Green Cross SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Bundle

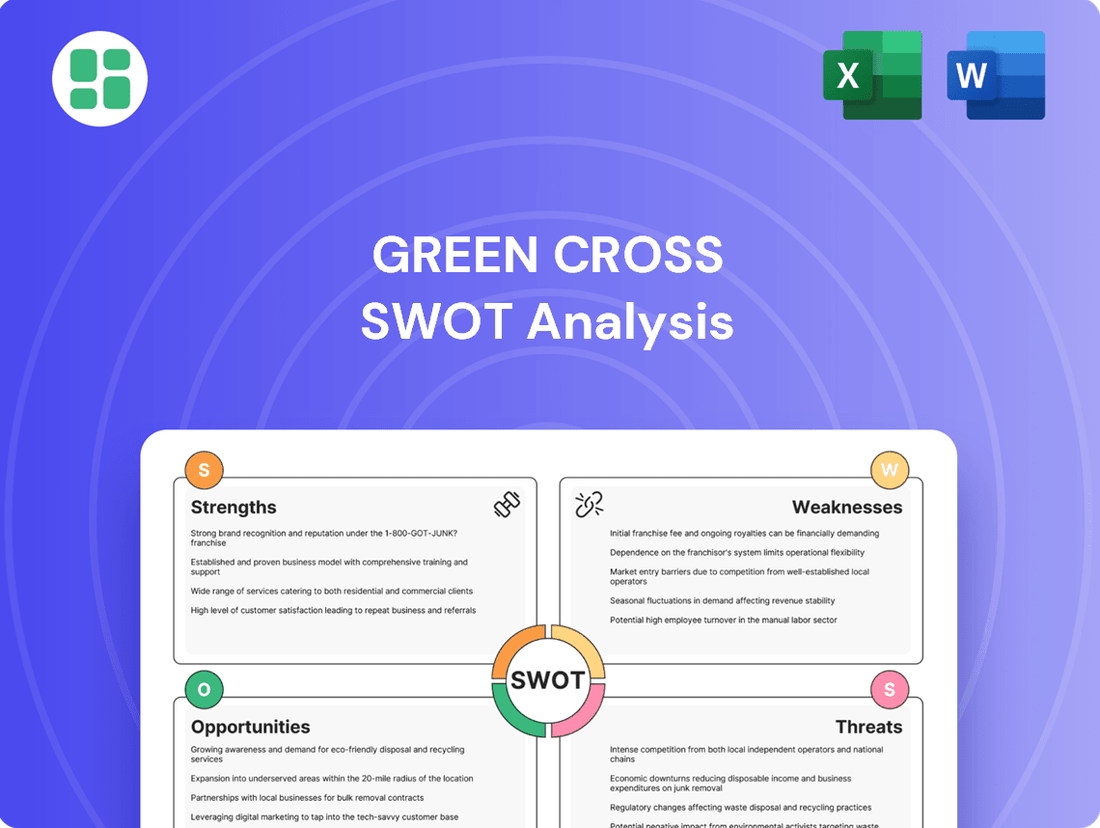

Green Cross possesses significant brand recognition and a strong commitment to sustainability, but faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Green Cross’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Green Cross Pharma (GC Pharma) leverages a profound specialization in niche biopharmaceuticals, particularly in plasma-derived products, recombinant proteins, and preventive vaccines. This focused approach allows them to tackle critical unmet medical needs, fostering a strong market position in these specific therapeutic areas.

With over 50 years of experience in these complex biopharmaceutical fields, GC Pharma has cultivated deep expertise and a significant competitive advantage. For instance, their plasma products segment has consistently been a revenue driver, contributing to their overall financial stability and allowing for targeted R&D investments.

Green Cross's strength lies in its focused product portfolio, particularly its dedication to immune deficiencies, infectious diseases, and rare diseases. These are often areas with significant unmet medical needs, attracting less competition from broader pharmaceutical players.

The company's success with products like Alyglo, which targets primary immunodeficiency diseases, showcases its ability to penetrate and grow within these specialized, high-demand markets. This strategic focus positions Green Cross for sustained development and market leadership in critical therapeutic areas.

GC Pharma is fortifying its position in the biopharmaceutical market through a robust strategy of vertical integration, specifically by acquiring plasma collection centers. This proactive approach guarantees a consistent and reliable source of raw materials, which is absolutely vital for the production of its plasma-derived therapies. This integration not only streamlines operations and trims expenses but also grants GC Pharma enhanced oversight of product quality, a non-negotiable aspect for biologics.

