Green Cross PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Green Cross Bundle

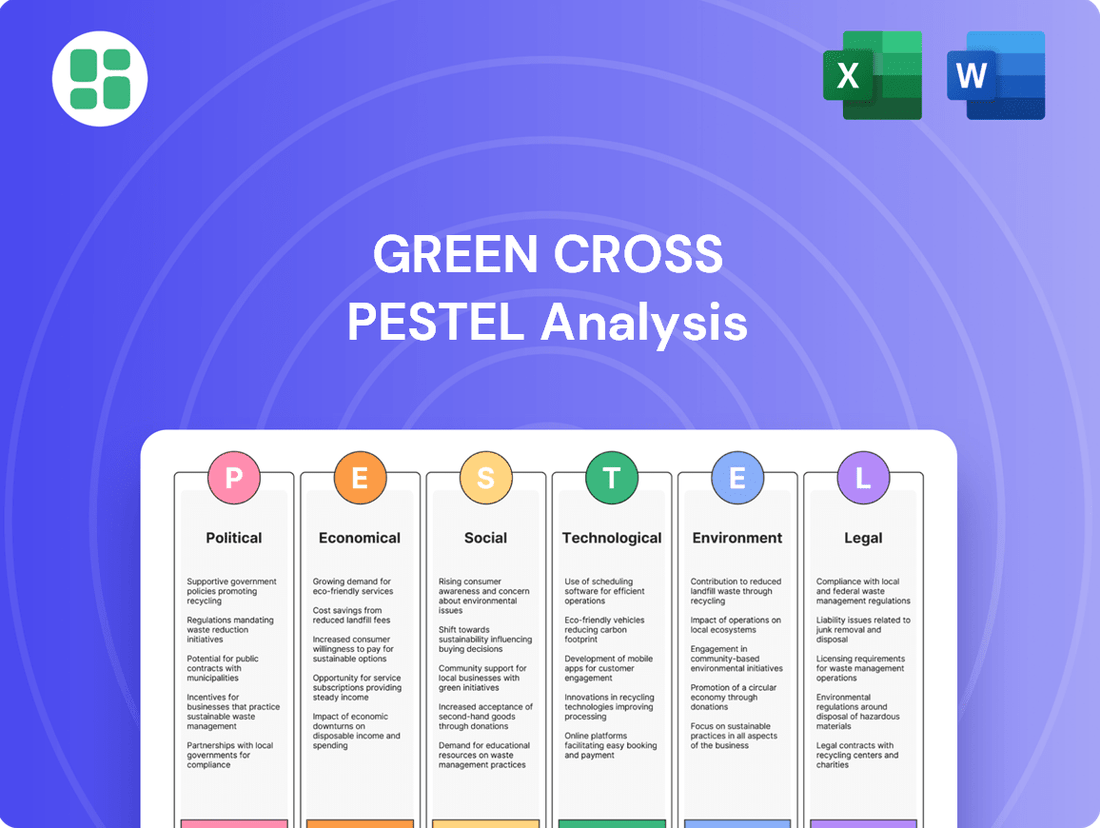

Unlock the critical external factors shaping Green Cross's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategic planning. Download the full PESTLE analysis now and gain a decisive advantage.

Political factors

Government healthcare policies are a major driver for biopharmaceutical companies like Green Cross. These policies dictate everything from how much drugs can cost to how they get paid for and how easily patients can access them. For example, shifts in national health spending, like a greater emphasis on vaccines or treatments for rare conditions, can directly alter GC Pharma's earnings and where it decides to invest its resources.

South Korea's Second Comprehensive National Health Insurance Plan, running from 2024 to 2028, is a prime example. This plan specifically aims to stimulate the development of new medications and improve patient access by ensuring fair payment for groundbreaking drugs. This initiative presents a potentially favorable environment for GC Pharma's innovative product pipeline.

The stringency and efficiency of drug approval processes significantly impact Green Cross's market entry. For instance, South Korea's Ministry of Food and Drug Safety (MFDS) is set to implement measures in 2025 aimed at shortening drug approval timelines, potentially benefiting GC Pharma's new product launches.

However, navigating the regulatory landscape for advanced therapies like CAR T-cell treatments in South Korea presents hurdles. These require strict adherence to adverse event reporting and alignment with international regulatory benchmarks, adding complexity to the approval journey.

Global trade dynamics, including the implementation of tariffs, directly influence the cost of raw materials and the overall competitiveness of pharmaceutical products. For instance, the potential for U.S. tariffs on imported pharmaceuticals, as discussed in trade policy debates throughout 2024, could significantly disrupt established supply chains and escalate operational expenses for multinational companies like GC Pharma.

