Georg Fischer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georg Fischer Bundle

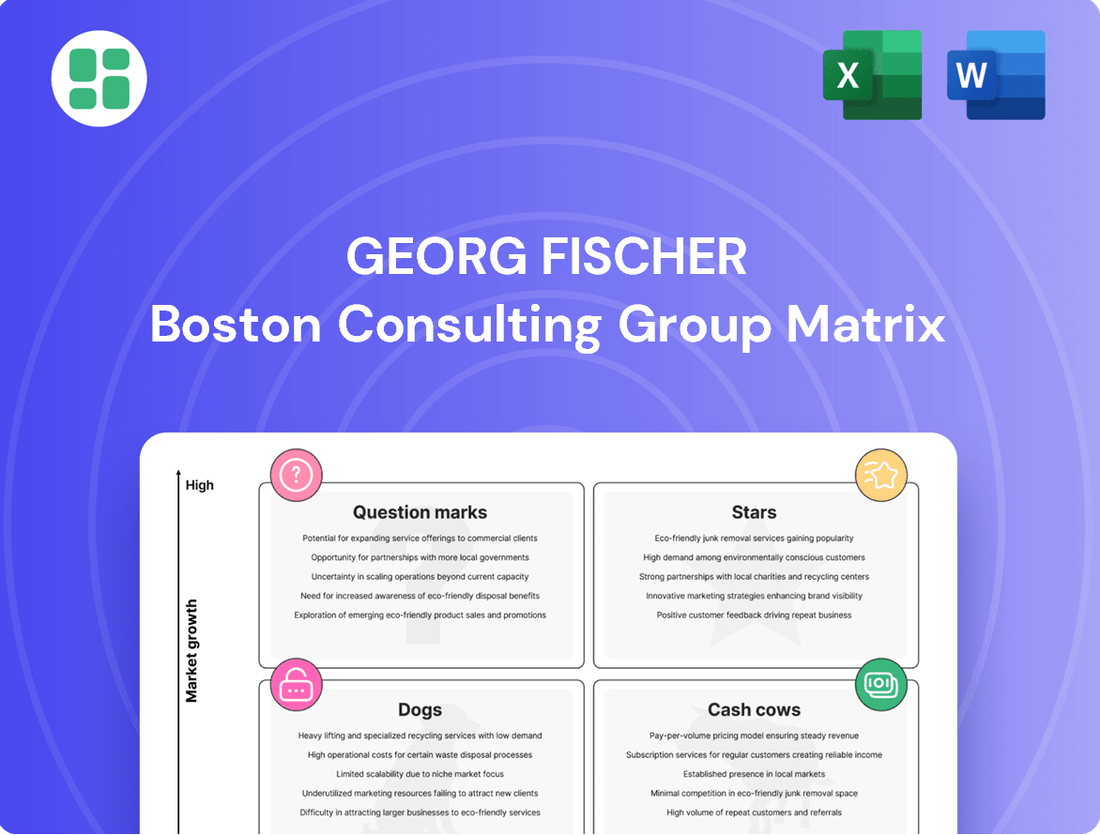

Unlock the strategic potential of Georg Fischer's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth and which require careful consideration.

This detailed breakdown will equip you with the knowledge to optimize resource allocation and foster sustainable success. Purchase the full BCG Matrix report for actionable insights and a clear path forward.

Stars

GF Piping Systems' high-purity piping solutions are indispensable for the semiconductor industry, a sector experiencing significant expansion and requiring ultra-clean fluid delivery for microchip fabrication. While the market faced some headwinds in 2023, the long-term outlook for microelectronics remains exceptionally strong, driven by increasing demand for advanced computing and electronics.

The semiconductor market, valued at approximately $600 billion in 2023, is projected to grow substantially in the coming years, with GF Piping Systems well-positioned to capitalize on this. GF's established reputation for quality and its specialized product offerings in this niche segment solidify its status as a Star in the BCG matrix, indicating high growth and a strong market share.

