Georg Fischer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georg Fischer Bundle

Georg Fischer's competitive landscape is shaped by the interplay of five key forces, revealing the intensity of rivalry, the power of buyers and suppliers, and the ever-present threats of new entrants and substitutes. Understanding these dynamics is crucial for navigating the industry effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Georg Fischer’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers to Georg Fischer (GF) is significantly shaped by the concentration of those providing critical raw materials. For instance, if the market for specialized metals or advanced polymers, essential for GF's products, is dominated by a small number of suppliers, these entities gain considerable leverage. This concentration can translate into higher input costs for GF, directly impacting its profitability.

As GF strategically pivots towards its 'Flow Solutions' initiative, its demand for specific raw materials and components will evolve. This shift could alter the existing supplier landscape, potentially increasing the bargaining power of suppliers who can meet these new, specialized requirements, or conversely, diminishing it for those whose offerings become less central to GF's operations.

Georg Fischer (GF) relies heavily on specialized components and high-precision manufacturing for its fluid transport and casting solutions. When suppliers provide unique, patented, or highly customized inputs, such as advanced sensors or specific metal alloys, their bargaining power increases significantly. For instance, GF's commitment to sustainable technologies may necessitate sourcing unique, eco-friendly materials from niche suppliers, further concentrating power in their hands.

Georg Fischer (GF) faces considerable switching costs when changing suppliers, particularly for its highly integrated systems and specialized, high-precision components. These costs can include significant expenses related to re-tooling manufacturing equipment, obtaining new certifications for materials or processes, and the potential disruption to production lines, all of which can impact operational efficiency and output.

For instance, in 2024, the automotive sector, a key market for GF's casting solutions, continued to see demand for increasingly complex and lightweight components. Switching suppliers for specialized aluminum alloys or advanced casting machinery could necessitate substantial capital investment and extended lead times for qualification, directly increasing GF's reliance on existing, qualified suppliers.

The complexity of GF's product portfolio, which often involves custom-engineered solutions and long-term supply agreements for critical materials like high-performance polymers or specific metal alloys, further elevates these switching costs. This situation inherently strengthens the bargaining power of suppliers who can provide these specialized inputs reliably and to GF's exacting standards.

Threat of Forward Integration by Suppliers

Suppliers could potentially integrate forward, moving into Georg Fischer's (GF) manufacturing or directly targeting GF's customer base. While this threat is typically lower in specialized industrial markets like those GF operates in, it's not entirely absent. A supplier achieving significant scale and developing expertise comparable to GF's could pose a competitive challenge.

For instance, if a key component supplier to GF's building technologies division were to develop its own integrated system solutions, it could bypass GF. This risk is somewhat mitigated by GF's own strategic backward integration into certain material processing, which strengthens its control over the value chain and reduces reliance on external suppliers for critical inputs.

- Forward Integration Threat: Suppliers may enter GF's market by manufacturing finished goods or serving GF's customers directly.

- Industry Specialization Impact: This threat is generally reduced in highly specialized industrial sectors but can emerge if suppliers gain substantial scale and GF-like expertise.

- Mitigation Strategy: GF's own backward integration into material processing helps to counter this risk by enhancing its control over the supply chain.

Importance of GF to Supplier's Business

The significance of Georg Fischer (GF) to a supplier's overall business is a key determinant of supplier bargaining power. If GF accounts for only a minor fraction of a supplier's revenue, that supplier will likely possess greater leverage. This is because the supplier is less reliant on GF's continued patronage and can afford to be less accommodating on pricing or terms.

Conversely, if GF represents a substantial portion of a supplier's sales, GF gains considerable bargaining power. This situation arises when GF is a major customer, making the supplier more dependent on the business relationship. The dynamic is further influenced by the supplier's customer base diversification. A supplier serving a broad range of industries and customers is less vulnerable to losing any single client like GF.

For instance, if a supplier of specialized alloys primarily serves the automotive and aerospace sectors, and GF is a significant buyer within these, the supplier's dependence on GF could be high. However, if the supplier also caters to construction, energy, and medical device industries, their overall dependence on GF diminishes, thereby increasing GF's potential bargaining power.

- Supplier Dependence: If GF constitutes a small percentage of a supplier's total revenue, the supplier's bargaining power is amplified.

