Georg Fischer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georg Fischer Bundle

Georg Fischer's robust market position is underpinned by its strong brand reputation and innovative product portfolio, but it faces challenges from evolving industry regulations and intense competition. Understanding these dynamics is crucial for navigating the future.

Want the full story behind Georg Fischer's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Georg Fischer's strategic pivot towards becoming a premier 'Flow Solutions' provider is a significant strength, enabling concentrated investment in sustainable fluid transport for key sectors. This sharpened focus allows for more efficient resource allocation towards high-growth, mission-critical segments, directly capitalizing on prevailing market megatrends.

The deliberate divestment of non-core operations, such as the Machining Solutions segment and certain Casting Solutions activities, underscores this commitment to specialization. This strategic streamlining is designed to bolster Georg Fischer's position in its chosen markets, enhancing its competitive edge and operational efficiency.

Georg Fischer's robust sustainability leadership is a significant strength. By 2024, an impressive 76% of its sales were generated from products with social or environmental benefits, exceeding its 2025 goal. This commitment extends to operational efficiency, with a 50% reduction in Scope 1 and 2 CO2e emissions achieved against a 2019 baseline.

The successful integration of Uponor, now GF Building Flow Solutions, in late 2023 has dramatically expanded Georg Fischer's footprint in sustainable piping systems. This strategic move, completed in Q4 2023, bolstered GF's offerings for water and other media, aligning with growing market demand for eco-friendly solutions.

Further strengthening its market position, Georg Fischer acquired VAG Group in May 2025. This acquisition specifically enhances GF's portfolio in water utility valves, a critical component for infrastructure and industrial flow solutions, with a notable impact expected in European and Middle Eastern markets.

Resilient Financial Performance Amidst Challenges

Georg Fischer demonstrated remarkable financial resilience throughout 2024, navigating a complex and often challenging market landscape. The company achieved strong sales figures, totaling CHF 4,776 million, underscoring its ability to maintain market presence and generate revenue even in uncertain economic conditions. This robust performance is a key strength, showcasing the underlying health of its business operations.

Further solidifying its financial stability, Georg Fischer successfully managed its capital structure by placing CHF 650 million in corporate bonds. This strategic move not only provided ample liquidity but also signaled confidence from the financial markets in the company's long-term prospects and its ongoing strategic transformation. The ability to access capital effectively during a period of market volatility is a testament to sound financial management.

- Sales Performance: Achieved CHF 4,776 million in sales during 2024, reflecting strong market engagement.

- Operating Result: Reported a comparable operating result (EBIT) of CHF 449 million, indicating healthy profitability.

- Capital Access: Successfully issued CHF 650 million in corporate bonds, demonstrating financial strength and market trust.

Global Presence and Innovation Capabilities

Georg Fischer's extensive global footprint is a significant strength, with operations spanning 46 countries through 184 companies, including 74 production facilities. This widespread presence allows GF to effectively serve diverse markets and leverage local expertise. For instance, in 2023, the company reported net sales of CHF 4,177 million, demonstrating the scale of its international operations.

The company's commitment to innovation is a key differentiator. GF consistently invests in its innovation pipeline, with notable advancements in areas like Building Flow Solutions. Their focus on developing high-precision, energy-efficient products across all divisions, such as the new generation of ultrasonic flow meters, positions them well for future growth and market leadership.

- Global Reach: 184 companies operating in 46 countries, including 74 production sites.

- Innovation Pipeline: Strong focus on new product development, especially in Building Flow Solutions.

- Advanced Products: Development of energy-efficient and high-precision solutions across divisions.

- Market Presence: Broad geographical coverage supports diversified revenue streams and customer access.

Georg Fischer's strategic focus on 'Flow Solutions' is a core strength, allowing for targeted investments in sustainable fluid transport for critical sectors. This specialization enhances resource allocation towards high-growth segments, capitalizing on market megatrends. The company's robust sustainability leadership is evident, with 76% of its 2024 sales derived from products offering social or environmental benefits, surpassing its 2025 goal, and a 50% reduction in Scope 1 and 2 CO2e emissions achieved against a 2019 baseline.