Georg Fischer's sustainable water treatment solutions are a prime example of a potential Star in the BCG Matrix. With growing global concerns about water scarcity and quality, GF Piping Systems' offerings in water reclamation and treatment are experiencing robust demand. The global water sector is projected to reach $1.3 trillion by 2030, according to some market analyses, indicating substantial growth opportunities for GF to leverage this trend.

The integration of Uponor significantly bolsters Georg Fischer's (GF) standing in the sustainable indoor climate sector, particularly with its energy-efficient radiant heating and cooling solutions. This strategic move capitalizes on the strong global push for green buildings and energy conservation, crucial megatrends shaping the construction and renovation markets.

This expanded portfolio, enhanced by the synergies from the Uponor acquisition, positions GF to capture a substantial market share within this burgeoning segment. For instance, the global green building market was valued at approximately USD 297.6 billion in 2023 and is projected to reach USD 1,034.4 billion by 2030, demonstrating robust growth potential.

Lightweight, Corrosion-Resistant Polymer Solutions for Marine Industry

GF Piping Systems is making waves in the marine industry with its advanced polymer solutions. These aren't just any plastics; they're engineered to be incredibly lightweight and resistant to corrosion, which is a huge deal for ships and offshore structures. Think about it: less weight means less fuel burned, and fighting off rust and saltwater damage means fewer costly repairs. This focus on efficiency and durability directly addresses the marine sector's growing need to comply with stricter environmental rules, like those pushing for lower emissions, and to simply operate more cost-effectively.

The market for these specialized polymer solutions in marine applications is certainly niche, but it's on an upward trajectory. Environmental regulations are a significant driver, pushing shipbuilders and operators towards materials that offer better performance and a lower environmental footprint throughout a vessel's lifecycle. The global marine coatings market, which often includes anti-corrosion solutions, was valued at approximately USD 16.5 billion in 2023 and is projected to grow, highlighting the importance of materials like those GF offers.

GF's position in this segment is bolstered by a history of strong, established partnerships. This long-standing presence suggests a deep understanding of customer needs and a significant market share, often a hallmark of a business unit in the "question mark" or "star" category depending on growth and market share dynamics. Their commitment to innovation in this area positions them well to capitalize on future growth opportunities as the marine industry continues its push towards sustainability and operational excellence.

- Market Driver: Increasing environmental regulations and demand for fuel efficiency in maritime operations.

- Product Advantage: Lightweight and corrosion-resistant polymer solutions reduce fuel consumption and maintenance costs.

- Market Position: Strong, long-standing partnerships indicate a high market share in this growing niche.

- Industry Context: The global marine coatings market, a related sector, shows robust growth, underscoring the value of advanced material solutions.

High-Performance Polymers for Commercial Potable Water

The commercial water market is actively seeking advanced materials for reliable fluid conveyance, and Georg Fischer (GF) stands out as a key supplier of high-performance polymers. This area presents significant growth opportunities, particularly within the US commercial potable water sector. GF's acquisition of Uponor is expected to bolster market penetration by combining Uponor's established access with GF Piping Systems' robust polymer offerings.

This strategic integration is designed to capitalize on the increasing demand for safer and more efficient water infrastructure. The focus on developing innovative fitting solutions further strengthens their competitive position in this expanding market.

- Market Demand: Growing need for alternative materials in commercial potable water systems.

- Growth Potential: Significant expansion opportunities, especially in the US commercial potable water market.

- Strategic Advantage: Uponor's market access combined with GF Piping Systems' polymer expertise.

- Innovation Focus: Development of new, more efficient fitting solutions to enhance competitiveness.

GF Piping Systems' high-purity solutions for the semiconductor industry are a clear Star. The semiconductor market, valued at approximately $600 billion in 2023, is experiencing robust growth, driven by demand for advanced electronics. GF's strong market share and specialized products in this high-growth sector solidify its Star status.

The sustainable water treatment segment is another promising Star for Georg Fischer. With global water concerns rising, GF's water reclamation and treatment offerings are in high demand. The global water sector is projected to reach $1.3 trillion by 2030, presenting substantial growth opportunities for GF's well-positioned solutions.

