Galapagos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

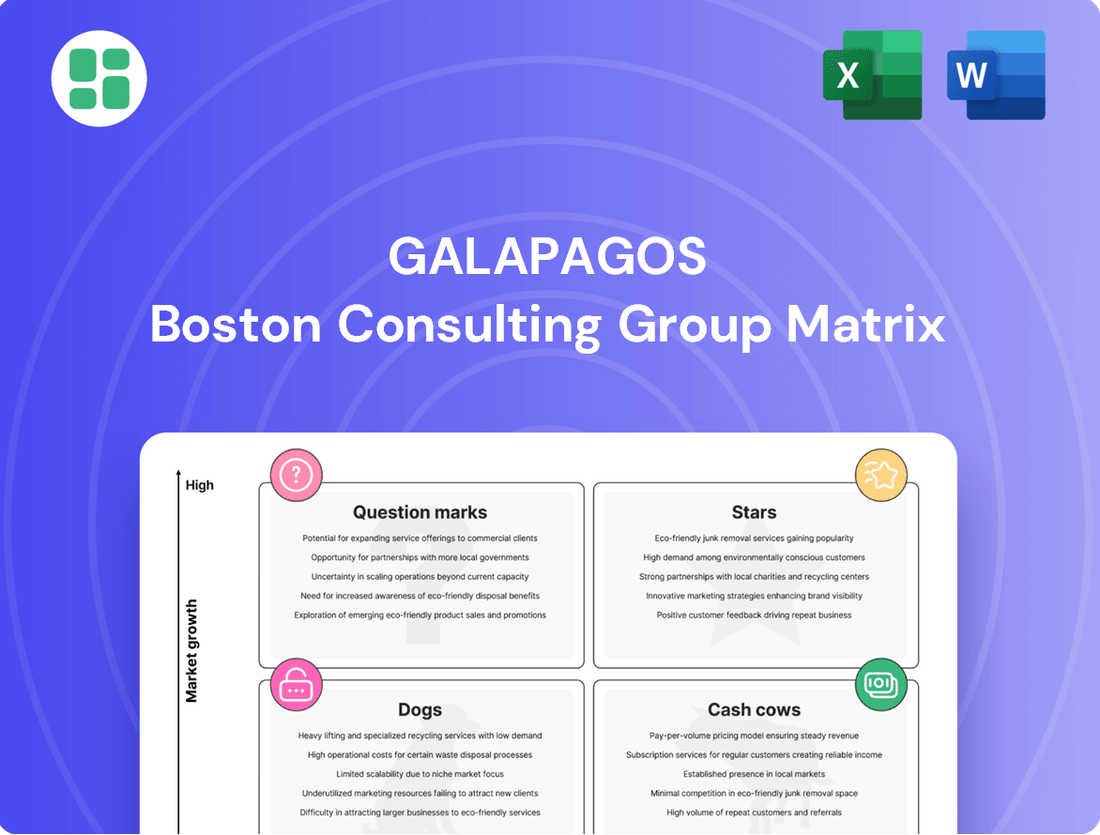

Unlock the strategic potential of the Galapagos BCG Matrix by understanding its core components: Stars, Cash Cows, Dogs, and Question Marks. This powerful framework helps businesses analyze their product portfolio and make informed decisions about resource allocation. Ready to transform your strategy?

Dive deeper into the Galapagos BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

GLPG5101, Galapagos' CD19 CAR-T therapy, is a star in their pipeline, targeting relapsed/refractory non-Hodgkin lymphoma. This program is a major focus, with pivotal development slated for 2026 and a potential approval by 2028. The company is heavily investing in this high-growth oncology area.

Galapagos' decentralized CAR-T manufacturing platform is a significant differentiator, allowing for swift and effective production of CAR-T cells. This proprietary technology gives them a crucial edge, enabling the delivery of fresh, stem-like cells with a median vein-to-vein time of just seven days, which is vital for patients facing rapidly progressing illnesses.

The company is strategically growing this network through partnerships, aiming to bolster its capacity for both ongoing clinical trials and future commercial demands. By the end of 2024, Galapagos anticipates having established several new decentralized manufacturing hubs across key regions, significantly increasing their production scalability.

