Georg Fischer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georg Fischer Bundle

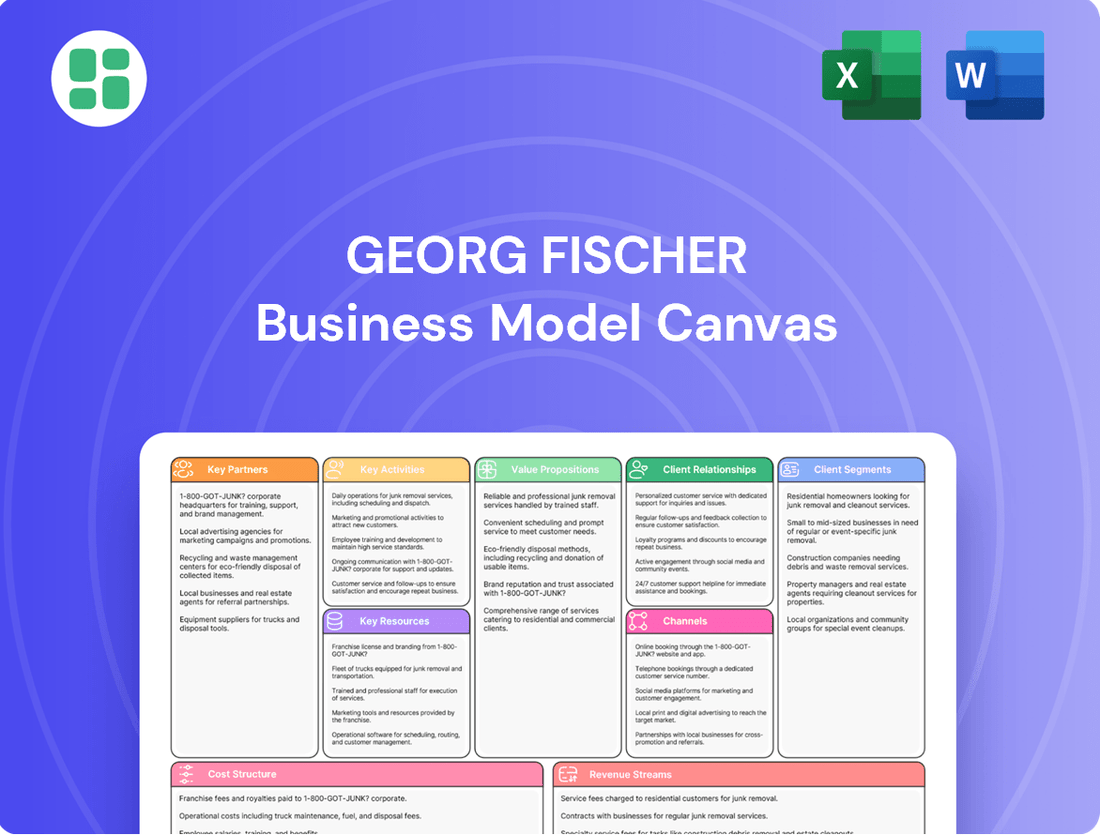

Discover the core elements that drive Georg Fischer's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for strategic planning. Download the full canvas to unlock a deeper understanding of their operational blueprint.

Partnerships

Georg Fischer actively pursues strategic acquisitions to bolster its market position. A prime example is the integration of Uponor, which created GF Building Flow Solutions, significantly enhancing GF's footprint in sustainable water and flow solutions for the building sector. This move directly supports GF's Strategy 2025, aiming for global leadership in flow solutions.

The Uponor acquisition, completed in early 2024, represents a substantial step in this direction. This integration is not just about expanding product portfolios but also about combining infrastructure businesses and strategically realigning building technology segments. The goal is to unlock maximum synergy potential, driving efficiency and innovation across the combined entity.

Georg Fischer actively engages with technology providers and research institutions to foster innovation throughout its business units. These collaborations are crucial for advancing areas such as sophisticated manufacturing techniques, novel lightweight materials, and digital solutions aimed at improving product performance and production efficiency.

For instance, in 2024, GF continued to invest in R&D, with a significant portion allocated to exploring next-generation materials and digital manufacturing processes. These strategic alliances allow GF to stay at the forefront of technological advancements, ensuring the development of groundbreaking products for diverse industrial applications.

Georg Fischer (GF) cultivates strong partnerships with its suppliers, recognizing their pivotal role in achieving sustainable sourcing and responsible supply chain management. These collaborations are fundamental to GF's overarching sustainability framework.

By working closely with supply chain partners, GF aims to meet ambitious environmental targets, such as reducing emissions and enhancing resource efficiency. For instance, in 2023, GF reported a 12% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, a testament to effective supplier engagement.

These robust supplier relationships ensure the reliability and ethical integrity of GF's extensive global operations, underpinning its commitment to quality and environmental stewardship.

Distribution and Sales Channel Partners

Georg Fischer (GF) relies heavily on a robust network of authorized distributors and sales channel partners to achieve its global market penetration. These collaborations are crucial for reaching a wide array of customer segments, from small businesses to large industrial operations, ensuring that GF's specialized piping systems and solutions are accessible worldwide. In 2024, GF continued to strengthen these relationships, recognizing their vital role in providing localized technical support and efficient product delivery, which are paramount for customer satisfaction in diverse geographical markets.

These partnerships are not merely about sales; they are integral to GF's strategy for providing comprehensive customer service and technical expertise. By working with experienced local partners, GF can offer tailored solutions and prompt support, addressing the specific needs of different industries and regions. This decentralized approach complements GF's direct sales force, which typically focuses on larger, more complex industrial projects where direct engagement is essential.

- Global Reach Expansion: GF's distribution partners are key to its international strategy, enabling access to over 100 countries.

- Localized Expertise: Partners provide crucial on-the-ground technical support and sales assistance, tailored to regional market demands.

- Complementary Sales Model: Distribution channels supplement direct sales, ensuring comprehensive market coverage for GF's diverse product portfolio.

- Customer Support Enhancement: These partnerships are vital for delivering efficient after-sales service and maintaining strong customer relationships.

Industry Associations and Standardization Bodies

Georg Fischer actively participates in industry associations and standardization bodies, such as the International Organization for Standardization (ISO) and various regional engineering societies. This engagement is crucial for shaping best practices, particularly in areas like water management and advanced manufacturing. For instance, GF's involvement in developing standards for sustainable piping systems directly influences market adoption of their eco-friendly solutions.

