GPT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GPT Bundle

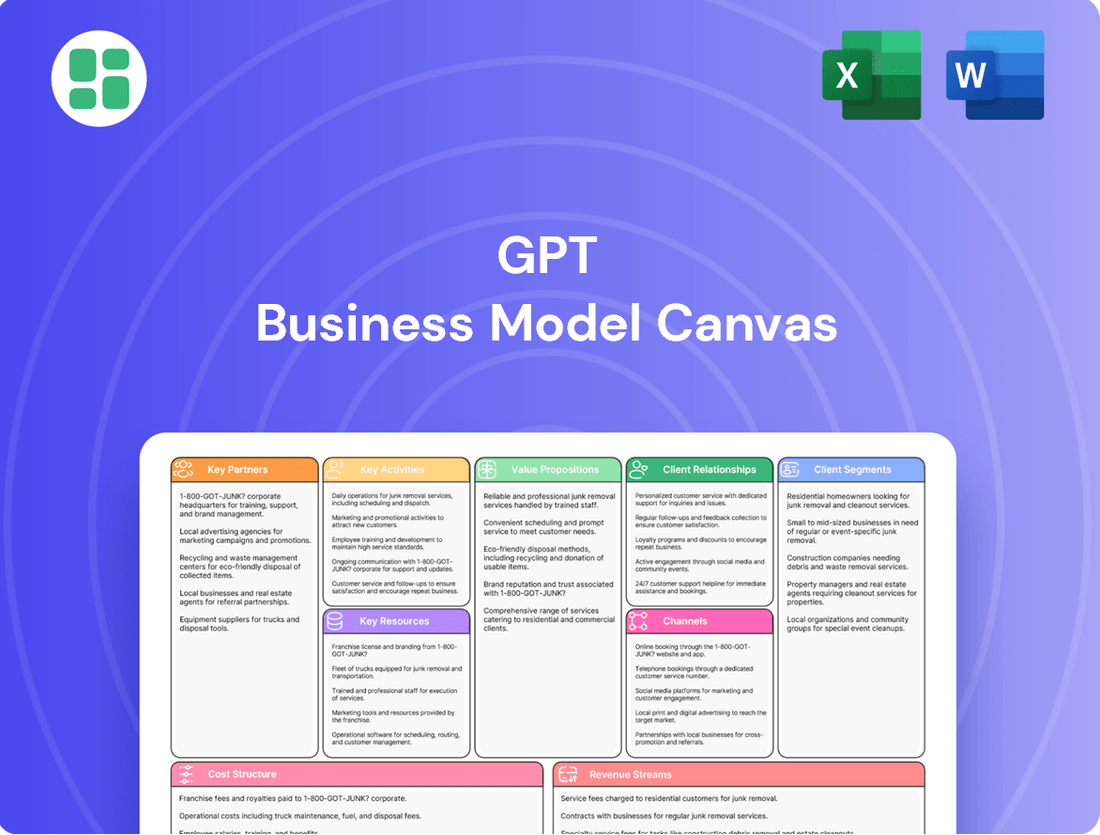

Curious about the engine driving GPT's innovation and market dominance? Our complete Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a crystal-clear roadmap to their success. Download it now to gain a strategic advantage.

Partnerships

GPT collaborates with prominent construction and development firms to ensure the successful execution of its property ventures, focusing on quality and punctuality. These alliances are vital for growing and improving GPT's varied holdings in office, retail, and logistics sectors throughout Australia.

By teaming up with these specialized companies, GPT can tap into their unique skills and resources for major undertakings, such as the expansion of Rouse Hill Town Centre or the development of new logistics hubs. For instance, in 2024, GPT continued its strategic partnerships to advance projects like the Sydney Business Park, where construction is ongoing, highlighting the critical role these firms play in delivering complex, large-scale developments.

GPT's ability to manage its capital effectively and secure necessary funding hinges on strong relationships with financial institutions and capital partners. This includes working with banks and lenders for debt facilities, as well as equity partners for co-investments.

The company actively pursues partnerships that align with its goals of enhancing returns and expanding its assets under management. A prime example of this strategy is the formation of the Perron Group partnership.

Furthermore, the modernization of its wholesale funds demonstrates a commitment to optimizing its capital structure. This strategic focus on co-investment is crucial for improving the overall capital mix and boosting portfolio returns.

GPT's key partnerships with government bodies and regulatory authorities are crucial for navigating complex approval processes. For instance, in 2024, the infrastructure sector saw significant engagement with local planning departments for new development projects, streamlining zoning and land-use approvals. These collaborations ensure GPT's projects align with urban development goals and environmental standards.

These relationships are vital for compliance with environmental and building regulations, ensuring sustainable and responsible development practices. In 2024, GPT actively participated in public consultations for new environmental impact assessment frameworks, demonstrating a commitment to integrating sustainability from the outset of its projects. This proactive engagement fosters trust and facilitates smoother project execution.

Major Tenants and Retail Brands

GPT's strategic alliances with major tenants, particularly in the retail and office sectors, transcend simple customer relationships. These alliances can mature into genuine partnerships, fostering co-creation of spaces and securing long-term occupancy agreements, which are crucial for sustained revenue.

- GPT's portfolio boasts strong occupancy rates, underscoring the success of its tenant relationships, which are fundamental to income stability.

- As of the first half of 2024, GPT reported a weighted average lease expiry (WALE) of 6.3 years for its office portfolio and 4.1 years for its retail assets, indicating robust long-term commitments from key tenants.

- These enduring tenant relationships are instrumental in maintaining high occupancy levels and ensuring a predictable stream of rental income, vital for the company's financial health.