- Customer Concentration: Conversely, if GF is a major customer, its leverage over the supplier increases.

- Industry Diversification: A supplier's ability to withstand pressure from GF is also linked to how diversified its own customer base is across different industries.

- 2024 Data Context: While specific supplier revenue breakdowns for GF are proprietary, general trends in industrial supply chains in 2024 indicate a continued emphasis on supplier consolidation and strategic partnerships, which can shift bargaining power dynamics based on the criticality of components and the supplier's market position.

The bargaining power of suppliers to Georg Fischer (GF) is influenced by the availability of substitute inputs. If there are readily available alternatives for critical materials or components, GF can switch suppliers more easily, thus reducing supplier leverage. However, the highly specialized nature of many of GF's products often limits the availability of direct substitutes, thereby strengthening supplier power.

Georg Fischer's (GF) bargaining power with its suppliers is diminished when suppliers provide differentiated or mission-critical inputs that are essential for GF's advanced manufacturing processes. For example, suppliers of specialized alloys for high-pressure systems or precision-engineered components for their automation solutions hold significant sway. The company's 2024 strategy, focusing on advanced solutions, likely increased reliance on suppliers with unique technological capabilities.

The bargaining power of suppliers to Georg Fischer (GF) is a key factor in its cost structure and operational efficiency. When suppliers possess significant leverage, they can command higher prices or impose less favorable terms, directly impacting GF's profitability and competitiveness. This power is magnified when GF has limited alternatives for essential inputs.

| Factor | Impact on GF's Bargaining Power | Example for GF |

|---|---|---|

| Supplier Concentration | Lowers GF's power | Few suppliers for specialized metal alloys |

| Switching Costs | Lowers GF's power | Re-tooling for new precision components |

| Supplier Dependence on GF | Lowers GF's power | GF is a minor customer for the supplier |

| Availability of Substitutes | Lowers GF's power | Limited alternatives for unique polymers |