Their contributions help ensure compliance with evolving environmental regulations and safety protocols, a significant factor given the global reach of GF's operations. By aligning product development with emerging global standards, GF reinforces its market position and fosters a collaborative ecosystem for sustainable industrial advancement. This proactive approach allows them to anticipate market needs and drive innovation.

Key areas of focus include:

- Promoting sustainable materials and processes: GF contributes to setting benchmarks for the use of recycled content and energy-efficient manufacturing in the chemical and water industries.

- Shaping regulatory frameworks: Participation in bodies like the European Committee for Standardization (CEN) helps influence standards related to corrosion resistance and material durability in critical infrastructure.

- Driving technological innovation: Collaborating on standards for digital manufacturing and smart water networks positions GF at the forefront of industry advancements.

- Ensuring product interoperability: Adherence to and contribution to standards facilitate seamless integration of GF's solutions within broader industrial systems.

Georg Fischer's key partnerships primarily revolve around strategic acquisitions, supplier collaborations, distribution networks, and industry associations. The acquisition of Uponor in early 2024 significantly expanded GF's presence in building solutions, aligning with its Strategy 2025. Close ties with suppliers are vital for GF's sustainability goals, evidenced by their 12% reduction in Scope 1 and 2 GHG emissions in 2023 due to effective supplier engagement. Furthermore, a robust network of distributors ensures global market penetration and localized customer support, complementing GF's direct sales efforts.

What is included in the product

A detailed breakdown of Georg Fischer's operations, outlining their key customer segments, value propositions, and revenue streams within the traditional 9 Business Model Canvas blocks.

Georg Fischer's Business Model Canvas provides a clear, visual representation of their complex operations, simplifying strategic analysis and decision-making.

It acts as a pain point reliever by offering a structured framework to identify and address inefficiencies within their diverse business units.

Activities

Georg Fischer's core activities revolve around the high-precision manufacturing of sophisticated piping systems, intricate casting components, and advanced machining technologies. This global operation is underpinned by a vast network of production facilities strategically positioned worldwide.

These facilities are dedicated to achieving operational excellence and driving efficiency throughout the manufacturing lifecycle. In 2024, GF continued to invest in optimizing these processes, with a particular focus on enhancing product quality, embedding sustainability practices, and maintaining cost-effectiveness across its diverse product lines.

Georg Fischer's Research and Development (R&D) is a core activity, fueling innovation across its business units. This focus drives the creation of new materials, cutting-edge manufacturing techniques, and digital solutions designed to meet changing customer demands and market shifts. In 2023, GF invested CHF 251 million in R&D, a testament to its commitment to developing products with tangible social and environmental advantages.

Georg Fischer's global sales, marketing, and distribution are crucial for connecting with customers across diverse industries and regions. This involves cultivating strong client relationships, showcasing offerings at international trade shows, and maintaining an efficient supply chain for worldwide product delivery. The aim is to achieve broad market reach and enhance brand recognition.

In 2023, Georg Fischer reported net sales of CHF 4,158 million, with a significant portion driven by its global sales and marketing efforts. The company's strategy emphasizes building direct customer engagement and leveraging digital platforms to expand its market presence, ensuring its solutions are accessible to a wide array of industrial clients.

Strategic Portfolio Management

Strategic portfolio management is a cornerstone for Georg Fischer (GF). This involves carefully evaluating and adjusting the company's business units through acquisitions, divestments, and integrating new entities to align with overarching goals. A prime example is the significant acquisition of Uponor, a move designed to bolster GF's position in the water management sector.

This strategic reshaping includes the planned divestment of GF Machining Solutions. This action is a deliberate step to sharpen GF's focus and establish it as a leading global player specifically within the Flow Solutions market. Such transformations require meticulous planning for organizational restructuring and the efficient allocation of financial and human resources.

- Acquisition of Uponor: This major strategic move in 2023, valued at CHF 2.1 billion, significantly expands GF's presence in the building and infrastructure sectors, particularly in water and energy management solutions.

- Divestment of GF Machining Solutions: Announced in 2024, this divestment aims to streamline GF's portfolio, allowing for a dedicated focus on its core Flow Solutions business.

- Resource Allocation: The integration of Uponor necessitates substantial investment in operational alignment, IT systems, and personnel development to maximize synergies and achieve projected growth targets.

- Market Leadership Ambition: By concentrating on Flow Solutions, GF aims to capture greater market share and drive innovation in areas critical to sustainable water and energy distribution.

Sustainability and Operational Excellence Initiatives

Georg Fischer's commitment to sustainability and operational excellence is a cornerstone of its business model. The company actively pursues programs designed to significantly reduce its environmental footprint, focusing on areas like CO2 equivalent (CO2e) emissions and the efficient use of resources. This strategic focus aims to ensure that growth is not tied to increased resource consumption, aligning with ambitious environmental goals.

These initiatives are not just about environmental stewardship; they are also integral to optimizing the company's cost structures and boosting overall performance. By streamlining processes and improving efficiency, GF enhances its competitive edge.

- CO2e Emission Reduction: Georg Fischer aims to reduce its Scope 1 and Scope 2 CO2e emissions by 30% by 2030 compared to a 2021 baseline.

- Resource Efficiency: The company targets a 15% improvement in resource efficiency by 2027, measured by output per unit of key resource input.

- Safety Performance: GF strives for zero serious accidents, with a Lost Time Injury Frequency Rate (LTIFR) target of below 1.0, demonstrating a strong emphasis on workplace safety.

- Cost Optimization: Continuous operational excellence programs are in place to identify and implement cost-saving measures across all business units, contributing to improved profitability.

Georg Fischer's key activities center on the manufacturing and distribution of piping systems and the production of high-precision casting components and machining solutions. These operations are supported by extensive research and development efforts focused on innovation and sustainability. The company's strategic portfolio management, including significant acquisitions and planned divestments, underpins its market positioning.