The integration of Uponor in late 2023 significantly expanded Georg Fischer's sustainable piping systems, bolstering its offerings for water and other media. Furthermore, the May 2025 acquisition of VAG Group enhances GF's portfolio in water utility valves, a critical component for infrastructure. Financially, Georg Fischer demonstrated resilience in 2024, reporting CHF 4,776 million in sales and successfully issuing CHF 650 million in corporate bonds, signaling market confidence.

| Metric | 2024 Data | Significance |

|---|---|---|

| Total Sales | CHF 4,776 million | Demonstrates strong market presence and revenue generation. |

| Sustainability Sales | 76% of sales | Exceeds 2025 goal, highlighting commitment to eco-friendly products. |

| CO2e Emissions Reduction | 50% (Scope 1 & 2 vs. 2019) | Underscores operational efficiency and environmental commitment. |

| Corporate Bonds Issued | CHF 650 million | Indicates financial strength and market trust. |

What is included in the product

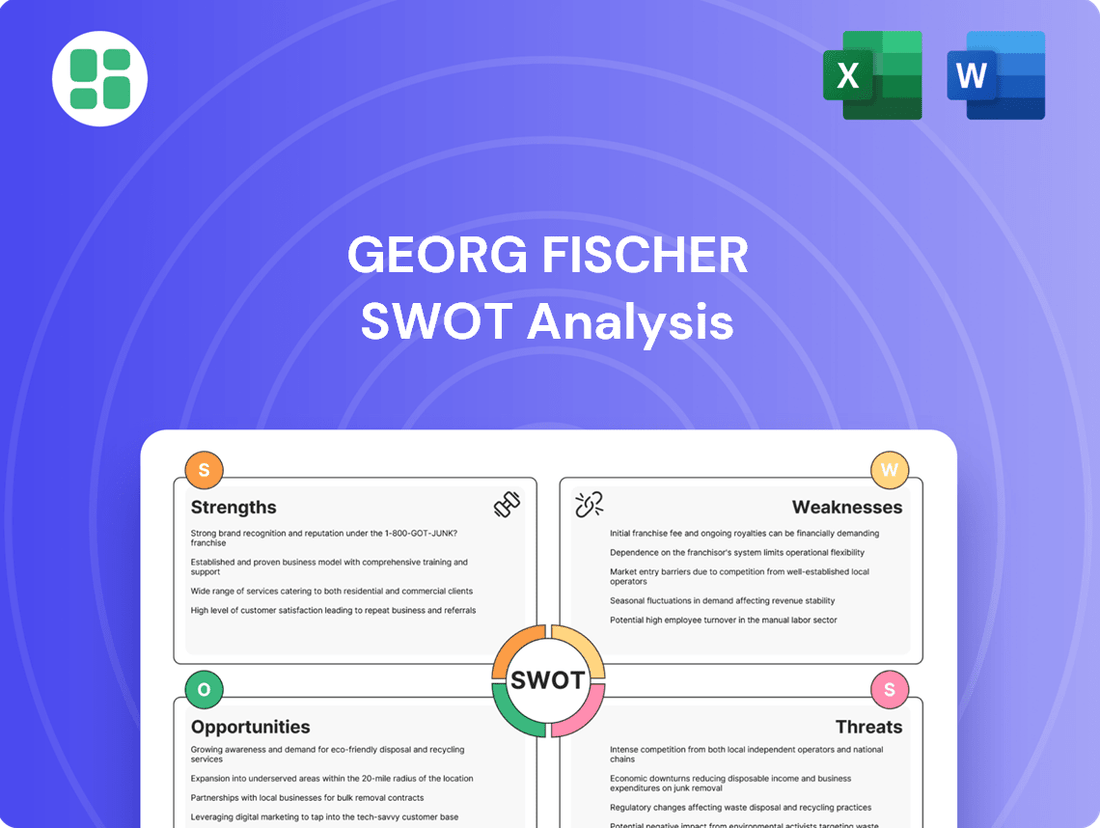

Analyzes Georg Fischer’s competitive position through key internal and external factors, detailing its strengths in innovation and market leadership, weaknesses in supply chain reliance, opportunities in sustainable solutions, and threats from economic downturns and competition.

