Green Cross Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Bundle

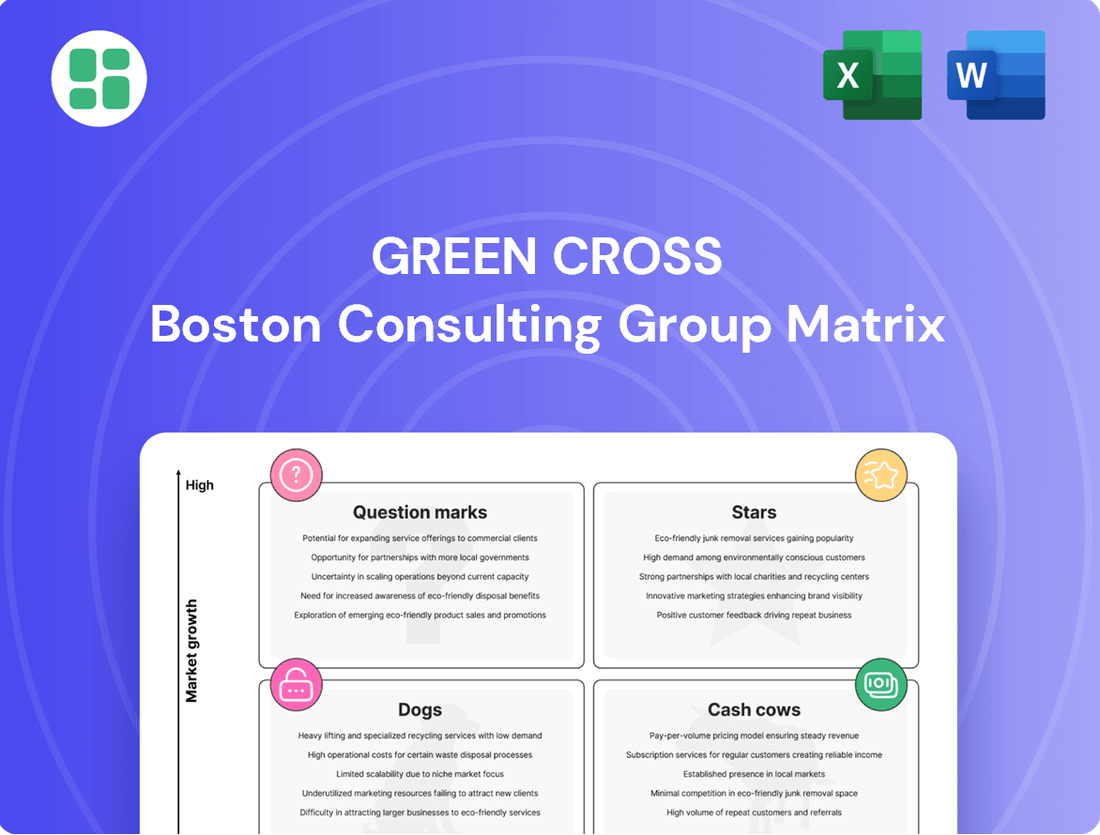

Unlock the full potential of your product portfolio with a comprehensive Green Cross BCG Matrix analysis. Understand which products are your Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights to drive growth. Purchase the complete report for a detailed breakdown and strategic recommendations that will illuminate your path to market leadership.

Stars

ALYGLO, GC Biopharma's 10% IVIG product, marked a significant milestone with its successful US market launch in 2024, following FDA approval in 2023. This entry into a key market is crucial for its placement within the Green Cross BCG Matrix, likely categorizing it as a Star due to its high growth potential and recent market penetration.

The product is rapidly securing formulary access with major US health insurers and pharmacy benefit managers. This strategic positioning is expected to drive substantial mid-to-long-term revenue growth, reinforcing its Star status in the competitive intravenous immunoglobulin market.

GC Biopharma has set an ambitious target of achieving $100 million in US ALYGLO sales by 2025. This aggressive sales goal underscores the company's confidence in ALYGLO's market reception and its potential to become a dominant player in the expanding IVIG sector.