These trade policies necessitate robust strategic supply chain management and may encourage localization efforts to buffer against such risks. The World Trade Organization reported in late 2024 that trade protectionism measures were on the rise, impacting sectors reliant on international sourcing and distribution.

Geopolitical Stability and Conflicts

Global geopolitical stability and ongoing conflicts significantly influence the biopharmaceutical supply chain. For companies like GC Pharma, this means potential disruptions in obtaining vital raw materials, such as plasma, and challenges in accessing markets affected by instability. For instance, the ongoing conflict in Eastern Europe has led to increased shipping costs and delays for many industries, including pharmaceuticals, impacting global logistics networks.

Diversifying supply sources and building resilient logistics are therefore paramount for GC Pharma to sustain operations amidst these geopolitical uncertainties. A single point of failure in the supply chain, exacerbated by regional conflicts, could have cascading effects on production and distribution.

Political shifts, such as changes in US administration, also play a crucial role. New policies on drug pricing, trade agreements, and international research collaborations can directly impact the financial viability and strategic direction of biopharmaceutical companies. For example, discussions around the Inflation Reduction Act in the US, enacted in 2022, continue to shape expectations for drug pricing negotiations, affecting revenue forecasts for 2024 and beyond.

- Supply Chain Vulnerability: Geopolitical tensions can disrupt the flow of essential raw materials, with plasma collection and processing being particularly sensitive to regional stability.

- Market Access Challenges: Conflicts and political instability can close off or severely restrict access to key markets, impacting sales and expansion plans for biopharmaceutical products.

- Policy Impact: Changes in government administrations, particularly in major markets like the US, can lead to significant policy shifts affecting drug pricing, R&D incentives, and international partnerships.

Public Health Initiatives and Vaccine Procurement

Government-backed public health campaigns, particularly those focused on widespread vaccination and readiness for new health threats, are a major boon for companies like GC Pharma. These initiatives directly translate into demand for their preventive vaccines.

National strategies for acquiring vaccines and achieving public health targets are critical drivers for GC Pharma's preventive vaccine sales. For instance, in 2024, many nations continued to bolster their national immunization programs, with significant budget allocations towards childhood vaccines and influenza shots.

The ongoing global emphasis on pandemic preparedness is fueling substantial investment and innovation within the vaccine sector. As of early 2025, several governments have announced multi-year funding commitments for research and development into broad-spectrum antivirals and novel vaccine platforms, aiming to counter future outbreaks.

- Government vaccination programs represent a substantial market for GC Pharma, creating consistent demand.

- National procurement policies directly shape sales volumes for GC Pharma's preventive vaccines.

- Global pandemic preparedness drives ongoing investment in vaccine research and development, benefiting companies like GC Pharma.

- Increased public health spending in 2024 and projected for 2025 highlights the growing importance of vaccine markets.

Government healthcare policies directly influence Green Cross's revenue streams and strategic investments, with South Korea's Second Comprehensive National Health Insurance Plan (2024-2028) prioritizing new drug development and fair payment for innovative treatments.

Regulatory environments, such as South Korea's MFDS plans to expedite drug approvals in 2025, can significantly impact Green Cross's market entry timelines for new therapies, though advanced treatments like CAR T-cells still face stringent reporting requirements.

Global trade policies and geopolitical stability, evidenced by rising trade protectionism reported by the WTO in late 2024 and supply chain disruptions from regional conflicts, necessitate robust supply chain management and diversification for companies like Green Cross.

Political shifts, like potential policy changes stemming from US administrations, can impact drug pricing and R&D incentives, with ongoing discussions related to the Inflation Reduction Act continuing to influence revenue forecasts into 2024 and beyond.

What is included in the product

This Green Cross PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, providing a comprehensive understanding of its external operating landscape.

The Green Cross PESTLE Analysis offers a clear, summarized version of complex external factors, making it easy to reference during meetings and reducing the pain of information overload.

Economic factors

The rising global healthcare expenditure is a significant tailwind for biopharmaceutical companies like Green Cross, directly boosting demand for their products, including vital protein therapies and vaccines. This trend is underscored by projections that the global biopharmaceutical market will expand substantially, potentially reaching USD 698.7 billion by 2030, fueled by the increasing need for sophisticated biologics and personalized treatments.

Green Cross's strategic focus on plasma-derived therapies and treatments for rare diseases aligns with rapidly growing market segments. The global plasma-derived therapy market is anticipated to reach approximately USD 42.65 billion by 2034, while the market for rare disease treatments is projected to achieve an impressive USD 792.8 billion by 2037, indicating strong future growth potential for the company's core offerings.