Galapagos has strategically shifted its primary focus to oncology cell therapy, a move designed to capitalize on high unmet medical needs, particularly in hematologic malignancies. This pivot represents a significant commitment to innovation and investment in this specialized area.

This dedicated strategy positions the company to potentially achieve market leadership in the rapidly evolving cell therapy landscape. The company's pipeline, heavily weighted towards oncology, underscores this long-term vision for substantial growth.

Future Oncology Cell Therapy Pipeline Expansion

Galapagos is aggressively expanding its oncology cell therapy pipeline, signaling a strong commitment to this high-growth sector. Beyond its current candidate, GLPG5101, the company has ambitious plans to introduce new clinical candidates regularly.

This strategic push includes initiating at least one first-in-human study in 2025. From 2026 onwards, Galapagos aims to advance two new clinical candidates into studies each year, underscoring a significant investment in future growth drivers.

The oncology market is a key area for Galapagos, and this pipeline expansion is designed to secure and enhance its competitive standing. These early-stage programs are fundamental to the company's long-term vision and future success.

- Pipeline Expansion Target: At least one first-in-human study in 2025.

- Annual Candidate Advancement: Two new clinical candidates annually from 2026.

- Market Focus: High-growth oncology sector.

- Strategic Goal: Establish and maintain a leading position in cell therapy.

uza-cel (TCR T-cell therapy in solid tumors)

Uza-cel, developed in collaboration with Adaptimmune, is a promising MAGE-A4 directed TCR T-cell therapy candidate. Its primary focus is on head and neck cancer, but it also holds potential for other solid tumor indications. This strategic targeting of solid tumors places uza-cel in a high-growth segment with significant unmet medical needs within the cell therapy landscape.

The early-stage development of uza-cel is supported by encouraging preclinical data. This data suggests a strong potential for future market penetration and revenue generation, positioning uza-cel as a key growth driver for Galapagos. The market for solid tumor cell therapies is projected to expand significantly, with estimates suggesting it could reach tens of billions of dollars by the early 2030s.

- Therapy Focus: MAGE-A4 directed TCR T-cell therapy for solid tumors.

- Key Indications: Head and neck cancer, with potential for other solid tumor types.

- Market Opportunity: High-growth, high-unmet-need area in cell therapy.

- Development Stage: Early-stage with promising preclinical data.

Galapagos' CAR-T therapy, GLPG5101, is a prime example of a "Star" in their BCG matrix, targeting relapsed/refractory non-Hodgkin lymphoma. This program is a significant focus, with pivotal development planned for 2026 and a potential approval by 2028, reflecting substantial investment in a high-growth oncology area.

The company's proprietary decentralized CAR-T manufacturing platform is a key differentiator, enabling a median vein-to-vein time of seven days, crucial for patients with aggressive diseases. By the end of 2024, Galapagos expects to have several new decentralized manufacturing hubs operational, enhancing production scalability for both clinical trials and future commercialization.

Galapagos is strategically expanding its oncology cell therapy pipeline, with plans to initiate at least one first-in-human study in 2025 and advance two new clinical candidates annually from 2026. This aggressive expansion aims to solidify their leadership in the rapidly evolving cell therapy market.

Uza-cel, a MAGE-A4 directed TCR T-cell therapy for solid tumors like head and neck cancer, also represents a "Star" due to its potential in a high-unmet-need, high-growth segment. Encouraging preclinical data supports its future market penetration, with the solid tumor cell therapy market projected to reach tens of billions of dollars by the early 2030s.

| Galapagos Pipeline Asset | Therapy Type | Target Indication | Development Stage | BCG Matrix Category |

| GLPG5101 | CD19 CAR-T | Relapsed/Refractory Non-Hodgkin Lymphoma | Pivotal Development (2026) | Star |

| Uza-cel | MAGE-A4 TCR T-cell | Head and Neck Cancer, Solid Tumors | Early-Stage Preclinical | Star |

What is included in the product

The Galapagos BCG Matrix analyzes a company's product portfolio based on market growth and share, guiding strategic decisions.

It categorizes products into Stars, Cash Cows, Question Marks, and Dogs to inform investment, divestment, or holding strategies.