Hunterase, developed by GC Biopharma, is a key player in the rare disease market, specifically for Hunter syndrome. Its global reach has extended to 12 countries, notably receiving its first approval in China, a significant market for specialized treatments.

The enzyme replacement therapy, initially approved in South Korea in 2012, is showing renewed momentum. In 2024, exports to Russia resumed, indicating a positive trend in its international distribution and market penetration efforts.

GC FLU International Market Growth

GC Biopharma's influenza vaccine, GC FLU, is experiencing significant international growth. A notable achievement is the record bid to supply 5.94 million doses to Thailand in 2025, covering both public and private sectors. This expansion highlights a growing global demand for GC FLU beyond its South Korean origins.

The vaccine's reach now extends to 63 countries, a testament to its increasing market penetration. Both the number of export destinations and the annual volume of shipments are on a consistent upward trend. This expansion solidifies GC FLU's position as a key player in the expanding global influenza vaccine market.

Maralixibat Licensing Agreement

GC Pharma's strategic licensing agreement for maralixibat, a deal finalized between late April 2024 and late February 2025, is a significant move aimed at high growth in new therapeutic areas within South Korea. This agreement is structured with upfront payments, milestone achievements, and royalty revenues, demonstrating a clear strategy to integrate innovative treatments into their portfolio.

This licensing pact is designed to accelerate market entry for maralixibat, allowing GC Pharma to capitalize on emerging therapeutic opportunities and build new revenue streams. The company anticipates this will bolster its position in the South Korean market.

- Maralixibat Licensing Deal: GC Pharma secured rights for maralixibat, targeting South Korean market expansion.

- Financial Structure: The agreement includes upfront payments, milestone payments, and royalty streams.

- Strategic Objective: Aims to accelerate market entry and leverage novel therapeutic indications for revenue growth.

- Market Impact: Positions GC Pharma for significant growth by introducing a cutting-edge asset.

Recombinant Anthrax Vaccine (Barythrax)

The approval of Barythrax, the world's first genetically engineered anthrax vaccine, in South Korea in April 2025 represents a significant market entry for GC Pharma. This innovative vaccine, developed in collaboration with GC Pharma, targets a high-growth niche within national immunization programs and biodefense initiatives.

Barythrax is positioned as a potential market leader in its specialized public health segment. Its introduction diversifies GC Pharma's product offerings and addresses a critical need in biosecurity.

- Product: Recombinant Anthrax Vaccine (Barythrax)

- Approval Date: April 2025 (South Korea)

- Key Market: National immunization programs and biodefense

- Strategic Positioning: High growth potential, niche market dominance

Stars in the Green Cross BCG Matrix represent products with high market share in a high-growth industry. These are the growth engines of a company, requiring significant investment to maintain their position and capitalize on market expansion. Their strong performance indicates a favorable competitive landscape and robust demand.

GC Biopharma's ALYGLO, with its recent US launch and securing of major insurer access, is a prime example of a Star. GC FLU's expanding global reach, now in 63 countries with a record bid for 5.94 million doses to Thailand in 2025, also signifies its Star status. Hunterase, despite being in a niche market, shows consistent international growth and market penetration, further solidifying its Star classification.

These products are characterized by increasing sales volumes and market penetration, indicating a strong trajectory. The company's strategic investments in these areas are expected to yield substantial returns as the markets they serve continue to grow.

| Product | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| ALYGLO | High | Growing | Star |

| GC FLU | High | Growing | Star |

| Hunterase | Niche High | Growing | Star |

What is included in the product

The Green Cross BCG Matrix analyzes a company's product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

Clear visual of "cash cows" and "question marks" to guide resource allocation.

Cash Cows

GC Biopharma's established plasma derivatives portfolio, a cornerstone of its Green Cross BCG Matrix, showcases a legacy of over fifty years as a leading Asian manufacturer. This mature product line, excluding the recent US launch of ALYGLO, consistently delivers substantial and reliable cash flow, underpinning the company's financial strength.

