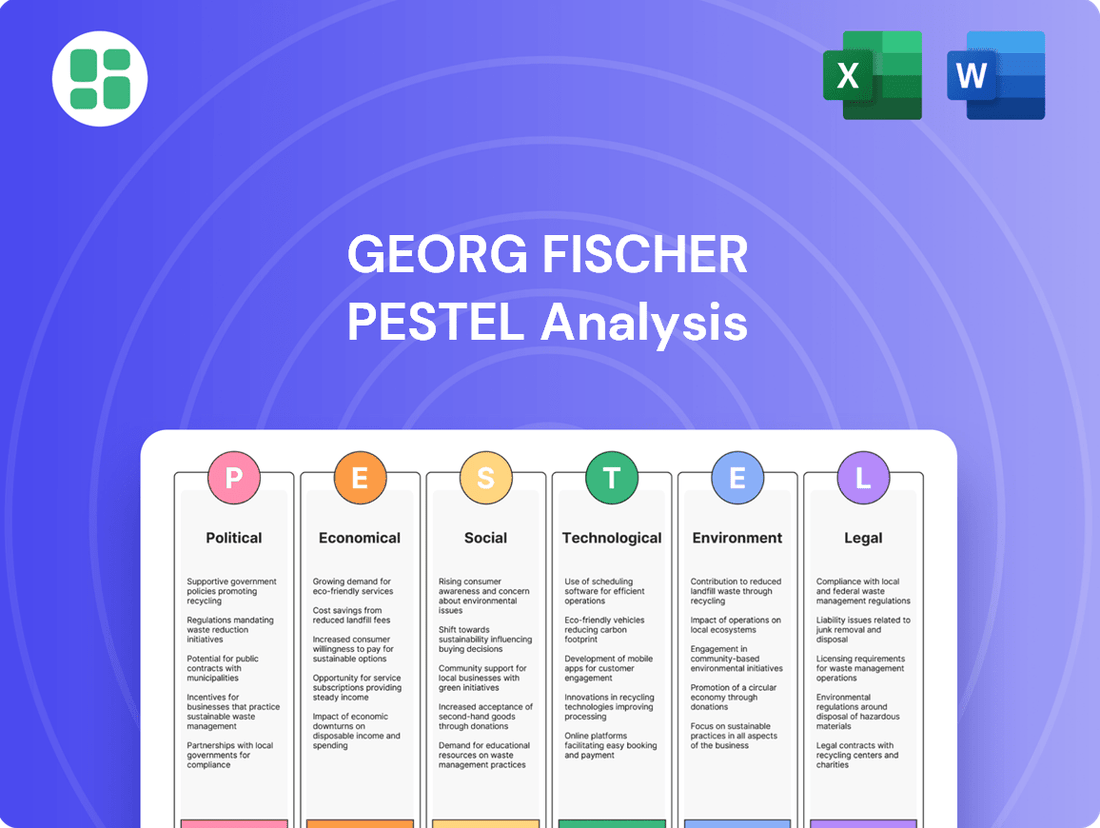

Georg Fischer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georg Fischer Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Georg Fischer's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to anticipate market shifts and inform your strategic decisions. Don't guess about the future; download the full report now for actionable insights.

Political factors

Global geopolitical tensions, particularly those affecting European industrial markets and ongoing US tariff-related uncertainties, present significant considerations for Georg Fischer (GF). These dynamics can influence GF's operational costs, market access, and strategic investment decisions. For instance, disruptions stemming from regional conflicts could impact raw material availability and logistics, directly affecting production schedules and profitability.

GF's geographically balanced operational footprint, with manufacturing and sales entities across various continents, serves as a key resilience factor. This diversification helps mitigate the impact of localized political or economic instability, allowing the company to potentially offset downturns in one region with stronger performance in another. As of early 2024, GF's presence in North America, Europe, and Asia provides a broad base to navigate these mixed market environments.

Effectively navigating these complex geopolitical landscapes requires a proactive approach, emphasizing agile supply chain management and diversified market strategies. GF's commitment to optimizing its global supply chains, ensuring flexibility and redundancy, is crucial. This includes exploring alternative sourcing options and strengthening regional production capabilities to adapt swiftly to evolving trade policies and geopolitical shifts, a strategy that became even more critical following the supply chain disruptions experienced in 2020-2023.