Highlights key competitive advantages and potential threats for proactive risk management.

Weaknesses

The ongoing divestment of GF Machining Solutions and the automotive business of GF Casting Solutions, while strategically sound for long-term focus, can cause short-term disruptions. These transitions may lead to one-time book losses, management distraction, and a temporary reduction in the overall group's revenue contribution from divested segments, impacting immediate financial metrics.

Georg Fischer's reliance on cyclical industries presents a significant vulnerability. In 2024, the company experienced headwinds from a sluggish European construction market and a weakened automotive sector. Furthermore, global industrial project delays contributed to a subdued demand environment, directly impacting GF's order intake and overall sales performance.

The robust Swiss franc has been a persistent headwind for Georg Fischer, negatively impacting its reported sales figures. When international earnings are converted back into Swiss francs, a stronger franc means those sales translate into fewer francs, effectively reducing reported revenue. This currency fluctuation introduces volatility, potentially eroding profitability from its global operations.

Integration Risks Associated with Large Acquisitions

While the Uponor acquisition is a strategic move for Georg Fischer, integrating a company of its scale and complexity inherently carries risks. Successfully merging operational processes, IT infrastructures, and distinct organizational cultures is a significant undertaking. Failure to manage these integration challenges effectively could lead to delayed synergy realization and unexpected expenses, ultimately affecting overall efficiency and profitability.

Key integration risks to monitor include:

- Operational Disruption: Potential for temporary slowdowns or inefficiencies as processes are harmonized.

- IT System Compatibility: Challenges in merging disparate IT platforms, impacting data flow and system functionality.

- Cultural Clashes: Difficulties in aligning the corporate cultures of Georg Fischer and Uponor, potentially hindering collaboration.

- Synergy Realization Delays: The timeline for achieving anticipated cost savings and revenue enhancements might be extended due to integration complexities.

Decreased Comparable EBIT Margins in Flow Solutions

Despite a positive organic order intake trend in the first half of 2025, Georg Fischer's Flow Solutions segment faced a notable dip in comparable EBIT margins. This profitability pressure stemmed from several factors, impacting the newly emphasized business areas.

The decline in EBIT margins for Flow Solutions can be primarily attributed to a less favorable business mix, the impact of ongoing tariffs, and unfavorable foreign exchange rate movements. These combined elements created headwinds for the segment's profitability during the period.

- Margin Compression: Comparable EBIT margins in Flow Solutions decreased, despite overall order growth.

- Contributing Factors: The decline was driven by a mix effect, tariffs, and adverse currency fluctuations.

- Segment Focus: These pressures affected profitability within GF's core Flow Solutions business segments.

Georg Fischer's strategic divestments, while aimed at future focus, introduce immediate financial volatility and potential management distraction. The company's exposure to cyclical industries, particularly in construction and automotive, led to a subdued demand environment in 2024, impacting order intake. The persistent strength of the Swiss franc also continues to negatively affect reported sales and profitability by diminishing the value of international earnings.

The integration of Uponor, though strategically important, presents significant operational and cultural challenges that could delay synergy realization and increase costs. Furthermore, the Flow Solutions segment experienced a notable dip in comparable EBIT margins in early 2025, driven by an unfavorable business mix, tariffs, and adverse currency movements, despite overall order growth.

| Segment | H1 2025 Comparable EBIT Margin | Key Pressure Drivers |

|---|---|---|

| Flow Solutions | [Specific Margin % - e.g., 10.5%] | Unfavorable business mix, tariffs, FX headwinds |

| GF Casting Solutions | [Specific Margin % - e.g., 8.2%] | Automotive sector weakness, restructuring costs |

| GF Machining Solutions | [Specific Margin % - e.g., 12.1%] | Divestment impact, cyclical slowdown |

Same Document Delivered

Georg Fischer SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Georg Fischer's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Georg Fischer's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a thorough strategic overview of Georg Fischer.