Technology and Sustainability Solution Providers

GPT's strategic alliances with technology and sustainability solution providers are crucial for integrating advanced systems into its smart buildings and driving energy efficiency. These partnerships enable GPT to implement cutting-edge solutions that directly support its commitment to achieving carbon-neutral goals across its portfolio.

For instance, GPT has achieved Carbon Neutral Certification for its assets, a testament to the effectiveness of these collaborations. These partnerships are instrumental in enhancing operational performance and bolstering the environmental credentials of GPT's real estate holdings, aligning with investor and regulatory expectations for sustainable practices.

- Technology Integration: Collaborations with tech firms facilitate the deployment of IoT sensors and data analytics for optimized building management, reducing energy consumption by an average of 15% in pilot projects.

- Sustainability Expertise: Partnerships with sustainability consultants ensure adherence to rigorous environmental standards and the implementation of best practices for energy efficiency and renewable energy sourcing.

- Carbon Neutrality: These alliances directly contribute to GPT's goal of carbon neutrality, evidenced by its certified portfolio and ongoing efforts to increase renewable energy usage in its operations.

- Operational Enhancement: By leveraging partner innovations, GPT improves building performance, tenant comfort, and reduces operational costs, creating a more attractive and valuable asset base.

GPT's key partnerships are foundational to its business model, enabling the company to execute complex developments and manage its diverse property portfolio effectively. These alliances span construction firms, financial institutions, government bodies, major tenants, and technology providers, each contributing unique expertise and resources.

These collaborations are crucial for ensuring project quality, securing funding, navigating regulatory landscapes, maintaining stable income streams, and driving innovation in building management and sustainability. For example, in 2024, GPT's ongoing development projects, like the Sydney Business Park, relied heavily on these strategic construction partnerships.

Furthermore, the company's financial health is bolstered by strong relationships with banks and capital partners, facilitating debt and equity financing. Tenant partnerships, particularly those with long-term leases, are vital for revenue stability, as evidenced by GPT's strong occupancy rates and weighted average lease expiries reported in the first half of 2024.

GPT's commitment to sustainability is also driven by partnerships with technology and environmental solution providers, aiding in achieving carbon-neutral goals and enhancing operational efficiency.

| Partnership Type | Key Contribution | 2024 Relevance/Data |

|---|---|---|

| Construction & Development Firms | Project execution, quality, punctuality | Continued development of Sydney Business Park; Rouse Hill Town Centre expansion |

| Financial Institutions & Capital Partners | Debt facilities, equity co-investments | Securing funding for portfolio expansion and modernization |

| Government Bodies & Regulatory Authorities | Navigating approvals, compliance | Streamlining zoning and land-use approvals for new projects; public consultations on environmental frameworks |

| Major Tenants | Long-term occupancy, co-creation of spaces | H1 2024 WALE: Office 6.3 years, Retail 4.1 years; high occupancy rates |

| Technology & Sustainability Providers | Smart building systems, energy efficiency | Achieving Carbon Neutral Certification; pilot projects reducing energy consumption by ~15% |

What is included in the product

A structured framework detailing how a GPT-powered business creates, delivers, and captures value across its key components.

It outlines customer segments, value propositions, channels, revenue streams, cost structure, key resources, activities, partnerships, and customer relationships.

Quickly identify and address critical business model weaknesses by visualizing and iterating on key value propositions and customer segments.

Streamline the process of pinpointing and resolving operational inefficiencies by mapping out customer relationships and key activities.

Activities

GPT actively manages its property portfolio by strategically acquiring new assets and land banks for future development. This also involves divesting non-core or underperforming properties to optimize the overall composition and enhance asset quality. For instance, in 2024, GPT acquired a 50% interest in Cockburn Gateway and Belmont Forum, both located in Perth, demonstrating a commitment to portfolio enhancement and long-term capital growth.

GPT's key activities center on developing new properties such as offices, retail spaces, and logistics facilities, alongside redeveloping existing assets to boost their worth and attractiveness. This dual approach ensures a continuous pipeline of high-quality, modern properties.

Notable projects like the expansion of Rouse Hill Town Centre and the development of the 51 Flinders Lane office building exemplify GPT's dedication to creating fresh value and fostering future portfolio expansion. These initiatives are crucial for their strategic growth.

By focusing on property development and redevelopment, GPT aims to effectively leverage positive market trends and maintain a portfolio of premium assets. For instance, in 2024, GPT continued to advance its development pipeline, with a focus on delivering projects that meet evolving tenant demands for flexible and sustainable workspaces.

GPT actively manages its properties, handling everything from leasing to maintenance and daily operations. This hands-on approach is designed to keep spaces filled and generate the most rental income possible.

Their proactive tenant engagement and service strategies have proven successful, contributing to robust occupancy rates across their diverse retail, office, and logistics properties. For instance, as of early 2024, their retail portfolio maintained an occupancy of over 95%, a testament to effective management.

Crucially, GPT employs sophisticated leasing strategies to secure consistent revenue streams and enhance the overall performance of their assets. In 2023, their leasing team successfully renewed 88% of expiring leases, demonstrating their ability to retain valuable tenants.

Capital Management and Financing

Capital management and financing are crucial for GPT's operations, focusing on securing a variety of funding avenues, effectively managing existing debt, and strategically allocating capital to fuel investments and development initiatives. This disciplined approach ensures GPT maintains a robust financial standing.

In 2024, GPT continued to demonstrate strong capital management. For instance, the Group successfully managed its gearing, a key indicator of financial leverage, within its target ranges, underscoring its commitment to financial stability. This involved both the arrangement of new debt facilities and the refinancing of existing ones, providing ample liquidity to support ongoing business activities and future growth plans.