Instantly identify underperforming "Dogs" and reallocate resources from "Cash Cows" to promising "Stars" with a clear, visual BCG Matrix.

Cash Cows

Gilead's exclusive access rights to Galapagos' drug discovery platform represent a strong cash cow. This agreement generated a substantial €230.2 million in revenue for Galapagos in 2024, showcasing its value.

The predictability of this revenue stream is further solidified by the €57.6 million earned in the first quarter of 2025. This consistent income requires very little additional investment from Galapagos, making it a highly efficient generator of cash for the company.

Following the February 2024 transfer of its Jyseleca business to Alfasigma, Galapagos now benefits from royalty income from Gilead. This shift means Galapagos no longer shoulders direct sales and development costs for the drug. The royalties represent a stable, albeit low-growth, cash flow stream for the company.

This royalty arrangement allows Galapagos to continue profiting from a mature product, Jyseleca, without incurring substantial ongoing operational expenditures. The financial benefit is a predictable income source, contributing to Galapagos's overall financial stability.

Galapagos boasts a robust financial position, holding €3.3 billion in cash and financial investments as of March 31, 2025. This substantial liquidity serves as a significant cash cow, enabling the company to comfortably cover its operational expenses and pursue strategic growth opportunities without immediate need for external funding.

Existing Strategic Alliances for Operational Efficiency

Galapagos leverages strategic alliances to enhance operational efficiency, particularly in its cell therapy manufacturing. Collaborations with Catalent and NecstGen are key to streamlining the production of their core cell therapy programs.

These partnerships allow Galapagos to tap into specialized expertise, optimizing resource allocation and reducing costs in mature operational areas. For instance, their work with Lonza on the Cocoon® platform aims to improve scalability and efficiency in cell therapy production.

- Catalent and NecstGen: Focus on cell therapy manufacturing, enhancing production capabilities.

- Lonza's Cocoon® platform: Supports efficient and scalable cell therapy production.

- Operational Efficiency: Alliances contribute to cost management and streamlined development.

- Cash Utilization: Optimizes spending in established operational segments.

Streamlined Operations Post-Restructuring

Galapagos' strategic restructuring, notably the divestment of Jyseleca's European operations, is designed to significantly curb its normalized annual cash burn. This move allows the company to concentrate resources and manage expenses more effectively.

By streamlining operations, Galapagos is enhancing its ability to generate positive net cash flow from its core business and existing revenue streams. This focus on efficiency is crucial for improving its financial standing.

- Divestment of Jyseleca's European business

- Refocus on cell therapy development

- Reduction in normalized annual cash burn

- Increased net cash generation from core activities

Galapagos's exclusive access rights to its drug discovery platform, generating €230.2 million in 2024 and €57.6 million in Q1 2025 from Gilead, represent a prime cash cow. The royalty income from the Jyseleca business, following its transfer to Alfasigma, further solidifies this status by providing predictable, low-growth cash flow with minimal ongoing investment. This allows Galapagos to leverage mature assets efficiently.

| Revenue Source | 2024 Revenue | Q1 2025 Revenue | Cash Cow Status |

|---|---|---|---|

| Gilead Access Rights | €230.2 million | €57.6 million | High (predictable, low investment) |

| Jyseleca Royalties | Not specified (ongoing) | Not specified (ongoing) | Moderate (stable, low growth) |

Delivered as Shown

Galapagos BCG Matrix

The Galapagos BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, is ready for immediate download and integration into your business planning. You can confidently expect the exact same professionally formatted and data-rich report to be yours, enabling you to effectively categorize and strategize for your business units.

Dogs

Jyseleca, formerly a significant asset for Galapagos, has transitioned out of its direct operations. In early 2024, Galapagos completed the divestment of its Jyseleca business in Europe and the UK to Alfasigma. This strategic shift means Jyseleca is no longer a primary focus for Galapagos' sales or development efforts, marking it as a divested asset rather than a current growth engine.

The financial implications of this divestment are that Galapagos now primarily receives royalty income from Jyseleca, rather than direct sales revenue. This positions Jyseleca as a past investment that has been largely offloaded, contributing to cash flow but not active operational growth within Galapagos' current portfolio.

