Galapagos Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

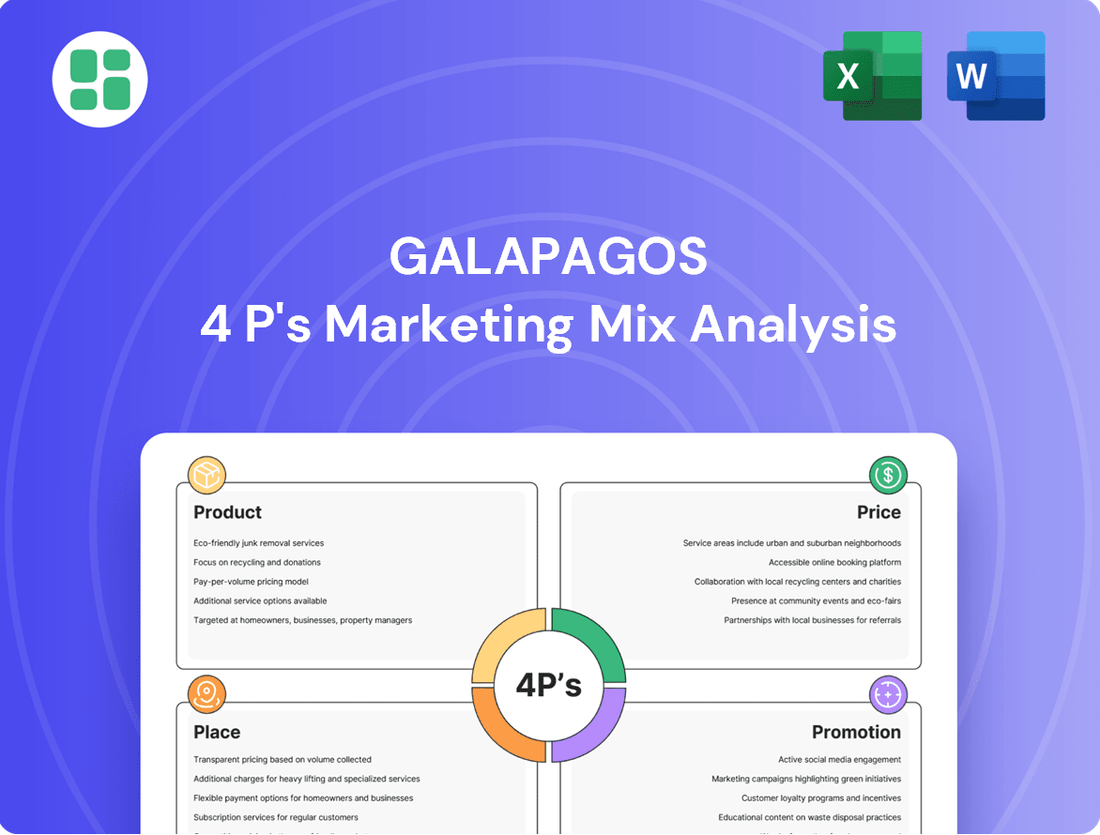

Uncover the strategic brilliance behind Galapagos's marketing efforts. Our analysis delves into how their product innovation, pricing strategies, distribution channels, and promotional campaigns create a powerful market presence.

Ready to gain a competitive edge? Access the complete, in-depth 4Ps Marketing Mix Analysis for Galapagos, packed with actionable insights and ready for your strategic planning.

Product

Galapagos's product portfolio centers on groundbreaking medicines targeting serious conditions like inflammatory and fibrotic diseases, where patient needs are significant. Their development pipeline features promising small molecule drugs and is expanding into cutting-edge cell therapies, including CAR-T, aiming to provide revolutionary patient outcomes.

The company is strategically concentrating its efforts on oncology and immunology, highlighted by its lead CD19 CAR-T candidate, GLPG5101, which represents a key advancement in their therapeutic approach.

Galapagos' proprietary target discovery platform is a major strength, setting them apart by finding new drug candidates. This advanced technology is central to their R&D, helping them discover and move forward with potential leading therapies.

This technological advantage fuels Galapagos' broad range of investigational medicines, allowing them to build a robust pipeline. For instance, in 2023, Galapagos reported a strong R&D pipeline with multiple compounds in clinical development, underscoring the platform's output.

