Galapagos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galapagos Bundle

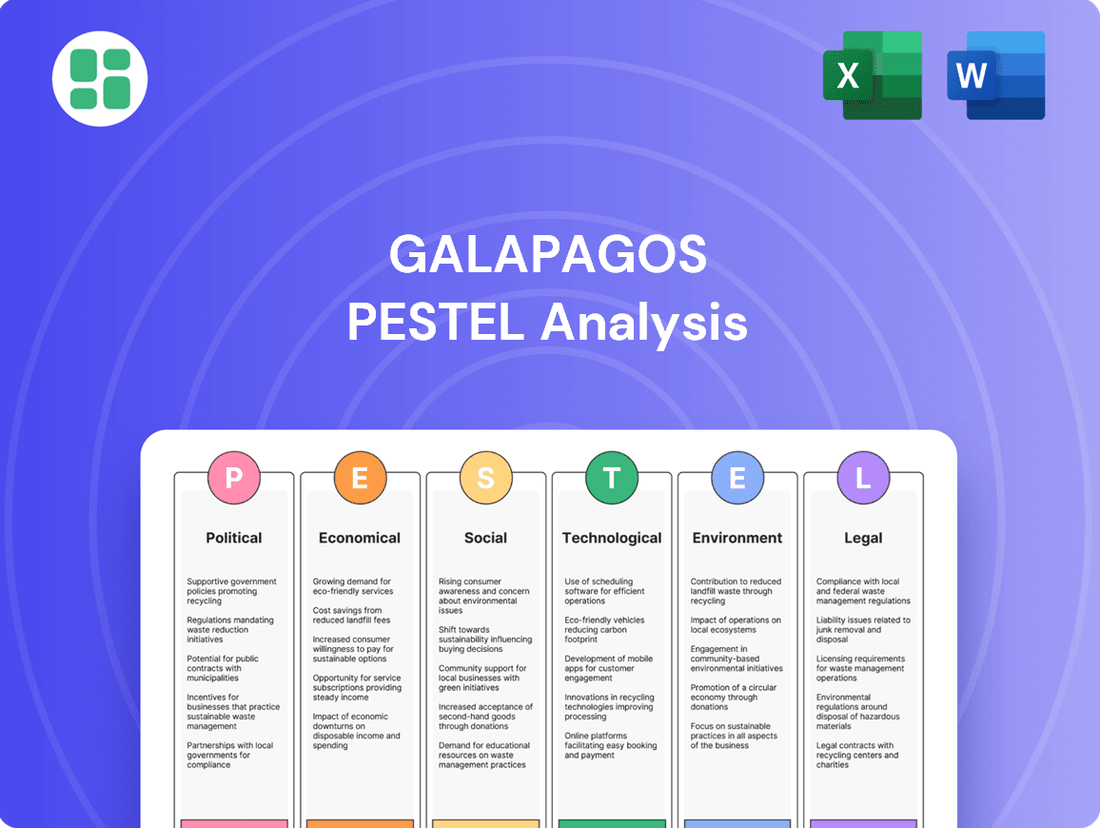

Navigate the complex external forces shaping Galapagos's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your investment or strategy. Gain a decisive advantage by downloading the full, actionable report today.

Political factors

Government healthcare policies profoundly shape the landscape for biopharmaceutical companies like Galapagos NV. Policies dictating drug pricing, reimbursement rates, and overall healthcare expenditure directly influence the revenue potential for new, innovative medicines. For instance, in 2024, many European nations are implementing stricter price negotiation frameworks for pharmaceuticals, potentially impacting the profitability of Galapagos' therapies.

Shifts in national healthcare budgets and strategic priorities present a dynamic environment. An increased government focus on specific therapeutic areas, such as rare diseases or inflammatory conditions where Galapagos has a strong pipeline, could unlock significant opportunities. Conversely, widespread cost containment measures, a trend observed in many OECD countries in 2024, might create hurdles for market access and adoption of novel treatments.

Regulatory frameworks for drug approval and market access are critical determinants of a biopharma company's success. Variations in these processes across different regions, including timelines for clinical trial approvals and marketing authorizations, directly affect the time-to-market and overall commercial viability of Galapagos' drug candidates. For example, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have distinct review pathways that can significantly alter launch strategies.

Galapagos NV operates within a political landscape heavily influenced by drug pricing and reimbursement pressures. The U.S. Inflation Reduction Act, enacted in 2022, is a prime example, empowering Medicare to negotiate prices for certain high-cost drugs, a move that could affect future revenue streams for innovative therapies. This legislative trend extends to Europe, where national health systems' reimbursement policies critically determine market access and patient affordability for novel treatments, directly impacting commercial viability.

