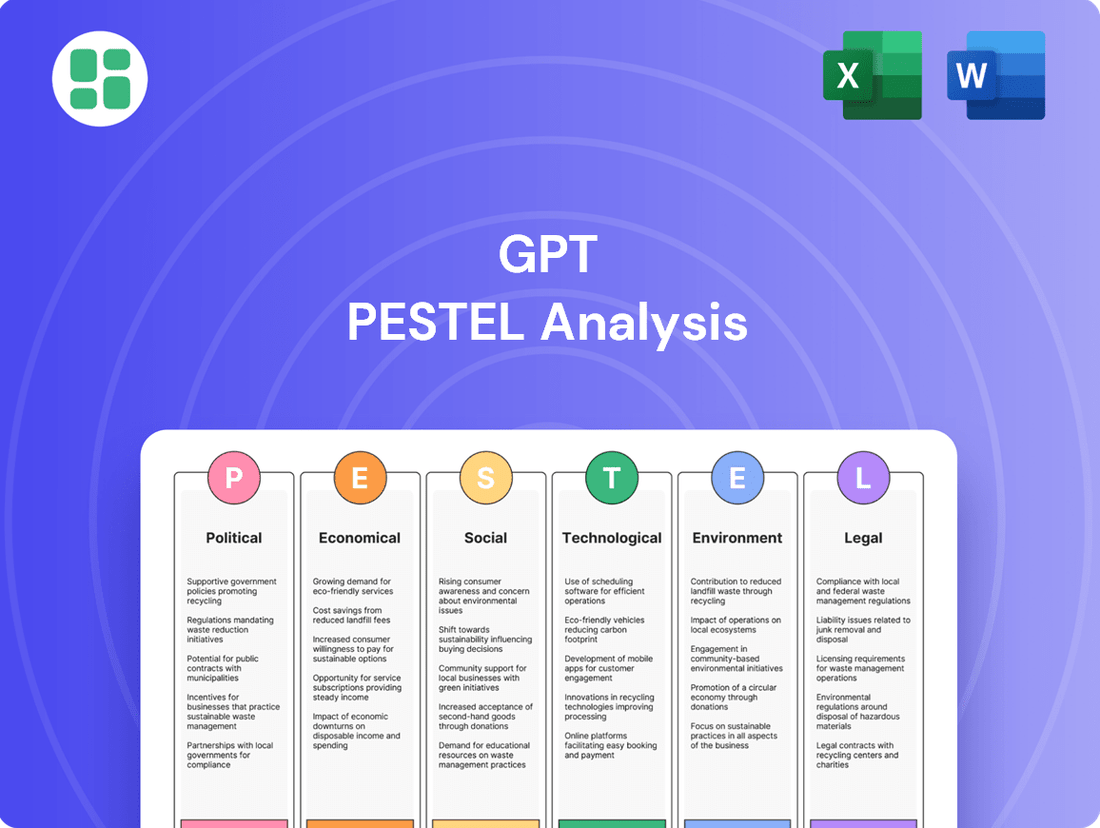

GPT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GPT Bundle

Unlock the intricate web of external forces shaping GPT's trajectory with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to its future success. Equip yourself with actionable intelligence to navigate this dynamic landscape and gain a significant competitive advantage. Download the full PESTLE analysis now to make informed, strategic decisions.

Political factors

Government policies, particularly those concerning urban planning and zoning, are pivotal for GPT Group's development pipeline. For instance, the Australian government's focus on sustainable urban development, as highlighted in the National Planning Policy Framework updates in early 2024, directly impacts where and how GPT can expand its property portfolio.

Changes in land use regulations, such as those recently introduced in Sydney impacting commercial rezoning, can either unlock new development opportunities or impose significant restrictions on GPT's existing assets. This regulatory environment is critical for strategic decisions, with compliance costs and approval timelines directly affecting project feasibility and profitability.

Changes in Australian federal and state taxation policies significantly influence GPT Group's financial performance. For instance, adjustments to corporate tax rates directly affect net profits, while shifts in stamp duty and land tax can impact property transaction costs and, consequently, investment returns. In the 2023-24 Australian Federal Budget, there were no major changes announced to the general corporate tax rate, which remains at 30% for larger companies, but ongoing discussions about tax reform could introduce future volatility.

Australia's foreign investment review framework significantly shapes international capital flows into its property sector, directly impacting demand and property valuations. Changes in these regulations, whether becoming more stringent or more relaxed, can alter GPT Group's capacity to secure foreign co-investors or divest assets to overseas purchasers.

For instance, in the fiscal year ending June 2024, the Foreign Investment Review Board (FIRB) processed a substantial number of applications, with approvals often contingent on specific conditions that can influence development timelines and project viability for entities like GPT.