What is included in the product

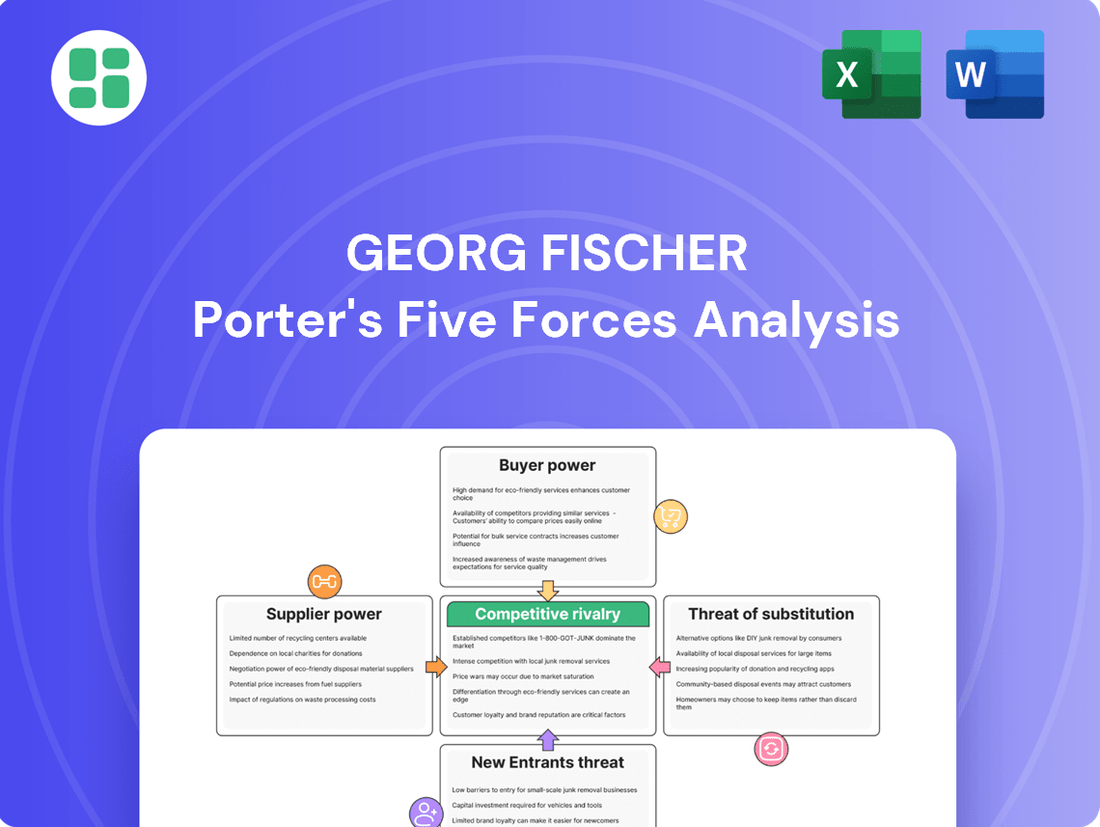

Analyzes the five competitive forces impacting Georg Fischer, including threat of new entrants, buyer and supplier power, threat of substitutes, and industry rivalry.

Quickly identify and address competitive threats with a pre-built framework, saving hours of manual analysis.

Customers Bargaining Power

Georg Fischer (GF) operates across diverse sectors like building technology and automotive. In industries where customers are few but purchase in massive quantities, such as major automotive manufacturers or large infrastructure developers, their bargaining power significantly increases. For example, securing a substantial contract for piping systems for a major city's water upgrade or supplying high-volume lightweight casting components to a leading car maker grants these customers considerable leverage in price negotiations.

Georg Fischer's (GF) customers face varying switching costs, directly impacting their bargaining power. For highly integrated piping systems or specialized, custom-designed casting components, switching suppliers often necessitates substantial re-engineering, re-certification processes, and can lead to significant operational disruptions. This complexity inherently raises the cost and effort for customers to change providers, thereby diminishing their leverage.

Conversely, for GF's more standardized product offerings, the barriers to switching are considerably lower. In these instances, customers can more readily source comparable products from alternative suppliers without incurring major additional expenses or operational interruptions. This ease of substitution grants these customers greater bargaining power, as they can more credibly threaten to move their business elsewhere if pricing or terms are not favorable.

Customers in sectors like automotive and construction are often very sensitive to price. This is due to strong competition and the sheer size of the projects they undertake. For example, in 2024, the automotive industry continued to grapple with fluctuating raw material costs, directly impacting vehicle pricing and consumer willingness to pay premiums.

While Georg Fischer (GF) aims to stand out with high-value, sustainable solutions, this doesn't always shield them from aggressive price wars in some markets. Buyers can leverage this competition to their advantage, pushing for lower prices, especially when many suppliers offer similar products.

GF's strategic shift towards focusing solely on 'Flow Solutions' is a key move. This aims to attract customers who prioritize long-term value, reliability, and performance over just the initial price tag. This transition is crucial for mitigating the impact of price sensitivity in their customer base.

Customer's Threat of Backward Integration

Large customers, particularly those in high-volume sectors, may explore backward integration to produce components or systems currently sourced from Georg Fischer (GF). This strategy could reduce their reliance on suppliers and potentially lower costs. For instance, a major automotive manufacturer might consider producing specialized fittings if GF's pricing or supply chain becomes unfavorable.

While the capital investment and technical expertise required for backward integration into GF's specialized areas like high-performance piping systems are substantial, it's a tangible threat, especially for more commoditized product lines. The complexity of GF's advanced materials and manufacturing processes acts as a significant barrier.

GF's ongoing commitment to innovation, such as their advancements in smart piping solutions and sustainable materials, directly counters this threat. By offering superior technology, customized solutions, and unparalleled expertise, GF enhances its value proposition, making backward integration less attractive for its key clients. For example, GF's development of advanced corrosion-resistant alloys for chemical processing industries in 2024 provides a critical technological edge that is difficult for customers to replicate internally.

- Threat of Backward Integration: Large customers may consider producing GF's components internally to gain cost control and supply security.

- Barriers to Integration: Significant capital outlay and specialized technical knowledge in GF's core competencies present substantial hurdles for potential integrators.

- Mitigation Strategies: GF leverages continuous innovation, including new material science and smart manufacturing, to maintain a competitive advantage and deter customer integration.

- Market Context: In 2024, the trend of supply chain resilience has amplified customer interest in vertical integration, making GF's value-added services and technological leadership even more crucial.

