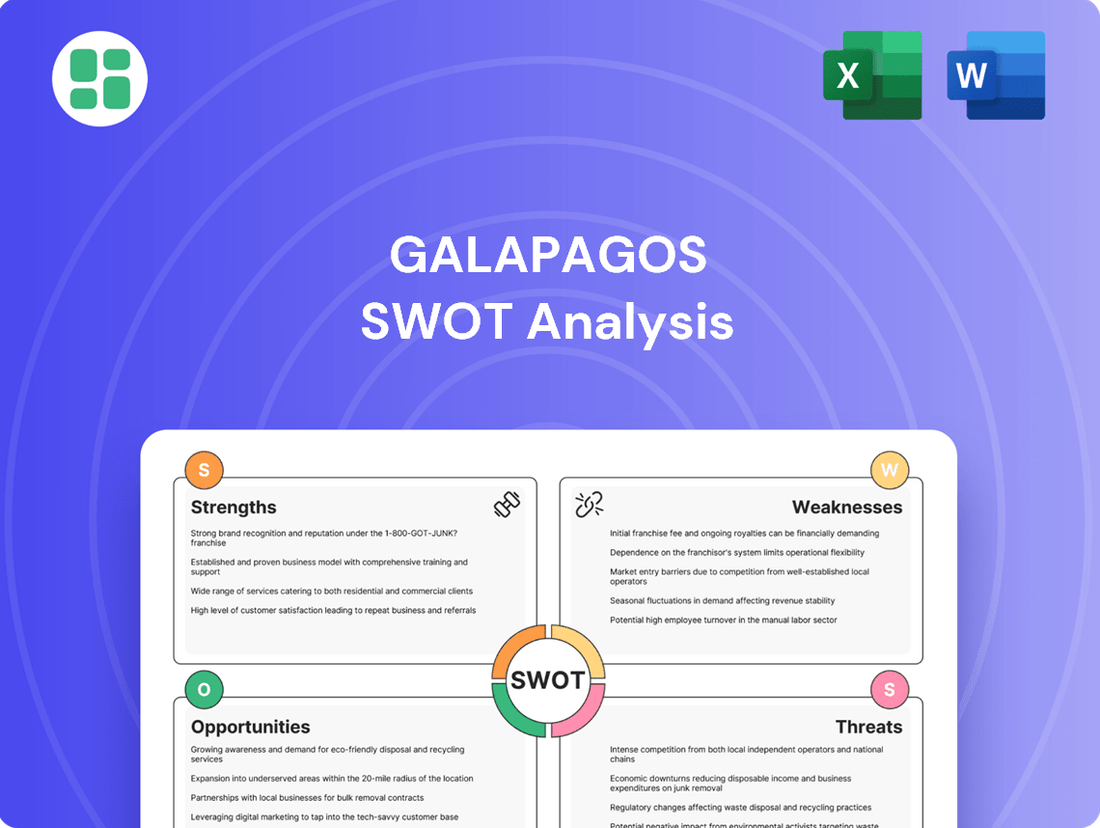

Galapagos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

The Galapagos SWOT analysis reveals a unique ecosystem facing both remarkable opportunities and significant threats. While its unparalleled biodiversity is a major strength, its isolation presents logistical challenges.

Ready to dive deeper into the strategic landscape of this extraordinary destination? Our full SWOT analysis unpacks the critical factors shaping its future, offering actionable insights for conservationists, tourism operators, and investors alike.

Gain access to a comprehensive, professionally formatted report that goes beyond the surface, providing detailed breakdowns and expert commentary. Equip yourself with the knowledge to navigate the complexities and capitalize on the potential of the Galapagos.

Strengths

Galapagos' proprietary target discovery platform is a significant strength, allowing them to pinpoint novel drug candidates. This advanced system is central to their innovation, enabling exploration of new biological pathways for first-in-class medicines.

The platform's ability to identify novel targets gives Galapagos a competitive advantage in tackling complex diseases with substantial unmet medical needs. For instance, in 2023, the company reported a robust pipeline with multiple promising candidates emerging from this discovery engine, underscoring its effectiveness in generating early-stage assets.

Galapagos has sharpened its strategic focus, concentrating its considerable resources on a robust pipeline within oncology and immunology. This includes significant investment in cutting-edge CAR-T cell therapies, a rapidly advancing area in cancer treatment.