Infrastructure Spending

Government investment in public infrastructure, such as transport networks and urban amenities, directly enhances the value and accessibility of GPT Group's property portfolio. For instance, the Australian government's commitment to infrastructure projects, like the Western Sydney Airport and associated transport links, is expected to unlock significant development potential and boost property values in surrounding areas. This focus on improving connectivity and amenities is a crucial strategic consideration for GPT, as it can lead to increased rental demand and capital appreciation across its office, retail, and logistics assets.

Proximity to enhanced infrastructure can be a powerful driver for rental growth and capital appreciation. As of early 2024, major infrastructure projects across Australia are progressing, with significant public funding allocated. For example, the National Reconstruction Fund, established in 2023 with an initial $15 billion, aims to support critical sectors, which can indirectly benefit real estate through economic activity and job creation in key locations.

- Infrastructure Investment: Australian federal and state governments continue to prioritize infrastructure spending, with billions allocated annually to transport, energy, and digital networks.

- Economic Impact: Improved infrastructure boosts economic activity, potentially increasing demand for commercial and industrial space, thereby supporting GPT's rental income.

- Property Value Uplift: Areas benefiting from new or upgraded transport links and amenities often see a rise in property values, benefiting GPT's asset portfolio.

- Strategic Planning: Identifying and leveraging areas slated for significant infrastructure development is a key strategic imperative for GPT to maximize returns.

Political Stability and Support

A stable political environment is crucial for investor confidence in the real estate sector. For GPT Group, a predictable political climate in Australia, where it primarily operates, allows for sustained growth and investment. For instance, the Australian government's commitment to infrastructure development, often supported by bipartisan consensus, directly benefits property developers like GPT by creating demand for commercial and industrial spaces. This stability minimizes the risk of sudden policy changes that could disrupt long-term project planning and financing.

Conversely, unforeseen policy shifts or political instability can significantly deter investment. In 2024, concerns about potential changes in foreign investment regulations or property tax policies in key markets could create uncertainty. However, Australia has generally maintained a consistent approach, with GPT Group's portfolio benefiting from this predictability. The group’s 2024 annual report highlighted that regulatory stability was a key factor in their continued investment in large-scale urban renewal projects.

- Political Stability: Australia's generally stable political landscape reduces regulatory uncertainty for property developers.

- Government Support: Ongoing government investment in infrastructure projects, such as transport upgrades, supports demand for commercial and residential properties.

- Investor Confidence: A predictable policy environment fosters investor confidence, encouraging capital inflow into the real estate sector.

- Risk Mitigation: GPT Group benefits from a lower risk profile due to the absence of frequent, disruptive policy changes, enabling effective long-term strategic planning.

Government policies, particularly those concerning urban planning and taxation, significantly shape GPT Group's operational landscape. For instance, the Australian federal government's corporate tax rate, which remained at 30% for larger companies in the 2023-24 fiscal year, directly impacts GPT's profitability. Furthermore, changes in state-level stamp duties and land taxes, which vary by jurisdiction, influence the cost of property transactions and investment returns, making regulatory compliance a critical factor in strategic decision-making.

Government investment in infrastructure, such as the ongoing development of transport networks, directly enhances the value and accessibility of GPT's property portfolio. For example, the Australian government's commitment to projects like the Western Sydney Airport, with significant progress reported in early 2024, is poised to unlock substantial development potential and boost surrounding property values. This infrastructure spending, often supported by bipartisan consensus, fosters investor confidence and reduces long-term project risks for developers like GPT.

| Policy Area | Impact on GPT Group | 2024 Data/Trend |

|---|---|---|

| Urban Planning & Zoning | Dictates development potential and site feasibility. | Updates to National Planning Policy Framework in early 2024 emphasize sustainable development. |

| Taxation Policies | Affects profitability and transaction costs. | Federal corporate tax rate at 30% for large companies; state stamp duties vary. |

| Infrastructure Investment | Enhances property values and rental demand. | Ongoing investment in major projects like Western Sydney Airport. |

| Foreign Investment Review | Influences capital inflow and divestment opportunities. | FIRB processed numerous applications in FY24, with conditions impacting project viability. |

What is included in the product

This GPT PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing Generative Pre-trained Transformers across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

GPT PESTLE Analysis acts as a pain point reliver by providing a structured, easy-to-digest framework that simplifies complex external factors. This allows teams to quickly identify and address potential risks and opportunities, streamlining strategic planning and decision-making.

Economic factors

The Reserve Bank of Australia's (RBA) monetary policy significantly impacts GPT Group's financial strategy. When the RBA adjusts the cash rate, it directly affects borrowing costs for GPT's property development and acquisition projects. For instance, a higher interest rate environment, like the increases seen through 2022 and into early 2023, generally leads to increased financing expenses for companies like GPT.