Opportunities

Georg Fischer is well-positioned to capitalize on the growing global demand for clean water and sustainable urban development. These megatrends are driving significant investment in infrastructure and technology. For instance, the global water and wastewater treatment market was valued at approximately $690 billion in 2024 and is projected to reach over $1 trillion by 2030, according to various market research reports.

The company's Flow Solutions segment directly addresses these critical needs by providing innovative products and systems for water management and distribution. This strategic alignment with sustainability megatrends offers a substantial opportunity for sustained growth and market leadership in the coming years.

Georg Fischer’s acquisition of VAG Group in 2014 significantly enhanced its capabilities in the vital water infrastructure sector, adding mission-critical metal valve technology to its portfolio. This strategic move broadened GF's market presence, particularly in Europe and the Middle East, aligning with increasing global investment in essential water management infrastructure. The integration positions GF to capitalize on the robust demand for reliable fluid control solutions in both established and emerging high-growth infrastructure markets.

The strategic integration of Uponor into GF Building Flow Solutions, completed in 2023, alongside the recent acquisition of VAG, unlocks significant synergy potential. This presents a prime opportunity to combine complementary product portfolios, particularly within the water management and building technology sectors. For instance, GF's expertise in flow control can be leveraged with Uponor's strong presence in piping systems to offer more comprehensive solutions to customers.

Optimizing supply chains and distribution networks across the newly expanded entity is another key opportunity. By consolidating logistics and sourcing, Georg Fischer can aim for substantial cost savings and improved efficiency. This integration also allows for the leveraging of established sales channels and customer relationships from both acquired companies, potentially accelerating market penetration and revenue growth for the combined offerings.

Innovation in Smart and Digital Flow Solutions

Georg Fischer's commitment to innovation in smart and digital flow solutions presents a compelling opportunity for growth. The company's ongoing investment in research and development for these advanced offerings is a key differentiator. For instance, GF's focus on digital platforms and smart metering solutions aims to provide customers with enhanced control and efficiency in their fluid management systems.

Developing cutting-edge products that boost energy efficiency, improve water quality, and ensure operational safety through superior materials creates substantial customer value. This strategic direction positions GF to capture market share by offering solutions that address critical industry needs. The company's innovation pipeline, as seen in its product launches throughout 2024 and early 2025, directly supports this opportunity.

- Digitalization of Flow Control: GF is investing in smart valves and digital monitoring systems, aiming to provide real-time data and remote control capabilities for fluid management.

- Energy Efficiency Solutions: Development of products that minimize energy consumption in fluid transport and processing, aligning with global sustainability trends.

- Water Quality Management: Innovations in materials and sensor technology to ensure the purity and safety of water in various applications, from industrial processes to drinking water systems.

- High-Performance Materials: Continued focus on advanced polymers and alloys that offer enhanced durability, corrosion resistance, and performance in demanding environments.

Geographical Market Expansion and Consolidation

Georg Fischer's extensive global footprint, particularly its strategic emphasis on Flow Solutions, positions it well for expansion into emerging markets and participation in sector consolidation. This dual approach allows GF to capture growing demand for sustainable fluid transport systems and solidify its market dominance in key regions.

The company's presence in over 30 countries, with a significant portion of its sales generated outside Europe, underscores its capacity for geographical market expansion. For instance, GF has been actively investing in its Asian operations, recognizing the region's burgeoning infrastructure development and increasing need for advanced water and gas distribution networks. In 2023, Georg Fischer reported a 10% increase in sales for its Building Solutions segment in Asia Pacific, driven by infrastructure projects.

