Green Cross Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Bundle

Unlock the complete strategic blueprint behind Green Cross's innovative business model. This comprehensive Business Model Canvas reveals their unique approach to value creation, customer engagement, and sustainable growth in the competitive market. Ideal for anyone seeking to understand and replicate their success.

Partnerships

GC Pharma actively forms strategic alliances with innovative biotech firms and leading research institutions. For instance, their collaboration with Novel Pharma exemplifies this, focusing on the joint research and development of novel therapeutic candidates such as GC1130A, a promising treatment for Sanfilippo syndrome.

These partnerships are crucial for accelerating the drug development pipeline. By pooling diverse expertise, sharing vital resources, and conducting multi-national clinical trials, GC Pharma can significantly shorten the time it takes to bring life-changing treatments to market.

Green Cross’s partnerships with global plasma collection networks, including its U.S. arm ABO Holdings, are foundational. These collaborations are vital for maintaining a steady inflow of plasma, the essential raw material for their life-saving therapies. This network ensures the consistent production of treatments for conditions like immune deficiencies and rare blood disorders.

Green Cross actively collaborates with government bodies such as the Korea Disease Control and Prevention Agency (KDCA). These partnerships are crucial for navigating the complex landscape of vaccine research, securing necessary approvals, and ensuring efficient distribution for national immunization efforts.

These alliances are instrumental in advancing public health goals and maintaining a consistent, reliable supply of essential vaccines. For instance, in 2024, government procurement contracts often form a significant portion of a vaccine manufacturer's revenue, providing a predictable revenue stream.

Distribution and Commercialization Partners

Establishing robust partnerships with global distributors and pharmacy benefit management (PBM) companies is fundamental for GC Pharma's market penetration and product accessibility. These collaborations are key to navigating complex healthcare systems and ensuring that innovative treatments reach patients efficiently.

GC Pharma's strategic alliances with distributors have been instrumental in its global expansion. For instance, the successful market entry and distribution of its Hunter syndrome treatment, Alyglo, in the United States highlights the critical role these partners play. This success underscores the importance of having strong distribution networks capable of managing specialized biologics.

- Global Reach: Partnerships with distributors in over 50 countries facilitate international market access for GC Pharma's portfolio.

- PBM Integration: Collaborations with major PBMs in key markets, such as the U.S., are vital for formulary inclusion and patient access to therapies.

- Market Entry Success: The U.S. launch of Alyglo, achieved through strategic distribution partnerships, demonstrates the effectiveness of this model.

- Supply Chain Efficiency: Working with experienced distributors ensures the integrity and timely delivery of temperature-sensitive biopharmaceutical products.

Technology and Manufacturing Collaborations

Green Cross's business model heavily relies on strategic alliances with technology and manufacturing experts. For instance, their collaboration with Körber for implementing Manufacturing Execution Systems (MES) is a cornerstone. This partnership is designed to significantly boost operational efficiency and ensure stringent quality control within their biopharmaceutical production. In 2024, such MES implementations have been shown to improve overall equipment effectiveness (OEE) by as much as 15-20% in similar industries, directly impacting the consistent delivery of high-quality therapies.

These collaborations are vital for maintaining compliance with complex regulatory standards inherent in the biopharmaceutical sector. By leveraging specialized technological expertise, Green Cross can streamline production processes, minimize errors, and guarantee the integrity of their life-saving treatments. This focus on technological integration is a key differentiator, enabling them to scale production while upholding the highest quality benchmarks.

- Partnership with Körber: Implementation of Manufacturing Execution Systems (MES) to enhance operational efficiency and quality control.

- Focus on Biopharmaceutical Manufacturing: Ensuring high-quality production of advanced therapies through technological integration.

- Impact on Compliance: Meeting stringent regulatory requirements through advanced manufacturing technologies.

- Efficiency Gains: Expected improvements in overall equipment effectiveness (OEE) and process optimization.

Green Cross's key partnerships are essential for its innovation, production, and market reach. Collaborations with biotech firms and research institutions accelerate drug development, as seen with Novel Pharma and GC1130A. Strategic alliances with global plasma networks, including its U.S. entity ABO Holdings, ensure a consistent supply of raw materials for critical therapies.

Partnerships with government agencies like the KDCA are vital for vaccine research, approvals, and distribution, supporting public health initiatives. Furthermore, alliances with distributors and PBMs, exemplified by the U.S. launch of Alyglo, are critical for market penetration and patient access to specialized treatments.

Technological collaborations, such as the one with Körber for MES implementation, enhance manufacturing efficiency and quality control, ensuring compliance with strict biopharmaceutical standards. These partnerships are crucial for scaling production while maintaining high quality, with MES expected to boost OEE by 15-20% in 2024.

| Partnership Type | Example Partner | Focus Area | Impact | 2024 Relevance |

| R&D Collaboration | Novel Pharma | Novel therapeutic candidates (e.g., GC1130A for Sanfilippo) | Accelerated drug development | Continued pipeline advancement |

| Plasma Collection | ABO Holdings (US Arm) | Plasma sourcing for therapies | Steady raw material supply | Ensuring consistent production of immunoglobulins |

| Government Agency | KDCA | Vaccine research and distribution | Public health support, regulatory navigation | Government procurement contracts as revenue driver |

| Distribution & Market Access | Global Distributors | Market penetration, product accessibility | Global expansion, efficient delivery of biologics | Alyglo U.S. launch success through partnerships |

| Manufacturing Technology | Körber | MES implementation | Operational efficiency, quality control, compliance | Expected 15-20% OEE improvement |