Active Global Expansion and Strategic Partnerships

GC Pharma is making significant strides in global expansion, exemplified by the recent successful shipment of its plasma derivative Alyglo to the United States. This move not only marks entry into a key market but also validates its product quality on an international stage.

Furthermore, strategic partnerships are a cornerstone of their international growth. Collaborations in Southeast Asia for cell therapies are particularly noteworthy, aiming to tap into burgeoning biotech hubs and leverage local expertise. These alliances are crucial for navigating diverse regulatory landscapes and building a robust global presence.

These international efforts are designed to diversify revenue streams and reduce reliance on domestic markets. By expanding its geographic footprint and forging key partnerships, GC Pharma is positioning itself for enhanced global competitiveness and long-term sustainable growth.

- Alyglo shipment to the U.S.: Demonstrates successful market entry into a major international territory.

- Southeast Asia cell therapy partnerships: Expands reach into high-growth regions and leverages local market insights.

- Broadened geographic footprint: Reduces market concentration risk and opens new revenue channels.

- Enhanced global competitiveness: Strategic alliances and international presence strengthen its position against global competitors.

Commitment to Innovation and R&D for Rare Diseases

Green Cross's unwavering commitment to innovation and R&D is a significant strength, especially in the challenging field of rare diseases. The company actively invests in developing novel therapies, as demonstrated by their ongoing clinical trials for Sanfilippo syndrome, a rare genetic disorder. This focus on unmet medical needs allows them to pioneer new treatments and secure a strong position in the biopharmaceutical market.

Their dedication to research is further highlighted by consistent participation and presentations at major scientific symposiums. This not only showcases their scientific advancements but also reinforces their image as a leader in cutting-edge biopharmaceutical development. Such efforts are crucial for introducing high-value therapies and maintaining a competitive advantage.

- Consistent R&D Investment: Green Cross allocates substantial resources to research, particularly for rare and complex diseases.

- Sanfilippo Syndrome Trials: Ongoing clinical trials for Sanfilippo syndrome exemplify their commitment to addressing significant unmet medical needs.

- Industry Leadership: Presentations at major symposiums solidify their reputation as innovators in biopharmaceutical research.

- High-Value Therapies: This R&D focus positions them to develop and market novel, high-value treatments for underserved patient populations.

Green Cross Pharma's strengths are deeply rooted in its specialized focus on niche biopharmaceuticals, particularly plasma-derived products and vaccines. Their extensive 50-year experience in these complex fields provides a significant competitive edge, as seen with their consistently strong performance in the plasma products segment, which fuels further R&D. This strategic concentration on immune deficiencies, infectious diseases, and rare diseases, exemplified by products like Alyglo for primary immunodeficiency, allows them to address critical unmet medical needs and carve out leadership positions in high-demand markets.

The company's vertical integration, including the acquisition of plasma collection centers, ensures a stable supply of raw materials, crucial for their biologics. This integration streamlines operations, reduces costs, and enhances quality control. Furthermore, Green Cross is actively expanding its global footprint, with the successful shipment of Alyglo to the United States marking a significant milestone. Strategic partnerships, such as those in Southeast Asia for cell therapies, are vital for their international growth, diversifying revenue streams and reducing reliance on domestic markets, ultimately bolstering their global competitiveness.

Green Cross's commitment to innovation is a core strength, evidenced by substantial R&D investments, especially in rare diseases like Sanfilippo syndrome. Their ongoing clinical trials and consistent presence at major scientific symposiums highlight their dedication to pioneering new treatments and solidifying their reputation as industry innovators. This focus on high-value therapies for underserved populations positions them for sustained development and market leadership.

| Strength | Description | Impact |

|---|---|---|

| Niche Biopharmaceutical Specialization | Focus on plasma-derived products, recombinant proteins, and vaccines. | Addresses unmet medical needs, establishes strong market positions. |

| Extensive Experience | Over 50 years in complex biopharmaceutical fields. | Cultivates deep expertise and a significant competitive advantage. |

| Vertical Integration | Acquisition of plasma collection centers. | Ensures raw material supply, streamlines operations, enhances quality control. |

| Global Expansion & Partnerships | U.S. market entry with Alyglo, Southeast Asia cell therapy collaborations. | Diversifies revenue, reduces market concentration, enhances global competitiveness. |

| Commitment to R&D | Investment in rare diseases (e.g., Sanfilippo syndrome trials). | Pioneers new treatments, builds reputation as an innovator, develops high-value therapies. |

What is included in the product

Provides a comprehensive assessment of Green Cross's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable SWOT framework to identify and address strategic challenges effectively.