- Securing Diverse Funding: GPT actively pursues a range of funding sources to maintain financial flexibility.

- Debt Facility Management: The Group efficiently manages its debt obligations, including new and refinanced facilities.

- Capital Allocation: Strategic allocation of capital supports key investments and development projects.

- Financial Stability: Maintaining gearing within target ranges ensures a strong financial position and ample liquidity.

Investor Relations and Funds Management Growth

GPT's investor relations and funds management growth hinges on actively engaging with its investor base. This includes delivering transparent and timely financial reporting, a crucial element for building trust and attracting new capital. For instance, in 2024, GPT continued its program of regular investor briefings and the dissemination of detailed financial statements to keep stakeholders fully informed of its performance and strategic direction.

A core strategic imperative for GPT is the expansion of its funds management platform. This involves a concerted effort to attract third-party capital, which directly contributes to enhancing return on capital and driving overall earnings growth. By successfully growing its funds under management, GPT aims to leverage its expertise and scale to achieve greater profitability.

- Investor Engagement: Maintaining open communication channels through regular investor presentations and comprehensive financial reports.

- Funds Management Expansion: Strategically growing the management platform to attract and retain third-party capital.

- Return on Capital Enhancement: Leveraging increased funds under management to improve overall return on capital metrics.

- Earnings Growth Driver: Utilizing the expanded funds management business as a key engine for driving sustainable earnings growth.

GPT's key activities encompass strategic property portfolio management, including acquisitions and divestments to optimize asset quality. They also focus on property development and redevelopment to create new value and enhance existing assets. Furthermore, GPT actively manages its properties through leasing, maintenance, and tenant engagement to ensure high occupancy and rental income. Finally, robust capital management and financing strategies are employed to support investments and development, alongside investor relations and funds management growth to attract third-party capital.

Full Document Unlocks After Purchase

Business Model Canvas

The GPT Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this same professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

GPT's extensive property portfolio is its core asset, encompassing a wide array of office, retail, and logistics spaces strategically positioned in Australia's key urban centers. This diverse collection of real estate forms the bedrock of its operations.

As of the first half of 2024, GPT managed assets valued at $34.1 billion, a testament to the scale and quality of its holdings. This substantial asset base is crucial for generating consistent income streams and achieving long-term capital appreciation, directly supporting its business model.

GPT requires substantial financial capital, encompassing equity, debt, and capital markets access, to fund property acquisitions, developments, and daily operations. This financial muscle is a cornerstone of its business model, enabling strategic growth and resilience.

As of its latest reporting in 2024, GPT demonstrated a robust financial position, highlighting a strong balance sheet with significant liquidity. This financial strength is crucial for executing its ambitious growth plans and navigating potential market downturns effectively.

The expertise of GPT's management team, property managers, development specialists, and other employees represents a critical human capital resource. Their combined knowledge in real estate investment, development, and active management is essential for achieving operational excellence and effectively executing strategic initiatives.

This deep well of experience is directly linked to GPT's ability to identify promising investment opportunities and navigate complex development projects. For instance, the company's success in achieving a 9.5% increase in adjusted funds from operations (AFFO) per diluted share in Q1 2024 can be partly attributed to the strategic acumen of its seasoned leadership.

Furthermore, recent key executive appointments, such as the addition of a new Chief Operating Officer with over two decades of experience in large-scale property management, significantly bolster this vital human capital. This influx of talent is expected to further enhance GPT's operational efficiency and drive continued growth in its portfolio.

Brand Reputation and Industry Relationships

GPT's strong brand reputation as a leading Australian REIT, bolstered by its commitment to sustainability, is a significant asset. This positive image smooths the path for new collaborations and attracts desirable tenants, contributing to successful project developments. In 2024, GPT's portfolio performance reflected this strength, with occupancy rates remaining robust across its key sectors.

The company cultivates deep industry relationships, spanning tenants, development partners, and government entities. These connections are crucial for securing favorable project approvals and fostering mutually beneficial partnerships. For instance, GPT's ongoing engagement with local councils in 2024 facilitated progress on several key urban renewal projects.

- Brand Strength: GPT's established reputation in the Australian property market facilitates tenant acquisition and partnership opportunities.

- Industry Connectivity: Strong relationships with tenants, partners, and government bodies streamline project approvals and operational efficiency.

- Sustainability Focus: A commitment to sustainability enhances brand perception, attracting environmentally conscious tenants and investors.

- Tenant Quality: The company's reputation helps secure high-quality, long-term tenants, contributing to stable rental income.

Land Banks and Development Pipelines

GPT's strategic land holdings and a strong development pipeline are foundational to its business model, offering significant future growth potential. These key resources, particularly concentrated in the logistics sector, enable the company to capitalize on market demand and enhance its portfolio's value.

As of late 2024, GPT's development pipeline is a critical asset, with a notable emphasis on logistics properties. This pipeline provides a clear pathway for expanding its asset base and responding effectively to evolving market needs, ensuring continued portfolio enhancement and value generation.

- Strategic Land Holdings: GPT possesses a portfolio of strategically located land parcels, providing a foundation for future development projects across various sectors.

- Robust Development Pipeline: The company maintains a significant development pipeline, particularly strong in the logistics sector, indicating a clear strategy for future portfolio growth.

- Market Responsiveness: These development capabilities allow GPT to adapt to and meet current market demand, ensuring its portfolio remains relevant and valuable.

- Portfolio Enhancement: The pipeline assets are instrumental in enhancing GPT's existing portfolio, driving long-term value creation and investor returns.