Information Availability and Product Differentiation

When customers can easily access information about various product choices and their prices, their ability to negotiate and influence terms grows significantly. This is a key aspect of customer bargaining power.

Georg Fischer (GF) counters this by developing highly differentiated products. For instance, their solutions incorporating advanced sustainability features or exceptional precision capabilities make direct comparisons by customers more challenging, thereby lessening customer leverage. In 2024, GF highlighted its commitment to sustainable solutions, aiming to capture a larger market share where such features are valued, which directly impacts customer price sensitivity.

- Information Availability: Increased access to competitor pricing and product specifications empowers customers.

- Product Differentiation: GF's focus on unique selling propositions like sustainability and high precision reduces direct product substitutability.

- Segmental Impact: In markets with less product differentiation, customers can more readily exert price pressure on GF.

- Market Dynamics: GF's strategic investments in R&D for differentiated offerings, as seen in their 2024 product launches, aim to mitigate customer bargaining power by creating unique value propositions.

The bargaining power of Georg Fischer's (GF) customers is a significant factor in its operating environment. When customers are few but purchase in large volumes, or when switching costs are low for standardized products, their leverage increases. Price sensitivity, particularly in sectors like automotive, further amplifies this power, especially in a competitive 2024 market. However, GF actively works to mitigate this by focusing on product differentiation, innovation, and value-added services.

Georg Fischer's (GF) customers can exert significant bargaining power, especially when they are large-volume buyers or when switching to alternative suppliers is easy and inexpensive. This is particularly true for standardized products where price is a primary consideration. In 2024, the automotive sector, a key market for GF, continued to face price pressures, making customers in this segment more assertive in negotiations.

The threat of backward integration by customers is a constant consideration. While GF's specialized products and the high capital and technical expertise required for their production create barriers, some customers, especially in more commoditized areas, may explore bringing production in-house. GF's continuous innovation, such as its 2024 advancements in sustainable materials for piping systems, is crucial in deterring this trend by offering superior, hard-to-replicate value.

| Customer Characteristic | Impact on Bargaining Power | GF Mitigation Strategy | 2024 Market Context |

|---|---|---|---|

| Large Volume Buyers | High Leverage | Focus on long-term partnerships and value-added services | Continued demand for efficiency in infrastructure projects |

| Low Switching Costs (Standard Products) | High Leverage | Product differentiation and technological superiority | Intensified competition in building technology segments |

| Price Sensitivity | High Leverage | Emphasis on total cost of ownership and sustainable solutions | Automotive sector grappling with cost management |

| Threat of Backward Integration | Moderate to High Leverage | Continuous R&D and unique material science | Supply chain resilience driving interest in vertical integration |

Preview the Actual Deliverable

Georg Fischer Porter's Five Forces Analysis

You're previewing the final version of the Georg Fischer Porter's Five Forces Analysis. This comprehensive document, detailing the competitive landscape for Georg Fischer, is precisely the same file you'll receive instantly after completing your purchase. You can trust that what you see is exactly what you'll get, ready for immediate use and strategic application.

Rivalry Among Competitors

Georg Fischer (GF) navigates a competitive landscape across its three core divisions: GF Piping Systems, GF Casting Solutions, and GF Machining Solutions. The global industrial markets it serves are populated by a mix of large, diversified industrial conglomerates and highly specialized niche players, all vying for market share.

In the piping systems sector, for instance, GF faces significant rivalry from entities like Genuit Group, a major player in the UK market with a broad product portfolio. Similarly, GF Casting Solutions contends with established foundries and metal processing firms, while GF Machining Solutions encounters competition from precision engineering companies. For example, Nachi-Fujikoshi is a notable competitor in the machining solutions space, offering a wide array of cutting tools and industrial robots.

The intensity of this rivalry is further underscored by the presence of other substantial competitors such as Diehl, which has a strong presence in various industrial segments including metal processing, and RMA, a key player in the fittings and valves market. This diverse competitive set means GF must constantly innovate and maintain operational efficiency to secure its market position.

The overall growth rate of the industries Georg Fischer (GF) serves significantly influences competitive rivalry. When industries are expanding rapidly, competition often becomes less intense as companies can grow without directly taking share from rivals. However, slower growth or declining markets can force companies to fight harder for existing customers.