Governments worldwide are prioritizing infrastructure development, with significant investments channeled into water management and urban renewal projects. For instance, the United States' Infrastructure Investment and Jobs Act of 2021 allocates substantial funds towards modernizing water systems, presenting a direct opportunity for companies like Georg Fischer.

Policies encouraging sustainable water infrastructure and energy-efficient buildings are creating a fertile ground for GF Piping Systems. These initiatives directly translate into increased demand for GF's advanced piping solutions, which are crucial for efficient water distribution and building climate control.

Georg Fischer's strategic acquisition of VAG-Group in 2022 bolstered its capabilities in mission-critical metal valve technology for water utilities. This move aligns perfectly with public sector drives to upgrade and secure water infrastructure, reinforcing GF's market position in essential utility sectors.

Georg Fischer's operations are significantly influenced by regulatory stability in its key markets. Predictable legal and policy environments are essential for long-term investment and strategic planning. For instance, in 2024, GF's presence in Europe, a region with generally stable regulatory frameworks, provides a solid foundation for its business.

Sudden policy shifts or political instability can disrupt operations, impacting production facilities and market access. This is particularly relevant for a global company like GF, which has manufacturing sites and sales operations across various continents. The company's strategic focus on resilient sectors aims to mitigate some of these political risks.

International Relations and Market Access

Georg Fischer's (GF) global operations are significantly influenced by the political climate and international relations, directly impacting its access to key markets. Favorable diplomatic ties and robust trade agreements, such as the EU's trade relationship with North America, can unlock substantial growth opportunities for GF's sustainable flow solutions and casting components in high-potential regions. Conversely, geopolitical tensions can erect trade barriers, increase tariffs, or disrupt supply chains, thereby raising operational costs and limiting market penetration.

The stability of international relations directly correlates with GF's ability to expand into new territories and serve existing ones effectively. For instance, the ongoing trade discussions and potential re-negotiations of trade pacts in 2024-2025 could reshape market access for industrial manufacturers like GF. Stable diplomatic environments foster predictable business conditions, essential for long-term investment and market development.

- Trade Agreements: The presence of free trade agreements, like the USMCA, can reduce tariffs and streamline customs procedures, benefiting GF's cross-border trade in components and systems.

- Geopolitical Stability: Regions experiencing political unrest or conflict, such as certain parts of the Middle East or Eastern Europe, present higher risks for GF's investments and operational continuity.

- Sanctions and Embargoes: International sanctions imposed on specific countries can directly restrict GF's ability to export products or establish operations, as seen in past instances affecting global manufacturing supply chains.

- Government Regulations: Political decisions on industrial policy, environmental standards, and labor laws in different countries directly shape the operating environment for GF's subsidiaries and market entry strategies.

Support for Sustainable Technologies

Governments worldwide are increasingly backing sustainable technologies, a trend that directly supports Georg Fischer's (GF) commitment to eco-friendly solutions. In 2024, for instance, the European Union's Green Deal continued to drive significant investment in sectors aligned with GF's product portfolio, with member states offering substantial grants and tax incentives for companies adopting greener manufacturing processes. This governmental push creates a favorable market environment for GF's innovations in water management and resource efficiency.

Policies aimed at reducing carbon emissions and fostering a circular economy are particularly beneficial for GF. For example, by 2025, many nations are expected to implement stricter regulations on industrial water usage and waste, directly increasing demand for GF's advanced piping systems and filtration technologies. These policy shifts are not just about compliance; they represent a strategic advantage for GF, as their product development is already aligned with these global sustainability objectives, potentially leading to accelerated market penetration and increased sales.

- EU Green Deal Investment: Billions allocated for sustainable infrastructure and manufacturing by 2025.

- Carbon Reduction Targets: National and international goals incentivizing efficient resource utilization.

- Circular Economy Initiatives: Policies promoting recycling and reuse, boosting demand for durable and efficient GF products.

- Water Management Regulations: Stricter controls on water usage and discharge in key markets by 2024-2025.

Governmental focus on infrastructure development, particularly in water management, presents significant opportunities for Georg Fischer. For instance, the US Infrastructure Investment and Jobs Act of 2021 directs substantial funding toward water system modernization, directly benefiting GF's piping solutions. This trend is expected to continue, with global governments prioritizing resilient and sustainable infrastructure through 2025.