Galapagos NV, like any global biotech firm, is sensitive to political stability. Geopolitical events, such as the ongoing conflict in Eastern Europe, can disrupt supply chains for critical raw materials and impact international research collaborations. For instance, the company's reliance on specialized chemical suppliers in various regions means that political instability there could lead to delays or increased costs in 2024 and 2025.

Furthermore, shifts in government policies regarding healthcare, drug pricing, and intellectual property protection in key markets like the United States and European Union can significantly influence Galapagos' strategic decisions and profitability. Changes in regulatory environments, potentially driven by political agendas, could affect the pace of clinical trial approvals or market access for its innovative therapies.

Regulatory Environment for Biopharmaceuticals

The regulatory environment for biopharmaceuticals significantly impacts Galapagos NV. Changes in drug approval pathways, clinical trial requirements, and post-market surveillance directly influence operational efficiency and speed to market. For instance, the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) continuously update their guidelines, affecting the time and cost of bringing new therapies to patients.

Stricter regulations or prolonged approval processes can escalate research and development expenses and postpone product launches, a critical consideration for a company like Galapagos. Conversely, more streamlined processes for innovative or breakthrough therapies, such as those for rare diseases or unmet medical needs, could expedite market entry. In 2024, the FDA continued to emphasize real-world evidence in its decision-making, a trend that may influence future Galapagos submissions.

Galapagos's reliance on these regulatory bodies means that shifts in their policies, such as increased scrutiny on manufacturing quality or data integrity, necessitate adaptive strategies. The company's ability to navigate these evolving requirements will be key to its success.

- Evolving EMA and FDA Guidelines: Continuous updates to drug approval pathways and clinical trial requirements directly impact Galapagos's R&D timelines and costs.

- Impact of Stricter Regulations: Lengthy approval processes can increase R&D expenditure and delay product launches, affecting revenue generation.

- Benefit of Streamlined Processes: Accelerated market entry for breakthrough therapies can provide a competitive advantage.

- Real-World Evidence Emphasis: The growing importance of real-world data in regulatory decisions, as seen in FDA practices in 2024, requires strategic data collection and analysis from Galapagos.

Intellectual Property Protection

Government policies surrounding intellectual property (IP) are paramount for biotech firms like Galapagos NV. These policies, encompassing patent laws and data exclusivity provisions, directly influence the company's ability to safeguard its groundbreaking research and development. Strong IP protection is a key driver for continued investment in R&D, offering a period of market exclusivity that underpins profitability.

Conversely, any weakening of these protections could significantly impact Galapagos NV. It might lead to earlier entry of generic competitors, potentially eroding market share and profitability. For instance, in 2023, the European Union continued to refine its IP framework, with ongoing discussions around patentability of AI-generated inventions and the balance between innovation incentives and access to medicines, which could have future implications for companies like Galapagos.

- Patent Laws: Galapagos's portfolio relies on patents for its novel drug candidates, with typical patent lifespans of 20 years from filing.

- Data Exclusivity: This provides a period where regulatory authorities will not approve generic versions of a drug, even if patents have expired, offering an additional layer of market protection.

- R&D Investment: In 2023, the global biotechnology sector saw significant R&D spending, with companies like Galapagos allocating substantial resources to discovery and clinical trials, incentivized by IP rights.

- Competitive Landscape: Weak IP enforcement in certain regions could expose Galapagos's pipeline to faster generic competition, impacting its revenue streams.

Government healthcare policies significantly influence Galapagos NV's revenue potential through drug pricing and reimbursement frameworks, with many European nations implementing stricter price negotiations in 2024. National healthcare budgets and strategic priorities also play a crucial role; increased government focus on areas like rare diseases could benefit Galapagos, while cost containment measures in OECD countries might create market access hurdles.

Regulatory frameworks for drug approval and market access are critical, with varying timelines for clinical trial approvals and marketing authorizations across regions like the EU and US impacting time-to-market. The U.S. Inflation Reduction Act, empowering Medicare to negotiate drug prices, exemplifies legislative trends that could affect future revenue streams for innovative therapies.

Political stability is vital, as geopolitical events can disrupt supply chains for critical raw materials and impact international research collaborations, potentially leading to delays or increased costs for companies like Galapagos. Shifts in government policies on healthcare, drug pricing, and intellectual property protection in key markets directly influence strategic decisions and profitability.

What is included in the product

This Galapagos PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the archipelago across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making for businesses operating within this unique ecosystem.

The Galapagos PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning.

By visually segmenting external risks and opportunities by PESTEL category, the Galapagos PESTLE Analysis alleviates the pain of understanding complex market dynamics at a glance.