Georg Fischer's expanded portfolio, particularly after integrating Uponor's energy-efficient indoor climate solutions, positions it strongly in the green building market. This market was valued at approximately USD 297.6 billion in 2023 and is expected to reach USD 1,034.4 billion by 2030, indicating significant growth potential for GF's Star performer.

| Business Unit | BCG Category | Key Market Driver | 2023 Market Value (USD) | Projected Growth Driver |

|---|---|---|---|---|

| High-Purity Semiconductor Solutions | Star | Demand for advanced computing | ~ $600 billion (Semiconductor Market) | Continued expansion in microelectronics |

| Sustainable Water Treatment | Star | Global water scarcity and quality concerns | ~ $1.3 trillion (Global Water Sector by 2030) | Increased focus on water reclamation |

| Sustainable Indoor Climate Solutions (Post-Uponor) | Star | Green building and energy conservation | ~ $297.6 billion (Global Green Building Market) | Projected to reach $1,034.4 billion by 2030 |

What is included in the product

Strategic framework for analyzing business units based on market share and growth.

Guides decisions on resource allocation for Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Georg Fischer's product portfolio, aiding strategic decision-making.

Cash Cows

Georg Fischer's Traditional GF Piping Systems for Municipal Water Distribution represent a classic cash cow. This segment boasts a dominant market share in a mature but essential sector, ensuring stable and predictable revenue streams. For instance, in 2024, the global municipal water infrastructure market was valued at approximately $350 billion, with GF Piping Systems holding a significant portion of the pipe segment.

Despite the slower growth characteristic of mature markets, the fundamental necessity of water and gas distribution guarantees consistent demand. GF Piping Systems' focus in this area is on operational efficiency and maintaining its leadership position rather than aggressive expansion. This strategic approach allows for substantial cash generation, which can then be reinvested in other areas of the business.

GF Building Flow Solutions, particularly its core residential plumbing for hot and cold water, operates in a stable, mature market. Following the integration of Uponor, Georg Fischer commands a substantial market share in this essential building infrastructure segment.

This business unit is a significant cash generator, benefiting from consistent demand for fundamental plumbing needs. In 2024, the global residential plumbing market was valued at approximately $150 billion, with GF's strong position contributing to reliable revenue streams.

Marketing efforts for this segment are typically focused and cost-effective, leveraging established distribution networks rather than extensive promotional campaigns. This strategic approach maximizes profitability from a well-understood and consistently performing product line.

GF Casting Solutions for Aerospace Components, prior to its strategic re-evaluation, held a strong position in supplying high-precision casting components to the aerospace sector. This segment has historically been a reliable revenue generator, reflecting a mature market.

Demand in aerospace and industrial turbines remained robust through the first half of 2025. This sustained demand underscores the consistent revenue generation potential of GF Casting Solutions' offerings within this established market.

Standard Industrial Flow Solutions (e.g., Chemical Process)

Georg Fischer's GF Piping Systems offers robust solutions for demanding industrial sectors like chemical processing. These systems, often built with advanced plastics, provide significant advantages over conventional materials, securing a stable market position.

The demand for these established industrial flow solutions is typically consistent, driven by ongoing needs from existing manufacturing plants. These are often characterized by long-term customer relationships and predictable revenue streams, making them reliable cash cows for the company.

- Stable Market Presence: GF Piping Systems holds a strong position in the industrial sector, particularly in chemical processing, leveraging the durability and chemical resistance of its plastic piping solutions.

- Predictable Demand: Long-term contracts and the essential nature of flow solutions in industrial operations ensure a steady and predictable demand from a loyal customer base.

- Focus on Operational Excellence: The strategy for these cash cow products centers on maintaining high operational efficiency and cost competitiveness to preserve market share and profitability.

- 2024 Performance Indicator: While specific 2024 figures for this segment are not yet fully detailed, Georg Fischer's overall reported sales for the first quarter of 2024 showed a 3.7% increase in local currencies, with the Building Technology and Industrial Solutions segments contributing positively, indicating continued strength in established markets.