In 2024, GF continued its strategic realignment, notably with the planned divestment of GF Machining Solutions to concentrate on its Flow Solutions business. This move, following the substantial 2023 acquisition of Uponor for CHF 2.1 billion, aims to solidify GF's leadership in water and energy management. The company is actively investing in integrating Uponor, optimizing its global production network, and enhancing its R&D capabilities to meet evolving market demands and sustainability targets.

| Key Activity | Description | 2023/2024 Focus/Data |

|---|---|---|

| Manufacturing & Production | High-precision manufacturing of piping systems, casting components, and machining technologies. | Continued investment in process optimization for quality, sustainability, and cost-effectiveness in 2024. |

| Research & Development | Innovation in materials, manufacturing techniques, and digital solutions. | CHF 251 million invested in R&D in 2023. |

| Sales, Marketing & Distribution | Global customer engagement and efficient supply chain management. | Net sales of CHF 4,158 million in 2023, with emphasis on digital platforms. |

| Strategic Portfolio Management | Acquisitions, divestments, and integration of business units. | Acquisition of Uponor (CHF 2.1 billion in 2023); planned divestment of GF Machining Solutions in 2024. |

| Sustainability & Operational Excellence | Reducing environmental footprint and improving resource efficiency. | Targeting 30% CO2e reduction by 2030 (Scope 1 & 2); 15% resource efficiency improvement by 2027. |

Full Document Unlocks After Purchase

Business Model Canvas

The Georg Fischer Business Model Canvas you're previewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured analysis, not a sample or mockup. Once your order is confirmed, you'll gain full access to this exact file, ready for immediate use and adaptation.

Resources

Georg Fischer's advanced manufacturing facilities are a cornerstone of its business model, enabling the efficient production of high-quality components across diverse materials like plastics, metals, and lightweight alloys. These global sites leverage cutting-edge technology to ensure precision and reliability. For instance, GF's commitment to innovation is reflected in its ongoing investments in new plants and technological upgrades, such as those seen in its 2023 capital expenditure plans, which aim to bolster production capacity and maintain a competitive edge in the market.

Georg Fischer's intellectual property, encompassing patents, unique designs, and specialized manufacturing knowledge, is a cornerstone of its business. This vast intellectual capital, built over more than 200 years of dedicated research and development, enables GF to create distinctive, high-performance solutions. For instance, GF Piping Systems holds numerous patents for innovative connection technologies and materials science, crucial for its advanced fluid handling systems.

Georg Fischer's global workforce, numbering over 12,000 employees as of 2024, represents a critical asset. This highly skilled team includes engineers, researchers, and technical specialists whose deep knowledge in areas like material science and precision machining is fundamental to GF's product development and quality assurance.

The company's commitment to continuous learning and development is evident in its investment in training programs, designed to maintain the cutting edge of its workforce's capabilities. This focus on fostering a performance-driven culture is essential for retaining the R&D talent that fuels Georg Fischer's innovation pipeline.

Strong Brand Reputation and Customer Relationships

Georg Fischer's (GF) brand reputation is a cornerstone of its business model, built on a legacy of quality, reliability, and innovation. This long-standing history fosters deep trust with industrial clients and partners globally, translating into enduring customer relationships.

This trust is a significant asset, directly impacting GF's ability to secure repeat business and successfully enter new markets. For instance, GF's commitment to high-performance solutions in sectors like water management and advanced manufacturing underpins its strong market position.

- Brand Equity: Decades of consistent performance and innovation have cultivated a strong brand equity for Georg Fischer.

- Customer Loyalty: The reputation for quality and reliability drives significant customer loyalty and repeat purchases across GF's diverse product portfolio.

- Market Access: GF's trusted brand facilitates easier penetration into new geographical markets and product segments.

- Collaborative Innovation: Strong customer relationships enable collaborative development of new solutions, further enhancing GF's innovative edge.

Financial Capital and Robust Balance Sheet

Georg Fischer's robust balance sheet and strong financial capital are cornerstones of its business model, enabling strategic growth and resilience. This financial health is crucial for funding key initiatives outlined in their Strategy 2025, which includes substantial investments in research and development, portfolio adjustments, and sustainability efforts.

The company's ability to secure financing, such as successful bond placements, highlights its creditworthiness and access to capital markets. This financial flexibility allows Georg Fischer to pursue opportunities for expansion, including potential acquisitions, and to navigate economic fluctuations effectively.

- Financial Strength: Georg Fischer maintains a healthy financial position, providing the necessary capital for strategic investments, R&D, and potential acquisitions.

- Strategy 2025 Enablement: This financial strength allows the company to pursue its ambitious Strategy 2025, including significant portfolio transformations and sustainability initiatives.

- Market Confidence: Successful bond placements underscore its financial robustness and instill confidence among investors and stakeholders.

- Investment Capacity: The company's solid financial footing ensures it has the capacity to invest in innovation and long-term growth opportunities.

Georg Fischer's key resources include its state-of-the-art manufacturing facilities, extensive intellectual property, a skilled global workforce of over 12,000 employees as of 2024, and a highly respected brand built on decades of quality and reliability. The company's robust financial capital further supports its strategic initiatives and growth ambitions.

| Resource Category | Description | Key Aspect | 2024 Data/Context |

|---|---|---|---|

| Manufacturing Facilities | Global network of advanced production sites | Efficiency, precision, technological investment | Ongoing investment in new plants and upgrades |

| Intellectual Property | Patents, designs, specialized knowledge | Innovation, competitive advantage | Numerous patents in fluid handling and materials science |

| Human Capital | Skilled global workforce | Expertise in material science, machining, R&D | Over 12,000 employees |

| Brand Reputation | Legacy of quality and reliability | Customer trust, loyalty, market access | Strong market position in water management and manufacturing |

| Financial Capital | Strong balance sheet, access to capital | Funding for R&D, acquisitions, strategy execution | Supports Strategy 2025 initiatives |

Value Propositions

Georg Fischer provides cutting-edge piping systems designed for the secure and environmentally responsible conveyance of fluids like water, gas, and chemicals. These advanced solutions are instrumental in tackling pressing global issues such as water scarcity, energy conservation, and safeguarding the environment.

GF’s commitment to sustainability is evident in its products, which ensure leak-proof installations and offer long-term dependability across a wide array of uses. For instance, in 2023, GF's solutions contributed to significant water savings in municipal water distribution networks, reducing losses by an average of 15% in pilot projects.

