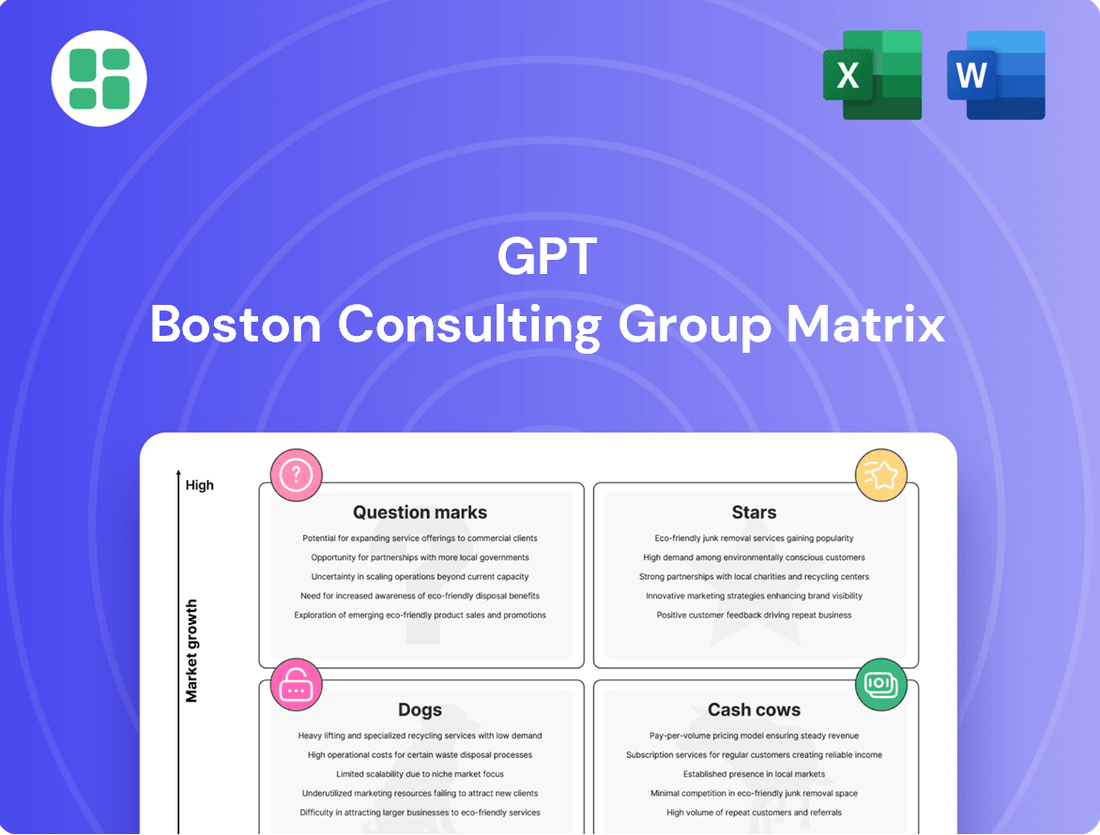

GPT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GPT Bundle

Unlock the strategic power of the BCG Matrix to understand your company's product portfolio at a glance. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks and identify areas for growth and divestment.

This preview offers a glimpse into the potential of the BCG Matrix. Purchase the full report for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your business's performance.

Stars

GPT's logistics development pipeline, featuring projects like Yiribana West and Truganina, is a key growth driver, holding substantial future value. These developments are strategically positioned to leverage Australia's robust demand for logistics assets, fueled by the ongoing expansion of e-commerce and the critical need for modern supply chains. The initial two facilities at Yiribana West are slated for completion in the second half of 2025, underscoring active investment and tangible progress in this sector.

Prime retail assets with redevelopment potential represent a strong category within the BCG Matrix, often considered Stars. Consider Rouse Hill Town Centre, a prime example, with approved expansion projects slated to begin in the first half of 2025. This center boasts high occupancy rates, exceeding 98% in 2024, and experienced a robust 7% year-over-year sales growth in the same period, underscoring its market leadership.