Malleable Cast Iron Fittings for Infrastructure

Malleable cast iron fittings, a staple in infrastructure for decades, represent a mature segment for Georg Fischer, likely housed within their broader Flow Solutions or legacy Casting Solutions divisions. These fittings, while not experiencing rapid expansion, fulfill a consistent demand for replacement and maintenance in established infrastructure networks, generating stable income with minimal capital expenditure needs.

The market for these fittings, though mature, benefits from ongoing infrastructure upkeep and upgrades. For instance, in 2024, global spending on infrastructure maintenance and repair is projected to remain robust, providing a predictable revenue base for GF's malleable cast iron fittings.

- Steady Revenue: These fittings provide a reliable, albeit not high-growth, income stream due to consistent demand in infrastructure maintenance.

- Low Investment: The mature nature of this product line generally requires limited new investment, contributing to healthy cash flow.

- Market Stability: Demand is driven by essential infrastructure needs, offering a degree of resilience even in fluctuating economic conditions.

- Replacement Focus: A significant portion of sales comes from replacing existing fittings in aging infrastructure, ensuring ongoing market relevance.

Georg Fischer's established piping systems for municipal water and gas distribution are prime examples of cash cows. These segments benefit from a dominant market share in essential, mature markets, ensuring consistent and predictable revenue. The global municipal water infrastructure market, valued at approximately $350 billion in 2024, provides a stable foundation for GF Piping Systems.

The GF Building Flow Solutions, particularly in residential plumbing, also operates as a cash cow. With a strong market position following the Uponor integration, this unit generates reliable income from the fundamental need for plumbing in homes. The global residential plumbing market, estimated at $150 billion in 2024, highlights the consistent demand GF capitalizes on.

These cash cow businesses are characterized by stable demand, operational efficiency, and a focus on maintaining market leadership rather than aggressive growth. Their consistent cash generation allows Georg Fischer to fund investments in its growth-oriented business units.

| Business Unit | Market Maturity | Cash Flow Generation | 2024 Market Context |

| GF Piping Systems (Municipal Water) | Mature | High & Stable | Global municipal water infrastructure market ~ $350 billion |

| GF Building Flow Solutions (Residential Plumbing) | Mature | High & Stable | Global residential plumbing market ~ $150 billion |

| GF Piping Systems (Industrial Sectors) | Mature | High & Stable | Consistent demand from existing manufacturing plants |

| Malleable Cast Iron Fittings | Mature | Moderate & Stable | Global infrastructure maintenance spending robust in 2024 |

What You’re Viewing Is Included

Georg Fischer BCG Matrix

The Georg Fischer BCG Matrix preview you are currently viewing is the complete, final document you will receive upon purchase. This means you're seeing the exact analysis and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning needs.

Dogs

GF Machining Solutions has been marked for divestment, with the deal anticipated to finalize in the first half of 2025. This move signals that it's no longer viewed as a central part of Georg Fischer's long-term strategy.

Despite experiencing some organic sales growth in 2024, GF Machining Solutions is categorized as a Dog within GF's portfolio. This is due to its comparatively lower profitability and its divergence from the company's strategic emphasis on 'Flow Solutions'.

GF Casting Solutions' automotive business, now divested to Nemak, was positioned as a Question Mark or potentially a Dog in the BCG Matrix. This strategic divestment was driven by a challenging automotive market, especially in Europe's premium segment, which saw sales decline significantly in the first half of 2025.

The decision to divest highlights the business's low growth prospects and likely limited market share within GF's evolving strategic priorities. This move allows GF to reallocate resources to areas with higher potential for growth and profitability.

Legacy metal-based pipe systems, where plastic alternatives now dominate, often fall into the 'Dogs' category within the BCG Matrix for Georg Fischer (GF) Piping Systems. These older product lines are seeing a decline in market share as demand shifts towards more sustainable, lightweight, and corrosion-resistant polymer solutions. For instance, in 2023, GF Piping Systems reported a significant portion of its growth coming from advanced plastic materials, highlighting the diminishing relevance of traditional metal offerings in many applications.

Underperforming, Non-Strategic Assets from Portfolio Optimization

Georg Fischer's strategic realignment, particularly focusing on its 'Flow Solutions' business, necessitates the divestment of assets that no longer fit the core strategy. These underperforming, non-strategic assets are akin to 'Dogs' in the BCG matrix. They typically exhibit low market share within industries experiencing slow growth, draining resources without significant future potential.