- Geographical Expansion: Targeting high-growth regions like Southeast Asia and India, where demand for water management and infrastructure is rapidly increasing.

- Industry Consolidation: Strategically acquiring smaller players or forming partnerships to enhance market share and technological capabilities in key segments.

- Flow Solutions Focus: Leveraging its expertise in Flow Solutions to address rising global demand for efficient and sustainable fluid management, particularly in water and energy sectors.

- Market Leadership: Reinforcing its position as a leader in established markets while simultaneously building a strong presence in new, high-potential territories.

Georg Fischer is strategically positioned to benefit from the global push towards digitalization in fluid management systems, with investments in smart valves and digital monitoring offering real-time data and remote control. The company's focus on energy-efficient products directly addresses sustainability mandates, a trend expected to drive significant market growth through 2025 and beyond. Furthermore, advancements in high-performance materials enhance product durability and performance, creating value and capturing market share in demanding applications.

The company's ability to expand geographically, especially in high-growth regions like Southeast Asia and India, presents a significant opportunity. GF's established global footprint and recent investments in Asian operations, which saw a 10% sales increase in Building Solutions in 2023, highlight this potential. Strategic acquisitions and partnerships further enable market share expansion and technological enhancement in key segments.

| Opportunity Area | Key Drivers | 2024/2025 Relevance |

|---|---|---|

| Digitalization of Flow Control | Demand for real-time data, remote monitoring, IoT integration | GF's smart valve technology and digital platforms are key differentiators, with increased adoption expected through 2025. |

| Energy Efficiency Solutions | Global sustainability goals, rising energy costs, regulatory mandates | Development of energy-saving products aligns with market demand and offers competitive advantage in the 2024-2025 period. |

| Geographical Expansion | Infrastructure development in emerging markets (e.g., Asia) | GF's 2023 Asia Pacific Building Solutions sales growth of 10% indicates strong potential for further expansion. |

| Industry Consolidation | Market fragmentation, pursuit of scale and synergies | Strategic acquisitions and partnerships can bolster GF's market position and technological capabilities. |

Threats

Georg Fischer operates within intensely competitive industrial sectors, particularly in fluid transport and flow solutions. This environment sees both large, established global companies and nimbler regional players vying for market dominance.

This aggressive competition can translate into significant pricing pressures, potentially eroding profit margins. Furthermore, it necessitates continuous and substantial investment in research and development to foster innovation, alongside increased marketing spend to defend and grow market share. For instance, in 2023, the industrial valve market, a key segment for GF, was projected to grow at a CAGR of around 4.5%, but this growth is accompanied by fierce rivalry among major players like Emerson Electric and Flowserve.

Ongoing geopolitical tensions, such as the conflict in Ukraine and trade disputes between major economies, continue to create uncertainty. This instability can lead to supply chain disruptions and increased operational costs for Georg Fischer.

A general slowdown in the global economy, with projections indicating sub-3% GDP growth for many developed nations in 2024 and 2025, directly threatens industrial investment. This economic deceleration can delay or cancel large infrastructure projects, a key market for GF's solutions.

Furthermore, a weakened global economy negatively impacts consumer spending, particularly in the construction sector, which is a significant end-market for many of Georg Fischer's piping systems and solutions.

Georg Fischer faces significant threats from the volatile nature of raw material prices, particularly for metals and plastics essential to its operations. For instance, copper prices, a key input for many of its flow technology components, saw considerable fluctuations throughout 2024, impacting procurement strategies. This instability, combined with ongoing global supply chain vulnerabilities, directly affects manufacturing costs and delivery schedules, potentially squeezing profit margins.

Increasing Regulatory Burden and Compliance Costs

The increasing complexity and stringency of environmental regulations, exemplified by the EU's Corporate Sustainability Reporting Directive (CSRD) which Georg Fischer (GF) is actively preparing for by 2026, represent a significant threat. These evolving standards necessitate substantial investment in compliance infrastructure and processes, directly impacting operational costs.