GPT's strategic pivot towards co-investment, especially in burgeoning logistics, signifies a calculated move to leverage external capital. This approach allows GPT to amplify its asset under management and boost portfolio performance by sharing risk and reward with partners.

The GPT QuadReal Logistics Trust (GQLT) serves as a concrete illustration of this co-investment model. This trust, established in 2023, aims to capitalize on the robust growth in the logistics sector, a market that saw significant expansion in 2024 due to e-commerce trends.

Melbourne Central's Continued Strong Performance

Melbourne Central continues to shine as a Star in the retail landscape, consistently achieving impressive sales figures. In 2024, it reported a robust 8.5% year-on-year sales growth, a testament to its enduring appeal and effective management.

The center boasts an impressive occupancy rate of 98%, demonstrating strong demand from retailers and a stable revenue stream. This high occupancy, coupled with sustained sales growth, firmly places Melbourne Central in the Star category of the BCG Matrix.

Future development plans are underway, including a proposed expansion of its dining and entertainment precincts, aimed at further solidifying its market dominance. These strategic moves are designed to enhance customer experience and drive continued revenue growth.

- High Sales Growth: Melbourne Central achieved an 8.5% year-on-year sales growth in 2024.

- Strong Occupancy: The center maintained a 98% occupancy rate throughout 2024.

- Strategic Development: Ongoing plans for precinct expansion underscore its Star status and future potential.

Sustainability-Certified Assets and New Green Developments

GPT's fully carbon-neutral certified operational assets are setting a high standard in the increasingly important sustainability market. This leadership position is a significant draw for both tenants and investors who prioritize environmentally responsible real estate. For example, by 2024, the demand for green-certified buildings has surged, with studies showing a premium of up to 13% in rental income for LEED Platinum certified properties compared to non-certified buildings in major urban centers.

New developments are actively targeting upfront embodied carbon neutrality, tapping into a robust growth sector. This focus on reducing the carbon footprint from construction materials and processes directly addresses the escalating demand from both commercial tenants and institutional investors for greener portfolios. A 2024 report indicated that over 60% of institutional investors now consider ESG (Environmental, Social, and Governance) factors as a primary driver in their real estate allocation decisions.

This strategic commitment to sustainability offers GPT a distinct competitive advantage. It not only attracts premium tenants willing to pay for environmentally conscious spaces but also appeals to a growing pool of capital specifically seeking green investments. This dual benefit positions GPT favorably in a market where sustainability is rapidly transitioning from a niche consideration to a core requirement.

- Market Leadership: GPT's carbon-neutral certified assets are leaders in a growing, valued market segment.

- Growth Area: New developments focusing on embodied carbon neutrality are a strong growth opportunity.

- Demand Drivers: Tenant and investor demand for green buildings is increasing significantly.

- Competitive Edge: This commitment attracts premium tenants and capital, providing a distinct advantage.

Stars in the BCG Matrix represent high-growth, high-market-share business units or assets. For GPT, these are assets like prime logistics developments and leading retail centers that are experiencing strong growth and command significant market presence. These assets are characterized by high demand, robust sales, and ongoing strategic development, ensuring their continued success and value generation.

| Asset Category | Example | 2024 Performance Highlights | Future Outlook |

|---|---|---|---|

| Logistics Development | Yiribana West | Active development, slated for H2 2025 completion. Leverages strong e-commerce demand. | Significant future value from Australia's growing logistics sector. |

| Prime Retail | Rouse Hill Town Centre | Over 98% occupancy, 7% YoY sales growth in 2024. Approved expansion projects. | Continued market leadership and revenue growth through expansion. |

| Prime Retail | Melbourne Central | 98% occupancy, 8.5% YoY sales growth in 2024. Plans for precinct expansion. | Sustained market dominance and enhanced customer experience driving revenue. |

What is included in the product

The GPT BCG Matrix analyzes products by market share and growth, guiding investment decisions.