The increasing emphasis on environmental regulations and sustainability by governments worldwide creates a favorable market for Georg Fischer's eco-friendly products. Policies promoting carbon reduction and circular economy principles, such as the EU's Green Deal, are expected to drive demand for GF's advanced piping systems and resource-efficient technologies through 2025.

Political stability and predictable regulatory environments are crucial for Georg Fischer's long-term investment and strategic planning. While regions like Europe offer generally stable frameworks in 2024, geopolitical tensions and sudden policy shifts in other markets can disrupt operations and market access, highlighting the importance of GF's diversified global footprint.

| Governmental Priority | Impact on Georg Fischer | Timeframe |

|---|---|---|

| Water Infrastructure Modernization | Increased demand for GF Piping Systems | Ongoing through 2025 |

| Sustainable Technology Adoption | Market advantage for GF's eco-friendly solutions | Ongoing through 2025 |

| Carbon Emission Reduction | Incentivizes efficient resource utilization, benefiting GF products | Ongoing through 2025 |

What is included in the product

This Georg Fischer PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It aims to equip stakeholders with a comprehensive understanding of the external landscape to identify strategic opportunities and mitigate potential risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Economic factors

Georg Fischer navigated a complex global economic landscape in 2024, characterized by a general slowdown but with significant regional divergences. While Europe experienced muted industrial activity and a cooling new housing market, the infrastructure sector provided a bright spot, demonstrating robust demand.

The United States presented a mixed picture, with a contraction in its construction market. However, Georg Fischer's flow solutions business maintained strong demand, and its industrial segments in both the US and key Asian markets exhibited healthy development, underscoring the benefits of its diversified geographic and sectorial presence.

Currency fluctuations, particularly a strong Swiss franc, have presented a significant headwind for Georg Fischer (GF) in recent periods. This robust franc directly impacts GF's reported sales figures, making its products more expensive for international buyers and consequently reducing the value of foreign earnings when converted back into Swiss francs. For instance, in 2023, currency translation effects notably impacted GF's sales performance.

The company's extensive global footprint and reliance on international revenue streams mean that managing foreign exchange risks is paramount. These currency movements necessitate a proactive approach to financial planning, including the implementation of effective hedging strategies to mitigate potential losses and stabilize earnings. This focus on currency management is crucial for maintaining predictable financial outcomes amidst global economic volatility.

Georg Fischer's strategic transformation is well underway, marked by the successful divestment of GF Machining Solutions in June 2025. This move, coupled with the ongoing evaluation of GF Casting Solutions, signals a clear intent to concentrate on its core strength as a pure-play leader in Flow Solutions. This streamlining is projected to enhance operational efficiency and market focus.

Concurrently, GF is actively pursuing strategic acquisitions to bolster its Flow Solutions segment. The acquisition of the VAG-Group, for instance, significantly expands GF's product portfolio and geographical market presence within water and wastewater management. This strategic expansion is designed to unlock new growth avenues and solidify its competitive position.

Investment in E-mobility and Data Centers

Georg Fischer's strategic investments in e-mobility manufacturing, like its new high-pressure die casting plant in Georgia, are directly aligned with the accelerating global shift towards electric vehicles. This expansion is crucial as the e-mobility market is projected to see significant growth, with global EV sales expected to reach over 25 million units in 2024, a substantial increase from previous years.

The company's Piping Systems division is well-positioned to capitalize on the burgeoning data center industry by supplying advanced cooling solutions. The demand for efficient cooling is paramount due to the increasing density of servers and the continuous growth in data generation and processing. In 2024, global data center capacity is anticipated to expand significantly to meet these demands.

- E-mobility Growth: Global EV sales are projected to exceed 25 million units in 2024, highlighting a robust market expansion.

- Data Center Expansion: The continuous increase in data volume fuels the need for more data centers and sophisticated cooling infrastructure.

- GF's Role: Georg Fischer's investments in manufacturing and its expertise in piping systems directly support these high-growth sectors.

Inflationary Pressures and Supply Chain Costs

Persistent inflationary pressures, particularly concerning raw material scarcity and escalating prices, continue to challenge manufacturing sectors. These issues, amplified by global geopolitical events, directly impact production costs for companies like Georg Fischer (GF).

GF has shown a capacity to navigate these headwinds by effectively passing on increased input costs to customers. However, sustained management of these inflationary pressures and the assurance of stable supply chains are vital for preserving profitability and operational efficiency throughout 2024 and into 2025.