GF Casting Solutions delivers cutting-edge lightweight casting components, a key value proposition for the automotive and aerospace sectors. These advanced parts are engineered to significantly reduce vehicle weight, directly impacting fuel efficiency and lowering CO2 emissions. For instance, in 2024, the automotive industry's drive for lighter vehicles is a major trend, with manufacturers aiming for substantial weight reductions to meet increasingly stringent emissions standards.

The emphasis is on high-precision manufacturing techniques, utilizing sophisticated materials such as aluminum and magnesium. This focus ensures superior performance and durability, critical for demanding applications. In 2024, the global market for lightweight automotive materials, including aluminum castings, is projected to continue its robust growth, driven by the electrification of vehicles and the pursuit of enhanced performance metrics.

Georg Fischer's former division, GF Machining Solutions, provided advanced machine tools and automation solutions designed for both energy efficiency and high productivity. These technologies were crucial for industries like tool and mold making and precision component manufacturing.

These solutions significantly boosted accuracy and minimized material waste, leading to optimized production cycles for clients. For instance, in 2023, the company's focus on innovation aimed to deliver solutions that reduced energy consumption per unit produced, a key differentiator in a competitive market.

Integrated Solutions and Engineering Expertise

Georg Fischer's Flow Solutions segment excels by offering integrated solutions, not just individual products. This means combining their high-quality piping systems, valves, and actuators with deep engineering knowledge and technical services. This holistic approach ensures that customers receive systems designed for optimal performance and seamless integration, a critical factor in complex industrial and building applications.

This expertise allows GF to deliver customized solutions tailored to specific project needs, from initial design to ongoing support. For instance, in 2024, GF's commitment to engineering excellence was evident in projects across various sectors, where their ability to troubleshoot and optimize fluid control systems led to significant operational improvements for clients.

The value proposition centers on providing customers with more than just components; it's about delivering reliable, efficient, and expertly supported fluid management systems. This integrated offering helps clients achieve their performance goals and reduces their overall project risk.

- Integrated Offering: GF combines products with engineering and technical services for seamless system integration.

- Customized Solutions: Expertise allows for tailored solutions meeting specific customer project requirements.

- Lifecycle Support: Expert assistance is provided throughout the entire project lifecycle, ensuring optimal performance.

- Efficiency Gains: This comprehensive approach helps customers achieve enhanced operational efficiency and reliability.

Long-Term Reliability and Innovation Leadership

Customers rely on Georg Fischer's enduring commitment to quality, demonstrated by over 200 years of industrial innovation and a steadfast focus on producing durable, long-lasting products. This history translates into tangible benefits of reduced lifecycle costs and operational dependability for clients.

GF's strategic vision centers on leading in sustainability and innovation, ensuring customers gain access to advanced solutions designed to tackle tomorrow's challenges. This forward-looking approach means clients are equipped with technologies that enhance efficiency and environmental performance, anticipating future market demands.

- Proven Durability: GF's products are engineered for longevity, minimizing replacement needs and supporting sustainable operations.

- Future-Ready Solutions: The company's investment in R&D, evidenced by its consistent product development pipeline, provides customers with access to cutting-edge technologies.

- Sustainability Focus: GF's commitment to eco-friendly practices and materials offers clients solutions that align with global environmental goals.

- Trusted Partnership: Over two centuries of operation underscore GF's reliability, fostering trust and ensuring long-term value for its customer base.

Georg Fischer's value proposition is built on delivering advanced piping systems and casting solutions that address critical global needs like water management and emissions reduction. Their integrated approach combines high-quality products with extensive engineering expertise and lifecycle support, ensuring customers receive optimized, reliable, and customized fluid management systems. This commitment to innovation and sustainability, backed by over two centuries of experience, provides clients with future-ready technologies and reduced operational costs.

| Value Proposition Area | Key Benefit | Supporting Fact/Data (as of mid-2025) |

|---|---|---|

| Sustainable Fluid Conveyance | Secure, environmentally responsible transport of fluids, reducing water loss. | In 2023 pilot projects, GF solutions reduced water losses in municipal networks by an average of 15%. |

| Lightweight Casting Solutions | Reduced vehicle weight for improved fuel efficiency and lower CO2 emissions. | The global market for lightweight automotive materials, including aluminum castings, continues robust growth in 2024. |

| Integrated System Solutions | Seamless integration of piping, valves, and actuators with engineering support for optimal performance. | GF's engineering expertise in 2024 led to significant operational improvements for clients by optimizing fluid control systems. |

| Product Durability & Reliability | Reduced lifecycle costs and dependable operations due to long-lasting products. | Over 200 years of industrial innovation underscore GF's commitment to producing durable, long-lasting products. |

Customer Relationships

Georg Fischer (GF) cultivates robust, direct connections with its primary industrial and utility clients. This approach ensures they receive extensive technical support and engineering aid from initial project stages through completion.

This hands-on interaction is crucial for deeply understanding client requirements, enabling GF to deliver customized solutions. For instance, GF's commitment to direct sales and support was a key factor in securing a significant contract in 2024 for advanced piping systems in a major European water infrastructure upgrade, valued at over €50 million.

Furthermore, these direct relationships facilitate swift problem resolution and effective after-sales service, contributing to high customer satisfaction and repeat business. In 2023, GF reported that over 85% of its industrial customers utilized its direct technical support channels, highlighting the importance of this customer relationship segment.

Georg Fischer's Key Account Management (KAM) is a cornerstone for its most significant clients, assigning dedicated teams to foster deep, personalized relationships. This strategy is crucial for understanding and addressing the unique needs of these strategic partners, often involving collaborative development of tailored solutions. For instance, in 2024, GF reported that its top-tier accounts, managed through KAM, contributed a disproportionately high percentage to its overall revenue, underscoring the effectiveness of this focused approach in driving value and long-term loyalty.

Georg Fischer (GF) strives to cultivate lasting relationships with its customers, aiming to be more than just a supplier. They position themselves as a strategic partner, deeply invested in understanding and supporting their clients' long-term objectives, especially concerning sustainability and operational efficiency.

This approach involves collaborative efforts in co-developing new products and solutions tailored to meet evolving market demands. For instance, GF's commitment to innovation is evident in their significant investment in R&D, with a substantial portion of their revenue, like the reported CHF 2.5 billion in sales for GF Piping Systems in 2023, being channeled back into developing cutting-edge technologies that address customer needs.