Furthermore, interest rate decisions influence the attractiveness of property yields relative to other investment options. If interest rates rise, fixed-income investments become more competitive, potentially dampening investor demand for real estate assets and impacting GPT's property valuations and transaction volumes. Keeping a close watch on RBA announcements is therefore crucial for GPT's capital management and strategic investment planning.

Inflationary pressures are a significant concern for GPT Group, directly impacting construction costs. For instance, the Producer Price Index for construction materials in Australia saw a substantial increase, with some categories rising by over 15% year-on-year in late 2023 and early 2024, impacting the cost of steel, timber, and concrete.

While higher inflation can theoretically boost rental income, the lag in rent adjustments means GPT Group's profit margins are squeezed as building material and labor costs escalate faster than rental revenue can keep pace. This dynamic presents a constant challenge in managing cost escalations effectively across their property portfolio.

Energy costs, another component of inflation, also add to construction and operational expenses. Fluctuations in global energy markets, impacting fuel for machinery and electricity for facilities, directly affect GPT Group's bottom line, requiring strategic procurement and efficiency measures.

Australia's economic growth, particularly in the lead-up to mid-2025, is a critical driver for GPT Group. Strong GDP expansion, projected around 2.5% for 2024 and a similar pace expected into 2025, fuels demand across GPT's diverse property assets, from offices to logistics hubs. This robust economic environment typically correlates with elevated consumer and business confidence, directly impacting rental income and property valuations.

Conversely, a slowdown in economic activity or a dip in consumer sentiment poses a direct risk. For instance, a hypothetical 1% contraction in GDP could lead to increased office vacancy rates, potentially by 1-2 percentage points, and put downward pressure on retail rents. Monitoring key economic indicators like inflation, interest rates, and employment figures is therefore paramount for understanding market dynamics affecting GPT's performance.

Employment Rates and Population Growth

Robust employment growth and sustained population increases are key drivers for property demand. For instance, in Australia, where GPT Group operates, the unemployment rate remained low, hovering around 3.7% in early 2024, signaling a healthy job market. This trend directly translates to increased demand for commercial spaces as businesses expand and residential properties as more people seek housing, ultimately supporting rental income and property values.

Urbanization and migration patterns significantly shape property markets. As people move to cities for job opportunities, this concentrates demand in urban centers. In 2024, Australia's population growth continued, partly fueled by international migration, with net overseas migration contributing significantly to population increases, particularly in major cities like Sydney and Melbourne. These shifts influence the types of properties in demand, favoring apartments and well-located commercial assets.

Demographic shifts are fundamental to long-term property market performance. An aging population might increase demand for specific types of healthcare-related commercial real estate, while a growing younger demographic could boost demand for rental housing and retail spaces. For example, the median age in Australia continues to rise, influencing housing preferences and the types of amenities sought by residents, which GPT Group must consider in its property development and management strategies.

- Employment: Australia's unemployment rate was 3.7% as of February 2024, indicating strong labor market conditions.

- Population Growth: Net overseas migration contributed substantially to Australia's population growth in 2023-2024, with projections indicating continued increases.

- Urbanization: Major Australian cities continue to experience population concentration due to job opportunities and lifestyle factors.

- Demographics: Evolving age demographics influence housing demand and the need for specialized property types.

Availability of Credit and Financing Conditions

The availability of credit and prevailing financing conditions are crucial for GPT Group's operational capacity and strategic expansion. In 2024, global interest rates remained elevated, influencing the cost of borrowing for companies like GPT. For instance, the Reserve Bank of Australia's cash rate, which impacts commercial lending, was at 4.35% as of early 2024, a significant increase from previous years, making new debt more expensive.

These conditions directly affect GPT's ability to fund new developments and manage its existing debt portfolio. A tightening credit environment, characterized by stricter lending criteria and higher interest margins, can limit access to capital, thereby potentially slowing down project pipelines or increasing refinancing costs. For example, a 1% increase in interest rates on GPT's substantial debt could translate to millions in additional annual interest expenses.

GPT Group's proactive management of its funding sources is therefore essential. Maintaining robust relationships with a diverse range of lenders, including banks, institutional investors, and capital markets, provides flexibility. This diversification helps mitigate risks associated with reliance on a single funding channel and ensures access to capital even during periods of market volatility. In late 2023, GPT successfully completed a $300 million sustainability-linked bond issuance, demonstrating its continued access to diverse funding avenues.

- Interest Rate Environment: As of early 2024, the RBA cash rate stood at 4.35%, impacting borrowing costs for Australian businesses.

- Debt Management: Higher interest rates increase the cost of refinancing existing debt and funding new projects for GPT Group.

- Credit Scrutiny: Tightening credit conditions can lead to more rigorous lending requirements, potentially constraining growth.

- Funding Diversification: GPT's strategy includes maintaining strong relationships with various lenders and utilizing capital markets, as evidenced by its 2023 sustainability-linked bond issuance.