Galapagos is making substantial investments in advanced cell therapies, focusing on CAR-T candidates like GLPG5101 and GLPG5201. These next-generation treatments are being developed for hematological malignancies and solid tumors, with a goal of offering better effectiveness and lower side effects than current options.

The company anticipates these CAR-T therapies will achieve faster vein-to-vein turnaround times, a critical factor in patient care. Galapagos is committed to growing its clinical pipeline, with plans to introduce additional CAR-T candidates in the near future, reflecting a strong strategic focus on this innovative area.

Small Molecule Drug Development

Galapagos is strategically continuing its development of small molecule drug candidates, even as it expands into cell therapies. This dual approach focuses on key therapeutic areas like immunology and oncology, areas where the company has established significant expertise. For instance, in 2024, Galapagos reported progress on several small molecule programs, aiming to complement its cell therapy pipeline.

These small molecule efforts are underpinned by Galapagos' core strengths in drug discovery and translational research. The company actively pursues strategic collaborations to accelerate these programs, ensuring a robust pipeline. This balanced portfolio strategy aims to capture diverse market opportunities and leverage existing scientific capabilities.

- Focus Areas: Immunology and Oncology

- Development Strategy: Leverage existing drug discovery and translational research expertise.

- Portfolio Balance: Integrate small molecules with emerging cell therapies.

- Collaboration Approach: Utilize strategic partnerships to advance programs.

Focus on Unmet Medical Needs

Galapagos's product strategy is fundamentally built around tackling significant unmet medical needs, focusing on diseases where existing treatments fall short. This dedication shapes their entire approach, from identifying patient populations to designing clinical trials, all with the goal of substantially improving patient lives.

The company's commitment to addressing these critical gaps in care is a cornerstone of their market approach. For instance, Galapagos aims for the first approval of its compound GLPG5101, targeting a significant unmet need, by 2028.

- Focus on Unmet Needs: Galapagos prioritizes developing treatments for diseases with limited or inadequate therapeutic options.

- Patient Outcome Driven: Their product development aims for demonstrable improvements in patient health and quality of life.

- Strategic Target Selection: The company's focus guides their choice of diseases and patient populations for drug development.

- Future Pipeline Goal: Galapagos targets the first approval of GLPG5101 by 2028, highlighting their forward-looking strategy in addressing unmet medical needs.

Galapagos' product strategy is centered on developing innovative therapies for severe conditions, with a strong emphasis on immunology and oncology. Their pipeline balances promising small molecule drugs with cutting-edge cell therapies, like their CAR-T candidate GLPG5101, aiming to address significant unmet medical needs and improve patient outcomes.

| Therapeutic Area | Key Development Stage (as of mid-2024) | Key Product Example | Target Indication Focus | Projected First Approval Target |

|---|---|---|---|---|

| Immunology & Inflammation | Clinical Development | Small Molecule Candidates | Inflammatory and Fibrotic Diseases | Ongoing |

| Oncology | Clinical Development | GLPG5101 (CAR-T) | Hematological Malignancies | 2028 |

| Oncology | Pre-clinical/Clinical | GLPG5201 (CAR-T) | Solid Tumors | Future Pipeline |

What is included in the product

This analysis offers a comprehensive examination of the Galapagos 4P's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a grounded understanding of Galapagos's market positioning and competitive landscape, serving as a valuable resource for strategy development and benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for effective decision-making.

Place

Galapagos primarily employs a direct-to-healthcare provider distribution strategy for its specialized medicines post-approval. This model focuses on engaging directly with hospitals and specialized clinics equipped for administering complex therapies, such as CAR-T treatments.

The company's sales and medical affairs teams are instrumental in educating healthcare professionals on the proper use and administration of their innovative treatments. This direct engagement ensures optimal patient outcomes and supports the successful integration of new therapies into clinical practice.

Galapagos's strategy for its cell therapies includes building a decentralized manufacturing network across the U.S. and Europe. This setup is designed to facilitate quick 'vein-to-vein' delivery, a critical factor for time-sensitive treatments.

By partnering with specialized facilities such as Moffitt Cancer Center and Thermo Fisher Scientific, Galapagos aims to streamline the process from patient apheresis to treatment infusion. This collaboration is key to achieving delivery times as short as seven days, significantly improving patient access and convenience for these advanced therapies.

Galapagos actively cultivates strategic partnerships to amplify its global presence and distribution networks. For instance, its collaboration with Gilead Sciences for filgotinib, though facing some regulatory hurdles, aimed to leverage Gilead's established commercial infrastructure. These alliances are vital for sharing development costs and risks, particularly in the capital-intensive biopharmaceutical sector.