Weaknesses

Developing cutting-edge biopharmaceutical products, particularly those targeting rare diseases or utilizing advanced therapeutic approaches, necessitates significant upfront investment in research and development. These costs are a major hurdle for companies like Green Cross.

The lengthy and often unpredictable nature of clinical trials, a process critical for drug approval, can place considerable strain on financial reserves. For instance, the development of a new therapy can span many years and require hundreds of millions of dollars before it can even be considered for market launch.

Green Cross's significant reliance on human plasma as a primary raw material presents inherent supply chain vulnerabilities. Despite efforts toward vertical integration, the availability of plasma donors, efficiency of collection networks, and intricate processing requirements can directly influence production consistency and operational costs. For instance, in 2024, fluctuations in donor participation rates in key collection regions could potentially lead to tighter supply, impacting Green Cross's ability to meet demand for its plasma-derived therapies.

Green Cross faces significant headwinds due to intense regulatory scrutiny. Biopharmaceutical products, especially vaccines and plasma derivatives, require rigorous approvals from bodies like the FDA and EMA, with standards constantly evolving. In 2023, the average time for a new drug approval by the FDA was around 10.7 months, highlighting the lengthy process.

Navigating and maintaining compliance across numerous international markets presents a substantial operational challenge and incurs considerable costs. This complexity can lead to significant delays in market entry, directly impacting revenue streams and competitive positioning.

Competition in Specialized Therapeutic Areas

GC Pharma, despite its specialized focus, encounters significant competition. Other biopharmaceutical firms, including major corporations, are also channeling resources into plasma-derived therapies, vaccines, and treatments for rare diseases. This competitive landscape means GC Pharma must continually innovate to maintain its edge.

The market is further intensified by the emergence of biosimilars and novel therapeutic agents. These developments can lead to increased pricing pressure and a potential erosion of GC Pharma's existing market share. For instance, the global biosimilars market was projected to reach over $68 billion by 2025, indicating a robust competitive environment.

- Intense Rivalry: Larger biopharma companies are also active in GC Pharma's niche markets.

- Pricing Pressure: New biosimilars and innovative therapies can drive down prices.

- Market Share Challenges: Competitors' advancements threaten GC Pharma's established position.

Financial Performance Volatility

Green Cross has experienced significant fluctuations in its financial performance. For instance, in the first quarter of 2024, the company reported a net loss of $10.5 million, a stark contrast to the profit seen in the same period of the previous year. This volatility can make it challenging for investors to predict future earnings and can deter potential investment.

The company's operating profit has also shown instability across different segments. Reports from late 2023 indicated a decline in operating profit for its agricultural solutions division, attributed partly to rising input costs driven by inflation. Such inconsistencies can create uncertainty regarding the company's long-term financial health.

- Financial Volatility: Net losses reported in early 2024 highlight performance instability.

- Segmental Weakness: Declining operating profit in key divisions like agricultural solutions impacts overall results.

- Investor Confidence: Inconsistent financial outcomes can erode investor trust and limit capital availability.

- Resource Constraints: Profitability dips can reduce funds available for crucial research and development or expansion initiatives.

Green Cross's reliance on plasma-derived products exposes it to supply chain risks, as donor availability and collection efficiency can directly impact production. For example, in early 2024, disruptions in plasma collection in certain regions could affect output. Furthermore, the company faces intense competition from larger biopharma firms and the growing biosimilar market, which can lead to pricing pressures and market share erosion. The company's financial performance has also shown volatility, with a net loss reported in Q1 2024, potentially impacting investor confidence and available capital for R&D.

| Weakness | Description | Impact | Supporting Data (2023/2024) |

| Plasma Supply Chain Vulnerability | Dependence on human plasma as a primary raw material. | Potential for production disruptions and increased operational costs due to donor availability and collection efficiency. | Fluctuations in donor participation rates in key regions in 2024 could tighten supply. |

| Intense Competition & Pricing Pressure | Competition from large biopharma companies and the rise of biosimilars. | Risk of market share erosion and reduced profitability due to aggressive pricing strategies from competitors. | Global biosimilars market projected to exceed $68 billion by 2025; new therapeutic agents can drive down prices. |

| Financial Performance Volatility | Inconsistent financial results, including net losses. | Challenges in predicting future earnings, potential deterrence of investors, and reduced capital for investment. | Reported net loss of $10.5 million in Q1 2024, contrasting with prior year profits. |

Preview Before You Purchase

Green Cross SWOT Analysis

The preview you see is the actual Green Cross SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete Green Cross SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Green Cross SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

The global biopharmaceutical market is booming, projected to reach over $700 billion by 2026, fueled by the rising incidence of chronic illnesses and a growing need for sophisticated biologics and personalized treatments. This expansion presents a significant avenue for GC Pharma to leverage its established expertise and promising pipeline, particularly in areas like plasma-derived therapies and recombinant proteins.