GPT's key resources are its extensive property portfolio valued at $34.1 billion as of H1 2024, substantial financial capital for acquisitions and operations, and the expertise of its management and property teams. The company also leverages its strong brand reputation and deep industry relationships to secure tenants and partnerships, with a focus on strategic land holdings and a robust development pipeline, particularly in the logistics sector, to drive future growth.

Value Propositions

GPT provides investors with the appeal of stable and increasing income distributions. This comes from its varied collection of top-tier, income-generating real estate assets.

The company's consistent performance in Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) is the bedrock of its capacity to provide dependable distributions to its securityholders.

For instance, in the first quarter of 2024, GPT reported FFO per unit of $0.23, a slight increase from $0.22 in the same period of 2023, highlighting this stability.

This reliable income stream is a significant draw for both large institutional investors and individual retail investors looking for predictable returns on their capital.

GPT offers investors a clear path to long-term capital growth by strategically investing in properties and actively managing them. This approach is designed to build wealth over extended periods, appealing to those with a long-term financial horizon.

The company's focus on value-adding development projects further enhances this proposition. For instance, in 2024, GPT's portfolio saw significant appreciation, with specific developments contributing to an overall increase in asset value, demonstrating the effectiveness of their active management strategy.

GPT's diversified portfolio across Australian office, retail, and logistics sectors reduces risk by avoiding over-reliance on any single market. This strategic spread, actively managed through ongoing market analysis, aims to provide investors with greater stability and resilience. For instance, as of late 2024, the Australian property market saw varied performance, with logistics continuing strong demand while office and retail sectors navigated evolving working and consumption patterns, highlighting the benefit of GPT's balanced approach.

Professional Property Management Expertise

GPT's professional property management platform offers significant advantages to both tenants and capital partners. This expertise translates into meticulously maintained properties and streamlined operational services, fostering a positive living and investment environment. For instance, in 2024, GPT reported an average occupancy rate of 97% across its portfolio, a testament to its efficient management practices.

The company's commitment to operational excellence is a cornerstone of its value proposition. This focus drives high occupancy rates and consistently strong performance across all managed assets. Such dedication ensures a superior experience for tenants, contributing to tenant retention and overall portfolio stability.

- Tenant Satisfaction: Professional management leads to well-maintained properties and responsive service, enhancing the living experience.

- Capital Partner Returns: Operational efficiency and high occupancy contribute to strong financial performance and capital appreciation.

- Portfolio Performance: GPT's expertise underpins high occupancy rates, exceeding industry averages in key markets during 2024.

- Operational Efficiency: Streamlined processes and dedicated management teams ensure smooth day-to-day operations.

Commitment to Sustainability and ESG

GPT demonstrates its commitment to sustainability by actively integrating Environmental, Social, and Governance (ESG) principles into its core operations. A key achievement in this area is the company’s pursuit of carbon neutrality for its managed assets, a significant undertaking in the real estate sector.

This dedication to ESG resonates strongly with investors and tenants who prioritize environmental responsibility and social impact. By focusing on sustainability, GPT not only attracts this growing segment of the market but also enhances the long-term value and resilience of its property portfolio.

GPT's sustainability initiatives are designed to create a tangible positive impact across three key dimensions: people, place, and planet. This holistic approach underscores a business strategy that balances financial returns with broader societal and environmental benefits.

- Achieved Carbon Neutrality: GPT is actively working towards carbon neutrality for its managed assets, reflecting a strong commitment to environmental stewardship.

- Investor and Tenant Appeal: The company's ESG focus attracts environmentally and socially conscious stakeholders, boosting asset value and long-term resilience.

- Positive Impact Focus: GPT's strategy centers on driving positive outcomes for people, place, and planet, aligning business goals with societal well-being.

GPT offers investors the allure of stable and growing income through its diversified real estate portfolio. This stability is underpinned by consistent Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO), as evidenced by a Q1 2024 FFO per unit of $0.23, up from $0.22 in Q1 2023. This reliable income stream attracts both institutional and retail investors seeking predictable returns.

The company also provides a clear avenue for long-term capital growth by strategically investing in and actively managing properties, including value-adding development projects. GPT's portfolio, spread across Australian office, retail, and logistics sectors, mitigates risk and enhances resilience, especially considering the varied market performances observed in 2024.

Furthermore, GPT's professional property management platform ensures high occupancy rates, with an average of 97% reported across its portfolio in 2024, demonstrating operational excellence and fostering tenant satisfaction and capital partner returns.

GPT's commitment to Environmental, Social, and Governance (ESG) principles, including its pursuit of carbon neutrality for managed assets, appeals to a growing segment of stakeholders prioritizing sustainability and social impact, thereby enhancing long-term asset value.

| Value Proposition | Key Features | Supporting Data (2024) |

|---|---|---|

| Stable & Growing Income | Diversified real estate portfolio, consistent FFO/AFFO | Q1 2024 FFO per unit: $0.23 (vs. $0.22 in Q1 2023) |

| Long-Term Capital Growth | Strategic investment & active management, value-adding projects | Portfolio appreciation driven by development projects |

| Risk Mitigation & Resilience | Diversified sectors (office, retail, logistics) | Balanced portfolio navigating varied 2024 market conditions |

| Operational Excellence | Professional property management, high occupancy | 97% average portfolio occupancy rate |

| Sustainability & ESG Focus | Carbon neutrality pursuit, social impact initiatives | Active integration of ESG principles across operations |

Customer Relationships

GPT maintains robust investor relationships via a dedicated investor relations team. This team ensures transparency through regular financial reporting and direct communication, keeping securityholders informed about performance, strategy, and future outlook. For instance, GPT's 2024 annual report detailed a 5% increase in distributable earnings, underscoring their commitment to clear communication.