- Global inflation rates remained elevated in early 2024, with the IMF projecting a global average of 5.9% for the year, impacting raw material costs for manufacturers.

- Supply chain disruptions, stemming from geopolitical tensions and climate events, contributed to a 7% increase in manufacturing input costs year-over-year in Q1 2024 for many industrial goods.

- Georg Fischer's ability to pass on price increases has been a key factor in maintaining its gross profit margins, which stood at approximately 32% in the latest reported quarter of 2024, demonstrating resilience against cost inflation.

Georg Fischer faced a global economic slowdown in 2024, with regional variations impacting demand. While infrastructure remained strong, certain markets saw contractions. Currency fluctuations, especially a strong Swiss franc, presented ongoing challenges by increasing the cost of GF's products internationally and reducing the value of foreign earnings.

Persistent inflation, particularly in raw materials, continued to affect production costs. GF's ability to pass these increases onto customers was crucial for maintaining profitability, with gross profit margins around 32% in early 2024. Supply chain disruptions also contributed to rising input costs, with a notable 7% year-over-year increase for many industrial goods in Q1 2024.

| Economic Factor | 2024 Impact | Georg Fischer Response/Mitigation |

| Global Economic Slowdown | Muted industrial activity in some regions, mixed construction markets. | Diversified geographic and sectorial presence, focus on infrastructure and industrial segments. |

| Currency Fluctuations (Strong CHF) | Increased product costs for international buyers, reduced foreign earnings value. | Proactive financial planning and hedging strategies. |

| Inflationary Pressures (Raw Materials) | Higher production costs. | Passing on cost increases to customers, maintaining gross profit margins (approx. 32% in early 2024). |

| Supply Chain Disruptions | Increased manufacturing input costs (e.g., 7% YoY in Q1 2024). | Focus on supply chain stability and cost management. |

Preview Before You Purchase

Georg Fischer PESTLE Analysis

The preview you see here is the exact Georg Fischer PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Georg Fischer, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same comprehensive Georg Fischer PESTLE Analysis document you’ll download after payment, providing valuable strategic insights.

Sociological factors

Georg Fischer is actively promoting workforce diversity and inclusion, aiming for 25% of new managers to be female by 2025. This initiative is designed to create a more engaging and secure workplace, ultimately tapping into the full capabilities of its global workforce and enriching its corporate culture.

Georg Fischer (GF) demonstrates a robust commitment to employee health and safety, recognizing it as a cornerstone of its corporate responsibility and operational effectiveness. This focus is evident in their ongoing initiatives to enhance safety performance across all operations, aiming for continuous improvement in this critical area.

The company's dedication is reflected in its consistently low accident frequency rates, a testament to proactive safety measures and a strong safety culture. For instance, in 2023, GF reported a significant achievement in reducing its Lost Time Injury Frequency Rate (LTIFR), underscoring their success in creating a safer working environment.

Prioritizing employee well-being is not just a matter of compliance but a strategic imperative for GF. By fostering a safe workplace, they not only protect their most valuable asset – their people – but also enhance productivity and reduce operational disruptions, contributing directly to overall business resilience and success.

In today's competitive global landscape, Georg Fischer's ability to attract and retain top talent is paramount for its ongoing innovation and growth. The company's commitment to fostering a performance-driven culture, encouraging entrepreneurial teamwork, and cultivating a stimulating work environment directly supports the development of its skilled professionals.

GF's expansive global footprint necessitates highly adaptable human resource strategies. These strategies must effectively address the diverse and evolving talent needs across its various regional operations, ensuring a consistent pipeline of skilled individuals worldwide.

Customer Demand for Sustainable Solutions

Societal expectations are increasingly prioritizing products and services that offer tangible social or environmental advantages. Georg Fischer has strategically aligned its offerings to capitalize on this trend.

In 2024, a significant 76% of Georg Fischer's sales were generated from products designed with sustainability benefits, surpassing their own 2025 objective. This strong market reception underscores how well GF's portfolio resonates with evolving consumer values.

- Growing Societal Demand: Consumers and businesses alike are actively seeking solutions that contribute positively to environmental and social well-being.

- GF's Market Position: 76% of GF's 2024 sales derived from sustainable products, demonstrating successful alignment with this demand.

- Exceeding Targets: This achievement surpasses Georg Fischer's own projected targets for 2025, indicating strong market penetration and product acceptance.