Economic factors

The global biopharmaceutical market is projected for robust expansion, with forecasts suggesting it will reach approximately $650 billion by 2025, up from an estimated $500 billion in 2023. This upward trend, fueled by advancements in biologics and personalized medicine, directly benefits Galapagos NV by creating significant opportunities for revenue growth and market penetration in its key therapeutic areas.

Galapagos NV's strategic focus on oncology and immunology aligns perfectly with the biopharmaceutical market's growth drivers. Demand for innovative treatments in these fields is escalating, with the oncology drug market alone expected to exceed $250 billion by 2027. This presents a fertile ground for Galapagos to introduce and scale its pipeline therapies, capitalizing on unmet medical needs.

The favorable market environment supports Galapagos NV's strategy for new product launches and expanding its reach. As the biopharmaceutical sector continues its upward trajectory, the company is well-positioned to leverage this momentum, potentially seeing increased investment and partnerships that further accelerate its development and commercialization efforts.

The pharmaceutical R&D investment landscape is dynamic, with both public and private entities contributing significantly. In 2023, global pharmaceutical R&D spending was estimated to be around $240 billion, a figure projected to continue its upward trajectory. However, the biotech sector's funding can experience volatility, often favoring more established scientific approaches and late-stage development projects.

Galapagos NV’s financial health and growth prospects are intrinsically linked to its capacity to secure robust funding for its innovative pipeline. This is particularly true for its emerging cell therapy programs, which often require substantial capital investment for clinical trials and development. The company's ability to attract investment in this specialized area will be a critical determinant of its future success.

Broader economic conditions significantly impact the healthcare sector. For instance, in 2024, persistent inflation and rising interest rates in many developed economies put pressure on disposable incomes, potentially affecting out-of-pocket healthcare expenses for consumers. Global healthcare spending, while generally resilient, can see shifts during economic slowdowns.

Economic downturns and national budget constraints can directly influence drug pricing and reimbursement negotiations. In 2024, several European countries continued to grapple with healthcare budget limitations, leading to more stringent value-based assessments for new therapies. This trend could mean increased pressure on pharmaceutical companies like Galapagos NV to demonstrate clear cost-effectiveness to gain market access and secure favorable reimbursement rates.

Consumer concerns about healthcare costs are a growing factor. As of early 2025 projections, out-of-pocket spending on prescription drugs remains a significant worry for many households, particularly in markets with less comprehensive public healthcare coverage. This sentiment can translate into political pressure for price controls, impacting the revenue potential for innovative medicines.

Competition from Generics and Biosimilars

The increasing availability of biosimilars and generic drugs presents a significant economic hurdle. These alternatives can erode the market share of original, branded biologics, putting pressure on pricing power. For instance, by 2024, the global biosimilar market was projected to reach over $60 billion, highlighting the scale of this competitive shift.

Galapagos NV, like other pharmaceutical innovators, faces the imperative to continuously develop novel therapies. As patents on existing drugs expire, the company must demonstrate clear clinical advantages and superior value propositions to retain its market standing. This dynamic underscores the critical need for a strong, ongoing research and development pipeline to counter the economic impact of generic and biosimilar competition.

- Patent Expirations: Key patents for many biologics are expiring in the coming years, opening doors for biosimilar manufacturers.

- Price Erosion: Biosimilars typically enter the market at a lower price point, forcing originator companies to consider price adjustments.

- Market Share Dilution: The introduction of biosimilars directly competes for patient prescriptions, potentially reducing sales volume for established treatments.

- Innovation Imperative: Companies like Galapagos must invest heavily in R&D to bring forward new, differentiated therapies that offer distinct advantages over existing options.

Currency Exchange Rate Fluctuations

Galapagos NV, with its operations spanning Europe and the United States, faces significant risks from currency exchange rate fluctuations. Changes in the value of the Euro against the US Dollar, for instance, can directly affect the reported earnings and the cost of doing business across these regions. For example, if the Euro strengthens considerably against the Dollar, Galapagos' US-based revenues would translate into fewer Euros, potentially impacting its consolidated financial statements.

These currency movements are a critical factor for Galapagos to manage. For instance, in 2024, the Euro experienced volatility against the US Dollar, trading within a range that could have a material impact on companies with substantial cross-border transactions. This necessitates robust financial strategies to mitigate potential negative impacts on profitability and cash flow.

- Revenue Impact: A stronger Euro can decrease the value of US Dollar-denominated revenues when converted for reporting purposes.

- Cost Management: Conversely, a weaker Euro can increase the cost of importing goods or services from the US.

- Financial Performance: Significant exchange rate shifts can distort reported earnings and affect investor perceptions of financial health.

- Hedging Strategies: Companies like Galapagos often employ financial instruments such as forward contracts or options to hedge against adverse currency movements, aiming to stabilize financial outcomes.