Their leading CAR-T candidate, GLPG5101, is showing strong potential, with promising clinical data guiding its progression towards pivotal trials. The company is targeting a potential approval for this therapy by 2028, highlighting a clear path to market for key assets.

This concentrated strategy allows Galapagos to efficiently deploy capital and expertise, aiming to accelerate the development of high-impact treatments in these critical therapeutic fields, potentially leading to significant market opportunities.

Galapagos's innovative decentralized cell therapy manufacturing platform is a significant strength, enabling a rapid vein-to-vein time of roughly seven days for CAR-T therapies. This speed is crucial for patients with aggressive conditions, offering a distinct advantage in patient access and potentially improving treatment efficacy. The company's focus on efficient manufacturing addresses a key bottleneck in cell therapy delivery.

Strong Financial Position and Strategic Capital Allocation

Galapagos's financial health is a significant strength. As of the first quarter of 2025, the company reported a substantial cash and financial investments balance, reaching approximately €3.3 billion. This strong liquidity provides a crucial financial runway for its operations and future growth strategies.

This robust capital position is instrumental in fueling Galapagos's ongoing research and development efforts, advancing its clinical pipeline, and supporting strategic initiatives. It also enables the company to adequately fund its planned SpinCo and explore potential future acquisitions, reinforcing its competitive standing in the biopharmaceutical sector.

Furthermore, Galapagos has projected a manageable annual cash burn rate following its separation, indicating a commitment to financial discipline and sustainability. This forward-looking financial planning ensures the company can maintain operational stability and pursue its long-term objectives without undue financial strain.

- Strong Liquidity: Approximately €3.3 billion in cash and financial investments as of Q1 2025.

- R&D and Strategic Funding: Capital supports ongoing R&D, clinical development, SpinCo funding, and potential acquisitions.

- Financial Stability: Projected manageable annual cash burn post-separation ensures financial resilience.

Strategic Flexibility and Potential for Value Creation through SpinCo

Galapagos' strategic flexibility, particularly its consideration of a spin-off, demonstrates a proactive approach to unlocking shareholder value. The initial plan to separate into a cell therapy-focused Galapagos and a SpinCo for acquiring innovative medicines aimed to sharpen strategic focus and pursue distinct growth pathways. This strategic agility allows for more targeted investments and partnerships, as seen in their ongoing pipeline development.

While the specific spin-off plans were re-evaluated, the underlying strategic intent remains a strength. This flexibility enables Galapagos to adapt to market dynamics and optimize its business segments. For instance, their commitment to advancing their CAR-T and gene therapy programs, alongside potential acquisitions, showcases this adaptability. As of early 2024, Galapagos continued to advance its pipeline, with several candidates in mid-to-late stage development, underscoring the potential for value creation through focused R&D and strategic business development.

Galapagos possesses a robust proprietary target discovery platform, enabling the identification of novel drug candidates for complex diseases with significant unmet needs. This innovation engine is key to their strategy, as evidenced by a strong pipeline in 2023, with multiple promising assets progressing from this discovery process.

The company's strategic focus on oncology and immunology, particularly CAR-T cell therapies, is a core strength. Their lead CAR-T candidate, GLPG5101, is advancing toward pivotal trials with a target potential approval by 2028, showcasing a clear development path for high-impact treatments.

Galapagos's decentralized cell therapy manufacturing platform offers a significant advantage, enabling rapid vein-to-vein timelines of approximately seven days for CAR-T therapies. This efficiency is critical for patient access and treatment efficacy in aggressive conditions.

Financially, Galapagos is well-positioned with approximately €3.3 billion in cash and financial investments as of Q1 2025. This strong liquidity fuels R&D, pipeline advancement, and strategic initiatives, including funding its SpinCo and potential acquisitions.

| Metric | Value (as of Q1 2025) | Significance |

|---|---|---|

| Cash & Financial Investments | €3.3 billion | Provides substantial financial runway for operations and growth. |

| Key CAR-T Candidate | GLPG5101 | Targeting potential approval by 2028, indicating strong development progress. |

| Cell Therapy Manufacturing | ~7-day vein-to-vein time | Enhances patient access and treatment efficacy for CAR-T therapies. |

What is included in the product

Delivers a strategic overview of Galapagos’s internal and external business factors, highlighting its strengths in R&D, weaknesses in commercialization, opportunities in emerging markets, and threats from competition and regulatory changes.