Inflationary pressures in 2024 and early 2025 are significantly impacting manufacturing, raw material acquisition, and research and development costs for companies like Green Cross. This directly squeezes profit margins. For instance, the cost of specialized biological materials and energy required for complex processes like plasma fractionation and purification has seen notable increases, making efficient cost management paramount.

The intricate biological nature of plasma-derived therapies means that collection, fractionation, and purification processes are inherently substantial cost centers. Rising inflation exacerbates these existing expenses, demanding rigorous supply chain optimization and efficient operational strategies to maintain profitability amidst escalating costs.

Reimbursement policies from national health systems and private insurers are critical for drug success. These policies directly influence how accessible and commercially viable a medication can be. For instance, in 2024, the U.S. Inflation Reduction Act continues to impact drug pricing negotiations for Medicare, potentially affecting revenue streams for pharmaceutical companies.

While treatments for rare diseases often justify higher prices due to high development costs and unmet patient needs, shifts in pricing and reimbursement frameworks, especially in key markets like the U.S. and Europe, can lead to reduced drug revenues. Navigating these evolving policies requires constant vigilance and strategic adaptation.

Access to Capital and Investment in R&D

The biopharmaceutical sector demands significant capital for research, development, and large-scale clinical trials, making access to funding paramount. Favorable financing conditions and consistent investment from both public and private sectors are essential for Green Cross to drive innovation and expand its operations.

The biopharmaceutical market's growth is heavily influenced by R&D investment, particularly in areas like chronic conditions and rare diseases. For instance, global biopharmaceutical R&D spending reached an estimated $200 billion in 2023, a figure projected to continue its upward trajectory through 2025, directly fueling advancements and market expansion.

- Capital Intensity: Biopharma requires substantial upfront investment in R&D, clinical trials, and manufacturing infrastructure.

- Funding Sources: Access to venture capital, public markets, and government grants is critical for sustained growth and innovation.

- R&D Investment Trends: Increased funding for chronic and rare disease research is a primary driver of market expansion.

- Projected Growth: Global biopharmaceutical R&D investment is expected to exceed $220 billion by the end of 2025, indicating a strong demand for capital.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for GC Pharma, given its global footprint. For instance, a strengthening US dollar against the South Korean won could reduce the won-denominated value of its overseas sales, impacting reported revenues. Conversely, a weaker dollar might increase the cost of raw materials sourced from the US.

Managing these currency risks is crucial for maintaining financial stability. GC Pharma likely employs strategies such as forward contracts or options to hedge against adverse currency movements. A diversified market presence across various currency zones can also mitigate the impact of any single currency’s volatility.

For example, in 2024, the South Korean won experienced considerable volatility against major currencies like the US dollar and the Euro, influenced by global economic conditions and interest rate differentials. This volatility directly affects the profitability of companies like GC Pharma with substantial international transactions.

- Impact on Revenue: A stronger USD in 2024 meant that GC Pharma's dollar-denominated sales translated into fewer Korean won, potentially lowering its reported top-line growth in local currency terms.

- Cost of Goods Sold: Fluctuations in the exchange rate directly influenced the cost of imported raw materials and active pharmaceutical ingredients (APIs), impacting GC Pharma's gross margins.

- Hedging Strategies: GC Pharma likely utilized financial instruments to lock in exchange rates for future transactions, aiming to protect its profit margins from unexpected currency swings.

- Diversification Benefits: Operating in multiple geographic regions helps GC Pharma to naturally hedge some of its currency exposure, as gains in one region might offset losses in another.

Global economic growth trends significantly influence healthcare spending and investment in biopharmaceuticals. As of early 2025, while some regions show robust recovery, others face persistent inflation and interest rate hikes, creating a mixed economic landscape that impacts demand for Green Cross's specialized therapies.

Interest rate policies enacted through 2024 and into 2025 are a double-edged sword for Green Cross. Higher rates can increase the cost of borrowing for capital-intensive R&D and expansion projects, but they also signal efforts to control inflation, which could stabilize raw material costs in the longer term.

The economic outlook for 2024-2025 suggests continued global economic uncertainty, with varying growth rates across major markets. For Green Cross, this necessitates agile financial planning to navigate potential shifts in consumer spending on healthcare and fluctuating raw material costs, particularly for plasma-derived products.

What You See Is What You Get

Green Cross PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis for Green Cross.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to immediately leverage the detailed Political, Economic, Social, Technological, Legal, and Environmental insights.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable PESTLE analysis for Green Cross.