In 2024, GF's diverse end markets presented a mixed picture. For instance, the demand for sustainable water solutions and components for electric vehicles (EVs) showed robust growth, creating opportunities. Conversely, some traditional automotive casting sectors and certain construction markets in Europe experienced slower growth, leading to heightened competition as companies vied for a limited pool of business.

Georg Fischer's (GF) capacity to distinguish its offerings through innovation, a focus on sustainability, and advanced high-precision technologies effectively dampens direct competition. For instance, GF's commitment to developing solutions for the growing hydrogen infrastructure, a key area of innovation, positions them strongly against competitors in this emerging market.

However, in market segments where GF's products are more standardized or commoditized, price inevitably emerges as a more significant competitive lever. This is a common challenge across many industrial sectors, where buyers may have less incentive to pay a premium if perceived product differences are minimal.

Furthermore, the presence of substantial switching costs for GF's customers can also serve to moderate competitive rivalry. When customers have invested significantly in GF's integrated systems or face considerable expense and disruption in transitioning to an alternative supplier, they are less likely to switch based on minor price variations.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry. When companies face substantial costs or difficulties in leaving a market, they are often compelled to stay and compete, even if profitability is low. This can manifest through specialized assets that are hard to repurpose, long-term contractual obligations, or significant social costs associated with workforce reductions.

Georg Fischer's strategic actions highlight the impact of exit barriers. The company's ongoing divestment of GF Machining Solutions and its evaluation of GF Casting Solutions suggest a deliberate effort to manage its exposure to segments where rivalry might be particularly fierce or where strategic alignment is less optimal. For instance, the sale of GF Machining Solutions, a business requiring specialized manufacturing equipment, likely involved navigating certain exit barriers.

- Specialized Assets: GF Machining Solutions, with its focus on high-precision machine tools, represents assets that may have limited alternative uses, increasing exit barriers.

- Contractual Obligations: Long-term supply agreements or customer contracts within certain business units could also create a commitment to remain operational.

- Strategic Realignment: GF's moves indicate a proactive approach to reducing exposure to markets with high rivalry or where the company's strategic fit is weakening, thereby managing its own exit barriers and competitive pressures.

Strategic Commitments of Competitors

Competitors in the industrial sector are making substantial investments in advanced technologies like additive manufacturing and AI for precision production. For instance, in 2024, many players announced significant capital expenditures aimed at upgrading their manufacturing capabilities to enhance efficiency and product innovation. These commitments, alongside aggressive pricing adjustments seen throughout the year, are intensifying the competitive landscape.

Georg Fischer's own strategic pivot towards 'Flow Solutions' is a clear indicator of its commitment to specific high-growth segments within the market. This strategic direction, which involves substantial R&D and potential acquisitions, directly influences how rivals position themselves and react. The company's focus on areas like advanced fluid handling systems for sectors such as semiconductors and renewable energy highlights a proactive stance that competitors must address.

- Technological Investments: Competitors are channeling significant capital into areas such as AI-driven process optimization and the adoption of advanced materials in manufacturing.

- Capacity Expansion: Several key players have announced plans for new facilities or expansions of existing ones to meet anticipated demand growth in 2024-2025.

- Pricing Strategies: Aggressive pricing models and promotional offers were prevalent in 2024, particularly in more commoditized product segments, forcing others to respond.

- GF's Strategic Focus: Georg Fischer's commitment to 'Flow Solutions' signals a deliberate move into specialized markets, prompting competitors to re-evaluate their own portfolio strategies.

Georg Fischer (GF) faces intense rivalry from a diverse set of competitors across its business segments, including large industrial conglomerates and specialized firms. This competition is amplified in slower-growing markets where companies fight harder for market share, as observed in some European construction sectors in 2024. GF's strategic focus on innovation, such as its hydrogen infrastructure solutions, helps differentiate it, but in more commoditized areas, price becomes a key competitive factor.

The intensity of competition is further shaped by customer switching costs, which can moderate rivalry by making it less attractive for buyers to switch suppliers. Conversely, high exit barriers for competitors can prolong rivalry by keeping firms invested in less profitable markets. For example, GF's divestment of GF Machining Solutions, a business with specialized assets, indicates a strategic move to manage exposure to such competitive pressures.