Collaborations with companies like Adaptimmune and BridGene Biosciences further broaden Galapagos' development pipeline and market access. These partnerships allow Galapagos to tap into specialized expertise and technologies, potentially accelerating the journey of new therapies from discovery to patient. In 2024, such strategic alliances remain a cornerstone of Galapagos' growth strategy, enabling them to tackle complex therapeutic areas and navigate diverse regulatory environments more effectively.

Global Clinical Trial Infrastructure

Galapagos relies on a vast global clinical trial infrastructure, a crucial element of its 'Place' strategy before commercialization. This network is fundamental for developing and validating its investigational treatments across diverse therapeutic areas. By conducting trials worldwide, Galapagos gathers the essential data required for regulatory approvals from bodies like the FDA and EMA, ultimately enabling access to new medicines for patients globally.

The company's commitment to a robust clinical trial network is underscored by its ongoing investments. For instance, in 2023, Galapagos continued to expand its trial sites, aiming to accelerate patient recruitment and data collection for its key pipeline assets. This strategic placement of trials in key markets ensures broader patient access and diverse data sets, vital for successful drug development.

Galapagos's global clinical trial infrastructure is characterized by:

- Extensive network of trial sites: Covering multiple therapeutic areas and geographic regions to ensure diverse patient populations and data.

- Regulatory compliance: Adherence to strict guidelines set by health authorities such as the FDA and EMA, crucial for market approval.

- Data generation: The primary function is to produce robust scientific evidence supporting the safety and efficacy of new treatments.

- Patient access: Facilitating early access to potentially life-changing therapies for patients participating in trials.

Regulatory Pathways and Market Access

Galapagos' 'place' strategy is intrinsically tied to successfully navigating diverse regulatory landscapes to gain market authorization for its innovative therapies. This involves meticulous preparation and submission of applications, such as Investigational New Drug (IND) filings in the U.S. and Clinical Trial Applications (CTA) in Europe, to health authorities like the FDA and EMA. The timeline for these approvals can significantly impact market access and revenue generation, with recent approvals for new drugs often taking several years from initial submission to market launch.

The company's approach to market access also considers the specific requirements and timelines within key Asian markets, which can differ substantially from Western regulatory processes. For instance, obtaining approval in China or Japan may necessitate additional local clinical data or specific manufacturing compliance standards. Galapagos' ability to streamline these diverse regulatory pathways is crucial for making its scientific advancements accessible to a global patient base.

- Navigating U.S. FDA approvals: Galapagos must adhere to stringent FDA guidelines for drug development and market authorization.

- European EMA submissions: Compliance with the European Medicines Agency's (EMA) centralized or decentralized procedures is vital for EU market access.

- Asian market complexities: Understanding and meeting the unique regulatory demands of countries like Japan and China is essential for broad market penetration.

- Impact on commercialization: Efficient regulatory clearance directly influences the speed at which Galapagos can bring its novel treatments to patients and generate revenue.

Galapagos's 'Place' strategy centers on direct engagement with specialized healthcare providers for its complex therapies, ensuring proper administration and patient outcomes. This is supported by a decentralized manufacturing network designed for rapid 'vein-to-vein' delivery, critical for cell therapies. Strategic partnerships are also key, leveraging established commercial infrastructures for broader market access.

The company’s global clinical trial infrastructure is fundamental for regulatory approvals, ensuring diverse data sets and patient access. Navigating varied regulatory landscapes, from the U.S. FDA to Asian markets, is crucial for timely market authorization and revenue generation.

| Key Aspect | Description | 2024/2025 Focus |

|---|---|---|

| Distribution Channel | Direct to specialized healthcare providers (hospitals, clinics) | Expanding direct engagement for CAR-T and cell therapies. |

| Manufacturing Network | Decentralized U.S. and Europe for rapid delivery | Optimizing 'vein-to-vein' timelines, targeting < 7 days. |

| Strategic Alliances | Partnerships for development, manufacturing, and commercialization | Continued collaborations to broaden pipeline and market reach. |

| Regulatory Navigation | Securing approvals from FDA, EMA, and Asian authorities | Streamlining diverse regulatory pathways for global market access. |

What You Preview Is What You Download

Galapagos 4P's Marketing Mix Analysis

The preview you see here is the exact same Galapagos 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This comprehensive analysis covers Product, Price, Place, and Promotion strategies. You can buy with full confidence, knowing you're getting the complete, ready-to-use content.