Economic factors significantly shape Galapagos NV's operating environment. Global healthcare spending, projected to reach over $11 trillion by 2025, offers a strong market base, yet economic slowdowns can strain healthcare budgets, impacting drug pricing and reimbursement negotiations. For instance, in 2024, many European nations faced budget constraints, leading to stricter value-based assessments for new therapies, potentially pressuring Galapagos to demonstrate cost-effectiveness.

Inflation and interest rate hikes in 2024-2025 can reduce consumer disposable income, affecting out-of-pocket healthcare expenses and increasing pressure for drug price controls. Furthermore, the growing biosimilar market, estimated to exceed $60 billion by 2024, poses a competitive threat, necessitating continuous innovation and clear value propositions from Galapagos to maintain market share against lower-priced alternatives.

Currency exchange rate volatility, particularly between the Euro and US Dollar, presents a material risk for Galapagos, impacting reported earnings and operational costs. As of early 2025, this volatility continues to require robust financial strategies for mitigation, as seen in the Euro's fluctuating trading range throughout 2024.

| Economic Factor | 2024/2025 Projection/Data | Impact on Galapagos NV |

|---|---|---|

| Global Healthcare Spending | Projected > $11 trillion by 2025 | Provides a large market but can be affected by budget constraints. |

| Inflation & Interest Rates | Persistent in developed economies (2024-2025) | May reduce disposable income, increase pressure for price controls. |

| Biosimilar Market Growth | Projected > $60 billion by 2024 | Increases competition and necessitates strong value demonstration. |

| EUR/USD Exchange Rate Volatility | Continued volatility observed (2024-2025) | Affects reported earnings and operational costs across regions. |

Full Version Awaits

Galapagos PESTLE Analysis

The preview you see here is the exact Galapagos PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Galapagos Islands, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same document you’ll download after payment, providing you with a complete and actionable PESTLE framework.

Sociological factors

The world's population is getting older, and with that comes a rise in chronic conditions. This trend directly impacts companies like Galapagos NV, as an increasing number of people will need treatments for age-related illnesses. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, a significant increase from 703 million in 2019, according to UN data.

Galapagos focuses on inflammatory and fibrotic diseases, which are often chronic and more prevalent in older individuals. This growing demographic means a larger potential patient base actively seeking solutions. The demand for innovative therapies to manage these conditions is expected to climb, presenting a substantial market opportunity for Galapagos's research and development pipeline.

Patient advocacy groups are increasingly influential, with organizations like the European Patients' Forum reporting a significant rise in patient engagement in healthcare policy discussions. This heightened awareness, amplified by social media platforms, empowers individuals to actively seek out and advocate for advanced treatment options, directly impacting the demand for innovative therapies.

Galapagos NV's patient-centric model aligns well with this trend, as informed patients are more likely to pursue and demand cutting-edge treatments for conditions like cystic fibrosis and inflammatory diseases. This growing patient voice can significantly influence reimbursement decisions and shape healthcare policy, creating a more favorable environment for companies offering novel therapeutic solutions.

Galapagos NV's focus on severe diseases aligns with a growing consumer interest in proactive health management. As individuals increasingly prioritize wellness and preventive care, there's a heightened demand for innovative treatments that address unmet medical needs. This societal shift can indirectly bolster the acceptance and adoption of Galapagos' precision medicine strategies, particularly as they target conditions with significant health impacts.

Public Perception and Trust in Biotechnology

Public perception and trust are paramount for companies like Galapagos NV operating in the biotechnology sector. Societal acceptance of advanced treatments, such as gene therapies and innovative drug discovery, directly impacts market success. For instance, a 2024 survey indicated that while public interest in medical advancements is high, concerns about the long-term safety and ethical implications of genetic modification persist, potentially affecting patient recruitment for clinical trials.

Galapagos's commitment to transparency and ethical conduct is therefore essential for fostering trust. Negative public sentiment can lead to increased regulatory hurdles and slower adoption rates for novel therapies. In 2025, regulatory bodies are expected to place even greater emphasis on public engagement and ethical oversight in approving new biotechnological interventions, making open communication a key strategy for Galapagos.

- Public Trust Metrics: A 2024 study found that only 55% of the general public felt confident in the safety of gene editing technologies, highlighting a critical area for improvement.

- Regulatory Impact: Public apprehension can translate into stricter regulatory reviews, potentially delaying market entry for new Galapagos treatments.

- Clinical Trial Participation: Trust is a significant driver for patient enrollment in clinical trials; low public trust can reduce the available participant pool for Galapagos's research and development efforts.

- Market Receptiveness: Positive public perception is linked to higher market demand and quicker adoption of new biopharmaceutical products.