Offers a clear, actionable framework to identify and address critical threats and weaknesses, thereby alleviating strategic uncertainty.

Weaknesses

Galapagos has faced persistent operating losses, a significant hurdle despite advancements in its pipeline. For instance, in the first half of 2024, the company reported a net loss of €281 million, underscoring ongoing profitability challenges.

Heavy investment in research and development, especially for its oncology portfolio, is a primary driver of these deficits. These substantial R&D expenditures, while crucial for future growth, directly impact the company's bottom line in the short term, as evidenced by the €232 million spent on R&D in H1 2024.

The lack of consistent net income indicates a struggle to convert promising research into reliable financial returns. This financial performance gap raises concerns about the company's ability to achieve sustainable profitability from its ongoing operations.

Galapagos's commitment to pioneering new treatments, particularly in the complex field of cell therapy, drives substantial Research and Development (R&D) expenses. These high costs are a characteristic of the biotech sector, presenting a significant financial challenge due to the lengthy and unpredictable nature of drug development.

For instance, in the first half of 2024, Galapagos reported R&D expenses of €316 million, a notable increase from €279 million in the same period of 2023. This upward trend highlights the significant investment required to advance its pipeline, with subcontracting costs for cell therapy programs contributing substantially to this rise.

Galapagos's progress is intrinsically tied to the success of its drug candidates in clinical trials and obtaining regulatory approvals. Setbacks in these areas, such as trial failures or safety concerns, can lead to substantial financial repercussions and erode investor trust. For instance, the discontinuation of the filgotinib program in the US market in 2021 due to regulatory concerns highlights the significant impact of such challenges.

Strategic Restructuring and Leadership Transitions

Galapagos has navigated considerable strategic restructuring, notably the decision to abandon its planned separation into two distinct companies. This pivot, alongside leadership transitions, introduces inherent risks. Such significant organizational shifts can create temporary operational disruptions and affect employee morale as teams adapt to new directions and leadership.

These changes can also influence investor sentiment, as the market digests the implications of altered strategic priorities and new management. For instance, the company’s stock experienced volatility following announcements related to strategic realignments in late 2023 and early 2024, reflecting this sensitivity.

- Strategic Uncertainty: The reversal of the proposed separation creates a period of strategic re-evaluation, potentially delaying key decisions or resource allocation.

- Leadership Impact: New leadership may bring fresh perspectives but also requires time to establish trust and operational efficiency, potentially impacting short-term execution.

- Operational Adjustments: Restructuring efforts, even if ultimately beneficial, can lead to temporary inefficiencies and require careful management to maintain momentum.

- Market Perception: Frequent strategic shifts can lead to investor caution, demanding clear communication to rebuild confidence in the company's long-term vision.

Limited Commercialized Product Portfolio (Post-Jyseleca Divestment)

Following the divestment of its Jyseleca business in late 2023, Galapagos now operates with a significantly narrowed commercialized product portfolio. This strategic shift, while aiming for greater focus, inherently elevates the company's reliance on its pipeline candidates for future revenue streams. The limited number of approved products means that any delays or failures in clinical development for its remaining pipeline assets carry a more substantial impact on the company's financial outlook.

This reduced portfolio makes Galapagos more vulnerable to pipeline setbacks, as there are fewer existing revenue-generating products to buffer against such events. Until new treatments successfully navigate the regulatory and market entry phases, the company's financial performance will be closely tied to the progression of its development programs. For instance, as of early 2024, Galapagos' primary commercial focus remains on its approved treatments, highlighting the critical need for successful pipeline advancements.

- Streamlined Focus: Post-Jyseleca divestment, Galapagos has a more concentrated approach to its R&D and commercial efforts.

- Increased Pipeline Reliance: The company's future revenue generation is heavily dependent on the success of its current pipeline candidates.

- Heightened Risk: Pipeline setbacks now pose a greater threat to Galapagos' financial stability due to the limited commercialized product base.

- Market Entry Urgency: Successful and timely launches of new products are crucial to diversify revenue and mitigate risks associated with pipeline dependencies.

Galapagos's financial health remains a significant concern, marked by persistent operating losses. The company reported a net loss of €281 million in the first half of 2024, a clear indicator of its ongoing profitability challenges.

These deficits are largely driven by substantial investments in research and development, particularly for its oncology pipeline. In H1 2024, R&D expenses reached €316 million, an increase from €279 million in H1 2023, reflecting the high costs associated with advancing novel therapies.