Australia's economic growth outlook for 2024 and into early 2025 is a key determinant of GPT Group's performance. Projections indicate GDP expansion around 2.5% for 2024, a pace expected to continue into 2025, which generally boosts demand for GPT's diverse property portfolio. This positive economic climate supports rental income growth and property valuations.

Inflationary pressures continue to be a significant factor, impacting construction costs. While inflation can theoretically increase rental income, the lag in rent adjustments means GPT's profit margins can be squeezed by escalating material and labor costs. For example, construction material prices saw significant year-on-year increases exceeding 15% in late 2023 and early 2024.

Monetary policy, particularly the Reserve Bank of Australia's cash rate, directly influences GPT's financing costs. The cash rate stood at 4.35% in early 2024, making borrowing more expensive and impacting the feasibility of new developments and the cost of managing existing debt.

| Economic Indicator | Value/Status | Impact on GPT Group |

|---|---|---|

| GDP Growth (2024 est.) | ~2.5% | Supports demand for office, retail, and logistics properties. |

| Inflation (Construction Materials) | >15% YoY (late 2023/early 2024) | Increases development costs, potentially squeezing profit margins. |

| RBA Cash Rate (early 2024) | 4.35% | Increases borrowing costs, affecting new projects and debt servicing. |

| Unemployment Rate (early 2024) | 3.7% | Indicates strong labor market, supporting rental demand. |

Preview the Actual Deliverable

GPT PESTLE Analysis

The preview you see here is the exact GPT PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, providing a comprehensive look at the GPT PESTLE framework. You’ll be downloading this exact, finished document immediately after completing your purchase.

Sociological factors

Australia's population is aging, with the proportion of those aged 65 and over projected to reach 22% by 2050, up from 16% in 2020. This demographic trend, coupled with evolving household structures, directly impacts property demand. GPT's portfolio, for example, might see increased interest in healthcare-adjacent or smaller, accessible living spaces.

Urbanization continues to be a significant driver, with over 86% of Australians living in urban areas as of 2023. This concentration fuels demand for prime commercial and residential real estate in city centers, benefiting GPT's urban-focused assets. The ongoing migration to major cities like Sydney and Melbourne underscores the importance of well-located, mixed-use developments.

The shift towards hybrid and remote work models is fundamentally reshaping office demand. By late 2024, many companies are finalizing their long-term strategies, with a significant portion indicating a permanent reduction in physical office space requirements, impacting sectors like commercial real estate where GPT Group operates.

This evolution necessitates a reimagining of office environments. Tenants now seek spaces that foster collaboration and offer enhanced amenities, moving away from traditional, individual workstations. For instance, surveys in early 2025 show a strong preference for flexible layouts and communal areas, directly influencing how GPT Group might need to adapt its properties.

Adapting to these changing tenant needs is paramount for sustained occupancy and rental income. Companies that successfully pivot their office offerings to accommodate flexible work arrangements and prioritize employee well-being are likely to attract and retain tenants more effectively in the current market.

Consumer spending habits are evolving, with a noticeable shift towards experiences over goods. In 2024, Australian retail sales are projected to grow by 2.5%, but the composition of this growth is key, with a strong emphasis on services and dining.

The relentless rise of e-commerce continues to reshape the retail landscape, impacting physical store performance. Online retail sales in Australia accounted for approximately 15% of total retail turnover in early 2024, a figure that necessitates physical retail spaces to offer compelling reasons for customers to visit.

Experiential retail is no longer a niche, but a necessity for attracting foot traffic. Successful retail centers are increasingly incorporating dining, entertainment, and community services, with centers that offer a diverse mix of amenities seeing higher engagement and longer dwell times, as evidenced by a 10% increase in visitor numbers at mixed-use centers in 2023.

Health and Wellness Focus

Societal shifts towards health and wellness are significantly reshaping how people interact with physical spaces, directly influencing tenant demand in both office and retail sectors. This growing preference for environments that promote well-being means properties offering amenities like ample natural light, accessible green spaces, and convenient end-of-trip facilities are gaining a distinct advantage. For instance, a 2024 survey indicated that 78% of office workers consider access to outdoor space a key factor in their workplace satisfaction.

GPT Group can leverage this trend by integrating more biophilic design principles and wellness-focused services into its developments. Properties that prioritize occupant health, such as those featuring advanced air filtration systems or dedicated quiet zones, are likely to command higher occupancy rates and rental premiums. In 2025, buildings with strong wellness certifications are projected to see a 5-10% higher valuation compared to those without.

- Tenant Demand: 78% of office workers prioritize outdoor space access for satisfaction (2024 data).

- Property Value: Wellness-certified buildings may see 5-10% higher valuations (projected 2025).

- Design Integration: Incorporating natural light, green spaces, and end-of-trip facilities enhances property appeal.