For instance, if GF were to divest a legacy product line that historically served a niche market with declining demand, and this product line contributed minimally to overall revenue or profit margins, it would be classified as a Dog. Such assets do not align with GF's forward-looking strategy, which emphasizes innovation and expansion in areas like smart water management and sustainable energy solutions.

Identifying and shedding these 'Dogs' is crucial for portfolio optimization. By freeing up capital and management attention, GF can reallocate resources towards its 'Stars' and 'Question Marks' that hold greater promise for future growth and profitability.

- Underperforming Assets: These are business units or product lines with low profitability and minimal growth prospects.

- Non-Strategic Fit: Assets that do not align with the company's core competencies or future strategic direction.

- Resource Drain: 'Dogs' often consume management time and capital without generating substantial returns, hindering investment in more promising areas.

- Divestment Rationale: The decision to divest is driven by the need to streamline operations, improve overall portfolio performance, and focus on strategic growth drivers.

Commoditized Components with Low Differentiation

Within Georg Fischer's diverse portfolio, certain basic or commoditized components might fall into this category. These are products where differentiation is minimal, and they operate in mature markets characterized by fierce price competition. For instance, standard fittings or basic piping systems, if not supported by unique technological advantages or service offerings, could exhibit these traits.

These types of products typically generate low profit margins. For example, if a specific line of standard connectors for industrial applications contributes only a few percentage points to Georg Fischer's overall operating profit, it might fit this description. Such items often require minimal ongoing investment, as their production processes are well-established and unlikely to yield significant growth.

- Low Profitability: Components with minimal differentiation often struggle to command premium pricing, leading to thin profit margins.

- Intense Price Competition: Mature markets for commoditized goods mean numerous suppliers compete primarily on price.

- Minimal Investment Needs: Established production methods for basic components generally require little capital expenditure for expansion or innovation.

- Potential for Divestiture: Such products may be candidates for sale or gradual phasing out to reallocate resources to more promising areas of the business.

Georg Fischer's strategic divestment of GF Machining Solutions in early 2025, despite some 2024 organic sales growth, firmly places it in the 'Dog' category due to lower profitability and a strategic pivot away from this segment. Similarly, the divested automotive business of GF Casting Solutions, impacted by a challenging European premium auto market with first-half 2025 sales declines, also represented a 'Dog' or 'Question Mark'. These moves underscore GF's focus on 'Flow Solutions' and the shedding of underperforming assets with limited growth prospects.

The divestment of GF Machining Solutions, expected to finalize in the first half of 2025, highlights its classification as a 'Dog' within Georg Fischer's portfolio. This is driven by its comparatively lower profitability and a strategic divergence from the company's core focus on 'Flow Solutions'. Despite some organic sales growth in 2024, the decision to divest signifies that it no longer aligns with GF's long-term strategic priorities, allowing for resource reallocation to more promising areas.

Georg Fischer's portfolio management strategy involves identifying and divesting 'Dog' assets, which are typically low-growth, low-profitability business units or product lines that do not fit the company's core competencies or future direction. The divestment of GF Machining Solutions, slated for completion in the first half of 2025, exemplifies this approach, freeing up capital and management attention for higher-potential 'Stars' and 'Question Marks' within its 'Flow Solutions' segment.

Legacy metal-based pipe systems within GF Piping Systems are often categorized as 'Dogs' due to declining market share against dominant polymer alternatives. For instance, while GF Piping Systems saw significant growth from advanced plastics in 2023, traditional metal offerings in certain applications are experiencing reduced demand. This strategic shift necessitates the divestment of such non-core, underperforming assets to optimize the portfolio and focus on growth areas.

| Business Unit/Product Line | BCG Category | Rationale | 2024/2025 Data Points |

| GF Machining Solutions | Dog | Low profitability, non-strategic focus | Divestment expected H1 2025; experienced some organic sales growth in 2024. |

| GF Casting Solutions (Automotive) | Dog/Question Mark | Challenging auto market, divested | Divested to Nemak; challenging European premium auto market with H1 2025 sales decline. |

| Legacy Metal Pipe Systems (GF Piping Systems) | Dog | Declining market share, commoditized | Growth driven by advanced plastics in 2023, indicating reduced demand for traditional metal. |

Question Marks

Georg Fischer's Flow Solutions is heavily investing in digitalization and AI, aiming to boost customer efficiency and decision-making. This strategic push aligns with the booming Industrial IoT and AI adoption in manufacturing sectors.