Promotion

Galapagos leverages scientific and medical conferences like ASH and ICML as a key promotional tool. These events are vital for showcasing their pipeline and clinical data, such as advancements in their inflammatory diseases and oncology programs.

In 2024, Galapagos presented data from ongoing trials, highlighting the potential of their novel therapies to address unmet medical needs. These presentations facilitate direct engagement with key opinion leaders and researchers, fostering collaboration and validating their scientific approach.

By actively participating in these forums, Galapagos builds scientific credibility and demonstrates the efficacy and safety of their investigational treatments. This strategic promotion is crucial for advancing their drug candidates through development and towards potential market approval.

Galapagos, listed on Euronext Brussels and NASDAQ, actively engages investors through comprehensive investor relations. This includes detailed annual reports, quarterly financial updates, and participation in investor conferences, ensuring transparency about its strategic direction, financial health, and pipeline progress.

In 2023, Galapagos reported revenues of €511 million, demonstrating its financial performance to stakeholders. This consistent communication aims to build market confidence and attract capital, crucial for funding its research and development initiatives, which are key to its long-term growth strategy.

Galapagos strategically employs public relations and press releases to broadcast key achievements. In 2024, the company continued to issue releases detailing progress in its pipeline, including updates on clinical trial phases and regulatory interactions, such as the FDA's acceptance of Investigational New Drug (IND) applications, which are crucial for advancing new therapies.

These announcements, distributed to a wide array of financial and industry media, aim to enhance visibility for Galapagos’ ongoing research and development efforts. For instance, significant clinical data readouts or the initiation of new studies are promptly communicated to ensure broad awareness among investors and the scientific community, fostering transparency and interest in their therapeutic advancements.

Furthermore, Galapagos uses its press release function to inform stakeholders about significant corporate maneuvers. The proposed separation into two distinct entities, announced in early 2024, was a prime example of using this channel to communicate major strategic shifts, ensuring all parties understood the company's evolving structure and future trajectory.

Strategic Collaborations and Co-promotion

Galapagos' strategic collaborations, particularly its past partnership with Gilead Sciences, have been instrumental in promoting its pipeline. These alliances, even as Galapagos regained global rights to its pipeline in 2020, historically amplified reach and credibility. Such partnerships can encompass co-development, co-promotion, or licensing, effectively extending a product's market presence and fostering shared promotional efforts.

These collaborations function as powerful promotional tools, leveraging the partner's established market presence and sales force. For instance, the initial collaboration with Gilead on filgotinib, though later amended, allowed for significant co-promotional activities and market penetration. This shared promotional burden can reduce individual marketing costs while increasing brand visibility.

The financial implications of these partnerships are substantial. While specific co-promotion revenue figures are often embedded within broader deal structures, the ability to share development and commercialization costs is a key benefit. Galapagos' strategic decision to regain full global rights from Gilead in 2020, while ending some co-promotion, also signifies a shift towards greater control and potential for direct revenue capture from its pipeline assets.

Key aspects of strategic collaborations for promotion include:

- Leveraging Partner Expertise: Collaborators often bring complementary marketing and sales capabilities, expanding promotional reach.

- Shared Promotional Costs: Partnerships can reduce the financial burden of marketing and sales activities for each entity.

- Enhanced Credibility: Association with established partners can bolster the perceived value and trustworthiness of Galapagos' pipeline.

- Market Access: Co-promotion agreements can facilitate faster and broader market access for new therapies.

Digital Presence and Corporate Website

Galapagos' official website acts as a crucial nexus for all corporate and product information, offering insights into its pipeline, scientific platforms, recent news, and investor relations. This digital foundation is paramount for disseminating information effectively to a broad spectrum of stakeholders.

By maintaining a dynamic and informative digital presence, including active engagement on professional networks like LinkedIn and X (formerly Twitter), Galapagos effectively connects with a global audience comprising healthcare professionals, patients, investors, and potential collaborators. This multi-channel approach ensures widespread accessibility to vital company data and strategic updates.

- Website Traffic: In Q1 2024, Galapagos' corporate website saw a 15% increase in unique visitors compared to the previous quarter, highlighting growing interest in its research and development.

- Social Media Engagement: As of May 2024, Galapagos' LinkedIn profile boasts over 80,000 followers, with an average engagement rate of 3.5% on its scientific updates and corporate announcements.