Competitors are actively investing in advanced technologies like AI and additive manufacturing, with significant capital expenditures announced in 2024 to boost efficiency and innovation. This, coupled with aggressive pricing strategies observed throughout the year, intensifies the competitive landscape. GF's strategic pivot towards 'Flow Solutions' in high-growth areas like semiconductors and renewable energy forces rivals to adapt their own portfolio strategies.

| Competitor | Key Business Area | 2024 Market Focus/Activity |

|---|---|---|

| Genuit Group | Piping Systems | Strong presence in UK water and climate solutions, expanding product portfolio. |

| Nachi-Fujikoshi | Machining Solutions | Focus on cutting tools and industrial robots, competing in precision engineering. |

| Diehl | Metal Processing, Aviation | Diversified industrial player with significant presence in metal components. |

| RMA | Fittings and Valves | Key supplier in the fluid handling components market. |

SSubstitutes Threaten

In the fluid transport sector, traditional metal pipes such as steel and copper present a significant threat of substitution for Georg Fischer's (GF) plastic piping systems. While GF highlights the sustainability and corrosion resistance advantages of its products, the established infrastructure and familiarity with metal piping can still sway purchasing decisions. For instance, the global market for metal pipes was valued at over $150 billion in 2023, indicating a substantial existing base of alternatives.

Furthermore, for GF's casting business, emerging manufacturing technologies like 3D printing and advanced fabrication methods pose a potential substitute threat. These processes can offer quicker turnaround times and greater design flexibility, particularly for specialized or low-volume components, potentially bypassing the need for traditional casting methods. The additive manufacturing market, for example, was projected to reach $30 billion by the end of 2024, showcasing rapid growth and increasing viability as an alternative.

The attractiveness of substitute products or services hinges significantly on their price-performance ratio. When alternatives provide similar functionality at a more competitive price point, the threat to Georg Fischer (GF) intensifies. For instance, if a new, lower-cost piping material emerges that offers comparable durability and flow rates to GF's advanced solutions, customers might be tempted to switch, especially in price-sensitive segments.

However, GF's strategic emphasis on delivering high-value, sustainable, and precision-engineered solutions often creates a compelling value proposition that can command a price premium. This focus on superior performance, longevity, and environmental benefits can mitigate the threat from simpler, less sophisticated substitutes. For example, GF's commitment to reducing water leakage in its piping systems, which can lead to significant cost savings for utilities over the long term, justifies a higher initial investment compared to less reliable alternatives.

In 2024, the global market for advanced materials and sustainable infrastructure solutions continued to see robust demand, with companies prioritizing total cost of ownership and environmental impact. GF's ability to innovate and maintain its technological edge in areas like smart water management and energy-efficient building solutions is crucial in differentiating its offerings and countering the appeal of lower-priced, but potentially less effective, substitutes.

Customer willingness to switch to alternatives hinges on several key drivers, including evolving environmental regulations, stringent performance demands, and how easily new options can be integrated. For example, the automotive sector's push for lighter, more fuel-efficient vehicles is fueling a significant interest in advanced materials and manufacturing processes that could directly challenge Georg Fischer's existing product lines.

In 2024, the global automotive lightweight materials market was valued at approximately $200 billion, with projections indicating continued robust growth. This trend directly impacts GF's traditional metal-based offerings by creating a strong incentive for customers to explore composite or advanced polymer alternatives that offer superior weight reduction and energy efficiency, thereby increasing the threat of substitution.

Innovation in Substitute Industries

Rapid innovation in industries that offer alternative solutions can significantly amplify the threat of substitutes. For instance, breakthroughs in additive manufacturing, commonly known as 3D printing, for metal components or the development of novel flexible and smart piping systems could present substantial substitution risks for Georg Fischer (GF). GF's strategic divestments in recent years, such as the sale of its Building Control business in 2023, reflect a deliberate effort to concentrate on its core competencies, which are perceived to be less vulnerable to such rapid technological substitution.

The potential for disruptive technologies to emerge and displace existing product categories is a constant concern. Consider the energy sector, where advancements in battery technology and renewable energy sources are steadily eroding the market share of traditional fossil fuels. While not a direct substitute for GF's core offerings in fluid systems, such broad technological shifts highlight the dynamic nature of competitive landscapes.