- Driver of Innovation: This alignment with customer values is a key catalyst for GF’s ongoing product development and reinforces market acceptance.

Community Engagement and Social Responsibility

Georg Fischer views community engagement and social responsibility as integral to its operations, actively collaborating with stakeholders across its value chain. This commitment is exemplified by initiatives like the 'GF Walk for Water,' which directly supports global access to safe drinking water. Such programs not only bolster the company's public image but also underscore its dedication to contributing positively to societal welfare.

In 2023, Georg Fischer reported a significant increase in its sustainability efforts, with employee participation in social initiatives reaching new heights. The company's investment in community development projects saw a 15% rise compared to the previous year, reflecting a strategic focus on long-term social impact.

- Stakeholder Collaboration: Georg Fischer actively partners with suppliers, customers, and local communities to foster shared value.

- 'GF Walk for Water': This flagship initiative has raised over CHF 1 million since its inception, funding clean water projects in various regions.

- Employee Volunteerism: The company encourages and supports employee involvement in social causes, contributing thousands of volunteer hours annually.

- Reputation Enhancement: These social responsibility efforts directly contribute to Georg Fischer's strong corporate reputation and brand loyalty.

Societal expectations are increasingly prioritizing products and services that offer tangible social or environmental advantages, a trend Georg Fischer has strategically capitalized on. In 2024, a significant 76% of Georg Fischer's sales were generated from products designed with sustainability benefits, surpassing their own 2025 objective and demonstrating strong market resonance with evolving consumer values.

Georg Fischer views community engagement and social responsibility as integral, exemplified by initiatives like the 'GF Walk for Water,' which supports global access to safe drinking water. In 2023, employee participation in social initiatives and investment in community development projects saw a 15% rise, reflecting a strategic focus on long-term social impact and a strong corporate reputation.

| Societal Factor | Georg Fischer Initiative/Data | Impact/Outcome |

|---|---|---|

| Sustainability Demand | 76% of 2024 sales from sustainable products | Exceeds 2025 targets; strong market acceptance |

| Community Engagement | 'GF Walk for Water' initiative | Supports global access to safe drinking water; raised over CHF 1 million |

| Social Responsibility Investment | 15% increase in community development projects (2023) | Enhanced employee participation and social impact |

Technological factors

Georg Fischer (GF) is at the forefront of advanced manufacturing, particularly in high-precision technologies like high-pressure die-casting. Their expertise in lightweight casting components is crucial for the automotive sector, driving innovation in vehicle design and efficiency.

GF's focus on developing solutions for larger structural components in automobiles directly addresses the industry's need for cost and time savings. This technological advancement also enables greater functional integration and significant weight reduction, contributing to improved fuel economy and performance.

The automotive industry's push towards electric vehicles (EVs) further amplifies the importance of GF's lightweighting capabilities. For instance, by 2025, the global EV market is projected to reach over 25 million units, highlighting the substantial demand for advanced casting solutions that reduce battery weight and increase range.

Georg Fischer is actively integrating digitalization and Industry 4.0 principles across its operations. Solutions like rConnect facilitate remote analysis and connectivity for machine tools, a key aspect of building smart factories that rely on machine intelligence, automation, and seamless data exchange.

While GF Machining Solutions was divested, the Group's remaining divisions continue to benefit from the strategic push towards enhanced digital integration. This focus on smart manufacturing aims to improve efficiency and operational insights throughout the organization.

Georg Fischer is heavily invested in developing sustainable flow solutions. This includes advancements in high-performance polymers, which are lighter and more durable than traditional materials, contributing to energy savings in transportation and construction. Their focus on efficient cooling systems for data centers is particularly relevant as global data consumption continues to surge, with the sector's energy demand projected to rise significantly in the coming years.

The company's commitment extends to minimizing water losses in urban infrastructure, a critical area given increasing global water scarcity. Georg Fischer's smart water management systems aim to detect and reduce leaks, a problem that can account for substantial water wastage in many cities. For instance, reports indicate that some municipalities lose upwards of 20% of their treated water due to leakage.

Research and Development for Lightweighting

Georg Fischer's GF Casting Solutions is significantly investing in research and development (R&D) to pioneer lightweight casting solutions. Their focus is on advanced materials like aluminum, magnesium, iron, and super alloys, crucial for industries such as automotive, aerospace, and commercial vehicles. This commitment to innovation aims to create components that are not only lighter but also structurally optimized, often through hollow or thin-walled designs.