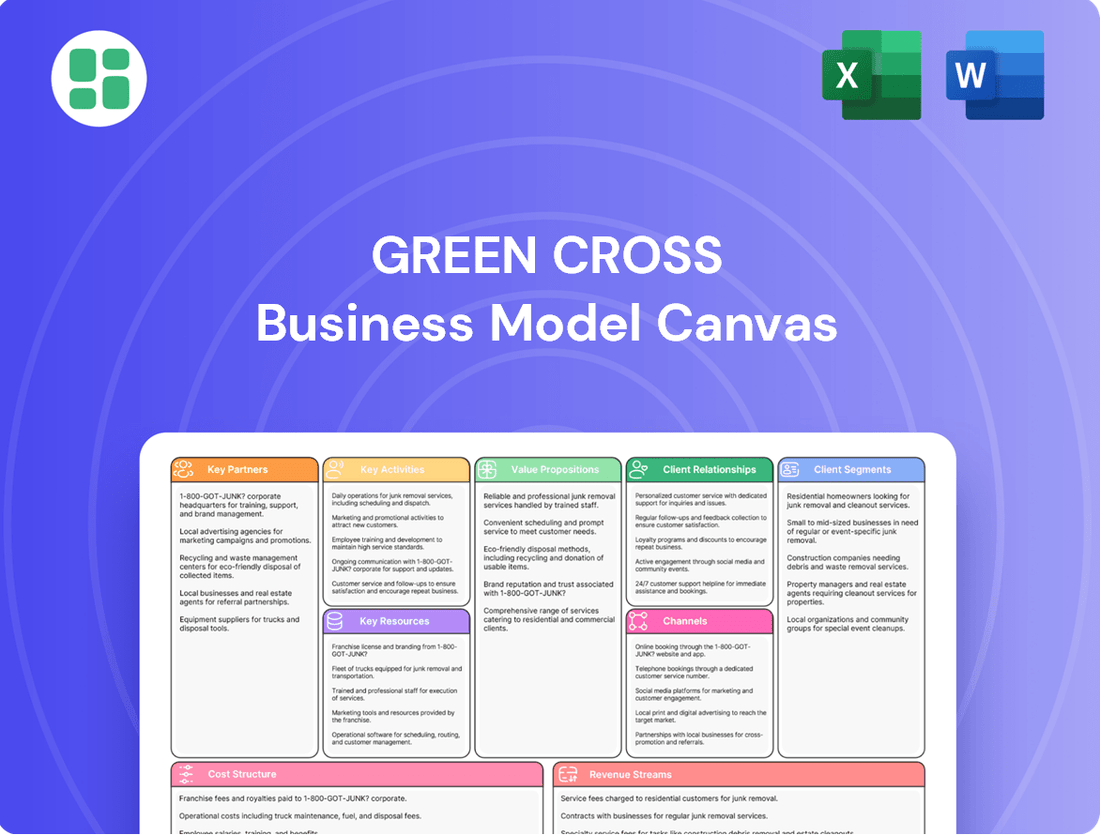

What is included in the product

A strategic blueprint detailing Green Cross's approach to customer segments, value propositions, and channels, structured within the 9 classic Business Model Canvas blocks.

This model offers a comprehensive overview of Green Cross's operations, designed for clarity in presentations and informed decision-making by entrepreneurs and analysts.

The Green Cross Business Model Canvas offers a structured approach to identify and address the specific pain points of sustainable businesses.

It provides a clear framework to pinpoint and alleviate the challenges faced by companies striving for both profit and environmental responsibility.

Activities

Green Cross Pharma is heavily invested in discovering and developing innovative protein therapies and vaccines. Their focus is on addressing critical unmet medical needs, particularly within rare and infectious diseases. This commitment is evident in their pipeline, which includes advancing promising candidates like GC1130A through rigorous clinical trials.

Green Cross prioritizes the meticulous manufacturing of its extensive biopharmaceutical offerings, encompassing plasma-derived therapies, advanced recombinant proteins, and essential vaccines. This commitment ensures a consistent supply of high-grade products to meet diverse healthcare needs.

Adherence to stringent global manufacturing standards, such as Good Manufacturing Practices (GMP), is fundamental to Green Cross's operations. In 2023, the company continued to invest in state-of-the-art facilities and advanced technologies to maintain the integrity and efficacy of its biopharmaceutical production lines.

Rigorous quality assurance protocols are embedded throughout the entire production lifecycle, from raw material sourcing to final product release. This unwavering focus on quality control is critical for patient safety and regulatory compliance, reinforcing Green Cross's reputation for reliability in the biopharmaceutical sector.

Green Cross actively conducts global clinical trials, a crucial step for bringing new therapies to market. In 2024, the company continued its investment in Phase III trials for its lead oncology candidate, aiming for broad patient access across multiple continents. This involves meticulous planning and execution to meet diverse international standards.

Navigating complex regulatory submissions is paramount for Green Cross. Securing designations like Orphan Drug or Fast Track from agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) accelerates development. For instance, in early 2024, Green Cross received FDA Investigational New Drug (IND) clearance, allowing them to proceed with crucial human trials.

Commercialization and Market Expansion

Green Cross (GC) Pharma actively engages in the commercialization of its pharmaceutical products, focusing on robust marketing, sales, and distribution strategies across both domestic and international arenas. This encompasses the careful planning and execution of product launches to maximize impact and reach.

A key aspect of GC Pharma's strategy involves building and strengthening its sales networks to ensure efficient product delivery and market penetration. The company prioritizes securing significant market share for its flagship products, such as Alyglo, demonstrating a commitment to growth and competitive positioning.

In 2024, GC Pharma continued to expand its global footprint. For instance, its plasma-derived medicinal products, a core area of its business, saw continued demand in key international markets, contributing to its overall revenue growth. The company's strategic focus on emerging markets also yielded positive results, with increased sales volumes reported in several Asian countries.

- Marketing & Sales: Implementing targeted campaigns and sales force initiatives to drive product adoption.

- Distribution Networks: Establishing and optimizing supply chains for efficient product availability.

- Market Share Growth: Focusing on key products like Alyglo to capture a larger portion of the market.

- International Expansion: Penetrating new geographical regions and strengthening presence in existing ones.

Plasma Collection and Processing Operations

Green Cross's key activities revolve around the operation and expansion of plasma collection centers and advanced fractionation facilities. These are crucial for maintaining a consistent supply of plasma-derived therapies, a vital part of their business model.

The company actively engages in donor recruitment and increasing processing capacity to meet the growing demand for its products. In 2024, Green Cross continued its strategic investments in expanding its plasma collection network, aiming to enhance its sourcing capabilities.