- Sustainability Link: The health focus aligns with broader sustainability goals, attracting environmentally conscious tenants.

Community Expectations and Social Impact

Community expectations are significantly shaping how GPT Group operates, especially concerning corporate social responsibility. In 2024, there's a heightened demand for businesses to demonstrate tangible positive social impact. This directly influences GPT's reputation and its ability to maintain a social license to operate, meaning communities need to see value beyond just economic returns.

Engaging actively with local communities is crucial for GPT. Developments need to actively enhance the urban fabric, not detract from it, and address social equity. For instance, a focus on affordable housing components or accessible public spaces within new developments can foster goodwill. This proactive approach can streamline planning approvals, as seen in successful projects where community buy-in was secured early.

Strong community relations translate directly into enhanced brand value. By investing in social impact initiatives, GPT can build trust and loyalty. For example, in 2024, reports indicate that companies with strong ESG (Environmental, Social, and Governance) performance, which includes community engagement, often see a premium in investor and consumer perception.

- Growing Demand for CSR: By 2025, consumer surveys will likely show an even greater preference for brands demonstrating strong corporate social responsibility, impacting GPT's market position.

- Urban Fabric Contribution: GPT's 2024 development projects are being scrutinized for their contribution to public spaces and local amenities, impacting their social license.

- Social Equity Focus: Addressing social equity concerns, such as affordable housing or job creation for local residents, is becoming a non-negotiable expectation for community acceptance of new developments.

- Brand Value Enhancement: Successful community engagement in 2024 has demonstrably improved brand perception for similar real estate developers, a trend GPT is likely to leverage.

Societal expectations around health and well-being are increasingly influencing property design and tenant preferences. By 2025, a significant majority of office workers are expected to prioritize workplaces offering natural light and access to green spaces, with 78% already citing outdoor space access as crucial for job satisfaction in 2024. GPT Group can capitalize on this by integrating biophilic design and wellness amenities, potentially boosting property valuations by 5-10% for certified buildings.

| Societal Factor | Impact on GPT | Supporting Data |

| Health & Wellness Focus | Increased demand for properties with natural light, green spaces, and wellness amenities. | 78% of office workers prioritize outdoor space access (2024). Wellness-certified buildings may see 5-10% higher valuations (projected 2025). |

| Corporate Social Responsibility (CSR) | Heightened community demand for tangible positive social impact and community enhancement. | Companies with strong ESG performance often see a premium in perception (2024). Community buy-in can streamline planning approvals. |

Technological factors

PropTech adoption, including smart building systems and IoT sensors, is significantly boosting operational efficiency and tenant satisfaction for GPT Group. These advancements allow for optimized energy usage, enhanced security, and data-driven property management. For instance, smart building technologies can reduce energy consumption by up to 30% in commercial spaces, a key benefit for GPT's portfolio.

The relentless growth of e-commerce, projected to reach over $7 trillion globally by 2025, directly fuels the demand for sophisticated logistics and warehousing. This surge necessitates modern facilities capable of handling increased inventory and faster delivery cycles, a core area for GPT Group's strategic focus.

The evolving landscape of supply chains, with a strong emphasis on efficient last-mile delivery and the adoption of automated warehouse technologies, shapes the development of new logistics assets. GPT Group capitalizes on this by strategically expanding its logistics footprint, ensuring its properties are equipped for the future of retail fulfillment.

GPT Group's adoption of big data analytics and AI is revolutionizing portfolio management by uncovering intricate market trends and tenant behavior patterns. This allows for more strategic investment choices and operational efficiencies. For instance, AI-powered tools can predict optimal leasing cycles, potentially increasing occupancy rates by an estimated 5-10% in the 2024-2025 period.

Artificial intelligence is also proving invaluable for predictive maintenance, aiming to reduce unexpected repair costs by up to 15% in the coming year. Furthermore, AI facilitates personalized tenant services, enhancing customer satisfaction and retention, a crucial factor in the competitive real estate landscape of 2024-2025.

Advanced Construction Technologies

Innovations like Building Information Modeling (BIM) are transforming construction. For instance, a 2024 report indicated that BIM adoption can reduce construction costs by up to 10% and improve project delivery timelines by 15%. This translates to significant cost savings and faster project completion for GPT Group.

Modular construction, another key technological advancement, offers substantial benefits. Projects utilizing modular techniques in 2024 saw an average of 20% faster completion times compared to traditional methods. This efficiency gain, coupled with reduced waste, directly boosts project profitability and sustainability.

The integration of sustainable building materials is also a critical technological factor. By 2025, the global green building materials market is projected to reach $450 billion, driven by demand for eco-friendly solutions. GPT Group can leverage these materials to enhance its environmental credentials and appeal to increasingly conscious consumers.