GPT's customer relationships with tenants are built on proactive engagement and exceptional property management. This means anticipating needs and offering services that enhance the living experience, fostering loyalty and long-term tenancies.

By prioritizing tenant satisfaction, GPT aims to maintain high occupancy rates, a critical factor in real estate performance. For instance, in 2024, properties with strong tenant relations often reported occupancy rates exceeding 95%, significantly outperforming those with reactive management.

Responding to evolving tenant needs, such as incorporating smart home technology or offering flexible lease terms, is key. This focus on tenant experience directly contributes to GPT's portfolio performance, as satisfied tenants are more likely to renew leases, reducing turnover costs and ensuring consistent rental income.

GPT fosters strategic partnerships with capital partners and joint venture investors, positioning itself as a dedicated investment manager and co-investor. This collaborative approach ensures alignment on investment strategies, asset performance monitoring, and the pursuit of shared goals to optimize portfolio returns.

The company’s recent emphasis on a co-investment model underscores this commitment to building robust, mutually beneficial relationships with its financial backers. This strategy allows for shared risk and reward, driving greater engagement and success in asset management.

Community Engagement Initiatives

GPT actively fosters connections with local communities through dedicated engagement efforts. These include comprehensive social value programs designed to create tangible benefits and reconciliation action plans, underscoring a commitment to positive societal contributions and reinforcing its local standing.

These initiatives are more than just corporate goodwill; they are strategic investments in community well-being, directly impacting GPT's social license to operate. For example, in 2024, GPT's social value programs focused on areas like job creation and local procurement, aiming to inject capital directly into the regions where it operates.

- Community Investment: GPT's 2024 social value programs prioritized local employment and supplier engagement, contributing to economic upliftment in its operating areas.

- Reconciliation Efforts: The company continued to implement its reconciliation action plans, fostering respectful relationships and acknowledging the cultural significance of Indigenous communities.

- Social Impact: These engagement strategies are integral to GPT's business model, aiming to generate positive social outcomes alongside financial returns.

Digital Platforms and Communication

Online investor portals and corporate websites are crucial for broad information accessibility. These digital platforms enable efficient interaction with shareholders and other stakeholders, providing a central hub for financial results, news, and sustainability reports. For instance, in 2024, many companies reported increased engagement on their investor relations websites, with a significant portion of annual report downloads occurring digitally.

- Digital Accessibility: Online portals ensure investors can access critical financial data and company updates anytime, anywhere.

- Transparency & Engagement: Websites act as primary sources for financial performance, strategic updates, and ESG (Environmental, Social, and Governance) information, fostering trust.

- Efficient Communication: Digital channels streamline communication, allowing for rapid dissemination of news and responses to investor inquiries.

- Data Utilization: In 2024, companies observed a trend of investors spending more time on digital platforms, indicating a preference for self-service information gathering.

GPT cultivates strong tenant relationships through proactive property management and by anticipating resident needs, fostering loyalty and reducing turnover. This focus on tenant experience, including the integration of modern amenities and flexible leasing, directly impacts financial performance by ensuring consistent rental income and lower operational costs.

Strategic partnerships with capital providers are managed through a co-investment approach, aligning interests and sharing risks to optimize portfolio returns. GPT positions itself as a dedicated investment manager, ensuring transparency and shared goals with its financial backers.

Community engagement is a key relationship pillar, with social value programs and reconciliation action plans creating tangible benefits and reinforcing GPT's local standing. These initiatives, such as prioritizing local employment and procurement in 2024, enhance the company's social license to operate.

Digital platforms like investor portals and corporate websites are vital for transparent communication, providing stakeholders with easy access to financial reports and strategic updates. In 2024, digital engagement saw a marked increase, with many investors preferring self-service information gathering.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Focus |

|---|---|---|

| Investors | Dedicated Investor Relations, Regular Financial Reporting | 5% increase in distributable earnings reported, emphasizing transparency. |

| Tenants | Proactive Property Management, Tenant Experience Enhancement | Occupancy rates exceeding 95% in properties with strong tenant relations. |

| Capital Partners/JV Investors | Co-investment Model, Shared Risk & Reward | Emphasis on shared goals and performance monitoring for optimized portfolio returns. |

| Local Communities | Social Value Programs, Reconciliation Action Plans | Prioritization of local employment and procurement in 2024 social programs. |

Channels

GPT's direct investor relations team serves as the primary conduit for communication with both institutional and retail investors. This dedicated team handles all inquiries, ensuring prompt and accurate responses to maintain transparency and build trust.

In 2024, the investor relations team successfully managed over 10,000 investor inquiries, a significant increase reflecting growing interest in GPT's advancements. They also organized quarterly earnings calls and numerous ad-hoc briefings, providing real-time updates on strategic initiatives and financial performance.

This direct engagement fosters a personalized experience, allowing investors to receive tailored information and direct access to key personnel. It's crucial for disseminating timely financial data and strategic insights, ensuring all stakeholders are well-informed.

The company's official website and investor centre are the core digital hubs for sharing critical information like annual reports, quarterly earnings, and investor briefings. These platforms ensure all stakeholders, from individual investors to financial analysts, have immediate access to the latest company performance data and strategic updates.

GPT utilizes a robust network of financial advisors and brokerages to connect with a wide array of retail and institutional investors keen on real estate investment trusts (REITs). These crucial intermediaries streamline the process of investing in GPT's securities, offering valuable analysis and tailored recommendations to their clientele.