Sociological factors

The global population is aging rapidly, with the World Health Organization projecting that by 2030, one in six people will be 60 years or older. This demographic shift directly correlates with an increased prevalence of chronic and rare diseases, consequently driving up demand for specialized medical treatments and therapies.

GC Pharma's strategic focus on therapeutic areas like immune deficiencies, infectious diseases, and rare diseases positions it well to capitalize on these evolving healthcare needs. The company's commitment to developing treatments for these conditions aligns with the growing patient populations experiencing these health challenges.

The market for rare disease treatments is experiencing significant growth, fueled by advancements in diagnostics and a greater understanding of these complex conditions. For instance, the global rare disease market was valued at approximately $175 billion in 2023 and is projected to reach over $300 billion by 2030, showcasing a robust expansion driven by an increasing patient pool and improved diagnostic capabilities.

Public trust in biopharmaceutical companies, particularly regarding vaccine safety and efficacy, is a critical factor influencing healthcare outcomes. In 2023, a Pew Research Center study indicated that while a majority of adults in the US expressed confidence in vaccines, a significant portion remained hesitant or opposed, highlighting ongoing challenges in public perception.

Misinformation, often amplified through social media channels, can rapidly erode trust, directly impacting vaccine uptake and patient adherence to prescribed therapies. For instance, during the COVID-19 pandemic, widespread but unfounded concerns about vaccine side effects contributed to vaccine hesitancy in various populations, affecting public health efforts globally.

GC Pharma's commitment to enhancing global health through innovative and accessible solutions necessitates a proactive approach to building and sustaining robust public confidence. This involves transparent communication about research, development, and the safety profiles of their products, aiming to foster a relationship of trust with patients and healthcare providers alike.

Growing public health consciousness is reshaping healthcare demands. For example, a heightened focus on preventive measures and the management of chronic conditions directly boosts the market for GC Pharma's plasma-derived therapies and vaccines, as these are crucial for immune support and disease prevention.

The trend towards personalized medicine and advanced diagnostics is also a significant driver. In 2024, the global personalized medicine market was valued at approximately $620 billion, with projections indicating continued robust growth, creating new opportunities for GC Pharma's innovative diagnostic solutions and tailored treatment approaches.

Demand for Accessible and Affordable Healthcare

There's a significant worldwide push for healthcare that's both cutting-edge and easy to get, especially in places with lots of people who still need medical care. This means companies like GC Pharma are navigating the challenge of keeping R&D and production costs manageable while still aiming to make treatments affordable for more people.

This societal expectation directly shapes how companies price their products and how they get them to patients. For instance, the World Health Organization's push for universal health coverage, with many countries aiming for significant progress by 2030, puts direct pressure on pharmaceutical pricing and accessibility models.

- Growing Demand: Global healthcare spending is projected to reach $11.9 trillion by 2027, according to Deloitte, highlighting the increasing need for accessible solutions.

- Affordability Challenge: The average cost of a new drug in the US in 2024 can be upwards of $150,000, creating a significant barrier for many patients.

- Emerging Markets Focus: Many developing nations are prioritizing healthcare infrastructure, creating opportunities for affordable and innovative treatments.

- Societal Pressure: Public opinion and government policies increasingly favor equitable access to essential medicines, influencing corporate strategies.

Ethical Considerations in Biopharmaceutical Development

Societal expectations regarding ethical practices in biopharmaceutical development are intensifying, particularly concerning plasma donation, genetic therapies, and vaccine production. Public and regulatory bodies are demanding greater transparency and accountability in these sensitive areas. For instance, in 2024, the debate around equitable access to gene therapies, which can cost millions per treatment, highlighted significant ethical dilemmas regarding affordability and distribution.

Green Cross must navigate these evolving ethical landscapes by prioritizing:

- Ethical Sourcing of Biological Materials: Ensuring fair compensation and informed consent for plasma donors is paramount, especially as demand for plasma-derived therapies grows.

- Transparent Clinical Trial Practices: Open reporting of trial data, participant safety, and data privacy are critical to building and maintaining public trust.

- Responsible Innovation: Balancing the pursuit of groundbreaking treatments with careful consideration of potential societal impacts and long-term consequences is essential.

- Community Engagement: Proactive dialogue with patient advocacy groups and the public can help address concerns and foster a collaborative approach to development.

Failure to adhere to these ethical standards can lead to significant reputational damage and regulatory hurdles. For example, a major biotech firm faced intense public scrutiny in early 2025 over alleged data manipulation in a gene therapy trial, underscoring the high stakes involved.