GF's focus on areas like high-performance valves and fittings for demanding industries, such as semiconductors and chemical processing, aims to position the company in markets where specialized expertise and reliability are paramount, potentially buffering against some forms of substitution. However, the pace of innovation means that even these specialized areas are not immune to future disruptive technologies.

- Additive Manufacturing (3D Printing): Potential to create complex metal components, reducing the need for traditional machining and assembly, impacting demand for certain GF piping solutions.

- Smart Piping Systems: Integration of sensors and advanced materials could offer enhanced monitoring and performance, potentially replacing conventional piping in specific applications.

- GF Divestments: The company has actively pruned its portfolio, divesting businesses like Building Control to sharpen its focus on areas with stronger competitive advantages and lower substitution threats. For example, in 2023, GF completed the divestment of its Building Control business.

Indirect Substitution from Broader Solutions

Beyond direct product replacements, customers might find alternative ways to meet their needs, posing a threat. For instance, in water management, decentralized treatment systems or smart networks could lessen reliance on traditional piping, impacting demand for GF's core offerings.

Georg Fischer's strategic move into 'Flow Solutions' is a direct response to this evolving landscape. This expansion broadens their scope to encompass a wider range of fluid management needs, aiming to preemptively address these indirect substitution threats by offering more comprehensive solutions.

- Broader Solutions Threat: Decentralized water treatment and smart networks offer alternatives to traditional piping infrastructure.

- GF's Response: Expansion into 'Flow Solutions' aims to capture a wider fluid management market.

- Market Impact: This diversification could mitigate the impact of indirect substitution by providing integrated offerings.

The threat of substitutes for Georg Fischer (GF) products is multifaceted, encompassing both direct material replacements and alternative technological approaches to fluid management. While GF's advanced plastic piping systems compete with traditional metal pipes, the rise of additive manufacturing and smart piping systems offers new avenues for substitution. For example, the global additive manufacturing market was projected to reach $30 billion by the end of 2024, indicating its growing viability.

Customer decisions are heavily influenced by the price-performance ratio of substitutes. If alternative solutions offer comparable functionality at a lower cost, GF faces increased pressure, particularly in price-sensitive markets. However, GF's focus on high-value, sustainable, and precision-engineered products often justifies a premium, mitigating the threat from less sophisticated alternatives by emphasizing total cost of ownership and long-term benefits.

The automotive sector's drive for lightweight materials, with a market valued at approximately $200 billion in 2024, exemplifies how broader industry trends can increase substitution threats for GF's offerings. Furthermore, indirect substitutes like decentralized water treatment systems could reduce reliance on traditional piping infrastructure, prompting GF's strategic expansion into 'Flow Solutions' to capture a wider fluid management market.

| Threat Category | Examples | Market Data/Growth Factor | Impact on GF |

| Material Substitution | Traditional metal pipes (steel, copper) | Global metal pipe market >$150 billion (2023) | Established infrastructure and familiarity can sway decisions. |

| Technological Substitution | 3D Printing (Additive Manufacturing) | Additive manufacturing market projected to reach $30 billion (2024) | Faster turnaround, design flexibility for specialized components. |

| Indirect Substitution | Decentralized water treatment, smart networks | Growing focus on sustainable infrastructure solutions | Reduced reliance on traditional piping infrastructure. |

Entrants Threaten

Entering Georg Fischer's core markets, like high-precision manufacturing or specialized piping systems, demands significant upfront capital. For instance, establishing advanced casting facilities or investing in the research and development for new materials can easily run into tens or even hundreds of millions of dollars. This substantial financial hurdle naturally discourages many smaller players from even attempting to compete.

Georg Fischer (GF) benefits from substantial economies of scale in its manufacturing, sourcing, and logistics operations. For instance, in 2023, GF reported net sales of CHF 4.2 billion, reflecting a significant operational footprint that allows for cost advantages in purchasing raw materials and optimizing production runs.

Newcomers would face considerable difficulty matching GF's cost efficiencies without achieving comparable production volumes. This cost disadvantage makes it challenging for new entrants to compete effectively on price against established players like GF, who can leverage their scale to offer more competitive pricing.

Furthermore, GF's extensive history, dating back to 1802, has cultivated deep industry experience and strong, long-standing relationships with customers. This accumulated knowledge and trust are invaluable assets that new entrants would struggle to replicate quickly, creating a significant barrier to entry.