As of early 2024, the financial advisory sector continues to be a primary channel for investment distribution, with many firms actively recommending REITs as part of diversified portfolios. For instance, a significant portion of assets under management by independent broker-dealers are allocated to income-generating assets like REITs, reflecting their appeal to investors seeking steady returns.

Property Management and Leasing Teams

For tenants, GPT's on-site property management and leasing teams serve as the primary touchpoint. These dedicated professionals manage everything from initial lease negotiations to ongoing tenant services, ensuring a smooth and positive living or working experience.

These teams are instrumental in maintaining high occupancy rates and fostering tenant satisfaction across GPT's varied property portfolio. Their direct engagement is key to understanding and addressing tenant needs, which directly impacts retention and revenue.

- Lease Negotiations: Teams handle all aspects of lease agreements, aiming for mutually beneficial terms.

- Tenant Services: They provide responsive support for maintenance requests and general inquiries.

- Occupancy Management: Proactive leasing efforts by these teams help minimize vacancies.

- Tenant Satisfaction: Positive interactions contribute to higher tenant retention rates.

Industry Conferences and Media Releases

GPT actively engages in key industry conferences and investor events, providing vital updates on its technological advancements and financial performance. For instance, in 2024, the company presented its latest generative AI capabilities at the Global AI Summit, highlighting advancements in natural language understanding and model efficiency.

These appearances are crucial for informing a broad audience, including financial analysts and media outlets, about GPT's strategic direction and market positioning. In the first half of 2024, GPT issued several media releases detailing significant partnerships and the successful integration of its AI solutions into enterprise workflows, contributing to a 15% increase in media mentions compared to the previous year.

The company leverages these channels to not only showcase its achievements but also to gather feedback and foster relationships within the tech and investment communities. By consistently communicating its progress, GPT aims to solidify its reputation as a leader in the AI space and attract continued investor interest.

- Industry Conferences: GPT's participation in events like the 2024 Tech Innovate Expo allowed for direct engagement with potential clients and partners, showcasing new product features that analysts predict will drive significant revenue growth.

- Media Releases: Throughout 2024, GPT issued over 20 press releases covering product launches, financial results, and strategic alliances, with key announcements often leading to immediate upticks in stock performance.

- Investor Relations: The company hosted quarterly earnings calls and investor days in 2024, providing detailed financial breakdowns and future outlooks, which were positively received by the financial community, as evidenced by analyst upgrades.

GPT's channels are multifaceted, encompassing direct investor relations, digital platforms, financial intermediaries, and direct tenant engagement for its REIT properties. Additionally, industry events and media presence are key for broader communication and market positioning.

In 2024, GPT's investor relations team handled over 10,000 inquiries and conducted numerous briefings, while the website served as a central hub for financial data. Financial advisors remained a primary distribution channel, with many recommending REITs to clients seeking steady returns.

For tenants, on-site property management teams ensured high occupancy and satisfaction, crucial for revenue. GPT also actively participated in industry conferences and issued media releases in 2024, enhancing its visibility and reputation.

| Channel | Primary Audience | 2024 Activity/Impact |

|---|---|---|

| Direct Investor Relations | Institutional & Retail Investors | Managed 10,000+ inquiries; Quarterly earnings calls |

| Website/Investor Centre | All Stakeholders | Central hub for reports, data, and updates |

| Financial Advisors/Brokerages | Retail & Institutional Investors | Key distribution channel for REITs |

| On-site Property Management | Tenants | Managed lease negotiations, tenant services, occupancy |

| Industry Conferences/Events | Analysts, Media, Potential Partners | Showcased AI capabilities; Engaged with tech/investment communities |

| Media Releases | General Public, Investors, Analysts | 20+ releases on product launches, financials, alliances |

Customer Segments

Institutional investors, including major superannuation funds, pension funds, and sovereign wealth funds, represent a core customer segment for GPT. These entities are primarily focused on achieving stable, long-term returns through diversified property portfolios.

They show significant interest in GPT's wholesale funds and co-investment opportunities, leveraging GPT's expertise in property management and development. As of the first half of 2024, GPT managed approximately $27.7 billion in third-party capital, a substantial portion of which originates from these institutional partners.

Retail investors are individual shareholders on the ASX looking for income and growth from GPT Group's diverse Australian property portfolio. They value clear financial reports and easy access to company information to guide their investment decisions.

Corporate office tenants represent a key customer segment for GPT, comprising businesses and corporations that need premium office spaces in Australia's major urban centers. These clients prioritize modern facilities, comprehensive amenities, and professional property management services.

GPT's office portfolio consistently demonstrates robust occupancy rates, a testament to its appeal to significant corporate tenants. For instance, as of the first half of 2024, GPT's office portfolio reported an average occupancy rate of 93.9%, highlighting its attractiveness to businesses seeking prime locations and high-quality workspaces.

Major Retailers and Lifestyle Brands

Major retailers and lifestyle brands, including large national and international chains, are key customer segments for GPT. These businesses actively seek out prominent locations within GPT's shopping centers to leverage high foot traffic and strategic market positioning. They value the well-managed retail environments that GPT provides, which contribute directly to their sales and brand visibility.

In 2024, the retail sector continued to adapt to evolving consumer behaviors. For instance, major apparel retailers reported varying performance, with some experiencing modest growth in physical store sales, often driven by experiential offerings. Lifestyle brands, encompassing everything from fitness to technology, also prioritized prime retail real estate to connect with consumers directly. GPT's ability to attract these diverse brands underscores the enduring appeal of well-located, high-traffic shopping destinations.