Societal shifts are profoundly impacting healthcare demands, with an aging global population and increased awareness of chronic and rare diseases driving demand for specialized treatments. This demographic evolution, where one in six people worldwide will be over 60 by 2030, directly fuels the market for therapies GC Pharma focuses on, like those for immune deficiencies and rare conditions. The rare disease market alone is projected to soar from $175 billion in 2023 to over $300 billion by 2030, underscoring this trend.

Public trust is a cornerstone for biopharmaceutical success, especially concerning vaccine safety, as studies in 2023 showed ongoing vaccine hesitancy. Misinformation, amplified by social media, can quickly erode this trust, impacting treatment adherence and public health initiatives. GC Pharma's commitment to transparent communication about its products is vital for fostering confidence.

There's a growing societal expectation for accessible and affordable healthcare, with global health spending predicted to reach $11.9 trillion by 2027. However, the high cost of new drugs, averaging over $150,000 in the US in 2024, presents a significant challenge. Companies like GC Pharma must balance innovation with the societal pressure for equitable access to essential medicines, especially as emerging markets prioritize healthcare infrastructure.

Ethical considerations are paramount, with increasing scrutiny on plasma donation, genetic therapies, and vaccine production. The debate around equitable access to gene therapies, costing millions per treatment, highlights significant ethical dilemmas. GC Pharma must prioritize ethical sourcing, transparent clinical trials, responsible innovation, and community engagement to navigate these evolving landscapes and avoid reputational damage, as seen with a biotech firm facing scrutiny in early 2025 over alleged data manipulation.

Technological factors

The biotechnology sector is experiencing a surge in innovation, with gene editing tools like CRISPR-Cas9 rapidly advancing. This technology is transforming how we approach drug discovery, allowing for the creation of more precise and effective treatments. For GC Pharma, this means a significant opportunity to broaden its development of recombinant proteins and therapies for rare diseases, potentially leading to breakthroughs in areas previously considered untreatable.

The vaccine development landscape is rapidly evolving, with mRNA technology, exemplified by its success in COVID-19 vaccines, now a cornerstone for future innovations. Companies are investing heavily, with Moderna and Pfizer-BioNTech leading the charge, projecting billions in revenue from mRNA platforms through 2025. This shift signifies a move towards more adaptable and potentially faster-to-market vaccine solutions.

Beyond mRNA, recombinant vaccine technologies continue to mature, offering alternative pathways for creating highly effective immunizations. Innovations in delivery systems, such as needle-free injectors and microarray patches, are also gaining traction, aiming to boost patient compliance and streamline administration, particularly in mass vaccination campaigns. These delivery advancements are crucial for improving vaccine accessibility and reducing healthcare burdens.

The healthcare sector's digital transformation, particularly the integration of AI and machine learning, is revolutionizing pharmaceutical research and development. These technologies are speeding up drug discovery, making clinical trials more efficient, and improving manufacturing. For instance, AI can analyze vast datasets to pinpoint potential vaccine targets and predict how the immune system will react, drastically cutting down the time for crucial steps like antigen selection.

Manufacturing Process Automation and Optimization

Automation and advanced process optimization are revolutionizing biopharmaceutical manufacturing, especially for intricate procedures like plasma fractionation. These advancements are key to boosting efficiency, maximizing yield, and ensuring superior product quality. For instance, in 2024, companies are investing heavily in AI-driven process control to reduce batch variability in complex protein purification, aiming for a 15% increase in consistent output.

Continuous innovation in production platforms is vital for accelerating the development and reducing the cost of all vaccine types. The industry is seeing a significant push towards single-use technologies and modular manufacturing facilities, which offer greater flexibility and faster scale-up. By 2025, it's projected that these technologies will enable a 20% reduction in the time-to-market for new biologic therapies.

- Increased Efficiency: Automation can reduce manual labor and processing times by up to 30% in biopharmaceutical production.

- Yield Improvement: Optimized processes, often guided by real-time data analytics, can lead to a 10-20% increase in product yield.

- Cost Reduction: Streamlined operations and reduced waste contribute to significant cost savings, potentially lowering manufacturing costs by 15-25%.

- Enhanced Quality Control: Automated systems provide more consistent and precise control over critical process parameters, improving product quality and reducing deviations.

Emergence of New Diagnostic Tools

Advancements in diagnostic tools are revolutionizing disease detection, especially for rare conditions. For instance, the global molecular diagnostics market was valued at approximately USD 13.5 billion in 2023 and is projected to reach USD 28.6 billion by 2030, growing at a CAGR of 11.4%.