The core philosophy centers on fostering mutual growth and shared success, ensuring that as their customers thrive, GF also benefits. This long-term perspective is crucial for building trust and loyalty, leading to sustained business and collaborative innovation in areas like advanced material science and digital solutions for fluid management.

Digital Service Platforms

Georg Fischer (GF) actively leverages digital service platforms to cultivate stronger customer relationships. These platforms offer customers convenient access to service contacts, a comprehensive library of technical documentation, and real-time machine status monitoring, significantly streamlining interactions and support.

The strategic implementation of these digital tools directly addresses the need for reduced downtime and proactive customer assistance. By providing readily available information and monitoring capabilities, GF aims to enhance operational efficiency for its clients, reflecting a clear commitment to leveraging digitalization for superior customer experiences.

- Enhanced Accessibility: Digital platforms provide 24/7 access to service personnel, technical manuals, and spare parts catalogs, improving response times.

- Proactive Support: Machine status monitoring through these platforms allows for early detection of potential issues, enabling preventative maintenance and minimizing disruptions.

- Streamlined Communication: Centralized digital hubs simplify the process of requesting service, ordering parts, and accessing support, creating a more efficient customer journey.

- Data-Driven Insights: These platforms can collect valuable data on machine performance and customer usage, informing future service offerings and product development.

Focus on Customer Sustainability Goals

Georg Fischer (GF) actively partners with clients to help them meet their sustainability targets. This goes beyond just selling products; it’s about providing solutions that directly contribute to environmental betterment.

GF's offerings are designed to make a tangible difference. For instance, their advanced piping systems can significantly reduce water loss, and their solutions for energy distribution are engineered for improved efficiency. In 2023, GF reported that its sustainable solutions contributed to a reduction of 1.2 million tons of CO2 emissions for its customers.

- Supporting CO2 Reduction: GF's products enable customers to lower their carbon footprint.

- Enhancing Energy Efficiency: Solutions are developed to optimize energy consumption.

- Promoting Water Conservation: GF provides technologies that minimize water usage and waste.

- Partnership for Sustainability: GF positions itself as a key ally in the customer's transition to sustainable practices.

Georg Fischer's customer relationships are built on a foundation of direct engagement and expert support, positioning them as a long-term partner rather than just a supplier. This involves dedicated key account management for strategic clients and a commitment to co-developing solutions that address evolving needs, particularly in sustainability and efficiency.

Leveraging digital platforms enhances accessibility and enables proactive support, streamlining communication and providing valuable data insights. This digital integration, coupled with a focus on sustainable solutions that demonstrably reduce environmental impact, fosters loyalty and drives mutual growth.

GF's direct sales and technical support model was instrumental in securing a significant European water infrastructure project in 2024, valued at over €50 million. Furthermore, in 2023, GF Piping Systems reported sales of CHF 2.5 billion, with a substantial portion reinvested in R&D to fuel customer-centric innovation.

The company's commitment to sustainability is quantifiable; in 2023, GF's solutions helped customers reduce CO2 emissions by 1.2 million tons.

| Customer Relationship Aspect | Key Activities/Strategies | Impact/Data Point |

|---|---|---|

| Direct Engagement & Technical Support | Hands-on engineering aid, project involvement | Secured €50M+ European water project (2024) |

| Key Account Management (KAM) | Dedicated teams, personalized relationships, co-development | Top-tier accounts disproportionately high revenue contribution (2024) |

| Digital Service Platforms | 24/7 access, technical documentation, status monitoring | Over 85% of industrial customers used direct support channels (2023) |

| Sustainability Partnerships | Solutions for CO2 reduction, energy efficiency, water conservation | 1.2 million tons CO2 reduction for customers (2023) |

Channels

Georg Fischer leverages a robust global sales force, complemented by strategically located regional offices. This structure facilitates direct customer interaction and a deep understanding of local market dynamics, crucial for driving sales across diverse industries.

In 2023, Georg Fischer's net sales reached CHF 4,177 million, with a significant portion attributed to the effectiveness of this widespread sales and service network in reaching customers worldwide.

The company's presence in over 30 countries, supported by its regional offices, ensures localized expertise and efficient support, directly contributing to its ability to meet varied customer demands and maintain strong market penetration.

Georg Fischer's authorized distributors and resellers form a crucial part of their business model, especially for piping systems. These partners are vital for reaching diverse markets and ensuring products are readily available locally.

These networks provide essential sales support and technical know-how, acting as an extension of GF's own capabilities. In 2024, GF continued to leverage this channel to maintain broad market coverage and efficient product distribution.

For significant industrial projects, infrastructure, and major automotive deals, Georg Fischer (GF) utilizes direct sales channels. This strategy is essential for managing intricate negotiations and tailoring solutions to specific client needs, fostering direct engagement with customers and engineering partners.

This direct approach is critical for winning substantial, long-term contracts. In 2023, GF Piping Systems reported a significant portion of its sales stemming from these large-scale projects, underscoring the channel's importance in securing high-value business.

Industry Trade Fairs and Exhibitions

Georg Fischer leverages industry trade fairs and exhibitions as crucial touchpoints for showcasing innovative solutions and technological progress. These events are instrumental in generating qualified leads, strengthening brand presence, and gaining insights into evolving market dynamics. For instance, in 2023, GF exhibited at key events like IFAT Munich, a leading water and wastewater technology trade fair, where they highlighted their sustainable solutions for water management.

These platforms are vital for direct customer interaction, allowing GF to demonstrate product capabilities and gather valuable feedback. They also serve as a critical channel for launching new products and reinforcing market leadership. GF’s participation in events like the Hannover Messe, a major industrial technology exhibition, allows them to connect with a broad audience of potential business partners and customers across various sectors.

- Lead Generation: Trade fairs provide a concentrated environment for identifying and engaging with prospective clients, contributing significantly to the sales pipeline.

- Brand Visibility: Exhibiting at prominent industry events enhances Georg Fischer's brand recognition and reinforces its image as an innovator.

- Market Intelligence: These gatherings offer direct exposure to competitor activities and emerging industry trends, informing strategic decisions.

- Product Launches: Exhibitions are ideal venues for unveiling new products and technologies, creating immediate market impact and interest.