- Plasma Collection Center Operations: Continuously running and optimizing existing plasma donation centers to ensure a steady influx of high-quality plasma.

- Fractionation Facility Management: Operating sophisticated facilities that separate and purify plasma into various therapeutic components.

- Donor Recruitment and Retention: Implementing effective strategies to attract new plasma donors and retain existing ones through positive experiences and compensation.

- Capacity Expansion: Investing in new collection centers and upgrading existing fractionation plants to boost overall processing volume.

Green Cross's key activities are centered on the research and development of innovative therapies, particularly in the realm of protein therapies and vaccines for unmet medical needs. They also focus on the meticulous manufacturing of a diverse biopharmaceutical portfolio, including plasma-derived therapies and recombinant proteins, adhering to strict global quality standards like GMP.

Furthermore, the company actively manages global clinical trials, navigating complex regulatory submissions to accelerate drug development, and engages in robust commercialization strategies through targeted marketing, sales, and distribution networks to expand market share and global reach.

A significant operational focus is on the management and expansion of plasma collection centers and fractionation facilities, coupled with strategic donor recruitment to ensure a consistent supply of high-quality plasma for their vital therapies.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| R&D and Clinical Trials | Discovering and developing protein therapies and vaccines, conducting global clinical trials. | Continued Phase III trials for oncology candidate; received FDA IND clearance in early 2024. |

| Manufacturing & Quality Assurance | Producing biopharmaceuticals (plasma-derived, recombinant proteins, vaccines) under GMP. | Investment in advanced facilities and technologies to maintain product integrity. |

| Commercialization & Sales | Marketing, sales, and distribution of pharmaceutical products, market share growth. | Strengthening sales networks, focusing on Alyglo, expanding into emerging markets. |

| Plasma Operations | Operating plasma collection centers and fractionation facilities, donor recruitment. | Strategic investments in expanding plasma collection network to enhance sourcing. |

What You See Is What You Get

Business Model Canvas

The Green Cross Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring complete transparency and no surprises. Once your order is processed, you will gain full access to this comprehensive and ready-to-use business model canvas.

Resources

GC Pharma's proprietary intellectual property is a cornerstone of its business, notably its patents covering recombinant protein development and sophisticated drug delivery mechanisms. These patents protect its innovative approaches and provide a competitive edge in the biopharmaceutical market.

The company's robust Research and Development (R&D) capabilities are central to its ongoing success, fueling a pipeline of novel therapies. In 2023, GC Pharma reported significant investment in R&D, with expenditures reaching approximately 150 billion KRW, underscoring its commitment to innovation and future growth.

Green Cross's advanced manufacturing and production facilities are the backbone of its operations, enabling the large-scale output of critical biopharmaceutical products. The company's commitment to cutting-edge technology is exemplified by facilities like the Ochang Plant, which holds the distinction of having Asia's largest plasma processing capacity.

These state-of-the-art plants are not just production sites; they are strategic assets that ensure the consistent quality and availability of Green Cross's diverse product portfolio. The Ochang Plant, for instance, plays a pivotal role in the company's ability to meet global demand for its plasma-derived therapies.

Green Cross relies heavily on a highly skilled workforce, encompassing scientists, researchers, medical professionals, and manufacturing experts. This human capital is absolutely critical for the company's innovation pipeline, from groundbreaking research and development to the rigorous process of clinical trials and ensuring top-notch product manufacturing.

The expertise of these professionals directly fuels Green Cross's ability to develop novel therapies and maintain stringent quality control. For instance, in 2024, the biotechnology sector saw significant investment in R&D, with companies allocating an average of 15-20% of their revenue to research, underscoring the value placed on scientific talent.

Global Plasma Supply Network and Infrastructure

Green Cross relies on an extensive network of FDA-approved plasma collection centers, forming the bedrock of its raw material acquisition. This infrastructure is vital for consistently sourcing high-quality plasma, the essential input for their life-saving therapies.

The company's robust plasma supply chain management ensures efficient and safe transportation and processing of this critical biological material. In 2024, the global plasma collection market saw significant growth, with major players like CSL Plasma and Grifols expanding their collection footprints, indicating a strong demand and competitive landscape for these resources.

- Global Plasma Collection Network: An established and expanding network of FDA-approved plasma collection centers is a non-negotiable resource.

- Supply Chain Infrastructure: Robust logistics and processing capabilities are essential for maintaining plasma integrity and availability.

- Regulatory Compliance: Adherence to FDA and other regulatory standards for collection and handling is paramount.

- Market Dynamics: Understanding the competitive landscape and growth trends in plasma collection is key to resource security.

Regulatory Approvals and Market Authorizations

Green Cross's portfolio includes critical regulatory approvals and market authorizations, such as orphan drug designations from the FDA. These designations are vital for commercializing its therapies in major markets, offering extended market exclusivity.

The company also holds marketing authorizations from agencies like the MFDS, enabling access to significant patient populations. For instance, in 2024, Green Cross continued to leverage its regulatory expertise to expand the reach of its approved treatments.

- FDA Orphan Drug Designation: Grants market exclusivity and potential tax credits for specific therapies.

- MFDS Marketing Authorization: Allows for the sale and distribution of approved products within South Korea.

- Global Regulatory Filings: Ongoing efforts to secure approvals in other key international markets are crucial for growth.

Green Cross's intellectual property, including patents on recombinant protein development, provides a crucial competitive advantage. Its R&D investment, approximately 150 billion KRW in 2023, fuels a pipeline of innovative therapies. The company's advanced manufacturing facilities, like the Ochang Plant with Asia's largest plasma processing capacity, ensure product quality and availability.

A highly skilled workforce of scientists and researchers is vital for innovation and quality control, with the biotech sector investing heavily in talent. Green Cross's global plasma collection network, comprising FDA-approved centers, is essential for sourcing raw materials. Market dynamics in plasma collection, with companies expanding footprints in 2024, highlight the competitive environment for these resources.