This improved diagnostic capacity directly influences the demand for specific treatments. By identifying larger patient populations with previously undiagnosed or misdiagnosed conditions, these tools significantly expand the market for targeted therapies and personalized medicine.

- Earlier Detection: New tools enable the identification of diseases at earlier, more treatable stages.

- Increased Patient Identification: Improved accuracy leads to the identification of larger patient cohorts for specific treatments.

- Market Expansion for Targeted Therapies: A clearer understanding of patient populations drives investment and growth in niche therapeutic areas.

- Impact on R&D: Enhanced diagnostics can refine clinical trial recruitment and accelerate drug development pipelines.

Technological advancements are reshaping the biopharmaceutical landscape, with gene editing tools like CRISPR-Cas9 enabling more precise therapies. The rise of mRNA technology, demonstrated by its success in COVID-19 vaccines, is accelerating vaccine development, with companies projecting billions in revenue through 2025. AI and machine learning are also speeding up drug discovery and clinical trials, while automation and single-use technologies are enhancing manufacturing efficiency and reducing time-to-market for new treatments.

| Technology Area | Key Advancement | Impact/Opportunity | 2024/2025 Data Point |

|---|---|---|---|

| Gene Editing | CRISPR-Cas9 | Precise drug discovery, novel therapies for rare diseases | Continued investment in gene therapy R&D, with a projected market growth of over 20% annually. |

| Vaccine Platforms | mRNA Technology | Faster vaccine development, adaptable solutions | mRNA vaccine market expected to exceed $60 billion by 2025. |

| Artificial Intelligence (AI) | Machine Learning in R&D | Accelerated drug discovery, efficient clinical trials | AI in drug discovery market projected to reach $10 billion by 2028. |

| Manufacturing | Automation & Single-Use Tech | Increased efficiency, reduced costs, faster scale-up | Single-use bioprocessing market expected to grow by 15-20% CAGR through 2025. |

Legal factors

Intellectual property rights, particularly patents and data exclusivity, are crucial for biopharmaceutical firms like Green Cross to safeguard their groundbreaking discoveries and significant research and development outlays. The pharmaceutical sector's very existence hinges on robust IP, and emerging technologies like AI are introducing novel complexities regarding data ownership and protection.

South Korea's upcoming drug data protection system, scheduled for implementation in February 2025, signifies a significant shift. This new framework will offer explicit data protection for marketing authorizations, superseding the prior re-examination system and offering enhanced security for innovative drug data.

Compliance with stringent drug approval processes, such as those mandated by the MFDS in South Korea, the FDA in the United States, and the EMA in Europe, is a critical legal factor for pharmaceutical companies like Green Cross. These regulations encompass the entire lifecycle of a drug, from preclinical and clinical trial requirements to Good Manufacturing Practices (GMP) and ongoing post-market surveillance.

The regulatory landscape is dynamic, with South Korea, for instance, actively working to streamline its new drug approval pathways, targeting faster review timelines starting in 2025. This initiative could significantly reduce the time-to-market for new therapies, impacting Green Cross's ability to launch innovative products efficiently.

Data privacy and security are paramount for GC Pharma, especially with strict regulations like GDPR and HIPAA governing patient data in clinical trials and commercial operations. Compliance with these laws is critical to safeguard sensitive patient information and prevent hefty legal penalties. For instance, the European Union's GDPR, implemented in 2018, has set a high bar for data protection, with fines reaching up to 4% of global annual turnover for non-compliance.

GC Pharma must maintain robust data security measures to protect proprietary information, as clinical trial data is increasingly recognized as a valuable strategic asset. Failure to do so could lead to breaches, impacting trust and potentially exposing the company to significant financial and reputational damage. The global average cost of a data breach reached $4.35 million in 2022, highlighting the financial imperative for strong security protocols.

Product Liability Laws and Litigation Risks

Biopharmaceutical firms like Green Cross are heavily exposed to product liability risks, especially concerning plasma-derived therapies and vaccines. Strict adherence to quality control and robust pharmacovigilance systems are paramount to mitigate these risks. For instance, in 2024, the pharmaceutical industry continued to grapple with litigation stemming from alleged side effects and manufacturing defects, with settlements often running into millions of dollars, impacting profitability and investor confidence.

Litigation concerning product safety or efficacy can lead to severe financial repercussions and significant damage to a company's reputation. The legal environment surrounding pharmaceutical patents is also dynamic, with ongoing disputes over licensing terms and indemnification clauses. These legal challenges can influence research and development investments and market access strategies.