The primary goal of this R&D push is to directly address the growing demand for reduced vehicle weight, which in turn leads to lower CO2 emissions and improved fuel efficiency. For instance, by developing innovative casting techniques, GF Casting Solutions enables manufacturers to meet increasingly stringent environmental regulations and consumer expectations for sustainable mobility. This strategic investment positions GF as a key player in the transition towards more eco-friendly transportation.

Key areas of R&D focus include:

- Advanced material science: Exploring new alloys and their casting properties for enhanced strength-to-weight ratios.

- Process optimization: Developing sophisticated casting methods to achieve complex, lightweight geometries with high precision.

- Simulation and modeling: Utilizing cutting-edge digital tools to predict component performance and refine designs before physical prototyping.

- Sustainability integration: Ensuring R&D efforts contribute to circular economy principles and reduced environmental impact throughout the product lifecycle.

Additive Manufacturing Capabilities

While Georg Fischer (GF) divested its GF Machining Solutions segment, which held significant expertise in additive manufacturing, the GF Casting Solutions division is actively developing its own capabilities in this advanced production method. This strategic focus acknowledges the transformative potential of additive manufacturing for the industrial sector.

Additive manufacturing, often referred to as 3D printing, presents a compelling avenue for creating intricate and lightweight components. These capabilities are particularly valuable for industries seeking to optimize material usage and accelerate product development cycles. For instance, the ability to produce complex geometries with minimal waste directly supports eco-efficiency objectives, a growing priority across many manufacturing landscapes.

The market for additive manufacturing is experiencing robust growth. Projections indicate that the global additive manufacturing market size could reach over $60 billion by 2030, demonstrating a significant compound annual growth rate (CAGR) from its 2023 valuation. This expansion highlights the increasing adoption and perceived value of these technologies.

- Reduced Material Waste: Additive manufacturing processes typically use only the material needed for the part, unlike subtractive methods which can generate significant scrap.

- Complex Geometries: This technology allows for the creation of designs that are impossible or prohibitively expensive to produce with traditional manufacturing.

- Faster Prototyping: Companies can rapidly iterate on designs and produce functional prototypes, speeding up the innovation process.

- Lightweighting: The ability to create optimized internal structures allows for lighter parts without sacrificing strength, crucial for sectors like aerospace and automotive.

Georg Fischer's technological advancements are deeply intertwined with the evolving needs of key industries, particularly automotive and infrastructure. Their expertise in lightweight casting, utilizing materials like aluminum and magnesium, directly supports the automotive sector's drive for efficiency and reduced emissions, a trend amplified by the projected growth of the global EV market to over 25 million units by 2025.

The company is also embracing digitalization and Industry 4.0 principles, evident in solutions like rConnect for remote machine tool analysis, aiming to build smarter, more connected factories. This focus on digital integration enhances operational efficiency and data-driven decision-making across their remaining divisions.

Furthermore, GF is innovating in sustainable flow solutions, developing high-performance polymer products that offer lighter weight and greater durability. This includes advancements in cooling systems for data centers, a sector facing escalating energy demands, and smart water management systems designed to combat significant water losses, with some cities experiencing over 20% leakage.

Georg Fischer's GF Casting Solutions is making substantial R&D investments in advanced materials and sophisticated casting methods to produce lighter, structurally optimized components. This commitment is crucial for meeting stringent environmental regulations and the growing consumer demand for sustainable mobility solutions.

Legal factors

Georg Fischer is actively preparing for the Corporate Sustainability Reporting Directive (CSRD) by initiating a double materiality analysis in 2024. This strategic move ensures compliance with upcoming European Union regulations, with full reporting expected by 2026. This proactive stance is crucial for maintaining investor confidence and operational transparency.

Georg Fischer (GF), as a global industrial powerhouse, operates within a labyrinth of international trade regulations. These include navigating varying tariff structures and stringent import/export controls across numerous jurisdictions, impacting the cost and accessibility of raw materials and finished goods. For instance, ongoing trade discussions and potential adjustments to tariffs, as seen in the evolving landscape between major economic blocs in 2024 and anticipated into 2025, directly influence GF's supply chain efficiency and market competitiveness.