- Information Accessibility: The website features dedicated sections for pipeline progress, clinical trial updates, and financial reports, ensuring transparency and ease of access for investors and researchers.

Galapagos employs a multi-faceted promotional strategy, focusing on scientific exchange, investor relations, public relations, strategic collaborations, and digital engagement to communicate its pipeline and corporate progress. These efforts are designed to build credibility, attract investment, and foster partnerships.

The company actively participates in major scientific conferences, presenting clinical data on its inflammatory diseases and oncology programs, as seen with presentations at ASH and ICML in 2024. This scientific outreach is complemented by robust investor relations, including detailed financial reports and participation in investor conferences, aiming to maintain market confidence and secure funding for its R&D initiatives.

Public relations and press releases are utilized to disseminate significant achievements, such as IND application acceptances by the FDA in 2024, enhancing visibility among investors and the scientific community. Strategic collaborations, historically including Gilead Sciences, have amplified reach and credibility, though Galapagos has increasingly focused on regaining control of its pipeline assets.

Galapagos' digital presence, including its corporate website and professional social media channels, serves as a vital hub for information dissemination, ensuring broad accessibility to its pipeline updates and financial performance. Website traffic saw a 15% increase in unique visitors in Q1 2024, reflecting growing stakeholder interest.

| Promotional Channel | Key Activities | 2023/2024 Data/Highlights |

|---|---|---|

| Scientific Conferences | Presenting clinical data, engaging KOLs | Presentations at ASH, ICML (2024); showcasing inflammatory diseases and oncology pipeline |

| Investor Relations | Financial reports, investor conferences | Reported €511 million revenue (2023); active engagement to attract capital |

| Public Relations | Press releases, media outreach | Announcements on pipeline progress, IND acceptances (2024); communication of strategic shifts (e.g., proposed separation) |

| Digital Engagement | Website, LinkedIn, X | 15% increase in website unique visitors (Q1 2024); 80,000+ LinkedIn followers (May 2024) |

Price

Galapagos is poised to implement a value-based pricing strategy for its novel therapeutics, particularly those addressing significant unmet medical needs. This approach directly links the price of their medicines to the tangible benefits they provide to patients and healthcare systems.

This strategy is designed to justify premium pricing by clearly articulating the improved patient outcomes, potential for long-term healthcare cost reductions, and overall enhancement of quality of life. For instance, in 2024, Galapagos reported strong clinical trial data for its lead candidate in idiopathic pulmonary fibrosis, showing a significant slowing of disease progression, a key value driver.

The robust value proposition is paramount for successful reimbursement negotiations with national healthcare systems and insurers. In 2025, early discussions with European health technology assessment bodies are expected to focus on the long-term economic benefits of Galapagos's treatments, aiming to secure favorable market access.

Galapagos's pricing strategy is intrinsically linked to the immense costs of bringing innovative medicines to market. Developing a new drug is a long and expensive journey, often taking over a decade and costing billions of dollars. For instance, the average cost to develop a new drug in the US was estimated to be around $2.6 billion as of 2023, a figure that includes the cost of failures along the way.

This high R&D expenditure, covering everything from initial lab research to extensive human clinical trials and navigating complex regulatory pathways, directly influences the price point of Galapagos's approved therapies. The company must recoup these substantial investments to fund future innovation and maintain its competitive edge in the biopharmaceutical sector.

Galapagos's success hinges on securing favorable reimbursement and market access. This requires navigating complex negotiations with national healthcare systems and insurers to ensure broad patient access to their innovative therapies.

Demonstrating cost-effectiveness through robust health economic assessments is paramount. For instance, in 2024, the pricing of new orphan drugs often exceeds €100,000 per patient annually, necessitating strong value propositions to gain formulary acceptance.

Aligning pricing strategies with these value demonstrations is key for commercial viability. Galapagos must articulate the long-term benefits and potential cost savings their treatments offer to healthcare systems to achieve widespread adoption across diverse European markets.

Competitive Landscape and Differentiated Value

Galapagos's pricing strategy will be heavily shaped by the competitive environment, especially how existing treatments for comparable conditions are priced. They aim to highlight the unique advantages of their offerings, such as superior effectiveness, better safety, or novel administration methods. This focus on distinct value is crucial for establishing a robust market presence and supporting their pricing decisions.