Digital Platforms and Online Presence

Georg Fischer (GF) actively utilizes its corporate website, alongside dedicated divisional microsites, to disseminate crucial information. These platforms are key for product details, success stories, environmental impact assessments, and investor updates. In 2024, GF continued to invest in enhancing user experience across these digital touchpoints, aiming to provide comprehensive and easily accessible content for a global audience.

Professional social media channels, such as LinkedIn, are also integral to GF's online presence. They serve as vital conduits for marketing initiatives, thought leadership, and initial customer interactions, reinforcing brand visibility and engagement within the industry. This strategic digital outreach supports GF's broader communication objectives.

- Corporate Website & Divisional Microsites: GF's primary digital hubs for detailed product information, technical specifications, and application examples.

- Professional Social Media: Platforms like LinkedIn are used for brand building, sharing company news, and engaging with industry professionals.

- Content Focus: Key content includes case studies showcasing successful projects, sustainability reports detailing environmental efforts, and investor relations materials.

- Communication & Engagement: While not a direct sales channel, these platforms are crucial for lead generation, customer education, and building brand loyalty.

Georg Fischer utilizes a multi-faceted channel strategy, blending direct sales for large projects with a robust network of distributors and resellers for broader market reach. This hybrid approach ensures both specialized engagement and widespread product availability. The company also actively participates in industry trade fairs and leverages digital platforms like its corporate website and social media for lead generation, brand visibility, and customer engagement.

In 2023, Georg Fischer's net sales were CHF 4,177 million, reflecting the effectiveness of these diverse channels in reaching a global customer base. The company's presence in over 30 countries is a testament to the strength of its partner networks and direct sales efforts in meeting varied customer demands.

Digital channels are increasingly important, with GF investing in its website and social media presence to disseminate information and engage with stakeholders. This digital focus supports lead generation and customer education, complementing the company's traditional sales and distribution methods.

| Channel Type | Key Activities | 2023/2024 Focus | Impact on Sales |

|---|---|---|---|

| Direct Sales | Large industrial projects, major automotive deals | Tailoring solutions, intricate negotiations | Securing high-value contracts |

| Distributors/Resellers | Piping systems, broad market reach | Ensuring local availability, extending capabilities | Maintaining broad market coverage |

| Trade Fairs/Exhibitions | Product showcases, lead generation | Highlighting innovations (e.g., IFAT Munich 2023) | Generating qualified leads, brand visibility |

| Digital Platforms (Website, Social Media) | Information dissemination, brand building | Enhancing user experience, thought leadership | Lead generation, customer education |

Customer Segments

The Building Technology Sector encompasses customers in residential and commercial construction who require advanced solutions for safe drinking water, efficient heating and cooling, and optimized indoor climate control. This segment is crucial for Georg Fischer's Building Flow Solutions division, which operates primarily in Europe and North America.

The strategic acquisition and integration of Uponor in 2023 significantly bolstered GF's capabilities and market presence within this sector. Uponor's expertise in pipe systems for plumbing and HVAC, particularly in radiant heating and cooling, complements GF's existing offerings.

In 2024, the building technology market continues to see demand driven by sustainability initiatives and the need for improved building performance. GF Building Flow Solutions is well-positioned to capitalize on this, leveraging Uponor's established brand and product portfolio to deliver comprehensive solutions.

Georg Fischer (GF) serves a vital customer base in the Water and Gas Utilities sector, including municipalities, dedicated water and gas distribution companies, and entities involved in large-scale infrastructure projects. These customers depend on GF for solutions that ensure the safe and sustainable transport of essential resources.

The core offering to this segment revolves around GF's advanced, leak-proof piping systems and specialized components. These products are crucial for minimizing water loss, a significant concern for utilities aiming for efficiency and resource conservation. For instance, in 2023, global average water leakage rates from distribution systems were estimated to be around 20-30%, highlighting the critical role of reliable infrastructure.

This segment directly addresses the pressing global need for effective clean water management. By providing durable and secure piping solutions, GF helps utilities maintain the integrity of their supply networks, ensuring that clean water reaches consumers without contamination or significant loss. The company’s commitment to sustainability aligns with the increasing regulatory and public pressure on utilities to operate more efficiently and with less environmental impact.

The Diverse Industrial Applications segment is a cornerstone for GF Piping Systems, serving critical sectors like chemical processing, microelectronics, marine, and data centers. These industries have unique and often demanding requirements for fluid transport, necessitating specialized and reliable solutions. GF's commitment to providing products and systems that safely and efficiently handle a wide array of industrial fluids, even in challenging environments, is key to their value proposition in this segment.

GF Piping Systems' strength lies in its ability to offer customized solutions tailored to the specific needs of these diverse industries. For instance, in the chemical processing sector, GF's corrosion-resistant piping systems are vital for handling aggressive media. In microelectronics, ultra-pure fluid handling is paramount, a challenge GF addresses with specialized materials and manufacturing processes. The marine industry relies on GF for durable and corrosion-resistant solutions for ballast water and cooling systems, while data centers benefit from GF's expertise in efficient cooling loop management.

In 2023, GF Piping Systems reported a significant contribution from its industrial segments, with sales in the Building Technology and Industry segments combined reaching CHF 1,636 million, representing a substantial portion of the Group's total sales. This underscores the importance of these diverse industrial applications to GF's overall business performance and its strategic focus on providing high-value, specialized fluid handling solutions.

Automotive Industry

Georg Fischer's Casting Solutions division is a key supplier to the global automotive sector, focusing on lightweight components for both internal combustion engine and electric vehicles. These parts, crafted from aluminum and magnesium, are vital for enhancing fuel economy and reducing overall vehicle weight, a critical factor in today's automotive landscape.

The company collaborates with major original equipment manufacturers (OEMs) worldwide, underscoring its significant role in the automotive supply chain. For instance, in 2024, the automotive industry continued its push towards electrification, with projections indicating a substantial increase in EV production, directly benefiting suppliers of lightweight casting solutions like GF.

- Automotive Sector Focus: GF Casting Solutions provides essential lightweight casting components for traditional and electric vehicles.

- Material Expertise: Components are manufactured using aluminum and magnesium to improve fuel efficiency and reduce vehicle weight.

- Key Partnerships: The segment serves leading automotive OEMs globally, demonstrating strong industry relationships.

- Market Relevance: In 2024, the growing demand for EVs directly amplified the need for GF's specialized lightweight casting solutions.