- Product Liability Exposure: Plasma-derived products and vaccines present high liability risks, demanding rigorous quality assurance.

- Litigation Impact: Legal battles over safety or efficacy can cause substantial financial losses and reputational harm.

- Patent Landscape: Evolving patent laws create challenges in licensing agreements and indemnification disputes.

- Regulatory Scrutiny: Increased regulatory oversight in 2024-2025 for biopharmaceuticals heightens the need for compliance to avoid legal penalties.

Anti-trust and Competition Laws

Anti-trust and competition laws are critical for the biopharmaceutical sector, aiming to prevent monopolies and foster a competitive landscape. These regulations directly shape how companies like Green Cross approach mergers, acquisitions, and licensing deals, impacting their market entry strategies and overall growth. For instance, the Federal Trade Commission (FTC) in the US actively scrutinizes pharmaceutical mergers, and in 2023, they challenged several proposed deals to maintain market competition.

Regulatory bodies diligently monitor market activities to ensure fair access to treatments and prevent practices that stifle competition. This oversight can lead to significant scrutiny of pricing strategies and patent enforcement. In 2024, ongoing discussions around drug pricing reform in various global markets, including potential government negotiation powers, underscore the sensitivity of competition within the biopharma industry.

- Mergers & Acquisitions Scrutiny: Increased regulatory review of pharmaceutical M&A activity to prevent market concentration.

- Licensing Agreement Oversight: Ensuring licensing terms do not create anti-competitive barriers for generic or biosimilar entry.

- Pricing and Patent Enforcement: Regulatory bodies examine pricing practices and patent strategies for potential anti-competitive effects.

- Market Entry Barriers: Laws aim to reduce obstacles for new entrants, promoting innovation and patient choice.

New drug data protection regulations in South Korea, set to begin in February 2025, will offer specific protections for marketing authorizations, replacing the older re-examination system and bolstering the security of innovative drug data.

The global regulatory environment for pharmaceuticals is becoming increasingly stringent, with a focus on faster review timelines for new drugs, aiming to reduce time-to-market for companies like Green Cross. This dynamic landscape necessitates continuous adaptation to evolving compliance standards.

In 2024, the pharmaceutical industry faced significant litigation related to product safety and manufacturing, with settlements often amounting to millions of dollars, impacting profitability and investor confidence. Green Cross, like its peers, must navigate these product liability risks, particularly with plasma-derived therapies and vaccines.

The evolving patent landscape continues to present legal challenges, with ongoing disputes over licensing terms and indemnification clauses directly influencing R&D investments and market access strategies for biopharmaceutical firms.

| Legal Factor | Impact on Green Cross | 2024/2025 Relevance |

| Intellectual Property Rights | Safeguards R&D investments and market exclusivity. | AI introduces new complexities in data ownership and protection. |

| Regulatory Compliance (MFDS, FDA, EMA) | Crucial for drug approval and market access. | Streamlining of approval pathways in South Korea from 2025 to reduce time-to-market. |

| Data Privacy (GDPR, HIPAA) | Protects sensitive patient data and avoids penalties. | Global average cost of data breach was $4.35 million in 2022. |

| Product Liability | Mitigates risks associated with plasma-derived products and vaccines. | Litigation over side effects and manufacturing defects led to significant settlements in 2024. |

| Anti-trust & Competition Laws | Shapes M&A, licensing, and market entry strategies. | Increased FTC scrutiny of pharmaceutical mergers in 2023; ongoing drug pricing reform discussions in 2024. |

Environmental factors

The biopharmaceutical sector is under growing pressure to adopt sustainable manufacturing, with companies like Novo Nordisk aiming for 100% renewable electricity by 2030. This involves embracing green chemistry, minimizing waste, and exploring circular economy models to lessen environmental impact.

Biopharma leaders are actively investing in eco-friendly operations; for instance, in 2023, the industry saw significant capital allocation towards energy efficiency and waste reduction technologies. Many are setting ambitious targets for carbon neutrality, reflecting a broader industry shift towards environmental stewardship.

Climate change is increasingly disrupting global supply chains, impacting everything from raw material availability, such as the sourcing of specialized components for medical devices, to the timely distribution of finished goods. Extreme weather events, like the widespread flooding in Southeast Asia in late 2024 that affected key manufacturing hubs, directly illustrate these vulnerabilities.

Building resilient and decarbonized supply chains is no longer optional; it's critical for operational continuity and reducing environmental footprints. Companies are investing in diversified sourcing and advanced logistics to mitigate risks, with a growing focus on reducing Scope 3 emissions throughout their value chains.