The rare disease treatment market is experiencing robust growth, driven by heightened awareness, breakthroughs in genetic research, and favorable regulatory environments. This expanding sector presents a significant opportunity for companies like GC Pharma.

GC Pharma is strategically positioned to leverage this growth, given its established presence and promising pipeline in rare disease therapies, including treatments for Sanfilippo syndrome and Hunter syndrome. For instance, GC Pharma's Hunter syndrome treatment, Hunterase, has already demonstrated success in key markets.

Innovations in biopharmaceutical manufacturing, like advanced Manufacturing Execution Systems (MES), offer significant opportunities for Green Cross. These technologies can boost production efficiency and shorten the time it takes to bring a product to market, potentially by reducing batch cycle times by as much as 20-30% in optimized settings.

By adopting cutting-edge production methods, Green Cross can streamline its operations, leading to improved product quality and faster delivery. This optimization is crucial in a competitive market where speed to market directly impacts revenue and market share.

The global biopharmaceutical manufacturing market is projected for substantial growth, with estimates suggesting it could reach over $250 billion by 2027, highlighting the potential rewards of embracing technological advancements.

Strategic Collaborations and Geographical Expansion

Green Cross (GC Pharma) can significantly boost its market position by forging strategic licensing agreements and joint ventures. These collaborations allow for the acquisition of cutting-edge technologies and the expansion into new territories, particularly in high-growth emerging markets. For instance, in 2024, the global biopharmaceutical market saw an increase in cross-border M&A activity, with companies actively seeking partnerships to leverage complementary strengths and share the substantial costs associated with research and development.

These strategic alliances are crucial for accelerating the market entry of new products and mitigating R&D risks. By partnering, GC Pharma can gain access to localized market knowledge and regulatory expertise, streamlining the process of introducing its innovative therapies to a wider patient base. The trend of strategic partnerships is expected to continue through 2025, driven by the need for innovation and market penetration in an increasingly competitive landscape.

- Access New Technologies: Gain rights to innovative drug candidates or manufacturing processes through licensing.

- Expand Geographic Reach: Enter new markets by partnering with local players who understand regional demands and regulations.

- Share R&D Risks: Collaborate on early-stage research to distribute the financial burden and increase the probability of success.

- Accelerate Market Entry: Leverage partners' existing distribution networks and market access for faster product launches.

Increasing Demand for Plasma-Derived Therapies

The global plasma-derived therapy market is experiencing robust expansion, with projections indicating significant growth. This surge is primarily fueled by the escalating need for immunoglobulins and other essential plasma proteins to treat a wide array of medical conditions.

GC Pharma is strategically positioned to capitalize on this trend. Their established strength in plasma-derived therapies, bolstered by their recent U.S. market introduction of Alyglo, presents a direct avenue for substantial revenue enhancement.

- Market Growth: The plasma-derived therapy market was valued at approximately $28.5 billion in 2023 and is anticipated to reach over $45 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 6.5%.

- Key Drivers: Rising prevalence of autoimmune diseases, hemophilia, and immune deficiencies are key factors driving demand for immunoglobulins.

- GC Pharma's Advantage: GC Pharma's U.S. launch of Alyglo, a treatment for primary immunodeficiency, in late 2024 is expected to contribute significantly to its market share and revenue in the coming years.

- Pipeline Strength: The company's ongoing investment in R&D for novel plasma-derived products further strengthens its competitive edge in this growing sector.

GC Pharma can capitalize on the expanding global biopharmaceutical market, projected to exceed $700 billion by 2026, by leveraging its expertise in plasma-derived therapies and recombinant proteins. The company is also well-positioned to benefit from the robust growth in the rare disease treatment sector, with existing successful products like Hunterase and a promising pipeline. Furthermore, adopting advanced manufacturing technologies, such as MES, could enhance production efficiency by up to 30%, while strategic licensing and joint ventures in 2024 and 2025 can accelerate market entry and mitigate R&D risks, particularly in emerging markets.