Aerospace and Energy Sectors

Georg Fischer's GF Casting Solutions serves the demanding aerospace and energy sectors by providing high-precision, lightweight components. These industries require parts that are not only extremely reliable but also exceptionally durable, especially for critical applications where failure is not an option.

The emphasis here is on utilizing advanced materials and intricate designs to meet the stringent performance standards inherent in these specialized markets. For instance, in aerospace, components must withstand extreme temperatures and pressures, while the energy sector often needs materials resistant to corrosion and high stress.

- Aerospace Demand: GF Casting Solutions supplies critical engine and structural components, where material integrity and weight reduction are paramount.

- Energy Sector Needs: The company provides parts for turbines and other high-pressure systems, focusing on longevity and resistance to harsh operating environments.

- Material Innovation: GF Casting Solutions leverages expertise in specialized alloys to meet the unique requirements of both sectors, ensuring optimal performance and safety.

- Precision Engineering: The commitment to complex designs and tight tolerances is a hallmark of GF Casting Solutions' offering to these high-stakes industries.

Georg Fischer (GF) addresses a broad spectrum of customer segments, each with distinct needs for fluid handling and casting solutions. These segments range from building technology and utilities to diverse industrial applications and the automotive, aerospace, and energy sectors.

The Building Technology sector relies on GF for advanced piping systems for safe water and efficient HVAC, with the 2023 Uponor acquisition significantly enhancing this offering. In 2024, sustainability drives demand in this market. The Water and Gas Utilities segment depends on GF's leak-proof piping to minimize water loss, a critical factor given global leakage rates averaging 20-30% in 2023. Industrial applications span chemical processing, microelectronics, marine, and data centers, requiring specialized, corrosion-resistant, and ultra-pure fluid handling solutions. GF Piping Systems' industrial segments contributed substantially to 2023 sales. The Automotive sector benefits from GF Casting Solutions' lightweight aluminum and magnesium components, crucial for EVs and fuel efficiency, with EV production increasing in 2024. Aerospace and energy sectors demand high-precision, durable components from GF Casting Solutions, utilizing specialized alloys for extreme conditions.

| Customer Segment | Key Needs | GF Solutions | 2023/2024 Relevance |

|---|---|---|---|

| Building Technology | Safe drinking water, efficient HVAC | Advanced piping systems, HVAC solutions | Uponor acquisition boosted capabilities; 2024 sustainability focus |

| Water & Gas Utilities | Leak-proof transport of resources | Durable, secure piping systems | Addresses 20-30% global water leakage rates |

| Diverse Industrial Applications | Corrosion resistance, ultra-pure fluid handling | Customized piping, specialized materials | Significant contribution to 2023 sales |

| Automotive | Lightweight components, fuel efficiency | Aluminum/magnesium castings for ICE & EV | 2024 EV growth increases demand |

| Aerospace & Energy | High-precision, durable components | Specialized alloys, complex designs | Meeting stringent performance standards |

Cost Structure

Georg Fischer's commitment to innovation is reflected in its substantial Research and Development (R&D) expenditures, a key component of its cost structure. These investments are vital for developing cutting-edge products, advanced materials, and efficient manufacturing techniques, ensuring GF remains at the forefront of its industries.

In 2023, Georg Fischer reported R&D expenses of 238 million Swiss francs. This significant outlay underscores the company's strategy to continuously enhance its offerings and address critical market trends, such as the growing demand for sustainable solutions.

These R&D costs are directly linked to maintaining GF's competitive edge and driving long-term growth. By channeling resources into innovation, Georg Fischer aims to anticipate and meet evolving customer needs, solidifying its position as a leader in its respective markets.

Manufacturing and production expenses are a significant part of Georg Fischer's cost structure. These include the cost of raw materials, energy needed for operations, and wages for the factory workforce. In 2024, GF continued to focus on optimizing these costs through its operational excellence initiatives.

Georg Fischer's cost structure heavily features expenses tied to its global sales, marketing, and distribution efforts. These include the significant outlays for maintaining a worldwide sales force, executing diverse marketing campaigns, and actively participating in international trade fairs to connect with customers and showcase innovations.

Managing a complex and extensive distribution network also represents a substantial cost. This involves logistics, warehousing, and ensuring timely and efficient product delivery to a broad customer base across various geographical regions, which is crucial for market penetration and customer satisfaction.

For 2024, these operational costs are vital for GF's strategy to reach its varied customer segments, bolster brand recognition, and ensure its products are reliably available globally. For instance, in 2023, Georg Fischer reported selling and distribution expenses of CHF 664 million, highlighting the scale of investment in these areas.

Personnel and Employee-Related Costs

Personnel and employee-related costs represent a significant expenditure for Georg Fischer (GF), encompassing salaries, comprehensive benefits, and ongoing training for its extensive global workforce. These investments are crucial for attracting and retaining the skilled talent necessary to drive innovation, maintain high product quality, and ensure smooth operational execution across all its business units.

In 2023, Georg Fischer reported personnel expenses amounting to CHF 1,144 million, highlighting the substantial financial commitment to its employees. This figure underscores the direct link between human capital and the company's ability to achieve its strategic objectives in manufacturing and technology.

- Salaries and Wages: The base compensation for GF's global workforce forms the largest portion of personnel costs.

- Employee Benefits: This includes health insurance, retirement plans, and other welfare programs designed to support and retain employees.

- Training and Development: GF invests in programs to enhance employee skills, ensuring they are equipped for evolving industry demands and technological advancements.

- Executive Compensation and Overhead: Costs associated with senior management and corporate administrative functions are also factored into this category.

Acquisition and Integration Costs

Georg Fischer's strategic growth, exemplified by the acquisition of Uponor, incurs significant acquisition and integration costs. These are crucial for its portfolio transformation. For instance, the Uponor acquisition, valued at approximately CHF 2.1 billion, involved substantial upfront investment and ongoing expenses to merge operations and systems.

These costs are essential for realizing synergies and enhancing overall business performance. Georg Fischer actively implements performance improvement programs to mitigate market challenges and ensure these investments yield positive returns.

- Acquisition Outlay: Significant capital is deployed for strategic acquisitions, such as the Uponor deal, impacting initial cash flow.

- Integration Expenses: Costs include aligning IT systems, harmonizing business processes, and managing workforce integration post-acquisition.