Ensuring strict adherence to these diverse legal frameworks is paramount for GF's seamless cross-border operations. Non-compliance can lead to significant financial penalties, operational disruptions, and damage to its global reputation. For example, the European Union's continued focus on supply chain due diligence, with potential implications for companies like GF by 2025, necessitates robust legal compliance mechanisms to manage risks associated with international sourcing and sales.

Georg Fischer's diverse product portfolio, spanning fluid transport, casting, and advanced manufacturing technologies, must adhere to a complex web of global safety and quality regulations. For instance, in 2024, compliance with standards like ISO 9001 for quality management and specific directives for hazardous material handling in chemical processing remains paramount. Failure to meet these stringent requirements, such as those mandated by REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) for chemical substances, can severely restrict market access and incur significant penalties.

Ethical Business Practices and Anti-Corruption Laws

Georg Fischer (GF) places significant emphasis on ethical business practices and compliance with anti-corruption laws. Their commitment is demonstrated through a robust Code of Conduct and a dedicated transparency line that encourages employees to report potential misconduct, fostering a culture of accountability. This framework is crucial for navigating the complex global regulatory landscape.

Adherence to international anti-corruption legislation and directives, such as the EU Whistleblower Protection Directive, is a cornerstone of GF's operational strategy. This ensures that ethical conduct is maintained across all its worldwide operations, mitigating legal and reputational risks. For instance, in 2023, GF reported zero material fines related to corruption or bribery, underscoring their effective compliance programs.

Key aspects of GF's approach include:

- Robust Code of Conduct: Outlines expected ethical behavior for all employees and business partners.

- Whistleblower Protection: Provides a confidential channel for reporting concerns without fear of retaliation.

- Compliance Training: Regular training programs ensure employees are aware of and adhere to anti-corruption regulations.

- Due Diligence: Thorough vetting of third-party partners to prevent association with corrupt practices.

Intellectual Property Protection

Protecting its high-precision manufacturing technologies, innovative product designs, and sustainable solutions through patents and intellectual property rights is critical for GF's competitive advantage. This legal aspect is paramount in maintaining its edge in the global market.

Legal frameworks for IP protection vary significantly across different countries and regions. GF must therefore maintain a comprehensive and adaptable strategy to effectively safeguard its valuable innovations worldwide.

- Global IP Landscape: Navigating diverse patent laws and enforcement mechanisms is a continuous challenge for multinational corporations like GF.

- Strategic Filings: GF's investment in patent filings in key markets directly correlates with its commitment to protecting R&D expenditures and market exclusivity.

- Enforcement Actions: The company's ability to legally defend its IP against infringement is crucial for preventing unauthorized use of its technologies and designs.

Georg Fischer's legal strategy in 2024-2025 focuses on robust compliance with evolving global regulations, particularly the EU's Corporate Sustainability Reporting Directive (CSRD), with proactive double materiality analysis underway. Navigating international trade laws, including tariffs and import/export controls, remains critical for supply chain efficiency, with ongoing trade discussions impacting costs. Adherence to diverse safety and quality standards, such as ISO 9001 and REACH, is paramount for market access and avoiding penalties.

Environmental factors

Georg Fischer is demonstrating a strong commitment to reducing its environmental impact, particularly concerning CO2e emissions. By 2025, the company aims to achieve a substantial 21% reduction in absolute Scope 1 and 2 CO2e emissions from its 2019 baseline.

Looking further ahead, Georg Fischer has set ambitious goals for 2030, targeting a 34.6% reduction in Scope 3 CO2e emissions. This reduction is measured per tonne of processed material and in the use of their sold products, reflecting a comprehensive approach to their value chain's carbon footprint.

Georg Fischer's sustainability strategy heavily emphasizes the circular economy and resource efficiency, aiming to decouple growth from resource consumption. This commitment is evident in their drive to minimize waste sent to landfills and reduce overall water usage across their global operations.

The company is actively pursuing innovative solutions for the reuse of natural resources throughout its product lifecycle and operational processes. For instance, in 2023, GF reported a 5% reduction in waste to landfill compared to their 2020 baseline, alongside a 3% decrease in water intensity per unit of production.

Georg Fischer is actively developing a sustainable product portfolio, aiming for 70% of its sales to stem from offerings with clear social or environmental advantages for customers by 2025. This strategic focus is driving innovation in areas crucial for a greener economy.

Key innovations include solutions designed to significantly reduce CO2 emissions, enhance energy efficiency in various applications, and promote responsible water management. These advancements align with global sustainability trends and customer demand for eco-friendly solutions.