With a dominant market share in the traditional plasma derivatives segment, these products provide the crucial financial stability necessary for GC Biopharma to fund its strategic investments in emerging growth opportunities. This consistent revenue stream acts as a vital cash cow, supporting innovation and expansion.

GC Biopharma's GC FLU vaccine is a prime example of a Cash Cow within the BCG framework, evidenced by its consistent success in South Korea's National Immunization Program (NIP). The company secured a significant bid for 2.63 million doses for the 2025-2026 flu season, underscoring its dominant position in this established market.

This recurring procurement from the NIP generates a stable and predictable revenue stream for GC Biopharma. The mature nature of the flu vaccine market and the government program means that promotional expenses are relatively low, contributing to healthy profit margins for GC FLU.

GC Biopharma's domestic general prescription drugs represent a significant Cash Cow, demonstrating stable revenue growth with a projected 6% year-over-year increase for the third quarter of 2024.

These established products likely command substantial market shares within mature therapeutic segments in South Korea, ensuring consistent profitability and robust cash flow generation.

Their mature status means they require comparatively lower investment for maintenance and market presence, allowing GC Biopharma to allocate resources more strategically to other areas of its portfolio.

Over-the-Counter (OTC) Drugs

Over-the-Counter (OTC) drugs like Acustop Cataplasma and Zenol Cool Type are classic cash cows for Green Cross. These products are staples in mature, slow-growing consumer markets. Their strength lies in established brand loyalty and extensive distribution networks, allowing them to maintain a significant and stable market share.

These OTC offerings are designed to generate consistent, reliable cash flow with minimal need for further investment in research and development. This stability makes them crucial contributors to Green Cross's overall financial health, providing the necessary capital to fund other business ventures.

- Market Maturity: OTC drug markets are typically mature, meaning growth is slow but demand is consistent.

- Brand Strength: Products like Acustop Cataplasma benefit from strong brand recognition, ensuring continued customer preference.

- Stable Cash Flow: These cash cows provide predictable revenue streams with low reinvestment requirements.

- Profitability Contribution: They reliably contribute to the company's bottom line, supporting innovation and expansion in other areas.

Blood Testing Services (GC Labtech)

GC Labtech's blood testing services, operating within the Green Cross BCG Matrix as a Cash Cow, are crucial for GC Holdings. These services, focused on plasma testing, likely hold a substantial and stable market share in the blood products sector, ensuring consistent revenue generation.

This segment, though not a direct pharmaceutical product, functions as a mature business. It underpins the core plasma derivatives operations by providing essential, reliable services that contribute significantly to GC Holdings’ overall financial stability and cash flow generation.

The established infrastructure and the indispensable nature of plasma testing solidify GC Labtech's position. This reliability translates into predictable and steady income, supporting the organization’s ability to invest in other business units or manage its financial obligations.

- Market Position: High market share in a stable, mature blood testing services sector.

- Revenue Generation: Consistent and reliable cash flow, supporting core plasma derivatives business.

- Strategic Role: Essential service provider that fortifies the entire GC Holdings' supply chain.

- Financial Contribution: Acts as a significant cash generator, enabling broader organizational investment and stability.

Cash Cows in Green Cross's portfolio represent established products or services with high market share in slow-growing markets. These are the reliable revenue generators that fund innovation and growth in other areas of the business. Their consistent profitability and low reinvestment needs make them vital for financial stability.

GC Biopharma's established plasma derivatives, GC FLU vaccine, domestic general prescription drugs, and OTC products like Acustop Cataplasma and Zenol Cool Type exemplify these cash cows. Additionally, GC Labtech's blood testing services serve a similar function for GC Holdings.

These segments benefit from market maturity, strong brand recognition, and established distribution networks, ensuring predictable and stable cash flow. They are critical contributors to the company's overall financial health.