The company's reliance on pipeline success for future revenue is a considerable weakness. With a narrowed commercialized product portfolio following the Jyseleca divestment in late 2023, any setbacks in clinical trials or regulatory approvals for its development candidates carry a magnified impact on its financial outlook.

Strategic uncertainty, stemming from the reversal of its planned separation and leadership transitions, also presents a challenge. These shifts can lead to operational disruptions and affect market perception, demanding careful management and clear communication to rebuild investor confidence.

| Metric | H1 2024 | H1 2023 |

| Net Loss (€ million) | 281 | N/A (specific comparable not provided) |

| R&D Expenses (€ million) | 316 | 279 |

Full Version Awaits

Galapagos SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are viewing the actual Galapagos SWOT analysis, ensuring you know exactly what you're purchasing. The complete, in-depth report will be available to you immediately after checkout.

Opportunities

Galapagos is well-positioned to broaden its cell therapy offerings, moving beyond existing targets and utilizing its decentralized manufacturing capabilities for promising CAR-T candidates.

The company has outlined a strategic plan to commence clinical development for new CAR-T candidates in 2025, with further next-generation programs slated for introduction in 2026. This expansion aims to address a wider spectrum of both blood cancers and solid tumors, potentially unlocking significant market opportunities.

Galapagos can leverage strategic partnerships to speed up the development of its drug pipeline and broaden its manufacturing capacity. For instance, collaborations can provide access to novel technologies, further strengthening its research and development efforts.

The company's existing partnerships, such as the one with Adaptimmune, demonstrate the value of these alliances in enhancing capabilities and market reach. These collaborations can also help mitigate development risks and smooth the path to market entry for new therapies.

The creation of SpinCo, backed by significant capital, opens a prime avenue for Galapagos to acquire or license promising assets, particularly in high-growth areas like oncology, immunology, and virology. This strategic move allows for swift pipeline diversification and the integration of cutting-edge therapies.

By focusing on external innovation through acquisitions and in-licensing, Galapagos can accelerate its growth trajectory. For instance, in 2024, the biopharmaceutical M&A market saw substantial activity, with companies actively seeking to bolster their pipelines, indicating a favorable environment for such strategic plays.

Leveraging Decentralized Manufacturing for Competitive Edge

Galapagos' distinct decentralized cell therapy manufacturing platform offers a compelling competitive edge, particularly in its ability to expedite the delivery of fresh CAR-T cells. This operational model is crucial in a field where cell viability and timely administration directly impact therapeutic efficacy.

Further enhancing and broadening this decentralized network, with strategic expansions planned for the U.S. and Europe, is poised to cement Galapagos' leadership in the rapidly evolving cell therapy landscape. This growth is expected to significantly improve patient access and clinical outcomes, acting as a powerful market differentiator.

By 2024, the global CAR-T therapy market was projected to reach over $10 billion, with decentralized manufacturing models like Galapagos' becoming increasingly vital for scaling production and meeting demand. The company's focus on optimizing this network aligns with industry trends emphasizing localized production to reduce logistical complexities and enhance patient centricity.

- Faster Delivery: Decentralized manufacturing allows for quicker transport of CAR-T cells from production to patient, crucial for cell viability.

- Market Leadership: Expansion of this network in key regions like the U.S. and Europe strengthens Galapagos' competitive position in cell therapy.

- Improved Patient Access: The model aims to overcome geographical barriers, making advanced therapies more accessible to a wider patient population.

- Enhanced Outcomes: Timely delivery of high-quality, fresh cells can directly correlate with better treatment results for patients.

Addressing High Unmet Medical Needs

Galapagos' strategic focus on high unmet medical needs, particularly in inflammatory diseases, fibrotic conditions, and oncology, places it in markets ripe for innovation and significant patient benefit. This targeted approach is crucial for driving substantial market penetration and securing strong pricing power for its novel therapies.

The company's commitment to addressing these complex diseases is reflected in its robust pipeline, with several candidates progressing through clinical trials. For instance, in early 2024, Galapagos advanced its Phase 2 study for filgotinib in ulcerative colitis, a condition affecting millions globally with limited treatment options. The potential for breakthrough designations in these areas, such as the recent positive feedback from regulatory bodies on its cystic fibrosis program, underscores the significant opportunity.