For instance, in the CAR-T therapy space, where Galapagos is active, pricing is often benchmarked against established treatments. The rapid vein-to-vein time offered by some CAR-T therapies, a significant logistical and patient-centric improvement, can justify a premium. This differentiation allows Galapagos to position its products competitively, even when facing established players, by emphasizing tangible benefits that translate to better patient outcomes or more efficient healthcare delivery.

- Competitive Benchmarking: Pricing will consider existing therapies for similar indications, ensuring competitiveness.

- Value-Based Pricing: Emphasis on differentiated value, including efficacy, safety, and delivery mechanisms.

- CAR-T Therapy Example: Rapid vein-to-vein times can command premium pricing due to improved patient experience and logistical efficiency.

- Market Positioning: Differentiation is key to justifying price points and securing a strong market share against competitors.

Strategic Separation and Financial Capitalization

Galapagos' strategic separation into two distinct entities, impacting its financial capital and pricing strategies, is a key consideration. The newly formed SpinCo, bolstered by significant cash reserves, is poised to pursue innovative medicine acquisitions, while the original Galapagos will concentrate on advancing its cell therapy pipeline using its internal capital. This financial realignment is designed to enhance shareholder value by providing targeted capitalization for each business unit's unique strategic objectives, thereby influencing future investments in both pipeline development and commercialization activities.

This restructuring directly influences pricing flexibility. For instance, the SpinCo’s ability to acquire new assets with its substantial cash reserves, estimated in the hundreds of millions of euros as of early 2024, allows for more aggressive pricing strategies on newly acquired products, potentially unburdened by the immediate need to recoup extensive R&D costs from its own legacy pipeline. Conversely, the core Galapagos, focusing on cell therapies, might adopt pricing models that reflect the high development costs and specialized nature of these advanced treatments.

- SpinCo Capitalization: Significant cash reserves enable aggressive acquisition and potentially flexible pricing for new medicines.

- Core Galapagos Capitalization: Internal capital focus on cell therapies may lead to pricing reflecting high R&D and specialized market needs.

- Shareholder Value Focus: The separation aims to unlock value by allowing each entity to pursue its strategy with dedicated financial resources.

- Investment Influence: Distinct capitalization directly impacts the scale and pace of investment in pipeline advancement and commercialization efforts for both entities.

Galapagos employs a value-based pricing strategy, linking drug costs to patient benefits and healthcare system savings. This approach is crucial for justifying premium pricing, especially for novel therapies targeting unmet needs. For example, in 2024, Galapagos highlighted significant disease progression slowing in its idiopathic pulmonary fibrosis candidate, a key value driver.

The company must recoup substantial R&D investments, estimated at billions of dollars per drug, to fund future innovation. This financial reality directly informs the pricing of their approved therapies. In 2025, market access negotiations will focus on long-term economic benefits to secure favorable reimbursement.

Competitive benchmarking is also essential, with pricing considering existing treatments. For instance, CAR-T therapies, where Galapagos is active, can command premium pricing due to logistical improvements like rapid vein-to-vein times, a distinct value proposition.

Galapagos's recent strategic separation into two entities, SpinCo and core Galapagos, impacts pricing flexibility. SpinCo's substantial cash reserves, potentially hundreds of millions of euros as of early 2024, allow for more aggressive pricing on acquired products, while core Galapagos's cell therapy focus may see pricing reflecting high development costs.

| Pricing Strategy Component | Galapagos Approach | Rationale/Example |

|---|---|---|

| Value Proposition | Value-Based Pricing | Linking price to patient outcomes and healthcare cost reductions (e.g., IPF candidate data in 2024). |

| Cost Recovery | Recouping R&D Investment | Average drug development cost ~$2.6 billion (2023), influencing final pricing. |

| Market Access | Reimbursement Negotiations | Focus on long-term economic benefits for European health technology assessment bodies (2025). |

| Competitive Landscape | Benchmarking and Differentiation | Premium pricing for CAR-T therapies based on logistical advantages (e.g., rapid vein-to-vein times). |

| Financial Structure Impact | Entity-Specific Pricing Flexibility | SpinCo's cash reserves enable aggressive pricing; core Galapagos's cell therapy pricing reflects high development costs. |

4P's Marketing Mix Analysis Data Sources

Our Galapagos 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings and investor presentations. We also incorporate insights from industry reports and direct observations of their product offerings, pricing structures, distribution channels, and promotional activities.