Healthcare Access and Equity

Societal expectations for fair access to healthcare, including cutting-edge treatments, significantly shape government policies on drug pricing and distribution. This trend pressures companies like Galapagos NV to consider how their innovative medicines reach a broad patient base, potentially requiring adaptable pricing strategies or collaborative ventures.

The drive for equitable access means advanced therapies must be available to varied patient groups. For Galapagos, this could translate into exploring tiered pricing structures or forming partnerships to broaden market reach and affordability.

- Growing Demand for Equity: Public opinion increasingly favors equitable healthcare access, influencing regulatory approaches to drug pricing and availability.

- Impact on Pricing Models: Galapagos may need to adopt flexible pricing, such as value-based or tiered pricing, to meet demands for accessibility.

- Partnership Opportunities: Collaborations with patient advocacy groups or governmental bodies could be crucial for ensuring wider distribution of innovative treatments.

- Global Health Initiatives: Galapagos's strategy might need to align with global health goals, promoting access in both developed and developing markets.

Societal shifts towards proactive health management and increased patient empowerment are reshaping the healthcare landscape. As individuals become more informed and vocal, they actively seek advanced treatment options, directly influencing demand for innovative therapies like those developed by Galapagos NV. This growing patient agency necessitates a patient-centric approach from pharmaceutical companies.

Public trust in biotechnology, particularly concerning novel treatments like gene therapies, remains a critical factor for market success. While interest in medical advancements is high, persistent concerns about long-term safety and ethical implications, as evidenced by a 2024 survey showing only 55% public confidence in gene editing safety, can impact clinical trial participation and regulatory approval processes.

The increasing emphasis on equitable access to healthcare is pressuring companies to adopt flexible pricing models. Galapagos must consider strategies that ensure their innovative medicines reach a broad patient base, potentially through tiered pricing or strategic partnerships, aligning with global health initiatives and public expectations for fairness.

| Sociological Factor | Description | Impact on Galapagos | Data Point/Trend |

| Aging Population | Global population is aging, leading to increased prevalence of chronic diseases. | Expands the potential patient base for Galapagos's focus on inflammatory and fibrotic diseases. | By 2050, the 65+ population is projected to reach 1.6 billion globally (UN Data). |

| Patient Advocacy | Growing influence of patient advocacy groups and increased patient engagement in healthcare policy. | Empowered patients demand advanced treatments, influencing market receptiveness and reimbursement decisions. | European Patients' Forum reports significant rise in patient engagement in policy discussions. |

| Public Perception & Trust | Societal acceptance of advanced treatments and concerns about safety/ethics. | Affects market success, regulatory hurdles, and clinical trial recruitment. | A 2024 survey indicated 55% public confidence in gene editing safety. |

| Demand for Equity | Societal expectations for fair access to healthcare, including cutting-edge treatments. | Requires adaptable pricing strategies and collaborations to ensure wider distribution. | Public opinion increasingly favors equitable healthcare access. |

Technological factors

Artificial intelligence and machine learning are rapidly transforming drug discovery, speeding up processes like identifying disease targets and designing new drug molecules. This means research and development can happen much faster and at a lower cost. For example, AI platforms are now capable of analyzing vast biological datasets to pinpoint novel therapeutic targets, a process that traditionally took years.

Galapagos NV can significantly benefit from these advancements. By integrating AI and machine learning into its existing target discovery platform, the company can more efficiently identify promising candidates for its pipeline. This technological edge is particularly valuable for accelerating the development of treatments for complex conditions like inflammatory and fibrotic diseases, potentially shaving years off the typical drug development cycle.

Breakthroughs in genomics and biomarker research are fueling the rise of precision medicine, allowing for treatments tailored to individual patient genetics. This shift means therapies can be far more effective by targeting specific biological pathways, a significant departure from one-size-fits-all approaches.

Galapagos NV, by concentrating on unmet medical needs, is well-positioned to leverage these advancements. The company can develop more personalized therapies, enhancing treatment efficacy and improving patient outcomes in areas like inflammatory diseases and cystic fibrosis, where genetic predispositions play a crucial role.

The cell and gene therapy sector is experiencing rapid advancements, with decentralized manufacturing platforms emerging as a key innovation. These platforms promise to make complex disease treatments more accessible and efficient. Galapagos NV is strategically investing in this domain, notably through its CAR-T cell therapy platform.

This focus positions Galapagos to leverage these cutting-edge technologies for developing new treatments, particularly in oncology and other serious illnesses. For instance, the global cell and gene therapy market was valued at approximately $12.6 billion in 2023 and is projected to grow significantly, with CAR-T therapies being a major driver.

Digital Health and Data Analytics

The rise of digital health is transforming how pharmaceutical companies operate. Galapagos NV can leverage wearable devices and telehealth platforms to collect real-world evidence, offering valuable insights into treatment effectiveness outside traditional clinical settings. This integration can streamline patient monitoring and potentially accelerate clinical trial timelines.