GLPG3970, the primary candidate from Galapagos' Toledo program targeting SIK inhibitors, unfortunately did not meet expectations in its Phase 2a clinical trials for rheumatoid arthritis and ulcerative colitis. The trial results indicated a lack of substantial efficacy, which, combined with observed dose-limiting toxicities, led to a strategic pivot by Galapagos.

Consequently, Galapagos has redirected its research efforts towards earlier-stage SIK inhibitor candidates. This strategic shift effectively places GLPG3970 into a discontinued development category within the company's internal pipeline.

Galapagos has made a significant strategic pivot, announcing the discontinuation of its internal small molecule research programs in immunology and oncology. This move signals a complete withdrawal from direct internal development in these therapeutic areas.

The company is actively pursuing partnerships to find new homes for these discontinued assets. This strategy aims to unlock potential value from these programs without continued internal investment.

Consequently, these former research endeavors are no longer viewed as key growth drivers for Galapagos. The focus has shifted to other strategic priorities, reflecting a re-evaluation of the company's R&D pipeline and resource allocation.

GLPG5201 (Second CD19 CAR-T Candidate)

GLPG5201, Galapagos' second CD19 CAR-T candidate, has been shifted to a lower priority. This strategic move allows Galapagos to concentrate its efforts and capital on advancing GLPG5101, its primary CAR-T program.

While GLPG5201 remains in the pipeline, its reduced strategic focus and investment mean it's unlikely to capture substantial market share or experience significant growth in the near term. This deprioritization places it in a Dogs category within a BCG matrix analysis, indicating low market share potential and low market growth.

- GLPG5201: Second CD19 CAR-T candidate.

- Strategic Shift: Deprioritized to accelerate GLPG5101.

- Market Potential: Unlikely to achieve significant market share or growth under current plans.

- BCG Classification: Positioned as a Dog due to low growth and low market share prospects.

Earlier-stage Fibrosis Programs (e.g., GLPG1205)

Galapagos' earlier-stage fibrosis programs, such as GLPG1205, are categorized as Dogs in the BCG Matrix. These initiatives represent past investments that did not translate into successful clinical outcomes or strategic alignment. For instance, Galapagos previously announced the discontinuation of GLPG1205 development, a molecule targeting fibrosis. This decision was often a result of disappointing clinical trial data or a strategic pivot in the company's research focus.

The discontinuation of programs like GLPG1205 signifies resources that were allocated but did not generate the expected returns or progress towards market approval. These are classic 'Dog' characteristics, consuming capital and management attention without contributing to future growth or revenue. Such programs, while representing valuable learning experiences, are typically divested or terminated to reallocate resources to more promising ventures.

- GLPG1205 Discontinuation: Galapagos halted development for GLPG1205, a fibrosis candidate, due to strategic re-evaluation.

- Resource Consumption: These earlier-stage programs consumed R&D investment without yielding marketable products, fitting the 'Dog' profile.

- Learning and Reallocation: While unsuccessful, these programs provided valuable insights, allowing for resource reallocation to more promising pipeline assets.

Galapagos' deprioritized assets, like GLPG5201, and discontinued early-stage programs, such as GLPG1205, are classified as Dogs in the BCG Matrix. These represent past investments that are unlikely to generate significant future returns due to low market share potential and limited growth prospects.

The company's strategic decision to discontinue internal small molecule research in immunology and oncology further solidifies the presence of "Dogs" as these programs are now being sought for partnerships rather than internal development, indicating a lack of expected growth.

These assets, while having consumed resources, are now managed to minimize further investment and potentially generate some residual value, freeing up capital for more promising pipeline candidates.

The divestment of Jyseleca, while a strategic move, also means it no longer contributes to active growth, fitting the profile of an asset that has passed its peak growth phase and is now managed for cash flow, similar to how "Dogs" are handled.

Question Marks

GLPG5301, a CAR-T therapy targeting relapsed/refractory multiple myeloma, represents a potential growth opportunity within Galapagos' pipeline. This indication addresses a significant unmet medical need, a critical factor for a potential Star in the BCG matrix. The global multiple myeloma market was valued at approximately $25 billion in 2023 and is projected to grow, offering substantial revenue potential if GLPG5301 achieves market success.