Georg Fischer's (GF) established reputation for high-quality, dependable, and innovative industrial solutions cultivates significant customer loyalty. This makes it challenging for new competitors to gain traction.

For instance, GF's commitment to R&D, which saw significant investment in 2023, allows them to consistently offer advanced products. New entrants would need to match this dedication, requiring substantial upfront capital for research, development, and marketing to even begin to build comparable trust and product differentiation.

Access to Distribution Channels

Securing robust and far-reaching distribution channels within global industrial markets presents a significant challenge, often demanding substantial investment and prolonged development. This complexity acts as a formidable barrier for any new player seeking to penetrate the market effectively.

Georg Fischer (GF) benefits from an established and extensive global distribution network, a critical asset that new entrants must overcome. For instance, GF's presence across numerous countries, serving diverse industrial sectors, means a newcomer would need to replicate this reach, a costly and time-intensive endeavor.

- Established Global Reach: GF's existing network provides immediate access to customers worldwide, a feat that new entrants would take years and significant capital to build.

- Channel Control: GF may have exclusive agreements or strong relationships with key distributors, limiting access for competitors.

- Logistical Expertise: Managing the complexities of global industrial product distribution, including warehousing, transportation, and compliance, is a core competency for GF that new firms lack.

Regulatory Hurdles and Proprietary Technology

Georg Fischer's (GF) markets are often characterized by significant regulatory hurdles. For instance, in the water and gas distribution sectors, compliance with strict safety and quality standards is paramount, requiring substantial investment and specialized expertise. GF's long-standing presence and established processes in these areas create a formidable barrier for potential newcomers.

Proprietary technology further solidifies GF's position. The company holds numerous patents and possesses specialized know-how in areas like advanced welding techniques and material science, particularly for its piping systems. This technological advantage, developed over years of research and development, makes it challenging for new entrants to replicate GF's product performance and reliability.

- Regulatory Compliance Costs: New entrants face substantial upfront costs to meet stringent industry certifications in sectors like aerospace and chemical processing.

- Patent Protection: GF's portfolio of patents on innovative technologies, such as their advanced joining solutions, limits the ability of competitors to offer similar products.

- Specialized Know-How: Decades of experience have endowed GF with unique operational knowledge, particularly in managing complex projects and ensuring product integrity in critical applications.

The threat of new entrants into Georg Fischer's (GF) core markets is generally low, primarily due to significant capital requirements and established brand loyalty. High upfront investments in advanced manufacturing, R&D, and global distribution networks create substantial barriers. GF's long history and reputation for quality further solidify customer allegiance, making it difficult for newcomers to gain market share.

New entrants face considerable challenges in replicating GF's established global distribution network and logistical expertise. For instance, GF's presence across numerous countries and diverse industrial sectors requires a newcomer to invest heavily and spend years building comparable reach. This established infrastructure provides GF with immediate market access and operational efficiencies that are difficult for new firms to match.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing advanced manufacturing facilities and R&D capabilities for GF's specialized products, such as high-precision casting or advanced piping systems, requires substantial investment, often in the tens to hundreds of millions of dollars. | Significantly discourages smaller players from entering the market. |

| Economies of Scale | GF's net sales of CHF 4.2 billion in 2023 highlight its large operational footprint, enabling cost advantages in sourcing and production. | Newcomers struggle to match GF's cost efficiencies without comparable production volumes, making price competition difficult. |

| Brand Loyalty & Reputation | GF's long history (since 1802) and commitment to quality and innovation foster deep customer trust and loyalty. | New entrants find it challenging to build comparable trust and product differentiation, requiring significant investment in R&D and marketing. |

| Distribution Channels | GF possesses an extensive global distribution network, a costly and time-consuming asset for new entrants to replicate. | New firms face difficulties in achieving market penetration and securing access to customers worldwide. |

| Proprietary Technology & Know-How | GF holds numerous patents and possesses specialized knowledge in areas like advanced welding and material science. | Replicating GF's product performance and reliability is challenging for new entrants due to technological advantages and operational expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Georg Fischer is built upon a robust foundation of data, including their annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and competitor analysis to gain a comprehensive view of the competitive landscape.