Threats

The biopharmaceutical landscape is fiercely competitive, with global giants like Pfizer, Roche, and Novartis consistently pouring billions into research and development, aiming to capture market share. This intense rivalry, further amplified by the rise of biosimilar manufacturers, directly impacts GC Pharma by potentially driving down prices for its innovative therapies and making it harder to establish a strong foothold for its new products.

Green Cross faces significant threats from a stringent and evolving regulatory landscape. Changes in healthcare regulations, drug pricing policies, and reimbursement frameworks across key markets like the US and Europe can directly impact profitability and limit market access for its products. For instance, ongoing debates and potential policy shifts around pharmaceutical pricing in the United States, a major market for many biopharmaceutical companies, could exert downward pressure on revenue streams.

Navigating the complexity of diverse global regulatory environments presents a continuous challenge. Each country has its own unique approval processes and compliance requirements, demanding substantial resources and expertise to manage effectively. Failure to adapt to these varying standards, such as differing data submission requirements for new drug applications in the EU versus the US, could lead to delays or outright rejections, hindering global expansion efforts.

Green Cross remains susceptible to disruptions in its supply chain, particularly concerning human plasma, a critical component for its blood-derived products. Despite advancements in vertical integration, the company's reliance on this biological source means that challenges in plasma collection, quality assurance, or unforeseen global shortages could significantly hinder production and, consequently, revenue streams. For instance, in 2024, several countries experienced fluctuations in blood donation rates due to public health concerns and logistical hurdles, underscoring the inherent volatility in securing this vital raw material.

Patent Expirations and Biosimilar Competition

The expiration of patents for key biologics presents a significant threat. As these patents lapse, the market opens up to biosimilar competitors, which are essentially highly similar versions of the original biologic drugs. This increased competition can lead to substantial price reductions and a subsequent erosion of market share for the originator products, impacting revenue streams.

For GC Pharma, this means established, profitable biologics could face reduced exclusivity and profitability. For instance, if a blockbuster drug like Hunterase (idursulfase-beta), a treatment for Hunter syndrome, sees its patent protection diminish, it could pave the way for biosimilar versions. This dynamic is a common challenge in the pharmaceutical industry, where the period of market exclusivity is crucial for recouping research and development costs.

- Patent cliff impact: The loss of patent protection on biologics can lead to a rapid decline in sales, often referred to as a patent cliff.

- Biosimilar market entry: The increasing number of approved biosimilars globally means more options for patients and payers, intensifying price pressures.

- Revenue and market share erosion: GC Pharma's established products may experience a significant drop in revenue and market share as biosimilar alternatives become available.

- R&D investment pressure: To counter this, companies like GC Pharma must continuously invest in developing new, innovative therapies to maintain a competitive edge.

Global Economic Volatility and Healthcare Spending Constraints

Global economic volatility presents a significant threat to Green Cross. Economic downturns and persistent inflationary pressures, evident in the 2024 inflation rates hovering around 3-5% in many developed economies, can curb consumer and government spending on healthcare. This macroeconomic instability directly impacts the demand for biopharmaceutical treatments and vaccines, potentially affecting GC Pharma's sales volumes and profit margins.

Furthermore, government budget constraints on healthcare spending, a trend observed globally as nations grapple with post-pandemic fiscal recovery, pose another challenge. For instance, many countries are reviewing their healthcare budgets for 2025, which could lead to tighter reimbursement policies or reduced procurement of high-cost biopharmaceutical products. This could squeeze GC Pharma's profitability and market access.

- Economic Downturns: Rising interest rates and slowing GDP growth in key markets could reduce overall healthcare expenditure.

- Inflationary Pressures: Increased costs for raw materials and manufacturing could impact GC Pharma's cost of goods sold.

- Healthcare Spending Constraints: Government budget limitations may lead to price negotiations or reduced market access for certain products.

- Currency Fluctuations: A strong US dollar, for example, could negatively impact the reported earnings of GC Pharma's international sales.

The increasing prevalence of biosimilar competition poses a significant threat, as patent expirations for GC Pharma's key biologics could lead to substantial price erosion and market share loss. For instance, if a product like Hunterase faces biosimilar entry, it could drastically reduce revenue streams, necessitating continuous investment in new product development to maintain a competitive edge.

SWOT Analysis Data Sources

This Green Cross SWOT analysis is built upon a robust foundation of data, incorporating financial reports, comprehensive market research, and expert industry insights to ensure a thorough and accurate strategic assessment.