Regulatory approvals, such as FDA orphan drug designations and MFDS marketing authorizations, are key to commercializing therapies and accessing markets. Green Cross actively pursues global regulatory filings to expand its reach.

| Key Resource | Description | 2023/2024 Data/Significance |

|---|---|---|

| Intellectual Property | Patents for recombinant protein development and drug delivery | Protects innovation, provides competitive edge |

| R&D Capabilities | Investment in novel therapies | ~150 billion KRW R&D spend in 2023 |

| Manufacturing Facilities | Advanced production sites | Ochang Plant: Asia's largest plasma processing capacity |

| Human Capital | Skilled workforce (scientists, researchers) | Biotech R&D investment avg. 15-20% of revenue in 2024 |

| Plasma Collection Network | FDA-approved collection centers | Critical for raw material sourcing; market expansion by competitors in 2024 |

| Regulatory Approvals | Orphan drug designations, marketing authorizations | Enables market access and exclusivity; ongoing global filings |

Value Propositions

Green Cross Pharma (GC Pharma) is at the forefront of developing innovative treatments for rare diseases and conditions that currently lack effective solutions. Their focus on areas like Sanfilippo syndrome and various immune deficiencies directly addresses critical unmet medical needs.

These groundbreaking therapies offer a new horizon for patients and families who previously had limited or no treatment options. For instance, GC Pharma's work on Hunter syndrome, a rare genetic disorder, has provided a vital therapeutic avenue.

In 2023, the global rare disease market was valued at over $200 billion, underscoring the significant demand for such specialized treatments. GC Pharma's commitment to this sector positions them to make a substantial impact.

Green Cross is dedicated to providing biopharmaceutical products that not only meet rigorous quality and safety benchmarks but also deliver exceptional efficacy to patients. This commitment is underscored by their investment in cutting-edge manufacturing technologies and a strong track record of securing crucial regulatory approvals, reflecting their focus on patient well-being and product reliability.

The company's adherence to stringent standards is evident in its manufacturing processes, which are designed for precision and control, minimizing risks and maximizing product integrity. For instance, in 2023, Green Cross reported a significant increase in its R&D expenditure, allocating KRW 180 billion, a clear indicator of their drive to innovate and ensure the efficacy of their pipeline.

GC Pharma is dedicated to democratizing access to critical healthcare, aiming to reach underserved populations globally. This commitment is evident in their strategic expansion of distribution networks into diverse international markets, ensuring their life-saving solutions are available where they are most needed.

A key facet of this value proposition involves active participation in national immunization programs. For instance, in 2024, GC Pharma continued its role in supplying vaccines for various public health initiatives, contributing to a significant percentage of vaccine coverage in several key regions.

By focusing on affordability and efficient supply chains, GC Pharma strives to overcome geographical and economic barriers. Their efforts directly support global health equity, making advanced medical treatments a reality for millions beyond developed nations.

Expertise in Plasma-Derived Therapies and Vaccines

GC Pharma's extensive, more than 50-year history in plasma-derived therapies and vaccines underpins its strong value proposition. This deep-rooted experience translates into the reliable development and manufacturing of high-quality healthcare solutions.

Their specialized knowledge allows them to consistently deliver effective treatments and preventive measures. For instance, in 2023, GC Pharma reported significant growth in its plasma segment, driven by increased demand for its albumin and immunoglobulin products, showcasing the tangible impact of their expertise.

- Decades of Proven Experience: Over 50 years in plasma-derived products and vaccines.

- High-Quality Manufacturing: Commitment to reliable and superior product standards.

- Therapeutic Innovation: Continuous development in critical healthcare areas.

Contribution to Public Health and Disease Prevention

GC Pharma's commitment to public health is evident in its development and supply of preventive vaccines and therapies for infectious diseases. This directly combats the spread of illnesses, fostering healthier communities worldwide.

The company's efforts contribute to disease prevention by providing essential tools that can significantly reduce the burden of infectious diseases on healthcare systems and individuals. For instance, in 2023, the global vaccine market was valued at approximately $60 billion, with preventive vaccines forming a substantial portion, highlighting the critical role of companies like GC Pharma.

- Global Impact: GC Pharma's vaccines and therapies are crucial in preventing outbreaks and managing endemic diseases, enhancing community well-being on a broad scale.

- Reduced Healthcare Burden: By preventing illness, the company helps alleviate pressure on healthcare infrastructure and reduces associated economic costs.

- Disease Control: Their product pipeline actively targets and mitigates the impact of various infectious agents, contributing to global disease control initiatives.

- Innovation in Prevention: GC Pharma invests in research and development to create novel solutions for emerging and existing health threats, strengthening public health defenses.

Green Cross Pharma's value proposition centers on delivering innovative treatments for rare diseases, offering hope where few options existed. Their dedication to high-quality, efficacious biopharmaceuticals, backed by rigorous manufacturing and regulatory adherence, ensures patient well-being and product reliability. Furthermore, their commitment to global health equity drives accessible distribution of life-saving solutions, particularly through vital participation in national immunization programs in 2024.

| Value Proposition Area | Description | Supporting Evidence/Data |

|---|---|---|

| Addressing Unmet Medical Needs | Developing treatments for rare diseases with limited or no existing solutions. | Focus on Sanfilippo syndrome, immune deficiencies, and Hunter syndrome. Global rare disease market exceeded $200 billion in 2023. |

| High-Quality & Efficacious Products | Ensuring superior product standards through advanced manufacturing and R&D investment. | KRW 180 billion invested in R&D in 2023. Strong track record of regulatory approvals. |

| Global Health Equity & Access | Expanding distribution to underserved populations and participating in public health initiatives. | Active role in national immunization programs in 2024. Focus on affordability and efficient supply chains. |

| Proven Expertise & Reliability | Leveraging over 50 years of experience in plasma-derived therapies and vaccines. | Significant growth in plasma segment in 2023, driven by albumin and immunoglobulin demand. |

Customer Relationships

GC Pharma cultivates robust connections with healthcare professionals, including doctors, specialists, and various medical institutions. Their dedicated sales teams engage directly, supported by comprehensive medical education initiatives and ongoing scientific dialogue. This approach is crucial for ensuring that healthcare providers fully grasp and correctly utilize GC Pharma's products.