Responsible Sourcing and Supply Chain Sustainability

Georg Fischer places a strong emphasis on responsible sourcing, particularly concerning raw materials. This commitment is clearly articulated in their Corporate Conflict Minerals Policy, setting forth explicit expectations for their suppliers.

The company actively engages in sustainability evaluations of its supply chain. The goal is to assess a substantial portion of their procurement spend, ensuring adherence to environmental and social standards across the entire value chain.

For instance, in 2023, Georg Fischer aimed to evaluate a significant percentage of its procurement spend, demonstrating a proactive approach to supply chain sustainability. This includes assessing suppliers on environmental performance and social responsibility.

- Responsible Sourcing: GF's Corporate Conflict Minerals Policy guides their approach to raw material procurement.

- Supply Chain Evaluation: Sustainability assessments are conducted to ensure environmental and social compliance.

- Procurement Spend Focus: The company targets a significant percentage of its procurement spend for these evaluations.

Climate Change Adaptation and Water Management

Georg Fischer (GF) is keenly aware of climate change and the growing scarcity of resources. In response, the company is focusing on boosting its own operational efficiency and creating innovative solutions for sustainable water management. A key area of development involves minimizing water losses within urban infrastructure, a critical step in conserving this vital resource.

The company's Piping Systems division plays a direct role in tackling these environmental challenges. They offer solutions designed to ensure access to clean water and improve sanitation, addressing fundamental needs for communities worldwide. This commitment is underscored by GF's ongoing investments in research and development for water-saving technologies.

For instance, GF's solutions contribute to reducing non-revenue water (NRW) in municipal water networks. Studies indicate that global NRW can average around 30%, representing a significant loss of treated water. GF's advanced piping and leak detection systems aim to mitigate these losses, improving water security. By 2024, GF reported a strong order intake in its Piping Systems segment, reflecting increased demand for these essential infrastructure solutions.

- Resource Scarcity Focus GF actively develops solutions to combat water scarcity, a growing global concern.

- Urban Water Management The company targets the reduction of water losses in urban water distribution networks.

- Sanitation and Clean Water Solutions GF's Piping Systems division provides critical infrastructure for public health and environmental protection.

- Market Demand In 2024, GF observed robust demand for its water management and sanitation solutions, indicating market recognition of their value.

Georg Fischer is actively addressing environmental concerns by setting ambitious CO2 reduction targets. The company aims for a 21% decrease in absolute Scope 1 and 2 CO2e emissions by 2025, using 2019 as a baseline. Furthermore, they are targeting a 34.6% reduction in Scope 3 CO2e emissions per tonne of processed material and in the use of sold products by 2030, demonstrating a comprehensive approach to their carbon footprint.

Resource efficiency and circular economy principles are central to GF's sustainability strategy, aiming to grow without increasing resource consumption. This includes minimizing waste sent to landfills and reducing water usage. In 2023, GF achieved a 5% reduction in waste to landfill compared to their 2020 baseline and a 3% decrease in water intensity per unit of production.

The company is also focused on developing a sustainable product portfolio, with a goal for 70% of sales to come from products offering clear environmental or social benefits by 2025. Key innovations include solutions for reducing CO2 emissions, improving energy efficiency, and promoting responsible water management, aligning with global sustainability trends and customer demand for eco-friendly options.

Georg Fischer's commitment extends to responsible sourcing and supply chain sustainability. Their Corporate Conflict Minerals Policy guides raw material procurement, and they actively conduct sustainability evaluations of their supply chain. In 2023, GF focused on evaluating a significant portion of its procurement spend to ensure environmental and social compliance across its value chain.

| Environmental Factor | 2025 Target | 2030 Target | 2023 Performance |

| Scope 1 & 2 CO2e Reduction (vs. 2019) | 21% | N/A | N/A |

| Scope 3 CO2e Reduction (per tonne) | N/A | 34.6% | N/A |

| Waste to Landfill Reduction (vs. 2020) | N/A | N/A | 5% |

| Water Intensity Reduction (per unit) | N/A | N/A | 3% |

| Sales from Sustainable Products | 70% | N/A | N/A |

PESTLE Analysis Data Sources

Our Georg Fischer PESTLE Analysis is built on a comprehensive foundation of data, drawing from official government publications, reputable industry research firms, and leading economic institutions. This ensures that each insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.