- Market Potential: The global market for inflammatory and fibrotic diseases is substantial, with analysts projecting continued growth driven by aging populations and increasing disease prevalence. For example, the market for inflammatory bowel disease treatments alone was valued in the tens of billions of dollars in 2023 and is expected to expand further.

- Innovation Advantage: By concentrating on areas with limited effective treatments, Galapagos aims to capture first-mover advantage and secure intellectual property protection for its novel mechanisms of action.

- Regulatory Tailwinds: Addressing high unmet needs often provides pathways for expedited regulatory review and approval, potentially shortening the time to market and revenue generation.

Galapagos is strategically expanding its cell therapy capabilities, aiming to introduce new CAR-T candidates into clinical development in 2025 and beyond. This expansion targets a broader range of cancers, including solid tumors, tapping into a significant and growing market. The company's unique decentralized manufacturing platform provides a crucial competitive edge, enabling faster delivery of CAR-T cells and improving patient access across the U.S. and Europe.

Leveraging strategic partnerships and external innovation, such as acquisitions and licensing deals, is a key opportunity for Galapagos to accelerate pipeline growth and diversify into high-demand therapeutic areas like oncology and immunology. The company's focus on addressing high unmet medical needs in inflammatory diseases, fibrotic conditions, and oncology positions it to capitalize on markets with substantial patient populations and limited treatment options, potentially leading to strong pricing power and expedited regulatory pathways.

| Opportunity | Description | Market Data/Impact |

| Cell Therapy Expansion | Broaden cell therapy offerings, including new CAR-T candidates for blood cancers and solid tumors. | Global CAR-T therapy market projected to exceed $10 billion by 2024. |

| Decentralized Manufacturing | Enhance and expand decentralized manufacturing network in the U.S. and Europe. | Crucial for scaling production, reducing logistical complexities, and improving patient centricity in cell therapy. |

| Strategic Partnerships & Acquisitions | Utilize collaborations and external innovation (M&A, licensing) to accelerate pipeline development. | Biopharmaceutical M&A saw substantial activity in 2024, indicating a favorable environment for pipeline bolstering. |

| Focus on Unmet Needs | Target high unmet medical needs in inflammatory diseases, fibrotic conditions, and oncology. | Inflammatory bowel disease treatment market alone valued in tens of billions in 2023; potential for expedited regulatory review. |

Threats

The biotechnology and cell therapy landscapes are incredibly crowded, with both large, established pharmaceutical giants and nimble, emerging biotechs aggressively pursuing market dominance. This intense competition means Galapagos constantly faces rivals who could potentially develop more effective treatments, secure faster regulatory approvals, or undercut pricing strategies. For instance, in 2024, the global biopharmaceutical market was valued at over $1.6 trillion, highlighting the sheer scale of investment and the number of players involved.

The path of drug development is fraught with inherent risks, and for Galapagos, late-stage clinical trial failures represent a significant threat. These failures can stem from unexpected adverse events in patients or simply not meeting the efficacy benchmarks set by regulators. Such setbacks can be financially devastating, as seen with the discontinuation of filgotinib in certain indications, leading to substantial write-offs and impacting future revenue projections.

Regulatory hurdles are another formidable challenge. Stringent requirements from agencies like the FDA and EMA mean that even promising compounds can face lengthy review processes or outright rejections. For instance, delays in obtaining approvals for new indications or market expansions can erode competitive advantages and reduce the commercial lifespan of a drug. In 2023, the market reacted negatively to regulatory delays for some of its pipeline candidates, highlighting investor sensitivity to these challenges.

Even after a drug like Galapagos's is approved, getting it into the hands of patients can be a hurdle. Many healthcare systems are scrutinizing costs, and expensive treatments, such as advanced cell therapies, often face tough reimbursement rules. This can restrict who can access the therapy and impact its overall market success.

For instance, in 2024, many European countries continued to implement stricter health technology assessments, demanding robust real-world evidence of cost-effectiveness before approving new, high-cost medicines. This trend is expected to persist into 2025, potentially affecting Galapagos's ability to secure favorable pricing and widespread adoption for its innovative treatments.

Intellectual Property Expiry and Patent Disputes

The biotechnology sector, including Galapagos, is fundamentally built on strong intellectual property (IP) protection. The expiry of crucial patents for its key drugs, or even successful legal challenges to their validity by competitors, presents a significant threat. This could pave the way for cheaper generic or biosimilar versions to enter the market, directly impacting Galapagos' market share and, consequently, its revenue streams. For instance, the loss of patent exclusivity on a blockbuster drug can lead to a dramatic drop in sales, as seen with many established pharmaceutical products.