While this segment represents a high-growth area, GF's market share in these emerging AI-driven applications is still being established, necessitating significant ongoing investment to secure a strong foothold.

Advanced solutions for water scarcity and reuse, particularly highly innovative or new technologies for extreme conditions and comprehensive reuse systems, often fit into the Question Mark quadrant of the BCG Matrix. This segment operates in a rapidly expanding market, fueled by pressing global water challenges, but Georg Fischer (GF) may still be in the early stages of building its market share within these specialized areas. Significant investment in research and development (R&D) and dedicated market adoption strategies are crucial for these offerings to mature.

Uponor's integration brings GF into promising new product categories, such as advanced indoor climate control systems, which are experiencing robust growth. This expansion into potentially untapped geographic markets and customer bases offers significant upside, aligning with a stars or question marks quadrant in the BCG matrix.

While these new ventures boast high growth potential, their current market share is still developing, necessitating strategic investment to solidify their position. For instance, the global indoor climate control market was valued at approximately USD 120 billion in 2023 and is projected to grow substantially, presenting a clear opportunity for Uponor's offerings within GF.

Circular Economy Solutions and Recycled Material Products

Georg Fischer actively pursues circular economy principles, developing products from recycled materials. This segment is experiencing robust growth, fueled by stricter environmental mandates and a strong corporate push for sustainability. For example, in 2024, the global market for recycled plastics alone was projected to reach over $50 billion, highlighting the significant potential.

While this represents a high-growth area, Georg Fischer's current market penetration in these nascent product lines requires substantial enhancement. Strategic investments are crucial to capture a larger share of this expanding market. The company's commitment is reflected in its 2024 sustainability report, which detailed a 15% increase in the use of recycled content across its product portfolio.

- Market Growth: The demand for products made from recycled materials is surging, with projections indicating continued expansion through 2030.

- Regulatory Tailwinds: Increasing environmental regulations globally are creating a favorable market environment for circular economy solutions.

- Investment Imperative: Georg Fischer needs to allocate significant capital to scale its offerings and gain a stronger foothold in this evolving market.

- Sustainability Goals: Corporate commitments to ESG targets are a primary driver, pushing companies to adopt and source recycled material-based products.

Solutions for Data Centers in GF Piping Systems

The burgeoning data center market, fueled by digital transformation and the AI revolution, presents a significant opportunity for specialized fluid management solutions. GF Piping Systems is actively participating in this high-growth segment, recognizing its substantial market potential.

However, securing a leading position in this competitive, high-demand niche necessitates strategic investments and focused development to outpace both established players and emerging competitors.

- Market Growth: The global data center market was valued at approximately USD 242 billion in 2023 and is projected to reach over USD 430 billion by 2028, showcasing robust expansion.

- GF Presence: GF Piping Systems offers advanced solutions for cooling, water treatment, and fire protection crucial for data center operations.

- Competitive Landscape: Key competitors include companies like Schneider Electric, Vertiv, and Siemens, who also provide integrated data center infrastructure solutions.

- Strategic Focus: GF's strategy should involve continued innovation in energy-efficient cooling technologies and expanding its service network to support the rapid deployment of new data centers.

New product lines, particularly those from the Uponor acquisition like advanced indoor climate control, represent potential Question Marks. These segments are experiencing high growth, with the global indoor climate control market valued around USD 120 billion in 2023, but GF's market share is still developing. Significant investment is needed to establish a strong position in these burgeoning areas.

BCG Matrix Data Sources

Our Georg Fischer BCG Matrix leverages comprehensive data from financial reports, market research, and internal sales figures to accurately assess product portfolio performance.