Galapagos is strategically positioning itself to enter the high-growth CAR-T market, with plans to advance novel candidates from preclinical stages into clinical development by 2025. This ambitious timeline reflects a significant investment in discovery research for these potentially groundbreaking therapies.

These unnamed CAR-T candidates are categorized as question marks within the BCG matrix due to their early stage of development. While they represent areas of substantial future growth potential, they also demand considerable research and development expenditure without guaranteed market success or immediate returns, highlighting the inherent risks in cutting-edge biotechnology.

GLPG3667, a TYK2 inhibitor in Phase 2 development for systemic lupus erythematosus and dermatomyositis, represents a potential asset in areas with significant unmet medical needs. Galapagos is actively seeking partnerships for its continued advancement and commercialization, reflecting a strategic pivot away from small molecule development.

The success of these partnership endeavors will directly influence GLPG3667's future valuation for Galapagos. As of early 2024, the autoimmune disease market, which includes lupus and dermatomyositis, is substantial and growing, with estimates suggesting global market sizes in the tens of billions of dollars.

Expansion of Decentralized CAR-T Network into New Applications

The expansion of a decentralized CAR-T network into new therapeutic areas or broader global markets is a classic example of a question mark in the BCG Matrix. While the underlying decentralized manufacturing platform itself might be a star, this strategic move into uncharted territory carries high growth potential but also significant risks and requires substantial investment. The success hinges on proving market viability and achieving adoption rates in these novel applications, which often involve lengthy clinical trials and regulatory hurdles.

For instance, if a company like Galapagos, known for its R&D in immunology, were to leverage its decentralized CAR-T platform for autoimmune diseases, it would represent a question mark. The market for CAR-T in autoimmune conditions is still nascent, with early-stage trials showing promise but not yet widespread commercial success.

- High Investment: Entering new therapeutic areas demands significant upfront capital for research, development, clinical trials, and regulatory approvals.

- Uncertain Adoption: The market acceptance and uptake of CAR-T therapies in non-hematological indications or new geographies are not guaranteed, leading to uncertain revenue streams.

- Competitive Landscape: Emerging competitors and evolving treatment paradigms in these new areas can further complicate market penetration and profitability.

- Potential for High Returns: If successful, expansion into these high-growth, unmet medical needs could yield substantial returns and establish market leadership.

Exploration of Strategic Alternatives for Existing Non-Core Assets

Following a re-evaluation of its SpinCo separation strategy, Galapagos is actively considering various options for its existing business segments, including non-core cell therapy assets and remaining small molecule programs.

These assets present an opportunity to unlock potential value through strategic transactions, but without such action, they could become significant drains on company resources.

Galapagos's portfolio, as of early 2024, includes several early-stage research programs and some assets in clinical development that may not align with its redefined strategic focus.

- Divestment: Selling off non-core assets to third parties, potentially recouping investment and freeing up capital.

- Partnerships/Licensing: Collaborating with other companies to advance development or commercialize these assets, sharing risk and reward.

- Internal Restructuring: Reallocating resources or integrating certain programs into core business units if they show renewed strategic promise.

- Wind-down: Ceasing development and operations for assets deemed unlikely to generate future value, thereby eliminating associated costs.

Question Marks in a company's portfolio, like Galapagos' early-stage CAR-T candidates, represent new ventures with high growth potential but uncertain outcomes. These assets require significant investment to develop, and their future success is not guaranteed, making them a crucial consideration for strategic resource allocation.

The decision to invest further in these Question Marks depends on factors like market demand, competitive landscape, and the company's ability to execute its development strategy. A successful transition from Question Mark to Star can significantly boost a company's market position and financial performance.

Galapagos' focus on advancing novel CAR-T therapies by 2025, despite their current Question Mark status, underscores a commitment to innovation in a rapidly evolving biotech sector. The success of these programs will be pivotal in shaping the company's future growth trajectory.

The strategic evaluation of non-core assets, including those that might be Question Marks, is essential for optimizing resource allocation. Options like divestment or partnerships can help mitigate risks and unlock value, as seen with Galapagos considering various avenues for its remaining small molecule programs and non-core cell therapy assets.

BCG Matrix Data Sources

Our Galapagos BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.