Galapagos needs to maintain a robust pipeline of new, innovative therapies to offset the potential impact of patent expiries. The company's ability to secure new patents and defend existing ones is paramount to its long-term financial health. As of early 2024, many biopharmaceutical companies are actively managing their patent portfolios, with an increasing number of patent disputes being filed in courts globally, highlighting the competitive landscape.

- Patent Expiry Risk: Loss of exclusivity on key Galapagos products could lead to significant revenue decline.

- Biosimilar Competition: The introduction of biosimilar versions of Galapagos' drugs poses a direct threat to market share.

- Patent Litigation: Competitors challenging the validity of Galapagos' patents can result in costly legal battles and potential loss of IP rights.

- Innovation Imperative: Continuous investment in research and development is crucial to replace revenue from expiring patents and maintain a competitive edge.

Economic Downturns and Funding Availability

Economic instability, such as a potential recession in major markets, could significantly dampen healthcare spending and reduce investment appetite for the biotechnology sector. This environment poses a threat to Galapagos by potentially slowing down R&D funding and impacting the valuation of its pipeline assets.

While Galapagos maintained a robust cash position as of its most recent reports, prolonged challenging capital market conditions could present a hurdle for financing its ambitious pipeline and strategic growth plans, including potential acquisitions for SpinCo. For instance, as of the end of Q1 2024, Galapagos reported approximately €1.4 billion in cash and cash equivalents, providing a cushion, but sustained market volatility could still strain future capital availability.

- Reduced Healthcare Budgets: Economic downturns often lead governments and private insurers to scrutinize and potentially reduce healthcare expenditures, impacting drug pricing and market access for Galapagos's therapies.

- Biotech Investment Slowdown: Venture capital and public market funding for biotech companies can dry up during economic contractions, making it harder to raise capital for clinical trials and commercialization.

- Impact on M&A: Challenging funding environments can hinder Galapagos's ability to pursue strategic acquisitions or partnerships, which are crucial for pipeline expansion and growth, especially for its SpinCo strategy.

- Valuation Pressures: A general market downturn can lead to lower valuations for publicly traded companies, including Galapagos, potentially affecting its market capitalization and ability to raise equity capital.

Galapagos faces intense competition from established pharmaceutical companies and emerging biotechs, potentially leading to faster development or better pricing by rivals. The inherent risks in drug development, particularly late-stage clinical trial failures, can result in significant financial setbacks. Stringent regulatory requirements and reimbursement challenges in healthcare systems also pose substantial threats to market access and commercial success, especially for high-cost therapies.

Patent expirations and successful IP challenges from competitors can lead to a sharp decline in revenue as generic or biosimilar versions enter the market. Economic downturns can reduce healthcare spending and biotech investment, impacting R&D funding and capital availability for growth initiatives. The company's ability to continuously innovate and secure new intellectual property is critical to counter these threats.

| Threat Category | Specific Threat | Impact on Galapagos | Example/Data Point (2024/2025 Trend) |

|---|---|---|---|

| Competition | Rival Drug Development | Loss of market share, reduced pricing power | Global biopharma market exceeding $1.6 trillion in 2024 indicates high competitive intensity. |

| Drug Development Risk | Late-Stage Trial Failures | Financial write-offs, pipeline delays | Filgotinib discontinuation in certain indications serves as a precedent for significant setbacks. |

| Regulatory & Market Access | Stringent Approval Processes | Delayed market entry, reduced commercial lifespan | Stricter health technology assessments in Europe (2024/2025) may impact reimbursement for new therapies. |

| Intellectual Property | Patent Expiry & Litigation | Revenue erosion, loss of exclusivity | Increased patent disputes globally (as of early 2024) highlight the need for robust IP defense. |

| Economic Factors | Economic Downturns | Reduced R&D funding, capital market challenges | Galapagos' €1.4 billion cash reserves (Q1 2024) provide a buffer but sustained volatility can strain future funding. |

SWOT Analysis Data Sources

This Galapagos SWOT analysis is built upon a foundation of diverse and credible data, including official company financial reports, comprehensive market research studies, and expert opinions from industry analysts.