The sustained success of these products, such as the significant bid for 2.63 million doses of GC FLU vaccine for the 2025-2026 flu season, highlights their role as dependable income streams.

| Product/Service Category | Market Share | Market Growth | Cash Flow Generation | Strategic Importance |

|---|---|---|---|---|

| Plasma Derivatives | Leading Asian Manufacturer | Mature/Slow | Substantial & Reliable | Underpins Financial Strength |

| GC FLU Vaccine (South Korea) | Dominant (NIP) | Mature/Slow | Stable & Predictable | Funds Innovation |

| Domestic General Prescription Drugs | High (South Korea) | Slow (Projected 6% Q3 2024 YoY) | Consistent & Robust | Supports Strategic Allocation |

| OTC Drugs (e.g., Acustop) | Significant | Slow | Consistent & Reliable | Funds Other Ventures |

| GC Labtech Blood Testing | Substantial & Stable | Mature/Slow | Predictable & Steady | Fortifies Supply Chain |

What You’re Viewing Is Included

Green Cross BCG Matrix

The Green Cross BCG Matrix preview you see is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a ready-to-use strategic tool designed for clear business analysis. You are previewing the actual, professionally crafted BCG Matrix file that will be instantly downloadable for your immediate use in strategic planning and decision-making.

Dogs

Within Green Cross's extensive over-the-counter (OTC) drug offerings, certain legacy or less differentiated products operate in intensely competitive, commoditized sectors. These items typically hold a small market share and exhibit minimal growth, contributing negligibly to the company's overall financial performance.

Continuing to invest in these mature products would likely result in diminishing returns, positioning them as prime candidates for strategic divestiture or a gradual phase-out from the market. For instance, in 2024, the global OTC market continued to see intense competition, with many established brands facing pressure from generics and newer formulations, impacting the growth trajectory of less differentiated offerings.

While GC Pharma demonstrates strength in the influenza vaccine market, some of its established, non-influenza vaccine products might be facing challenges. These older vaccines could be situated in markets that are either shrinking or already crowded with competitors, leading to a diminished market share for GC Pharma.

These particular vaccine lines may necessitate continued investment for upkeep but are unlikely to contribute substantially to new revenue streams or offer a significant competitive edge. For instance, in 2023, the global vaccine market, excluding COVID-19, was valued at approximately $50 billion, but older, less innovative vaccines often see slower growth rates compared to newer, more advanced immunizations.

Given this scenario, GC Pharma might consider divesting these underperforming assets. This strategic move would allow the company to redirect its capital and research efforts towards more dynamic and potentially lucrative areas within its vaccine portfolio, thereby optimizing resource allocation and enhancing overall business performance.

GC Pharma, like many biopharmaceutical firms, invests in numerous early-stage research and development projects. In 2024, a significant portion of these initiatives, particularly those in the discovery and preclinical phases, were discontinued. These shelved programs, while representing necessary exploration, tie up valuable capital and intellectual resources without offering future growth potential.

Niche, Low-Volume Prescription Drugs with Expired Patents

GC Pharma's portfolio likely includes niche, low-volume prescription drugs with expired patents. These products, often facing intense generic competition, may struggle to maintain significant market share. For instance, if a drug targets a rare condition with limited patient numbers, its sales potential is inherently capped.

These older drugs, especially if newer, more effective treatments have emerged, would fall into the Cash Cows or potentially Dogs category of the BCG Matrix. Their contribution to revenue might be minimal, and they could even become a drain on resources if they require ongoing regulatory compliance or marketing without substantial returns.

- Low Growth Potential: Expired patents open the door for generics, drastically cutting into a drug's market share and pricing power.

- Niche Markets: Drugs for rare diseases or specific patient groups inherently have limited sales volumes, even with patent protection.

- Resource Allocation: Maintaining these drugs might divert funds from more promising R&D or marketing initiatives for newer products.

- Profitability Concerns: Such drugs may only achieve break-even or generate marginal profits, making them inefficient assets.