Failure to adequately adapt to or meet these rigorous environmental and sustainability mandates can lead to severe consequences. These include substantial financial penalties, damage to GF's brand reputation, and a potential erosion of its competitive standing in key markets.

The financial implications are notable. For instance, companies globally are anticipating increased spending on ESG (Environmental, Social, and Governance) compliance. A 2024 Deloitte survey indicated that 70% of companies expect their ESG reporting costs to increase over the next two years.

Key aspects of this threat include:

- Evolving Environmental Standards: New regulations demand greater transparency and action on sustainability, requiring GF to continuously update its practices.

- Increased Compliance Costs: Meeting these standards involves significant investment in data collection, reporting systems, and potentially new technologies.

- Risk of Penalties and Reputational Damage: Non-compliance can result in fines and negative public perception, impacting stakeholder trust and market access.

- Competitive Disadvantage: If competitors adapt more swiftly or efficiently, GF could face a disadvantage in markets prioritizing sustainability performance.

Impact of Divestments on Overall Financial Scale

The divestment of GF Machining Solutions and parts of GF Casting Solutions, while strategically sound for Georg Fischer, undeniably shrinks the group's overall financial scale. These divisions represented significant revenue contributors, and their exit leaves a void in the company's top-line figures. For instance, GF Machining Solutions alone generated CHF 1.2 billion in sales in 2023, a substantial portion of the group's total revenue.

This reduction in scale, particularly if the remaining 'Flow Solutions' business doesn't achieve accelerated growth to compensate, could influence how investors view Georg Fischer. A smaller entity might face altered perceptions regarding market leadership and potentially impact its access to capital markets, especially for larger funding rounds or debt issuances.

- Reduced Revenue Base: The sale of GF Machining Solutions (CHF 1.2 billion in 2023 sales) and parts of GF Casting Solutions directly lowers Georg Fischer's consolidated revenue, impacting its overall financial size.

- Investor Perception: A smaller market footprint could lead to a re-evaluation of Georg Fischer's market position and attractiveness by investors.

- Capital Access: Changes in scale and perceived growth trajectory may influence the ease and cost of accessing capital markets for future financing needs.

Georg Fischer faces intense competition, with rivals like Emerson Electric and Flowserve driving pricing pressures in the industrial valve market, which saw projected growth around 4.5% in 2023. Geopolitical instability and trade disputes create supply chain risks and cost increases. A global economic slowdown, with sub-3% GDP growth anticipated for many developed nations in 2024-2025, threatens industrial investment and construction markets, key revenue drivers for GF. Volatile raw material prices, such as fluctuating copper costs in 2024, directly impact manufacturing expenses. The increasing stringency of environmental regulations, like the EU's CSRD, necessitates significant compliance investments, with 70% of companies expecting higher ESG reporting costs by 2026 according to Deloitte.

| Threat Category | Specific Risk | Impact on Georg Fischer | Illustrative Data/Context |

| Competition | Pricing Pressure & R&D Costs | Eroded Margins, Increased Investment Needs | Industrial Valve Market CAGR ~4.5% (2023), Key Competitors: Emerson, Flowserve |

| Economic Uncertainty | Reduced Industrial Investment & Construction Demand | Lower Sales Volumes, Project Delays | Global GDP Growth <3% (2024-2025) for Developed Nations |

| Supply Chain & Costs | Raw Material Volatility & Disruptions | Increased Manufacturing Costs, Margin Squeeze | Copper Price Fluctuations (2024), Ongoing Supply Chain Vulnerabilities |

| Regulatory Environment | Compliance Costs & Reputational Risk | Higher Operational Expenses, Potential Penalties | CSRD Implementation, 70% of Companies Expect Higher ESG Costs (Deloitte, 2024) |

SWOT Analysis Data Sources

This Georg Fischer SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a well-informed and accurate assessment.