Advanced data analytics, fueled by digital health tools, allows for deeper understanding of patient populations and drug performance. For instance, in 2024, the global digital health market was valued at over $300 billion and is projected to grow significantly, indicating a strong trend towards data-driven healthcare solutions. Galapagos can harness this data to refine its drug development strategies.

Galapagos can benefit from these technological advancements in several key ways:

- Enhanced Real-World Evidence: Utilizing data from wearables and remote monitoring to gain a more comprehensive understanding of drug efficacy and patient outcomes.

- Optimized Clinical Trials: Employing digital tools to improve patient recruitment, data collection, and overall trial efficiency, potentially reducing costs and time-to-market.

- Improved Patient Engagement: Digital platforms can foster better communication and adherence among patients participating in clinical trials or using approved therapies.

- Data-Driven Insights: Leveraging advanced analytics to identify trends, predict patient responses, and personalize treatment approaches.

Advanced Manufacturing and Automation

Innovations in pharmaceutical manufacturing, such as continuous manufacturing and advanced automation, are significantly boosting efficiency and quality. For instance, companies are increasingly investing in these technologies to streamline production, which can lead to substantial cost reductions. Galapagos NV can leverage these advancements to enhance its production capabilities, ensuring a consistent and high-quality supply of its novel therapies.

The adoption of automation in pharmaceutical production is not just about speed; it's also about precision and reliability. This translates to fewer errors and a more robust quality control system. By integrating these sophisticated manufacturing processes, Galapagos can solidify its position in the market and meet the growing demand for its innovative treatments.

Galapagos' investment in cutting-edge manufacturing technologies is crucial for its long-term success. The company's commitment to innovation extends to its production lines, aiming for operational excellence. This strategic focus on advanced manufacturing supports its pipeline and commercialization efforts.

- Increased Efficiency: Continuous manufacturing can reduce batch cycle times by up to 50% compared to traditional methods.

- Cost Reduction: Automation can lower operational costs by an estimated 15-20% through reduced labor and waste.

- Quality Improvement: Advanced process analytical technology (PAT) integrated with automation leads to a significant reduction in product variability.

- Supply Chain Reliability: Enhanced production capabilities ensure a more dependable supply of critical medicines to patients.

Galapagos NV is capitalizing on advancements in artificial intelligence and machine learning to accelerate drug discovery and development, aiming to reduce costs and time-to-market for novel therapies. The company's strategic focus on precision medicine, driven by genomics and biomarker research, allows for the creation of highly effective, personalized treatments for complex diseases.

Investments in cell and gene therapy, particularly CAR-T platforms, position Galapagos at the forefront of innovative treatment modalities, with the global cell and gene therapy market projected for substantial growth. Furthermore, the integration of digital health tools and advanced data analytics enhances real-world evidence collection and optimizes clinical trial efficiency, supporting data-driven strategy refinement.

Innovations in pharmaceutical manufacturing, including continuous manufacturing and automation, are being adopted by Galapagos to boost production efficiency, improve quality, and ensure a reliable supply chain for its therapeutic offerings.

Legal factors

Galapagos NV's reliance on innovation makes robust intellectual property laws crucial. These laws safeguard substantial research and development expenditures, ensuring market exclusivity for novel therapies, which is vital for recouping investment and driving future growth. For instance, the company's pipeline, including promising candidates in areas like inflammatory diseases, depends heavily on strong patent protection to maintain its competitive edge.

Shifts in patent litigation, such as recent rulings on patentability or enforcement strategies, can directly affect Galapagos' competitive standing and its projected revenue streams. The outcome of these legal battles can determine how long the company can exclusively market its drugs, impacting its ability to generate returns on its significant R&D investments. For example, a successful defense of a key patent could secure years of market exclusivity, while a challenge might shorten that period, influencing financial forecasts.

Galapagos NV navigates a complex web of regulations, with agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) setting rigorous standards. For instance, in 2023, the FDA's approval timelines for new molecular entities averaged around 10 months, a critical factor for Galapagos' pipeline.

Adherence to evolving guidelines for clinical trials, Good Manufacturing Practices (GMP), and ongoing post-market surveillance is paramount to their operations. Failure to meet these exacting standards can lead to significant setbacks.

Any delays in securing regulatory approvals, such as the recent scrutiny on certain gene therapies in 2024, can directly impede product launches and substantially affect financial outcomes. This regulatory environment necessitates substantial investment in compliance and robust data management.