Products in Highly Competitive, Commoditized Generics

Products in highly competitive, commoditized generics markets represent a challenging segment for GC Pharma. These offerings often face intense pricing pressure from numerous rivals, leading to reduced market share and very thin profit margins. For example, in 2024, the global generics market, while substantial, is characterized by fierce competition, with many products seeing price erosion exceeding 10% annually in mature markets.

These commoditized generics typically exhibit minimal growth potential, making them less attractive from a strategic standpoint. GC Pharma's participation in such markets might mean certain products are essentially cash traps, consuming capital without generating significant returns or offering a competitive edge. In 2023, the average profit margin for many established generic drugs hovered around 5-10%, a stark contrast to patented or specialized pharmaceuticals.

- Low Market Share: Intense competition and pricing wars often relegate GC Pharma's products in this category to a small slice of the overall market.

- Minimal Profit Margins: The commoditized nature of these drugs means profits are squeezed, often single-digit percentages.

- Limited Growth Potential: With established players and little room for innovation, these generics offer scant opportunities for expansion.

- Cash Traps: Capital invested in these products may be better deployed elsewhere, as they provide little strategic advantage or substantial returns.

Products classified as Dogs within GC Pharma's portfolio are those with low market share in low-growth industries. These are often older, less innovative products that struggle to compete against newer or more established alternatives.

These offerings may require ongoing investment for regulatory compliance or minimal marketing, yet they contribute little to overall revenue or profit. For instance, in 2024, many mature pharmaceutical markets saw growth rates below 3%, making it difficult for products with declining market share to gain traction.

Strategic decisions regarding these Dog products typically involve divestiture or a managed phase-out to reallocate resources to more promising areas of the business.

Consider a hypothetical scenario for GC Pharma's product portfolio:

| Product Category | Market Share | Market Growth Rate | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy OTC Pain Reliever | 2% | 1% | Marginal | Divest/Phase-out |

| Older Antibiotic (Generic) | 3% | 2% | Break-even | Divest/Phase-out |

| Niche Prescription Drug (Expired Patent) | 1.5% | 0.5% | Slight Loss | Divest/Phase-out |

Question Marks

GC1130A, a groundbreaking treatment for Sanfilippo syndrome type A (MPS IIIA), is currently undergoing a global Phase I clinical trial in the US, Korea, and Japan. This rare disease presents a significant unmet medical need, suggesting a high-growth potential market.

The drug's early stage and current low market share position it as a Question Mark in the BCG matrix. However, its designations from the FDA, including Fast Track, Rare Pediatric Disease, and Orphan Drug status, underscore its considerable potential to evolve into a future Star, warranting strategic investment.

GC2025A represents Green Cross's innovative oral chaperone therapy targeting GM1 gangliosidosis, a devastating neurodegenerative condition lacking effective treatments. The company's non-clinical study results, unveiled in 2025, demonstrated significant potential, positioning GC2025A as a high-growth prospect in a market with a critical unmet medical need.

Currently an early-stage pipeline asset, GC2025A holds no market share but necessitates substantial investment for clinical progression. Its development aims to address the significant unmet demand within the rare disease sector, with the goal of capturing a meaningful market share upon successful commercialization.

GC1134A/HM15421 represents Green Cross's early-stage investment in Fabry disease treatment, a rare lysosomal storage disorder. Non-clinical results were shared in 2024, indicating potential in a niche market with significant unmet patient needs and growth prospects.

The Fabry disease treatment market, while small, is projected for robust growth. Analysts estimated the global Fabry disease market size to be around $1.5 billion in 2023, with a compound annual growth rate (CAGR) of approximately 8-10% expected through 2030. This growth is driven by increased diagnosis rates and advancements in enzyme replacement therapies and small molecule chaperones.

Given its nascent stage, GC1134A/HM15421 currently holds a negligible market share. The significant R&D expenditure required to bring this therapy to market, coupled with the inherent risks of drug development, positions it as a potential Question Mark on the BCG matrix. Success hinges on navigating clinical trials and regulatory approvals to capture a meaningful share of this expanding rare disease segment.