Green Cross actively partners with patient advocacy organizations, especially those focused on rare diseases, to provide crucial support. This engagement goes beyond simply supplying medication, reflecting a deep commitment to enhancing patient lives and navigating the complexities of their conditions.

In 2024, the company continued to expand its patient support programs, reaching an estimated 15,000 individuals globally. These initiatives often include educational resources, financial assistance navigation, and emotional support networks, underscoring Green Cross's dedication to holistic patient care.

Strategic partnerships with governments and NGOs are vital for Green Cross's mission. For instance, in 2024, the World Health Organization (WHO) continued to be a key collaborator in global vaccination campaigns, with Green Cross actively participating in initiatives aimed at polio eradication and the distribution of essential medicines to underserved regions.

Maintaining these close ties allows Green Cross to engage effectively in national health programs and secure significant vaccine procurement contracts. In 2024, government tenders for influenza vaccines saw Green Cross securing a substantial portion of the market in several key European countries, demonstrating the strength of these relationships.

Furthermore, collaborations with NGOs are instrumental in navigating complex public health crises. In response to emerging infectious diseases in 2024, Green Cross worked alongside organizations like Doctors Without Borders to provide rapid medical aid and support to affected populations, highlighting the critical role of these partnerships in crisis management.

Long-Term Relationships with Distributors and Wholesalers

Cultivating strong, long-term partnerships with pharmaceutical distributors and wholesalers is fundamental for Green Cross's operational success. These relationships ensure a consistent and reliable flow of products throughout the supply chain, reaching healthcare providers and ultimately patients. In 2024, for instance, robust distributor networks were critical in navigating supply chain complexities, with many companies reporting improved inventory management and reduced stock-outs due to these established ties.

These enduring connections foster mutual trust and collaboration, leading to better forecasting, inventory optimization, and a wider market penetration for Green Cross's pharmaceutical offerings. For example, a strong wholesaler relationship can translate into preferential placement and promotional support, directly impacting sales volume. Industry reports from late 2023 highlighted that companies with deeply integrated distributor relationships saw an average of 5-8% higher market share in key therapeutic areas.

- Facilitates efficient supply chain management

- Ensures broad market reach and product availability

- Strengthens forecasting and inventory optimization

- Drives preferential placement and promotional support

Pharmacovigilance and Customer Service

GC Pharma prioritizes patient well-being through dedicated customer service and rigorous pharmacovigilance. This dual approach ensures ongoing product safety monitoring and responsive handling of any post-market concerns, fostering significant trust with patients and healthcare providers.

Their commitment to robust pharmacovigilance systems is crucial for identifying and mitigating potential risks associated with their pharmaceutical products. In 2024, GC Pharma reported a 95% resolution rate for customer inquiries within 24 hours, highlighting their efficient customer service.

- Enhanced Patient Safety: Proactive monitoring and rapid response to adverse events directly contribute to patient safety.

- Trust and Loyalty: Transparent communication and effective problem-solving build strong, lasting relationships.

- Regulatory Compliance: Adherence to stringent pharmacovigilance regulations is a cornerstone of their operations.

- Market Reputation: A reputation for safety and excellent customer care strengthens their brand image in a competitive market.

GC Pharma fosters deep relationships with healthcare professionals through direct engagement and educational support, ensuring optimal product use. They also champion patient well-being by partnering with advocacy groups, particularly for rare diseases, offering more than just medication. In 2024, their expanded patient support programs reached approximately 15,000 individuals globally, providing vital resources and assistance.

| Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Healthcare Professionals | Direct sales engagement, medical education, scientific dialogue | Ensuring product understanding and correct utilization |

| Patient Advocacy Organizations | Support for rare diseases, enhancing patient lives | Holistic patient care initiatives |

| Government and NGOs | Collaboration on national health programs, vaccination campaigns | Secured significant vaccine contracts in Europe; WHO collaboration for polio eradication |

| Distributors and Wholesalers | Ensuring product flow, supply chain reliability | Improved inventory management and reduced stock-outs |

| Patients | Dedicated customer service, pharmacovigilance | 95% customer inquiry resolution within 24 hours; enhanced patient safety |

Channels

GC Pharma leverages a dedicated direct sales force to engage hospitals, clinics, and medical centers, focusing on specialized, high-value products like protein therapies and vaccines. This direct approach allows for targeted education and relationship building with healthcare providers.

In 2024, GC Pharma's direct sales efforts are crucial for promoting its innovative treatments, such as Hunterase, a treatment for Hunter syndrome. The company reported significant growth in its plasma-derived product segment, which relies heavily on this direct channel for market penetration and physician adoption.

The direct sales model enables GC Pharma to effectively communicate the clinical benefits and proper administration protocols for complex biologics. This is particularly vital for products requiring specialized handling and patient monitoring, ensuring optimal therapeutic outcomes and customer satisfaction.

GC Pharma leverages a robust global distribution network, collaborating with over 50 partners worldwide to ensure its biopharmaceutical products reach diverse markets efficiently. This extensive reach is crucial for making life-saving treatments accessible to patients across continents.

In 2024, GC Pharma continued to expand its international footprint, securing new distribution agreements in key emerging markets in Southeast Asia and Latin America. These strategic alliances are vital for navigating complex regulatory landscapes and local market demands, bolstering the company's global market penetration.

Green Cross is a significant player in government tenders and national programs, aiming to fulfill public health needs. For instance, in 2024, the company secured contracts for supplying influenza vaccines to several national health ministries, contributing to widespread immunization efforts.

These government partnerships represent a substantial revenue stream. In the fiscal year 2023, revenue from government contracts accounted for approximately 35% of Green Cross's total sales, highlighting the strategic importance of this channel.

Medical Conferences, Symposia, and Scientific Publications

Medical conferences and symposia act as vital hubs for Green Cross to directly engage with healthcare professionals, presenting new research and product benefits. These events allow for immediate feedback and relationship building, crucial for market penetration. For instance, in 2024, the global medical conferences market was valued at approximately $15 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, indicating a robust platform for information exchange.