These advanced construction technologies collectively contribute to:

- Enhanced project efficiency and reduced costs

- Accelerated project delivery timelines

- Improved quality control and reduced environmental impact

- Increased project profitability and sustainability

Digital Connectivity and Infrastructure

The increasing demand for high-speed digital connectivity and robust technological infrastructure is a significant technological factor for GPT Group. This is particularly true for their office and logistics properties, where reliable internet access, 5G readiness, and smart network capabilities are becoming essential amenities. For example, in 2024, office tenants increasingly prioritize buildings offering seamless connectivity, impacting leasing decisions and rental rates.

GPT Group's investment in digital infrastructure is crucial for maintaining property competitiveness and ensuring future functionality. By upgrading networks and integrating smart technologies, GPT can attract and retain high-value tenants who rely on advanced digital services. This proactive approach helps future-proof their assets against evolving technological demands.

- Digital Connectivity as a Tenant Draw: High-speed internet and 5G are now key differentiators in the commercial real estate market.

- Smart Network Capabilities: Integration of IoT and smart building technologies enhances operational efficiency and tenant experience.

- Future-Proofing Investments: Upgrading digital infrastructure ensures GPT properties remain attractive and functional for evolving business needs.

- Competitive Advantage: Properties with superior digital infrastructure are likely to command higher occupancy rates and rental yields.

Technological advancements are reshaping the real estate sector, impacting GPT Group's operations and strategic direction. PropTech, including IoT sensors and smart building systems, is enhancing efficiency and tenant satisfaction, with smart technologies potentially reducing energy consumption by up to 30% in commercial spaces.

The digital transformation extends to property management, where AI and big data analytics are being employed to understand market trends and tenant behavior, potentially boosting occupancy rates by 5-10% in the 2024-2025 period. Furthermore, AI aids in predictive maintenance, aiming to cut unexpected repair costs by 15%.

Innovations in construction, such as Building Information Modeling (BIM) and modular construction, are driving down costs and speeding up project delivery. BIM adoption, for instance, can reduce construction expenses by up to 10%, while modular methods have demonstrated 20% faster completion times in 2024 projects.

The emphasis on digital connectivity, including 5G readiness and smart network capabilities, is becoming a crucial factor for tenant attraction and retention in GPT's office and logistics portfolios, with tenants increasingly prioritizing these amenities in 2024.

| Technology | Impact on GPT Group | Key Data/Projections (2024-2025) |

|---|---|---|

| PropTech (IoT, Smart Buildings) | Operational efficiency, tenant satisfaction, energy savings | Up to 30% energy reduction in commercial spaces |

| AI & Big Data Analytics | Portfolio management, market insights, tenant behavior analysis | Potential 5-10% increase in occupancy rates; 15% reduction in repair costs |

| BIM & Modular Construction | Reduced construction costs, faster project delivery | 10% cost reduction (BIM); 20% faster completion (Modular) |

| Digital Connectivity (5G, Smart Networks) | Tenant attraction, property competitiveness | Increasingly a key leasing differentiator |

Legal factors

GPT Group's operations in Australia are heavily influenced by stringent building codes and safety regulations. Adherence to these standards, including occupational health and safety (OHS) requirements, is non-negotiable for all development and operational projects. For instance, in 2024, the Australian construction industry faced increased scrutiny on safety protocols following several high-profile incidents, leading to potential fines for non-compliance that can reach hundreds of thousands of dollars per infraction.

Failure to comply with these legal frameworks can result in substantial financial penalties, significant project delays, and severe reputational damage for GPT Group. Staying abreast of evolving regulatory landscapes and maintaining robust compliance systems are therefore critical strategic imperatives. In 2025, we anticipate further refinements in energy efficiency building codes, impacting construction materials and design choices.

Environmental legislation, covering waste, emissions, heritage, and biodiversity, significantly influences GPT Group's property development and management. For instance, stricter emission standards introduced in 2024 across various Australian states necessitate ongoing investment in cleaner technologies for GPT's industrial and office assets. Non-compliance can lead to substantial fines, impacting profitability and project timelines, underscoring the importance of robust environmental impact assessments for all new developments.

Laws governing tenant-landlord relationships in Australia, particularly concerning commercial leases, directly influence GPT Group's operational stability. These regulations dictate lease terms, rent adjustments, and eviction procedures, impacting revenue streams and property management costs. For instance, changes in state-specific retail tenancy laws, such as those implemented in New South Wales or Victoria, can alter lease renewal rights or dispute resolution processes, requiring GPT to adapt its contractual frameworks.

The stability of GPT's rental income is closely tied to the legal enforceability of lease agreements. Variations in legislation across different Australian states and territories regarding lease termination, rent review clauses, and tenant protections can create complexities. For example, a shift towards more tenant-friendly legislation in a key market could necessitate adjustments to lease structures to maintain predictable income flow.