Clear visual identification of underperforming "Dogs" and resource-draining "Cash Cows" to streamline portfolio decisions.

Cash Cows

GPT's established regional shopping centers, like Charlestown Square and Highpoint Shopping Centre, are prime examples of Cash Cows. These assets consistently deliver robust rental income, boasting very high occupancy rates, demonstrating their enduring appeal and market dominance.

Operating in mature markets, these centers require minimal new investment for marketing or expansion, allowing them to generate substantial and stable cash flows. This efficiency makes them crucial pillars supporting GPT's overall recurring earnings.

For the year ended December 31, 2023, GPT's retail portfolio, which includes these strong performers, reported a net operating income of $336.3 million, highlighting the consistent profitability of these mature assets.

GPT's core office portfolio, especially prime assets in Sydney and Melbourne's central business districts, continues to be a reliable income generator. These properties boast high occupancy rates, demonstrating resilience even amidst some market headwinds.

While the growth trajectory for these assets might be moderate, their strategic positioning and the quality of their tenants provide a stable and consistent cash flow, characteristic of a Cash Cow.

GPT's leasing approach for this segment prioritizes maintaining robust occupancy levels and effectively managing inherent risks, ensuring the continued stability of this income stream.

GPT's mature logistics investment assets, encompassing properties on its balance sheet and within the GPT QuadReal Logistics Trust (GQLT), represent significant cash cows. These assets generate stable income, bolstered by consistently high occupancy rates and robust demand within the sector.

The reliable cash flow from these logistics properties is further secured by long-term leases and highly efficient operational management. This stability translates into relatively low ongoing capital expenditure, particularly for promotional activities, allowing for consistent returns.

Funds Management Platform Fees

The fees generated from GPT's funds management platform, including the GPT Wholesale Shopping Centre Fund (GWSCF), GPT Wholesale Office Fund (GWOF), and GPT QuadReal Logistics Trust (GQLT), are a key Cash Cow. These fees represent a stable and growing income stream, capitalizing on GPT's established property management and investment capabilities.

This segment offers consistent revenue by managing third-party capital, effectively shielding GPT from the direct ownership risks associated with physical property. For instance, in the first half of 2024, GPT reported a 3.1% increase in funds under management to $27.5 billion, underscoring the platform's growth and fee-generating potential.

- Funds Under Management Growth: GPT's funds under management reached $27.5 billion by the end of H1 2024, a 3.1% increase.

- Stable Fee Income: Management fees from these funds provide a reliable revenue source, independent of direct property value fluctuations.

- Leveraging Expertise: GPT's established track record in property management allows it to attract and retain third-party capital, driving fee growth.

- Reduced Risk Profile: By managing external funds, GPT benefits from fee income without the balance sheet impact of direct property ownership.

Long-Term Leased Portfolio Properties

Properties within GPT's portfolio that feature long weighted average lease expiry (WALE) periods are essentially its cash cows. These assets generate consistent and dependable rental income because tenants are locked in for substantial periods, minimizing the unsettling risk of vacancies. This extended tenant commitment translates directly into stable, predictable cash flow, which is crucial for the company's overall financial health and earnings stability.

The long-term leases on these properties mean fewer re-leasing efforts are needed, which saves on costs and further bolsters the predictable income stream. For instance, as of the first half of 2024, GPT's industrial portfolio maintained a strong WALE, contributing significantly to its robust performance. This stability allows for reliable cash flow generation, as tenants are committed for extended durations, reducing vacancy risk and the need for frequent re-leasing efforts.

- Predictable Income: Long WALEs ensure consistent rental revenue.

- Reduced Vacancy Risk: Extended leases minimize periods without tenants.

- Lower Re-leasing Costs: Less frequent tenant turnover reduces operational expenses.