Biopharmaceutical research and manufacturing are notoriously energy-hungry, leading to a significant carbon footprint. This sector's processes, from lab work to large-scale production, demand substantial power, directly contributing to greenhouse gas emissions.

The pharmaceutical industry as a whole accounts for a notable share of global carbon emissions, with a considerable amount stemming from the sourcing of raw materials and the manufacturing stages. For instance, in 2024, the sector's emissions were a key focus for environmental regulators.

Companies are now prioritizing energy reduction, resource optimization, and adopting renewable energy sources. Many biopharma firms have set ambitious targets for carbon neutrality by 2030, investing heavily in solar and wind power to offset their operational impact.

Compliance with Environmental Protection Regulations

Adhering to environmental protection regulations, covering everything from hazardous waste disposal to air quality standards, is paramount for businesses. The World Health Organization (WHO) is increasingly emphasizing sustainability throughout the pharmaceutical supply chain, prompting companies to develop and implement rigorous new environmental standards and operational guidelines. For instance, in 2024, the European Environment Agency reported a 5% increase in regulatory fines for non-compliance in the chemical manufacturing sector, highlighting the financial implications of neglecting these rules.

Companies must proactively manage their environmental footprint to avoid penalties and maintain public trust. This includes investing in cleaner technologies and robust waste management systems. The push for sustainability is not just about compliance; it's about future-proofing operations. By 2025, it's projected that over 60% of major corporations will have publicly disclosed their Scope 3 emissions, driven by regulatory pressure and investor demand for environmental accountability.

- Water Usage: Implementing water-efficient technologies and recycling systems to meet stricter discharge limits.

- Air Emissions: Investing in advanced filtration and emission control technologies to comply with air quality standards.

- Waste Disposal: Developing comprehensive hazardous waste management plans and exploring circular economy principles for waste reduction.

- Supply Chain Sustainability: Collaborating with suppliers to ensure their environmental practices align with the company's sustainability goals.

Corporate Social Responsibility (CSR) and ESG Initiatives

Growing stakeholder expectations and regulatory directives, such as the EU's Corporate Sustainability Reporting Directive (CSRD) coming into effect in 2025, are compelling pharmaceutical firms to embed Environmental, Social, and Governance (ESG) criteria into their core strategies. This shift is amplified by increasing investor demand for transparency and accountability in corporate social responsibility. For instance, a 2024 report indicated that over 70% of institutional investors consider ESG factors when making investment decisions.

GC Pharma's dedication to global health inherently aligns with broader ESG objectives, underscoring the importance of responsible resource management and environmental stewardship. This commitment is not merely about compliance but also about building long-term value and resilience. The company’s focus on sustainable sourcing and waste reduction directly contributes to its environmental footprint, a key metric for ESG performance.

- Stakeholder Pressure: Increased demand from consumers, employees, and investors for ethical and sustainable business practices.

- Regulatory Landscape: New regulations like the CSRD (effective 2025) mandate extensive ESG reporting, impacting compliance costs and strategic planning.

- Investor Focus: A growing trend in 2024-2025 sees a significant portion of investment capital allocated to companies demonstrating strong ESG performance.

- Brand Reputation: Companies with robust CSR and ESG initiatives often enjoy enhanced brand loyalty and a stronger market position.

Environmental factors are increasingly shaping the biopharmaceutical landscape, pushing companies towards sustainable practices. This includes a strong focus on reducing energy consumption, as the sector is inherently energy-intensive, with many firms setting 2030 carbon neutrality goals. Furthermore, stricter regulations on waste disposal and air emissions are driving investment in cleaner technologies and circular economy principles, with significant financial implications for non-compliance.

| Environmental Focus Area | 2024 Data/Trend | 2025 Outlook/Action |

|---|---|---|

| Renewable Energy Adoption | Companies like Novo Nordisk aiming for 100% renewable electricity by 2030. | Increased investment in solar and wind power for operations. |

| Waste Reduction & Circularity | Exploration of circular economy models for waste minimization. | Development of comprehensive hazardous waste management plans. |

| Supply Chain Resilience | Climate change impacting raw material availability and distribution. | Diversified sourcing and advanced logistics to mitigate climate risks. |

| Regulatory Compliance | 5% increase in regulatory fines for non-compliance in chemical manufacturing (EEA, 2024). | Over 60% of major corporations expected to disclose Scope 3 emissions by 2025. |

PESTLE Analysis Data Sources

Our Green Cross PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable environmental research institutions, and leading industry-specific reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in accurate and current data.