presents a significant deterrent for new entrants. For example, a new large-scale office development in a prime CBD location could require an investment exceeding AUD 500 million.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Development and acquisition of large commercial properties demand significant upfront investment, often in the hundreds of millions of dollars. | High; limits entry to well-capitalized firms or those with strong access to debt financing. |

| Industry Experience & Expertise | Managing diverse property portfolios, understanding market cycles, and sophisticated risk management are crucial. | High; requires years of hands-on experience in leasing, property management, and development. |

| Regulatory & Approval Processes | Navigating complex zoning laws, environmental assessments, and obtaining development approvals is time-consuming and costly. | Moderate to High; steep learning curve and potential for project delays for inexperienced entrants. |

| Brand Reputation & Relationships | Established trust with tenants, suppliers, and financial institutions is vital for securing deals and favorable terms. | High; building equivalent reputation and networks takes considerable time and consistent performance. |

| Site Acquisition & Land Banks | Limited availability of prime locations and existing land banks held by established players restrict new entrants. | High; competition for desirable sites is intense, with established entities often having a first-mover advantage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, industry-specific market research reports, and reputable financial news outlets to provide a comprehensive view of competitive dynamics.