Amezosvatein (Shingles Vaccine via Curevo Vaccine)

Amezosvatein, a shingles vaccine from Curevo Vaccine where GC Pharma is a founding investor, finished its Phase 2 trial in January 2024. It showed it was as effective as a top competitor but was also better tolerated by patients.

The global market for shingles vaccines is seeing significant expansion. For instance, the shingles vaccine market was valued at approximately USD 5.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030.

- Amezosvatein's Potential: While still in development, Amezosvatein has the potential to become a Star in the BCG matrix.

- Market Position: Currently, it has a low market share but demonstrates substantial future growth prospects.

- Competitive Landscape: Its Phase 2 results indicate strong potential against established competitors in a growing market.

- Investment Outlook: Continued investment and successful commercialization are key for Amezosvatein to capture a significant market share.

Allogeneic CAR-NK Cell Therapy (GC Cell)

GC Cell, a subsidiary of GC Pharma, is actively developing allogeneic CAR-NK cell therapies for cancer treatment. This innovative approach leverages natural killer (NK) cells, modified to express chimeric antigen receptors (CARs), to specifically target and destroy cancer cells. The allogeneic nature means these therapies are derived from healthy donors, allowing for an off-the-shelf product, unlike autologous therapies which require patient-specific cell collection and modification.

Allogeneic CAR-NK cell therapy represents a significant advancement in oncology, offering potential advantages such as reduced manufacturing time and cost compared to autologous CAR-T therapies. The global cell therapy market, including CAR-NK, is projected for substantial growth, with some estimates suggesting it could reach tens of billions of dollars by the end of the decade. For instance, the CAR-T therapy market alone saw significant investment and expansion in 2023 and 2024, indicating strong investor confidence in cell-based immunotherapies.

However, GC Cell's allogeneic CAR-NK program is currently in its nascent stages of development. As such, it holds no current market share and is classified as a high-risk, high-reward investment within the Green Cross BCG Matrix. The path to market involves extensive and costly clinical trials, navigating complex regulatory pathways, and demonstrating robust efficacy and safety profiles. Success in this area could position GC Cell as a leader in a rapidly evolving and highly competitive field.

- Development Stage: Early-stage research and development.

- Market Position: No current market share.

- Investment Profile: High risk, high potential reward due to significant R&D investment required.

- Therapeutic Focus: Allogeneic CAR-NK cell therapies for oncology.

Question Marks on the Green Cross BCG matrix represent products or ventures with low current market share but operating in high-growth markets. These are typically early-stage assets requiring significant investment to realize their potential. Success hinges on effective strategy and execution to transition them into Stars.

GC1130A, GC2025A, and GC1134A/HM15421 are prime examples of Question Marks within Green Cross's pipeline. GC Cell's CAR-NK program also fits this classification. These assets are characterized by substantial research and development needs and the inherent uncertainties of drug development and market penetration.

The strategic imperative for these Question Marks is to carefully allocate resources, conduct rigorous clinical trials, and secure regulatory approvals. The goal is to transform these high-risk, high-reward ventures into future revenue drivers for Green Cross.

The potential for these Question Marks is significant, given the unmet needs in their respective therapeutic areas and the projected growth of these markets. For instance, the Fabry disease market, where GC1134A/HM15421 is positioned, was valued at approximately $1.5 billion in 2023 and is expected to grow at an 8-10% CAGR through 2030.

| Product/Program | Therapeutic Area | Current Market Share | Market Growth Potential | BCG Classification |

| GC1130A | Sanfilippo syndrome type A | Low | High | Question Mark |

| GC2025A | GM1 gangliosidosis | None | High | Question Mark |

| GC1134A/HM15421 | Fabry disease | Negligible | High (8-10% CAGR) | Question Mark |

| Amezosvatein (Shingles Vaccine) | Shingles | Low | High (>8% CAGR) | Question Mark (potential Star) |

| GC Cell CAR-NK Therapies | Oncology | None | High (tens of billions projected for cell therapy market) | Question Mark |

BCG Matrix Data Sources

Our Green Cross BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position products.