- Financial Stability: Contributes significantly to the company's stable earnings.

GPT's established regional shopping centers and prime office assets in major CBDs function as its cash cows. These properties consistently deliver strong rental income due to high occupancy rates, requiring minimal new investment and generating substantial, stable cash flows that underpin GPT's recurring earnings.

The company's mature logistics investments and its funds management platform, which generates fees from managing third-party capital, also represent significant cash cows. These segments benefit from long-term leases, high occupancy, and established management expertise, providing reliable and growing income streams with a reduced risk profile.

| Asset Type | Key Characteristics | Financial Contribution (2023/H1 2024 Data) |

|---|---|---|

| Regional Shopping Centers | High occupancy, market dominance, mature markets | Retail NOI: $336.3 million (FY 2023) |

| Prime Office Assets | High occupancy, strategic CBD locations, tenant quality | Stable income generation |

| Mature Logistics Investments | High occupancy, long-term leases, efficient operations | Stable income generation |

| Funds Management Platform | Fee income from managing third-party capital | FUM: $27.5 billion (H1 2024), 3.1% increase |

Delivered as Shown

GPT BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready strategic tool ready for your immediate use. You can confidently proceed with your purchase, knowing that the professional-grade BCG Matrix report will be delivered directly to you, exactly as you see it now, enabling swift integration into your business planning and decision-making processes.

Dogs

Secondary office assets, particularly those in less prime locations or failing to meet current tenant demands for amenities and sustainability, often fall into the Dogs category of the BCG Matrix. These properties face significant headwinds, including lower occupancy rates and the need for substantial capital investment to become competitive.

In 2024, the office sector continues to see a bifurcation, with demand heavily favoring modern, well-located, and amenity-rich buildings. Older, less desirable secondary assets are experiencing declining valuations and increased vacancy, with some reports indicating vacancy rates in older office stock exceeding 20% in certain markets. This makes them cash traps requiring costly upgrades with uncertain return prospects.

GPT's recent divestments, including portions of Austrak Business Park and 396 Mount Derrimut Road in Derrimut, highlight a strategic move away from non-core assets. These actions reflect a deliberate effort to streamline the portfolio by exiting segments with lower growth potential or market share.

In 2024, GPT Group continued its strategy of portfolio optimization. For instance, the divestment of Austrak Business Park contributed to capital recycling, allowing for redeployment into higher-growth areas. This focus on divesting non-core assets is a key component of managing the business within the BCG matrix framework, aiming to improve overall portfolio performance.

Retail assets with persistent negative leasing spreads, meaning new leases are signed at lower rents than expiring ones, would be classified as Dogs within the BCG Matrix. For instance, a shopping center where average new lease rates in 2024 were 5% below expiring rates, compared to a market average of 2% growth, signals this challenge. This suggests these specific properties are underperforming, struggling to command market-level rents, possibly due to location issues or outdated tenant mixes.

Properties Requiring Excessive Refurbishment Costs

Certain older properties, especially some retail centers, that demand frequent and significant refurbishment simply to retain tenants and remain competitive, without a corresponding rise in revenue, could be categorized as Dogs. These properties might have seen their peak appeal diminish, requiring constant investment just to stay relevant.

The financial strain from these high maintenance costs can significantly impact profitability. For instance, a retail property requiring a 20% capital expenditure for refurbishment in 2024, yielding only a 5% increase in rental income, would represent a classic Dog scenario. This situation ties up valuable capital that could be better utilized in more promising ventures.

Consider these factors when evaluating such properties:

- High Capital Expenditure Ratio: Properties where refurbishment costs exceed 15% of their current market value annually.

- Stagnant or Declining Rental Income: Retail centers that have not increased rents in over three years despite refurbishment efforts.

- Low Occupancy Rates: A consistent occupancy below 80% despite significant investment in property upgrades.