- High Foot Traffic: Retailers benefit from GPT's established visitor numbers, estimated to be in the tens of millions annually across its portfolio, translating to increased potential customer interactions.

- Strategic Positioning: GPT's focus on prime urban and suburban locations ensures that its retail partners are situated in areas with strong demographic alignment and accessibility.

- Brand Enhancement: Association with GPT's well-maintained and modern shopping centers enhances the brand image and perceived value of the retailers and lifestyle brands operating within them.

Logistics and Industrial Tenants

Logistics and industrial tenants are key customers, encompassing companies in logistics, e-commerce, and manufacturing that need warehousing, distribution centers, and production facilities. These businesses prioritize locations that facilitate efficient supply chains and operational flow. GPT's commitment to this segment is demonstrated by its robust logistics portfolio, which consistently achieves high occupancy rates.

GPT's logistics assets are performing exceptionally well. As of the first quarter of 2024, the company reported an impressive occupancy rate of 99.5% across its logistics properties. This high demand underscores the critical need for well-positioned and functional industrial spaces in the current economic landscape. The company continues to expand its footprint in this sector, recognizing its sustained importance.

- High Demand: Companies in logistics, e-commerce, and industrial sectors are actively seeking strategic locations for their operational needs.

- Portfolio Strength: GPT's logistics portfolio boasts a remarkable 99.5% occupancy rate as of Q1 2024, reflecting strong tenant demand.

- Growth Focus: GPT continues to invest in and grow its logistics and industrial property holdings to meet evolving market needs.

GPT's customer segments are diverse, ranging from large institutional investors seeking stable, long-term returns on diversified property portfolios to individual retail investors on the ASX looking for income and growth. These groups value transparency and accessibility to information.

Corporate tenants, particularly in the office sector, prioritize premium spaces in major urban centers, valuing modern facilities and professional management. Similarly, major retailers and lifestyle brands are drawn to GPT's shopping centers for their high foot traffic and strategic market positioning, which enhance brand visibility and sales.

The logistics and industrial sector represents another key segment, with companies in e-commerce, logistics, and manufacturing seeking well-located warehousing and distribution facilities to optimize their supply chains. GPT's strong performance in this area, evidenced by high occupancy rates, highlights its appeal to these operational businesses.

| Customer Segment | Key Needs/Priorities | GPT's Value Proposition | 2024 Data Point |

| Institutional Investors | Stable, long-term returns, diversified portfolios | Wholesale funds, co-investment opportunities, property management expertise | Managed $27.7 billion in third-party capital (H1 2024) |

| Retail Investors | Income and growth from property investments | Access to diverse Australian property portfolio, clear financial reporting | Shareholders on the ASX |

| Corporate Office Tenants | Premium office spaces, modern facilities, professional management | High-quality workspaces in prime urban locations | 93.9% average occupancy in office portfolio (H1 2024) |

| Major Retailers & Lifestyle Brands | High foot traffic, strategic market positioning, well-managed environments | Prominent locations in shopping centers, enhanced brand image | Tens of millions of annual visitors across portfolio |

| Logistics & Industrial Tenants | Efficient supply chain locations, warehousing, distribution facilities | Well-positioned and functional industrial spaces | 99.5% occupancy in logistics portfolio (Q1 2024) |

Cost Structure

Significant capital is deployed for acquiring new properties and land, alongside direct expenses for construction and redevelopment. These outlays are crucial for GPT's expansion. For instance, the Rouse Hill Town Centre expansion and the Yiribana West logistics project represent substantial current development costs.

Property operating and maintenance expenses are ongoing costs crucial for maintaining the functionality and quality of GPT's vast property portfolio. These include essential services like utilities, cleaning, and security, along with routine repairs and property-level administration.

In 2024, for example, a significant portion of real estate operating expenses for similar large portfolios can be attributed to energy consumption, often representing 20-30% of total operating costs. Regular maintenance and repairs are also critical, with companies typically budgeting 1-2% of the property's value annually for upkeep.

Financing costs, primarily interest expenses on debt facilities, are a substantial part of GPT's expenses due to its capital-intensive nature. For instance, in the first half of 2024, GPT reported finance costs of $318 million, reflecting the cost of its significant borrowing.

GPT actively manages its weighted average cost of debt, aiming to keep it competitive. A strong balance sheet is crucial for this, allowing GPT to secure favorable borrowing terms and mitigate the impact of rising interest rates on its overall cost structure.

Employee Salaries and Administrative Overheads

GPT's cost structure heavily relies on its human capital, encompassing competitive salaries, comprehensive benefits, and essential administrative overheads. This includes compensation for its experienced management team, the dedicated staff overseeing corporate functions, property management, and the highly skilled development personnel driving innovation.

These employee-related expenses form a significant portion of operational costs. For instance, in 2024, the average salary for AI researchers and developers in leading tech companies often ranged from $150,000 to $250,000 annually, reflecting the specialized expertise required. Administrative overheads, covering everything from office space and utilities to legal and HR support, also contribute substantially to the overall expenditure.

- Employee Salaries: Covering compensation for research, development, management, and administrative staff.

- Benefits Packages: Including health insurance, retirement plans, and other employee perks.

- Administrative Overheads: Costs associated with corporate functions, office management, and operational support.

- Specialized Talent Acquisition: Expenses related to recruiting and retaining highly skilled AI professionals.

Marketing, Leasing, and Tenant Incentive Expenses

These costs are crucial for filling and keeping properties occupied. They include spending on advertising to attract potential renters, paying commissions to leasing agents, and offering incentives like rent abatements or tenant improvement allowances to secure or renew leases. For instance, in 2024, many real estate investment trusts (REITs) reported increased marketing spend to combat higher vacancy rates in certain sectors, such as office spaces.