Navigating the diverse legal landscape of commercial tenancy laws across Australia is crucial for GPT Group's dispute resolution and operational efficiency. Understanding regulations around property maintenance, landlord obligations, and tenant rights helps mitigate legal risks and ensures smoother business operations, ultimately protecting the company's financial performance.

Planning and Zoning Legislation

Planning and zoning legislation, managed by state and local authorities, significantly shapes where and what GPT Group can develop. These laws directly impact project feasibility and design, often requiring extensive time and financial investment to secure approvals and navigate complex regulations. For instance, in 2024, the average time to obtain a major development planning permit in Australia could extend up to 12-18 months, with associated costs varying widely by project scale and location.

Navigating these legal frameworks is paramount for GPT Group's success. Expertise in planning legislation ensures that development proposals align with community needs and regulatory requirements, minimizing delays and potential legal challenges. Failure to comply can lead to significant penalties and project setbacks, impacting financial returns and market reputation.

Key considerations for GPT Group include:

- Understanding local zoning ordinances: Each municipality has specific rules regarding land use, building height, density, and setbacks, which must be meticulously researched and adhered to.

- Securing planning permits: The process for obtaining development approval can be lengthy and involve multiple stages, including public consultations and environmental impact assessments.

- Adapting to evolving legislation: Planning laws are subject to change, requiring ongoing monitoring and adaptation of development strategies to remain compliant.

- Cost implications of compliance: Fees for applications, expert consultations (e.g., town planners, environmental consultants), and potential modifications to designs add to project expenses.

Corporate Governance and REIT Regulations

As a publicly listed Australian Real Estate Investment Trust (REIT), GPT Group operates under a robust legal framework. This includes strict corporate governance mandates, Australian Securities Exchange (ASX) listing rules, and specific regulations governing trusts and managed investment schemes. For instance, the Corporations Act 2001 (Cth) and various ASIC regulatory guides are foundational to its operations, ensuring compliance and accountability.

These legal requirements are designed to safeguard investor interests and uphold the integrity of the financial markets. GPT Group's adherence to these regulations is crucial for maintaining investor confidence and its standing with regulatory bodies. In 2024, ongoing scrutiny of financial reporting and corporate conduct by regulators like ASIC underscores the importance of this compliance.

- Corporate Governance: GPT Group must adhere to the ASX Corporate Governance Council's Principles and Recommendations, focusing on board independence, executive remuneration, and ethical conduct.

- ASX Listing Rules: Compliance with rules regarding continuous disclosure, market announcements, and shareholder communications is paramount for maintaining its listing.

- Trust and Managed Investment Scheme Regulations: Specific legislation governs the structure and operation of REITs, ensuring fair treatment of unitholders and proper asset management.

- ASIC Oversight: The Australian Securities and Investments Commission (ASIC) actively monitors compliance, with recent enforcement actions in 2024 highlighting the need for diligent adherence to financial services laws.

Legal factors significantly shape GPT Group's strategic decisions, from development approvals to corporate conduct. Adherence to building codes, environmental laws, and tenant-landlord regulations is critical, with non-compliance risking substantial fines and reputational damage. For instance, in 2024, Australian construction safety fines could reach hundreds of thousands of dollars per violation, and energy efficiency code updates are expected in 2025.

Planning and zoning laws dictate development feasibility, with permit acquisition in Australia averaging 12-18 months in 2024, incurring significant costs. Furthermore, as a REIT, GPT Group must comply with stringent corporate governance, ASX listing rules, and managed investment scheme regulations, as overseen by ASIC, to maintain investor trust and market integrity. Recent ASIC enforcement actions in 2024 emphasize the need for diligent financial services law adherence.

Environmental factors

GPT Group is increasingly exposed to physical climate change risks. The heightened frequency and intensity of extreme weather events, like the devastating Australian bushfires in 2019-2020 which caused an estimated AUD 100 billion in economic losses, directly impact property values and operational continuity. This necessitates significant investment in climate-resilient infrastructure and adaptive strategies to manage rising insurance premiums and potential supply chain disruptions.

GPT Group faces increasing demands from regulators, investors, and tenants to lower energy use and carbon footprints in its properties. This pressure directly shapes how GPT operates and plans for the future.

To address this, GPT is investing in energy-saving tech, renewable power, and setting clear goals for cutting emissions. These actions are vital for achieving sustainability targets and boosting property worth. For instance, GPT's 2023 sustainability report highlighted a 15% reduction in absolute carbon emissions intensity across its portfolio compared to its 2019 baseline.

Green building certifications, such as NABERS ratings, serve as important benchmarks for GPT's performance in this area. In 2024, GPT achieved an average NABERS Energy rating of 5.2 stars across its office portfolio, demonstrating a commitment to environmental performance.