- Negative Net Operating Income (NOI) Growth: When NOI growth is consistently below inflation or market benchmarks after accounting for refurbishment expenses.

Assets in Declining or Stagnant Micro-Markets

Properties situated in micro-markets facing sustained economic downturns or population stagnation are akin to Dogs in the BCG Matrix. These locations often exhibit persistently weak demand and minimal capital appreciation, severely limiting an asset's potential for growth or profitability.

For example, certain Rust Belt cities in the US have seen consistent population outflows and manufacturing job losses. By 2024, some of these areas might still be grappling with vacancy rates exceeding 15% in their commercial real estate sectors, a clear indicator of a stagnant market where assets struggle to generate returns.

- Stagnant Demand: Assets in these areas face a shrinking pool of potential buyers or renters, suppressing rental income and property values.

- Limited Capital Growth: Due to low demand and economic headwinds, properties in declining micro-markets are unlikely to see significant appreciation in their market value.

- Divestiture Consideration: Such assets often become candidates for sale, even at a loss, to free up capital for more promising investments.

- Minimal Investment Strategy: Alternatively, a strategy of minimal maintenance and cost containment might be employed if divestiture is not immediately feasible.

Properties classified as Dogs within the BCG Matrix are those with low market share and low growth prospects, often requiring significant capital to maintain but offering little return. These are assets that drain resources without contributing meaningfully to overall performance.

In 2024, this often translates to older office buildings in secondary locations or retail centers with declining foot traffic and rental income. For example, a retail property requiring a 20% capital expenditure for refurbishment in 2024, yielding only a 5% increase in rental income, exemplifies a Dog scenario.

These assets are characterized by high maintenance costs, stagnant rental growth, and low occupancy, making them prime candidates for divestiture or a strategy of minimal investment.

GPT's divestment of non-core assets in 2024, such as parts of Austrak Business Park, demonstrates a proactive approach to managing its portfolio by exiting segments with lower growth potential.

| Asset Type | BCG Category | Key Indicators (2024) | GPT Example |

|---|---|---|---|

| Secondary Office Assets | Dogs | Vacancy > 20% in some markets; Declining valuations | Divestments of non-core office holdings |

| Underperforming Retail Centers | Dogs | Negative leasing spreads (-5% vs market +2%); High refurbishment CAPEX (20% of value for 5% rent increase) | Focus on divesting non-core retail |

| Properties in Declining Micro-Markets | Dogs | Population outflow; Stagnant demand; Vacancy > 15% in some areas | Strategic portfolio optimization |

Question Marks

New mixed-use development projects, exemplified by the extensive Melbourne Central Masterplan, are essentially question marks in the BCG matrix. These ventures involve significant capital infusion and are positioned in markets with high growth potential, aiming to revitalize urban spaces and create vibrant hubs.

The Melbourne Central Masterplan, for instance, is a multi-billion dollar undertaking designed to reshape a significant portion of the city's core, integrating retail, residential, office, and public spaces. Its success hinges on attracting substantial pre-leasing or pre-sales and navigating complex planning and construction phases, making its future market share and profitability uncertain in the near term.

GPT's early-stage industrial landbank developments, like the Truganina estate, are classic examples of Question Marks in the BCG Matrix. These projects are positioned in the rapidly expanding logistics sector, a definite strength, but they are still in their nascent stages.

Significant capital is being deployed for construction, with full occupancy and substantial revenue generation still on the horizon. For instance, in 2024, industrial land values in Melbourne's west, including Truganina, saw continued appreciation, with some precincts experiencing double-digit percentage increases year-on-year, reflecting the strong demand but also the significant upfront investment required.

Emerging property sectors, like student accommodation, represent areas where companies like QuadReal are making new ventures. These segments are often in growing markets, but the company's current market share and long-term profit potential are still being established. For instance, the global student housing market was valued at approximately $200 billion in 2023 and is projected to grow significantly.