Galapagos NV operates under stringent data privacy and security regulations, including Europe's General Data Protection Regulation (GDPR), which significantly impacts how patient data is managed throughout clinical trials and commercial operations. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

As Galapagos increasingly integrates digital health tools and real-world data into its research and development, maintaining robust data security and ensuring compliance with evolving global privacy laws becomes paramount. This is crucial not only for avoiding legal repercussions but also for fostering and preserving the trust of patients and partners in their data handling practices.

Anti-Trust and Competition Laws

Galapagos NV operates within a complex legal framework governed by anti-trust and competition laws across its key markets, including Europe and the United States. These regulations are designed to ensure fair market practices, preventing any single entity from dominating the biotechnology sector. For Galapagos, this means any potential mergers, acquisitions, or strategic collaborations must undergo rigorous scrutiny to ensure they do not stifle competition or lead to monopolistic practices.

The company's strategic partnerships, crucial for drug development and commercialization, are directly influenced by these laws. For instance, in 2023, the European Commission continued to closely monitor the pharmaceutical industry for anti-competitive behavior, with a particular focus on patent settlements and pricing strategies. Galapagos must ensure its agreements, like its collaboration with Gilead Sciences, adhere to these competition mandates to avoid significant fines and regulatory hurdles.

- Regulatory Scrutiny: Galapagos NV faces ongoing review of its collaborations and potential acquisitions by competition authorities like the European Commission and the U.S. Federal Trade Commission.

- Market Impact: Anti-trust laws directly shape Galapagos's ability to form strategic alliances and expand its market reach by preventing anti-competitive market structures.

- Compliance Costs: Ensuring compliance with evolving anti-trust regulations necessitates dedicated legal resources and careful structuring of all business development activities.

Environmental Regulations and Compliance

Galapagos NV faces increasing legal obligations due to tightening environmental regulations, especially concerning pharmaceutical production, waste disposal, and the environmental impact assessments of new drugs. For instance, the European Green Deal, aiming for climate neutrality by 2050, imposes stricter requirements on industries like pharmaceuticals, impacting everything from manufacturing processes to product lifecycle management. Failure to adhere to these evolving standards can result in significant penalties, including fines and the potential loss of operating permits, underscoring the critical need for proactive compliance strategies.

Compliance with these environmental laws is not merely a matter of avoiding penalties; it's essential for maintaining operational continuity and corporate reputation. In 2024, the European Environment Agency reported a continued trend of increased enforcement actions against companies for non-compliance with environmental directives. Galapagos must therefore invest in robust environmental management systems and stay abreast of legislative changes, such as updated REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, to ensure their operations remain legally sound and sustainable.

- Stricter Emission Standards: Adherence to evolving air and water quality standards for manufacturing facilities.

- Waste Management Directives: Compliance with regulations on hazardous waste handling, treatment, and disposal, particularly for pharmaceutical byproducts.

- Chemical Safety Regulations: Meeting requirements for the registration, evaluation, and authorization of chemicals used in drug development and manufacturing, such as under the updated REACH framework.

- Environmental Impact Assessments: Conducting thorough risk assessments for new medicinal products and manufacturing processes to mitigate ecological harm.

Galapagos NV's strategic growth hinges on navigating evolving labor laws and employment regulations across its operating regions. Adherence to fair labor practices, worker safety standards, and collective bargaining agreements is crucial for maintaining a stable workforce and avoiding costly disputes. For instance, changes in minimum wage laws or regulations concerning employee benefits can directly impact operational costs.

The company must also comply with international labor standards, particularly when engaging in cross-border collaborations or research. Ensuring fair treatment and proper working conditions for all employees, including those involved in clinical trials or manufacturing partnerships, is essential for corporate reputation and legal compliance. Recent trends in 2024 have seen increased focus on remote work policies and employee data privacy, requiring companies like Galapagos to update their employment contracts and internal policies accordingly.

Environmental factors

The pharmaceutical sector, including companies like Galapagos NV, is under increasing scrutiny to embrace sustainable manufacturing. This means adopting cleaner production methods, minimizing resource consumption, and ensuring responsible disposal of pharmaceutical waste. Such practices are crucial for meeting global sustainability targets and complying with evolving environmental regulations.

Climate change poses significant risks to Galapagos NV, with extreme weather events potentially disrupting critical supply chains and manufacturing processes for their biotechnology operations. For instance, a severe drought or flood could impact the availability of specialized materials or disrupt logistics for their drug development pipeline.

Growing global awareness of resource scarcity is compelling Galapagos to prioritize sustainable sourcing for its raw materials and energy. This necessitates investments in renewable energy solutions and the optimization of operational efficiencies to reduce their environmental footprint and ensure long-term viability.

Galapagos NV faces increasing scrutiny regarding the environmental impact of its pharmaceuticals, particularly with new, stricter regulations emerging, especially within the European Union. These regulations mandate comprehensive environmental risk assessments (ERAs) for all medicinal products, requiring companies to thoroughly evaluate potential ecological consequences.