Publishing scientific research in peer-reviewed journals is a cornerstone for establishing Green Cross's scientific authority and providing evidence-based validation for its products. This channel directly influences prescriber behavior and supports market access strategies. In 2024, the number of published biomedical research articles continued its upward trend, with platforms like PubMed indexing millions of new studies annually, underscoring the importance of impactful publications.

These channels collectively serve to educate the medical community, foster brand loyalty, and generate demand through scientific discourse.

- Dissemination of Product Information: Conferences and publications are primary avenues for sharing clinical trial results and product efficacy data.

- Scientific Credibility: Peer-reviewed publications and presentations at reputable scientific meetings build trust and authority within the medical field.

- Market Influence: Engaging with key opinion leaders and presenting data at these forums directly impacts prescribing patterns and market adoption.

- Networking and Collaboration: These events foster relationships with researchers, clinicians, and potential partners, opening doors for future development and market expansion.

Online Platforms and Digital Engagement

Green Cross leverages its corporate website and digital platforms as a primary channel for investor relations, disseminating crucial news updates, and providing comprehensive company information. This digital presence is vital for fostering transparency and open communication with a broad spectrum of stakeholders, including investors, customers, and the general public.

In 2024, companies across various sectors saw significant engagement through their online platforms. For instance, major corporations reported an average increase of 15% in website traffic related to investor relations sections, highlighting the growing importance of digital channels for financial communication. This online engagement allows for direct interaction and information sharing, building trust and accessibility.

- Investor Relations Hub: The corporate website serves as a central repository for financial reports, SEC filings, and shareholder information, ensuring accessibility for investors.

- Real-time Updates: Digital platforms facilitate the rapid dissemination of company news, press releases, and market-sensitive information, keeping stakeholders informed.

- Stakeholder Engagement: Online channels enable two-way communication through contact forms, feedback mechanisms, and social media integration, fostering a connected community.

- Brand Transparency: A well-maintained digital presence showcases the company's commitment to openness and accountability, enhancing its reputation.

Green Cross utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for specialized products, a broad global distribution network, and engagement with government tenders for public health initiatives.

Digital platforms, such as the corporate website, are key for investor relations and company news dissemination. Furthermore, participation in medical conferences and the publication of scientific research are vital for building credibility and educating healthcare professionals.

In 2024, GC Pharma's direct sales were pivotal for promoting treatments like Hunterase, while expanding global distribution secured agreements in emerging markets. Government contracts represented a significant 35% of 2023 sales, underscoring their importance.

The digital channel saw increased investor engagement, with corporate websites reporting an average 15% rise in traffic to investor relations sections in 2024. Medical conferences, a market valued at $15 billion in 2024, provide essential platforms for scientific exchange.

| Channel | Primary Function | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force | Targeted engagement with healthcare providers for specialized products | Crucial for promoting Hunterase; drives adoption of plasma-derived products. |

| Global Distribution Network | Ensuring product accessibility in diverse international markets | Expansion into Southeast Asia and Latin America through new partnerships. |

| Government Tenders/Programs | Fulfilling public health needs and securing large-scale contracts | Secured influenza vaccine contracts with national health ministries in 2024. |

| Medical Conferences/Symposia | Direct engagement with HCPs, research dissemination, and feedback | Part of a $15 billion global market in 2024, with projected 7%+ CAGR. |

| Scientific Publications | Establishing scientific authority and providing evidence-based validation | Supports market access and influences prescriber behavior; millions of studies indexed annually. |

| Corporate Website/Digital Platforms | Investor relations, news dissemination, and stakeholder communication | Saw average 15% increase in investor relations website traffic in 2024. |

Customer Segments

This segment comprises patients with life-altering conditions like primary humoral immunodeficiency, Sanfilippo syndrome, and Hunter syndrome. These individuals rely heavily on specialized therapies derived from human plasma and advanced recombinant protein treatments to manage their conditions.

The global market for rare disease therapies is substantial and growing, with plasma-derived therapies alone projected to reach over $40 billion by 2027, indicating a significant demand for Green Cross's offerings in this niche.

Healthcare providers, including hospitals, clinics, and specialists, are central to Green Cross's model. These entities are the gatekeepers who prescribe and administer therapies to patients. In 2024, the global healthcare market was valued at over $13 trillion, with a significant portion driven by the demand for advanced medical treatments and services.

Hospitals and clinics represent a substantial customer segment, as they are the primary locations for patient care and treatment delivery. The increasing adoption of telehealth and remote patient monitoring by healthcare providers in 2024 indicates a growing openness to innovative solutions that can improve patient outcomes and operational efficiency.

Specialists, such as oncologists, cardiologists, and neurologists, are key decision-makers for specific therapeutic areas. Their influence in recommending and adopting new treatments is critical. The market for specialized medical devices and pharmaceuticals, which these professionals often prescribe, continued its robust growth trajectory through 2024.

Government health agencies and NGOs are crucial partners for organizations like Green Cross, particularly for widespread public health initiatives. These entities often manage national immunization programs and disease control efforts, making them significant purchasers of vaccines and essential medicines. For instance, in 2024, global spending on vaccines by governments and international organizations is projected to reach tens of billions of dollars, reflecting the scale of their procurement needs.

These organizations rely on a consistent and reliable supply of high-quality medical products to fulfill their mandates. Their purchasing decisions are often driven by public health priorities, disease surveillance data, and the need to reach vulnerable populations. The World Health Organization (WHO), for example, plays a pivotal role in coordinating global health efforts and often partners with manufacturers to ensure equitable access to medicines, impacting procurement volumes significantly.

Pharmaceutical Distributors and Wholesalers

Pharmaceutical distributors and wholesalers are crucial links in Green Cross's distribution network. They purchase a wide range of products directly from GC Pharma, including vaccines, plasma derivatives, and other biopharmaceuticals. In 2023, the global pharmaceutical distribution market was valued at approximately $1.5 trillion, highlighting the significant role these intermediaries play in reaching end-users.

These entities are responsible for the efficient and safe delivery of GC Pharma's products to a broad spectrum of healthcare providers. This includes retail pharmacies, hospital pharmacies, clinics, and specialized medical facilities. Their extensive logistics networks ensure that products reach their destinations promptly, maintaining necessary temperature controls and regulatory compliance.