Investing in these nascent areas requires careful strategic allocation of capital to scale operations and build a strong market position. The development of new purpose-built student accommodation (PBSA) projects globally continues, with significant pipelines in countries like the UK and Australia, indicating ongoing demand and investment opportunities.

Investments in Advanced Technology for Property Management

Investments in advanced property technology (PropTech), such as data analytics and generative AI, are positioned as potential Stars within the BCG Matrix for property management firms. These technologies offer significant promise for enhancing operational efficiency and elevating the tenant experience, representing a high-growth area for improvement. For instance, a 2024 report indicated that companies leveraging AI in property management saw an average 15% increase in operational efficiency.

- High Growth Potential: PropTech adoption is accelerating, with the global PropTech market projected to reach $134.4 billion by 2032, up from an estimated $26.2 billion in 2023.

- Uncertain ROI and Market Share Impact: While efficiency gains are evident, the direct correlation to increased market share and a clear return on investment is still under development and requires substantial initial capital outlay and user adoption.

- Significant Upfront Capital: Implementing these advanced technologies necessitates considerable investment in software, hardware, and specialized talent, impacting immediate profitability.

- Focus on Operational Improvement: The primary driver for these investments is the pursuit of better operational performance and tenant satisfaction, rather than immediate market dominance.

Pilot Projects in Renewable Energy or ESG Innovation

Pilot projects in renewable energy or ESG innovation represent a company's "Question Marks" on the BCG matrix. These are ventures with high growth potential but currently low market share, often involving early-stage investments in technologies like advanced solar, green hydrogen, or sustainable building materials.

For example, a real estate developer might invest in a pilot project for a new building integrated photovoltaic (BIPV) system. While this aligns with growing demand for sustainable properties, its long-term cost-effectiveness and scalability are still being proven. In 2024, the global renewable energy market continued its expansion, with solar PV installations alone expected to reach record levels, yet the profitability of niche, cutting-edge solutions remains uncertain.

- High Potential, Uncertain Returns: These projects aim to tap into the rapidly growing ESG and renewable energy sectors, which are projected to see significant growth through 2030 and beyond.

- Early-Stage Investment Risk: Despite the potential, widespread adoption and proven financial viability are still under evaluation, necessitating continued investment to demonstrate market impact and secure future returns.

- Strategic Alignment: Investing in these pilots demonstrates a commitment to future market demands and sustainability goals, potentially enhancing brand reputation and attracting environmentally conscious investors and tenants.

- Need for Further Development: Success hinges on overcoming technological hurdles, reducing costs, and establishing clear market demand, requiring ongoing research, development, and demonstration phases.

Question Marks in the BCG Matrix represent ventures with high growth potential but low current market share, demanding significant investment to capture future market leadership.

These are typically new products, services, or markets where the company is still establishing its presence and the ultimate success is uncertain.

Strategic decisions involve whether to invest heavily to grow market share or divest if the potential is deemed too risky or unlikely to materialize.

For instance, GPT's investments in emerging sectors like purpose-built student accommodation (PBSA) or pilot projects in renewable energy technologies fit this category, aiming for future growth in expanding markets.

| Venture Type | Market Growth | Current Market Share | Investment Requirement | Strategic Consideration |

|---|---|---|---|---|

| New Mixed-Use Developments (e.g., Melbourne Central Masterplan) | High | Low (initially) | Very High | Develop to gain market share, or divest if viability is uncertain. |

| Early-Stage Industrial Landbanks (e.g., Truganina estate) | High | Low (initially) | High | Invest to capture growth in logistics sector. |

| Emerging Property Sectors (e.g., Student Accommodation) | High | Low (initially) | High | Scale operations to build market position. |

| Pilot Projects in Renewable Energy/ESG | High | Low (initially) | Moderate to High | Invest to prove viability and capture future sustainability trends. |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial statements, market research reports, and industry growth forecasts to deliver a comprehensive strategic overview.