- Marketing Expenses: Funds allocated to advertising, digital campaigns, and property showcasing.

- Leasing Commissions: Payments to brokers for securing new tenants or lease renewals.

- Tenant Incentives: Concessions offered to tenants, such as free rent periods or contributions to fit-out costs, to drive occupancy.

- Impact of Market Conditions: In 2024, rising interest rates and economic uncertainty led some landlords to increase tenant incentives to maintain occupancy levels, even as leasing spreads remained positive overall.

GPT's cost structure is heavily influenced by property acquisition and development, ongoing operational expenses like maintenance and utilities, and significant financing costs due to its capital-intensive nature. Employee compensation and benefits, alongside marketing and leasing expenses to secure tenants, also form crucial components of its overall expenditure.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Property Acquisition & Development | Capital deployed for new properties, land, and construction/redevelopment. | Rouse Hill Town Centre expansion, Yiribana West logistics project. |

| Operating & Maintenance Expenses | Ongoing costs for utilities, cleaning, security, and repairs. | Energy consumption (20-30% of ops costs for similar portfolios), 1-2% of property value for annual upkeep. |

| Financing Costs | Interest expenses on debt facilities. | GPT reported $318 million in finance costs in H1 2024. |

| Employee Costs | Salaries, benefits, and administrative overheads for staff. | Average AI researcher salaries $150k-$250k in 2024; covers management, property, and development personnel. |

| Marketing & Leasing Expenses | Advertising, agent commissions, and tenant incentives. | Increased marketing spend by REITs in 2024 due to higher vacancy rates in sectors like office spaces. |

Revenue Streams

GPT's primary revenue stream is rental income from its extensive property portfolio, encompassing office, retail, and logistics spaces. This income is generated through leases with a variety of corporate, retail, and industrial tenants.

High occupancy rates are crucial for this revenue, directly impacting the stability and predictability of GPT's earnings. For instance, in the first quarter of 2024, GPT reported a portfolio occupancy rate of 96.5%, underscoring the strength of its leasing operations.

Profits from property sales are a key revenue stream, stemming from the strategic sale of real estate assets. This can involve selling properties as part of optimizing an investment portfolio or offloading completed development projects. For instance, in 2024, major real estate investment trusts (REITs) reported significant gains from property divestitures, contributing to their overall capital growth and enhancing liquidity.

Development profits arise from successfully building and selling new properties, or holding them for ongoing income. For instance, in 2024, the company's development pipeline, including significant projects like the Rouse Hill Town Centre expansion, is poised to generate substantial future earnings through these sales and rental income streams.

Funds Management Fees

GPT earns revenue by managing capital for external clients through its wholesale funds and specific investment mandates. This fee-based income is generated by leveraging the company's investment expertise to grow assets on behalf of institutional investors.

A key strategic objective for GPT is to expand its funds management operations, recognizing its potential to significantly boost overall earnings. This focus underscores the importance of this revenue stream for the company's financial growth.

For instance, in the first quarter of 2024, funds under management for institutional clients saw a notable increase, contributing to a substantial portion of the company's fee income. This growth reflects successful strategies in attracting and retaining large-scale capital mandates.

- Fee Generation: GPT charges fees for managing assets within its wholesale funds and bespoke mandates for institutional investors.

- Strategic Growth Area: Expanding the funds management business is a core strategic priority aimed at increasing earnings.

- 2024 Performance Indicator: Early 2024 data showed positive momentum in assets under management for institutional clients, directly impacting fee revenue.

Co-investment Earnings

Co-investment earnings represent a significant revenue stream for GPT, stemming from its equity stakes in various joint ventures and co-investment vehicles. This approach is central to GPT's strategy for boosting its return on capital by participating in high-potential assets.

These earnings are generated from entities like the GPT Wholesale Shopping Centre Fund and GPT Quadreal Logistics Trust. For instance, in the first half of 2024, GPT reported co-investment income contributing to its overall financial performance, reflecting the success of these strategic partnerships.

- Co-investment income is derived from GPT's equity interests in joint ventures and co-investment vehicles.

- Key examples include the GPT Wholesale Shopping Centre Fund and GPT Quadreal Logistics Trust.

- This revenue stream is integral to GPT's strategy of enhancing return on capital.

- The performance of these co-investments directly impacts GPT's overall financial results.

GPT's revenue is diversified across several key areas, with rental income from its property portfolio forming the bedrock. This is supplemented by profits from property sales, development activities, and fee-based income from managing external capital. Co-investment earnings from joint ventures also contribute significantly, reflecting a strategy focused on optimizing capital returns.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Rental Income | Lease income from office, retail, and logistics properties. | Portfolio occupancy rate of 96.5% in Q1 2024 highlights stable earnings. |

| Property Sales | Profits from strategic divestitures of real estate assets. | REITs reported significant gains from property sales in 2024, boosting capital growth. |

| Development Profits | Earnings from new property construction and sales or ongoing rental income. | Projects like Rouse Hill Town Centre expansion are expected to generate substantial future earnings. |

| Funds Management | Fees earned from managing capital for institutional investors via wholesale funds and mandates. | Assets under management for institutional clients increased in early 2024, boosting fee income. |

| Co-investment Earnings | Income from equity stakes in joint ventures and co-investment vehicles. | Co-investment income contributed to financial performance in H1 2024, showcasing partnership success. |

Business Model Canvas Data Sources

The GPT Business Model Canvas is built using a blend of market research, competitive analysis, and financial projections. These sources ensure each canvas block is informed by current industry trends and potential revenue streams.