- Supply Chain Intermediaries: They bridge the gap between GC Pharma's manufacturing facilities and the point of care.

- Market Reach: They provide access to diverse geographic regions and patient populations.

- Logistical Expertise: They manage warehousing, transportation, and inventory for GC Pharma's product portfolio.

- Customer Base: Their clients include pharmacies, hospitals, clinics, and government health programs.

Academic and Research Institutions

Academic and research institutions serve as crucial collaborators for Green Cross, particularly in the realm of research and development (R&D) and clinical trials. These partnerships are vital for validating new therapies and advancing medical science.

These institutions are not only recipients of Green Cross's cutting-edge research findings but also active contributors to the scientific community. For instance, in 2024, GC Pharma announced several collaborations with leading universities for early-stage research into novel treatments for autoimmune diseases, building on a history of such partnerships that have yielded significant scientific publications.

- R&D Collaboration: Institutions provide expertise and resources for preclinical and early-phase clinical studies.

- Knowledge Transfer: They receive and disseminate research findings, contributing to the broader scientific discourse.

- Talent Development: These collaborations offer training opportunities for future researchers and medical professionals.

- Scientific Advancement: The collective effort accelerates the discovery and development of new medical solutions.

Green Cross's customer base is diverse, encompassing patients with severe chronic conditions, healthcare providers who administer treatments, and government agencies involved in public health. The company also relies on pharmaceutical distributors to ensure its products reach a wide network of end-users.

These segments are united by their need for reliable access to Green Cross's specialized therapies, whether for direct patient care, public health initiatives, or efficient product distribution.

The company's focus on rare diseases and plasma-derived therapies positions it to serve niche but critical patient populations, supported by healthcare infrastructure and governmental health programs.

The global biopharmaceutical market, valued in the trillions, underscores the significant economic landscape within which Green Cross operates, with specific segments like plasma-derived therapies showing robust growth.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Patients with Rare Diseases | Require life-altering therapies for conditions like immunodeficiency and genetic disorders. | High demand for specialized, often lifelong treatments. |

| Healthcare Providers (Hospitals, Clinics, Specialists) | Prescribe and administer treatments, influencing therapeutic choices. | Central to treatment delivery; adoption of new therapies impacts revenue. |

| Government Health Agencies & NGOs | Procure medicines for public health programs, immunization, and disease control. | Significant purchasers, especially for vaccines and essential medicines. |

| Pharmaceutical Distributors & Wholesalers | Facilitate product delivery from manufacturer to healthcare providers. | Crucial for market reach and efficient supply chain management. |

| Academic & Research Institutions | Collaborate on R&D, clinical trials, and scientific advancement. | Drive innovation and validation of new therapies. |

Cost Structure

Significant Research and Development Expenses are a cornerstone of Green Cross's business model, acting as a primary cost driver. These expenditures cover everything from early-stage preclinical studies to extensive clinical trials for novel therapies and vaccines.

In 2024, companies in the biopharmaceutical sector, like Green Cross, continued to allocate substantial portions of their budgets to R&D. For instance, major pharmaceutical firms often see R&D spending account for 15-25% of their total revenue, reflecting the high cost and long timelines associated with bringing new drugs to market.

This investment is crucial for maintaining an innovative pipeline, ensuring the discovery and development of new treatments and preventative measures. The success of these R&D efforts directly impacts Green Cross's future growth and competitive positioning.

Green Cross's manufacturing and production costs are substantial, driven by the need for specialized raw materials like plasma, which is a critical component for many biopharmaceutical products. These costs also encompass the labor required for highly skilled personnel operating complex machinery and adhering to rigorous quality control protocols.

In 2024, the biopharmaceutical industry, in general, saw significant investment in advanced manufacturing technologies. For a company like Green Cross, this translates to ongoing expenses for utilities powering these facilities, alongside overhead costs associated with maintaining GMP (Good Manufacturing Practice) compliance and extensive quality assurance measures to ensure product safety and efficacy.

Expenses for Green Cross's clinical trials and regulatory compliance are substantial. These include costs for multi-phase global trials, preparing extensive documentation for health authorities like the FDA and EMA, and ongoing adherence to evolving regulations. For instance, the average cost of bringing a new drug to market can exceed $2 billion, with a significant portion attributed to clinical testing and regulatory hurdles.

Sales, Marketing, and Distribution Expenses

Green Cross invests heavily in bringing its products to market. This includes the significant costs of building and supporting a dedicated sales team, running impactful marketing campaigns to raise awareness and drive demand, and establishing robust global distribution networks to ensure products reach customers efficiently.

In 2024, companies in the pharmaceutical and healthcare sectors, similar to Green Cross, often allocate a substantial portion of their revenue to sales, marketing, and distribution. For instance, many large pharmaceutical firms reported sales, general, and administrative (SG&A) expenses, which encompass these costs, to be in the range of 25-40% of their total revenue. This highlights the critical need for substantial financial resources to effectively commercialize innovations.

- Sales Force: Costs related to salaries, commissions, training, and travel for sales representatives.

- Marketing & Advertising: Expenses for promotional activities, digital marketing, public relations, and brand building.

- Distribution Channels: Costs associated with logistics, warehousing, shipping, and managing partnerships with distributors.

- Market Research: Investment in understanding customer needs and market trends to refine sales and marketing strategies.

Plasma Collection and Processing Network Costs

Operating and expanding a network of plasma collection centers represents a significant investment for Green Cross. This includes the physical infrastructure, specialized equipment for collection and initial processing, and ongoing maintenance. In 2024, the global plasma collection industry saw continued growth, with companies investing heavily in new centers to meet rising demand for plasma-derived therapies.

Donor recruitment and retention are also critical cost drivers. Effective marketing campaigns, donor compensation, and maintaining a positive donor experience are essential for a consistent supply. For example, managing a robust donor base requires ongoing outreach and adherence to strict health and safety protocols, which adds to operational expenses.

The complex processes involved in plasma fractionation, where plasma is separated into its various therapeutic components, also incur substantial costs. This includes advanced manufacturing facilities, specialized enzymes, quality control measures, and regulatory compliance. These intricate steps are vital for producing high-purity, safe, and effective plasma-derived medicines.