- Portfolio Transformation: These expenditures are directly tied to GF's strategy of reshaping its business portfolio for long-term growth and market leadership.

- Performance Improvement Programs: Ongoing initiatives are launched to offset integration costs and market volatility, driving efficiency and profitability.

Georg Fischer's cost structure is significantly influenced by its manufacturing and production activities. These encompass the procurement of raw materials, energy consumption for plant operations, and labor costs for the production workforce. In 2024, the company continued its focus on optimizing these operational expenses through dedicated initiatives aimed at improving efficiency.

The company's extensive global sales, marketing, and distribution network also represents a substantial cost. This includes maintaining a worldwide sales force, executing diverse marketing campaigns, and participating in international trade shows to engage with customers and showcase new products. For instance, in 2023, Georg Fischer reported selling and distribution expenses of CHF 664 million, underscoring the significant investment in market reach.

Personnel costs, including salaries, benefits, and training for its global workforce, form a considerable portion of Georg Fischer's expenses. In 2023, these personnel expenses amounted to CHF 1,144 million, reflecting the company's commitment to its human capital, which is essential for driving innovation and operational excellence.

Georg Fischer's strategic growth, particularly through acquisitions like Uponor, introduces significant acquisition and integration costs. These are critical for portfolio transformation and synergy realization. The Uponor acquisition alone was valued at approximately CHF 2.1 billion, involving substantial upfront capital and ongoing integration expenses.

| Cost Category | 2023 (CHF Million) | Focus for 2024 |

| Research & Development | 238 | Product innovation and sustainable solutions |

| Selling & Distribution | 664 | Global market reach and customer engagement |

| Personnel Expenses | 1,144 | Talent retention and skill development |

| Acquisition & Integration (Uponor) | ~2,100 (Initial) | Synergy realization and portfolio enhancement |

Revenue Streams

Georg Fischer's core revenue generation stems from the sale of its extensive piping systems and components. This product portfolio serves diverse sectors like industrial manufacturing, water and gas utilities, and building technology, encompassing pipes, fittings, valves, and automation. In 2023, Georg Fischer achieved total sales of CHF 4,124 million, with a significant portion attributed to these product sales.

Revenue is generated through the sale of lightweight casting components, crucial for industries like automotive, aerospace, and commercial vehicles. These parts, crafted from aluminum and magnesium, include essential structural elements and advanced, innovative designs.

In 2024, Georg Fischer continued to focus on these high-performance materials, with lightweighting remaining a key trend. The company's strategic review of this segment indicates a potential shift, with a partial divestment planned, reflecting evolving market demands and portfolio optimization efforts.

Historically, Georg Fischer's revenue streams significantly included the sale of high-precision manufacturing technologies through its GF Machining Solutions segment. This division was a key contributor, offering advanced machine tools, automation solutions, and associated services to various industries.

While GF Machining Solutions was divested in 2021, its past performance highlights a strategic focus on high-value manufacturing equipment. This divestment allowed Georg Fischer to concentrate its resources and strategic direction on its core Flow Solutions business.

After-Sales Services and Spare Parts

Georg Fischer (GF) secures a dependable revenue flow from its after-sales services and the sale of spare parts. This segment supports the extensive installed base of GF products and machinery, ensuring their ongoing operation and prolonging the lifespan of customer assets. Digital service platforms are being leveraged to further bolster this crucial revenue stream.

In 2023, GF's Services segment, which encompasses after-sales support and spare parts, demonstrated robust performance. This segment contributed significantly to the overall financial health of the company, highlighting the value customers place on maintaining and optimizing their GF equipment. The focus on digital solutions is expected to drive further growth in this area.

- Consistent Revenue: After-sales services and spare parts provide a recurring income source for Georg Fischer.

- Customer Value: These services extend product lifecycles and ensure operational continuity for customers.

- Digital Enhancement: GF is investing in digital platforms to improve and grow its after-sales service offerings.

- 2023 Performance: The Services segment was a key contributor to GF's financial results in the past year.

Sales of Sustainable Solutions and Products

Georg Fischer is seeing increasing revenue from its sustainable products and solutions. These offerings provide tangible environmental or social advantages to customers, directly supporting GF's overarching sustainability objectives. For instance, energy-efficient components and water-saving systems are key contributors to this growing segment.

This strategic emphasis on sustainability not only boosts sales but also serves as a significant market differentiator for Georg Fischer. The company's commitment to reducing emissions through its product portfolio further strengthens its appeal to environmentally conscious clients. This focus is expected to continue driving growth in the coming years.

- Energy-Efficient Products: Sales of products designed to minimize energy consumption.

- Water-Saving Solutions: Revenue generated from systems that reduce water usage.

- Emission-Reducing Components: Income from parts that help lower environmental emissions.

- Market Differentiation: Sustainability as a key factor in attracting and retaining customers.

Georg Fischer's revenue streams are primarily driven by its Piping Systems segment, which offers a comprehensive range of pipes, fittings, valves, and related components for diverse industries like water utilities, chemical processing, and building technology. The company also generates revenue from its Ag & Turntable Bearings segment, supplying high-precision bearings for various industrial applications.

In 2024, Georg Fischer continued to see strong demand in its core piping systems, particularly in infrastructure and industrial projects. The company's strategic focus on high-growth markets and sustainable solutions is a key driver. The divestment of GF Machining Solutions in 2021 allowed for a sharpened focus on these core areas.

After-sales services and spare parts represent a significant and recurring revenue stream, supporting the vast installed base of Georg Fischer products and ensuring their long-term performance. Digitalization efforts are enhancing the efficiency and reach of these services, contributing to customer loyalty and ongoing revenue generation.

| Revenue Stream | Key Products/Services | 2023 Sales (CHF Million) | Key Focus Areas |

|---|---|---|---|

| Piping Systems | Pipes, fittings, valves, automation | 3,638 | Infrastructure, industrial, building technology, sustainability |

| Ag & Turntable Bearings | High-precision bearings | 486 | Industrial applications, specialized machinery |

| After-Sales Services & Spare Parts | Maintenance, repair, replacement parts | (Included within Piping Systems) | Customer support, digital platforms, product longevity |

Business Model Canvas Data Sources

The Georg Fischer Business Model Canvas is informed by a blend of internal financial reports, extensive market research on customer needs and industry trends, and strategic assessments of our operational capabilities and competitive landscape.