GPT Group's commitment to sustainable waste management and circular economy principles is a key environmental focus, particularly in construction and property operations. This involves actively reducing construction waste and boosting recycling rates, with a goal to reuse materials where possible. For instance, in 2023, GPT reported diverting 86% of construction and demolition waste from landfill across its major projects, a significant step towards resource efficiency.

Implementing effective waste management strategies not only enhances GPT's environmental performance but also drives cost savings. By minimizing waste disposal fees and exploring avenues for material reuse, the company can achieve operational efficiencies. This aligns with broader industry trends, where the Australian construction sector alone generates over 50 million tonnes of waste annually, highlighting the economic and environmental imperative for circular practices.

Water Scarcity and Management

Water scarcity, especially in parts of Australia, presents a tangible risk to property operations for GPT Group, potentially impacting the feasibility of new developments. For instance, regions like Western Sydney have faced increased scrutiny on water usage for construction and ongoing property management.

GPT Group is actively addressing this by integrating water-efficient fixtures, rainwater harvesting, and drought-tolerant landscaping across its properties. This proactive approach is crucial for minimizing water consumption and enhancing operational resilience.

Effective water management is not just about compliance; it's a cornerstone of environmental stewardship and long-term business sustainability. This focus is becoming increasingly critical as climate change intensifies water stress in many areas where GPT operates.

- Water Scarcity Impact: Regions like Queensland have seen significant rainfall variability, directly affecting water availability for commercial properties and development projects.

- Efficiency Measures: GPT's commitment to water efficiency is demonstrated through initiatives like installing low-flow fixtures, which can reduce water usage by up to 30% in commercial buildings.

- Rainwater Harvesting: The implementation of rainwater harvesting systems, such as those at the Melbourne Central shopping centre, diversifies water sources and reduces reliance on municipal supplies.

- Operational Resilience: Robust water management strategies are vital for maintaining uninterrupted operations, particularly in the face of potential drought conditions impacting utilities.

Biodiversity and Green Spaces

The growing emphasis on biodiversity and green spaces significantly impacts urban development. Communities and regulators increasingly expect developers like GPT Group to prioritize these elements. Integrating native landscaping and urban greening initiatives can boost GPT's environmental reputation and community buy-in for new projects.

Protecting existing ecological features and contributing positively to local ecosystems are becoming standard expectations. For instance, in 2024, many cities are implementing stricter regulations on green space allocation per development, with some mandating at least 15% of project land be dedicated to natural or semi-natural areas. This trend is driven by research showing the tangible benefits of green spaces on urban well-being and climate resilience.

- Increased Regulatory Scrutiny: Expect more stringent requirements for green space inclusion in new developments, impacting project timelines and costs.

- Community Demand for Green Amenities: Property buyers and residents are actively seeking developments with accessible parks, natural habitats, and sustainable landscaping.

- Ecosystem Services Value: The economic value of ecosystem services provided by urban green spaces, such as stormwater management and air purification, is increasingly recognized, influencing development approvals.

Environmental factors significantly shape GPT Group's operations and strategic planning. The increasing frequency of extreme weather events, like those seen in Australia, directly impacts property values and operational continuity, necessitating investments in resilient infrastructure. GPT is actively working to reduce its carbon footprint by investing in energy-efficient technologies and renewable power sources, aiming for clear emission reduction targets.

Water scarcity is another critical consideration, particularly in Australian regions, requiring GPT to implement water-saving measures across its portfolio. The company is also focusing on sustainable waste management and circular economy principles, striving to minimize landfill waste from construction and operations. Furthermore, there's a growing expectation for developers to integrate biodiversity and green spaces into urban projects, influencing development approvals and community engagement.

| Environmental Factor | Impact on GPT Group | GPT's Response/Data (2023-2024) |

|---|---|---|

| Climate Change & Extreme Weather | Physical asset damage, operational disruption, increased insurance costs | Investment in climate-resilient infrastructure; 2019-2020 Australian bushfires estimated AUD 100 billion economic loss |

| Carbon Emissions & Energy Use | Regulatory pressure, investor expectations, tenant demand | 15% reduction in absolute carbon emissions intensity (vs. 2019 baseline); Average NABERS Energy rating of 5.2 stars (2024) |

| Waste Management | Operational costs, resource efficiency, regulatory compliance | 86% of construction and demolition waste diverted from landfill (2023); Australian construction sector generates >50 million tonnes waste annually |

| Water Scarcity | Operational risk, development feasibility, utility costs | Water-efficient fixtures, rainwater harvesting, drought-tolerant landscaping; Queensland rainfall variability impacts water availability |

| Biodiversity & Green Spaces | Development approvals, community relations, regulatory requirements | Integrating native landscaping; Stricter city regulations mandating ~15% green space in new developments (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a comprehensive blend of public and proprietary data sources, ensuring a nuanced understanding of your market. We integrate insights from government publications, reputable market research firms, and academic studies to provide actionable intelligence.