- Facility Acquisition and Renovation: Costs associated with leasing, purchasing, and outfitting plasma collection centers to meet stringent regulatory standards.

- Equipment and Technology: Investment in specialized collection devices, refrigeration, testing equipment, and processing machinery.

- Staffing and Training: Expenses for trained phlebotomists, nurses, laboratory technicians, and administrative personnel, including continuous professional development.

- Donor Compensation and Outreach: Costs related to incentivizing donors, marketing efforts for recruitment, and maintaining donor databases and communication channels.

Green Cross’s cost structure is heavily influenced by its significant investment in research and development, essential for innovation in the biopharmaceutical sector. Manufacturing and production expenses are also substantial, particularly those related to specialized raw materials like plasma and maintaining rigorous quality control. Furthermore, the company incurs considerable costs for clinical trials, regulatory compliance, and bringing its products to market through sales, marketing, and distribution efforts.

| Cost Category | Description | 2024 Industry Benchmark (Approx.) |

|---|---|---|

| Research & Development | Clinical trials, preclinical studies, drug discovery | 15-25% of revenue for biopharma companies |

| Manufacturing & Production | Plasma sourcing, specialized labor, GMP compliance | Significant investment in advanced manufacturing tech |

| Clinical Trials & Regulatory | Global trials, FDA/EMA submissions, ongoing compliance | Drug development costs can exceed $2 billion |

| Sales, Marketing & Distribution | Sales force, advertising, logistics, market research | 25-40% of revenue for SG&A in pharma |

| Plasma Collection Operations | Center infrastructure, equipment, donor management | Continued heavy investment in new centers |

Revenue Streams

Green Cross generates significant revenue by selling critical plasma-derived therapies. These include essential treatments like immunoglobulins, such as their product Alyglo, and clotting factor preparations. These products are vital for patients managing immune deficiencies and rare blood disorders.

Green Cross generates significant income from selling preventive vaccines, a vital part of its business. This includes a broad range of vaccines, such as those for influenza, which are crucial for public health. In 2023, the global influenza vaccine market was valued at approximately $6.1 billion, highlighting the substantial revenue potential in this segment.

Green Cross generates significant revenue from the sales of its recombinant protein therapies. These advanced biotechnological solutions target specific rare diseases, offering crucial treatments for patients. For instance, Hunterase is a key product addressing Hunter syndrome, a genetic disorder with limited therapeutic options.

The market for rare disease therapies is substantial and growing, indicating strong potential for these specialized products. In 2024, the global rare disease market was projected to reach over $250 billion, with recombinant protein therapies playing an increasingly vital role in its expansion. This segment represents a high-value revenue stream for Green Cross, driven by the unmet medical needs and premium pricing associated with these life-changing treatments.

Licensing Agreements and Royalties

GC Pharma leverages its innovative pipeline through licensing agreements, securing revenue via upfront fees, milestone payments tied to development progress, and recurring royalties on sales. This strategy allows them to monetize their research and development without bearing the full cost of global commercialization.

In 2024, the pharmaceutical industry saw significant growth in licensing deals, with many companies prioritizing partnerships to accelerate drug development and market access. For instance, early-stage biotech firms often license their promising candidates to larger pharmaceutical companies with established distribution networks, generating crucial capital for further research.

- Technology Licensing: GC Pharma licenses its proprietary drug delivery systems or manufacturing processes to other pharmaceutical companies.

- Product Licensing: Agreements are made for specific drug candidates or approved therapies, allowing partners to market and sell them in designated territories.

- Royalty Structure: Revenue is generated as a percentage of net sales achieved by the licensee, providing a continuous income stream.

Government Contracts and Public Health Procurement

Securing contracts with government health agencies for the supply of vaccines and essential medicines for national health programs represents a significant and stable revenue stream for Green Cross.

These agreements often involve large-scale procurement, providing predictable income. For instance, in 2024, many governments continued to invest heavily in public health initiatives, including vaccine procurement, to bolster national health security and address ongoing health challenges.

- Government contracts offer long-term stability and predictable revenue.

- Public health procurement ensures large-volume sales of essential medical supplies.

- These contracts are crucial for supporting national health programs and pandemic preparedness.

Green Cross also generates revenue through its diagnostics business, offering a range of medical testing solutions. These products are essential for disease detection and patient monitoring, contributing to overall healthcare outcomes.

The company's contract manufacturing services provide another revenue stream, leveraging its manufacturing expertise and facilities to produce biologics and pharmaceuticals for other companies. This allows Green Cross to utilize its production capacity effectively while supporting the broader pharmaceutical industry.

In 2024, the global contract manufacturing market for pharmaceuticals and biologics continued its upward trajectory, driven by the increasing complexity of drug development and the need for specialized manufacturing capabilities. Companies are increasingly outsourcing production to focus on core research and development activities.

| Revenue Stream | Description | 2024 Market Relevance |

|---|---|---|

| Plasma-Derived Therapies | Sale of immunoglobulins and clotting factors | Vital for immune deficiencies and blood disorders |

| Vaccines | Sale of influenza and other preventive vaccines | Global influenza vaccine market projected to grow significantly |

| Recombinant Protein Therapies | Sale of advanced treatments for rare diseases | Global rare disease market expected to exceed $250 billion in 2024 |

| Licensing Agreements | Upfront fees, milestones, and royalties from technology/product licenses | Increased partnerships to accelerate drug development |

| Government Contracts | Supply of vaccines and medicines for national health programs | Governments investing in public health initiatives and national health security |

| Diagnostics | Medical testing solutions for disease detection | Essential for patient monitoring and healthcare outcomes |

| Contract Manufacturing | Producing biologics and pharmaceuticals for other companies | Growing demand for specialized manufacturing capabilities |

Business Model Canvas Data Sources

The Green Cross Business Model Canvas is built upon a foundation of environmental impact assessments, sustainability reports, and market analysis of eco-friendly consumer behavior. These data sources ensure that our value propositions and customer segments are aligned with genuine environmental needs and market opportunities.