To comply with these evolving legal frameworks, Galapagos must integrate detailed ERAs into its drug development and approval pipelines. This includes identifying and implementing effective mitigation strategies to minimize any adverse environmental effects associated with its products, ensuring adherence to standards that prioritize ecological sustainability.

Ecosystem Impact of Pharmaceutical Production

The pharmaceutical industry, including companies like Galapagos NV, faces environmental challenges stemming from the production and disposal of active pharmaceutical ingredients (APIs). These processes can lead to water pollution, potentially harming aquatic ecosystems and biodiversity. For instance, studies have detected pharmaceutical residues in waterways globally, impacting fish reproduction and behavior.

Galapagos, as a biotechnology firm, must actively manage its environmental footprint. This involves adopting sustainable manufacturing practices and considering the entire lifecycle of its products, from development to disposal. Minimizing waste, treating wastewater effectively, and exploring greener chemical synthesis routes are crucial steps in mitigating ecological impact.

- Water Pollution: Pharmaceutical manufacturing can release APIs into water bodies, affecting aquatic life. A 2024 report indicated that over 75% of tested European rivers contained detectable levels of pharmaceuticals.

- Biodiversity Impact: The presence of certain APIs in the environment has been linked to adverse effects on wildlife, including endocrine disruption in fish.

- Lifecycle Management: Galapagos needs robust strategies for responsible product disposal and waste management to reduce its environmental contribution.

- Sustainable Practices: Adopting green chemistry principles in API synthesis can significantly lower the ecological burden of pharmaceutical production.

Corporate Sustainability Reporting (ESG)

Galapagos NV, like many in the biotech industry, faces growing pressure for robust Environmental, Social, and Governance (ESG) reporting. Investors and stakeholders are increasingly scrutinizing companies' sustainability practices. This trend is amplified by global initiatives and regulatory shifts pushing for greater corporate accountability on environmental impact and social responsibility.

Galapagos's proactive stance, including its commitment to net-zero emissions targets and sustainable supply chain management, is vital for maintaining investor confidence and enhancing its brand image. For instance, as of early 2024, the biotech sector is seeing a surge in ESG-focused investment funds, with assets under management in sustainable funds projected to reach $50 trillion globally by 2025, according to industry reports. This demonstrates a clear financial incentive for Galapagos to highlight its ESG performance.

- Investor Demand: A significant majority of institutional investors now integrate ESG factors into their investment decisions, with over 80% considering ESG performance when selecting companies.

- Regulatory Landscape: Evolving regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), mandate detailed ESG disclosures for companies operating within the European Union, impacting Galapagos' reporting obligations.

- Brand Reputation: Strong ESG credentials can differentiate Galapagos in a competitive market, attracting talent and fostering positive public perception, especially as consumer awareness of corporate environmental impact grows.

- Risk Mitigation: Addressing environmental factors like emissions and supply chain resilience helps mitigate operational and reputational risks, crucial for long-term business stability in the face of climate change.

Galapagos NV must navigate stringent environmental regulations, particularly concerning water pollution from pharmaceutical manufacturing. The presence of active pharmaceutical ingredients (APIs) in waterways, with over 75% of tested European rivers showing detectable levels in 2024, poses a direct threat to aquatic ecosystems.

The company's commitment to net-zero emissions and sustainable supply chains is crucial for attracting the growing wave of ESG-focused investment. By early 2024, assets in sustainable funds were on track to reach $50 trillion globally by 2025, highlighting a significant financial incentive for Galapagos to prioritize environmental stewardship.

Galapagos's operations are susceptible to climate change impacts, such as extreme weather events that could disrupt critical supply chains and manufacturing. Proactive measures in waste management and the adoption of green chemistry principles are essential for mitigating ecological burdens and ensuring operational resilience.

| Environmental Factor | Impact on Galapagos | Mitigation/Opportunity |

|---|---|---|

| Water Pollution from APIs | Risk to aquatic ecosystems, regulatory fines | Implement advanced wastewater treatment, explore greener synthesis |

| Climate Change & Extreme Weather | Supply chain disruption, manufacturing delays | Diversify suppliers, invest in resilient infrastructure |

| Resource Scarcity | Increased raw material costs, operational limitations | Prioritize renewable energy, optimize resource efficiency |

| ESG Scrutiny & Investor Demand | Reputational risk, access to capital | Enhance ESG reporting, demonstrate sustainability commitment |

PESTLE Analysis Data Sources

Our Galapagos PESTLE Analysis draws from official government reports, scientific research from environmental agencies, and economic data from international organizations. We integrate insights from local conservation efforts and global tourism trends to provide a comprehensive view.